Sebelius admits errors, pays $7,000 in back taxes – Another 0bambi cabinet nominee with tax problems.

Crocodile Dundee's Tax Audit

This film trailer parody from the Australian show Chaser’s War On Everything cracked me up, especially the special way Crocodile Dundee has of dealing with his tax auditor.

Calif. IRS agent admits cheating on his own taxes – Drudge has this article reminding us that even IRS has some tax cheats working in their midst. The article is vague as to several details, such as whether he tried to use the Tim Geithner defense and which cabinet position he is now in line to take over.

From Leno via NewsMax:

President Obama has announced a task force to review the tax codes. He’s concerned there are too many loopholes and too many people manipulating the system to avoid paying taxes. And that’s just in his administration.

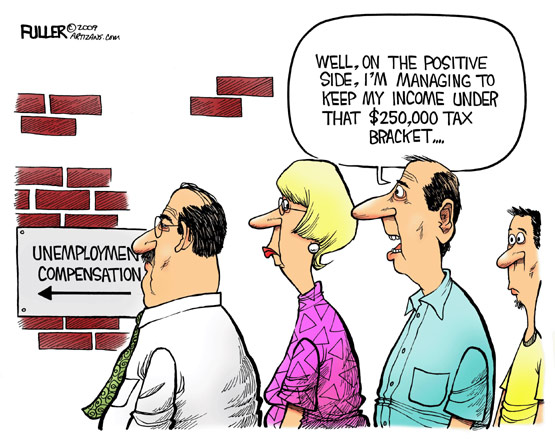

Desperate for deductions?

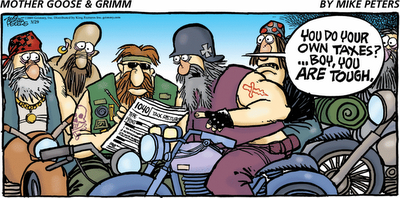

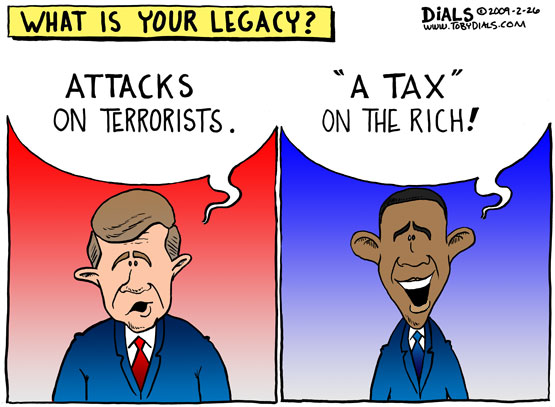

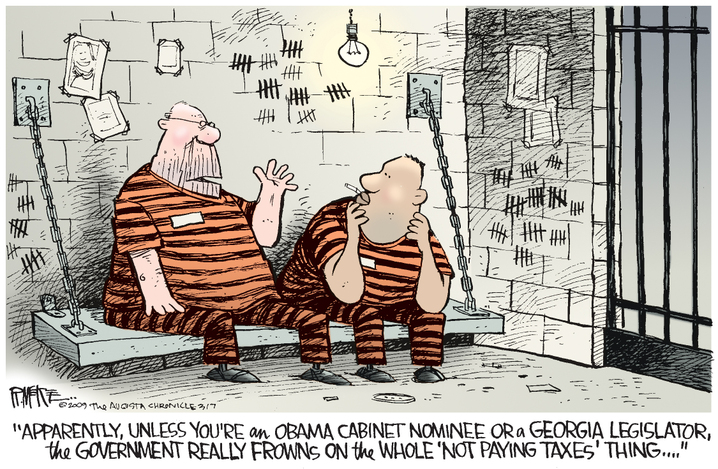

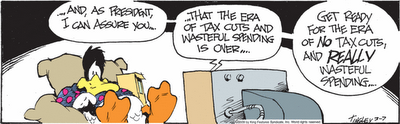

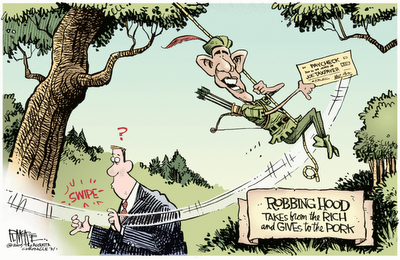

(Click on image for full size)

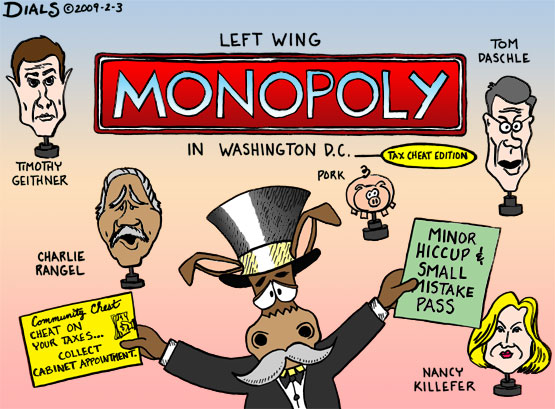

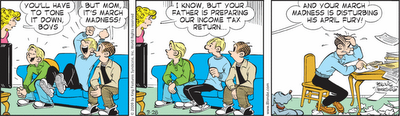

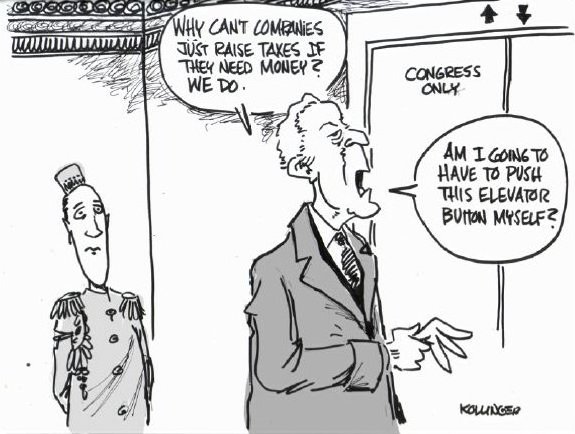

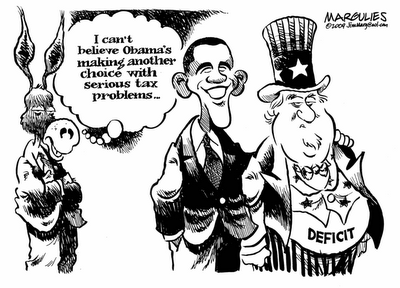

(Click on image for full size)

Labels: comix, Deductions, Kids

Peeking behind the curtain...

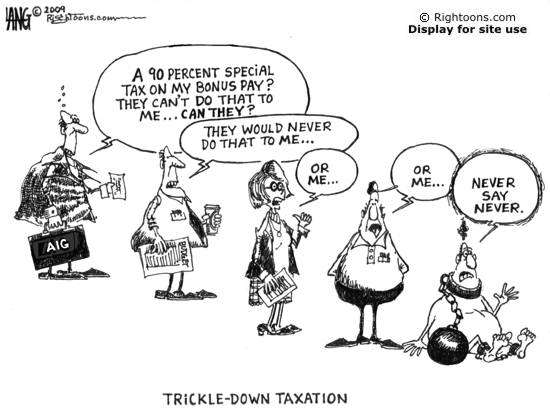

A recent episode of South Park had the following bit on how our exalted rulers in DC are making the insane financial decisions they have been pummeling us with over the past several months. It can’t be any more ridiculous than what is really happening with blithering idiots like President 0bambi, Tax Cheat Geithner, Banking Queen Barney Frank and Corrupt Senator Christopher Dodd in charge of the USA’s financial systems.

Don Rickles on our DC Rulers...

I have no idea what show this transcript is from; but he has some good zingers.

Charlie Rangel... still alive and still robbing the taxpayers blind. What does that make, six decades of theft? Rangel's the only man with a rent-controlled mansion. He's the guy who writes our tax laws but forgot to pay taxes on $75 grand in rental income! So why isn't he the Treasury Secretary? Rangel runs more scams than a Nigerian Banker.

Barney Frank - he's a better actor than Fred Flintstone. Consider... he and Dodd caused the whole financial meltdown and they're not only not serving time with Bubba and Rodney, they're still heading up the financial system!

You know, if Senator Dodd were any more crooked, you could open wine bottles with him.

Dodd's involved in more shady deals than the Clintons. Even Rangel looks up to him!

Selling Gifted Property

Q-1A+B:

Subject: Re: may I have your enlightened advice?

Dear Mr. Kerstetter,

My accountant recommended I contact you.

My stepmother gave me her house last year as a gift. She built it in 1968. I am her executrix.

How do I establish the basis for the house?

She didn't file a 709 gift tax return last year when she gave it to me so I will need a basis for her estate to pay those late taxes.

Then do I use that same basis for paying the 706 gift tax return this year?

Thank you so much.

Best Wishes,

Subject: Re: Is gift property to be included at death in one's estate?Dear Tax Guru,My stepmother gave me her house (worth over 1Million dollars) as a gift in 2007. She died in October 2008. Is that property considered part of her estate?Are there any gift taxes owing at the time of death for that property or just the 709 gift tax return when she gave me the gift?Thank you

A-1:

I'll cover both of your recent emails here since they are basically dealing with the same issues.

First off, it is obvious that you need to be working with experienced and up to date professional tax and legal advisors to make sure you do things properly here. As executrix, you should be aware of the potential personal liability you face if the Gift and Estate tax returns aren't prepared properly and filed with IRS. A very high percentage of these tax returns are audited by IRS; so they will be looking to you to cover any deficiency they find.

Both Gift and Estate taxes are calculated based on the fair market values of the assets at the time of the gift and of death. The original basis of assets transfered is generally only important for the recipients of gifts, who have to use the carryover basis as their own.

The gift of the home to you should have been reported on a 709 Gift Tax return. Since the value of that gift alone was more than the million dollar lifetime exclusion, there will definitely be some gift tax due for that gift. Before being able to properly prepare that 709, you will need to find out about other gifts made during your stepmother's lifetime because all or part of that million dollar lifetime exclusion may have already been used up.

The 706 Estate Tax return is one of the most time consuming tax returns to work on. It is quite possible that part of the value of the home that was given to you, plus the gift tax that was required to be paid on it, will be included in the inventory of assets she owned as part of her taxable estate. Again, an experienced professional tax advisor will be able to help you with this.

From your perspective, you do need to do some more homework to establish a carryover cost basis of the home that you can use when you either sell it or convert it to business or rental usage. I'm assuming there are no records of what your stepmother paid for the home; so you will need to reconstruct the costs that were put into the house. Using photos or whatever you can come up with, do your best to document the history of the house, starting with the purchase of the land and use estimates of the costs that would have been incurred for the construction and the major capital improvements. You have to use your best estimate of the actual dollars spent in those earlier years. There is no adjustment allowed for inflation. Again, an experienced professional tax advisor can help you compile those costs and will prod you with questions about costs that you can't think of on your own.

Depending on your stepmother's personal history, there may also be other factors to consider, such as whether she inherited a share of the home from a spouse and if the state is community property or not. That would give rise to a step up in the cost basis of all or part of the home.

Good luck.

I hope this helps.

Kerry Kerstetter

Q-2:

Dear Mr. Kerstetter,

Thank you so much for your advice. The house my stepmother gave me in September 2007 is in Portugal. In 1968 she and my father bought some land there (they both were US citizens) and built the house in question. The house and land were in his name. He willed all of it to my stepmother in 1997. There have been no upgrades or improvements since that time.

Should I contact the IRS to find out about any possible gift exclusions she might have had during her life? I don't know any other way.

Are you saying that MY BASIS FOR CAPITAL GAINS TAX when I sell is NOT the fair market value at the time of the gift but on what she spent to buy the land and build the house 40 years ago?

I have an accountant here in California and I have my American attorney in Portugal. He specializes in international inheritance law and said that he could help me fill out the 709 form. I think I should trust him. He is very experienced.

Thank you very much for your valuable time and information.

Sincerely,

A-2:

If you don’t have access to your stepmother’s professional tax advisor for copies of the gift tax returns, you can try submitting Form 4506 to IRS along with their $57 fee in order to get a copy of what they have. See this page on the IRS website for more info.

Your starting basis of items received as gifts is the same as it was for the person who gave it to you. If the home’s value was much higher than that, you also accepted responsibility for the capital gain taxes on the difference when you received the gift.

I mean no offense to your current professional tax advisor, but if he doesn't now this very basic principle of taxation in the USA, I would be very worried about the depth of his skills in handling your other tax matters.

However, it’s your call; so good luck.

Kerry Kerstetter

Labels: Gifting

Revoking S Corp Election

Q:

Subject: article on S Corp termination (converted to C Corp)

Thanks, informative.

2 1/2 month rule, 5 years, etc.

My question, if you'd be so gracious to answer...

It is a "formal request" to the IRS?

Just a letter??

No Form (reverse 2553 form)???

Thanks!

A:

Surprisingly, there is no official IRS form for revoking the S election. A statement including certain info is required to be submitted to IRS.

Your own personal professional tax advisor may already have a template to use. There are also other ones available from tax reference publishers, such as the following ones I copied and pasted here.

From Page 19-5 of TheTaxBook:

Shareholder revocation. The S corporation election may be revoked with the consent of shareholders holding more than 50% of the shares of stock of the corporation. A revocation made on or before the 15th day of the third month of the taxable year is effective as of the first day of the taxable year (March 15 for a calendar year corporation).

Revocation made after the 15th day of the third month of the tax year is effective for the following taxable year.

Revocation can be made for a prospective date which is on or after the date the revocation is made. [IRC §1362(d)(1)]

Corporation statement. The corporation files a statement of revocation, signed by an officer who is authorized to sign Form 1120S, with the IRS Service Center where the original election was filed.

Include the following information:

• A statement that the corporation is revoking its S corporation election under IRC Section 1362(a).

• The corporation’s name, address, and EIN.

• The number of shares of outstanding stock.

• The effective date of the revocation.

Shareholder statement. A statement signed by the shareholders, under penalty of perjury, which includes:

• The name, address, and EIN of the consenting shareholder.

• The number of shares owned by the shareholder.

• The date the shareholder acquired the stock.

• The shareholder’s tax year end.

From the CFS Tax Corresponder program:

Statement to Revoke Sub chapter S Election (IRC Section 1362(d))

To: Internal Revenue Service

<insert service center address>

Re: [Client: Taxpayer & Spouse name(s)/Company Name]

[Client: Street address, Apt/Ste/PMB #, plus line 2 (if any)]

[Client: City, State Zip]

ID: [Client: Taxpayer's SSN/Company FEIN]

The above mentioned company hereby revokes its election under IRC Section 1362(a) in accordance with IRC Code Section 1362(d). As of < insert date >, there are < insert number > shares of issued and outstanding shares of stock in [Client: Taxpayer & Spouse name(s)/Company Name]. Attached are signed consents by all shareholders holding more than one-half of the issued and outstanding stock in [Client: Taxpayer & Spouse name(s)/Company Name].

[Client: Taxpayer & Spouse name(s)/Company Name]

By: ____________________________

(Title)

Date: _____________________

Attachment of Shareholders to Statement of Consent to Subchapter S Revocation

The undersigned shareholders in accordance with IRC Section 1362(d) hereby consent to the revocation by the [Client: Taxpayer & Spouse name(s)/Company Name], ID# [Client: Taxpayer's SSN/Company FEIN] of its election under IRC Section 1362(a). Such revocation is effective < insert date >.

By: _____________________________________ ___________________

<insert name of shareholder> Date

<insert address>

<insert city, state, zip>

ID: <insert ID#>

By: _____________________________________ ___________________

<insert name of shareholder> Date

<insert address>

<insert city, state, zip>

ID: <insert ID#>

By: _____________________________________ ___________________

<insert name of shareholder> Date

<insert address>

<insert city, state, zip>

ID: <insert ID#>

At the time of this revocation, the issued and outstanding shares of the [Client: Taxpayer & Spouse name(s)/Company Name] are held as follows:

<insert shareholder> <insert number of shares>

<insert shareholder> <insert number of shares>

<insert shareholder> <insert number of shares>

As I have mentioned on several occasions, before you take the step of revoking the S election and subjecting your corp to the limitations that entails (12/31 year end, etc), you should work with your own professional tax advisor to see if setting up a new C corp in addition to the existing S corp would be a better plan.

I hope this helps. Good luck,

Kerry Kerstetter

Follow-Up:

Really cool of u. Actually its a smllc to c corp. Form 8832. And I am a tax advisor. Pleasure to make your acquintance!

Labels: corp

13 companies getting bailout money owe back taxes – Consistent with picking members of the 0bambi cabinet.

Labels: Crooks

Sec. 179 vs. Standard Mileage Rate

Q:

Subject: Re: section 179

Hi,Thanks for your previous replies in the past. If you take a section 179 deduction can you still deduct your businees mileage. O does the section 179 deuction fall under the itemised deductions therefore precluding mileage claims?thanks

A:

You really need to be working with a professional tax advisor because you are mixing up different tax issues that are technically not connected.

As I have explained on several occasions, if you use Section 179 or any other accelerated method of depreciating a vehicle, you are required to use the actual cost method of calculating deductible vehicle expenses for that particular vehicle for as long as you own it. You are not allowed to switch to the IRS's standard per mile rate because that rate includes a portion for deprecation and to switch to it would end up giving you double deductions for deprecation.

The issue of the standard personal deduction versus Schedule A itemized deductions is completely separate from the issue of how the vehicle costs are calculated. As always, it's generally a good idea to keep track of all of your actual itemized deductions and use them on Schedule A if they are higher then the standard personal deduction.

I hope this helps; but you need to be working with a tax professional.

Good luck.

Kerry Kerstetter

Follow-Up:

Hi,Thanks a lot.

Why tax problems have plagued Team Obama – A more serious look at why so many of the new administration’s members are being exposed as tax cheats.

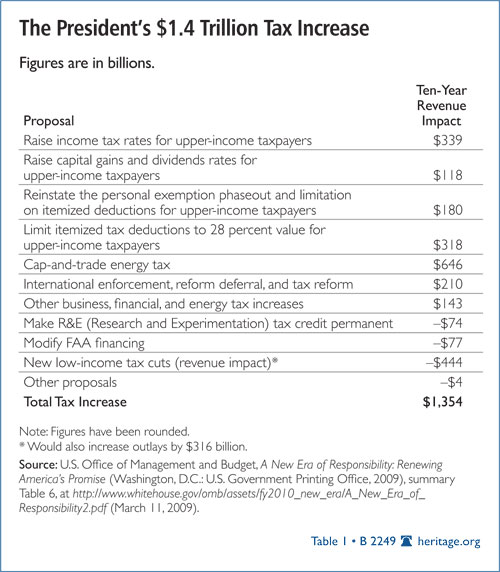

The Obama Budget: Spending, Taxes, and Doubling the National Debt – The Heritage Foundation looks at some of the upcoming tax hikes that we will be facing in order to support 0bambi’s new socialist paradise.

Labels: Crooks, Obambi, TaxHikes

Smoothing income...

Q:

Subject: s versus c article

I read your article with some interest and have a question about your tax splitting.

Lets say the C-corp does a split and takes $50k in a 15% bracket. Now what? A C-corp doesn’t have to buy food or put a kid through college. Why is it helpful for the C-corp to have 50k in the bank, especially if you are an individual with small company and just want all your money in your pocket so you can buy cocaine?

A:

The effective use of C corps to shift and smooth out income is a multi-year process; so looking at one year's end result isn't the best way to evaluate it. Any experienced professional tax advisor should be able to assist you with implementing these tactics in the best way for your particular goals and situations.

So, in addition to your particular financial priorities, be sure to budget enough money to pay for the services of a good professional tax advisor.

Good luck.

Kerry Kerstetter

Labels: corp

Tax pros and corps...

Q:

Subject: C Corporations

How do I find an accountant in my area that is comfortable with C corporations. It seems like each one I talk to wants to continue to steer me away from them?

A:

That is frustrating; but look at the good side of that situation. Any tax pro who doesn't understand how to utilize C corps effectively is doing you a huge favor by admitting his/her shortcomings up front, saving you from wasting a lot of time.

As I have repeatedly said, C corps are not automatically a one size fits all solution for everyone any more than S corps are. Any tax pro who can't logically explain his/her rationale for recommending any particular strategy, including the fact that all of the pros and cons that I have spelled out have been evaluated, is to be avoided. Anyone who automatically rules out C corps without asking you a ton of questions and tries to assume that an S corp is automatically the right approach is too lazy and/or ignorant to be trusted.

Unfortunately, we don't have anyone specific to whom we could refer you. I did recently post some names and links for some like-minded tax pros around the country.

If you haven't already done so, you should check out my tips on how to select the right tax preparer for you.

You should note that geographic location should not be the main criterion for selecting a tax pro.

I wish I could be of more assistance; and I wish you the best of luck.

Kerry Kerstetter

Labels: corp

Setting up a corp...

Q-1:

Subject: S-Corp vs. C-Corp

Kerry,

I read your article on S-corporations vs. C-corporations. Thank you. The article was very informative.

I suppose one benefit of S-Corp status would be in a situation where the entity generates significant losses early in the life of the company and the individual has other taxable ordinary income from which these losses can be deducted. The present value of deducting those losses would likely be beneficial versus being trapped as NOL's in a C-Corp.

Am I thinking about this correctly?

A-1:

That is one way to look at this. However, you have fallen into the trap of believing that a business only needs one entity for its entire existence.

A more useful approach would be to use an S corp during the loss years if they will be helpful on the 1040s of the owners and then, when it becomes profitable, set up a new C corp to use to accomplish such things as smoothing out the income, doubling the potential Section 179 deduction, and shifting income between fiscal years.

Any creative tax pro should be able to know how to use multiple entities for maximum tax savings. Anyone who claims that you have to select one single entity at the beginning and use it exclusively for the lifetime of the business should be avoided.

Thanks for writing.

Kerry Kerstetter

Q-2:

Thank you.

If you expect losses in excess of your basis due to the use of debt to finance an acquisition, is there a structure that makes the most sense

to deduct those losses against other income?Thanks again.

A-2:

There are far too many options to consider and possible scenarios that can be used to achieve your goals for me to even begin giving you specific advice via this medium. You will need to work directly with an experienced tax pro who can analyze your unique circumstances.

I wish I could be more help; but I already have too many clients to take care of properly; so we are still trimming back on the difficult clients and are not accepting any new ones at this time.

Unfortunately, we don't have anyone specific to whom we could refer you. I did recently post some names and links for some like-minded tax pros around the country.

If you haven't already done so, you should check out my tips on how to select the right tax preparer for you.

You should note that geographic location should not be the main criterion for selecting a tax pro.

I wish I could be of more assistance; and I wish you the best of luck.

Kerry Kerstetter

Follow-Up:

Thank you

Labels: corp

Mandatory repeat business...

This reminds me of a conversation several years ago with a client who was an attorney. He told me how much he envied my profession because the clients are forced by law to use our services every year, while his clients only need his services on rare occasions.

A Strategy For Capital Gains – Bruce Bartlett looks at a topic I have been following for decades, indexing the cost basis of capital assets for inflation. Expecting that to be done in light of 0bambi’s very vocal hatred of investors and any perceived special tax breaks for them, as well as the fact that neither Bush 41 nor Bush 43 had the balls to issue the executive order to allow this kind of indexing, mean that this is going to be an unfulfilled wish for at least several more years.

Labels: CapGains

IRS Drops Interest Rates

Per their news release, the following rates will be in effect for the quarter starting April 1, 2009.

four (4) percent for overpayments [three (3) percent in the case of a corporation];

four (4) percent for underpayments;

six (6) percent for large corporate underpayments; and

one and one-half (1.5) percent for the portion of a corporate overpayment exceeding $10,000.

Labels: IRS

Sec. 179 Phase-Out

Q:

I do not understand the phase out concept for Sec. 179 accelerated depreciation. For 2009 for example, the maximum deduction is $250,000, so what does it mean to have higher phase outs? You would never claim more than $250,000, so how would it ever phase out?

A:

The expensing election under Section 179 was always intended to be for smaller businesses. To make sure that larger businesses weren't able to benefit from it, our rulers in DC added the phase-out thresholds based on the dollar amounts of equipment that were acquired during the year. The underlying concept is that, any company large enough to be able to afford those large amounts of new equipment purchases didn't need the additional tax help from Section 179 because their normal deprecation deductions would be large enough.

Whether this makes sense or not isn't the key. It's how our rulers have decided to limit the application of Section 179.

I hope this clears up any confusion you have.

Kerry Kerstetter

Follow-Up:

I get it now. By making sense, I did not mean in the ultimate sense, but in the limited sense of whether there was even an arguable policy rationale. Without one, I would not be sure whether the explanation was correct. Now I get it.

Labels: 179

Vehicles qualifying for maximum Section 179

From a client with a 3/31/09 corp year-end:

Dear Kerry:

Our corp is considering purchasing a van such as a delivery van (GMC, Chevy, etc.).

Could you please inform me of the IRS specifications that must be met to allow us to expense the entire amount.

Before we would purchase the vehicle I will check with you to make sure it meets the requirements.

Thanks.

My reply:

As you requested, here are the specifications for what a vehicle has to have in order to qualify for deducting all of its cost in the first year. Basically, these rules are most important if a vehicle either weighs less than 6,000 pounds or costs less than $25,000.

I excerpted this from my main tax reference source, TheTaxBook. Section 280F is the part of the tax code that severely limits the deprecation deduction for vehicles.

Vehicles not subject to Section 280F. The following vehicles are not subject to the depreciation limitations under Section 280F or any of the other listed property rules:

• Clearly marked police and fire vehicles.

• Unmarked vehicles used by law enforcement officers if the use is officially authorized.

• Ambulances used as such and hearses used as such.

• Any vehicle with a loaded gross vehicle weight of over 14,000 pounds that is designed to carry cargo.

• Bucket trucks (cherry pickers), cement mixers, dump trucks, garbage trucks, flatbed trucks, and refrigerated trucks.

• Combines, cranes and derricks, and forklifts.

• Qualified specialized utility repair trucks.

• Tractors and other special purpose farm vehicles.

• A vehicle used directly in the business of transporting persons or property for pay or hire, including school buses, and other buses with a capacity of at least 20 passengers.

• A truck or van that is a qualified nonpersonal-use vehicle.

Qualified nonpersonal-use vehicles.

These are vehicles that by their nature are not likely to be used more than a minimal amount for personal purposes. They include trucks and vans that have been specially modified so that they are not likely to be used more than a minimal amount for personal purposes, such as by installation of permanent shelving and painting the vehicle to display advertising or the company’s name. Delivery trucks with seating only for the driver, or only for the driver plus a folding jump seat, are qualified nonpersonal-use vehicles.

Trucks and vans.

Trucks and vans are passenger autos built on a truck chassis, including minivans and sport utility vehicles (SUVs) that are built on a truck chassis. They have the same definition as passenger autos, except that instead of unloaded gross vehicle weight, the definition is gross vehicle weight not more than 6,000 pounds. The Section 280F depreciation limits for trucks and vans are higher than the limit for cars.

Vehicles over 6,000 pounds.

Passenger autos rated at more than 6,000 pounds unloaded gross vehicle weight, or trucks and vans rated at more than 6,000 pounds loaded gross vehicle weight are not subject to the Section 280F depreciation limits. However, such vehicles may still be considered listed property for purposes of the other listed property rules, including the requirement that the vehicle be used more than 50% for business to take the Section 179 deduction.

Remember that the expensing deduction is only allowed if you actually place the vehicle into service before the end of your tax year. It won't be sufficient to prepay for it by March 31 and then take delivery later in your next fiscal year. You need to actually use it before the end of the day on March 31 in order to claim it on this year's tax return.

I hope this helps. Let me know if you have any specific questions.

Kerry

Follow-up:

Kerry:

Could you please let me me know if any or all of the following vehicles qualify for deducting all of the cost in the first year.

1) 2009 GMC Sierra 2500 crew cab pickup. GVWR = 9600 lbs. Bed length = 77 inches. This is the same model we purchased nd were able to deduct in 2006. Price = $39,480

2) 2009 GMC Savanna 12 passenger van. GVWR = 9600 lbs. The seats can be removed. Price = $33,027

3) The dealer also has the same model 2008 GMC Savanna available for about $21,000

Thanks.

My Reply:

I looked over the vehicle descriptions you faxed over and compared them to the rules for the first year expensing.

1. Because the 2009 GMC Sierra has an exterior bed of larger than 72 inches, it would qualify for deducting the entire purchase price of $39,480 plus the sales tax.

2. Because the 2009 GMC Savanna has seats for so many people, it would only qualify for a first year deduction of $25,000 of its purchase price. The remaining cost would be depreciated over five years.

3. Because the 2008 GMC Savanna costs less than the $25,000 limit, its entire $21,000 purchase price plus sales tax could be expensed in the first year.

Besides the fact that the vehicle needs to be actually placed into service before the end of 3/31/09, which I mentioned last time, another important point is that the dollar figure we are working with is after deducting any trade in value the dealer may give you if you are swapping another vehicle for the new one. For example, with vehicle number 1 above, if you are receiving a trade in credit of $10,000, only the net cost of $29,480 will be available to deduct in the first year.

I hope this is clear and not too confusing. Let me know if you have any more questions.

Kerry

Selling Vacant Land

Q:

Subject: Vacant Land

If I sale my vacant land and meet all requirements can I still take an Exclusion on the land without the sale of my residence? Still confused about the tax law/ publication #523 any response would be greatly appreciated! Thanks

A:

You didn't say if the vacant land was connected to your primary residence or not.

I have a section on this topic on my page on home sales.

Unless you are planing to sell your home within two years of the separate sale of adjoining bare land, it will not qualify for any exclusion of gain.

You really need to be working with a professional tax advisor to see if there will even be any capital gains taxes on the land sale. There is a special zero percent tax on some gains for some people in 2009 and 2010 that you might be able to utilize.

Good luck.

Kerry Kerstetter

Follow-Up:

KERRY, Yes the vacant land is connected to my primary residence. Thank you for the current reply.

Labels: 121

Presidential Tax Returns

I came across this page on the Tax Analysts site that has links to download pdf copies of several tax returns for a number of US Presidents (Obama, Bush 43, Clinton, Bush 41, Reagan, Carter, Nixon, & FDR), some Vice Presidents (Cheney & Biden), and some recent candidates (McCain & Palin). From a true historical perspective, the 1913 tax return for FDR is interesting to look at because it was the very first year tax returns were required to be filed in this country.

IRS ends use of private collectors

From the AP: IRS dumps private debt collectors, shifts pendulum

From IRS: IRS Conducts Extensive Review, Decides Not to Renew Private Debt Collection Contracts

I didn’t have any real world experience dealing with the private collectors, so I can’t comment on how this experiment actually worked out. If anyone wants to share some examples of their real life experiences with the contract collectors, I’d be glad to post those. There’s a good chance this will be attempted again in the future.

Leading by example...

From Jay Leno via NewsMax:

Quite a scare in Washington, D.C. today. Police were called to the White House. Apparently President Obama was in a meeting with some potential Cabinet nominees when someone noticed a suspicious-looking document on the table that no one had ever seen before. Turns out it was just a tax form.

The president’s latest nominee for U.S. trade representative, Ron Kirk, who owes the government $10,000 in back taxes, has agreed to pay his taxes. When was there a choice? You try that on April 15.

Treasury Secretary Timothy Geithner announced he plans to go after tax evaders . . . this after failing to pay his own taxes. This is part of operation “Do As I Say, Not As I Do.”

From Jimmy Fallon via NewsMax:

Ten office workers won New Jersey’s $260 million Mega lottery. Unfortunately, under Barack Obama’s tax plan, they now owe $300 million.

Required to work for the 0bambi team...

From last night's Leno show via NewsMax:

Here we go again: President Obama’s latest nominee for U.S. trade representative, a man named Ron Kirk, owes $10,000 in unpaid back taxes. Apparently when it comes to taxes, “yes we can” is now “no we didn’t.”

One of his tax deductions was $17,000 for tickets to a Dallas Mavericks game. He deducted $17,000 for basketball tickets. But to be fair, since it was the Mavericks, he should be able to write that off as a failed investment.

Visiting IRS HQ...

Last night, we were watching a NetFlix DVD by the extremely funny and talented ventriloquist, Jeff Dunham, and he had the following short bit about our favorite government agency. As Jeff has said in interviews, he is lucky by being able to say a lot of politically incorrect things through his dummies that wouldn’t be tolerated from a human.

Another Obama pick owes back taxes, but it's OK because, now caught, he'll pay up – Obviously nothing new about one more tax and spend hypocrite joining the 0bambi team. What is surprising is that this snarky type look at that team is in the LA Times, which I had always understood to be the Left Coast equivalent of the NY Times, the official propaganda outlet for the DemonRat Party. Are some of the loyal little donkeys finally having their fill of 0bambi hiring tax cheats, while calling for higher taxes on everyone else?

Labels: Commies

The Silver Lining

Upper-Income Taxpayers Look for Ways to Sidestep Obama Tax-Hike Plan – As I have long been saying, electing a Marxist president would be the biggest boost to our business ever as more people see the need to stay out of his cross-hairs. It’s only a matter of time before that $250,000 threshold is reduced, bringing in more and more victims of Obama confiscation to see us about using income smoothing strategies, such as C corps.

Interestingly, I have noticed that the creative team at Tax Coach Software realized this money making opportunity as well and have been adding more and more Obama defense warnings and strategies to their arsenal over the past several months, with new ones showing up constantly.