More From The Tax Cut War Front

The Bad Guys:

Mixed Feelings on Scaled-Back Tax Cut

The Good Guys:

Short-sighted senators must rethink their position on the Bush tax-cut plan.

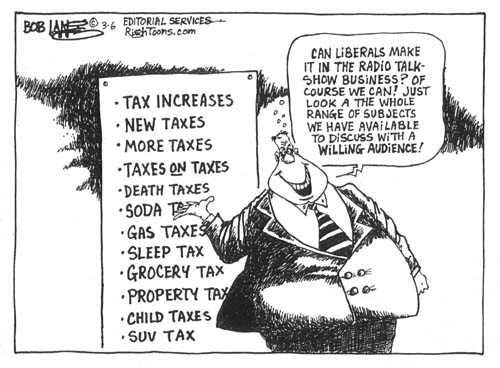

As is normally the case, the media's overwhelming left-wing bias does mean that we are outnumbered in terms of media coverage.

Dismantling Prop 13

25 years ago, the voters of the PRC passed a ground breaking property tax reduction measure and limit on future taxes. It shouldn't be any surprise that, given the deep financial hole the rulers out there on the Left Coast have dug for themselves, they are looking for ways to unravel the tax limits in Proposition 13. Just as no tax is temporary, no tax limit is permanent.

KMK

Tax Cuts Still Possible

It was good to see this claim that the friends of capitalism are going to keep up the fight for the full Bush tax cut. It seems that the only way the Senate was able to reduce the plan, as it did last week, was because a couple of dim bulb GOP Senators fell for the Social Security lock box scam and voted with the DemonRats. As has been illustrated countless times, intelligence is no requirement to be elected to positions of power.

KMK

CCAGW Warns Congress Not to Use War Supplemental as an Excuse for Pork

That's as realistic as asking Bill Clinton to keep his hands to himself when he visits a Hooters restaurant. Some impulses are truly impossible to resist or control.

State Taxes

This is an interesting look at the issue of the tax burden on residents of various states, as the rulers of the PRC debate increasing their income taxes even more. The wiser among them realize this will just compound the problem even more by motivating more people and corporations to move to nearby states with no income tax, such as Nevada and Washington.

As pointed out in the article, income taxes are just one piece of the overall tax burden. Most states without an income tax make it up through other means, such as sales and property taxes. This is why there is no cut and dried answer to the question of which state has the lowest overall tax burden. The answer would be different if you are a property owner or a renter.

However, the cited examples of average per capita state taxes are interesting. For 2000, Alabama had the lowest ($2,117) and Connecticut the highest ($4,600). With the PRC's average burden rated at the tenth highest ($3,550), it seems like too many rulers in Sacramento feel safe in raising taxes.

Also interesting in this article is the almost universal appeal of soaking nicotine addicts with increasing taxes. They have become virtual pariahs of our society, supposedly deserving of increasing financial punishment for their sin.

KMK

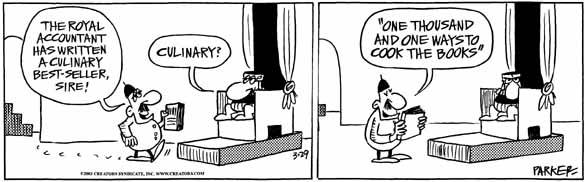

Making tax cheats pay up can pay off

However, before striking it rich by turning in all of the tax cheats you know, make sure your house is in order. I have seen plenty of cases where informants had the whole thing bite them in the butt when the tables were turned on them. That's in addition to the inevitable retribution from the persons being turned in.

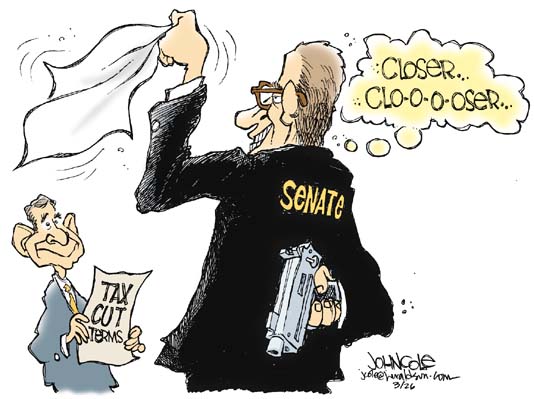

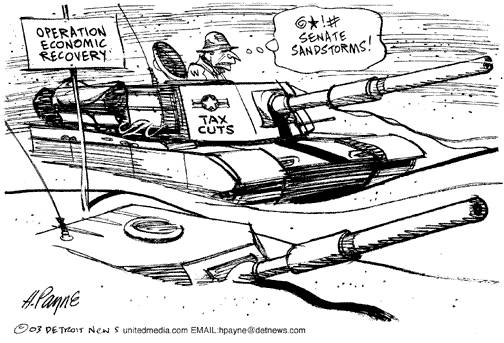

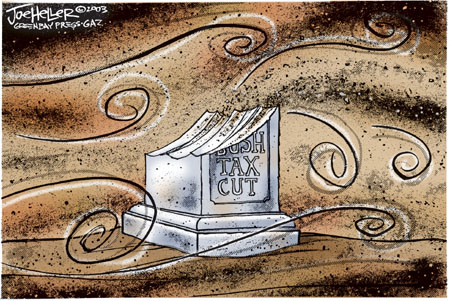

It is a fact that the momentum for the tax cut has been slowed by the Iraq situation.

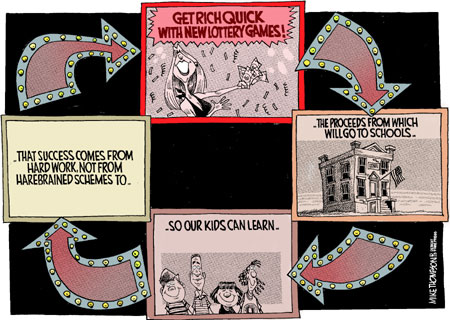

While a few of the editorial cartoonists around the country seem to grasp that, most of them feel a need to continue to spread the Left's lies about the tax plan, such as it's only for the evil rich, it is irresponsible in times of war, and it will increase the deficit. All of those are untrue and will not be tolerated here. Our rulers in DC, especially the Senate, need to focus on the truth that reducing tax rates will encourage much more economic activity and more tax revenue, and fight off the Left's propaganda machinery.

Estate planning has a lot of twists.

Some parents let their future heirs know what to expect, while others keep it a secret. My instinct is that giving your kids a reason to hope for your early demise may not be the wisest move.

Who's smarter?

Some more details on how foolish it is to trust Hollywood lefties for foreign affairs advice over the officials in the Bush administration. Playing a scientist or other intelligent person in a movie doesn't magically implant a real scientific education into the brain of actors.

This is why IRS loves withholding of taxes before you are paid. If they didn't snatch the money up front, and people had to write actual checks for their taxes, they would catch on to how much they are paying in taxes; to say nothing of the fact that most people aren't disciplined enough to save money for taxes after paying for everything else.

Reducing tax rates will stimulate economic activity.

Those holding up the cuts are intentionally stifling the economy for their own political benefit. Tom Dashole and his Fellow Travelers in the JackAss Party want the country to stay in a recession so they can exploit it in 2004.

Luckily, IRS does give a lot more advance notice before swooping in (for normal non-criminal audits). However, let's hope this doesn't give them any ideas.

American First, Journalist Second

Neil Cavuto, and most of his colleagues at Fox News, definitely have their priorities straight. The other so-called journalists, who are actively rooting for the USA to lose in this effort in Iraq, are pathetic disgraces and as unappreciative of the freedoms and rights we have here as their fellow traveler Hollywood lefties. I'm sure Walt Disney is spinning in his grave over how his company and its ABC News crew (led by Canadian socialist Peter Jennings) hate the United States and what it stands for so much.

Any journalist who claims s/he must maintain perfect objectivity in a conflict such as this would stand by and watch a little girl get run over by a truck rather than get involved in the story. There are times when common decency as a human should be more important than some ridiculous journalistic standard of objectivity and impartiality.

I am glad to see that the public is responding to the decency and common sense shown by the Fox News crew by relying on it more than the anti-American news sources, which used to have monopoly control over what we peons were allowed to know. I think Cavuto and the Fox News team are actually much better journalist for understanding the difference between right and wrong. How can we trust anyone who refuses to take sides in such an important matter?

KMK

Too many of our exalted rulers in DC have no clue as to the main and most important function of the Federal government, to protect us. They would rather spend our money on their (and their contributors') pet projects.

Timeless Quote - lifted from Neal Boortz's blog

"We contend that for a nation to tax itself into prosperity is like a man standing in a bucket and trying to lift himself up by the handle."

--Winston Churchill, quoted in the Chicago Daily Herald

Double Taxation

You can learn some more about the unfair double taxation of corporate income at this site. They also include a way to send a quick message to your U.S. Senators and Congressperson to voice your opinion on this issue.

Senate OKs resolution shrinking tax cuts

White House raps vote on tax cut

Let's hope they continue to fight for the full level of cuts. Just because the Senate wimped out on this first pass doesn't mean they can't be reinstated in the final compromise bill between our rulers in the House and those in the Senate.

Thoughts On Tax-Cuts

The blogosphere is growing so fast that it's impossible to avoid circular references among different blogs. One of the purposes of blogs such as mine is to avoid reinventing the wheel and repeating what others have already written about, which is why hyperlinking to other articles and references is such a powerful tool. To that end, Donald Luskin has some excellent observations and comments on the current tax cut debate and the underlying thesis of supply side economics.

QuickBooks versus Quicken

I've posted my comparison of the two different programs on my main website.

It is a very real battle on the home front for capitalism against the class warfare tactics of the Left.

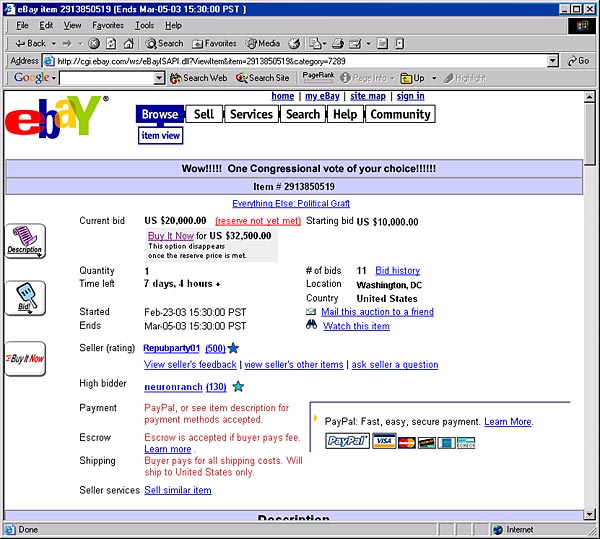

PayPal Not For Everyone

I have frequently touted PayPal as the most convenient and efficient manner by which to send money over the Internet. I have no plans to stop using it, but according to this article, there are several types of transactions for which payments will not be allowed through the PayPal system. As of May 12, the rules will kick in to make eligible transactions for PayPal restricted for the same kinds of things as for eBay, PayPal's owner.

Are Higher Taxes and Fees Discouraging Air Travel?

Taxes do affect behavior. According to this article, direct taxes add an additional 26% to most travel costs. I like his idea that, instead of giving the airlines billions of dollars in taxpayer bailout money, reducing or removing some of the taxes would do a lot more to stimulate more customer support.

One-Third of Federal Work Force May Quit

Too good to be true; but this would be a step in the right direction of reducing the cost of government and taxes to fund it.

Our Deficit-Averse Politicians Should Target Waste

Of course, one person's waste is another person's pork and payoff to campaign contributors.

A Setback, But All Is Not Lost

An optimistic fellow, that Larry Kudlow. He thinks we may end up with a 50% exclusion for dividend income. That means corporate income will only be taxed one a half times. At least it's a step in the right direction.

Senate Slashes Bush Tax Cut Package

A lot of good having the majority is doing for the GOP if some of them vote along with the DemonRats.

I do have to admit that, because of the stupid way in which the tax reduction proposal has been described, it is very awkward to ask for tax cuts at the same time as more funds are being requested for the Iraq war. While such a thing seems irresponsible on its face, it really isn't. However, it is just one more example of the problems of using static analysis to describe the effects of tax law changes.

The tax reduction proposal is constantly being described as costing $726 billion, with the implication that the Federal government will be out of pocket that much money if the law is passed as President Bush is requesting. That is just not the case. However, the truth about the effects of tax rate reductions is consistently distorted by the DemonRats and their propagandists in the media, who like to use their class warfare strategy of calling it a tax cut for the evil rich.

While I don't have a crystal ball, I feel very confident in predicting that, if Bush's tax rate cuts and elimination of double corporate taxation are allowed to become real, the results will be the same as after Ronald Reagan's tax rate cuts of the early 1980s. There will be more economic activity, resulting in more taxable income and overall much higher tax dollars to the Federal government. It will not cost the government anything, but will stimulate more revenue. However, that is based on the more realistic dynamic analysis of tax law changes, which is taboo and not allowed to be part of the discussion. I am certain that Bush, as a fellow MBA, understand this. However, he is not doing a good job overcoming the left-wing media bias to explain this very well to the American public, who have a terrible understanding of basic economics.

KMK

American Royalty

I get a lot of grief from fellow Libertarians and conservatives over my support for term limits for all politicians. They claim that we already have term limits via the ballot box. I wish that were true. The fact of the matter, as described in this article, is that once elected, the powers of incumbency are practically insurmountable, with almost 99% reelection rate. They become rulers for life.

I maintain my belief that if our founding fathers had predicted that future generations would not heed their examples of serving a few terms and then moving on to normal civilian lives, with a constant turnover, they would have included maximum terms of office in the Constitution. They did their best to prevent against being ruled by royalty; but failed to anticipate the addiction to power that would set in with incumbents. Career politicians, who are not required to abide by the rules we little people have to, are dangerous. Without mandatory limits on their time on the throne, things just continue to get more unbalanced. They continue to increase the size and cost of government, with increasing size of extorted campaign donations from their victims.

KMK

When out of ideas, the lefties can always revert to telling lies about the Social Security system and trying to scare more old folks.

Conspicuous Consumption

I have always been fascinated with all aspects of how people deal with money; how they get it, how they invest it, how they spend it, and so on. From a purely academic perspective, how criminals handle money is interesting. I have mentioned how humorous I find it when people spend more time and energy to illegally make money than it would take to earn similar amounts via legal means.

Since a well established method of finding things is to follow the money, a wise criminal (oxymoron?) knows not to make too big a scene with a newly acquired windfall of cash so as to avoid attracting undue attention. I found this story amusing of a bank robber who laid low and waited a year before going on a wild spending spree, as if all memory of the robbery would have disappeared by then.

KMK

Tax Stats

Tax geeks should be interested in the latest statistics from IRS, covering the period from October 1, 2001 through September 30, 2002. You can download the entire 64 page pdf report or visit this page to access individual reports in Excel format.

Nominee to Head IRS Vows to Strengthen Enforcement

We'll have to wait and see what this will mean in the real world.

Tax Cheats Under Fire

It looks like tax scammer Irwin Schiff and many of his gullible followers are looking at more prison time for using his idiotic argument that taxes are voluntary. As I've always explained when people ask me about Schiff and this ridiculous line of reasoning, that is only half of the equation.

It's not a choice between filing tax returns or not, as Schiff claims. People are allowed to voluntarily calculate and pay their taxes or else the IRS will do it for them. As always, when IRS calculates one's taxes, they do it in such a way as to show the highest amount due as possible, with no deductions or exemptions.

I have absolutely no sympathy for idiots who buy Schiff's books and attend his seminars and use his oft-debunked theories to cheat on their tax obligations. I guess I could possibly understand following the lead of someone who has come up with a tax avoidance scheme and gotten away with it. However, following the advice of someone who has spent several years in prison for his strategies is idiocy piled on top of stupidity.

KMK

Some helpful articles from Jeff Schnepper:

Deduct it: Odds against an audit are good

Don't panic if the IRS sends you a letter

Married? The right filing status could save you money

Let the IRS share your loss from disaster or theft

Bush scores House victory on budget, tax cuts

House Approves Bush's $726 Billion Tax Cut

There is still a long way to go before the tax cut is real; but at least we're still heading in the right direction.

Anti-Protestors

I was impressed with the gumption, creativity and bravery of Kfir Alfia and his friends who took on the loony tunes protesting the war in my old stomping grounds of San Francisco. The peaceniks can get very violent against anyone who doesn't agree with them. Check out Kfir's website for the posters he and his group carried while infiltrating the recent protest.

I particularly liked how this one sums up the DemonRat game plan. It's a little hard to make out point one:

High taxes and regulations keep minority upstarts down, protects old boy network.

Senate Votes to Shave New Bush Tax Cuts

I guess we should be grateful that there will be any tax cuts.

Tax-and-Spend Republicans?

Budget Crunches in Nevada, New Mexio Challenge Democratic, GOP Stereotypes

The Truth About Deficits

The truth about the so-called surpluses that Bush supposedly squandered is that they were complete fabrications by the Clinton gang, based on such ridiculous assumptions as the stock market continuing to rise by 50% every year until the end of time, with the government sharing in that through capital gains taxes.

Web Enthusiasts Take Up Scam Baiting

Getting back at those email scammers seems like a constructive hobby.

Still Fighting The Tax Cut Battle

Senate Showdown Likely on Bush Tax Cuts

Budget Debate Comes Down to Size of Tax Cuts

Republicans Say They'll Push for Tax Cuts Regardless of War

The good guys

Resist Tax Cuts in Wartime

The bad guys

Filing Extensions Readily Available by Phone or Computer

As I have explained on several occasions, filing tax returns after April 15 is a smart move.

Unaccountable

One of the gripes we have long had about the way in which IRS employees administer the tax laws has been their immunity from personal responsibility for what are often blatantly illegal actions. In 1998, a law was passed requiring discipline against IRS employees who break the laws. According to this 62 page GAO report on the effects of the law, during the 50 months from July 1998 to September 2002, 71 IRS employees were fired.

The summary of the report in this Wall Street Journal article is quite interesting and quite a bit easier to digest than the GAO's. 62 of the fired IRS employees were actually let go for not filing their own tax returns; not for any of the routine law-breaking that goes on constantly by over-zealous agents. What really frosts me is the implication that the 1998 law has put a serious damper on IRS enforcement actions, thus allowing the tax cheats to run rampant. What a load of crap.

KMK

Move afoot in Congress to slash Bush's tax cut

Why it's never a good idea to count on tax breaks until they make it through the congressional legislation - digestion process.

Dynamic scoring assumes that we aren't dummies

As I have always said, changes in tax rates and rules do affect behavior. To not consider those behavioral changes when estimating the expected effects of proposed legislation is completely irresponsible, but business as normal for our rulers.

Raising taxes makes state fiscal crisis worse

Typical level of government intelligence to take a bad situation and make it worse. Also a good illustration of the difference between the common sense market driven thinking of private businesses and the idiotic responses by our rulers in government. For example, when airlines are having financial difficulties, they lower their fares and bring in more customers. When the Post Office (the epitome of moronic management) and State governments are losing money, they raise all of their prices, driving customers and taxpayers away. It is a fundamental tenet of basic economics that people buy more of things when prices are lower and less when they are higher. Of course, understanding the realities of economics has never been a requirement to be in positions of power. Migration from high tax states to low or no-tax states will just continue as people reach their breaking points over having their pockets picked by obnoxious politicians.

KMK

This is why, when shopping, I only compare the up-front prices of products. Most rebates are bogus and it is wrong for any merchant to advertise "after rebate" costs as if they were realistic.

What am I missing here? The last time gas prices started going up, some of our rulers proposed temporarily removing part of the Federal gas tax. This time, they want to add on more tax. No wonder the most most flagrant oxymoron is "government intelligence."

Funny Money

I have long had several two dollar bills in my wallet that never get taken when Sherry raids my wallet for cash. From this story, I can see why. Taco Bell employees don't seem to know that there are such things as $2 bills and tried to have a customer arrested when he attempted to use one to pay for some food.

While it does seem like a stupid thing to counterfeit something as small as a two dollar bill, here's a story about someone faking one dollar bills and using them at toll booths. He was too lazy to print on both sides of the paper and thought having it folded would do the trick.

KMK

Taking Advantage

One thing about the kinds of taxes our rulers use to take money from people is how much control people have over whether or not to pay them. Some are close to voluntary, such as the luxury and gas guzzler taxes. A person can easily decide simply not to buy those things. Other things are not so easily avoided. Nicotine addicts have been popular targets for tax hungry rulers who are literally exploiting the addiction by tacking several dollars of taxes on each pack of cancer sticks.

Another target of money-hungry rulers seems to be nursing home residents. About two years ago, I discussed efforts here in Arkansas to levy a $5.25 per day per bed tax on those people. According to this story, the rulers in Pennsylvania are considering the same kind of thing, $5.00 per bed per person.

Am I wrong in thinking that this kind of exploitation of people at their most vulnerable state is disgusting, or is it just a matter of the ends justifying the means? Governments need money and however they get it is fine and bringing morality into the discussion is just out of place. Is that how people see this? If so, where does it stop? Will we see huge taxes levied on organ transplant patients? Pay it or die.

KMK

Some good pointers. I could add several more, such as:

File tax returns later - earlier filed returns are more likely to be selected for audit

Over-document out of the ordinary items - attach plenty of documentation to avoid having to go through an audit.

Avoid electronic filing - unable to explain things in the limiting format required by e-filing.

Use a Professional Tax Preparer - While this may sound self-serving, it is a fact that amateurs make many times more mistakes than pros; so IRS reviews self-prepared returns more closely.

Use a C corp to smooth out income and prevent yourself from going into the higher target upper income levels. Small corps are also audited much less frequently than 1040s or large corps.

KMK

Corp Tax Deadlines

I must not have been clear in my earlier post about the due date of corporate income tax returns because a lot of people are worrying about theirs being due this Monday. The due date is March 17 only for those corporations with a fiscal year ending December 31. This is the case for all S corporations.

However, those C corps who have taken my advice to use a different tax year will have a different due date. It will be 2.5 months after the end of the fiscal year. For example, a corp with a fiscal year ending September 30 will have a deadline for filing the tax return (1120) or extension (7004) by December 15. The extension moves the deadline to six months later.

KMK

QuickBooks Tips

I am trying my best to help everyone use QuickBooks most efficiently. I have posted some new tips on my website, along with another more detailed explanation of why QuickBooks is a necessity for everyone, whether or not they run a business.

Everyone Needs To Use QuickBooks

Lower Tax Rates = Higher Revenue

Those who continue to lie about the effects of the Reagan tax cuts are not to be trusted.

Will They Or Won't They?

It's very hard to tell if Bush has what it takes to get his tax cut package through. Some members of his own party are already jumping ship.

On the other hand, there still some in his administration supporting the idea.

KMK

IRS News

IRS has done a nice job in the past few months in improving its dissemination of news releases, both through emails and on their website. You can sign up for the email version, which I have noticed arrive a day or two before they are posted on the website.

Some interesting recent news releases from IRS:

The interest rate they charge on late tax payments is reviewed and modified every quarter to stay in line with the markets. For the second quarter of 2003 (April through June), it will remain at 5.0%. This is also what they pay on refunds for amended returns. I have seen some people actually sit on filing 1040Xs in order to accrue more interest from IRS than they would be able to earn in a savings account. Be careful that you don't wait too long and submit the refund request after the three year statute of limitations has expired. IRS interest rates are compounded daily, which does make the effective APR (Annual Percentage Rate) a little higher than 5.0%. It is not, as I have heard some people claim, 5.0% interest per day. That would work out to about 1,825% APR, which is more in line with what the Sopranos and H&R Block charge. This notice also only applies to interest and is completely separate from the various penalties IRS charges.

IRS is beefing up their educational programs to get kids started right on the road to being willing and obedient taxpayers. The Understanding Taxes program looks interesting and seems like a very good idea. It even includes a new type of the VITA (Volunteer Income Tax Assistance) program, which is how I first learned about preparing tax returns, back in 1975. In fact, that hands-on experience was 100 times more educational than the textbook courses in taxation I was taking at the same time.

KMK

If It Looks Like A Duck...

One trick politicians love to use is to break out the euphemism thesaurus and refer to government charges as anything but the dreaded "T" word so they can claim not to have raised taxes. Bill Clinton called them "investments." The governor of Alaska is calling them "user fees," including the snatching of $100 from every employee's first paycheck, allegedly for schools.

KMK

Watch What You Say

I've mentioned on several occasions how, when it comes to taxes, the normal protections we Americans have under our Constitution are not in effect. Basically, our masters in all branches of the government have consistently ruled that money for the imperial Federal government trumps all personal liberties.

While I don't agree with almost any of the routine violations of our civil rights by the IRS, I do have some sympathy for their campaign against frivolous appeals. As I have described ad nauseam, the tax protestor scammers try to shirk their legal responsibilities based on a variety of idiotic arguments as to why they are not required to file tax returns. They teach their followers to raise these arguments when IRS comes looking for their money and tax returns. The IRS bureaucracy and the Tax Court system have been clogged up for years working on cases involving these same ridiculous tax protestor arguments. It has become so bad that they have been assessing a a variety of frivolous appeal penalties against people who have raised the same arguments that have long ago been debunked.

While the tax protestor community considers this a violation of their freedom of speech, I understand the IRS's need to not tolerate the same old crap being tossed at them over and over again. As IRS explains in this recent news release about several cases where the frivolous appeals penalties have been assessed, they can charge up to $25,000 per incident against people who raise any of these arguments. For an IRS report on what these arguments are, check out this pdf document. This is why, whenever I encounter someone who is all hot and bothered about IRS and taxes, and starts to mention any of these idiotic reasons why taxes aren't legal, I warn them to keep it to themselves because if they mention that to an IRS employee, they could be hit with a $25,000 fine.

KMK

Tax Research

As we all know, the tax systems in this country are a hideous mess. As is illustrated quite often, you can ask a dozen different tax experts how something should be handled and receive literally dozens of different answers. These could all be technically correct. What has always kept this profession interesting for me has been the multitude of options we can use for clients. In contrast to popular opinion about taxes and accounting, where everything is perceived to be cut and dried, there are almost always several ways to structure and report transactions.

When looking for legal authority that a proposed strategy is proper or legal, it gets even trickier. It has been well documented that calling IRS is a waste of time. If you are able to get through, the answers are correct only about a third of the time. Even official IRS publications are not official representations of tax law; but merely IRS's opinion of how things should be done. They are obviously slanted in favor of higher taxes.

A good summary of valid tax research sources, along with their level of authority can be found here. The following quote regarding IRS publications is helpful:

IRS Publications are issued to assist taxpayers. Although they may contain useful information, they do not cite to authority and should not be relied upon by researchers. In addition, the information in the Publications is written from the point of view of the government.

From another good recap of tax authorities is the following quote about IRS publications

IRS Publications ("IRS Pubs"). Although IRS Pubs are issued to help taxpayers comply with the tax laws, they are not precedent. Courts have held that IRS isn't bound by the literal language of these publications, that they neither have the force of law nor create any rights, and that they aren't an authoritative source of income tax law. Despite these limitations, IRS Pubs are an important resource because they often explain provisions in greater detail than other forms of guidance. Sometimes, they represent the only IRS guidance on a subject until more formal guidance (e.g., a reg or ruling) is issued on it.

What I have always believed to be the ultimate test of tax strategies is how they work in real life. That is why I have refused to follow the financially lucrative path of many tax writers and speakers who long ago gave up the stressful tasks of working on real life tax returns and instead earn huge amounts by speaking and writing about theoretical application of tax law. The examples of how theory differs from real life are endless. What I write and speak about are almost always based on real life usage, including battles with IRS. I will put my real life experiences up any day against any other tax expert's ideas of how things "are supposed to be."

KMK

Returning Some Sanity To Stock Values

One of the reasons I counseled against investing in the stock market during the late 1990s dot-com boom was that there was no sane investment reason for the prices people were paying for stocks of companies that were predicted to lose money forever. It was pure out of control speculation that was a house of cards that couldn't do anything but collapse.

I received a lot of very hostile criticism for refusing to jump on that bandwagon and endorse what many supposedly intelligent financial gurus were calling the "new economy" where none of the rules of the "old economy" applied any more. We all now know that those people were completely full of crap. As I learned in college, and I said throughout the dot-com stock fiasco, basic fundamentals of business and economics are the same as they have always been and always will be. A company's true value is (or should be) based on the amount of real life income it can generate for its investors; not on how much you can get some bigger idiot than you to pay for it (the greater fool concept). I therefor concur with Larry Kudlow's prediction that, if the double tax is removed from corporate dividends, it will encourage more corporate earning to be distributed to shareholders and will then provide a much more realistic method for determining a fair value for the stocks.

Of course, this is based on capitalism, and will not do much good in the class warfare battle the disciples of Karl Marx, the DemonRats, are waging to fight the dividend tax cut because they refuse to give up the unrealistic notion that only evil filthy rich people own corporate stock.

On a related topic, investors still need to keep their heads screwed on straight and beware of following the advice of pundits who can't distinguish the difference between percentage and dollar returns. The misinformation on these points is just as bad with taxes. I have long cautioned people to focus on the actual dollars they have to pay rather than the abstract and often meaningless tax rates.

KMK

Postal worker accused of stealing $100,000

This is why we try to keep the Post Office out of the loop as often as possible. We encourage our clients to pay us by faxing checks to us or by using PayPal. Since government checks are so easily identified, they have long been targets of mail thieves, including the freelancers who aren't USPS employees. If you do have a tax overpayment on your return, and have decided not to apply it to the next tax year, you may want to choose the automatic deposit option by providing your bank info on your tax return.

KMK

I found these on this Fark page with a PhotoShop contest for creative ways for the Feds to raise money. It didn't say they had to be new ways.

Who Are You Calling Non-Essential?

In their search for more money, State Rulers are starting to broaden the tax base for sales taxes. Rather than have it apply to just sales of physical items, fees for services are now in the cross-hairs. Here in Arkansas, they are discussing levying the state sales tax on revenues from non-essential services.

This will just start the typical fight over what services are non-essential and which are life or death. This is really a pretty subjective assessment; especially considering that the services mentioned in this article include barbers and accountants. I could make the argument that without our accounting services, the government wouldn't be receiving any tax money. That should make us fairly essential. Likewise, they also want to consider veterinarians non-essential and not human doctors. This is blatant discrimination against our animal friends and will probably trigger a protest from PETA.

The bill currently being debated only mentions the State-wide sales tax of 5.125%. However, if that makes it through, there is no way the local jurisdictions will sit back and not tack on their local taxes. In some cities around the state, that will add an extra nine percent to the cost of these "non-essential" services.

This is a perfect illustration of why I have never been afraid of losing work if the income tax system were ever replaced with a national sales tax. We would have all kinds of fights over proper taxation and there would be plenty of work for creative accountants to help clients minimize their taxes.

KMK

The president�s pro-growth tax plan is alive and well

Larry Kudlow is still optimistic that we'll see Bush's plan become reality. However, the later into the year this battle goes, the less likely it is to be retroactively effective as of January 1, 2003, as Bush wants. However, that is just what we need, if a kick-start for the economy is truly the goal of our rulers in DC.

D-I-Y Tax Software

I am in no way endorsing the concept of anyone preparing their own tax returns. However, some people insist on doing it themselves. For those folks, this review of the major consumer tax prep software may be useful. Remember that, no matter how well any software does tax calculations (including the very expensive software I use), it is a simple matter of GIGO (garbage in, garbage out). You still need to know where and how to enter your data to maximize your tax savings and minimize your audit potential.

KMK

Man Saves $75,000 In Loose Change, Donates To Church

It took him 84 years to accumulate that much, but little things do add up.

One of the reasons I've never been a big fan of playing the stock market is that, with its volatility, you need to check each day to see if you're doing well or lost it all. It doesn't impart much in the way of feelings of long term security.

Certified Exchange Specialist

After a few years of discussion and planning, the Federation of Exchange Accommodators, the professional organization of 1031 exchange facilitators, is kicking off its new certification program. The first certification exam is scheduled for two months from now, on May 16 in Washington, DC. There will be 120 multiple choice questions in a two and a half hour testing period. You can see more details and download an application for the exam on their new special website.

I've already asked Sherry if she is interested in taking the test and she answered just as I had expected. She hates tests and since her business is already very well established, she doesn't see the need for some new letters after her name.

While I have always done very well in tests (acing the CPA on my first try), I doubt that I will be taking it. I already have more credentials than can fit on my letterhead and more work than I can possibly keep up with. However, there is an exam scheduled for October 2 in Las Vegas, a place neither of us has been to; so anything is possible.

KMK

Labels: 1031

Budget Simulator

I came across this simulation program for the Federal budget, where you can supposedly see the effects of changes in spending and taxation on the deficit. It looks like it may actually be very similar to the kinds of models actually used by our rulers in DC because it uses the same kind of unrealistic static based assumptions that have been proven wrong so many times that they aren't worth anything.

Tax rate cuts are considered to be government expenditures, increasing the deficit. This, in spite of the fact that Reagan's tax rate cuts caused a doubling of revenues and anyone with any appreciation for the real world realizes that static scoring is complete bunk and a waste of time. Only a dynamic look can reflect the fact that people do alter their behavior when tax rates are changed. Lower tax rates cause people to earn more taxable income, increasing the overall haul for the IRS. Any financial model that fails to consider that is no better than just fabricating numbers out of thin air, another popular technique used by our rulers.

KMK

Strange Formatting

If you've noticed the strange fonts and formats in my posts over the past few days, it's due to a new program I just started using, called BlogWeaver. It works with my normal Blogger.com posting page, and is supposed to function just like Microsoft FrontPage (which I do use for the main web sites I control); but I am still trying to figure out how to better control the font settings. Hopefully, we will see more consistency over the next several days.

KMK

Not Ready For Prime-Time

I just completed a survey from Intuit on their online QuickBooks service and they asked why I wasn't referring it to clients. Here is my answer:

Your data format is not backwards compatible and you are keeping clients captive. If someone decides to switch from online to desktop QuickBooks, everything I have seen says that the data from the online version cannot be imported into the desktop version. When you make it so that clients can switch back and forth without losing any of their data, I will gladly recommend your service.

Bruce Bartlett doesn't think Stephen Moore was correct in his assessment of the new chairman of Bush's Council of Economic Advisers. This is very strange because Bartlett and Moore normally see things in the same light.

Swap 'Til You Drop

I often hear of people who think doing 1031 (aka Starker) exchanges on real estate is a waste of money because it just postpones and doesn't actually eliminate the inevitable payment of capital gains taxes. It is not true that the tax will always eventually be due. It will be if you end up selling the property before you pass away. Likewise, if you gift the property to someone else, that person will also receive your cost basis and potential capital gain.However, if you pass away and leave the property in your estate, all of the accumulated gains are literally wiped off the books. Your heirs receive the property at a stepped up cost basis of its fair market value as of the data of death. Because inheritances are tax free to the recipients, your kids can sell inherited property and have no capital gain. In fact, they often end up with capital losses after counting the selling costs, such as Realtor commissions. We call this the ultimate escape from taxes. The phrase we like to use to describe this is "swap 'til you drop."

This is definitely a big win-win deal for people whose estates are under the taxable threshold. For those people with estates subject to estate tax, there is room for some tax strategizing in terms of valuations to use on the 706. Since estate tax rates are higher than capital gains rates, lower values on the 706 generally reduce the overall tax hit.

There may or may not be a change in this escape from taxes. The currently phasing in changes to the estate tax is scheduled to eliminate the step-up basis in 2010 and require heirs to carry over the same cost basis as the decedents. That will only become real if our rulers in DC don't mess with that law between now and 2010, which is not too likely to be the case.

KMK

Labels: 1031

IRS Increases Criminal Investigations of Tax Return Preparers

Taxpayers Advised to Use Care in Selecting Preparers

Another case of the classic "If it sounds too good to be true..."

This is exactly how special tax breaks find their way into our laws in the sausage factory that is our capitol. Plus the fact that none of our rulers ever actually read any of the tax bills before voting on them makes it very easy to slip all kinds of junk in there. As I've said on several occasions, this is also the best business investment possible in terms of profitability. Congress-critters routinely sell billion dollar tax breaks for just a few hundred thousand dollars of campaign contributions (aka bribes).

Having It Both Ways

I've written a lot about states taxing income earned inside their borders by non-residents; what some call the jock-tax because of the many states in which professional athletes earn income. When an athlete, or anyone else, has their main tax home in a taxable state, their home state normally gives them a credit for the income taxes they have to pay to the other states in order to avoid two state income taxes on the same income. This obviously doesn't apply to people whose main tax home is in a tax free state, such as Nevada, Texas, Florida or Washington.

While I have never been hesitant to point out how ruthless the tax collectors of the PRC are in squeezing money from every source possible, it seems that Illinois is taking things to an even higher level. They are making the ridiculous claim that Sammy Sosa is not entitled to an offsetting credit against his Illinois tax for the taxes he has to pay to other states on the same income he reports on his Illinois tax return. This is completely unfair and I'm glad to see that Sosa is contesting it.

Illinois is just like all other states, requiring people who don't live there to pay Illinois tax on income earned there. In fact, I have a number of clients for whom I do prepare Illinois non-resident income tax returns for income that is generated up there. However, their home states do allow them the offsetting credit for the Illinois tax. Illinois should be grateful Sammy Sosa hasn't done what many other professional athletes and entertainers have done, establishing their official tax homes in Florida. After being treated like this, I hope Sosa and his fellow athletes teach Illinois a lesson and relocate. That will end up costing Illinois much more than the Other State tax credit they want to deny Sosa.

KMK

Unfortunately, it doesn't work this way with our friends at the IRS.

They dictate that we have an end at least every 12 months, with plenty of deadlines.

On State Tax Policy, Everyone Has a Formula for Reform

In the PRC, reform generally means higher taxes.

Survivor Assistance

Since I last discussed Mark Colgan's very useful Survivor Assistance Handbook, he has prepared a new revised edition. My copy of the new version just arrived yesterday and it is very impressive. Mark has definitely made an already excellent reference work even more so. The additional information is even easier to locate, with a much more comprehensive index. Taking care of things after someone passes away is something most of us will have to deal with. Every household should have a copy of this book.

KMK

QuickBooks Help

The official QuickBooks website makes it a bit difficult to find local advisors, so I have added a direct link to that page on my website. Even if you're going to be doing the work yourself, it pays to get some professional help in setting up things properly. I've had to spend a lot of very expensive time straightening up QuickBooks for people who should really have used some professional help at the beginning.

Buying Royalty

Since the USA has only one officially acknowledged royal family, and not everyone is fortunate enough to be descended from an Irish-American bootlegger and stock swindler, it seems like there would be a ready market here in the States for this company that sells British titles to anyone anywhere. I have no idea how useful being declared a Lord or Baron can be in real life, this at least sounds more satisfying than naming a star or buying a plot of land on the moon.

Professor Puts Religion in Tax Debate

While I have always considered most kinds of taxes to be immoral from the perspective of capitalism, I have heard people wonder why ten percent of our income is good enough for God, yet our Rulers here on Earth require so much more than that.

Active trading hazardous to your wealth

So true. This is also why, for the umpteenth time, I don't invest in the stock market or advise others to do so. Over the long haul, most tax returns I have seen have shown net losses from stocks and net profits from real estate.

A Salesman for Bush's Tax Plan Who Has Belittled Similar Ideas

It's not just Stephen Moore who has qualms about Mr. Mankiw. Somebody at the White House needs to cut this bozo loose before he destroys all prospects for a tax cut.