Killing the Golden Goose...

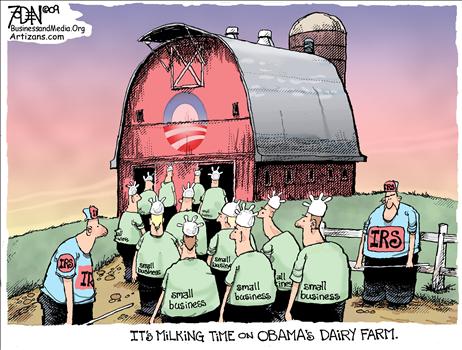

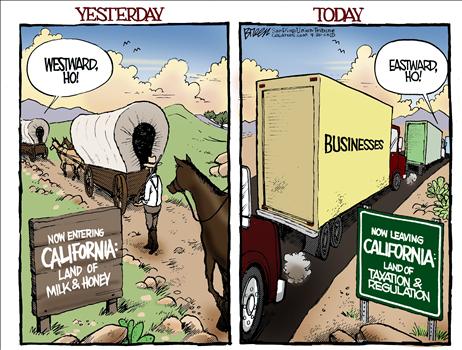

Risky business: States tax the rich at their peril - Too many of our rulers have short term mentalities and have no concern for the long range consequences of their decisions to steal as much money as they can from the "evil rich."

I am very happy to see that rather than just bend over and accept these kinds of financial rapes, more people are voting with their moving vans.

New Jersey, New York and California Have Worst Tax Climates for Business, Tax Foundation Says

Labels: StateTaxes

IRS scam now world's biggest e-mail virus problem – These phony IRS emails that I mentioned a few weeks ago are still floating around the net. I have been receiving at least one copy each day since then. As this article explains, they contain a nasty computer Trojan virus; so be extra careful when encountering these scam emails.

Labels: scams

You can't trust government financial predictions...

How many people would willingly invest everything they own with someone who has a lengthy track record of being 100% wrong on every single prediction? Any sane investor would stay miles away from anyone with such a history. However, that’s the case with anyone who believes a single financial fact touted by our rulers in DC.

Job losses, early retirements hurt Social Security – This is just one more reminder that, whenever our rulers in DC predict the costs and finances of a government program, they are off by huge magnitudes. The naive way to look at this fact would be to assume that they just made honest miscalculations. The more realistic assessment is that they lied through their teeth in order to sell the programs, knowing full well that nothing could be done to them when the truth became clear.

That is exactly what we are facing today. Every single one of the cost figures being used in the current fight to socialize health care is being intentionally understated so as to con gullible people into accepting it. By the time the truth emerges that the actual costs are hundreds of times more than promised, just as with Social Security and Medicare, the politicians responsible for selling the programs will be long gone and the people too dependent on it to ever go back.

Section 179 & Losses

Q:

Subject: Sec 179 depreciation.

Hello, just found you on the web and had a question regarding this tax law. If our business takes a loss the first year (this year) can we still use this for the over 6,000 lb. commercial truck we purchased this year also?

Please let me know and thanks.

A:

Section 179 is very explicit on the fact that it cannot be used to cause or increase a net loss for the year.

The first year bonus depreciation doesn't have that restriction, so it can be used to generate a net loss for the year.

Your own personal professional tax advisor should be able to properly handle the appropriate depreciation deductions for all of the capital assets for your business. Do not attempt to do this on your own.

Good luck.

Kerry Kerstetter

Bleeding Off Income

Q:

Subject: C Corp Question

Good Morning,

I am looking at forming a C Corp, based on your advice online. One thing I do not understand is how one bleeds off income at the end of the personal tax year (12/31) back to the corporation, to limit personal exposure to income tax. Can you explain that a little bit for me? Also, if (as I anticipate to do) I form the C corp, are you available as a CPA for my company? And if so, at what cost?

Thanks for the information.

A:

The easiest way to bleed off income from your 1040 is to pay your corp for "Business Services" or "Management Services" and deduct it on the same schedule(s) where you are reporting your income (C, E, or F).

If all of your income is from a W-2, you will need to deduct the Services on Sch. A.

As you can see below, I am still not accepting new clients.

Good luck. I hope this helps.

Kerry Kerstetter

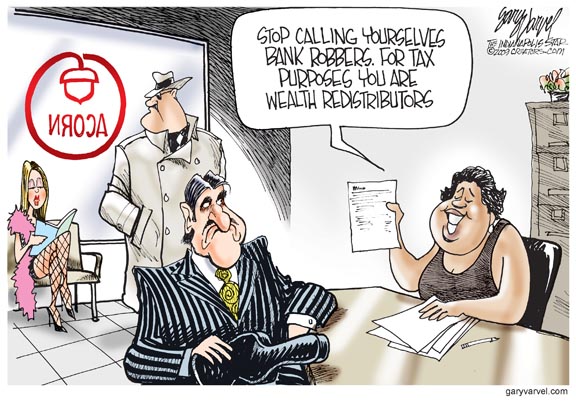

IRS severs ties with ACORN over scandal – No longer part of the IRS VITA program. Who will take up the slack now in preparing tax returns for ACORN’s unique clientele?

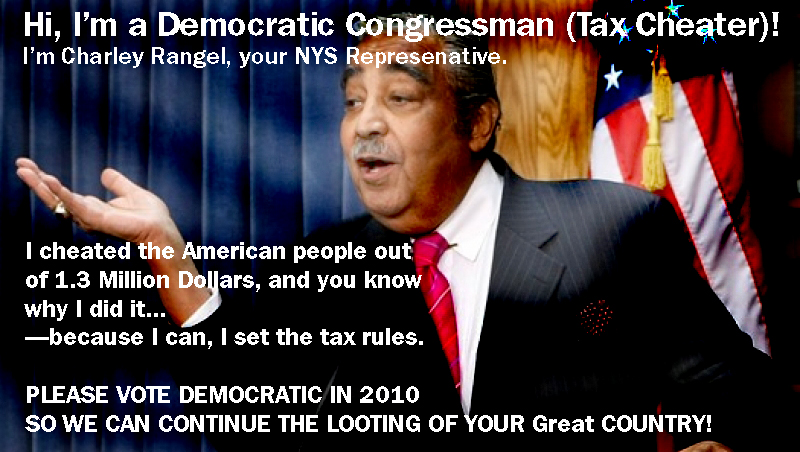

Rank has its privileges...

One of the accepted benefits of being in charge of the Ways & Means Committee is not having to worry about complying with any of the tax and financial disclosure laws that other less worthy people have to bother themselves with.

However, as we all know, this special perk of the job is null and void if it is ever held by a member of the GOP.

ACORN: Tax Cheats. One expects better from self-styled “progressives.” – Fitting right in with the rest of 0Bambi’s cabinet and advisors.

Labels: Crooks

Income Shifting

Q:

Subject: Tax issues-c corp

Hi, thanks for the awesome website! Lots of useful info. However, I was wondering if you could clarify for me how the shifting of money between fiscal years works. Why does it have to be at the end of the year? How can I legitimately transfer funds to the corp and deduct them from my personal income? Is the repayment in January and the paying of money from the corp in June or whenever two separate transactions? Just trying to decide on the right business structure for the lowest amount of taxes on our precast concrete company.

thanks a lot!

A:

The income shifting is normally an ongoing process throughout the year based on what the businesses can afford. However, it is also critical to have your professional tax advisor take a glance at how the net taxable income is looking about a month or so before the end of the entity's tax year just in case there is a need to shift a lot more income than normal before year-end to get the income down to a reasonable tax bracket.

I have also been seeing some clients who have been shifting too much income during the year, creating a large negative taxable income; so that we need to make an adjustment in the opposite direction before the end of the tax year.

As I constantly warn. this kinds of strategy to shift income between entities is not overly complicated to do; but should not be attempted without the assistance of a professional tax advisor who understands the benefits of this. Too many people simply look at their company's bank balance as an indicator of their current level of net income; while an experienced tax pro knows that the actual taxable income figure will often be very different from the bank balance.

If your current professional tax advisor is one of those who believe that intentionally shifting income between entities is too much hassle to even think about doing, it's time to switch to another tax pro who is not as lazy and is more concerned about helping you hold onto your money.

Good luck.

Kerry Kerstetter

Labels: corp

Section 179 For 2010

Q:

Subject: Tax Issue

Is there any information as to what the 179 election and bonus depreciation will be in 2010? Thanks!

A:

This was in the recent CCH report of 2010 tax changes that I mentioned on my blog.

"Code Sec. 179 expensing. Unless Congress intervenes, Code Sec. 179 expensing will return to pre-2008 levels for 2010. For tax years beginning in 2010, the Code Sec. 179 expensing limit will be $134,000 and the cost-of-equipment limit set at $530,000. (Note: Expensing is currently scheduled to return to $25,000 ($200,000) levels in 2011.)"

Nothing was mentioned about any changes in the special first year depreciation, so that will expire as of 1/1/10 for most types of assets, unless our rulers in DC decide to pass another extension.

I hope this helps.

Kerry Kerstetter

Follow-Up:

I like the our rulers in DC comment. Kind of scary, isn't it! Thanks!

Labels: 179

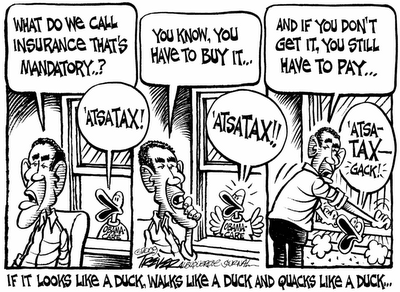

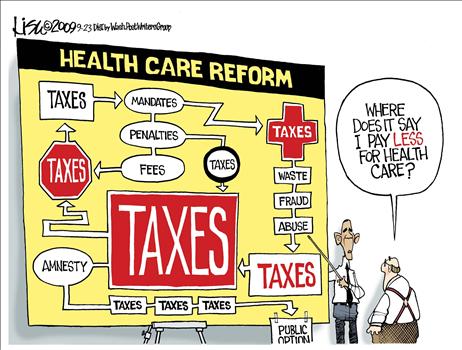

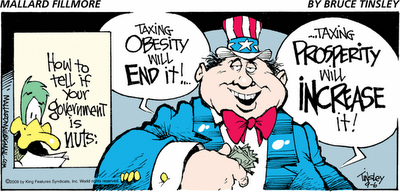

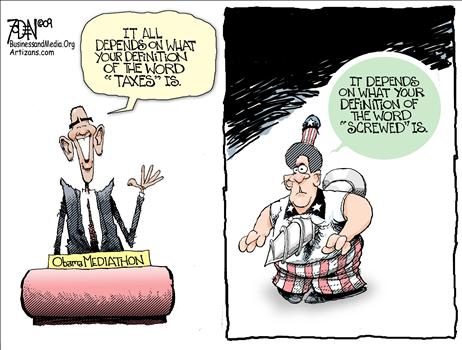

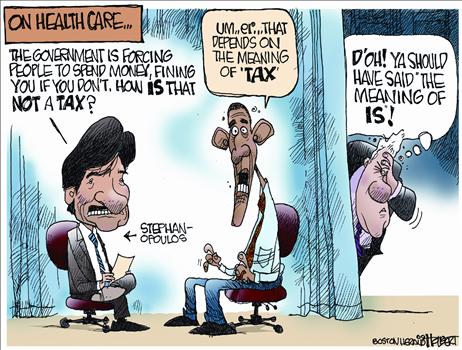

Pretending a Tax Isn't

A rose (tax) by any other name is still a rose (tax)

Apparently Using the Dictionary to Define 'Tax' Is Cheating

Health bill says 'tax' when President Obama said 'not'

President Obama Offers a Taxing Definition

Mandatory insurance: Yes, it’s a tax

Classic trick by politicians; to label a tax increase as something else (fee, service charge, license, insurance) so they can pretend to not be a tax hiker. Bottom line is the exact same as a tax; so for those of us living in the real world, things are getting more expenseive.

That wasn’t anything new. What was new was the fact that former Clinton operative, George “Steffy” Stephanopoulos actually had the cojones to disagree with 0Bambi on this issue. He is obviously a racist.

Limits on Sec 179 For Pass-Through Entities...

Q-1:

Subject: LLCs and 179 deduction

Hi Kerry,

I recently did a Google search on Section 179 deductions and LLCs. Your site came up, but I was unable to find any reference to how LLCs handle the 179 deduction on the site. Can you point me to the right section? Basically, I want to know if the 179 deduction flows through the LLC to the members personal returns like other profits and losses do.

Thank you for any help.

Cheers,

A-1:

Back in February, I sent you a link to a previous blog post I did on Section 179 deductions with pass through entities.

Nothing has changed since then. The Section 179 deduction is one of the separately stated items required to be passed through to the members via their K-1s. The actual amount of Section 179 deduction each member will be able to deduct on their 1040s may be quite different, based on their unique tax situations.

Your LLC's professional tax preparer should have software to prepare the 1065 and its K-1s properly, while the members' professional tax preparers' software should handle their 1040 Section 179 properly.

I hope this helps.

Kerry Kerstetter

Q-2:

Hi Kerry,

Thank you so much for your note of September 6, 2009. My accountant is adamant that a 179 deduction can only flow through to a single member LLC. This opinion stands to cost me about $40k and beyond that logically drives me nuts. Why would the deduction not flow to all the members, particularly in this case where the partners are my wife and I and we file a joint 1040?

Could you point me to something in the IRS or professional literature that clearly (a faint hope on my part) lays out the 179/llc ground rules?

You mentioned that you are thinking of setting up business related Webinars, I'm very interested. Often those of us doing business are very interested in the deductions that are allowed in the conduct of business depending on the corporate form. As you can see, from my own very painful situation, it would have helped to know that only single member LLCs can take the 179.

I would be very interested in being kept informed about your webinars and if there is any info on the multiple partner LLC (particularly husband and wife) I would be most appreciative.

Best Regards,

A-2:

There must be some kind of misunderstanding here because what you claim is your accountant's statement makes absolutely no sense. To claim that only single member LLCs can use Section 179 is ridiculous. I have seen and prepared thousands of tax returns with multiple owners sharing Section 179 deductions.

With a multi-member LLC that is reporting its activity as a partnership on Form 1065 or as an S corp on Form 1120S, the treatment is exactly the same. Just as the net operating income or loss is divided among the owners on their K-1s based on their ownership percentages, Section 179 deductions are similarly allocated among the members' K-1s.

If your accountant uses professional software to prepare the 1065 or 1120S, it will handle that allocation automatically.

If your accountant prepares tax returns by hand and doesn't understand how to properly handle Section 179, it sounds like it may be time to move on to someone with more experience. If it's a family member and you don't want to hurt his/her feelings by switching to a more competent tax pro, only you can decide if that is worth $40,000.

You asked for documentation of this. How about the official IRS instructions for Form 1065, which you can download here.

From Page 28:Line 12. Section 179 DeductionNote that it says "Partners" with an S, meaning that the Section 179 is to be split between all of the partners.

A partnership can elect to expense part of the cost of certain property the partnership purchased during the tax year for use in its trade or business or certain rental activities. See Pub. 946 for a definition of what kind of property qualifies for the section 179 expense deduction and the Instructions for Form 4562 for limitations on the amount of

Complete Part I of Form 4562 to figure the partnership’s section 179 expense deduction. The partnership does not claim the deduction itself but instead passes it through to the partners. Attach Form 4562 to Form 1065 and show the total section 179 expense deduction on Schedule K, line 12.

Also from Page 28 is this statement of a limitation on the only kinds of partners who may not claim Section 179 deductions.Do not complete box 12 of Schedule K-1 for any partner that is an estate or trust; estates and trusts are not eligible for the section 179 expense deduction.

Notice that there is no restriction mentioned regarding multi-member LLCs.

Good luck. I hope this helps. Fur future reference, when a tax pro presents you with some claim that seems to be wrong on its face, you should demand that s/he present you with documentation to prove his/her point. I would be very interested in seeing something official that states that multi-member LLCs are not eligible to use Section 179.

If you keep tabs on my blog, we will be announcing the dates of the webinars there.

Kerry Kerstetter

Labels: 179

Helping people cheat on their taxes...

From Jay Leno via NewsMax:

ACORN is an organization that gets government money to help poor people. Well, now they’re in trouble. These two film-makers went to ACORN posing as a pimp and prostitute saying they wanted to buy a house and run it as a brothel. ACORN gave them advice on how to do it and how to avoid prosecution and how to avoid paying taxes. If they want to get away with prostitution and not paying taxes, they should go to Congress. These are the professionals.

2010 Federal CPI Adjustments

For several years now, a popular topic has been the annual inflation adjustments for those aspects of the US Internal Revenue Code that require such modifications. Once again, CCH has made their calculations available to the public in this announcement. As soon as I can, I will set up a new page on my website to reflect these new figures.

Another very popular topic is the annual gift tax exemption, which can only be adjusted in even $1,000 increments. According to the CCH report, it will remain at $13,000 for 2010.

[Update: The 2010 rate page is up, and the Section 179 page has been updated for 2010 maximums.]

Labels: TaxRates

Changes to tax free home sale rules?

Q:

Subject: Sale of Primary Residence

I am trying to find out when the $500,000 ($250,000 per spouse) Exclusion expires; and what is the current thinking on how it would be changed.

Sincerely

A:

The current law allowing the tax free exclusion of some or all of the gain from the sale of a primary residence (aka Section 121) was enacted in May 1997 and does not have an expiration date. It will be the law, with the exact same dollar amounts (unadjusted for inflation) until our rulers in DC explicitly change it.

While nobody can know for sure what changes, if any, this law will have in the future, I can guess at a few possible ones. It is very likely that some provisions of this law will be trimmed back for home sellers.

Going back to a once in a lifetime usage, rather than the current once every two years, would probably be a politically acceptable change since that was how it applied for several decades prior to 1997.

Another likely change with the growing sentiment in DC to screw over the evil rich would be to completely or partially deny the exemption to those taxpayers with AGIs over a certain dollar figure that our rulers will establish to define them as evil rich who are unworthy of any more tax breaks. Several other tax deductions and credits already have AGI eligibility thresholds; so this would be consistent with that.

Your own personal professional tax advisor should be up on the latest laws in regard to home sales; so any planned sale should be run by him/her first.

I hope this helps. Good luck.

Kerry Kerstetter

Follow-Up:

Dear Kerry

Thank you so very much for the information ... it is extremely helpful

Sincerely

Labels: 121

House Republican Leaders Ask IRS to Sever Ties with ACORN – It looks like that crime syndicate’s community tax work was officially sanctioned by IRS after all. Where will child sex slave-masters go to for their tax help now if ACORN is out of that business?

Labels: Acorn

Higher Taxes Are Coming. Are You Prepared? – A short look at some of the upcoming tax hikes we will all be facing. There are also some ideas on why and how some people may want to intentionally recognize income earlier than normal in order to get the taxes out of the way at their currently lower rates than the much higher rates that will be here in future years. 0Bambi’s stated desire to make long term capital gains rates higher as part of his Marxist definition of “fairness” create a number of tax planning opportunities.

Labels: TaxHikes

Offshore Tax Gap?

US citizens in rush for offshore tax advice – Ohio CPA Dana Stahl forwarded this to me with the following message:

Mr Guru - Obama's war on the rich in the USA continues.

While that is obviously true, what caught my attention was the following reference to my old bugaboo, the tax gap:

A Senate committee has estimated that the parking of assets offshore costs the US $100bn in lost taxes each year.

As I have been explaining for decades, any “tax gap” is by definition impossible to know with any certainty. Any figure that is being bandied about has either been pulled out of some politician’s rectum or is merely a WAG (wild ass guess). Of course, that's SOP for our rulers in DC, as illustrated by the health care reform discussions. None of those figures has any relation to reality.

Labels: TaxGap

Charlie in rental di$order – At least Charlie Rangel’s consistent in his income reporting. Not only hasn’t he declared his rental income from his villa in the Dominican Republic, rental income from a six unit apartment complex in Harlem isn’t worth reporting either.

As usual, none of this is considered to be serious enough to reduce his power in Congress as the head of the Ways & Means Committee, which writes all of the income tax laws that we mere peons are required to comply with. Our DemonRat rulers have more important things to investigate, such as how to punish a Republican who couldn’t resist the temptation to yell out “You Lie” while 0Bambi was lying through his teeth. It’s good to know our rulers have their priorities in the right place.

Labels: Rangel

Who uses ACORN for tax work?

Why is ACORN giving tax advice? Started with shakedown of H & R Block – That was the first thing I was wondering while watching the clips of the ACORN rep giving advice to a pretend pimp and hooker on how to handle the taxes for a child sex slave business. I have long known about their organized crime and voter fraud activities, but was ACORN also in the tax preparation business?

I thought they may have been part of the IRS’s VITA program, which is designed to provide free tax help for lower income people in the community. That’s where I started my tax career in the early 1970s. I don’t recall their policy on who we could prepare free tax returns for; but I am guessing that an illegal alien child sex slave business would have been off limits.

Which brings me to the other thing running through my mind while watching those undercover videos. What would other tax professionals do if confronted with new clients like the ones James O'Keefe and Hannah Giles were portraying? I doubt that any reputable tax pro would accept them as clients and give the kind of illegal advice the ACORN rep was presenting, even in these tough economic times. The proper response would be to either kick them out of your office or even to call the police on them.

Labels: preparers

New Fake IRS E-mail

Snopes.com covers this latest phony email pretending to be from the IRS. Sherry actually received one of these the other day and wondered if it was real, until I explained that IRS does not send out emails to people. Their notices are sent via snail mail.

As I advised Sherry, anyone receiving these kinds of emails should forward them to the special IRS email address that was set up to handle this growing problem: phishing@irs.gov

Hopefully, IRS is using these emails to hunt down and nail the scammers who are sending these out.

Labels: scams

2010 IRA Conversions

From the latest Intuit ProConnection Newsletter:

Is 2010 "The Year of the Roth"? – After 12/31/09, more people will be eligible to convert conventional IRAs to Roth IRAs as the evil rich clause (AGI over $100,000) expires.

I pass this along in the spirit of better understanding your available options. As I have explained several times since Roth IRAs came into being, I am still strongly opposed to these kinds of IRA conversions if they will require you to pay actual taxes in exchange for the promise of future tax free Roth IRA benefits. If you have other kinds of losses to offset the IRA income so that there are no actual taxes on the conversion, such a strategy might be a good move.

While the actual Federal taxes on 2010 IRA conversions can be paid with the 2010 1040 or spread out over the 2011 and 2012 1040s, I still have very serious doubts that our rulers will leave the tax free status of Roth IRA income alone for those they deem to be evil rich. We have seen time and time again where our rulers in DC reneged on promises of this kind and every indication is that they will have no qualm whatsoever about taxing evil rich folks on their Roth IRA distributions even though that was not the way it was supposed to be.

Labels: Retire

Florida Exodus: Rising Taxes Drive Out Residents - This is a bit ironic because so many people relocated to Florida specifically to escape income taxes in other states. However, as the shortsighted rulers of Florida fail to realize, it is the overall tax burden, including rapidly escalating property taxes, that motivate people to relocate to less expensive states.

Labels: StateTaxes

STAFF AS 'FORGETFUL' AS THE BOSS - Not quite a huge surprise. Rangel's staff is made up of a lot of the same kind of crooks as he is.

The clock is ticking on tax cheat Charlie Rangel - I'm not holding my breath waiting for this to actually happen.

Labels: Rangel