Refusing to bend over...

Montgomery sees huge decline in taxable income – It's always great to see when State rulers are slapped in the face with the real world fact that people in their cross-hairs for punitive taxation don't just bend over and accept it; but move to lower tax jurisdictions. States that think they can solve their fiscal blunders by sticking it even more to the “evil rich” will suffer the same consequences.

Labels: StateTaxes

More IOUs for TaxPayers

Cash-Strapped States Delay Tax Refunds; NY Says It's an Option - As always, crazy ideas hatched in the PRC have a way of spreading across the country.

Just try sending an IOU payable to your State in with your State tax return and count the days before your bank account is levied.

Labels: StateTaxes

Class Warfare's Next Target: 401(k) Savings - Raiding private retirement accounts, either with an upfront tax or as a conversion to government control, has been under consideration by our rulers in DC for a while now; at least since the Clinton years. That huge pool of wealth is simply too tempting for our money and power hungry rulers to resist.

This is also another example of how our rulers have no shame about changing the rules after the fact in regard to retirement plans, as I have explained on countless occasions when warning about Roth IRAs. How can anyone seriously feel safe about Roths remaining tax free for much longer, when our out of control rulers are openly contemplating a full scale confiscation of private retirement funds?

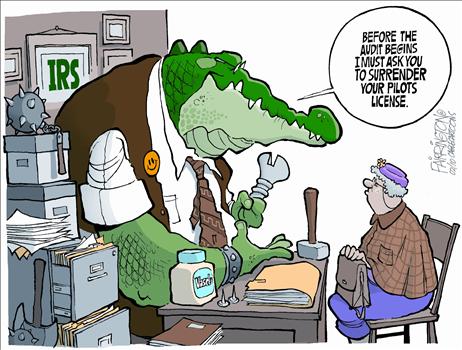

Insane Tax Protest

The nut job who "got even" this morning with the IRS in Austin for the results of an audit had published a ranting semi-explanation of why he took this drastic step; but it was taken down by his web hosting company. The Smoking Gun was able to snag a copy of it prior to its removal, and has it posted here.

From this passage on the fifth page, it sounds like his CPA, Bill Ross, should be very careful and on the lookout for booby traps, such as car bombs and suspicious packages in the mail. Any current tax clients of his should also be careful not to get caught in the crossfire from this dispute.

Labels: Morons

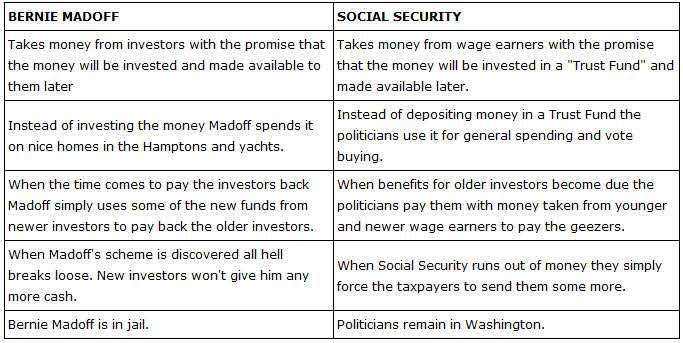

Comparing Ponzi Schemes

Neal Boortz recently posted this side by side comparison of the two largest Ponzi schemes used to steal investor money in this country.

Another big difference between the two schemes was the fact that Madoff's victims invested their money voluntarily, while Social Security is funded at the point of a gun. Madoff's investors stopped giving him their money as soon as it was revealed to be a fraud. IRS is still forcing people to pay in to the SSA even now that's its collapse has been revealed to be imminent.

Desperate For Money

Like drug addicts craving their next fix, politicians will stoop to any means to squeeze more money out of the little people in order to feed their out of control spending addiction, as with this story from New York that will be duplicated all over the country..

Debunking Tax Protestors

Long time readers know that one of my long running pet peeves is having to waste time debunking ridiculous theories espoused by tax protestors. For a long time, I felt like I was doing the IRS’s job because they refused to even acknowledge publicly that those arguments were floating around under the completely mistaken belief that to even mention them would in some way legitimize them. The promoters of those arguments used the IRS’s silence as an endorsement of their arguments.

Finally, after decades of ignoring the idiotic arguments used by tax protestors to convince others that they don’t need to file tax returns, IRS has been taking a more pro-active approach. They have recently updated their guide to most of these bogus claims, entitled The Truth about Frivolous Tax Arguments.

IRS Press Release – IRS Debunks Frivolous Tax Arguments

The table of contents below gives us a good idea of the growth in this segment of our society, as there have obviously been enough stupid people advocating these ridiculous theories to earn a spot on this list of morons.

THE TRUTH ABOUT FRIVOLOUS TAX ARGUMENTS

January 1, 2010

I. FRIVOLOUS TAX ARGUMENTS IN GENERAL

A. The Voluntary Nature of the Federal Income Tax System

1. Contention: The filing of a tax return is voluntary

2. Contention: Payment of tax is voluntary

3. Contention: Taxpayers can reduce their federal income tax liability by filing a “zero return.”

4. Contention: The IRS must prepare federal tax returns for a person who fails to file.

5. Contention: Compliance with an administrative summons issued by the IRS is voluntary.

B. The Meaning of Income: Taxable Income and Gross Income

1. Contention: Wages, tips, and other compensation received for personal services are not income.

2. Contention: Only foreign-source income is taxable.

3. Contention: Federal Reserve Notes are not income.

C. The Meaning of Certain Terms Used in the Internal Revenue Code

1. Contention: Taxpayer is not a “citizen” of the United States, thus not subject to the federal income tax laws.

2. Contention: The “United States” consists only of the District of Columbia, federal territories, and federal enclaves.

3. Contention: Taxpayer is not a “person” as defined by the Internal Revenue Code, thus is not subject to the federal income tax laws.

4. Contention: The only “employees” subject to federal income tax are employees of the federal government.

D. Constitutional Amendment Claims

1. Contention: Taxpayers can refuse to pay income taxes on religious or moral grounds by invoking the First Amendment.

2. Contention: Federal income taxes constitute a “taking” of property without due process of law, violating the Fifth Amendment.

3. Contention: Taxpayers do not have to file returns or provide financial information because of the protection against self-incrimination found in the Fifth Amendment.

4. Contention: Compelled compliance with the federal income tax laws is a form of servitude in violation of the Thirteenth Amendment.

5. Contention: The Sixteenth Amendment to the United States Constitution was not properly ratified, thus the federal income tax laws are unconstitutional.

6. Contention: The Sixteenth Amendment does not authorize a direct nonapportioned federal income tax on United States citizens.

E. Fictional Legal Bases

1. Contention: The Internal Revenue Service is not an agency of the United States.

2. Contention: Taxpayers are not required to file a federal income tax return, because the instructions and regulations associated with the Form 1040 do not display an OMB control number as required by the Paperwork Reduction Act.38

3. Contention: African Americans can claim a special tax credit as reparations for slavery and other oppressive treatment.

4. Contention: Taxpayers are entitled to a refund of the Social Security taxes paid over their lifetime.

5. Contention: An “untaxing” package or trust provides a way of legally and permanently avoiding the obligation to file federal income tax returns and pay federal income taxes.

6. Contention: A “corporation sole” can be established and used for the purpose of avoiding federal income taxes.

7. Contention: Taxpayers who did not purchase and use fuel for an off-highway business can claim the fuels tax credit.

8. Contention: A Form 1099-OID can be used as a debt payment option or the form or a purported financial instrument may be used to obtain money from the Treasury.

II. FRIVOLOUS ARGUMENTS IN COLLECTION DUE PROCESS CASES.

A. Invalidity of the Assessment.

1. Contention: A tax assessment is invalid because the taxpayer did not get a copy of the Form 23C, the Form 23C was not personally signed by the Secretary of the Treasury, or Form 23C is not a valid record of assessment.

2. Contention: A tax assessment is invalid because the assessment was made from a substitute for return prepared pursuant to section 6020(b), which is not a valid return.

B. Invalidity of the Statutory Notice of Deficiency.

1. Contention: A statutory notice of deficiency is invalid because it was not signed by the Secretary of the Treasury or by someone with delegated authority.

2. Contention: A statutory notice of deficiency is invalid because the taxpayer did not file an income tax return.

C. Invalidity of Notice of Federal Tax Lien

1. Contention: A notice of federal tax lien is invalid because it is unsigned or not signed by the Secretary of the Treasury, or because it was filed by someone without delegated authority.

2. Contention: The form or content of a notice of federal tax lien is controlled by or subject to a state or local law, and a notice of federal tax lien that does not comply in form or content with a state or local law is invalid.

D. Invalidity of Collection Due Process Notice

1. Contention: A collection due process notice (Letter 1058, LT-11 or Letter 3172) is invalid because it is not signed by the Secretary or his delegate.

2. Contention: A collection due process notice is invalid because no certificate of assessment is attached.

E. Verification Given as Required by I.R.C. § 6330(c)(1)

1. Contention: Verification requires the production of certain documents.

F. Invalidity of Statutory Notice and Demand

1. Contention: No notice and demand, as required by I.R.C. § 6303, was ever received by taxpayer.

2. Contention: A notice and demand is invalid because it is not signed, it is not on the correct form (such as Form 17), or because no certificate of assessment is attached.

G. Tax Court Authority

1. Contention: The Tax Court does not have the authority to decide legal issues.

H. Challenges to the Authority of IRS Employees.

1. Contention: Revenue Officers are not authorized to seize property in satisfaction of unpaid taxes.

2. Contention: IRS employees lack credentials. For example, they have no pocket commission or the wrong color identification badge.

I. Use of Unauthorized Representatives.

1. Contention: Taxpayers are entitled to be represented at hearings, such as collection due process hearings, and in court, by persons without valid powers of attorney.

J. No Authorization Under I.R.C. § 7401 to Bring Action.

1. Contention: The Secretary has not authorized an action for the collection of taxes and penalties or the Attorney General has not directed an action be commenced for the collection of taxes and penalties.

III. PENALTIES FOR PURSUING FRIVOLOUS TAX ARGUMENTS

IRS Shotguns

Rush also picked up on the Drudge item about IRS purchasing a bunch of new shotguns. He had this to say about the topic, as transcribed on his website.

Look at this: "The IRS Is Looking For 60 12-Gauge Pump Action Guns To Arm Its Investigators." This is from BusinessInsider.com. "Working for the IRS doesn't sound so wimpy anymore. The IRS apparently has plans to buy 60 Remington Model 870 police 12 gauge pump action shotguns for the Criminal Investigation Unit. According to the federal business government website, these guns are serious. The Remington parkerized shotguns come fully loaded with:

A fourteen inch barrel

Modified choke

Wilson Combat Ghost Ring rear sight

XS4 Contour Bead front sight

Knoxx Reduced Recoil Adjustable Stock

Speedfeed ribbed black forend

"We're not sure what kind of IRS duty requires this kind of combat artillery, but it sounds badass. And oddly, these are the only guns the IRS is allowed to use, 'based on compatibility with IRS existing shotgun inventory.'" (interruption) No, I don't think this is for Geithner. You mean to get him to repay? You know, I'll tell you what, with as much as they're going to raise taxes they're going to have to be a big problem. It won't be long before they bring the military in to do this. Sixty 12-gauge pump action shotguns for the IRS?

Next in Line for a Bailout: Social Security – All Ponzi schemes eventually collapse on their own.

Labels: SSA

Drudge had some interesting tax related stories in today’s headlines:

Case backs need for sex-change surgery. US tax court rules costs deductible – A new more generous interpretation of the dispute between “required” medical costs and “elective,”

Budget-strapped states avoid the word 'taxes.' Rise disguised as penalty, fee. - This trick has long been used by slimy politicians to pretend they aren’t raising taxes, while using various other means to steal money from us peons.

Acquiring Shotguns – This bid by IRS to purchase 60 shotguns illustrates that I haven’t been exaggerating when I say that we are forced to pay taxes and for the Social Security Ponzi scheme at the point of a gun. It’s also another example of how “voluntary” paying taxes is, for those idiot tax protestors still clinging to that stupid argument.

Expiring tax breaks

Unfortunately, it is much more likely that the DemonRats in DC will let Bush’s tax cuts expire, resulting in huge tax increases for everyone.

Tax Cuts to Expire for Top Earners

Labels: TaxHikes