CAGW Blasts Washington For Projected $480 Billion Deficit - It's not die to the tax cuts. It's due to our rulers spending money like power mad drunken sailors.

California's tax myth. Despite complaints, state's rate is far from highest - Overall tax burden is a function of much more than just the nominal tax rates. With all of the taxes and the excessive regulations on every part of life in the PRC, that State easily ranks at the bottom of the Freedom index.

Using QuickBooks to Record Stock Investments - There has been some confusion regarding whether stock traders should use QuickBooks or Quicken; so I've posted a rather lengthy explanation of why QuickBooks is the best choice on my main website.

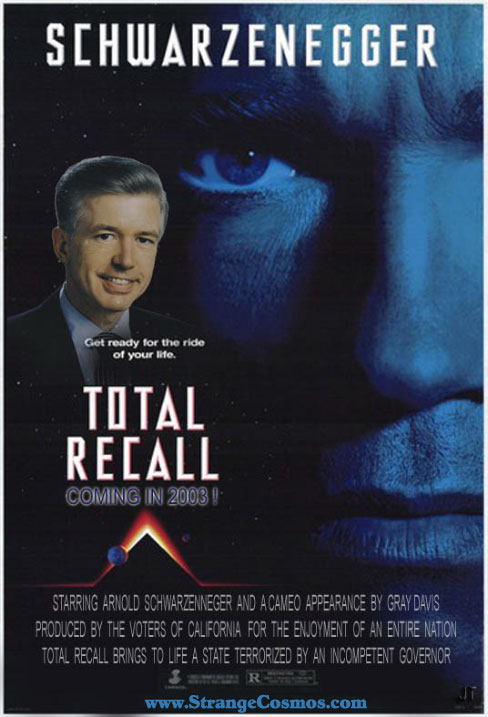

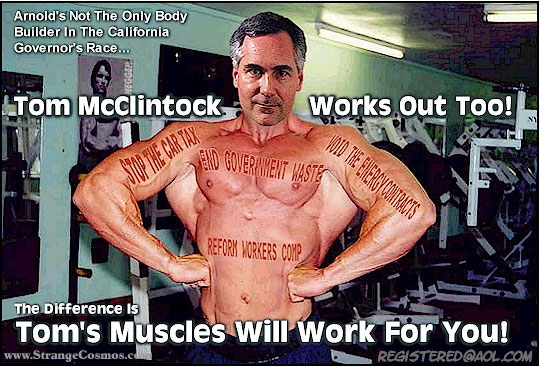

When it comes to conservative issues, Tom McClintock is the stongest candidate and Arnold is nothing more than a little girly-man.

Contradictions abound for Schwarzenegger

McClintock has no gray areas. For this Republican recall candidate, sometimes his own party is too far to the left.

Schwarzenegger picks lend clues. His choices for economic advisers, many from a conservative think tank, may illustrate his fiscal plan.

A taxing issue for candidates

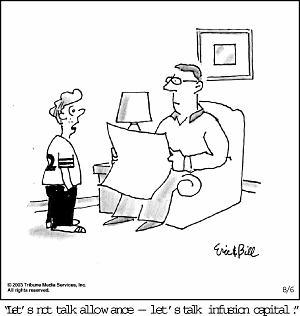

Legal Loan Sharks

One of the most expensive misconceptions people have is that leases have no interest included as part of their payments. When deciding between buying or leasing anything, it's important to know the cost in terms of the inherent interest rate. Whether it's for a new vehicle, or a new machine for one's business, the lease versus buy decision is common for everyone.

This is much more difficult for leases because the leasing companies have paid off politicians to remain exempt from the APR (annual percentage rate) disclosures that are required for normal loans.

With leases, there is no mention of APR. When you ask the salesperson what the interest rate is for a lease, they will tell you zero. This is due to a combination of sales people too stupid to know about the interest built into leases and sales people who know, but bank on the ignorance of their customers.

The motivation for this little rant was an ad that came in Saturday's snail-mail for a chain of rent to own places, with several locations around Arkansas. Just glancing at the numbers made it obvious that these people are the very definition of loan sharks. For example, the very first item is a big screen TV. It has a cash price of $1,754.42 and a rent to own price of $29.99 per week for 117 weeks. The ad does show the total of the payments ($3,508.83), but absolutely nothing about interest.

Using my handy TaxTools program, which allows me to calculate the interest rate in a loan, it came up with a nominal rate of 70.517% and an effective rate of 101.425%. If consumers knew this, they could easily realize that using a credit card, with interest rates of 20% to 30%, would save them a ton of interest.

Nowhere in the four page circular is there any mention of an APR. I did a Google search of their website, and there is no mention of APR there either.

It's not nearly as bad in terms of the rate with car leases; but it is still hidden. However, I have done this kind of calculation for clients who thought they had gotten a great deal and came up with interest rates as high as 35%. Again, nowhere in vehicle leases can you find this disclosed. It's a loophole in financial disclosure rules big enough to drive an SUV through.

I recently wrote to the Arkansas Attorney General's office asking for their comments on this matter. In my message, I also asked if his office has any plans to crack down on this practice of quasi-legal loan sharking, which we all know hurts lower income people the hardest. Whether or not they can legally charge over 70% interest isn't as important as the way they disguise it. Forcing them to disclose the interest rate would go a long way towards enabling consumers to make more educated decisions on their purchases. I will post any response I receive.

More important than the classic "Buyer Beware" warning is "Renter (lessee) Beware."

Political Donation or Bribe? - As if there's a difference. Next they'll be telling us a fart isn't the same as passing gas. Different names; same smell.

Maybe the Post Office can come out with special stamps showing something more appropriate, such as a leech, tick, mosquito or vampire bat.

Proposition 13 isn't out of the water - Warren Buffett and other fans of high taxes just can't get their minds off removing the limits built into the Prop 13 rules.

How Congress Can Achieve Savings of 1 Percent by Targeting Waste, Fraud, and Abuse - I'm sure waste accounts for a much higher portion of the Federal budget than just one percent. More like 25% would be closer to reality.

Five mysteries that give the tax experts fits

Five tax myths that can cost you money

How to fight your ballooning property tax

Rent your house for a business meeting

The governor can be recalled, but will the people return? - I have no desire to ever move back to the PRC; and I doubt if any of the millions of other refugees from the Left Coast could stomach returning after experiencing the much better quality of life elsewhere.

In Your Heart, You Know Arnold's Not really a conservative (but it may not matter).

In line with big government - It seems like the League of Women Voters is just like most of the other supposedly non-partisan groups (AARP, et al) and is a big supporter of the biggest and most expensive government possible.

Trying To Protect Financial Privacy

Gov. Gray Davis Signs Sweeping Financial Privacy Bill Into Law

Washington to Limit Financial Privacy Rights

Financial privacy bill is signed into law in PRC

Governor signs privacy measure. Tough financial-data law faces threat in Congress, Davis says

New state privacy law threatened. Federal law could block bills protecting financial information

Financial Privacy Bill Signed. Consumer groups hail the new law as a landmark victory in protecting Californians. Gov. Davis calls it a model for the nation.

Tax Hawk Group Backs Schwarzenegger

The Huffington Tax Dodge

Petition Seeks to Lower Threshold for Tax Hikes - Just what they need in the PRC; a way to make it even easier to raise taxes.

Alabamians seem to be a lot smarter than their governor in regard to raising taxes.

The Republican Spending Binge

Non-Resident Taxes

I've often mentioned how states and cities with income taxes require everyone who earns money inside their borders from services or property located there to pay that State or City's income taxes, regardless of where the person's full time home is. This applies to everyone; but is enforced most aggressively against professional entertainers and athletes, who can earn hundreds of thousands of dollars for a day's work.

Celebrities have the added benefit of having their tax screw-ups exposed to the public, such as this judgment against the boy band NSync, who failed to pay the appropriate income taxes to the City of Columbus, Ohio.

Raise Taxes At Your Peril

I know from personal experience with hundreds of clients that many people have fled the extremely heavy taxation in the PRC by relocating to Nevada. Those tax refugees also brought with them the concept of direct citizen participation in controlling misbehaving rulers.

Recent tax hikes by Nevada's GOP governor have riled up enough people that they have already started a recall effort against him. This is great, that people are no longer just bending over, grabbing their ankles and letting their State rulers have their way with them and their money.

State Tax Amnesty Programs

The Federation of Tax Administrators has a handy summary of the currently open state tax amnesty programs, as well as all such programs that have been used since 1982.

The amnesty programs currently in progress are:

Florida: July 1 - Oct. 31, 2003

Missouri: Aug. 1 - Oct. 31, 2003

Arizona: Sept. 1 - Oct. 31, 2003

Maine: Sept. 1 - Nov. 30, 2003

Virginia: Sept. 2 - Nov. 3, 2003

Kansas: Oct. 1 - Nov. 30, 2003

New York City: Oct. 20, 2003- Jan. 23, 2004

There are pros and cons to participating in these programs; so examine all of the consequences before jumping in. The biggest con is the fact that the information provided to the State tax agencies will be shared with IRS, which has no amnesty program. You really shouldn't consider even taking part in any State amnesty program unless you are ready to come clean on delinquent Federal taxes as well.

No Tax Pledge Becomes Test for Schwarzenegger

The Realities of Courage - According to the all so wise members of the media, bravery is raising taxes. Some of us would call it stupidity.

Gross Distortions - Would the media lie about the effects of the tax cuts? Do bears crap in the woods? Molly Ivins also does her part to distort the truth about the results of lower taxes on dividends.

Oregon Tax reform is among issues that could spur extra sessions

IRS Out of Control - Last year, during the campaign for the real PRC election for governor, some jerks at IRS revealed what was supposed to be confidential info on challenger Bill Simon's taxes. Even though it was a clear violation of the law, nobody at IRS has been punished. Business as usual, using the IRS as a political weapon. This is how I predicted it would end up when I wrote about this matter last year.

California conservatives and the choice they face

Why Rush is Wrong about California and Why Arnold Schwarzenegger is the right guy at the right time

Schwarzenegger rakes in money. $788,000 HAUL: State businesses flock to aid actor - So much for his claim that he had plenty of his own money to use for the campaign and that he wouldn't take anything from special interests.

IRS, FBI Agents to Track Terror Financing in Saudi Arabia - The side benefit to this is less IRS resources to harass us law abiding citizens.

Harrison Abstract auction faulted - At the time, I thought the auction of Harrison Abstract's building was fairly sudden, with very little advance notice.

The level of public, political, and press ignorance about matters financial is truly staggering. - Duh.

For David Broder, "Realism" Always Means Raising Taxes

CNN Lauds Arnold for "Savvy" of Rejecting "No New Taxes Pledge" - They aren't still called the "Clinton News Network" for nothing.

Wall Street Seeks Clearer Deficit Signal - In typical liberal fashion, this article blames the deficit on the tax cuts, when it has been directly caused by out of control spending.

National Conservative Groups Warm Up to Schwarzenegger

Arnold's a supply-sider, which works to Bush's advantage. - At least Larry Kudlow thinks so. I'm not so sure. You have to have doubts about anyone who relies on Marxists for financial and economic advice.

Big-Government Conservativism Is Here - That is another term to be added to the list of oxymorons we encounter every day.

California Needs Conservatism. The case for someone other than Arnold Schwarzenegger. - Rush shares my opinion that Arnold is not the kind of true tax fighter that the PRC needs if there is to be any hope of salvaging the State from its slide into the abyss of socialism.

Fighting Taxes

Readers may have noticed that, unlike most tax professionals, who just accept taxation as a given out of the control of mere mortals, I have always considered taxes to be the symptoms of out of control spending by power hungry government rulers. Rather than just advise everyone to simply accept the fact that they must bend over, grab their ankles, and allow our rulers to have their way with us (as most tax professionals do), I champion efforts to legally fight back against excessive taxation of all kinds.

It is encouraging to see that not everyone is a sheep allowing themselves to be led peacefully to slaughter. Spreading the word about legal resistance to undue taxation should hopefully encourage others that the cause is not futile. Working within the system to effect such changes is what I support. I do not condone the illegal actions of tax protestor scam artists, such as Irwin Schiff.

Opponents pledge fight to cancel Oregon tax package

New Zealand Farmers hit the street in fight against fart tax - I would have loved to hear Arnold, in his recitation of all the taxes we have to pay each day, include paying a tax each time our animals fart.

Multicolored greenbacks coming in October - It's hard to stay ahead of the counterfeiters. Doesn't it seem like our currency is being changed more often than normal?

License bill faces challenge from IRS. It's risky to use taxpayer ID numbers for noncitizen drivers, agency says. - Just the fact that there is a debate over what ID numbers illegal aliens should be using on their driver's licenses shows how far into the abyss the PRC has slipped. To continue to force taxpayers to fund benefits for people who have broken our laws is just the same old insanity we all expect from the ruling class out there. The chances of any change in this open season on the wealth of the productive members of our society in order to buy votes for the DemonRats in power are slim to none.

Over the Cliff. Social Security is about to plunge, but retirement benefits don't have to. - What a surprise. FDR's Ponzi scheme house of cards is showing signs of weakness.

Analysts Are Skeptical of Ueberroth's Tax Amnesty. Critics doubt the plan would produce the $6 billion that the candidate predicts, and they see difficult political hurdles. - Predicting how much money can be raised through a tax amnesty program is nothing more than a guessing game. Nothing more than a WAG (wild ass guess).

The Triumph of Leviathan - Fans of big expensive government outnumber those of us who believe in abiding by the constitutional limits that were supposed to prevent the existence of an all powerful and controlling central government.

Bloglet Service Out Of Commission

The Bloglet service that sent nightly emails with the latest postings hasn't been working for the past few weeks. There have been temporary outages in the past; but this time it appears to be much more serious. Scouring the web and checking with other users, it appears that nobody can reach the Bloglet administrator. Many people believe that the Bloglet site has been abandoned because none of us is able to get beyond the main page.

I have therefore removed the Bloglet sign-up function. I will be looking for another service to take over that will hopefully be more reliable. In the meantime, you can always see everything I have posted on this page right here. It always shows everything for the past 30 days on this main page. The archives have the postings going back to November 2000.

As entertaining as the whole political freak show is out on the Left Coast, I'm just glad that we can laugh at it from the relative safety and security of two thousand miles away. Everything that is going on makes our choice to bail out of the PRC ten years ago look so much wiser. In fact, regardless of how the election turns out on October 7, I don't see much hope for saving the State from its unstoppable slide into the abyss. Taxpayers who choose to remain are going to see more of their money under attack.

The Power of the Pledge. Merely saying "no" to tax hikes isn't enough. - I too was very underwhelmed with Arnold's performance in yesterday's press conference where he wimped out on the issue of new taxes. Claiming that he can't rule out new taxes because some kind of natural disaster might occur was a major cop-out. He's talking like the "girly-men" he used to make fun of. Everyone knows that if a huge disaster happens, the Feds will pick up the reconstruction costs.

Prop. 13 change looks unlikely

Myths about Prop. 13 obscure its profound value in protecting taxpayers

Uncle Sam rips off California

Fixing California

Young Americans: Pay Attention, Or Pay The Bills

Higher Taxes Would Harm Alabama - Between this tax issue and the fight over the ten commandments statue, Alabama is running a close second behind the PRC for weirdness this Summer.

This isn't too different from what IRS auditors experience when they make their first visit to our ranch, and are greeted by our three very large dogs, including Nikita, our Great Pyrenees, who is almost as tall as I am when she stands on her hind legs.

A Lesson for Arnold Schwarzenegger: Warren Buffet to the California Democrat's Rescue - Thomas Sowell joins the chorus of pundits who believe that having a Marxist as his number one financial advisor has been an idiotic choice for Arnold.

Stewing Over Too Low CA Taxes, Applauding Buffett for Saying So - We can always count on the mainstream media to support higher taxes.

Latte tax debate whips up strong feelings - Ten cents a cup doesn't seem like much, but it would set a very expensive precedent to start adding goofy taxes and fees to just about anything.

Hating the Rich - It's long been socially acceptable in this country to despise and persecute the evil rich, who are defined as anyone having any more than anyone else.

Keeping IRS Auditors At Bay

I haven't written extensively about strategies to deal with IRS audits because it would be counter-productive to reveal many of them to the enemy. However, in regard to protecting your rights related to what IRS auditors are allowed to do, I can share some guidance. Many (actually most) auditors do try to force themselves onto taxpayers well beyond what is legally allowable. Some of these illegal encroachments are based on the auditors' ignorance of the laws and having been improperly trained; while others are very intentional attempts to take advantage of taxpayer ignorance of their rights.

One of the most common misconceptions people have is that IRS auditors are as expert on tax law as anyone. Nothing could be further from the truth. I can't recall a single IRS audit I have handled (out of hundreds) where I didn't have to spend time educating the auditor and his/her manager on the proper application of tax law. Sometimes, I feel like IRS should be paying me for training their employees.

IRS auditors operate from a fairy tale world, asking for everything and the moon; much more than is legally required to document the tax return items. They give people the impression that if even one item on their fairy tale wish list is missing, they are screwed.

They also try to rush things so as to catch the taxpayers unprepared to defend themselves. Although they try to schedule a meeting in the immediate future, the meeting can be delayed for several months to allow the taxpayer plenty of time to assemble all of the proper documentation.

Auditors also imply that they have to meet with the taxpayers themselves at their home or business location. While this may sound self serving, that is a very dangerous way to handle an audit. Taxpayers representing themselves frequently say things, quite innocently, that hurt their cases beyond repair. I have seen this happen all too often. Auditors snooping around the taxpayer's location can also open a can of worms that is best left sealed.

Having someone else interface with the IRS on your behalf is a very powerful method of protection. Once you submit a signed power of attorney (Form 2848) to the IRS, designating a CPA, attorney or Enrolled Agent to represent you in this matter, IRS personnel are not allowed to contact you directly. They must go through the rep first. This also applies to where the actual audit work will be conducted. The auditor would like to be at the taxpayer's location so s/he can snoop around for other things to dig into than the initial audit issues. These kinds of fishing expeditions can stretch what should be a quick examination into a never ending mess.

There are times when it's a good idea to have the auditor work at the taxpayer's location. I have set a few audits up that way, when I wanted the auditor to see first-hand what the business location looked like. However, in most cases, I considered it to be preferable to keep the auditor away from the client. We had the auditor come up to our place and look at the client's records here.

In recent years, I have noticed auditors getting even pushier. Even when the taxpayer has designated someone else to represent him/her, the auditor claims that s/he must be allowed to meet the taxpayer face to face and tour the taxpayer's business location. The claim that they have a right to demand such direct access to the taxpayer, even when the actual audit work is at the rep's location.

They have no such right when a 2848 has designated that they must work with a duly authorized representative. I have had auditors try that pushy approach on me and I have informed them that they must play by the rules and that meeting with the client or touring their business facilities is too disruptive to their operations. They have had to go along with this restriction. However, I can't stop them from driving by the taxpayers' locations and checking them out from the street. Some auditors have done that; but they have never confronted the client or barged in to the business premises without my permission.

Audits are intended to verify the accuracy of the numbers on a tax return. They have nothing to do with what color carpet or wallpaper someone has in his office. In fact, if you were to completely ignore an IRS audit notification, the result would be a complete disallowance of the deductions under review. Nowhere is there a need to visit the taxpayer or his/her business location. Such requests by auditors are nothing more than attempts to snoop around. I'm not saying that such requests should never be allowed; but that choice is yours and your representative's. If you don't want the auditor sticking his/her nose into your physical space, you have a right to insist that they stay away.

The Real Warren Buffett

Anti-tax proponent may advise Schwarzenegger. But announcement of Arthur Laffer's panel appointment might have been ahead of the curve.

A Buffett-ing on Property Taxes. The billionaire advisor to Schwarzenegger raises some hackles among neighbors in an Orange County enclave for Prop. 13 remarks.

A Higher Tax on All Your Houses - A leftist supporter of Warren Buffett's call for higher property taxes in order to soak the evil rich.

Schwarzenegger worries rabid Republican right

Arnold's Achilles Heel. If he is to win, Schwarzenegger has to win over conservatives. - So far, he's been doing everything possible to alienate us.

Hasta la vista, Buffett - Jack Kemp also doesn't think having a Marxist like Buffett on his team is helping Arnold any.

Arnold Tells Advisors He Will Not Rule Out Higher Taxes - Very stupid thing to say during a campaign. Higher taxes are already the plan with the current governor. If the recall is to make any sense (a very big IF), the replacement has to do the opposite of the incumbent; not more of the same thing. I can visualize many of the people who would earlier have eagerly voted for Arnold changing their minds and gravitating to someone with a real alternative plan to higher taxes, such as Tom McClintock.

Bill Would Curb Seizure, Sale of Homes Over Unpaid Taxes - You can never completely own property. You can lose it if you fail to pay the "rent" to the county rulers.

Taxpayers under attack in the PRC. Politicians take aim at Prop. 13's protections.

Alabama Tax Increase Referendum

Schwarzenegger's influence among rich could help shift opinions about tax cuts - Most Hollywood stars already oppose tax cuts for regular people because, even after losing 50% from an income of $20 million, they still have plenty. They fail to understand that it's not so easy for someone earning $100,000 to have 50% snatched away by our rulers.

Would Jesus raise your taxes? - The Alabama governor is stretching things a bit far in his attempt to use the Bible to justify higher taxes.

Tax Protester Faces Justice Dept. - Why anyone gives Irwin Schiff any heed has always escaped me. He and those stupid enough to follow his lead often end up in prison.

Arnie isn't endearing himself to many in the GOP by filling his campaign team with DemonRats; especially ones who are already pushing for higher taxes, as Marx aficionado Warren Buffett is doing.

New Dividend Tax Cut's Impact on 401k Withdrawals - It's always been the case that income earned within tax deferred retirement accounts doesn't benefit from the lower capital gains and dividend rates that are available for income earned directly by individuals.

2003 Schedule D

IRS has posted the latest draft of the 2003 Schedule D. What makes this year's form different than most others is the need to separate gains and losses that happened from January 1, 2003 through May 5, 2003 and those that occur from May 6, 2003 through December 31, 2003. The tax rates are lower for the gains in the second part of this year.

This shouldn't be too difficult for normal full cash sales. It will be the trickiest to keep straight for installment sales. You will need to provide your tax preparer with the total principal payments received from 1/1/03 to 5/5/03 and what is received between 5/6/03 and 12/31/03.

Rolling blackouts in Toronto are making our web and email services very sporadic. Patience and persistence are the operative words right now.

Bush Is A Big Government Conservative

The Nevada Tax Debacle

News From IRS

IRS Grants Tax Relief to Power Blackout Victims - They are allowing an extra week (to August 22) for those people who were affected by this mess. Luckily, I was able to get the last of the 80+ extensions I prepared into the mail today.

IRS Announces Application Fee for Offers in Compromise - I'm of a mixed mind on this decision to charge people $150 to submit OICs. On the one hand, there are people who abuse this program by submitting really idiotic offers. Charging a fee should reduce some of those. However, in all of the OICs that I have worked on, the clients were already being unfairly screwed over by IRS. Making them pay even more money to have their case reviewed by upper authorities at IRS seems a bit like adding insult to injury. In a way, this would be similar to your local police department charging you to report a crime.

There are all kinds of reasons why you would select a certain financial advisor over others. I've heard dozens of strange theories; many of them making this sound very reasonable.

California tax-weary residents say 'no mas' - Just a few reasons why it earned the name of the People's Republic of California.

Kerry hints at reform for Social Security - Coincidentally, this is exactly what I have been predicting for decades as the fate of Social Security. Means testing will be instigated to determine who is worthy enough to receive any benefits. Anyone determined by our rulers to be evil rich will not be paid anything, regardless of how much had been paid in during their working lives. For anyone who thinks this will just be used to freeze out people in the income levels of Bill Gates and Oprah Winfrey, just look at where our rulers have established the similar threshold for taxation of SS benefit. Any single person with adjusted gross income over $25,000 is considered evil rich. For married couples, that level is $32,000 AGI. I have long said that such a plan is the only way to keep the SS system alive for much longer.

That's why it always amazes me to either see people intentionally flushing money down the SS rat-hole or not taking the very easy steps to reduce or eliminate those taxes paid in. Holding on to $10,000 to $15,000 per working year can allow a person to accumulate a very sizable net worth, which will be a thousand times more useful for their retirement years than the promise of benefits from the SS Ponzi scheme if you can prove yourself to be a worthy pauper. What's even more disgusting is the majority of professional tax practitioners who just merrily let their clients continue to piss away all of that money and don't help them arrange things to keep it for their own use.

Woman Beats IRS in Court Over Income Tax Protest - More on the FedEx pilot who avoided prison for not filing tax returns, but who will still have to pay the taxes, interest and penalties. As Judge Andrew Napolitano says, she was lucky to have such idiots on the jury to let her skate. There's no guarantee that other tax protestors will be able to count on the same lucky draw. However, considering that some people consider juries to be principally comprised of people too stupid to get out of jury duty, the odds may not be that bad.

Power Outage

FYI: Our power here in the Ozarks has been working just fine. However, all of our websites and email are hosted by MyHosting.com, (provider of the Mail2Web service) which happens to be in Toronto. They obviously don't have backup generators up there, because all of their and our sites have been unusable during this power outage.

Huffington Paid Little Income Tax - One of the pifalls to running for high office is the requirement to open your normally private tax returns for public scrutiny. Arianna Huffington has long been a walking talking example of hypocrisy on so many levels. Her crusade against tax breaks for other businesses, while she takes advantage of every one possible for herself, is just one more example. The LA Times has more details on her finances.

Warren Buffett Adds Muscle to Schwarzenegger's Campaign - Arnie doesn't seem to be too concerned with pleasing true conservatives by the choices he is making in his support team. Buffett, as I've mentioned several times, is also a rich hypocrite, who supports the Marxist principles of central government wealth redistribution.

Webb OKs Harrison Abstract's Assets Sale - There won't be any real money left over, after paying the mortgage; but it is a step forward in cleaning up this mess.

It's long been a dream of mine that this is how spammers, those vermin of the Internet, will be dealt with. Track them down and use sledge hammers to send their computers to cyber heaven. What judge or jury would convict a spam vigilante for doing what we all wish would happen?

Respect for April 15 Deadline Is Eroding - It sounds like more people are catching on to the benefits of filing tax returns later. I do only a few returns by April 15, and most of them around October 15. I hope the fact that a lot of other people are copying this doesn't mess things up with IRS. Sometimes there is a tendency for tax breaks to be spoiled when too many people try to take advantage of them and they rise to a higher profile on the IRS's radar.

ABA Loosens Attorney-Client Secrecy Rules - Am I reading this correctly? If an attorney suspects a client is involved in a financial crime, s/he should inform the authorities. If the client is involved with something like a murder, rape or terrorist bombing, does the attorney have to keep quiet because it wasn't financial?

Dean Gave VT High Taxes, Yet Media Tag Him "Fiscal Conservative" - Just another example of why the leftist agenda driven media can't be trusted; especially in the coming months as they ramp up their push to anoint Queen Hillary as the smartest human to ever grace the planet in her drive for a third term in la Casa Blanca.

No cameras, please! Big Lotto winner's shy - He's starting off on the right foot in his new life as a target for all the leaches in the world.

Alabama GOP Governor, Christian Coalition Support Billion-Dollar Tax Increase

At least three Libertarian candidates will appear on California recall ballot - I haven't yet decided who to endorse for Governor of the PRC. Obviously, anyone, even the strangest of the group of clowns running, would be better than the thoroughly corrupt and incompetent career politician currently in the office. The novelty factor of Arnold S. is interesting. However, as many are already pointing out, he is the classic RINO, and is just as fond of government taxpayer funded programs as the DemonRats are. I don't know any of the three Libertarians running; but this could be the best chance for a very real alternative to the status quo two party monopoly. I wish Art Olivier, the LP's 2000 VP candidate, were in the running, because we were very impressed with him during his campaign swing through Arkansas that year. Coincidentally, Art was once the mayor of Bellflower, where Arnie and Arianna had their big candidacy filing show last Saturday.

End of the income tax? - There are still some people pushing the idea of replacing the income tax with a national sales tax. It is a very radical idea, with a very uphill battle; but I have long supported it as much fairer than the hideous monstrosity we have with the income tax system in this country. Such a drastic change would obviously dramatically alter what we professional tax practitioners do; but it would in no way put us out of business. There will still be plenty of clients looking for ways to minimize their new sales tax liabilities.

Howard Dean the tax machine - I'm not planning on spending much time analyzing any of the idiots pretending to run for president on the DemonRat ticket because, as I've always said, their purpose is nothing more than a distraction for the actual nominee, Queen Hillary. However, it's interesting to note how in love with taxes the person who is being touted as the most fiscally conservative is. That pretty well tells the story of how any DemonRat in power will deal with tax issues.

States set bait to lure California companies - It shouldn't be hard for any state to look better than the PRC.

Some major companies still use pro forma accounting - Aka where accounting and creativity meet.

Harrison Abstract auctioned - They are actually liquidating things from this mess much more quickly than I expected.

More Media Propaganda For Higher Welfare

More Fretting About Unfairness of Who Gets Child Credit Hike

ABC Delivers Another Story About Poor Missing Child Credit

Justice Rejected IRS Call for Enron Probe - It's interesting to note that this happened in 1999, when the Clintons were co-presidents. So much for the theory that Ken Lay and Enron had the Bush administration on their payroll. While most of the big corporate accounting scandals were publicized during the past few years, they were actually taking place under the watchful eyes of the Clinton gang, who rode the stock market bubble up for all it was worth. Let's not hold our breath waiting for anyone in the press to ask Queen Hillary about this during her current presidential campaign.

Retailers see results from child tax credit checks - People are spending their tax savings now; not next April.

Big cuts loom for Social Security, GAO warns - What? A house of cards isn't very sturdy?

Prelude to higher taxes

A call for common sense. Taxpayers wish government would budget more as they do - Common sense among our rulers is as rare as an honest politician.

IRS Loses One Battle Against Tax Protestor

I have always been very open with my opinions on the ridiculous arguments many people use in their attempts to illegally evade their responsibilities for filing tax returns and paying taxes. One of the tricks commonly used by these people is to refuse to file tax returns until someone from the IRS will provide them with specific legal citations of where in the law it requires people to file tax returns and pay taxes. IRS policy in response to these requests is to ignore them and just send the standard demands for tax returns and payment of taxes based on the W-2 and 1099 info it has in its computers.

Many in the tax protestor movement are currently declaring victory with this approach based on this recent case in Memphis, where a FedEx pilot was acquitted of criminal tax evasion charges because IRS didn't answer her questions. While she did dodge the bullet in regard to the most serious criminal charges that would have sent her to prison, she hasn't escaped responsibility to pay the taxes on her income. She will still end up having her paychecks garnished and assets seized and will have to pay at least triple the amount that would have originally been required, after factoring in the compounded interest and penalties that she will still be forced to pay.

Defining a Small Business - Some clarification of the very misunderstood hobby vs. business rules.

Fight Club - The Club For Growth is getting noticed for its attacks on RINOs. It will be interesting to see how they address the issue of Arnold for guv in the PRC, because he appears to be a textbook example of a RINO.

In Seattle, prospect of espresso tax is grounds for anger - Caffeine addicts are now in the cross-hairs.

Tax Agents Descend On Yard Sale - Just as with the Sopranos, it's risky to forget to share the loot with our ever-present business partners, the government.

California voters aren't crazy. Free-spending pols are. - A little house-cleaning to get rid of the stench of career politicians in Sacramento is long overdue.

Spidell has just released a schedule of the 2003 PRC tax rates and related amounts for individuals. I've also added a link to it on my main website.

Uncle Sam keeping more of state's cash - Is there any end to the load placed on PRC taxpayers?

This kind of estate plan is growing in popularity, especially among people who have no human offspring. We suspect this is why one of our cats is constantly trying to trip us.

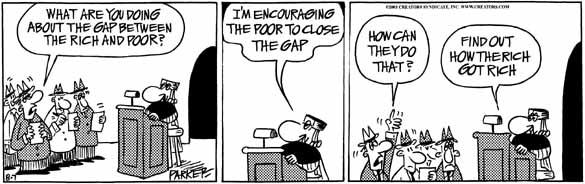

This is a perfect illustration of the difference between the philosophies of liberals and conservatives. Liberals, in their misery loves company game plan, would prefer to bring the rich down to the level of the poor. Conservatives would prefer to give the poor the freedom and tools to raise themselves up to the levels of the rich, if they so choose. If they prefer not to do those things that can create wealth, they are free to remain poor.

Corporate Taxes

IRS Tells Intel of Tax Adjustment - This is a good illustration of why IRS has auditors on full time year-round duty checking the books of multi-billion dollar corporations, and leave the smaller corporations alone. This one little proposed adjustment of $600 million in tax for two years makes all of that auditor time worth while for the Feds.

For those who have never been audited by IRS, this kind of public announcement gives the impression that taxpayers' private tax and financial data are subject to everyone's perusal. That is not true. Audits are very private and confidential between the IRS, the taxpayer and the taxpayer's representative. The reason Intel made this announcement was not to abide by IRS rules, but to comply with SEC requirements to make everyone in the investing public aware of anything that could affect the corporation's bottom line. This is only required for publicly traded corporations. Closely held corporations can keep their IRS dealings as secret as can private individuals.

Banks Moved Billions to Shelter Income From State Taxes - The insinuation here is that these banks are evil and unpatriotic because they set things up so as to minimize their taxes. The truth of the matter is that the officers of corporations have a very explicit legal fiduciary responsibility to do whatever it takes to legally maximize the return to the owners of the business. To do otherwise would be an actionable dereliction of duty. To not use every legal loophole and strategy to reduce the tax burden would be an example of incompetence.

Bailing Out Of the PRC

Just as we did ten years ago, many productive people have reached their breaking points in regard to tolerating the high taxes, heavy regulations and overall lack of freedom in the Left Coast utopia of socialism. However, there are still plenty of new people moving in who are looking for the freebies the generous rulers in Sacramento give them from the pockets of the producers.

California Is Seen in Rearview Mirror. For the first time, the Census Bureau finds that more people have moved to other states from here than the other way around.

Californians leaving state in droves. Many residents looking elsewhere for work, homes after dot-com bust

State turns up heat on cigarette tax scofflaws - Another example of why I have never been worried about my career if the income tax were ever replaced with a sales tax. Any time there is a tax, there will be a battle between those who don't want to pay it and the collectors. As other types of taxes are raised, such as those on nicotine addicts, there will be attempts to avoid paying them.

Proposal Would Dock Officials' Pay When Budget Doesn't Pass - A novel idea; penalizing our elected rulers for not doing their jobs.

Report Cites I.R.S.'s Failure to Follow Up on Tax Cases - They're not acting against tax protestors as strongly as they need to if they expect to stop their influence from growing.

Who Are Tax Fighters?

It's not just people in government, or talk show hosts, or those of us who write about the need for lower taxes who are the true tax fighters. I consider anyone who assists in arranging things legally to reduce his/her own taxes, and those of others, to be warriors in the battle to allow people to keep more of their own money.

Most important is among the ranks of professional tax practitioners. There are still far too many in this country whose advice and tactics are no different than the official IRS line. This is most extreme with former IRS agents who attempt to move to the other side of the table. On far too many occasions I have seen where the mindset that all people are tax cheats is so ingrained in these people that it's a waste of time working with them at all. I check out several tax message boards on the web, and can definitely see that we who believe it is our duty to assist our clients in paying the lowest taxes legally possible are vastly outnumbered by those who think such an attitude is unpatriotic. Any tax advisors or preparers who do their best to help their clients minimize their taxes are very real tax fighters with more actual real life impact on the lives of real people than all of the theorists who may spout reams of rhetoric about the need for lower taxes, yet do nothing to put tax savings tactics into action. It has been my pleasure the past 20+ years sharing my knowledge and experience with other like-minded tax professionals.

New Tax City. Congressmen aren't the only Washington pols who want more money. - They're looking at a new commuter tax to stick it to people who live outside the DC limits. These are always excellent targets for taxes since they can't vote out the scoundrels who tax them. They used to have a slogan for this: "Taxation Without Representation."

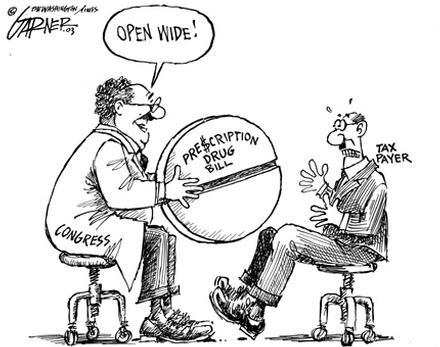

Study says high cost of drug entitlement would force tax rise - I've long used an analogy of drug pushers getting their users hooked for how our politicians add to the size and scope of government programs. With this new program, that is no longer an analogy. Just as they did with Medicare, our rulers are intentionally underestimating the expected costs for this new benefit for Seniors. By the time the true costs are apparent, people will be so addicted to the government program that to do anything but raise taxes to pay for it will be considered the same as murdering old people, a commonly used accusation from the DemonRats.

Judging the New Nevada Tax Hike. CSE Launches Petition Drive Against the Renegade Tax-and-Spend Nevada Supreme Court

IRS Seeks Proof Poor Taxpayers Earned Income Credit - This is a very easy refundable credit to scam from the IRS, so it's actually good to see that they are at least checking a few of the returns for legitimacy.

At what price? - Bush is simply spending too much taxpayers money trying to buy votes from DemonRats. He is repeating his father's mistakes in abandoning conservative principles and may lose a lot of support from his normal constituency next November. With Queen Hillary on the ballot for the Donkeys, we could have another election like 1992. She already has her "Clinton 44" hat, to go along with Bill's "Clinton 42." Bush's only hope for retaining support from the right in 2004 is the fear of being defenseless militarily under the control of the anti-American, commie loving DemonRats.

Not Exactly Rocket Scientists

We recently received our newly increased property tax appraisals for our ranch here in the boonies. While we don't like the idea of their going up at all, especially since most of the money goes to the schools and we are childless, the taxes are still a tiny fraction of what they would be in the PRC.

It seems that our county tax collector's office has the same work principle as most of the mass media in this country; where it's much more important to be fast than to be accurate. There is supposed to be a limit on the increase of 10% per year. Since the most recent reappraisals were three years ago, the cap is 30% in this go-around. Not everyone can do percentages in their head, or even with a calculator. However, some increases are just so obviously out of whack that anyone should notice. For example, according to this article, one man's property went up from $300 to $14,000 (an increase of 4,667%), and another from $1,000 to $27,100 (up 2,710%). When he called to complain, he was told that they already knew his numbers were screwed up, but they had to get the new appraisals out in the mail by a certain date regardless of whether or not they were correct. How many people had the crap scared out of them from these erroneous bills? How many are going to just pay the inflated amounts without bothering to question them?

It may or may not be connected, but this is the same county that has been so desperate for cash that they have forced my favorite charity, Turpentine Creek Wildlife Foundation, to pay taxes on its property in complete disregard for the standard exemption given to other more politically connected charities.

Money-Money-Money

Astute readers will have recognized that, although tax issues do dominate many of the topics I cover, I have always been fascinated with all kinds of money related issues. Dealing with taxes is just one aspect of handling money.

Easy Come, Easy Go

Not that it happens to many people; but stories of how people cope with sudden massive wealth have always fascinated me. It's something we all dream about happening to us. We believe it would solve all of our problems and let us relax in leisure for the rest of our lives. We believe that we would be the exception to what appears to be the rule, such as:

Big lottery winners who are too stupid to know better than to leave half a million in cash in an unoccupied car in front of a strip joint.

Thieves Steal Lottery Winner's $545,000

Jackpot winner robbed

Illiterate thug rapists who piss away their hundreds of millions on fancy toys. The only surprise in this story was how he was able to avoid bankruptcy for so long.

Tyson's Bankruptcy Is a Lesson in Ways to Squander a Fortune

The Feel of Cold Hard Cash

I've never been a big fan of gambling, especially slot machines, which give the impression of being random in their outcome, but which are actually programmed by the casinos to regulate the winnings allowed. Even so, there is something quite tactile about the mechanics of the whole process. Putting in the coins. Pulling the handle. Watching the wheels turning. Seeing and hearing the coins gush out for winners. I'm having a hard time understanding how people are able to get the same sensations from the new fangled machines, where you just push a button and winnings are printed on a slip of paper. While the payout percentages probably aren't actually any worse with the new electronic versions of slot machines, it's just too tempting to suspect crooked programming of winners.

IRS Wants States in on Hunt - Working together to catch tax cheats makes a lot of sense for both IRS and the State tax agencies.

Tax rift among DemonRats - They just can't decide how much higher to raise taxes.

Follow-Up To Mandatory PRC E-Filing

I received the following response back from the FTB as to whether the 100 tax return threshold whereby preparers will be required to file individual income tax returns electronically referred to 100 California returns, or 100 overall. I was obviously quite pleased with this answer.

The mandate concerns CA returns. If you only file 12 CA returns you are not in the mandate.

Thanks

Sean McDaniel

CA e-file Coordinator

Franchise Tax Board

Ph: 916-845-6180

email: sean.mcdaniel@ftb.ca.gov

Tax relief to elude many poor - The Left won't give up on their mis-use of the terms. "Tax Relief" is much more marketable a phrase to use than what this really is, Welfare for people who already pay zero income tax.

Brown contempt citation asked - As most of us suspected, Dian Brown has been liquidating assets that haven't been caught up in the Harrison Abstract freeze and hiding them from the growing list of creditors.

Public pensions far short - It's not just private company employees who can't trust their full pension benefits to be waiting for them.

Big-government Republicans

Prop. 13, 25 Years Old, Is Still Under Attack

Social Security ambuscade

Judge Says I.B.M. Pension Shift Illegally Harmed Older Workers - Employers can and do twist pension plan rules to benefit the top dogs, while screwing the little guys. I have helped plenty of them do just that. Having your own controlled retirement plan is a more reliable hedge for actually having some money in the account in retirement years.

Mike Eyes Repeal Of NYC Tax Hikes - Those didn't last long.

Government wants fewer home closing-cost surprises - One of the worst parts about buying property is the last minute surprises lenders try to pull, tossing in all kinds of new fees and higher rates. They know they have you by the short & curlies and you don't have much choice but cave in or lose the property.

Judges Being Judged

I'm not sure I'd like the idea of any of those jokers in Congress passing judgment on each item on my tax returns; but that's what prospective Tax Court judges have to subject themselves to. Tax returns are too subjective to make a clear cut and dried assessment of someone's credibility based on what s/he puts on it. I hope none of my clients has to go through this humiliation, because I use every legal trick to keep their taxes as low as possible. It seems like these Congressional critics only want applicants who believe it is their patriotic duty to pay in as much in taxes as possible, rather than the other way around, as I prefer to handle things.

Interesting Quotes From StangeCosmos

Light travels faster than sound. This is why some people appear bright until you hear them speak.

When you go into court you are putting yourself in the hands of 12 people who weren't smart enough to get out of jury duty.

I started out with nothing, and I still have most of it.

I wished the buck stopped here, as I could use a few.

A fine is a tax for doing wrong. A tax is a fine for doing well.

You can't have everything. Where would you put it?

It is hard to understand how a cemetery raised its burial costs and blamed it on the high cost of living.

Despite the cost of living, have you noticed how it remains so popular?

Nothing is foolproof to a sufficiently talented fool.

2002 Extensions

Deadlines are an essential part of life. If there were no such due dates for tax returns, most people would never get around to doing them. However, one of the worst things anyone can do in regard to tax returns is to rush together something just to meet a deadline. While some errors can be fixed with amended returns, there are enough that become locked in stone to make it a much wiser move to take our time and wait until we can do as accurate an original return as is possible.

With the first extensions for 2002 1040s running out on August 15, it's time to work on filing the second extension, which moves the due date to October 15. I've already started preparing and mailing in the 70+ extensions I will be filing by August 15.

The form that needs to be mailed to your IRS Service Center by August 15 is the 2688. Many people get intimidated by the 2688 because it asks you to state a reason for the extension request and requires a signature, neither of which is included on the first extension filed by April 15 (Form 4868). Many people think they need some kind of earth shattering reason for IRS to grant the extension. Not true. The following language, which I learned from an IRS agent decades ago, is just fine and is what I have pre-programmed into my Lacerte software. It has never failed to work on any of the thousands of 2688s I have sent to IRS for the October 15 extension.

We have been unable to assemble all of the information we require to prepare a complete and accurate tax return by August 15.

IRS will check the bottom of the 2688 and mail it back to the address you provided at the bottom, you or your preparer. The approved 2688 should be attached to the 1040 that you send in. The problem with doing this is that IRS doesn't process the 2688s very quickly and most of the approved forms aren't actually sent back until after the returns have been finished and mailed in. In this case, just attach a copy of the 2688 to the 1040 and keep the approved form in your file after it comes back.

The extension is really only necessary if you end up owing money with your 1040 because any late penalties are based on the amount due. If you are overpaid, the extensions aren't as crucial. I still send them in for returns that aren't expected to have any tax due for a couple of reasons. If there is ever any change in the tax, such as through an audit, where the refund becomes a tax due amount, the extensions will prevent any new late penalties from being charged. The extensions also keep the IRS computers from sending out late notices for unfiled tax returns, avoiding the tensions those letters create.

Just as with the initial extensions, some State tax agencies require that you send in a special extension form for them, while others just piggyback on the IRS's due dates. Check with your State's rules to see if it requires a separate extension form.

While many people, including clueless IRS employees, believe that October 15 is the end of the line for extensions, that is not the case. If there is a very traumatic problem in a person's life, additional extensions can be obtained from IRS. I actually have received approval from IRS to extend the due dates for some clients' 2001 1040s to October 15, 2003. I had only asked for June 15; but they close October 15. Such life-altering events that justify these longer extensions include deaths and medical problems for the taxpayers or their family, changes in marital status, relocations, disasters, and other major events that have made it impossible to prepare the returns. Just claiming that you've been too busy or forgot will not work.

"I have enough money to last me the rest of my life - unless I buy something."-- Jackie Mason

Are taxes really a losing topic for the DemonRats? - We just might be able to finally see the total implosion of the JackAss Party if they continue with their rants over the need for higher taxes and how Saddam Hussein was a more trustworthy person than George Bush. As they say with dealing with idiots, just stand back and let them hang themselves with their own stupidity. They are doing an excellent job of that. Even when Queen Hillary steps to the front of the herd, the DemonRat rhetoric should hopefully seal their fate as a group whose time has passed.

Cost of government gets more taxing under Bush -

Voters don't trust the DemonRats on taxes and security - Who in their right mind would trust any group that advocates higher taxes and dismantling our ability to defend ourselves?

The Boomer Bust - The costs to support the Baby Boom generation will be humongous.

AccountantsWorld Employees Caught in FBI Sting - There is a little more intrigue and excitement in the CPA world than most people know about. Can a TV show about a CPA firm be in the works, to balance all the dozens of shows about law firms?

Famed golf course designer gets 10 years for tax evasion - Another idiot tax protestor bites the dust. There are so many legal ways to minimize taxes, especially in Florida, that only a moron would risk his life by following the ridiculous tax protestor schemes.

IRS Has Its Hands Tied In Pursuing Tax Fraud - An interesting part of the PR program to encourage our rulers to give IRS more money and power is the historical revisionism regarding the stories of IRS abuses. Claiming that the people who testified before Congress perjured themselves in order to make the IRS look bad is ridiculous. Why weren't any of those people charged with perjury if that was the case? Those stories were merely the tip of the iceberg in regard to the strong arm tactics IRS has been allowed to use in pursuit of money for our rulers to spend.

(Thanks to fellow tax fighter Dana Stahl for the heads-up on this article).