Home conversion not a taxable event...

Q:

Subject: 1031 Exchange

Back in 2005 we sold a vacant property and had a gain of $130K and bought a $180K house using a 1031 exchange.. We have had it for a rental for 4 years.

Due to our financial situation, we have to sell our primary residence at a loss of $40K and move into our 1031 rental house and make it our residence house.

Do we have to pay taxes on the original deferred gain on our rental house? .

A:

Converting a business asset to personal use is not a taxable event, so no tax will be due for the year of the conversion.

However, down the road when you sell this property, you will need to possibly pay tax on some of the gain. The law was recently changed to require a five year look-back period. If you occupy the home as your primary residence for a full five years before selling it, you will be allowed to exclude up to $500,000 of profit on its sale. If you sell the home after less than five years of personal occupancy, the tax free gain will be prorated according to the amount of time it was used as a primary residence.

Your own personal professional tax advisor should be able to explain this to you in more specifics for your unique circumstances.

Good luck.

Kerry Kerstetter

Labels: 1031

Timing of Section 179

Q-1:

Subject: Section 179 question

Can the date of purchase be defined as the date placed in service. If payment is made this year, can it go toward next year's expense if not placed into service until then?

A-1:

You seem to be confused about when depreciation and Section 179 expensing become available for business assets. The key date is when the asset is placed into service; so there isn't actually any choice here. If you buy a new item this year and don't actually start using it until next tax year, the only year you could possibly claim Section 179 would be next year.

Your own personal professional tax advisor should be able to explain this to you in more specifics for your unique circumstances.

Good luck.

Kerry Kerstetter

Q-2:

Thanks, but as a practical matter in my business (I sell software to dentists) the docs expense is when they write the check (or when they charge it to their credit card, or when the first lease payment is made. Nobody comes around to see if it is being used and when it started being used.

So, you are saying they could opt to pay for it in 2008 and not place into service until 2009, therefore taking the deduction in 2009. This is requested at the end of the year sometimes if the doc has used up as much 179 expense as he has profit for the current year.

A-2:

Normally, this question goes in the opposite direction. People assume they can prepay for some business asset in December and claim Section 179 even though it isn't received or set up for use until next year.

As we all know, the tax system has a lot of the "honor system" built into it in regard to people claiming their deductions in the proper years. However, IRS does occasionally audit tax returns to verify that things have been handled properly. A canceled check is not sufficient documentation for a piece of business equipment or expensive custom software. Auditors will demand to see the purchase invoice and will check the delivery and installation dates to see if the year placed in service matches that shown on the tax return.

I have to say that you are sticking your neck out quite dangerously by daring to give tax advice to your customers. While they may play fast and loose with the technicalities of the years in which they claim their deductions, you run the risk of being sued by them if any of them were to get into trouble with IRS based on any such advice you provide. The smart thing for you to do is to advise each of your customers to consult with their own personal professional tax advisors who can work out appropriate strategies for when to pay for and deduct the costs of your software.

Good luck. I hope this helps.

Kerry Kerstetter

Labels: 179

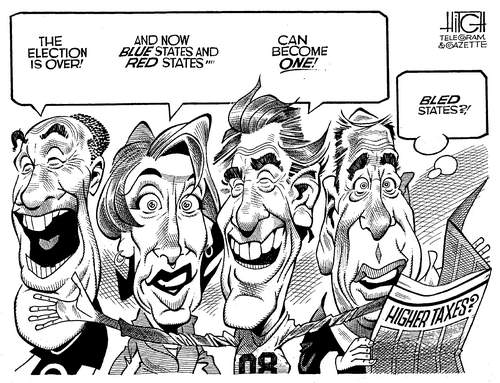

Obambi's Tax Plan

Excellent video of Obambi explaining his taxation policy, with editorial commentary from Penn Jillette.

This was produced before the election; but shows why those of us in the tax reduction profession are going to be super busy for the next several years.

Labels: Obambi

2009 IRS Mileage Rates

From the IRS website:

Beginning on Jan. 1, 2009, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be:

As described in Revenue Procedure 2008–72, the depreciation portion of the standard rate is 21 cents per mile for 2008 and 2009. This is useful info for calculating depreciation recapture on vehicles that are sold after using the standard rate.

Labels: Vehicles

A RINO wants to tax pets in the PRC...

A Recommended Sales and Use Tax Proposed by Governor Schwarzenegger Will Tax Veterinary Services - People are already calling this a “Pet Tax,” courtesy of the RINO governor of the PRC.

It's an understatement to say that those of us expecting some change in the big government mentality in Sacramento are sorely disappointed in the administration of Ted Kennedy's nephew in law. Rush Limbaugh put it quite well in today's show.

"Can you understand how Gray Davis is probably laughing himself silly? He was thrown out of office for stuff that made far more sense than this. I just say, wait 'til Bloomberg hears about this, the esteemed mayor of New York City."

There is already a movement to fight this new proposal, claiming that pets are not furniture, and shouldn’t be taxed as if they were.

Labels: StateTaxes

From the latest Intuit ProConnection newsletter:

New Law Extends and Expands Tax Breaks for Individuals and Businesses

Labels: NewTaxLaws

2009 Luxury Car Limits

Ahead of the official IRS news release, CCH has calculated the inflation adjusted luxury car limits for vehicles placed into service in 2009. Some of those limits have actually dropped from their 2008 levels.

Labels: comix

Offsetting other income with Sec. 179

Q:

Subject: 2008 Section 179

I found your info on the web. I have a quick question. I am looking at a cap gains tax on the capital account of an LLC which I left in January. The account is about $460,000 and the tax about $69,000.

I am considering starting a property restoration business and the equipment is about $20,000 to $30,000. I might also need a van. If I spend 30,000 on equipment, will that reduce my cap gains tax by $30,000 because I am deducting 100% up to $250,000?

Thanks,

A:

This is something that you need to work on with the assistance of your personal professional tax advisor because it is more complicated than you are assuming.

The first misconception you have is regarding how the Section 179 deduction reduces taxes. It is a deduction and not a credit; so it reduces taxable income and that reduces the income tax only by a percentage. It is not a 100% reduction of tax as a credit would be. The amount of actual tax savings will be based on your Federal and State tax brackets, along with several other factors. So, a $30,000 Section 179 deduction may only reduce your net taxes by only $10,000; not by $30,000.

The other big issue that you need to deal with is the limit on the Section 179 that you can claim based on your business related income. Normal capital gain income does not qualify for the Section 179 purposes, so the gain on your LLC termination can't be offset against new Section 179 unless it also includes business profit and depreciation recapture.

The best thing to do would be to have your personal professional tax advisor run some pro-forma 2008 figures for you based on the real info you have, as well as the different assumptions you want to test in order to get a realistic estimation of any potential tax savings from buying and starting to use new business equipment before the end of 2008.

Good luck. I hope this helps.

Kerry Kerstetter

Follow-Up:

Yes very helpful.

Thanks a lot.

Labels: 179

Corp Fiscal Years

Q:

Subject: C Corp fiscal tax year.

Hello Kerry,

I was interviewing an account for my taxes and he was telling me that the only choice for a C Corp fiscal year is either Oct. 1st or Jan. 1st. I could not find the info on the IRS web site and I knew you would know off the top of your head. Thanks for your time. I was wanting the July 1st to June 30th like you mention in some of your articles. Thanks for your time.

A:

A C corp can have a fiscal year ending at the end of any calendar month. I have some more info on fiscal years on my main website.

It looks like you need to find yourself a professional tax advisor who is a little more knowledgeable about such basic matters.

Consider yourself lucky that this person revealed his ignorance so early in your potential relationship.

Good luck.

Kerry Kerstetter

2008 Fixed Assets

Q:

Subject: 2008 section 179We have a "C" corporation that has a fiscal year ending September 30th. If we purchase equipment between 10/01/08 and 12/31/08, can we still get the addition 179 expense deduction and bonus depreciation?

Regards,

A:

That specific provision is currently based on the calendar year of 2008, so any assets that you do place into service from 10/1/08 through 12/31/08 will qualify for that special bonus depreciation on the 1120 you file for the FYE 9/30/09.

Your professional tax preparer's tax software should pick that up automatically. I know that my 2007 Lacerte software is automatically claiming the bonus depreciation on any asset that has a 2008 setup date.

There is also the possibility that the provision for the bonus depreciation will be extended for assets placed into service in 2009; but that will be up to our new rulers in 2009.

Good luck.

Kerry Kerstetter

Follow-Up:

Thank you very much .

Labels: 179

Section 179 Webinar

Since it is one of the largest potential deductions available on income tax returns, the Section 179 expensing election generates a lot of email from people who are confused about it. In the last few months, I have been receiving at least one each day, often from salespeople who are looking for ways to induce their customers to buy more products. These sales pitches often include a flyer or short article on the benefits of Section 179.

I am still plowing through a massive backlog of email, and I noticed one yesterday from a scientific equipment company promoting a free online seminar on December 2 presented by a CPA on what they call “Tax Code 179.” It appears to be open to anyone and aimed more for small business owners than for tax professionals. It doesn't appear to qualify for CPE for tax pros; but it may still be useful for the newer ones.

I have no connection with any of the parties involved and don’t even know how I go on that particular mailing list. I am passing it along in the hope that some folks will check it out and not need to send me so many repetitive questions on the issues of Section 179. You can sign up for this webinar at Gerber Scientific Products’ website:

www.gspinc.com/taxcode179/

Labels: 179

2008 AMT Exemptions

Q:

Subject: any update on AMT for 2008?

Just trying to get a handle on what my liability will be. Last year we crept over the line and we subject to AMT for the first time. I suspect we will be again this year, but would like to get a better fix on how big it will be.

thx

A:

As part of the big bail-out bill that was passed last month, the AMT exemption amounts were increased for 2008 to:

$46,200 for people filing as Single or Head of Household

$69,960 for Married Filing Joint or Qualifying Widow

$34,975 for Married Filing Separate

As it stands now, these amounts will drop for 2009 to:

$33,750 for people filing as Single or Head of Household

$45,000 for Married Filing Joint or Qualifying Widow

$22,500 for Married Filing Separate

Whether those figures will be changed is completely up in the air now that we have an anti-success Socialist administration ready to take over control of the tax code next year.

You can download the complete 24+ page pdf summary of the latest tax bill from The TaxBook at:

www.thetaxbook.com/updates/thetaxauthority_update_service/pdf/bulletin/10-10-2008_update.pdf

Good luck. I hope this helps.

Kerry Kerstetter

Labels: AMT

Bonus Depreciation - New or Used?

Q:

Subject: Special Bonus Dep and Section 179

Hello:

I saw on your website that used vehicles qualify for section 179 deduction, but will a used vehicle qualify for the 50% special bonus depreciation allowed under the 2008 eco stimulus package…or does it have to be a new vehicle?

Thank you

A:

While Section 179 deductions have always been available for business equipment that had been previously owned by unrelated parties, one of the requirements for special first year bonus depreciation has always been that it was only available for the first user of that specific asset. So, a used vehicle will not qualify for the special bonus depreciation.

Your personal professional tax advisor should be able to give you more specific advice for your unique circumstances.

Good luck.

Kerry Kerstetter

Follow-Up:

Super. Great website. Thank you for your response and clarification. Best of luck to you!

Labels: 4562

Taxes: A Fair Share for All – Jonah Goldberg looks at one of the idiotic oxymorons that I have always despised about the tax system in this country, the Progressive tax rate structure that is actually a counter-productive punishment and persecution of success. Considering that the root of “progressive” tax rates is 0Bambi’s spiritual mentor, Karl Marx, the chances of this going away any time soon are precisely zero. In fact, it will make the use of the income shifting and smoothing techniques I have been discussing for several decades even more worthwhile.

Labels: TaxHikes

Preparing for 0bambi Tax Increases

As I have been telling everyone for months, while the election of an avowed Socialist as President would be absolutely terrible for the future of the United States; it is the best thing possible for those of us in the Tax Minimization profession from a purely selfish viewpoint. The upcoming full bore assaults on the ability of people to hold onto their own income and assets will require many more planning strategies than ever before. I am not in the least happy about the results of the election, but we have to find our silver linings wherever we can.

I was checking the info on the TaxCoach website this morning, actually looking for something on the new higher AMT exemptions for 2008. They haven’t yet updated the AMT amounts for the increases that were in the October Bail-Out bill. However, I checked their Client Alerts and noticed they already had one up for the upcoming changes based on yesterday’s election.

Higher Taxes Are Coming. Count on Us to Help! It's official - Democrat Barack Obama has been elected 44th President of the United States. Back in 1800, Thomas Jefferson called his own election a "revolution" because it marked the first time power passed from one party to the other. This election promises to be more revolutionary than most.

Obama has proposed the most sweeping changes to the Tax Code in a generation. He plans to raise the top marginal rate from 35% back up to 39.6%, as well as raise rates on corporate dividends and capital gains. He plans to impose a new employment tax on earned income above $250,000. And he promises to create new tax credits for college tuition, homeowners who don't itemize, and employers who create new jobs. But who knows how the struggling economy may force him to change plans?

We know you may be worried that the new administration will mean higher taxes. So we're writing to tell you we'll be following all of the new administration's proposals closely to protect you from paying any more than you have to.

We realize there will be no shortage of places where you can learn about coming tax developments, from television news, newspapers and magazines, and the internet. But you can count on us to cut through the hype and clutter, to give you the answers you need for your unique circumstances.

None of these proposals require you to act today. But together they make our tax planning services even more valuable. Call us with your specific questions.

Labels: TaxHikes

Wealth Redistribution

It’s not just the 0Bambi team who are frightenly open about their devotion to Marxism. Thanks to Rush Limbaugh for playing this speech by DemonRat CongressCritter Jim Moran of Virginia, which includes the following quote:

We have been guided by a Republican administration who believes in the simplistic notion that people who have wealth are entitled to keep it and they have an antipathy towards means of redistributing wealth. And they may be able to sustain that for a while, but it doesn't work in the long run.

Labels: TaxHikes

S Corp taxes under 0Bambi?

Q-1:

Subject: S Corporations

Tax Guru,

I am a Obama supporter but work at a S Corporation. Needless to say, I am getting hammered for my voting preferences.

Can you tell me if Obama will destroy S Corporations. I read he would increase from 35% to 39% on scorps but can not find any evidance that he will not due away with them.

Any help would be greatly appreciated.

Obama & Scorp supporter.

A-1:

S corps don't pay taxes. Their income is reported and taxed on the 1040s of the shareholders.

Since Obama is promising to raise the tax rates for 1040s, the end result will be higher taxes for the shareholders on their S corp income.

I don't see any push to eliminate S corps because they are often taxed at higher rates than C corps.

I hope this helps you understand.

Kerry Kerstetter

Q-2:

Thank you for your response.

I currently have around 40,000 in stock through our S-corp. However I have never seen my stock or dividends on my yearly income.

Our company is roughly 2400 people, employee owned, with 6 "owners", 5 real people and one account (representing the esop balance).

If I dont pay taxes on my dividends ($5.50 per share last year) until I retire then is S-corp advantagous to C-corp?

Thank you so much for your responses. I am trying to understand the situation but find it beyond my grasp at this time.

Please advise..A-2:

It sounds like you have an interest in a tax deferred retirement account. You're little vague on the dividends you received, but I'm assuming that those were deposited into your share of the retirement account and not actually paid out to you directly.

While the details of retirement plans can vary, the basic concept is that you pay no taxes on any income it earns while your money is inside the plan. When you start to draw it out, you will pay income taxes on your distributions at ordinary income tax rates for the years of the withdrawals. If you are under 59.5 years old when taking distributions, you may also be subject to the additional 10% Federal (+ your state's) early withdrawal penalties if you don't meet any of the exceptions for that.

I really don't see how whether your employer is a C or S corp will make any difference to you in regard to your taxes on your share of this retirement account.

Your retirement account administrator and your personal professional tax advisor should be able to explain how this all works in much more specific detail for your unique situation than I possible could.

Good luck.

Kerry Kerstetter

Labels: corp

0Bambi Theme Song

Thanks to John J. Miller at NRO for the link to this short video on what the DemonRats have in mind for our money if they win next week.

Labels: TaxHikes