Debunking Bogus Rumors

Snopes.com had some interesting and timely topics in their most recent weekly newsletter.

FDIC protection – Many people are spreading false info on how this works.

We Deserve It Dividend – Nutty proposal I have already received in several spam emails.

Labels: scams

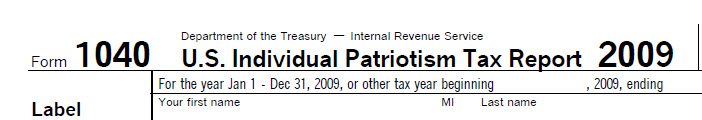

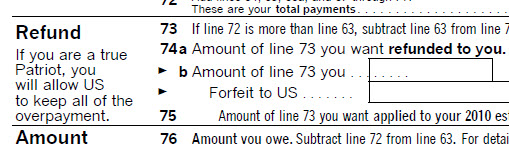

Draft 2009 1040?

I have worked up a draft of what our 2009 1040 could look like if the DemonRats were to win back control of the Executive Branch.

Full Form (2 page pdf)

Two of the main changes:

On Page 1:

On Page 2:

Labels: TaxForms

Will the Obama-Biden administration change our favorite agency's name to something more fitting, such as the Department of Patriotism?

MySpace boast nets partiers $320K Okla. tax bill - Interesting tactic by the OK Tax Commission, trolling for possible tax cheats bragging on the internet. Remember that Big Brother is watching everything you say and checking that you paid all of the taxes on all of the income you claim to have made.

Labels: StateTaxes

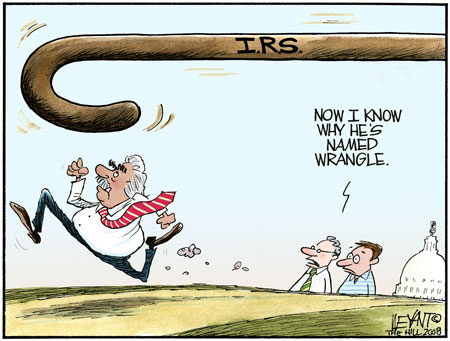

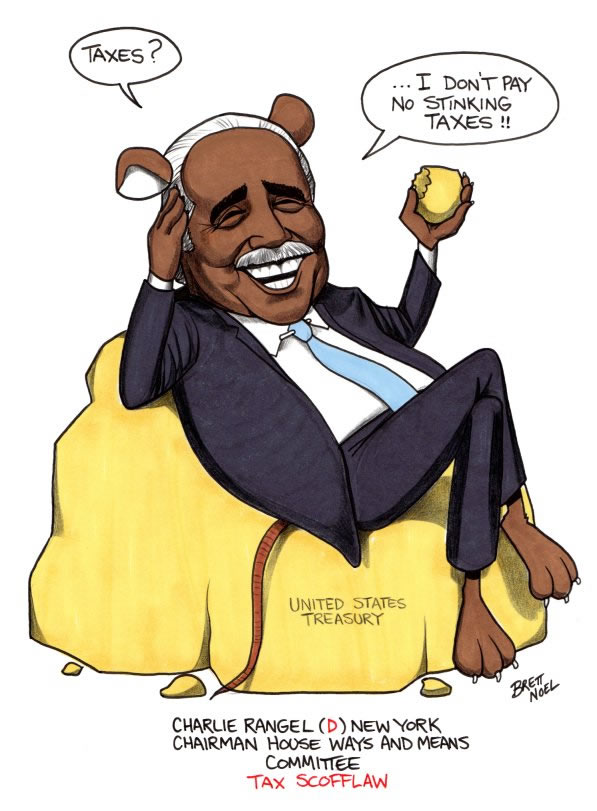

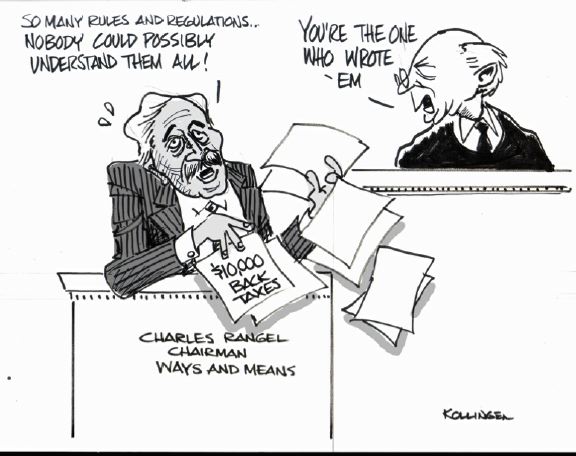

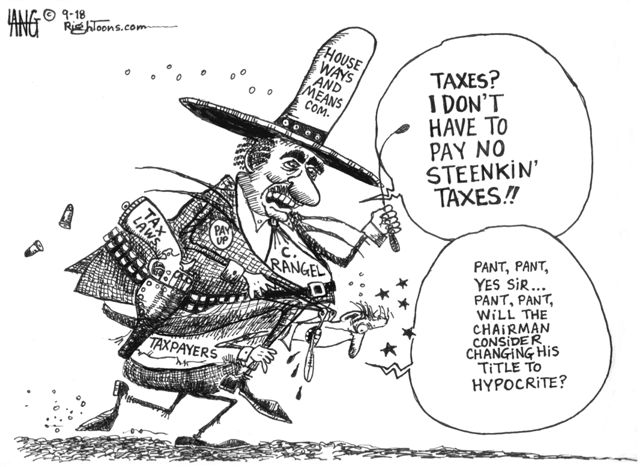

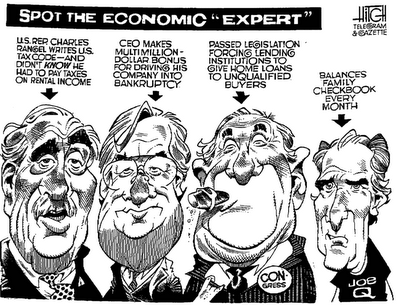

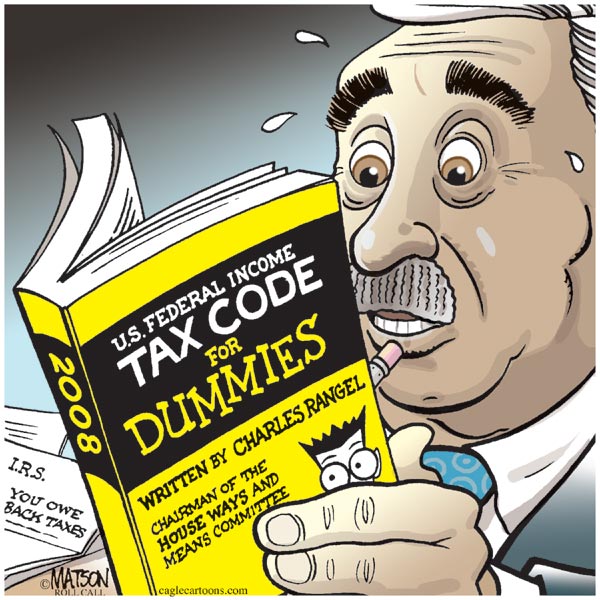

Rangel Audio Parody

Rush had this funny parody of Charlie Rangel discussing his tax problems with his new forensic accountant on his Friday show.

If this player doesn't work, you can also get the MP3 file with this direct link.

Dim Jokes

From Thursday’s late nite shows, via NewsMax:

Leno:

The stock market was up 400 points today, or as the Democrats call it - terrible news.

Barack Obama said again today that he wants to raise taxes on the rich - that's provided by November anyone is still rich.

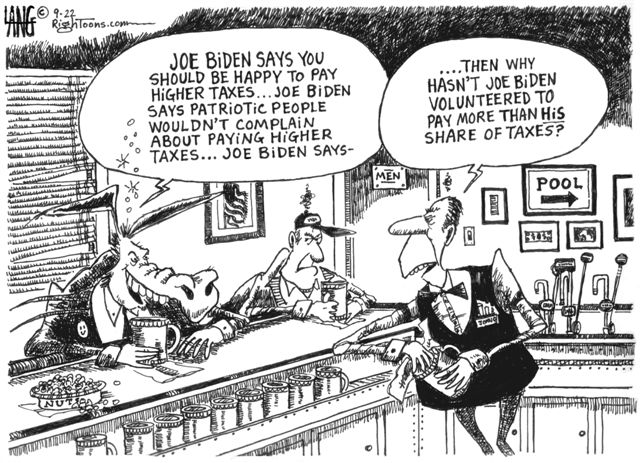

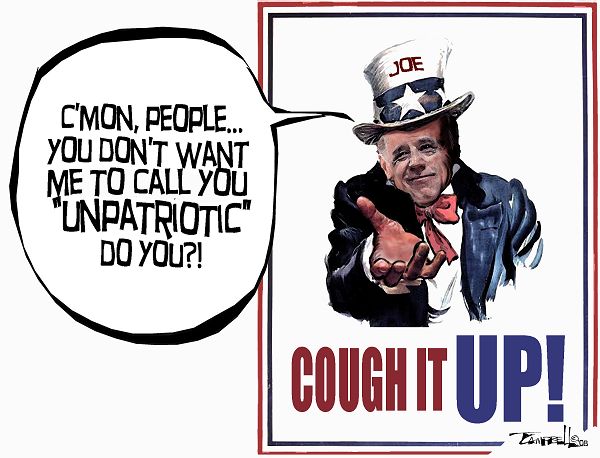

That seems to be the theme: In a speech today, Joe Biden said that paying higher taxes is patriotic. The Republican strategy on Joe Biden? Let him keep talking.

The Democratic-controlled Congress said they are going to adjourn for the rest of the year. They said regarding the financial crisis, no one knows what to do. Well, that's a ringing endorsement to re-elect them - "You're on your own! We're leaving."

Kimmel:

The government had to bail out two huge companies, and today they strongly hinted that they'd bail out others . . . at taxpayers' expense of course. It's all part of a new approach that leaders in the White House and Congress are taking - it's called socialism.

Corp tax rates don't change

Q:

Subject: C- corp tax rates

Is this C-Corporation Income tax rate schedule published on your website for 2007 or 2008?

Thank you for your response

A:

Unlike individual income tax rate brackets, which are adjusted annually for inflation, the corporate tax rates are only adjusted every few decades, if ever, by our rulers in Washington.

The corp rates shown on my website have been in effect for the past several years and will most likely be in effect for several more years.

I hope this helps.

Kerry Kerstetter

Labels: corp

Are you patriotic?

Biden calls paying higher taxes a patriotic act - I've been fighting this Lefty definition of patriotism all of my career. My driving force has always been this quote from Judge Learned Hand, which Jonah Goldberg has posted in The Corner.

Anyone may arrange his affairs so that his taxes shall be as low as possible; he is not bound to choose that pattern which best pays the

treasury. There is not even a patriotic duty to increase one's taxes.

Over and over again the Courts have said that there is nothing sinister in so arranging affairs as to keep taxes as low as possible. Everyone

does it, rich and poor alike and all do right, for nobody owes any public duty to pay more than the law demands.

Labels: TaxHikes

2009 Tax Rates

As has been the case for the past several years, CCH has been the quickest to use the August 31, 2008 CPI figures to calculate the Federal tax brackets that will be in use for 2009 1040s.

As I had been predicting, the cumulative increase in the CPI since the last bump in the annual gift tax exclusion was enough to increase it to $13,000 for 2009.Hurricane Ike clobbered our area; so I’m running further behind than normal; but will try to set up my own page with the 2009 schedules as soon as I can.

Update: The new 2009 figures have been posted on my main website.

Labels: taxes

Gifts From India

Q-1:

Dear Sir, Guru Kindly respond to me pl 1) I need to send a sum much more than 12 k to my son in USA , in one Financial year. I am a NRI, Indian, & have no USA limitations to send money to my son as 12k. from my side. As it is generated out of India & out of salary. 2) Now can my son receive money from me (parents) without any tax at his end. Will the Tax department treat anything above 12 k as other income & charge Income tax, for sum in excess of 12k. r forb that matter Gift tax? 3) Will it help us to send the money by increasing the number of Donors from our side to avoid tax from his end. We are clear to send , & have no problem with our tax regime. Kindly revert please

Kindly ignore my previous Email pl. pl. respond to the below instead pl. sub.What is the limit a Donee can receive cash gift in a Financial year in USA from single or multiple Non Resident, non US donor/s. 1) How can a donee in USA receive money from parents without any Gift tax at his end from a third country where they are employed? Is the Gift restriction of $.12k, is only for a USA Citizen donor? Will the Tax department treat anything above $.12.in USA as other income of the Donee & charge Income tax,/gift tax, for sum in excess of $.12k If received as Gift from out side country sent by parents. 2) Is there a restriction that amounts received by the Donee in USA, from a PARENT donor non US Citizen, out side USA should not exceed 12k? 3) Will it help the Donee to receive money by increasing the number of Donors, to avoid gift/income tax as other income from his end during a Financial year? Kindly revert please

A-1:

I have no knowledge or experience with the tax system in India, so my comments can only cover the USA tax systems.

You seem to be under the impression that people in the USA have to pay tax on gifts that they receive. That is actually not the case at all. Gifts are one of the very few things that are statutorily exempt from tax on the recipients. Any gift tax obligation, or even requirement to report larger annual gifts is on the giver (aka donor).

Again, I have no idea how the gifting taxes are structured in India; so you need to work with a professional tax advisor in that country.

However, for your relatives in the USA who will be receiving gifts from you, there is technically no dollar limit on the amount of gifts they can receive that are exempt from any taxes on them.

In addition, as their USA professional tax advisors should warn them, they should be sure to have excellent documentation of the fact that any monies received are in fact bona fide gifts and not for anything that could be construed as taxable, such as proceeds from the sales of assets or compensation for services rendered. Out tax authorities in the USA do operate from the presumption that any money received is automatically taxable income unless the recipients can prove otherwise.

Good luck. I hope this helps.

Kerry Kerstetter

Q-2:

Thank you Sir,Yes, I am fully aware of the Tax Laws in India fully. Your notes surely helped. But a little doubt exists. pl. see below. I feel the term GIFT is only for the DONORs concern. For Donee it is an additional income as per below. (2)Does the Tax books say that a Donee(1)they should be sure to have excellent documentation of the fact that any

monies received are in fact bona fide gifts and not for anything that

could be could be construed as taxable, such as proceeds from the sales of assets or compensation for services rendered.(2) A resident of the United States, (Warning: A foreign citizen living in the United States for more than 182 days is considered a taxable U.S. resident by operation of IRS Code and is taxable on his world-wide income, even if he/she never did any business in the United States.Does above (1) phrases over rides (2) for Donee. We have no problem here at all.Thank you for your time, I appreciate your kind advice.RegdsWhat do you think of this below please. It’s the law: "U.S. Persons" are taxable on their word-wide income, no matter what/where/when/how the source of such income, unless there�s an exception or exemption i.e. Tax Treaty. A GIFT is not under Tax treaty A "U.S. Person" is defined by Internal Revenue Code Section 957(d) as: A citizen of the United States, A resident of the United States, (Warning: A foreign citizen living in the United States for more than 182 days is considered a taxable U.S. resident by operation of IRS Code and is taxable on his world-wide income, even if he/she never did any business in the United States regds

Dear Sir, I have understoof your very helpful, simple advice. I am grateful. I am fully aware of Indian Laws. Only one thing i wanted to clarify is, My son who will be the Donee in USA, can he receive in ANY one particular Financial year indefinate amounts? Though our contribution & need is just 60k.$. to buy his first house to minimise loan from the bank. Will the tax authorities treat the gift from parents as a additional income to Donee, as USA Computes Tax on Global receipts. pl. see below A "U.S. Person" is defined by Internal Revenue Code Section 957(d) as: A citizen of the United States, A resident of the United States, (Warning: A foreign citizen living in the United States for more than 182 days is considered a taxable U.S. resident by operation of IRS Code and is taxable on his world-wide income, even if he/she never did any business in the United States) A domestic corporation, A domestic partnership; or An estate or trust other than a foreign estate or trust. Thank you kindly.

A-2:

I see why you may be confused; but the distinction is in the definition of "Income." Gifts are not considered to be income and are thus not taxable to the recipients (donees).

Taxable income is generally money received in exchange for something; such as services (wages), items (capital gains), or use of money (interest & dividends). Gifts, by definition, are not given or received in exchange for anything.

Your relatives here in the USA should be working with their own professional tax advisors in the USA who can give them more specific suggestions on how to properly document and report the gifts they receive.

Good luck. I hope this helps clarify things for you.

Kerry Kerstetter

Follow-Up:

Dear Mr. Kerry Kerstetter,

Your recent message clarifies my below doubt for

It's the law: "U.S. Persons" are taxable on their word-wide income, no matter what/where/when/how the source of such income, unless there's an exception or exemption i.e. Tax Treaty.

The point is " A gift received by a Donee in a single Financial year or more is not an Income by Definition."

We are much obliged.

with all Sincererity

I added:

While it probably doesn't apply in this case, I just wanted to add some more clarification on the reporting rules for people in the USA who receive gifts from outside of the country.

If more than certain amounts are received during the year, the recipient is required to file Form 3520 with our IRS, which is strictly informational and has no actual tax obligation.

The following is from the instructions for Form 3520 for who has to file it:4. You are a U.S. person who, during the current tax year, received either:

a. More than $100,000 from a nonresident alien individual or a foreign estate (including foreign persons related to that nonresident alien individual or foreign estate) that you treated as gifts or bequests; or

b. More than $13,258 from foreign corporations or foreign partnerships (including foreign persons related to such foreign corporations or foreign partnerships) that you treated as gifts.

I thought you said your goal was to gift $60,000 to your kids, so this shouldn't apply; but they should check with their own personal professional tax advisors in the USA.

For further info, you can download the 3520 and instructions from the IRS website.

I hope this info is useful for you.

Kerry Kerstetter

His Reply:

Thanks a lot Mr. Kerstetter,

I understood what you have said. So to avoid any unforeseen complications, what we are trying to do is, by Dec-2008 my wife & I will make 2 gifts of $.12 k each =$.24k. Later in January-2009, will make another $.12K x 2=$.24K. sO we are within Laws.

Rest we may do it subsequently in the same year or following year.

As I read below the provisions of form 3520, may not apply,as we are not gifting more than 100k in a year or even cummulatively in years, nor we are foreign corporation, nor partnerships. I feel we are within Laws. We try to be Law abiding citizens every were. We have no large amounts to give, as what we give is out of affection to our wards. Just a sacrifice.

Since $.24k from parents is allowed, in any 1 single Financial year, I may feel the question of filing form 3520 may not necessarily be required or if he does it there may not be harm to keep peace of mind.

However, I saw you placing my query on your NEWS Bulletin. Thank you, it may help many over there.

Kind Regds

Labels: Gifting

Tax Credit to Aid First-Time Homebuyers; Must Be Repaid Over 15 Years - IRS explains how the new credit, aka interest free loan, works.

How Not to Balance a Budget - The WSJ looks at how higher state taxes motivate more people to leave those states. This is common sense to almost everyone except the rulers in Sacramento and Albany. They continue to believe that people will just stick around and subject themselves to more and more financial rape.

Labels: StateTaxes

No Ads Accepted

Q:

Hello,

I'd like to buy an ad on your page : http://www.taxguru.org/incometax/prepare.htm.

The ad would be for a website which offers tax attorney.

I don't have a huge budget, but I'm sure there is a reasonable price we can arrange.

Please get back to me if you're interested.

Thanks!

A:

I do not sell ad space on my websites.

If you feel you would be a fit for my page on other tax pros who share my philosophy of using tax laws creatively to help clients minimize their tax burdens, I may be willing to list you on my page of Other Tax Pros.

Kerry Kerstetter

Follow-up: She did respond with a website that I didn’t feel was appropriate to include on mine.

IRS Too Nice?

From Ohio CPA Dana Stahl:

Mr Guru - thought you'd find this interesting, but full of bulls**t!

Has the IRS lost its appetite for collecting payroll tax?

DS

My Reply:

Dana:

That article sounds so similar to all of the other scare stories on the dreaded tax gap crisis, and about as accurate, using fabricated numbers as a justification for giving IRS more Draconian powers than they already have.

Kerry

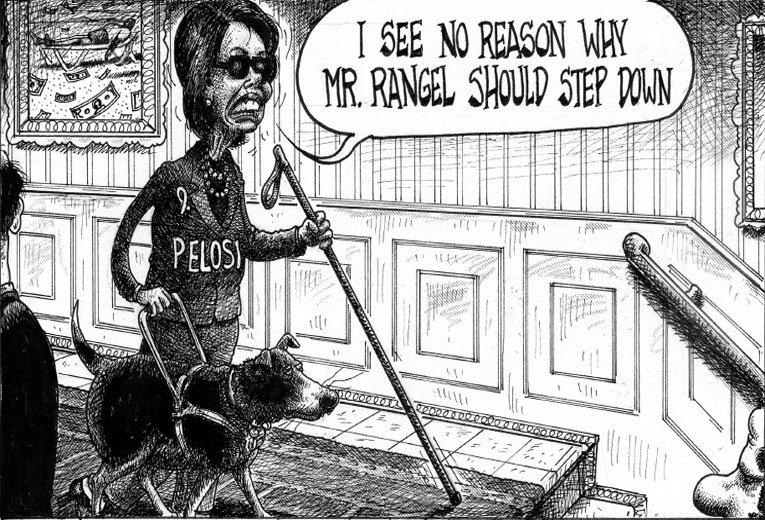

More errors for Rangel; hires new accountant - It may be sick, but there's just something so satisfying about seeing that the head of the congressional tax writing committee can't keep his own taxes straight.

The Education of Charlie Rangel - From the WSJ

Labels: Rangel

Charlie Rangel vs. Wilbur Mills

From a Reader:

Subject: OUPblog and Rangel

Dear Kerry,

I am the blog intern at Oxford University Press, and I found your blog very informative and humorous (I love the cartoons!).

I noticed that you recently posted about the scandal over Congressman Rangel’s failure to comply with tax law. Edward A. Zelinsky recently posted on this topic on our site, and I thought that perhaps you’d like to recommend it to your readers.

http://blog.oup.com/2008/09/rangel_tax/

Zelinsky is a Professor of Law and the author of The Origins of the Ownership Society: How The Defined Contribution Paradigm Changed America. He discusses Rangel’s situation in light of the achievements of his predecessor, Wilbur Mills.

If I can help you in any other way, please let me know!

Best,

My Reply:

That is a very interesting comparison of the differences in the Ways & Means Chairmen over the decades.

Even though I wasn't yet living in Arkansas back in the 1970s, I remember following many of the exploits of Wilbur Mills, both on the tax writing committee, as well as with his friend, Fanne Fox.

I would be glad to post a link to this on my blog.

Thanks for sharing that and feel free to pass along other ideas you have for items I should add to my blog.

Kerry Kerstetter

Here is a short news video covering Rangel’s current problems.

Tips on Donating Your Car

Here is a short video with Tom Herman of the WSJ discussing the rules for claiming a deduction for a donated vehicle.

After all of these years reading Tom Herman's columns in the WSJ, this is the first time I have seen what he actually looks like.

Over the years, I have discussed this topic several times and the biggest misconception seems to be with the term Fair Market Value. Even Mr. Herman glosses over this point in this video.

Most people assume that the Kelley Blue Book value is gospel as establishing a vehicle's value. The truth is that the only true determination of an item's worth is what it will actually fetch on the open market, as per this definition from all over the web.

The price that an interested but not desperate buyer would be willing to pay and an interested but not desperate seller would be willing to accept on the open market assuming a reasonable period of time for an agreement to arise.

That is why the relatively recent IRS rule requiring people to use the charity's actual sales price of the vehicle for the charitable deduction makes a lot of sense. That isn't something you ever see me say very often; IRS doing something that makes sense.

I don't follow used car prices or track what Kelley Blue Book has been doing in response to the higher fuel prices. However, if they haven't dropped values of gas hogs to reflect their decreases in the real world, that is no excuse to consider the Blue Book prices as Fair Market Value.

Update:

A day after posting this, I sent the following to a client:

We received your 2007 personal tax organizer and other docs. I've

looked them over and the only item that is obviously incomplete has to do with the Jeep you donated to St. Vincent de Paul (SVP).

I see that you wrote $2,000 in the organizer as the value, but that won't be enough documentation. As the letter from SVP says, you need to have a 1098-C from them showing how much they actually sold the vehicle for if you are going to claim a value of more than $500. I didn't see a 1098-C among the documents that you sent in. Please contact SVP to obtain a new copy of that form or else we will have to stick with a deduction of just $500.

To help you understand more about this issue, I have attached a copy of the page from The TaxBook, my main tax reference book with the section on vehicle donations circled in red. Please look it over and see how your situation matches up with the examples shown.

Also, just by coincidence, I recently posted an entry on my blog, with a video from the WSJ, on exactly this subject.

Thanks for you help with this. Let me know if you would like to set up a phone appointment to discuss the details of this in more depth.

Kerry

The client wrote back:

I don't have any such documentation. In that case, I'll go ahead and claim $500.

Thanks,

Labels: Charity, Vehicles, video

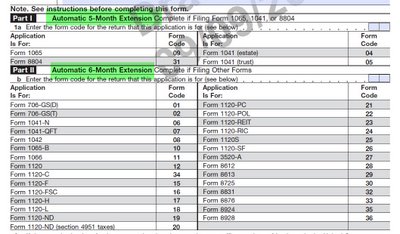

Revised Extension Form

IRS has posted a new draft of the revised Form 7004 for business tax returns.

The biggest change is the inclusion of both a five month and a six month extension to reflect the new shorter time that will be allowed for some 2008 tax returns, including partnerships (1065) and trusts (1041).

(Click on image for full size)

Labels: extensions

Closing the Information GAAP – Interesting look at plans to replace GAAP (Generally Accepted Accounting Principles) with IFRS (International Financial Reporting Standards) here in the USA. I always get a kick out of non-accounting people who fell for the stereotype of tax and accounting being so cut and dried as to be boring because nothing could be further from the truth. Tax and accounting rules are constantly changing and evolving and will never stop doing so.

Labels: Accounting

Rangel Has A Bad Chair Day – Congressman Charlie is now amending his prior tax returns and trying to convince IRS that he just accidentally failed to report over $75,000 of rental income and didn't do so intentionally, which could subject him to criminal sanctions.

Of course, we all know that his position as head of the tax law writing Ways & Means Committee means he will be treated by IRS exactly as any other taxpayer would be.

Labels: Rangel

A New Way to Tap Home Equity – A new twist on equity sharing arrangements, such as this plan from Grander Financial.

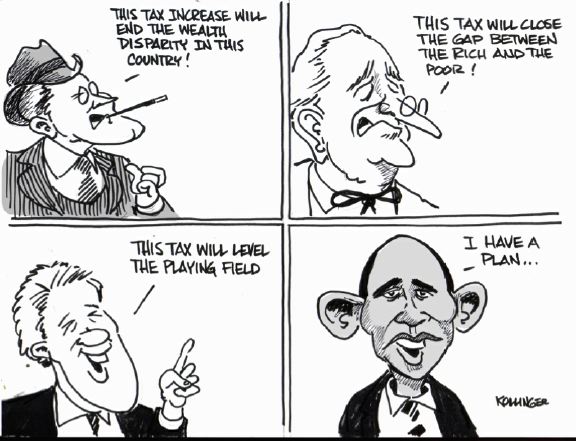

Winning campaign strategy?

Walter Mondull can attest to how effective it is to promise to raise taxes during a presidential campaign.

Labels: comix, Obambi, TaxHikes

The fox guarding the henhouse?

RANGEL ADMITS TO VILLA INCOME - Interesting story about how the top DemonRat in charge of the Federal Tax Code has accidentally failed to report over $75,000 of rental income on his tax returns and Congressional disclosure forms.

When can we expect the IRS to indict him for tax fraud? Let's not hold our breath waiting for that to happen.

I guess this is another example of the old "it takes a thief to know one" in relation to his constant rantings about the infamous "Tax Gap" and how everybody is a tax cheater so that we need to have tougher tax enforcement. He does know how easy it is to pocket tax free rental income.

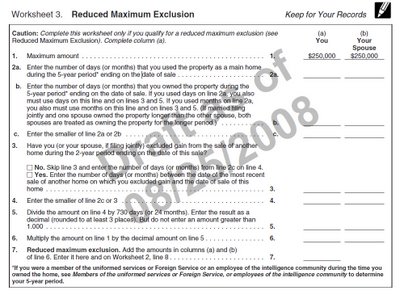

Reduced Sec 121 Exclusion Worksheet

As I was perusing the latest draft tax forms on the IRS website, I came across this file that contains some new worksheets and other info for Publication 523, which deals with the tax free sales of primary residences.

What I was mainly interested in is the brand new provision in the law that limits the tax free exclusion for homes that were also used as a rental or second personal home. For that calculation, IRS has this new worksheet, which is on Page 7 of the draft pdf file.

(Click on image for full size)

Labels: 121

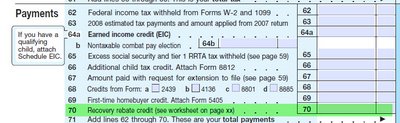

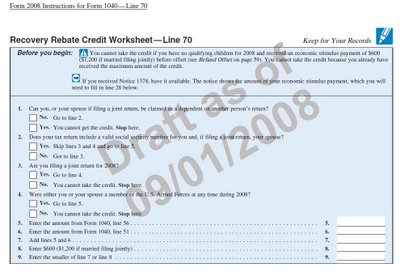

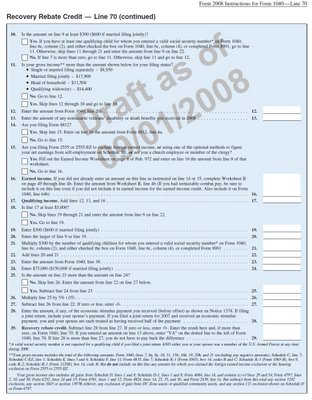

Recovery Rebate Credit Worksheet

As we have discussed quite a bit, there is a lot of confusion over how the rebates will be handled on the 2008 tax returns, both for people who receive checks and for those who don't.

IRS has just released this draft of the instructions for the 2008 1040. On pages 18 and 19 are the rebate credit worksheets for computing the amounts to enter on Line 70 of the 1040.

From the 9/1/08 draft of the 2008 1040 form:

(Click on image for full size)

I used my trusty SnagIt program to create the following images of these worksheets.

Part 1 from Page 18:

(Click on image for full size)

Part 2 from Page 19:

(Click on image for full size)

Labels: Rebates