Tax Guru-Ker$tetter Letter

Sunday, June 30, 2002

Self Employed Retirement Plans

Here's a good brief summary of some of the options available to self employed individuals. SEP-IRAs have long been the preference for my clients over Keoghs for a number of reasons. Unlike Keoghs, which require that they are established before the end of the tax year (i.e. 12/31/01 for 2001 1040s), a SEP-IRA can be established & funded as late as the extended due date of the tax returns (i.e. 10/15/02 for 2001 1040s).

SEP-IRAs also have the same high dollar limits as Keoghs, but aren't required to submit any 5500 forms, as are required each year for Keoghs.

One big word of warning. Most of these plans are based on the same income that is subject to the 15.3% self employment tax. It is often a much wiser move to take steps, such as using a C corp, to reduce or eliminate the SE tax, and invest that tax savings in something that will grow for your retirement years, such as your business or some real estate.

KMK

Intro To Creative Accounting

Here is a good explanation of the way in which companies like WorldCom artificially inflated their net profits. This has actually been very common practice for many companies for several years. Any claim that it is a new concept is completely bogus.

I can recall dozens of stories during the late 1990s dot-com stock hysteria where it was reported that companies such as AOL and Amazon were routinely capitalizing marketing and other operating costs that should have been included in normal expenses. Every few years, in order to clean up their balance sheets and please their outside auditors, they would take an extraordinary charge for a huge amount, as WorldCom & Xerox recently did. The sneaky strategy behind this maneuver was that most investors and stock analysts valued share prices based on "normal" earnings and did not penalize them for extraordinary charges, such as writing down the values of fictitious assets. Some analysts were able to see through this scam and valued the stocks accordingly. Others, who didn't understand the true nature of extraordinary charges, were fooled.

Here's a brief accounting lesson for those of you curious as to what an extraordinary charge should be. It is meant to be used only for large expenses that were unusual & unexpected in nature. Losses from catastrophes are properly reported as extraordinary expenses because they are freak events. The write-down of improperly capitalized expenses, as WorldCom and Xerox are doing, does not fit that description by any stretch of the imagination. It was routine and completely expected.

This trick has also long been used by our rulers in DC, which is why they were able to claim that they had balanced the annual budget, yet the overall Federal debt was still climbing. They have been moving more & more types of expenditures out of the normal operating budget and into non-accountable extraordinary expense categories. It is absolutely no different from what WorldCom, Xerox, et al have been doing. That is why I scoff at demands by our esteemed rulers in DC that corporate America clean up its act with its accounting. Hypocrisy of the highest level.

Lou Dobbs has a good look at how our rulers in both parties are trying to exploit the recent creative accounting scandals for their own power grabs.

Income Taxes

This entire issue points out the different goals of financial statements. For lender & investor purposes, we want them to paint a picture of a money making machine. However, when it comes to reporting to IRS, we normally try to expense as many things as quickly as possible in order to appear to be making the least amount of profit. At first blush, the tricks WorldCom, Xerox, et al were playing should have also artificially inflated their income taxes. That would be true if they didn't keep two sets of books, which is standard practice for large corporations. I can still recall learning how to account for the income taxes on the difference between the two sets of figures in my early accounting classes at Cal State Hayward almost 30 years ago; so this is not a new practice.

Are the corporate executives on the lam?

KMK

Tax Deductible Vacations

For those of us who are self employed, it isn't hard to find ways to justify a perfectly legitimate tax deduction for travel anywhere in the world. I work with a lot of Realtors and have to constantly remind them that any trip they take can be considered as deductible business travel if they check in with local real estate offices wherever they go to see what properties are available for their local clients and to show the other offices what properties they have listed.

Gary Klott has an interesting article with some other tips for writing off what would normally be non-deductible vacations for W-2 wage slaves. Happy trails.

KMK

Saturday, June 29, 2002

Making A Bad Situation Worse

One very consistent thing in this world is the utter incompetence whenever our rulers in DC deem it necessary for them to intrude into the marketplace and fix a problem. You can be sure that they will succeed in making the problem worse.

With the recent revelations of creative accounting at some large corporations, politicians are literally chomping at the bit to take over the auditing profession. I couldn't agree more with this prediction of even less reliable numbers if our rulers succeed in getting their fangs into our profession. As I've said ad infinitum, the accounting tricks our rulers in DC have been pulling for decades are so much more nefarious than anything I have seen so far with the private corporations.

KMK

No Such Thing As A Free Lunch

With both of the big political parties working to continue their expansion of the imperial Federal government's control over every aspect of our lives by providing prescription benefits for senior citizens, the impression is that all seniors are demanding this costly benefit.

I was glad to see this letter to Rich Lowry of National Review from a man who understands the trade-off between freedom and government benefits. As Queen Hillary's failed socialist health care plan so explicitly laid out, when individuals accept Federal assistance, they cede to our rulers in DC the decisions as to what, if any, health care is allowable. I hope there are more people like this letter writer who understand the connection between money & freedom. Government payment plans always have very restrictive strings attached.

KMK

Friday, June 28, 2002

Postal Dis-Service

I'm sure there are business professors on college campuses out there who use the United States Postal Service as the epitome of how not to run a real capitalist for profit company. However, being a taxpayer subsidized monopoly means that the normal rules don't really apply to it; so maybe such a comparison isn't fair. However, the head honchos of the USPS keep telling our rulers in Congress that their goal is to make it self sufficient. If so, they are again heading in the wrong direction.

I could write endlessly on the idiotic mistakes they continue to make. However, I will limit myself to a few recent ones.

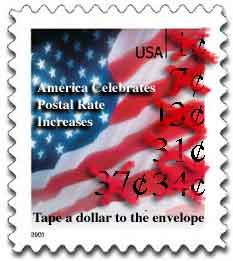

Raising Rates

The PO allegedly needs more money because of the losses it suffered after the 9/11 attacks. The geniuses at the USPS automatically jumped to raise their rates. As with almost every government policy, the result will be exactly opposite from the stated goal. Anyone with even the most basic understanding of elementary economics knows that an increase in prices for a product or service will result in lower consumption. With plenty of alternatives to sending things through the mail (fax, e-mail, FedEx, etc), the actual revenue will drop. Idiots.

I'm not a big fan of the GAO (General Accounting Office); but even they acknowledge that the USPS business model is destined for failure according to this press release from Citizens Against Government Waste.

Delivery Time

The PO has a nice website. They even allow you to order stamps online. However, what's wrong with this picture? This is an actual quote from the USPS site:

Question & Answer Page

Question: How soon after I place my order will it arrive?

Answer: Please allow 3 to 5 business days for processing and delivery. Please allow 3 weeks to receive orders sent to foreign addresses.

If anyone has a head start in trimming delivery times, it would be the Post Office. Why is it that I can order a hard drive from a company on the Left Coast and receive it the very next day; but if I order a roll of stamps, I have to wait three to five days? Incompetence doesn't even begin to describe this situation.

Anonymous Stamps

It's always irked me when buying stamps around the time of a postage rate increase and finding that the stamps have a letter instead of the amount of postage. I'm sure we're not alone with a drawer cluttered with lettered stamps and no idea of how much they are worth. Showing that there is no limit to stupidity with the PO, they have outdone themselves this time. Sherry just bought a roll of new 37 cent stamps and they have no number or letter. Just a picture of a US flag. How stupid is that?

It's not easy to find, but I was able to locate the values of the previous lettered stamps from the USPS website. They call them Nondenominational Postage. I seriously doubt if our local PO knows these amounts; so I will be writing the amounts next to the stamps I use.

A breakdown of the A-H stamps with their denomination is as follows:

A $0.15

B $0.18

C $0.20

D $0.22

E $0.25

F $0.29

G (Old Glory) $0.32

G (postcard) $0.20

G (Dove) $0.03 (MAKE-UP)

H (Hat) $0.33

H (Rooster) $0.01 (MAKE-UP)

It would be good to print this out & keep near your stamp collection.

KMK

Double Standard Accounting

I in no way intend to defend the crooked accounting now coming to light by large corporations. I just couldn't help but laugh at the hypocrisy of Bush threatening jail time for the book cookers, while these kinds of phony accounting techniques, and plenty of much worse ones, are routinely done by the Federal government's own accountants.

How soon do you think it will be before any of them are sent to prison? About the time that Hell sends an ice hockey team to the Olympics. The fact that there are hundreds of millions of victims of the crooked government accounting (many times the number of WorldCom, Enron, et al victims) is beside the point.

KMK

It's Our Turn

There was a time not very long ago that the accounting profession was rated in high regard among the public compared to other professions. With all of the recent disclosure of creative accounting in large corporations, that has changed. This joke from last night's Letterman show makes that very clear.

There's all these corporate scandals. First Enron and now this WorldCom thing. Things are getting so bad that New York Mets catcher Mike Piazza held a press conference today to say he wasn't an accountant.

How long will it be before Willie Nelson's song is changed to "Mama, Don't Let Your Babies Grow Up To Be CPAs?" In fact, with Willie's history of blaming his tax problems on his CPAs, I'm surprised that hasn't already happened.

KMK

Thursday, June 27, 2002

Big Government Is Expensive

Do you think the outrageously high & insatiable appetite for tax dollars by our rulers in DC could have anything to do with the fact that there are now 15 cabinet agencies, as opposed to just three when the country was founded? The Bush plan for another cabinet post, without eliminating any of the redundancy & overstepping in the existing ones, is just more of the same. Stephen Moore has a good take on this.

KMK

Profits Are Not Evil

To say that the economic literacy of the American populace is practically non-existent would be stating the obvious. A weekly lesson from the nation's premier economics professor, Walter E, Williams, would go a long way towards brightening the dim bulbs that are strewn across this great nation. In this essay, Dr. Williams explains what profits really represent, and why non-profit organizations shouldn't be as revered as they are.

KMK

Wednesday, June 26, 2002

Tuesday, June 25, 2002

Blind Leading the Blind

One of my many hot button issues is the fact that our rulers in DC base all of their decisions on economic predictions made by complete idiots who use static analysis. As Tom Nugent points out in this interesting article, the predictions by the DC static analyzers are almost always so far off when compared to the real life results, that no sane person should believe a thing they say.

He points put the very real analysis (which many people think is a satire) they did about a decade ago, estimating huge windfalls of revenue for the Federal government if the top marginal tax rate were raised to 100%. That study actually predicted higher revenues in each subsequent year, as taxpayers made more money that would be forked over to the IRS.

A more practical dynamic analysis of such a tax rate would reveal that a 100% tax rate would result in very little actual dollars for DC because, unlike the space aliens who populate DC, those of us in the real world would just as soon do something else with our time than work our butts off to make money that we can't keep.

Once again, that is the reason that Federal income tax revenues doubled after Ronald Reagan reduced the top marginal tax rate from 70% to 28%. People will take risks and work harder if they are allowed to keep more of the fruits of their labors. Contrary to the conventional wisdom promulgated by the media, the truth is that the deficit grew in the 1980s solely because Congress went on a wild spending binge, much like they are doing right now.

KMK

Friday, June 21, 2002

There Are Actually A Few Non-Communists In The DemonRat Party

The Arkansas Democrat has a good editorial today praising our Democrat Senator, Blanche Lambert Lincoln, for breaking from her party's standard support of wealth confiscation and voting in favor of a permanent repeal of the estate tax. Unfortunately, there aren't enough fair minded Democrats in the Senate to outweigh the fans of big government and Tom Daschole's 60 vote rule for lowering taxes.

Link warning: The link to the editorial may not work for everyone. The Arkansas Democrat is one of the most difficult news sites on the web to link to stories, which is why I rarely discuss articles I read there.

KMK

Been There, Done That

It's been over nine years since we made the big move from the San Francisco Bay Area to the Ozark Mountains of Arkansas. Stories like this, explaining that the Bay Area still has some of the worst traffic congestion in the country, reaffirm the wisdom of the move in my mind.

Having worked in several Bay Area cities, including San Francisco, Oakland, Fremont, San Ramon, Dublin and Santa Clara, and wasting countless hours in beep & creep traffic, all I can say is "been there, done that," and feel gratitude for the current commute from one end of our main house to the other.

KMK

Thursday, June 20, 2002

Blinders On

This is really becoming a war between those of us who believe in freedom, capitalism and private property rights and those who support big government and communistic philosophies.

This article by Beverly Goodman from TheStreet.com (supposedly a capitalist website) is wrong in its claim that the estate tax is good for everyone, for a number of reasons.

First is the often used defense of the estate tax that it only affects a small minority of Americans. Such an argument is offensive on its surface. It is nothing short of mob rule and blatant discrimination and persecution of a minority. If it's okay to do evil things to the richest two percent of the nation's citizens, why can't we also justify doing nasty and immoral things to other groups of people that make up a small percentage of the overall population?

Ms. Goodman puts far too much focus on one aspect of the recent change in the estate tax law, the change in the carryover basis for heirs.

As I have advised for decades, the biggest tax saving opportunity is to use the swap 'til you drop strategy when investing in certain assets, such as real estate. Instead of selling property and paying Uncle Sam a chunk of the gain, all of the profits can be rolled over into new real estate without any income tax bite. Savvy real estate investors routinely use Section 1031 (aka Starker) exchanges to accomplish this. While we usually call these tax free exchanges, they are actually tax deferred exchanges. This means that if an investor were to sell off replacement property while alive, all of the cumulative gain that had been deferred previously would become taxable.

However, as I often advise, patience has some big tax benefits. The big payoff is that when a person dies (drops), all of his assets are given a tax cost basis for the heirs of their fair market value as of the date of death. This is called a stepped up basis. This literally wipes out all of the capital gains that accumulated during the decedent's lifetime. This applies to all assets, not just real estate.

As Ms. Goodman points out, the new tax law will eliminate the stepped up basis as of 2010 and replace it with the same kind of carryover basis that currently applies to assets transferred as gifts. I agree that this is not a good move in terms of reducing taxes. However, retaining the immoral estate tax just to keep the stepped up basis is very short sighted. In fact, as the current law stands, when the estate tax comes back to life in 2011 with a measly one million dollar exemption per person, the stepped up basis won't also be coming back. Our rulers in DC have to pass another law to reinstate the stepped up basis rule, which is unlikely.

I don't mean to dump on Ms. Goodman; but she is also wrong to say that we should all support the Federal estate tax because some states will probably raise theirs. I discussed that issue a few months ago, where some states are planning to uncouple their estate tax from the Federal system and make it a stand alone tax because they don't believe they can survive without that revenue stream. Even if that happens, the state tax will be smaller than the up to 60% that IRS takes.

KMK

Labels: 1031

Wednesday, June 19, 2002

Who Supports Estate Tax?

Bruce Bartlett has a good piece on the super rich fat cats, such as Bill Gates, Sr., who are fighting to retain the estate tax, while most of the rest of us normal folks consider it to be evil. He explains why they would support something that theoretically should hurt them the most.

The super rich, such as America's royal family, the Kennedys, have the money and resources to set up trusts and other mechanisms to exempt themselves from the estate tax. Joe Kennedy's loot from his bootlegging & stock swindles has lasted for generations of non-productive spoiled rich kids due to his wise use of trusts to shield it from estate taxes.

Interestingly, Mr. Bartlett is still too squeamish to make the connection between supporters of government wealth confiscation and its heritage as part of the Communist Manifesto.

KMK

Sunday, June 16, 2002

Multi-Level Scams

For decades, I have made many people mad by exposing the idiocy & illegality of several multi-level and pyramid schemes that were destined to implode, after making money only for the folks who got in early.

There is an interesting website devoted to just that topic, MLM WatchDog.

Interestingly, they have stories on two big pyramid scams that I wrote about over the past few years, warning everyone to stay away from.

The founders and many investors in the Global Prosperity Group scam are going to the slammer. My only question is why did it take the government so long to bust these guys? About five years ago, when some former clients became involved with it, and tried to lure me in, I did some investigation and wrote a lengthy piece on how it was blatantly illegal and destined for prosecution.

The Tax People was a group selling many of the same tax tips I have been writing & speaking about for decades, but in a multi-level pyramid fashion. These people are now heading to the slammer. You can see a short summary on the MLM WatchDog opening page, and a more lengthy expose on this page from another good alert site, Pyramid Scheme Alert.

KMK

Saturday, June 15, 2002

Another Double Standard

By now, it's well known that the supporters of the communistic estate tax in the U.S. Senate have prevailed in their efforts to keep it in place. How they accomplished this is utterly disgusting.

In 1993, when there was a bill to drastically increase taxes retroactively, the Senate vote was 50 to 50. It was passed due to Al Gore's vote as the tie breaker.

When the recent bill to repeal the estate tax was voted on, it actually received 54 votes in favor and 44 against, with two Senators not voting. This was deemed not good enough to actually pass the law because the leader of the senate, Tom Daschole, mandated that it takes 60 votes to pass a law reducing taxes. Even a vote from Dick Cheney wouldn't have helped. I hope this article is right, that those voting to retain the estate tax will be held accountable in November.

When it takes only 51 votes to raise taxes and 60 votes to cut them, things are clearly out of whack with our rulers in DC. If anything, it should be the other way around. As a bare minimum, the standards should be equal in both directions. This is why I have never believed any claim that a tax or fee is temporary. There is no such thing. Once is tax or fee is imposed, our masters make sure that it lasts forever.

KMK

Friday, June 14, 2002

Handy Tax Resource

TaxPlanet.com by Gary Klott is a very useful resource for tax info for individuals. It's actually the kind of site I envisioned doing myself if I had more time and/or worker bees to assist me. I like it so much, I've even included a link to it in the section on the left of this page.

KMK

Wednesday, June 12, 2002

Enforcement Can Be Counter-Productive

For decades, I have discussed and consulted on the issue of sourcing for tax purposes, mostly between different state jurisdictions. For example, establishing a tax home in certain states, such as Texas, Nevada, Florida, or Washington, allows individuals to eliminate state income taxes on much or all of their income.

Manhattan District Attorney Robert Morgenthau is on a crusade to ensure that individuals and corporations pay as much tax to the State of New York as possible and is prosecuting (some may say persecuting) corporate executives who take steps to avoid State and/or Federal taxes.

As Bruce Bartlett explains in this piece, the results of Mr. Morgenthau's efforts may just be to encourage more businesses to flee from his jurisdiction rather than hang around and wear a bulls-eye.

Mr. Bartlett's essay also includes the quote from Judge Learned Hand that has been my guiding light for my entire career. It's on the back of my business cards and is usually quoted at the beginning of my seminars.

"Nobody owes any public duty to pay more than the law demands: taxes are enforced exactions, not voluntary contributions. To demand more in the name of morals is mere cant."

KMK

Thursday, June 06, 2002

Estate Tax Is Communistic

When I saw the sub-head (The argument to keep the inheritance tax is un-American) for this article by Tom Nugent supporting the permanent repeal of the estate tax, I thought he would be another person brave (and un-PC) enough to remind people where the concept of estate taxes came from. Unfortunately, he didn't have the nerve to mention that the concept of confiscating wealth from decedents and redistributing it is directly from Karl Marx's Communist Manifesto.

I don't mean to impugn Mr. Nugent's fine article; but it is also very ironic that his example of a big victim of the estate tax is the same Bill Gates whose father is on the offensive to preserve the tax.

In the spirit of accuracy, Mr. Nugent's dates are off by one year. 2010 is the year to die free from any estate tax and it comes back in 2011. You can see the full phase out (and back in) schedule here.

Our rulers in the House of Representatives did the right thing and passed a bill to make the estate tax repeal permanent today. However, the tougher battle will be the Senate which is controlled by little Tommy Daschole and several other leftists who are claiming that they will block any effort to repeal the estate tax. I know that I am in a very small minority in wanting to tell it like it is; but I don't intend to back off from pointing out the fact that anyone who votes to keep the estate tax in this country is a supporter of Communism.

KMK