Reporting S Corp Activity

Subject: 1040/ S corp questionI saw your website and think it is great... but I have one question.I have a 1-person Massachusetts S corp (I own all shares and there are no other employees) and have filed a separate return for it in past years.Question: Can I include this S corp on my personal return, or do I have to file it separately?Thank you!

If I understand your question correctly, you want to skip filing an 1120S for your corp and just report all of its activity directly on your 1040.

If that's your inquiry, this is another perfect example of the pitfalls of trying to set up and operate a corp without the assistance of professional advisors.

A corp is required to file its own income tax return; so you may not skip the 1120S and just include its activity directly on your 1040. You must file an 1120S and then include the K-1 info on your 1040.

Some pre-planning with an experienced professional tax advisor could have saved you a lot of hassles.

If you had wanted to avoid having to file another income tax return, you could have set up a single member LLC instead of an S corp. That would enable you to report all of your business activity on a Schedule C with your 1040.

However, that could very well be more expensive for you because the net income from the Schedule C would have been subject to the 15.3 self employment tax. Net K-1 income from an S corp is not subject to the SE tax.

Depending on the size of your profits, the cost of having to prepare another income tax return could be a tiny fraction of the SE tax you are saving.

I don't mean to insult you here, but it is clear that you are out of your depth in attempting to properly handle the tax matters for your S corp. Whether you have been preparing the K-1s properly, especially in regard to items that are required to be reported separately, is extremely doubtful. You need to start working with a professional tax advisor ASAP to clean up your past mistakes and ensure that you don't make any more.

Good luck.

Kerry Kerstetter

Kerry,

Thanks for your feedback. I appreciate your thoughts and information.

Labels: corp

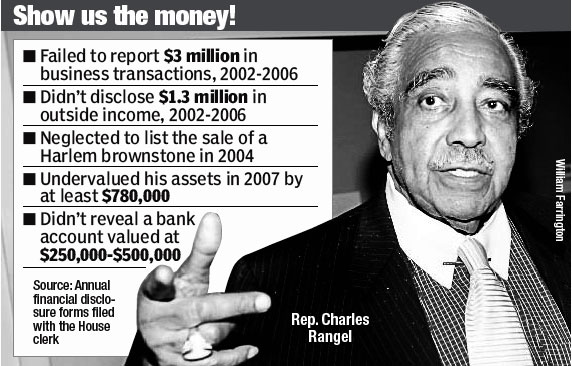

Inmates running the asylum

It's bad enough that the person in charge of the IRS, Treasury Secretary Timothy Geithner, is an acknowledged tax cheat who claims not to understand how to use TurboTax.

Now, Charlie Rangel, the Chairman of the House Ways & Means committee, which writes all of the tax laws, has been discovered to be hiding even more income and assets than were previously disclosed. Just a few of the current news stories, courtesy of Drudge:

The Absent-Minded Chairman. Charlie Rangel wins the personal lottery.

OOPS! CHARLIE FORGOT THIS $1M HOUSE. REALTY BITES TAX-THEM-NOT-ME RANGEL

Stop embarrassing us, Mr. Rangel. Resign

Not that I've ever had much respect for the bozos in power in DC; but this kind of example should make it tougher for average people to continue to bend over and allow the DemonRats to fiscally rape us.

Loose lips...

It’s long been an item of common sense that if you are hiding from the tax authorities or cheating on your taxes, the worst thing you could do would be to tell people about it. Eventually, that info will reach the tax authorities. This article explains how some State tax agencies are catching idiots who brag about themselves on such web services as FaceBook and MySpace.

Thanks to Stephen Spruielli at NRO for this.

Labels: Morons

Deducting Rental Losses

Q:

Subject: Rental property

Dear Kerry Kerstetter,

One of your clients is our friend and realtor. We are thinking about investing in rental property for tax purposes and later to use as a retirement source once the properties are paid for.

She told me that you have helped her so much regarding taxes. She suggested I should contact you to ask the following question.

If you are in the 35% tax bracket- do you get a better tax break by having the rental property under our names or by setting up a corporation to manage the rentals. We just want to be sure there will be a tax benefit by obtaining rental property and we have been given different advise and are not sure which is correct. She said you would know the answer to this question.

Thank you for your time.

A:

You are going to need to work with your own personal professional tax advisor on this matter because there is no easy cut and dried answer.

For example, it depends on what occupations you and your husband have. If either one of you qualifies as a Real Estate Professional (REP), you will be able to deduct your net rental losses against your other kinds of income, with no limit.

However, if neither of you qualifies as an REP, your net rental losses will be treated as nondeductible passive activity losses and will have to be deferred until future years when you have some passive activity profits, such as from the sales of rental properties.

I can tell this by the fact that you claim to be in the 35% Federal tax bracket, which means your Taxable Income is well over $300,000. The passive activity restriction phases out any rental loss deduction if your Adjusted Gross Income exceeds $150,000.

Using a C Corp sometimes makes sense because it is allowed to deduct rental losses up to the amount of other income. However, there is a downside to owning real estate in C corps because they don't have the same special low long term capital gains tax rates that individuals can use.

A strategy that may be able to give you the best of both worlds is to own the property individually and lease it to your C corp, which can then operate it as a rental.

Your C corp would need to have net income from other operations in order to be able to claim the rental losses. If you don't already have a C corp, even without the rental property issue, one could be used to shift some of your 1040 income so that you aren't in such a high tax bracket. I have a lot of info on using corps on my website.

Your own personal professional tax advisor should be able to help you come up with the best strategy for your particular situation.

Good luck.

Kerry Kerstetter

Follow-Up:

Thank you so much for your response. If you should ever take new clients please keep us in mind. This information was very helpful and I will look at your website.

Sincerely,

Taxes too high? You ain't seen nothing yet. - A quick look at many of the very expensive tax increases on the horizon for just about everyone. As always, this means much more work for those of us in the business of helping clients minimize their taxes.

Labels: TaxHikes

2009 California Tax Rates

Unlike the Federal tax rates, which have their annual inflation adjustments announced before the tax year starts, the geniuses in my former home state wait until the year is half over to do those calculations.

Spidell has just released a handy two-page pdf with the new 2009 inflation adjusted rates, credits and deductions for personal income taxes.

Labels: StateTaxes

Recording Mileage

I would be very interested in hearing from anyone who uses this new app as to how accurate and convenient it is in real life usage.

Naming A Corp

Q:

Subject: c corporation question

I am utilizing the information that you provide as a guideline to set up my C Corporation. Are you saying to use Corporation or Inc., etc. in the name? It sounded like you are saying to avoid these words.

Thanks very much.

A:

Regarding the selection of a name for a corp, you seem to be misunderstanding the point I was trying to make.

I have never had any problem with the use of a corp signifier in the official name, such as Corporation, Inc, or Ltd. In fact, most states require one of these to be used as part of their chartering.

What I have long seen as a bad choice was to have the owners' personal names as part of the corp name. Too often, people just put Inc or Corp after their own names.

One of the many benefits of working with a corp entity is the ability to have more privacy and anonymity than you would have by using your own personal name. As we all know, in this day and age there are fewer and fewer aspects of our personal and business lives that we can keep private. This is why I have aways liked the idea of using a generic non-descriptive name for the official corp filing. I have seen people use a few initials, parts of their kids' or grandkids' names and even completely made-up words for their official corp names. It doesn't matter that nobody can understand the meaning of the corp name. It's nobody else's business.

Even with the generic non-descriptive official corp name, you can still also lock in some DBAs to show to the public if that would be helpful for conducting your business operations. Behind the scenes tasks, such as buying and selling properties and filing tax returns, would be under the generic official corp name. This makes snooping on your confidential affairs more difficult with Google and other tools at everyone's disposal nowadays.

I hope this helps you better understand my feelings on naming corporations.

Good luck.

Kerry Kerstetter

Follow-Up:

Kerry,

I am sorry. I did misunderstand. Thanks so much for the clarification. I look forward to working with you in the future.

Labels: corp

Double Depreciating Vehicles?

Q:

Subject: Question about Section 179 Deduction

I was reading your website and had a question about section 179.

In 2007 I purchased an Expedition EL >6000 lbs. I took the $25,000 deduction, I am being audited and am being told that I can not take the milage deduction and the 179 deduction. I thought the 179 was a depreciation event and had nothing to do with deducting milage. Can you elaborate??

Thanks in advance

A:

I constantly warn people about the dangers of trying to prepare their own tax returns because it is all too easy to make simple mistakes such as the one you did.

With business vehicles, you generally have the option of claiming the IRS's standard per mile deduction or the prorated actual expenses based on business miles to total miles for the year.

The standard mileage rate includes a factor for straight line depreciation. This was 19 cents per mile for 2007.

The Section 179 expensing election is basically a kind of very accelerated depreciation. If you claim it, you are required to use the actual expense method for that vehicle and you are not allowed to use the standard mileage rate ever for that particular vehicle because that would result in double deducting the same depreciation.

There is no nice way to say this; but you screwed things up big time by trying to deduct both Section 179 and the standard mileage rate on the same vehicle. Any professional tax preparer with even limited experience would know better than to do that.

With that kind of basic error in your tax return, there's no telling what others you have as well, including many that probably cost you money. Before you go any further with the IRS auditor, you should hire a professional tax advisor to review your 2007 1040 and see if s/he can find some tax saving deductions that will offset the extra taxes that you are going to have to pay as a result of double deducting vehicle depreciation.

If you already prepared your own 2008 1040, you will also need to have a professional tax advisor fix the mistakes that it has.

I'm sorry to be the bearer of such bad news and I hope this helps you salvage some tax savings.

Kerry Kerstetter

Follow-Up:

Thanks for the quick response. The situation is not quite so bad, we found almost $20k in deductions missed.

Thanks again for your help

First-Time Homebuyer Credit

Q:

I just closed escrow on the purchase of my first ever house in July 2009. Is my Realtor correct that I can file an amended 2008 tax return to claim the special credit for first time homebuyers? Is he also correct that this credit is mine to keep forever and doesn’t need to be repaid? I had read somewhere that the credit was just an interest free loan that had to be repaid on future tax returns. It sounds too good to be true.

A:

Your Realtor is correct that you won’t have to wait until April 15, 2010 to receive this credit, which can be as much as $8,000. You have the option to claim the credit on your original or amended 2008 1040, as long as the purchase has been completed.

As always, this kind of thing should be handled by a professional tax preparer, whose software should have the ability to properly calculate the credit on Form 5405. This can get tricky if your modified Adjusted Gross Income is over $75,000 ($150,000 for married couples) because that places you into the dreaded “Evil Rich” category as defined by our imperial rulers in DC.

In regard to repaying the credit, there was a change in the original program from what we had in 2008. For homes purchased in 2008, the credit must be repaid in 15 annual installments, starting with the 2010 1040. If the home ceases to be the main residence before the 15 year repayment tine is up, the remaining amount of the credit will be due in one lump sum on that year’s 1040.

For homes purchased between January 1, 2009 and December 1, 2009 (the current end of the credit qualification period), the credit does not have to ever be repaid if you use the home as your primary residence for at least three years. If you move out of the home, sell it or convert it to business or rental usage before the three year anniversary of your purchase, you will be required to repay the full amount of the credit in one lump sum on the tax return for the year in which the home ceased to be your principal residence.

If you don’t already have your own professional tax preparer, be careful of who you use to prepare the amended 1040. As IRS has announced in this press release, they have discovered some unscrupulous preparers who are soliciting clients who don’t actually qualify for the credit. If you happen to use one of those preparers, your credit will be disallowed and your full tax return will most likely be audited by IRS.

As with any tax law, there are even more twists to this one; so be sure to work with a professional tax advisor.

Good luck. I hope this helps.

Kerry Kerstetter

Obama’s Pledge to Tax Only the Rich Can’t Pay for Everything, Analysts Say

Geithner Won’t Rule Out New Taxes for Middle Class – Just one more reminder that not only the super evil rich are in the cross-hairs of the DemonRats to have more of their money confiscated for the greater good.

Labels: TaxHikes