Tax Guru-Ker$tetter Letter

Friday, February 28, 2003

Not On The Same Team

I hope Stephen Moore is wrong in his assessment of the new Chairman of Bush's Council of Economic Advisors, Gregory Mankiw. If it is true that he denies the effectiveness of the Reagan tax cuts of the early 1980s, our chances of seeing substantial new cuts are dwindling.

I know Bush has bigger things to worry about right now; so I am assuming that some of his advisors, who chose this person, are out to sabotage the tax cut agenda. Selecting someone who denies the reality of the Reagan tax cuts to be an economic advisor makes as much sense as having a member of the Flat Earth Society be Director of NASA. It's ludicrous.

KMK

TimeSlips

As big a fan as I am of QuickBooks for bookkeeping, I have to admit that I do not like its billing features at all. Each year, when the new version of QuickBooks comes out, I give the billing a test spin with the hope of using it for my own practice. Every year, it comes up quite short.

I had been using TimeSlips back in my offices in the PRC, but wanted something simpler and less expensive when we moved here to the Ozarks ten years ago. While I had dozens of workers and thousands of clients to keep track of back there, it was going to be a much smaller operation here. After realizing that QuickBooks was completely unacceptable for my billing needs, I found that TimeSlips had come out with a much less expensive version for just two timekeepers. I have been using it ever since moving here, buying the new versions as they have been released. There were some upgrades a few years back that had so many bugs that it caused me to shop around again. However, the most recent version (11) has been the most stable and reliable yet.

KMK

QuickBooks Is Mandatory

People seem to think we are kidding about our explicitly stated requirement that all clients have their records on QuickBooks. We have been receiving a lot of inquiries from people who want us to take them on as clients, who we have to turn away because they are unwilling to set their info up on QuickBooks. What's been frustrating is that many of the inquiries are referrals from existing clients who are well aware of our QuickBooks requirement.

We just want to make sure that there is no misunderstanding about how serious we are regarding the importance of QuickBooks for new and existing clients. We have even been dropping several very long term clients who feel it is too much hassle; so we are not just picking on new people.

We are determined to provide the best service possible, as efficiently as possible, and have decided that the high level of quality in which we pride ourselves is not achievable with the classic "shoe-box" and other kinds of sloppy bookkeeping that most people use. I am very confident that once people get up to speed on QuickBooks and learn how to use it in place of their normal checkbook, they will wonder how they could have survived without it. It will also make tax and financial planning tasks amazingly easier and quicker to accomplish, with a much higher degree of accuracy.

In spite of what many people have claimed, this isn't just to please me. Having everything on QuickBooks is a smart move regardless who prepares your tax return and definitely if you do your own. In addition, if you apply for a loan or need to review how your finances are doing, you will be able to appreciate being able to produce up to the moment financial statements in a matter of a few minutes, rather than the several weeks or months after the fact that is normally the case. It is also the most widely used and supported accounting software; so finding someone to help with it is easier than with any other program in the world. Contrary to how many other tax practitioners operate, we do not want to keep clients captive to our systems or ways of doing things. We try to make them as self sufficient and flexible as possible.

KMK

Corporate Extensions

Corporate income tax returns, both C and S, are technically due two and a half months after the end of the tax year. For those with a normal January though December calendar fiscal year (required for S corps, not a good idea for C corps), this means the due date is March 15. However, since the 15th falls on Saturday this year, the official date will be Monday, March 17.

We have already had people contacting us panicking about this impending due date as if it's a set in stone, drop-dead do or die deadline. Not even close. Just as there are extensions of time to file individual income tax returns, there is an automatic six month extension available for corporations with IRS by sending them Form 7004 by March 17.

Just as with individual extensions, this only gets you out of the late filing penalties and does not affect late payment penalties. If it looks like your C corp will owe any tax, you should enter that on the 7004 and deposit that amount with your bank with a corporate depository coupon by March 17. Since S corps don't normally pay any Federal income tax, only the 7004 needs to be sent in for them to have an additional six months of time.

After filing the 7004, the new deadline for the corporate tax return will be September 15.

KMK

State Farm to Exclude Nuke Attacks

Do they know something the rest of us don't about the immediate future? Insurance companies are notorious for having loopholes in their coverage. At least State Farm is up front about this one. I did a search on the Farm Bureau (our insurance provider here) website for "nuclear" with no mention of coverage. Likewise with the other commonly used variations of that word (nucular, nukular, nuke-u-lar, etc.).

Wednesday, February 26, 2003

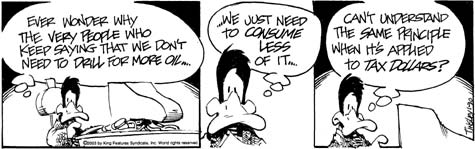

When tax-cut shelf life is short

There is no such thing as a permanent tax cut. That would require that our rulers keep their hands off the tax code for any length of time, which we all know is not even remotely possible.

Tuesday, February 25, 2003

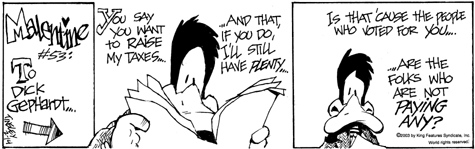

Enemies Of Tax Cuts

As Bush continues his efforts to reduce the tax burden and remove the double taxation of corporate income, the opponents of capitalism are not stopping their class warfare. Some typical leftist rants I came across:

New York Slimes, upset that evil rich people who pay more taxes will receive a larger dollar benefit from the tax cut than people who pay less. There is just no reasoning with idiots like this.

A self proclaimed lover of Communist philosophy, claiming that it's good to tax both corporations and their evil rich shareholders on the same income because their tax burden is still too low. Not surprisingly, this Marxist will soon be starting a career teaching law at Rutgers.

KMK

Don't Miss Credit Card Charges

I have long maintained, based on real life knowledge, that the conventional wisdom that everyone cheats on their taxes is 180 degrees off from how things really are. The truth is that most people overpay their taxes, mostly because of lousy bookkeeping. That is why we have been very forceful in requiring our clients to set their accounts up on QuickBooks. I will be explaining many of the benefits of doing this, especially for personal non-business accounts, in this blog and on my web site over the next several weeks.

One of the biggest areas where people shortchange themselves in terms of claiming perfectly legitimate deductions, is when credit cards are involved. Most people, when getting their info together for their tax preparer, only look through their checkbooks and completely overlook their credit card activity. There is also a misconception that you can only deduct those charges that have been paid off by the end of the year. Not true. IRS treats credit card charges exactly the same as cash payments. This is not even a grey area and has been official IRS policy for as long as I have been doing taxes (27+ years). You can literally go to Best Buy on December 31 and buy a computer with a credit card and deduct it on that year's taxes, even though the bill won't arrive until next year. It also doesn't matter when, or if, you ever pay off the credit card. An additional benefit is that, if a charge was for legitimate business reasons, all subsequent finance charges on that balance are deductible on the same tax return schedule where the original charge was claimed. This is another often overlooked deduction, because most people are under the assumption that credit card interest is a non-deductible personal expense.

The only way to accurately account for all of your credit card activity is to post all of the transactions in QuickBooks, along with all of your bank accounts. A separate account should be set up for each card and it should be reconciled with the credit card statement each month to ensure completeness. Each charge should be entered into the card's register and coded to the appropriate expense as of the date of the charge.

KMK

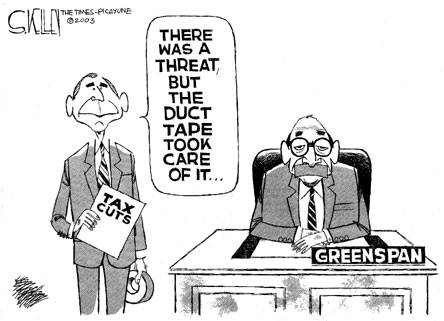

It will take a pretty large roll of tape to take care of all of the liberals in the media and in the JackAss Party who can't stop lying about the effects of tax rate cuts.

Monday, February 24, 2003

IRS Claims Homeless Man Owes Six Million Dollars

Proving once again that all IRS notices should be verified before being accepted as accurate.

H&R Block Agrees to Pull Ad Dissing CPAs

I guess a lot of CPAs have no sense of humor. I haven't seen this commercial, but any CPA who feels threatened by H&R Block has bigger problems to worry about.

Labels: 179

IRS Carrot To Entice E-Filing

I mentioned several weeks ago that IRS was planning to make some new efficient web based services available to tax practitioners who participate in their e-filing program. I really liked the ideas for the new services and, although I still think actually using e-filing for clients of the kind I work with (complicated) is irresponsible, I mentioned that I might just sign up with IRS as an e-filer in order to be able to use the new services.

It doesn't look like that is going to be possible, according to this news release from IRS. They are only going to allow the new web based services to be accessed by practitioners who e-file at least 100 1040s each year. That counts me out.

I guess I'll have to continue dealing with IRS via the old fashioned ways until they realize that they are just hurting themselves by denying us non e-filers access to the more efficient methods. It may take several years for IRS to come to that realization since they don't do anything quickly and are not exactly filled with rocket scientists. But, I do have to give IRS some credit for using the Carrot approach to encouraging e-filing rather than the Stick approach being discussed by the PRC to make e-filing mandatory there.

KMK

Sunday, February 23, 2003

Taxes In the PRC

Having worked for several years on the Left Coast, I long ago learned that, when it comes to collecting taxes, the most ruthless bunch in the entire country are the Franchise Tax Board. While it may be hard to believe, they are much more trigger happy than even the IRS. In fact, the FTB trains IRS employees on better means of collecting past due taxes.

That came to mind when I saw this item from Spidell that the PRC is planning to be much more aggressive than IRS in its desire to have taxpayers file their returns electronically. They are discussing making it mandatory for practitioners who prepare more than 50 (or 100) tax returns each year. Then to top it off, they are planning to charge the practitioners an annual fee for use of the Tax Practitioner Hotline.

If these changes make it through in the PRC, you can expect them to spread across other states and even to the IRS.

KMK

Churches Getting More Online Donations

This make a lot of sense as well. All charities should be able to accept donations online. It's a big convenience for both them and their donors. I'm a big fan of PayPal and have been using it for the past few years. In fact, when I am shopping online, such as at eBay (where I find the lowest prices for new software), I select vendors who accept PayPal.

KMK

Doctors Add Fees For Calls, e-mails

This makes a lot of sense to me. Of course, it's because I long ago understood the motivating power of money to influence behavior and have always charged for my services purely based on time spent. Doctors who do start charging will find they receive fewer calls from people who are - for lack of a better term - too lazy to look for things on their own. It happens here in our office every year. We receive calls from clients who can't find the tax organizer we sent them and want us to mail them another copy. When Sherry notifies them that they will be charged for the time it takes us to print and mail a new copy, it's amazing how the clients are all of a sudden willing to look a little harder and can locate the earlier copy we sent. It will be no different for doctors' patients.

KMK

Saturday, February 22, 2003

QuickBooks Training Guide

As always, I am running behind in the production of my new QuickBooks training video. In the meantime, I have posted the official QuickBooks training tools that are supplied to us Certified QuickBooks Pro Advisors on my website.

Friday, February 21, 2003

Tax Free Residence Sales

Even the "experts" get confused on the rules. Gail Buckner had this erroneous explanation on how the pro-rated exclusion works when a home is sold after less than 24 months.

Here is my e-mail to her:

Ms. Buckner:

Your explanation in today's FoxNews.com column on the reduced primary residence exclusion was wrong. The excludable gain itself isn't pro-rated. The maximum exclusion is prorated.

For example, someone who owned & lived in the home for 12 months and was selling for valid unforeseen circumstances would be entitled to half of the maximum excludable gain, which would be $125,000 for a single person or $250,000 for a married couple. If their gain is less than those amounts, their entire gain would be tax free; not just a portion of it as in your example.

I have much more on this rule on my website at:

http://www.taxguru.org/re/primary.htm

It may seem like being overly picky, but it does make a difference.

Thursday, February 20, 2003

Social Security is structurally damaged and in need of immediate repair

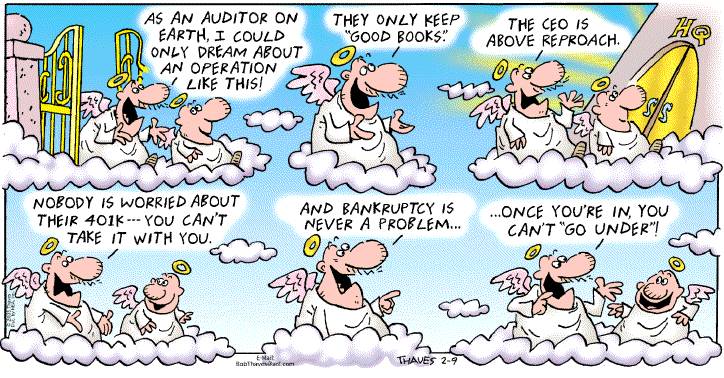

I can still remember, 30 years ago in my first college accounting class, one of our first financial analysis projects was of the Social Security system and the financial assumptions and formulas on which it has been based. Our conclusion was that it was a house of cards that could not last in perpetuity as its supporters had claimed. Any private company promoting a similarly structured investment plan would be shut down and its officers tossed into the slammer for fraud. A similar fate would be certain for any trustee of a private pension fund who commingled plan monies and dipped into them as readily as our rulers in DC have been doing for the past forty years.

That is why it has been my biggest priority to help people legally avoid pouring the hundreds of thousands of dollars down the toilet that most workers end up losing through this Ponzi scheme. At least one tip-off to the fraudulent intent in the design of the system is the fact that the only way you can ever receive any money back is to live well beyond the average expected life span and if you pass away before getting any or all of your money back, tough luck. It's all lost. Who would invest in such a policy in the real free market world? This also explains why participation is mandatory, enforced at the point of a gun by the IRS; unless you take steps to keep yourself (and your money) out of the scheme.

KMK

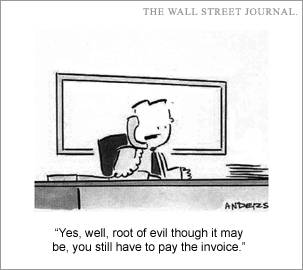

The most useful tax advisors are just like this. They ask you how much you want to pay in taxes and help you structure things to legally accomplish that. They understand that you aren't at the mercy of just having to accept taxes without any control.

Wednesday, February 19, 2003

1031 Exchanges

I've updated the website for Tax Free Exchange Corporation and added some new questions and answers to the FAQ section.

Labels: 1031

Seven Ways To Avoid An Audit

Some basic common sense tips. I would add not using the e-filing so that you can include enough details and documentation to avoid any further IRS inquiries.

Tuesday, February 18, 2003

Or you could start your own business and not be dependent on anyone else to take care of your future.

New Treasury Secretary Hits the Road to Promote Tax Cut Plan

A definite improvement over his predecessor, who felt it was more important to spend his time traveling around the world with an Irish rock star giving away US taxpayer money.

And why is it that Little Tommy Daschole and his fellow travelers in the DemonRat party are fighting Bush on all three fronts?

Sunday, February 16, 2003

Retirement Funds

One of the many arguments against relying too much on the Social Security Ponzi scheme is the fact that, despite what many people may believe, there is no such thing as a trust fund holding the money you have been paying in all of your working lives. Again, anyone who claims that there is such an account is either a liar, an idiot or both, and not to be trusted.

When a person passes away, there is no money or account to pass on to one's heirs, other than a measly monthly payment for some surviving spouses, until they die. This very real rip-off definitely earns the SS system the right to be called the Death Tax For The Other 98% of Americans (other than the evil rich top 2% who have to pay estate tax).

While my game plan has always been to help clients legally avoid paying anything into the SSA Ponzi scheme and use that $10,000 to $20,000 per year in savings to better invest for their own futures, Bush's idea to allow some privately controlled investing of money that would normally go to those corrupt rascals in DC is a step in the right direction. In fact, sticking that money under your mattress would yield a better rate of return than sending it in to DC for most people.

KMK

Saturday, February 15, 2003

Non-Resident State Taxes

I've written a lot on establishing a tax home in a low-tax or no-tax state, such as Texas, Florida, Nevada or Washington. While that kind of step exempts most kinds of investment income from state income taxes, it doesn't necessarily eliminate state taxes on income that was earned within a taxable state from services rendered or from property located inside that state. Rent income earned from a property located in a taxable state has to be reported on a tax return with that state, regardless of where the owner lives.

Likewise, when property inside a taxable state is sold, a tax return has to be filed reporting the resulting profit, loss or tax deferred exchange that was done. For example, we have helped hundreds of people dispose of high gain real estate located in the PRC and reinvest the proceeds into new properties in low or tax free states. All of the tax on the profits from the PRC properties is deferred and rolled over into the replacement property. If those people ever sell the replacement property and don't do a 1031 exchange, they will technically have to report the previously deferred gain to the PRC and pay the tax on that. However, there is an element of the honor system in this because if the property is located in another state, the California Franchise Tax Board will literally be out of the loop in terms of knowing anything about the sale, unlike the situation for sales of California property.

Compensation for personal services is a little trickier and depends on how your employer reports it. As this article in the Wall Street Journal discusses, many states have what they call a "Jock Tax" to get their share of income tax from highly paid athletes and entertainers who perform inside the state. Their income for the year has to be prorated between the various states in which they performed and they have to file income tax returns for all of those that have income taxes. While many athletes and entertainers have established Florida as their official tax home, they are still keeping their tax preparers quite busy preparing tax returns for each of the states in which they earned income.

There are tricks that can be used to disguise where the income was actually earned. A good creative and aggressive tax advisor can help set those up.

KMK

Labels: 1031

Friday, February 14, 2003

IRS Response To Tax Protestors

IRS has updated their response to many of the bogus arguments used by tax protestors. You can even download a more detailed 36 page pdf document covering these points. It pretty well speaks for itself and is consistent with what I have been saying forever, that the arguments are complete garbage and anyone who tries to use them to avoid filing tax returns will get a well deserved stay in the Fed's gray bar hotel.

KMK

1099 Discrepancies

A common situation when setting up a new corporation is discrepancies with 1099s by customers. They are required to be submitted to IRS for unincorporated payees, but no 1099 reporting is required for payments to corporations. What often happens is a customer includes payments that were made to one's corporation or deposited into the corp's bank account under the person's unincorporated ID number. While it would be best to have them correct the 1099, that isn't always possible and in fact is not even a big deal.

Some people think this means they have to pay the much higher personal and self employment taxes on this erroneously reported income. Not true. As I mentioned earlier, the amount of income you pay tax on is not dependent on the 1099s. I have had this situation hundreds of times with clients and have worked out a simple way to avoid any IRS problems. To avoid a nasty-gram from IRS when they match up 1099s with 1040s, it's essential to report gross receipts at least as high as the amounts reported as income to you personally on 1099s. Then, in either the Cost of Goods Sold or Other Expenses section of the Schedule C, include an entry for "Income Deposited Into Corporate Account and Reported On Its 1120" to back out that income and avoid double taxation of it. I usually include another attached statement explaining about the newly formed corporation (giving its FEIN) and how erroneous 1099s are being handled. IRS has never had a problem with my reporting these in this manner.

As I have mentioned on several occasions, this kind of additional self defense info is one of the reasons I refuse to accept electronic filing of income tax returns. There is no place to explain such discrepancies in that format.

KMK

Thursday, February 13, 2003

Enron Tax Tricks

Maybe it's because I have long made a good living helping people win the tax game; but I can't share the disgust over the fact that Enron had a large staff with the sole purpose of structuring things to minimize taxes. My disgust is with the rulers in DC who force companies to devote so much manpower to such tasks with their idiotic and outright punitive tax laws and regulations. I can still remember many of my college classes, where we were taught that the main function of a corporation's management is to maximize the return (aka profit) for the shareholders. Minimizing taxes is just as important in that equation as reducing other overhead costs, such as labor and rents.

KMK

Economists For Sale

It's long been common knowledge that opinions of economists can be purchased in exactly the same way as murder defendants buy the "expert testimony" of psychologists. The fact that a bunch of left wing economists don't want people to be able to keep any of their own money is nothing new and no big deal.

KMK

Wednesday, February 12, 2003

Tuesday, February 11, 2003

Let It Snow

The new Treasury Secretary seems to be on the right track in support of lower taxes.

In his own words

Larry Kudlow's take

Davis recall is gaining traction

Wishful thinking. The GOP in the PRC ran such an incompetent campaign for governor last year, what makes them think they can do any better in a recall election against Gray-Out Doofus?

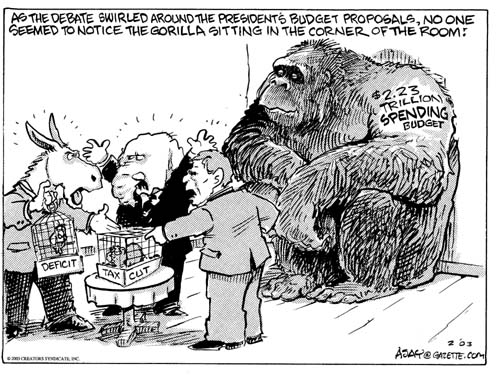

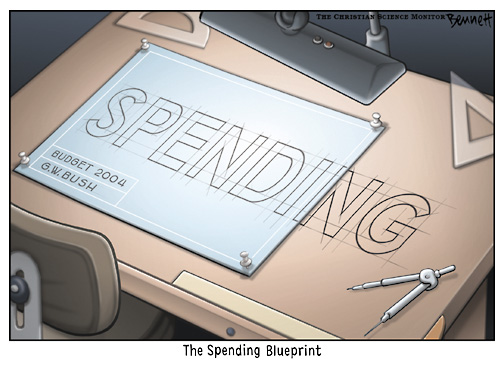

Out of Control Spending

While I believe it is completely unfair to blame the Federal deficit on the Bush tax cuts, it is perfectly justified to hold him responsible for not putting the brakes on Congress' wild out of control spending. That is one of my few complaints about Ronald Reagan. His tax rate cuts produced record levels of tax revenues; but he didn't use his veto power to stop Congress from spending like the classic drunken sailors. I'm not sure Bush is going to be any more effective than Reagan was.

I'm not alone in this opinion. It's shared by:

Bill O'Reilly

Veronica de Rugy

Audits of wealthy could increase

Another reason to smooth out income between the 1040s and 1120s by using at least one C corporation.

Those in the boomer and later generations who don't take steps to provide for their own retirement assets, including not paying in as much to the SSA, will have nobody to blame but themselves.

This reminds me of the idiots who claim that money can't be considered as income because of various lame arguments, such as it not being backed by gold.

Monday, February 10, 2003

Tax Cut Reverse Spin

It's become something of a non-story that the DemonRats are hypocrites on the issue of tax cuts.

It's also not news that the Dems have nothing but this kind of class warfare garbage to counter Bush's proposed tax cuts. This is just outright wrong on several counts. Letting people keep more of their own money isn't a cost to the government. Lower tax rates do result in more revenues. Eliminating the double taxation on dividends will not kill poor people and increase the gap between rich and poor.

KMK

Sunday, February 09, 2003

Who can give advice on law?

Protecting their monopoly. We should all be so grateful for attorneys looking out for our welfare - not.

Having It Both Ways

About four or five years ago, I was starting work on earning my securities licenses so that I could share in the big bucks investment advisors were making. I had to drop it when I became far too busy to handle those projects I already had. While I missed out on the fees from the booming stock market, his has worked out well. As this story shows, everyone was as happy as could be while their portfolios were rising in value. However, when things turned sour, they started looking for someone to blame and cover their losses.

While I have no doubt that there were some stock brokers using the classic account churning techniques to generate commissions, many of the investors suing their brokers are just sore losers who don't want to pay the price for their own risk taking. It's really just another example of people refusing to suffer the consequences for their actions, such as suing McDonalds for making them fat.

KMK

Saturday, February 08, 2003

AMT Sneaking Up On More Taxpayers

This is very true. There are more and more cases where I have actually had to back off claiming legitimate deductions on clients' returns in order to reduce or eliminate the AMT and achieve an overall lower tax bite. That's not a problem for IRS because they aren't in the business of telling people that they didn't claim enough deductions.

One of the more extreme examples of the AMT kicking in was with a client who went from being a Schedule C self employed independent contractor (IC) to a W-2 employee. By moving the exact same amount of his unreimbursed expenses from Sch. C to Sch. A, the AMT kicked in, for several thousand dollars of additional tax than if he had remained as an IC. How does that make any sense?

Reform AMT is still the most vocal and active group working for a change in this insidious tax.

KMK

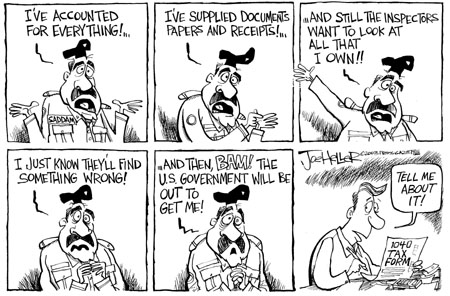

IRS Penalty Notices

It's time for a refresher on how to deal with notices from the IRS and State tax agencies claiming that a penalty should be applied or another change needs to be made to a recently filed tax return.

The first thing to remember is that, contrary to popular belief, IRS and State tax agencies aren't infallible. They make mistakes. I don't mean to burst anyone's illusions, but more times than not, notices they send out are either completely or partially wrong. I've never done a scientific study; but at least 75% of the notices I have reviewed have been seriously in error. Who knows how much money they get from people who are either too scared to question the IRS's accuracy or simply labor under the misconception that they are always right. So, before sending off a check, have your tax pro check it for accuracy.

If, as it usually is, there is an error in the notice, write to the IRS or State and explain the error. The first letter doesn't always do the trick. It then becomes a game of bluff. I have often seen IRS and States deny a waiver request, only to accept it after sending the exact same letter back a second or third time. If you know that you are right, do not give up at the first level. Write to the Taxpayer Advocate's office next. If all else fails, contact the local office of your elected officials. They have staff designated as liaisons with the tax agencies.

I have often heard IRS personnel suggest that you pay the bill and then request a refund. That is the absolute worst thing you could so if you feel you are right that you don't owe the money. Do not ever send in any payment for a tax penalty that you are not positive that you owe until you have exhausted all appeal options. On far too many occasion, I have found that they use any prepayment as an admission of guilt, reducing the chance of recovering the money to almost zero. You completely lose all negotiating power once they have your money.

Many people panic over the deadlines given in penalty notices and worry that they will be hauled off in shackles if they don't pay the bill by that particular date. Those dates are just arbitrary ones and, if you don't truly owe the money, mean nothing. You may receive a follow-up notice if they haven't heard back from you by that date, but nothing serious.

Again, contrary to popular belief, penalties are negotiable. Interest charges on late payments are not. However, if you can explain why a penalty should be removed, it and the interest on the penalty will be taken off the bill, normally making a sizable dent in the original amount requested.

KMK

Friday, February 07, 2003

What to do if you don't get your W-2

Some Users of Free Tax E-Filing Say the 'E' Doesn't Stand for 'Easy'

America's funniest tax stories

1031 Exchanges

Although delayed like kind (aka Starker) exchanges have been legal since 1984, we still come across people every day who are unclear as to how they work. The scariest thing is that many of the uninformed are tax and real estate professionals. Sherry turned me on to this excellent article on the history, rules and procedures for tax deferred exchanges. I have to admit it's a more complete article than what we have on the Tax Free Exchange Corporation website.

KMK

Labels: 1031

Thursday, February 06, 2003

Budget Bloat

As Stephen Moore points out, our GOP controlled DC ruling bodies are losing the battle against big government spending. A 50% increase in the Federal budget doesn't make their claims of fiscal control and smaller government very credible. Our chances of ever seeing our tax burden decrease drop off in direct proportion to the growth in the Federal budget. GOP pork is just as expensive and irresponsible as that doled out by the Dems. The National Taxpayer Union is just as upset over this as Stephen Moore and I are.

I do take exception to the connection that NTU and everyone in the mainstream media make between tax rate cuts and the deficit. As proven by the Reagan tax rate cuts, lower rates produce more revenue. Deficits are a direct result of uncontrolled spending, just as they were in the 1980s and 90s. Every time you see someone try to blame deficits on tax rate cuts, you need to realize that person is either an idiot, a liar, or more likely both, and definitely not to be trusted.

KMK

Wednesday, February 05, 2003

Tuesday, February 04, 2003

A Tax Code Not Intended for Amateurs

Of course not. That's what makes the tax profession the most secure career in the country.

Most States were like the grasshopper, with no plan for downturns in the economy. And of course, their rulers continue to be reelected.

Monday, February 03, 2003

Bush Proposes New Tax-Free Savings Plans

More complicated options added to a slew of already confusing plans. However, this is just a proposal, with a long way to go before enactment into real world law; so don't worry about learning these rules yet. They will be changed quite a bit. Remember how tax laws are developed.

KMK

Taxes Are The Symptom

While it should be obvious, I always need to remind people that our ever increasing Federal tax burden is merely the symptom of a much bigger problem. The root cause is this, a non-stop expansion of the reach and cost of running all of the programs that our rulers in DC insist on sticking their noses into. Over 2.2 trillion dollars need to be taken from the people each year. The chances of this number ever decreasing in our lifetimes are slim to none; so you can either accept the fact that you have an increasingly greedy financial partner or you can take steps to minimize the damage.

KMK

Sunday, February 02, 2003

Not All or Nothing

As I have been advising for decades, there is no quicker way to reduce one's tax burden than by using a C corporation. However, too many people shoot themselves in the foot by not consulting with a professional advisor who understands how to most effectively utilize the corporation. I have touched on several of the most common mistakes made over the past few years and will continue to comment on others.

Most corporations are an evolution from a Schedule C sole proprietorship. Moving to a C corp allows huge savings in both income and Self Employment taxes, as well as allows for the corp to pay for many tax free benefits for the owners, such as medical, childcare, travel and education costs. Most people believe that once the corp is established, the Schedule C business should be terminated. That's not a good idea for a number of reasons, such as family employees and self employed retirement accounts.

One of the big tax breaks that many people overlook is the special exemption that there is for employing their kids in their business. Dependent children under 18 are statutorily exempt from all of the payroll taxes that are normally due for unrelated employees. Rather than paying kids a non-deductible allowance, it is a much more tax efficient means to pay them family wages for helping out in the business. How much you pay is up to you. Many people pay their kids up to the amount of the standard deduction ($4,750 for 2003) so that they (the kids) don't have to file income tax returns. However, I have seen plenty of cases where teenagers are paid $20,000 or more per year for working in their parents' businesses. While the kids obviously have to file tax returns and pay tax on this, they are usually in a much lower tax bracket than their parents. Income shifting in this manner has been around much longer than I have; but can still save some serious money.

The reason that it's a good idea to keep at least one Sch. C going in addition to the C corp is to be able to channel some tax free family wages for your kids. The corp pays your Sch. C business some money for generic services. Your Sch. C business then pays your kids for helping out. It's a wash. Corporations aren't human and thus can't have family employees, so the only way to avoid the payroll taxes on wages for your kids is to run them through your Sch. C. What you call the Sch. C business isn't really important. It should just be whatever will allow you to deposit the check from your corp into your personal bank account. Your corp should also report those payments to you on a 1099-MISC.

Another common mistake I have seen is for people to bleed out all of the profits from their corporations by paying all of the income out to themselves. This defeats the benefit of smoothing out income between the 1040 tax brackets and the 1120 brackets. With the punitive tax structure in this country, the worst thing is to have all income show up on one tax return, 1120 or 1040. With accurate up to date books, as well as a different fiscal year for the C corp, it is very easy to smooth income out so that neither the 1040 nor 1120 goes over the 15% Federal tax bracket.

KMK

Tax Division of the Justice Department

IRS isn't the only Federal agency dealing with tax cheats. This is an interesting look at how the serious cases are dealt with, especially many of the tax protestor schemes that I have been warning about.

Again, it seems to me that it would be a good idea for the convictions of tax cheats to be more widely publicized as a means of discouraging others from following the lead of such charlatans as Bob Shulz, Irwin Schiff and Lynn Meredith.

Phone bill �cramming� spikes again

Phantom charges sneaked onto statements across the U.S.

It's crucial to check your monthly phone bill to catch these sneaky charges. Same thing with credit card bills.

Saturday, February 01, 2003

IRS E-File Not for Everyone

It looks like I'm not the only tax pro who recognizes the limitations to the the IRS e-filing program and refuses to use it for clients.

1099 Recipient Misconceptions

During this time of year, as people are receiving their 1099 and W-2 forms and preparing to give everything to their tax preparers, it's a good time for a refresher on some of the most common mistakes made regarding these documents.

First is the perception many people have, that if they do not receive a 1099 or W-2 from payers, the income is tax free. With the legal requirement for 1099-MISC forms to be filed when annual payments exceed $600, the common belief is that any income below $600 is tax free. Not true. All income received for services is taxable, whether or not a 1099 is received.

In the unlikely event that you are selected for an IRS audit, the auditor will come prepared with a listing of 1099s that have been received reporting income that you were paid. The auditor will also demand to see all of your bank statements for the year under review, plus the statements for the previous December and subsequent January. The auditor will total up all of the deposits shown on the bank statements for the year under audit. S/he will then try to match up the total deposits to the gross income you reported on the various schedules of your 1040. While some kinds of deposits are not technically taxable or reportable income, such as transfers from other accounts, loan proceeds or gifts, the burden of proving their tax free source is on you. That is why I have always advised making photo-copies of each and every deposit you make. If you can't prove that a deposit is from a tax free source, IRS will consider it unreported taxable income. Trying to defend not reporting compensation with the argument that there was no 1099 received will get you nothing more than a laugh from the auditor.

Accuracy: Believe it or not, information on 1099s and W-2s is often wrong. The burden of verifying their accuracy is also on you. You should never accept the amounts as gospel before you have gone through your records and matched up the totals. This is another reason why it is crucial to have all of your personal accounts set up on QuickBooks. If the amount is wrong, notify the payer ASAP to correct it. If you do this before the payer has sent the IRS its copy (which isn't due until February 28), it will save everyone a lot of grief later on. If the change is made after the original forms have been sent to IRS, there will probably be a mis-match with IRS computers now having two 1099s, even though one may have the tiny "CORRECTED" box checked.

Attaching: I constantly hear people complain that they can't finish their tax returns because they haven't yet received all of their 1099s. This is a bogus excuse for a couple of reasons. First, the amount of income you received and will be reporting on your 1040 is not dependent on what shows up on the 1099. Your records (ideally QuickBooks) will have those amounts. Second, 1099s are not required to be attached to 1040s. W-2s are required to be attached to 1040s if there has been any Federal income tax withheld. Same thing with the States. They will not give you credit for those withholdings without the W-2s attached.

KMK