Tax Guru-Ker$tetter Letter

Sunday, November 30, 2003

Turkey-Time Tax Moves - Doing year-end tax planning is a hundred times more effective if you have all of your current year activity properly entered into QuickBooks. Otherwise, it's just a matter of shooting in the dark.

Time to Commit to Your Company's Retirement Plan

This measure will not strengthen Medicare - Written by one of the few GOP Senators with enough common sense to vote against this idiotic expansion of government control over health care.

Bush Now Directing Attention to Revamping Social Security - Any attempt to fix a system as fundamentally dishonest as SS is nothing more than our rulers' standard practice of rearranging the deck chairs on the Titanic.

Congress decides bigger is better: Tax breaks target big SUVs - I'm still amazed at how many people, including plenty of tax pros, think that the six thousand pound weight threshold for generous vehicle tax breaks is something new. As I have been saying for the past nineteen and a half years, this rule exempting vehicles weighing more than 6,000 pounds from all of the luxury vehicle tax limits was enacted back in 1984. It is obviously worth a lot more starting in 2003 because the Section 179 deduction was increased from $24,000 to $100,000 per year.

Luckily, recent attempts by busy-bodies in the US Senate to limit the vehicle portion of that deduction to just $25,000 have failed to make it past committee. I'm sure all of those jokers who voted for that penalty against buyers of SUVs are completely oblivious to the fact that their taxpayer funded limousines weigh far more than any SUVs normal people would buy.

Labels: 179

Saturday, November 29, 2003

Spending escalates under GOP watch - While many commentators, such as Rush Limbaugh, are speaking out about this abandonment of small government principles by the GOP, they are too scared to explain how to stop it. Republican politicians are not going to change their ways unless they are punished for their big spending actions. This can be accomplished by refusing to donate to their campaigns, and more powerfully, not voting for their reelection. They obviously take their constituents for granted, believing that they have no choice but to vote for the GOP incumbent rather than a DemonRat. What they wouldn't like is for their normal supporters to vote for candidates from a party that is very consistent in its support of limited constitutional government, the Libertarians.

Supply-Spend Economics

Yay for Naysayers - It's a definite sign of a big shift to the left for the GOP when only nine of its US Senators could do the right thing and vote against this huge expansion in the size and cost of government. The DemonRats only voted against it because it was supported by Bush and the GOP. They would have all voted in favor of it in a heartbeat if a DemonRat president had been in charge.

TAX-CUT TRICKLE-UP - As is often said, a rising tide lifts all boats.

Taxpayers pick up tab for benefits

The Medicare bill was inevitable - Not for those of us who think the Federal government shouldn't be in charge of medical care.

The embarrassing GOP

Digging into spending

Medicare fraud: Reforming our way to bankruptcy

Bad Medicine. How on Earth Did We Get Here?

Hopefully WEA next in line for IRS audit

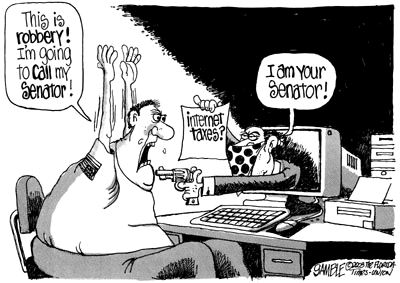

Senators Lamar "Sundquist" Alexander And George Voinovich Kill Internet Tax Moratorium

Friday, November 28, 2003

Tax-raising governors could lift Bush in 2004 - Very strange "logic" at work in this article that confuses the heck out of me.

2003 Organizers Are Available

Consistent with the schedule for the previous several years, the organizers for 2003 individual income tax returns (Form 1040) are now ready to be sent out. Any clients who have already received their 2002 1040s should contact us when they are ready for their 2003 organizers. For those clients whose 2002 1040s have yet to be finished, the 2003 organizer will be automatically included in the folder with the 2002 tax returns.

A reminder that organizers are only available for individual income tax returns - Form 1040. Information for all other types of tax returns - corporations, partnerships, trusts, estates, LLCs, non-profits, and foundations - must be submitted in the form of QuickBooks data files.

Thursday, November 27, 2003

The GOP has devolved into the PIG: the Party of Increasing Government

As Fed Expands Credit, Consumers Drown in Debt

Governor's tough task: finding the waste to cut. Budget can be shrunk -- but by $10 billion? - That should be no problem for anyone with an objective understanding of the true purpose of government in a capitalist society.

Dem Presidential Candidates Hammered for Missing Medicare Vote - One of the many things wrong with our current political system is the fact that campaigning for high office is itself a full time job lasting for months and years on end. This makes the only ones able to afford it those who are either independently wealthy or those who have jobs that don't require them to actually do anything; which is why our choices are almost exclusively professional politicians who are paid and supplied with massive perks whether or not they do any of the things they were elected to do. Bush couldn't have afforded his 2000 campaign if he hadn't been governor of Texas at the time. Ditto for Clinton in 1992. Those of us in the private sector, who have to actually do things in order to be paid, can't afford to spend a year or more out on the campaign trail.

Wednesday, November 26, 2003

The Quiet Earthquake in Spending - The reason I've spent so much time ranting about the reckless spending by our rulers in DC is the inevitable net result of higher taxes. Contrary to the leftist propaganda, tax rate cuts don't cause deficits; but uncontrolled spending sure does.

Internet Tax Ban Bill Stalls in Senate

Tuesday, November 25, 2003

The GOP's Spending Spree. Aren't Republicans supposed to be the party of small government? - Those were the good ole days, when the GOP cared about controlling government spending on wasteful and corrupt social programs, and didn't consider the Constitution to be some irrelevant relic of the past.

Bring back gridlock - Having so much agreement between the DemonRats and the GOP is extremely dangerous for taxpayers, to say nothing of the Constitution that both parties routinely flagrantly disregard with no consequences.

Federal Income Tax Burden Falls Ever Harder on Taxpayers in Areas with High Cost of Living

Garbage Time - I'm glad to see that I'm not the only one disgusted with Fox News' trashy focus on the celebrity court cases. I haven't been watching much of Fox News for the past several months because their target audience must be those who just can't get enough dissection of every minute irrelevant detail of these cases. The only one who seems to still care about covering real news is Brit Hume. It's a shame that Fox News has become just like the other sensationalist media because I think there is a market for people like me, who couldn't care less about these celebrity scandals.

A New Age for AARP - Calling AARP nonpartisan shows how reliable NewsWeak is. AARP has consistently supported any program to increase the size and cost of big government programs. That hasn't changed in this case. The DemonRats are just mad that the GOP is going to get credit for this new boondoggle.

IRS Audits Nation's Top Teachers' Union - Maybe the Clinton Gang's protection of left wing charities from having to obey the laws against overt political activities is finally wearing off.

Monday, November 24, 2003

As with the original Medicare program, by the time we discover the true cost of these new benefits, it will be too late to turn back and everyone over 65 will literally be addicted to this taxpayer funded subsidy.

Tax repeal revs up PRC car dealerships - Funny how that works. Reduce taxes and encourage purchases. As I've already said on several occasions, the sales tax revenues from vehicle sales should more than offset the revenue loss caused by Arnold's repeal of the previous governor's tripling of the car tax.

Schwarzenegger raising fast funds -- and critics' ire - So much for Arnold's promise of an end to the standard practice of hustling for campaign contributions.

A bequest or a breach of trust? - Unfortunately, this kind of thing happens far too often with banks and attorneys literally stealing from the recently departed and decimating their wishes to leave things to their family members.

GOP Dishes Out Pork In Growing Portions

Alarms Sounded On Cost of GOP Bills

Sunday, November 23, 2003

No conservative can be happy about giving at least $400 billion in additional taxpayer funding to an entitlement program. - No kidding. As with the original predictions for the cost of Medicare, the numbers being used as expected costs of the new drug benefits are understated to the max.

Bill Gates tops list of charitable givers - As it should be. The persons who have the most can donate the most.

Spending Bill in Congress Might Draw Bush Veto - If Bush were to be in any way consistent in controlling unconstitutional spending, he would also veto the pork heavy energy bill and the perpetual deficit generating Medicare drug plan.

Couric Gushes Over Rubin's Record, Blames Tax Cuts for Deficit - Expecting anything resembling honesty from Clinton worshippers like Couric is futile.

Rx for bankruptcy - Adding more benefits to the system will push an already fiscally teetering Medicare system over the edge. As is inevitable for Social Security, the only way to keep Medicare from collapsing entirely will be to deny benefits to the evil rich, regardless of how much they have paid into the system. A reminder once again that our rulers currently define "evil rich" as any person earning more than $25,000 per year or married couple earning more than $32,000 per year for purposes of taxing Social Security benefits. Similarly low thresholds for Medicare will keep the impoverishment planning consultants and creative tax accountants quite busy.

Strange Cosmos

You can always find plenty of amusing things at Strange Cosmos.

I particularly like this week's inclusion of a new version of the classic "two-cow" economics lesson, updated for the recent recall circus in the PRC.

The definitions for these new words are also entertaining, especially:

Intaxication: Euphoria at getting a tax refund, which lasts until you realize it was your money to start with.

Cashtration (n.): The act of buying a house, which renders the subject financially impotent for an indefinite period.

Saturday, November 22, 2003

When Credit Counselors Prey on Consumers - Gail Buckner also has some good advice on how to deduct losses on stock in bankrupt companies. Just the fact that it's bankrupt doesn't justify a capital loss. You have to dispose of the shares.

Bad Political Medicine. Will the Medicare bill help the GOP next year? Don't count on it. - It's a very big mistake on Bush's part to try to expand the size and cost of government in order to buy votes in the traditional DemonRat style. This will end up being a lose-lose-lose situation for everyone who cares about Constitutional government.

Friday, November 21, 2003

Real estate agents avoid retirement disaster. 'Exit strategies' include investing in rental properties, REITs - This is what I have always tried to explain to our many Realtor clients. They are in the best position to find good investment opportunities and should be able to accumulate a much larger retirement portfolio by acquiring properties than by putting cash away in "conventional" retirement accounts.

As I've described on several occasions, one of the main reasons that I have somewhat specialized in real estate tax issues is that, growing up in the San Francisco Bay Area, I had seen that as the more reliable path to wealth. It has always amazed me how many Realtors don't personally invest in real estate, including some who don't even own their own homes.

On a couple of occasions during my life in the PRC, I even got my own real estate license just so that I could be more in the loop for good investment opportunities. Unfortunately, my CPA work kept me much too busy to utilize the real estate licenses as often as I had hoped to.

However, I have not lost my faith in real estate as a less risky path to wealth accumulation than the stock market.

Tax Hike May Doom Mike - As it should be for tax loving Nurse Bloomberg. He has been a terrible replacement for Giuliani.

Governor: Pass bond or raise taxes. Schwarzenegger rejects reductions in social programs - Not a good follow-up to his reduction of the car tax. Everyone knows that the fiscal problems in the PRC are not due to a lack of revenue; but to too much reckless DC-style spending.

Battling over Buffett - The recall election may be over, but the stench of Arnold's number one economic advisor calling for huge property tax increases is still lingering in the PRC.

Is Your tax Preparer In India?

Many people may not be aware of the fact that the trend of companies farming out many of their back office services to India isn't just with telemarketers and technical support lines. It seems that some large tax preparation offices are doing the same thing.

Several months ago, out of curiosity, I checked out the similar service offered by Sure Prep. I was planning to write an article on it back then, but got side-tracked.

I was very unimpressed with the entire concept of this approach to dealing with tax prep work. With all of the time needed to scan all documents to send to the Indian preparer, this concept doesn't make much sense to me. Their rates, as I recall, weren't much better than just hiring local CPAs for the tax season load, which is what I used to do back in the PRC.

I have no idea how many of these services exist in India; but their numbers will grow if the demand does. One other one I just learned of, courtesy of Ohio CPA Dana Stahl, is this so called Tax Portal from a company in India called eSoftCircle.

I have no current info on the quality of their work. What I think is important is that clients be informed of exactly who is working on their tax returns. Back when I had a large staff of preparers in my offices in the Bay Area, clients knew who was doing the bulk of their prep work, and that all returns were reviewed closely and signed by me before being sent out. If tax prep firms just use Indian preparers in impersonal assembly line style to pump out returns, I can't see that as being good for clients.

Thursday, November 20, 2003

Am I the only one nostalgic for the time when the GOP supported limited government?

Internet Access Tax Battle Heats Up in Senate

Entitlements Are Forever. Republicans make a bad deal on Medicare.

Big Government Republicans Rule?

Wednesday, November 19, 2003

Morning Shows Express Hope Arnold Can Get Around Tax Cut Pledge

Networks Rue How Schwarzenegger’s Car Tax Cut Will Swell Deficit - It wasn't just my imagination that newscasts were focused on an imaginary revenue loss and completely ignored the additional sales tax revenue that will be generated from new vehicle sales.

States that cashed in on a landmark $246 billion settlement with tobacco companies five years ago are spending little on programs to curb smoking - Standard operating procedure for our rulers. Claim a new tax or fee is for a special project or cause and then spend the money on whatever else they want to.

Tuesday, November 18, 2003

Ten most overpaid jobs in the U.S. - Any list of this kind is by definition very subjective.

Social Security Reform High on Political Agenda

Social Security Is an Election Year Issue - Which means there will be plenty of scare stories from the DemonRats and nothing done to improve the system.

Bush readies more tax breaks - Get ready for the diatribe about "tax cuts for the rich" who supposedly don't need them, according to the DemonRats who believe only they know how to spend other people's money.

Both sides looking ahead to tax vote in Oregon

Oasis No More? Internet users: Beware the MTC

The Grinch who robbed the Internet

Stephanopoulos Ignores Spending: "What Taxes Would You Raise?" - How that Clintonoid munchkin can be considered to be anything resembling a journalist shows just how deeply the leftist propagandada machinery has taken over most of the media in this country.

Reject tax-free Internet; Florida would take hit - The smell of money is bringing out the selfish side of lots of people.

Monday, November 17, 2003

Senate Panel Finds Abuses in Tax Shelter Sales

Schwarzenegger repeals car tax increase - You can't get any faster in cutting taxes than this. Many of the reports on this on FoxNews claimed that this would immediately add over $4 billion dollars to the State's budget deficit. That's ridiculous. As I've pointed out over the past month, new car sales have dropped like a rock since Davis tripled the car tax. The lost sales tax revenue must have made the car tax revenue seem like a drop in the bucket. Why isn't anyone reporting how much new sales tax revenue will start flowing to the State and counties now that Arnold has repealed the higher car tax?

Davis' Pension: About $105,000 - Politics is one of the few professions where a person can be fired for gross incompetence and corruption, yet still retire handsomely at taxpayer expense.

Stop the Email Tax - Doing nothing to prevent taxes on Internet services is not an option.

Fewer workers make use of 401(k)s - Assuming the money is invested wisely, deferred comp plans are much better tax savings vehicles than IRAs.

Ask about Social Security - Don't hold your breath waiting for any of our rulers, least of all the DemonRat presidential wannabes, to fix this disaster of a retirement plan.

Congress has created an SUV-sized loophole - The anti-freedom environmental wackos aren't giving up in their efforts to prevent people from claiming the Section 179 deduction for what they consider to be evil gas guzzlers. These people should just mind their own business and stop trying to force their own idiotic ideas of what is a legitimate form of transportation down the throats of others. Buyers of "gas guzzlers" are already punished enough every time they fill up their gas tanks. They don't deserve to be treated as the kind of scourge of society that has long been used against unpopular groups, such as smokers.

Labels: 179

Sunday, November 16, 2003

Cattle Rushed to Market as the Price of Beef Soars - This is excellent news for cattle ranchers, including many of our clients and neighbors. Most people have no appreciation for how risky farming is. I can't think of any other occupation that is so much at the mercy of elements completely out of one's control, such as the weather and world commodity markets.

Iraq Has a Flat Tax. We Don't. Why? - Good question.

Call for Increased Tax Shelter Penalties - Buying scam tax shelters should get people in trouble. There are plenty of easy common sense steps to reduce taxes, such as using C corps, that breaking the law can't be condoned, even by someone as anti-tax as I am.

N.Y.C. is capital of taxes. State & local levies here highest in U.S. - It should be no surprise that the PRC is in second place.

More retirees still paying mortgages - This is actually a good thing. Owning a home free and clear, yet having no cash with which to play is not a good way for seniors to spend their golden years. They have no obligation of any kind to preserve all of their wealth for their kids and should be enjoying the fruits of their labors and investments while they are still alive.

This makes as much sense as the Treasury Dept. spending millions of dollars to promote the new $20 bill.

Saturday, November 15, 2003

Tax refunds expected to jump 27% - Those refund checks should give Bush a big boost in popularity and counter the DemonRats' rants that the tax cuts need to be repealed.

Restraining federal spending - He agrees with my contention that term limits are required to prevent ever more of these unaccountable spending sprees.

Passing down wealth - It's good to see that more people are spending their kids' inheritances. That's how I've always believed it should be.

Bush Is Said to Weigh Changes to the Tax Code - Exempting investment income from taxation makes perfect sense from a capitalist free market perspective. However, in the real world of "Hate the Rich" that is so pervasive in our society, it will be a very tough sell. The most likely scenario is an exemption just for those people whose income falls below some arbitrary level, as is done with dozens of other tax breaks.

Friday, November 14, 2003

Dealers, drivers riding high on SUV tax loophole - people are often asking if there is a single handy list of vehicles weighing more than 6,000 pounds. I have never seen one. However, most manufacturers have at least one SUV or truck exceeding that limit. Dealers will be all too glad to point them out to you. You can even splurge on something like this bulletproof Cadillac. This article doesn't say how much it weighs; but with all of that armor, it must be well over the magic 6,000 pound threshold.

From the PRC

Schwarzenegger prepares to undo Davis actions - It will be as close as Arnold can get in regard to imitating the time travel exploits of his Terminator character.

Torturous state-local fiscal relationship reaching climax - It's been 25 years since Proposition 13, and they're still whining about not being able to adjust to its restrictions on excessive property taxation.

Double Taxation of Savings in the Crosshairs - Unfortunately, this idea will be pilloried with the same mantra of the left, "tax cuts for the evil rich" because under their view of the world only the wealthiest scum can afford to put money into savings accounts.

Betting on Gambling is a Risky Wager - As many people have noted, lotteries and other forms of gambling are nothing more than a tax on stupid people.

Man Asks To Buy 7 Million Lottery Tickets - Back when the PRC started its lottery, I wrote an article on how, even if a person could guarantee being a winner by buying every single combination, it would still be a stupid move. The tickets have to be bought with real money today, while the winnings are paid out over 20 or more years. Anyone with that kind of money would have to be a moron to make such an "investment."

The Clinton Snipe Hunt. Twenty years later, Arkansas is still poor. - Here in Arkansas, they have always said "Thank God for Mississippi" as an explanation for our being the 49th ranked state in terms of education quality. Billary Clinton forced through the biggest tax increase in state history to raise it from 49th to 49th. Of course, as they did while in the White House, they took credit for their intentions. With liberals, results are never important; only intentions.

What Company Benefits Will You Need Next Year?

Thursday, November 13, 2003

Arnold to repeal auto fee Monday - Retroactive to October 1, effectively canceling out this bit of damage caused by Grey-Out Doofus.

Graydon "Quadrillion" Carter, Vanity Fair's editor, is so bad he makes Krugman look good. - Since the level of most American's education of how economics works is (by design) so low, the masses believe the outright lies told by the elite media, such as that tax cuts cause deficits.

Stopping the Internet tax - Includes a good use of a quote from George Harrison's "TaxMan" song; something I have referred to on several occasions as being all too prophetic.

Conservative Bumper Stickers - Many of these are out of date; but they're still funny.

Repub Guru Compares Taxes to Genocide - While the tone of this article is to ridicule anyone who would make such a comparison, that analogy is completely appropriate. In today's America, it has become quite acceptable to justify downright evil and immoral actions as valid because they are only being done against a small portion of our populace.

As I have continuously mentioned, our rulers have exploited envy to such a degree that there is nothing too dastardly that can be done to the "evil rich." While it is true that the estate tax (aka death tax) currently only applies to a limited few in the top tier of wealth, it is an entirely immoral thing to do to people, to strip their families of the wealth they worked their butts off to accumulate.

It is, as I have also mentioned on several occasions, right from the Communist Manifesto to deny people the right to pass their things on to anyone but the supreme central government. I, for one, have always believed that communism, with its denial of freedoms of choice and private property ownership, is itself inherently evil.

Anyone who believes it's okay to deny a certain portion of our citizens the right to keep their things is, as Grover Norquist said, no different from the Germans who supported the elimination of a certain portion of their populace. Wrong is wrong, whether it happens to everyone or just one single person.

Wednesday, November 12, 2003

Congress Raises Executive Minimum Wage To $565.15/Hr - This parody from The Onion makes as much sense as any other attempt by socialists to arbitrarily mandate any pay rates against the natural forces of the free market.

I also liked this from their News Briefs section

Ad Campaign For New $20 Bill A Success

WASHINGTON, DC—The U.S. Department of the Treasury deemed the new multicolored $20 bill a raging success Monday, thanks to its $30 million advertising campaign. "Due to our print and TV ads, people across the nation are choosing our $20 bill when they need to exchange currency for goods and services within the United States and its territories," Secretary of the Treasury John Snow said. "We couldn't be happier. Americans agree that the Series 2004 U.S. currency is the legal tender for all debts, public and private." Due to high demand for the bill, the Treasury has already ordered second and third printings.

Policing Tax Preparers

IRS Found Tolerating Poor Tax Preparers - IRS may not be collecting all of the penalties they have assessed against tax preparers; but they are going after (albeit quite slowly) some of the tax pros who are promoting scam tax protestor arguments, such as ex IRS agent Joe Bannister, who has been using the same kind of idiotic claims that income isn't taxable and the 16th Amendment wasn't properly ratified, as dozens of other tax protestor scammers. He gets no sympathy from me as he tries to raise funds to fight his disbarment by IRS, which he is calling a lockout.

QuickBooks For Macintosh

Things have been progressing well as we assist clients in their use of QuickBooks for more accurate and efficient bookkeeping. For most of our clients, I am able to work with their actual data files and obtain more accurate information. The frustrating thing has been working with the few clients who use Apple Macintosh computers. Earlier attempts to access their QB data files on my WinTel machines were unsuccessful. I have been forced to work with the much less efficient printed reports rather than the actual data files.

A few days ago, I received the latest versions of QuickBooks for Windows and was reading over the included documents and noticed a flyer for the latest version for Mac, 6.0. It included the following feature that allows users to make a copy of their data that can be shared with the Windows version of QB.

Share QuickBooks data between Mac and Windows (New)

Experience greater efficiency, communication, and collaboration with Windows users, such as your accountant. QuickBooks: Pro 6.0 for Mac allows you to share your QuickBooks Mac data with users of QuickBooks for Windows. You can send your Mac data to Windows and Windows users can send it back to Mac users.

I've already passed this news on to the clients who are on Macs. Even though this requires buying the more expensive Pro version of the program, I have strongly encouraged them that, if they have been debating upgrading to 6.0, they should add this feature to the list of reasons to do so. I know that I am able to do a much more efficient job in tax prep and consulting when I have the actual QB data file to work with; so it should pay for itself quickly.

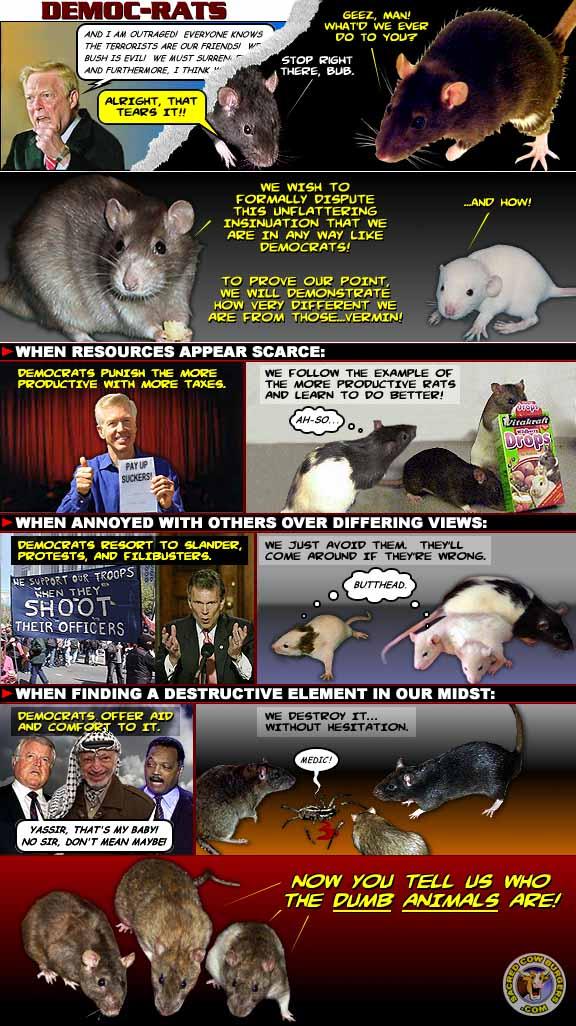

Actual rats are offended by comparison to their namesake politicians.

It shouldn't be too long before PETA starts hassling those of us who refer to members of the JackAss Party as DemonRats.

Who is rich?

This is a topic I've discussed many times; the difficulty in defining who is wealthy or rich. There are many different methods used in our country. It could be based on a person's annual income, what their net worth is, or simply how much cash they have.

Tuesday, November 11, 2003

Against Krugmanomics. Republicans learn to love--well, like--the deficit. - The big difference between those who understand reality and those who long for a socialist utopia is that the deficits are caused by rampant spending and not by too few taxes on the wealthy.

Monday, November 10, 2003

Flat tax revolution - Jack Kemp expresses the same disappointment in the hypocrisy of our rulers as I did earlier. They see the wisdom of a low flat tax for Iraq, yet continue to force us to live under the Marxist punitive confiscatory structure in our own country.

QuickBooks 2004 - I had been beta testing the early versions of the latest QB program; but just received my copies of the final versions today. Among the many other disks in the package was the official Intuit QuickBooks 2004 Training Guide. It's only about four megabytes in size; so, as I did last year, I zipped the files and uploaded them to my website to be available to anyone who wants to refer to them. My belief in the benefits of QuickBooks for everyone continues to grow every day; so I will continue to post resources to make it easier for everyone to use QB as efficiently as possible.

QuickBooks 2004 Training Guide

QuickBooks 2003 Training Guide

Beware of Unscrupulous Debt Counseling Services - Most of them are scams. You are better off negotiating directly with creditors than trusting these other crooks to do anything for you except make a bad situation much worse.

Sunday, November 09, 2003

Tax hikes urged in PRC for wildfire relief - This is just another exploitation of a tragedy for the Left's goal of higher taxes. The Federal government is already picking up the tab for the repairs required by the recent firestorm. We all know that pretending that a new sales tax will go for fire prevention is bogus on its face. It's never long before specially earmarked taxes are hijacked for other big government projects.

Saturday, November 08, 2003

New tax-free savings accounts are the next Bush push

These proposals are basically extensions of Roth IRAs. I have the same reservations about these as I have always had with Roths. First, there will be no immediate deduction for the contributions to the savings plans. The payoff is that all income earned by these accounts will supposedly be tax free when drawn out. That is very risky because it depends on our rulers not changing the rules over the next few decades.

As I have to keep reminding people, our rulers have no qualms about breaking promises in regard to issues just like this one. The most blatant example of this happening has been with Social Security. The original plan was set up with no deductions for the money paid into the SS system with the trade-off being that the benefits would be completely tax free. As we have seen, this was changed so that 85% of benefits received are subject to income tax for those who are considered by our rulers to be too wealthy; which means anyone with an annual AGI (adjusted gross income) of more than $25,000 ($32,000 per couple).

There is no way anyone can convince me that our rulers won't pull the same switch in future years. The concept of "means testing" (aka screw the evil rich) is too ingrained into the tax system of this country to expect it not to arise in regard to future withdrawals from tax free savings accounts by "wealthy" people.

Internet Tax Ban Stops Dead in Senate - The money is just too tempting for our rulers to resist.

A flood of red ink - The wild spending spree by our rulers in DC shows no sign of ever slowing down. The attempts to blame the deficit on the tax cuts is typical leftist propaganda; but there is no denying that spending is completely out of control, with no end anywhere in sight, especially if Medicare is expanded to pay for medicines.

Friday, November 07, 2003

Businesses Jump on an SUV Loophole. Suddenly $100,000 Tax Deduction Proves a Marketing Bonanza - And this is a surprise to people?

Most Like The New $20 Bill

Shifting Tax Payouts In The PRC

Thursday, November 06, 2003

News From the Left Coast

Property taxes back to cities? Schwarzenegger's plan to account for lack of vehicle fees

Auto buyers stall, wait for fee cut. Dealers eager for Schwarzenegger to keep promise - Nothing freezes economic activity more than uncertainty and the promise of lower prices in the future. Arnold had better act quickly on repealing the car tax or the already terrible financial situation will just get worse, with no sales tax revenue from car sales.

And In DC

Senate Debate Due on Internet Tax Bill

Renewal expected on ban of Internet access taxes

Sen. Roberts must take charge - It's not just backbones that the GOP in DC are lacking. It's long seemed that the gutless wonders in the GOP, who are afraid to play hardball with the DemonRats, need to get some replacements for the body parts they are missing.

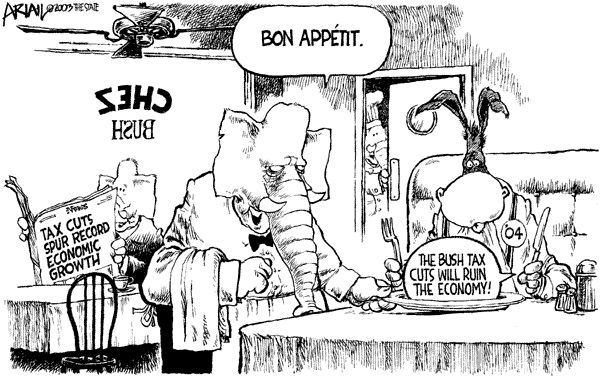

It wasn't a case of the DemonRats saying the wrong thing. They knew perfectly well that tax cuts would stimulate the economy and they had to do everything in their power to prevent that, including their standard practice of lying and scaring people. Their only chance of recapturing the White House has been to continue sabotaging the economy and then blaming it on Bush.

In classic "Do as we say, not as we do," a flat tax rate is good enough for Russia and Iraq; but not the USA.

No Freebies

The people who run QuickBooks are planning to promote a "New Business Starter Kit" that will include a free hour of consultation with a QuickBooks Pro Advisor. I have declined their offer to take part in this program because I have far too much work to do for paying clients to be able to do any work for free. Anyone considering using our services has plenty of opportunity to get a feel for our approach and experience by checking out the ever growing volume of free info on our web sites. Wasting an hour of my time chit-chatting with people who can't figure out our expertise from the websites just isn't going to happen.

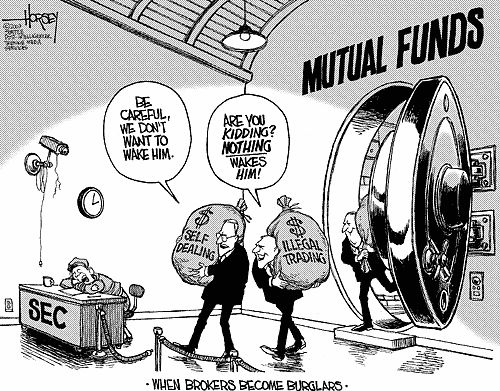

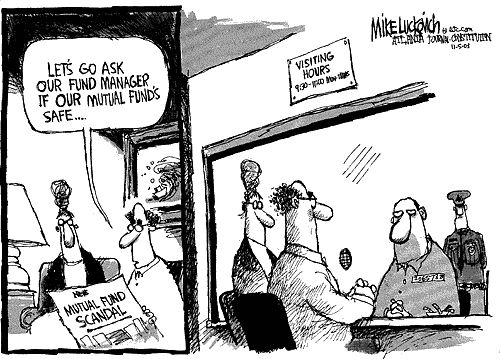

Investor Beware

None of these scandals should be surprising to anyone who understands how Wall Street works. They are part of the reason I have never been a big fan of investing in the stock market. There are very few people with enough financial clout to not be among the masses lined up for slaughter by the wolves and vultures who control the markets.

Unfortunately, financial ignorance is so pervasive that too many people had the false impression that mutual funds are different than the stock market. I constantly have to explain that mutual funds are just a basket full of stocks as selected by professional traders who are compensated for their efforts. To be surprised that those managers have been milking the system for their own benefit is naivete at the highest level.

Wednesday, November 05, 2003

Dem-onomics. On economics, the Democratic presidential candidates are far to the left of Clinton. - You know we're circling the drain when Marxists like the Clintons are considered to be moderate.

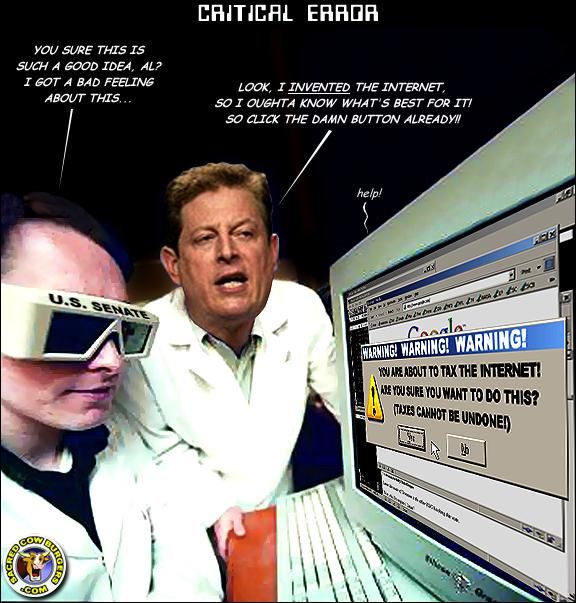

Why doesn't it surprise me to think that the same doofus who claimed to have invented the Internet would want to exploit the web for his even bigger love, money for big government?

Tuesday, November 04, 2003

As California businesses make an exodus, Idaho is hoping to lure the firms with the promise of low business operating costs - It's not exactly a tough job for any locale to look more business friendly than the PRC.

Fires notwithstanding, Schwarzenegger says he won't raise taxes.

Oregon Governor hires firm to analyze spending

Works every time

Letting people keep more of their own money never fails to stimulate economic activity, in spite of the left's claim that only our rulers know best how to spend our money.

Monday, November 03, 2003

Economic surge from tax cuts

Use of Tragedy to Justify Illegal Car Tax Is a Scandal

Car tax cut to be tough after fires

Sunday, November 02, 2003

Corporate Plea on Tax Breaks: Ours Come First

Revolt against car tax picks up pace

IRS Aims to Stop Increase in Tax Evasion

Saturday, November 01, 2003

Way open for taxing Internet

U.S. Administrator Imposes Flat Tax System on Iraq - Just one more good thing the Iraqis are getting that we Americans will probably never see. Why is it that Russia and Iraq have flat rate income taxes, while we in the USA use the Communist system of penalizing success by using severely punitive graduated rate schedules?

Small-business help - Tax breaks do motivate behavior. Nothing encourages people to spend money on new business equipment more than allowing them to deduct more of the cost sooner rather than having to stretch it out over several years.