New Tax Law

As busy as I am working on tax returns for the October 15 deadline, I have no idea when I will be able to write up my analysis of the recently passed tax law that extends many of the soon to expire provisions of the 2001 tax cut law. In the meantime, CCH has a nice summary in pdf format.

Another New Version of QuickBooks

Intuit Unveils Simplified Software for Small Businesses - I have ordered a demo CD of this new program and will write an article on my feelings about its practicality as soon as I receive it and have a chance to test it out. It sounds like a midpoint between Quicken and QuickBooks. The Basic QuickBooks program is cheap enough and easy to work with, so I'm skeptical as to whether another version is really necessary; but I will take it for a spin and post my report.

Not Again! Congress Evades Its Budget Caps

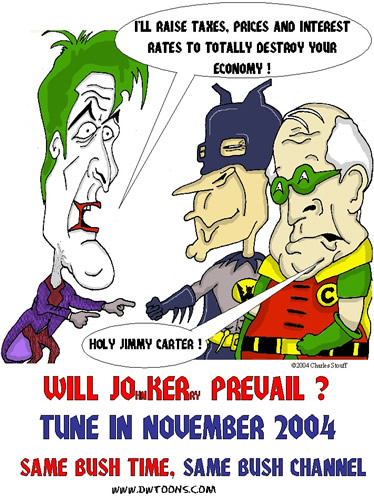

How Much Would John Kerry Raise Taxes? A whole lot.

Student Loan Swindle

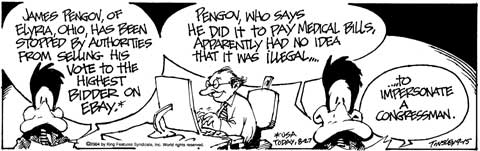

Federal Court Stops Ohio Tax Scam Promotions

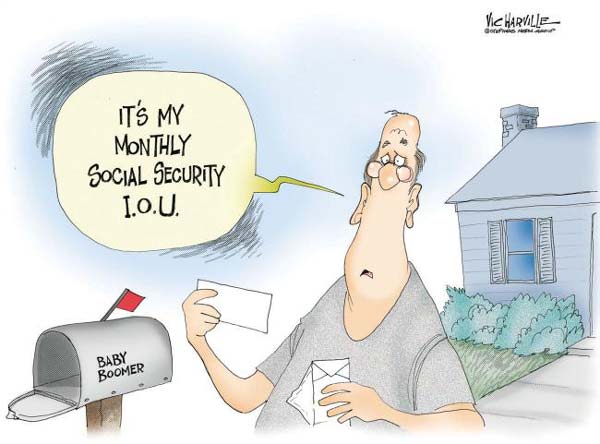

Privatizing Social Security

The usual suspects are screaming bloody murder about the possibility of changing the current Ponzi Scheme system to allow people more control over their own retirement funds rather than trusting in the bozos in DC.

Some good articles.

Raising the Stakes on Social Security Reform - From the Cato Institute

Manipulating Numbers: The Mythical $940 Billion Fee for Social Security Personal Retirement Accounts - From the Heritage Foundation

Privatizing Social Security - From Thomas Sowell

Privatizing Social Security: Part II - More From Thomas Sowell

A Trillion Lies - From James T. Miller

One Cheer for the Tax Extender Package

More firms flee Big Four accountants

The Escalation of Income

Banks Want Credit Unions to Pay Taxes, Sherman Says

Foreign Tax Havens Costly to U.S., Study Says - The capitalist response to this situation is to lower US tax rates so that there is less incentive shift profits to other countries; and not to further harass companies, as is the natural reaction of many of our rulers.

Taxpayer Bill of Rights Proposed For Maine - Thanks to The Club For Growth's Andrew Roth for keeping an eye on the tax battles in the smaller states.

Citizen Group Calls Tax Cut Extension a Good Start, Not the Finish of Relief Effort for Taxpayers

SEATTLE MAN ORDERED TO STOP PREPARING TAX RETURNS - Cleaning out another bad apple from our profession.

Revised Data Show Some Candidates' States Profit from Federal Taxing and Spending, Others Foot Bill

WHY DON'T YOU STUDY THE PLAN BEFORE YOU COMMENT ON IT? - Neal Boortz nails a stupid CPA who has spouted off against the Fair Tax plan without having the foggiest idea of what it entails. I'm no longer surprised, but I am still disappointed, in how many CPAs and other tax pros are high tax loving Marxists. I feel very sorry for their clients who are paying them to keep their tax bills high.

A perfect illustration of how bad all so-called experts, including top scientists, are at predicting the future, this is a funny picture of what a scientist in 1954 thought a home computer would look like in 2004.

Update 1: This picture may be a hoax, showing a nuclear ship's controls and not an actual imagined "home computer."

Update 2: Snopes.com has debunked this as a fake picture; but acknowledges that it does represent what many people back in 1954 did envision a home computer would look like.

Would Senator Kerry’s Budget Really Reduce the Deficit?

Congress Extends Middle-Class Tax Breaks

Congress Increases Pay While Promoting Government Inefficiency

Do Your Homework to Get the Dividend Tax Break

Oprah's car giveaway turns into a tax nightmare

Whoever Wins, More Taxes May Be the Only Way Out

2005 Federal Income Tax Schedules

I am constantly being asked when the 2005 tax rate schedules, indexed for inflation, will be available and posted on my main website. Every year, some private sector tax experts (even geekier than I am) release their predictions of what those inflation adjustments will be; often months before IRS announces its official figures, which are usually almost exactly the same.

CCH has released its Tax Projections for 2005

Update: I have posted a page with these 2005 figures on my main website. The figures I used are those calculated under the assumption that the current pending legislation to extend the tax rate schedules passes, which is extremely likely to happen.

John Kerry's Social Security plan is to ignore it and hope a fairy godmother comes down, waves her magic wand, and makes it all work out.

Hill panel OKs tax-cut extension

Conferees Pass $146 Billion Tax Cut Extension Bill

Many Fortune 500 Firms Paid No Tax During Bush Administration, CTJ Finds - And of course, that's inherently bad because we're all supposed to understand that corporations are evil.

Congress gives president pre-election win with tax cuts

DemonRats Blast GOP National Sales Tax Proposal - Sales taxes don't allow as much social engineering and control as income taxes do.

New $50 Note Available Beginning September 28 - Ulysses Grant has had his gay makeover.

Congress Sends $146 Billion Tax Cut Package to President Bush

Lawmakers OK Extension of Tax Cuts

John Kerry: Fiscally Disciplined? Not even close

Social Insecurity

Sherry has posted another warning for our Realtor clients on how important it is to be aware of when a client should consider disposing of a property as a tax deferred 1031 exchange. It is not an exaggeration to say that sellers who are not informed of 1031s will be upset next tax time and could actually sue the Realtor, and even their tax advisor, for not recommending it.

Labels: 1031

Schedule C-EZ Change Means Time Savings for Small Businesses - While more small businesses will now qualify for this EZ form, I will continue to suppress the form from my software. Just as with my opposition to e-filing, it is my firm belief that being able to itemize detailed descriptions of expenses on a tax return, rather than having to lump them together, is a way to minimize the potential for a return to be selected by IRS for an audit.

The media are making such a big deal about these poor people who have to pay taxes on the free car they received from GM. All they have to do is sell the car and they will have plenty of cash to use for the taxes if there are any. Lottery and other gambling losses can be used to offset this income. If they still need a new car, they can buy a more affordable used one.

Oprah's car giveaway not totally 'free'

Recipients In Oprah's Car Giveaway Face Hefty Taxes

Pressing issue of Social Security

The Specter of Poverty in America - Many big government programs are built on the foundation of dire poverty in the populace, with the ridiculous impression given that low income people in the USA are equivalent to starving dirt farmers in Africa.

How to Minimize Taxes And Control Your Estate Without Trusts

Court Orders Halt To Texas Man's Tax Promotions - And those people foolish enough to fall for this scammer's "corporation sole" and "claim of right" schemes will be hearing from IRS as well.

GOP crafting tax-cut package

Chirac Touts Plans For Worldwide Anti-Poverty Tax - I'm sure John Kerry's all in favor of France setting American tax policy, just as he want to turn over all of our military decisions to those cheese eating surrender monkeys and the United Nations

Productive inequality - Basic supply & demand concepts explain why a few people earn millions times more than most people.

The Candidates' Tax Plans: Comparing the Economic and Fiscal Effects of the Bush and sKerry Tax Proposals

Snopes.com has some more explanation of the upcoming Check 21 procedures for banks processing checks.

Simplify, Simplify, Simplify - Let's not all hold our breath for this to ever happen.

FBI: Mortgage Fraud Is Rampant in U.S. - Michelle Malkin has an interesting theory that the uncontrolled borders have allowed a lot of illegal residents to scam the banking industry in this country.

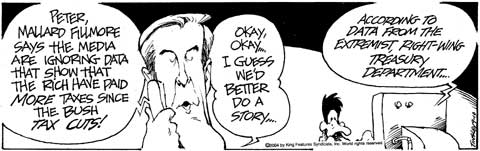

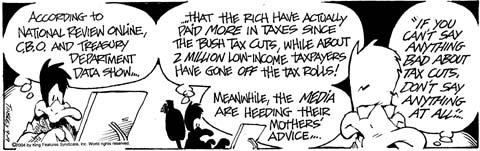

The Revenue Effects of Reinstating the Top Tax Rates

Liberal Democrats plan to tax SUVs off city streets in UK - The libs haven't given up their efforts trying to do the same thing here in the USA. As I've tried to explain on numerous occasions, SUV owners are already punished for exercising their free market right to buy their vehicle of choice by the higher price of gas.

How Tax Cuts Feed the Beast - This is a ridiculous ass-backwards assessment of Bush's tax cuts. This numbskull calls the tax rate cuts wealth redistribution, when the reality is that the entire purpose of using graduated tax rate schedules is to redistribute wealth from the producers to the non-producers. Bush's rate cuts have allowed more people to keep the results of their own efforts and reduced the amount of Marxist redistribution that is still very inherent in the tax rate structure in this country.

Congress Considers Extending Tax Relief with Significant Benefits to Middle-Income Taxpayers

Florida Property Tax Bills Hit Hurricane-Damaged Homes at Full Force

Judges need lessons about power to raise taxes - Much of the growth in the size and cost of government is due to activist judges overstepping their legal authority and nobody doing anything about it. Impeachments aren't just for perjuring presidents.

John Kerry's A man without a plan - And luckily for the USA, without a snowball's chance in Hell of coming even close to being elected.

Viacom’s Redstone dumps stock during Rathergate - Even the top dogs can see how Dan Blather is pulling their network into the toilet. You can't blame them wanting to bail out before the financial losses become too much. Protecting their investment by kicking old Danny boy's butt out would take too much integrity and offend their fellow DemonRat travelers too much.

As I've always explained to those concerned about my career if taxes were ever to be drastically simplified, I'm not in the least bit worried. Substituting income taxes with sales taxes will just increase the need for our services to minimize those new taxes.

Big 'bounty' needed to catch spammers - Money motivates.

China executes bank staff for fraud - Those commies are harsh with their punishments.

How reality shows keep contestants from spilling beans - One of my favorite phrases has long been the classic "Money talks & B.S. walks." If you want to motivate people to do or not do something, there is no better way than through financial incentives or penalties. Just look at the stupid and disgusting things people will do for a measly $50,000 on the Fear Factor show to appreciate the motivational power of money. It's also why I have never used flat fees and have always charged purely based on time spent. Clients with their things organized pay less than those who don't.

Our rulers in DC are as effective at regulating private businesses as they are at simplifying the tax code. The end result is almost always the same, more cost to us taxpayers.

Understanding Poverty and Economic Inequality in the United States

Oklahoma TABOR: Let's Adapt Colorado's Plan

sKerry, Bush differ sharply on tax policy - Well, duh. That stands to reason when comparing the beliefs of a capitalist versus a Marxist.

John Kerry spells out his prescription for economic disaster.

The House voted to bar IRS from outsourcing tax collection. But, what if the IRS subcontracted with the mob?

It's good to see people realizing that John Kerry's "Tax the Rich" mantra will include just about everyone in its scope.

House Adds Debt Collection Amendment to Treasury Funding Bill

IRS Files $15 Million Claim Against Credit-Counseling Agency - Another scammer gets a little taste of justice.

Tennessee Return Preparer Sentenced in False Tax Claims Case - It's good when the crooks in our profession are cleaned out.

America loves to hate dastardly CEOs

Hawks tell spenders, 'Enough!'

Stocks & Polls Agree on Bush - This is an obvious correlation since the stock market is, for the most part, the bastion of capitalists, who would naturally be more likely to support capitalist George Bush than Marxist John F'ing Kerry.

'Shooting from the Hip' on Social Security Reform

John & Teresa Kerry Skimp on Their Income Taxes - Typical elitist liberal hypocrisy.

John Kerry Vows To Raise Wife's Taxes

Hurricane Porky Blows Through Capitol Hill - Excellent choice of words to describe what our rulers in DC do.

Building Your Own Dynasty - Interesting look at how to set up perpetual trusts.

Improvements Are Needed to Ensure Tax Returns Are Prepared Correctly at IRS VITA Sites - Having started my tax prep career with the IRS's VITA program in conjunction with Cal State Hayward back in 1975, I have always been well aware that its free service is no match for a professional. We were supposed to be for the benefit of low income individuals, but I can recall working on some fairly high income returns with plenty of business and rental schedules. We didn't turn them away because of the excellent real life experience it gave us; but those people did get what they paid for.

With Thousands Of Pensions Closing,How Safe Is Yours?

Net operating losses are back for Calif. taxpayers - Deducting NOLs has always been relatively straight forward for Federal income taxes. The number of years a loss can be carried backwards or forwards has been changed a few times; but the mechanics have remained the same. The rulers of the PRC have a long history of tinkering with the deduction as means of shortchanging taxpayers and thus increasing tax revenues. Eliminating carrybacks completely, only allowing a deduction for half of the NOL, and actually suspending the deduction are tricks they have used in Sacramento. We'll see how long it is before they screw around with it again.

New Zealand Moves to Extend Legal Privilege to Tax Advisors - I generally don't follow tax issues in other countries; but this reminds me of a long running unfairness in the administration of tax laws in the USA. Not allowing the same level of client confidentiality with info provided to CPAs, EAs and other tax advisors as with actual attorneys has always been just plain wrong. I'm obviously biased in this and perhaps I would think differently if I had continued with my original plan out of high school to become an attorney; but I doubt it.

Bush Not Pleased With IRS Funding - For obvious reasons, I don't suspect we'll find a lot of people sharing Bush's sadness over the fact that IRS isn't being given hundreds of millions of taxpayer dollars to be used to harass taxpayers.

IRS Appeals Getting Better, Faster, Officials Say - I wish this were true. However, from my real life experiences handling scores of IRS cases, they have often been dragging on for several years at the Appeals level and the Appeals Officers have become much less objective in their approach to viewing the facts of the case and much more protective of the IRS's side. They have strayed dramatically from the much more unbiased perspective that the San Francisco Appeals Officers used to have back before I abandoned the Left Coast.

Kansas Antitax Primary Spending Causes Campaign Finance Controversy - It looks like the Club For Growth is doing an excellent job in targeting high tax loving RINOs for early retirement. They also had similar success in Wisconsin and Washington State.

Former Atlanta Mayor Campbell Indicted On Corruption and Tax Charges - I can recall several stories over the years by Atlanta radio host Neal Boortz as to Mr. Campbell's flagrant corruption; so it's good to see that he will be tasting a bit of justice.

Danger of no tax liability - Good article by Walter Williams on how unfair it is that a smaller and smaller minority of people are having their wealth plundered by a growing mass of people in this country. Of course, since that minority consists of the dreaded "evil rich," such exploitation will continue without opposition from any of the normal advocates who usually jump to defend other persecuted minority classes in this country.

Public Confidence in Charities Stays Flat

Tax Consequences of Oprah's Car Giveaway

sKerry's missed opportunity to address Tax Reform

'Price gouging' in Florida

Ownership society: Make it so!

How to incrementally reduce the tax bias against saving and investment.

Corporate Tax Reform: sKerry, Bush, Congress Fall Short

Teachers lose tax breaks for supplies

Democrat offers income-tax alternative

Some SUVs Have a Serious Weight Problem - Another story on how the same weight threshold that qualifies a business vehicle for the very lucrative Section 179 expensing deduction can also make it illegal to be driven in certain neighborhoods in the PRC. Of course, if you're driving one of these new $100,000 babies, you won't be letting any neighborhood watch nannies intimidate you.

Labels: 179

Do Newspapers Make Good News Look Bad?

What A "Fairer" Tax Code Might Look Like

Industry databases help IRS close a taxing gap

Tax Reform Revisited

Speeches ignore impending U.S. debt disaster. No mention of fiscal gap estimated as high as $72 trillion

Tax reform detour?

GOP renews push to lift IRS ‘muzzle’

Protester's Tax Battle Ends With Settlement - As I described over a year ago when the criminal case was decided, the Tax Protestor movement has been using it to validate their arguments that nobody is legally required to file income tax returns. As I explained back then, this pilot only succeeded in staying out of prison. She still owed the taxes, penalties, and interest on her income. Having to pay the Feds over a half million dollars doesn't sound like much of a real victory for the scammers in the Tax Protestor community.

Electing Low Tax Rulers

Thanks to TaxProf Paul Caron for the info on the NTU's attempts to get all of the candidates for Congress and the US Senate to answer an 11 question survey about their beliefs on taxes and whether or not they will work towards lowering them.

You can check how your state's candidates have responded from this page. Not everyone has responded to the survey. When I checked Arkansas, only four of the eleven names (36.4%) had any feedback as of the September 1 tabulation date. Missouri had responses from 12 of the 30 candidates listed (40%).

If you understand the anti-tax tone of the questions, you can pretty well assume the stand of candidates who refuse to answer them.

Social Security to Become Insolvent by 2018

Poor credit history can doom job offers - Potential employers frequently check credit reports on job applicants. I occasionally did it back in the PRC; so this is nothing new.

Homes Sale In Multiple Transactions

I received the following email:

My Reply:Hi, you seem to know what you are talking about and I keep getting different opinions, so is there any way I do not have to pay long term capital gains on the following situation:

I bought 36 acres, w/house, barn,workshop, in 1983 for $165,000. We have probably put $50,000 into it over the last 20 years. We sold 15 acres of it in March. for $225,000. We are now selling the remaining acreage and house for $650,000. This closes in 30 days. Total $875,000. I think we can take the $500,000 deduction plus the amount we paid on the house, plus improvements. Is there anything we can do to keep from paying capital gains on the remainder? Does the 15 acres sold in March go; with the primary residence since it was originally bought together?

I would love to get your help !!!!

Thanks,

I'm assuming that none of the acreage was used for farming or other business activities for more than three years out of the five years prior to the sale. If it was, you would need to do a 1031 exchange on that portion of the property sold.

IRS allows primary residences that include acreage to be sold in multiple transactions and counted as the sale of the same primary residence, as long as all portions are sold within two years of each other. In your case, as long as you sell the second portion by March 2006, you're okay.

Using rough numbers, it sounds as if your basis in the property as a whole is $215,000 (165 + 50). With a combined selling price of $875,000, you have a net profit of $660,000. The tax free exclusion for a married couple is $500,000; so the additional $160,000 would be taxable as long term capital gain.

I really doubt if your profit will be that much, unless you are selling the place on your own with no expenses. Selling costs, such as inspections, Realtor commissions, transfer taxes, repairs and escrow fees, reduce your profit.

If your expenses for both transactions are less than $160,000 in total, I would advise doing a little more reflection on the cost of all the improvements you made to the property over the past 20 years. Unless you've been keeping a tight set of books, most people short-change themselves when figuring up how much they have invested into their home. The best way to do this is to get a pad of paper, pull out your old photos and start jotting down each of the things you did to your home from the very beginning, along with your best recollection of what it cost. IRS will accept this kind of reconstruction of costs, as long as they sound reasonable. For example, if you built a deck 10 years ago, you need to use the lumber and contractor costs from back then; not today's prices. The one thing you cannot include is your own time (aka sweat equity). You can only include what you paid other people.

Good luck. I hope this helps.

I have added the info on selling a residence in multiple transactions to the page on primary residence sales on my main website.

Labels: 1031

President derides sKerry for 'hidden' tax proposal

Ownership Society Will Determine Victory

2003 Cuts Yielded Dividends (Literally!)

Tax vote in Virginia spurs rival candidates

Leadership Heeding Bush Call for Five-Year Tax Cut Extensions

Justice Dept. Sues To Halt Alleged Internet Tax Scam - Another tax protestor scammer bites the dust. You can see some examples of his idiotic arguments that nobody has to pay taxes on this page

Study finds N.Y. residents pay $131 for every $1,000 earned, Tennessee taxes residents the least.

Bush Attacks His Opponent Over His Record on Taxes - Shooting fish in a barrel.

Victims of Class Warfare

I recently received the following:

Kerry, maybe you could clarify this for me...(from John Kerry's website) http://www.johnkerry.com/pdf/budget.pdf

pg 3 he claims to raise taxes on only those making over $200K, but then says he will restore the top two tax rates to their levels under president Clinton. Doesn't the 2nd tax rate start at 146,750 for individuals and 178,650 for couples - doesn't Kerry have to have some clarification on this?Thanks for your updates, I find them useful.

My reply:

You are close on the figures; but have an excellent point. I pulled out my 2000 Federal income tax rate schedules and the 36% bracket started at $161,451 for married couples and $132,601 for single taxpayers. Inflation adjustments have continued to move the starting points up over the years.

This practice of nailing many more people than the avowed targets isn't anything new for DemonRats. In 1993, when the Clinton-Gore team passed their humongous tax increase, they instituted a 10% "Millionaire Surtax," which gave us the top 39.6% bracket (36% + 3.6%). The funny thing was that this top bracket started at taxable income of $250,000 and above. Many people were then punished as evil millionaires without earning anywhere close to a million dollars.

Thanks for writing.

Scrutiny on the Bounty

Taking the air out of floating checks - More on the new upcoming rules for banks to clear checks.

A Social Security Tax Puzzle

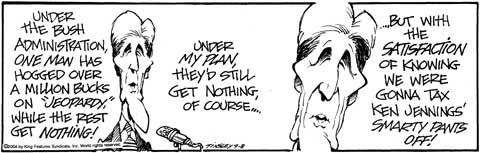

Tax Cuts, Jobs and 'Jeopardy!'

More IRS Incentives To E-File

IRS has been trying to lure us hold-outs from the use of electronic filing of tax returns by offering some very handy online services. The latest is the ability to get client account transcripts immediately. I have to admit that this would be a very useful tool, especially in trying to resolve the constant problem of payments being applied to the wrong tax period. However, as tempting as this is, I still believe that the down-sides of filing tax returns electronically outweigh the benefits; so I won't be signing up for this program. There is no way I will ever meet the qualification of filing 100 or more tax returns electronically per year.

Don't be economic girlie-men - Jack Kemp

Why Regulate Insider Trading?

Income inequality - Walter E. Williams

Let's Talk Taxes - R. Glenn Hubbard

National Sales Tax Promoted as Fairer System - The underlying problem is that the terms fairness and taxes are incompatible in the minds of our leftist rulers who insist on using the tax code for their social(ist) engineering projects.

The 'compassion' racket - Thomas Sowell has some excellent points regarding how unfair it is to the rest of us taxpayers to continuously bail out people who choose to live in dangerous places.

Tax Cut Jujitsu

Tax cuts were just the beginning: the President is signaling a far more radical agenda.

The president takes on an entitlement - The "Third Rail" of politics, Social Security.

Creative Accounting Only Goes So Far. Unsound transactions are going to catch up with the government - As I've always said, none of the goofy accounting done by Enron and the other big corporations can hold a candle to the absolutely insane accounting done by our rulers in government. While much of the creative accounting done by corporations falls within the wide range of what is called Generally Accepted Accounting Principles (GAAP), the ways our rulers keep books pretty much defy all financial logic.

Sunsetting Tax Cuts Would Shrink Deficit, CBO Finds - Many in government are literally licking their lips waiting for the tax cuts to drop off because of the stupid way our rulers set them up as temporary. As a reminder of what those coming tax hikes are, here is the summary I posted several months ago. I think it's obvious that if Lurch were to in some way steal the election in November, there would be no way he would sign any legislation extending the lower rates or making them permanent, as President Bush wants to do.

Ponzi schemes may be technically legal when they're run by our rulers in DC; but they're still stupid investments for our future.

The Reform Term - Social Security and the Internal Revenue Code don't need any more reforming. They need elimination.

John Kerry’s Secret Economic Plan - What isn't a secret is what a blithering idiot that guy is. I'm starting to feel that a year from now, the name Kerry will become shorthand for "incompetent buffoon" and the worst presidential election blowout in history in much the same way that the name Lewinsky has become the nickname for a different kind of blowout.

The Origin of the Income Tax - Many thanks to Andrew Roth for finding this very interesting history lesson with a lot of juicy facts from well before my time.

Understatement of the Millennium

President Bush Says Current Tax Laws Are a 'Complicated Mess' - And we know how all attempts to fix it end up.

Official 2004 California Tax Rates

The Franchise Tax Board has officially announced their income tax brackets for individuals for 2004, as adjusted for inflation. I have updated the link to this new schedule on my main website.

Next President to Face Pressure on Taxes

IRS Clarifies Portions Of Home-Sale Tax Law - What's still amazing to me is that, more than seven years after this huge change in the law for residence sales, there are so many people, including a lot of tax and real estate professionals, who think the old replacement rule is still in effect. Rarely a day goes by that I don't see or hear someone explaining that the way to avoid tax on a home sale is to buy another more expensive one. That's very scary for their clients.

What's also interesting to consider is that the tax free exclusion was set at $250,000 per person ($500,000 per heterosexual married couple) back more than seven years ago. With some of the appreciation in real estate values in places like the PRC and Las Vegas, that often isn't enough to cover the entire gains people are realizing. Unfortunately, the chances of that figure being raised, or even allowed to rise with the CPI (Consumer Price Index), are very slim. Most of the country already believes that people have to be nuts to live on the Left Coast, and there just isn't much sympathy for the fact that only half a million dollars of tax free profits every two years isn't good enough.

Creative Accounting (aka Book Cooking) Class

You may not be headed for an illustrious career in accounting if your professor uses this text.

How To Hold Business Assets

Another frequent question I receive is whether a business asset (normally buildings and vehicles) should be owned individually or in the corporate name. Here is my response to a client who asked about an office building.

There is no cut and dried answer to the best way to own business assets, personally or in a corp. There are pros and cons to each tactic.

However, from a general sense, it is more advantageous to own real estate individually and lease it to the corp. This accomplishes a number of things. It allows you to pull income out of the corp that is not subject to payroll taxes. When you sell the property, the long term capital gains rates are lower for individuals than they are for corps.

The only big advantage I can think of for owning the building in the corp name has to do with liability. If someone were to get hurt in or on the business property, having it owned by the corp would prevent any lawsuit or judgment from going against your personally owned assets.

If you are going to keep the property in your personal name, you do need to clean up the payment stream. The corp should be writing you a monthly check for rent, and you should be making the loan payments out of personal funds. For loan payments already made out of the corp account, you should categorize them in your QuickBooks as rent expense and pick up equal amounts on your personal QuickBooks as rent income.

IRA Confusion

As I've long said, there are few areas with more confusion than having to deal with the growing number of kinds of IRA accounts. This will only get worse as our rulers add more and more different flavors of specialized savings accounts to the tax code.

Valuing A Business

Besides tax questions, the most common inquiries I receive have to do with how to appraise the value of a small business, either for possible purchase or sale. The actual details of how to do this are too much to include here. However, this is how I answered a client's recent question about possibly buying an existing business.

Business valuations are very tricky because the values can have a wide range. Basically, the low end is the distress sale value; what you could get if you held an auction for the hard assets with very short notice.

The high side of a business valuation is capitalized earnings. You look at the expected net profit without deducting anything for interest, depreciation, income tax, or owner compensation. You then divide the annual expected net income by the rate of return you want to earn. For example, if you want to earn 20%, you would divide the net of (using your figure) $150,000 by 0.20. This gives a value of $750,000. The higher the capitalization rate you use, the lower the valuation and vice versa (lower rate = higher valuation).

So, we end up with a very wide range of acceptable values for the business. Your goal, as well as the seller's, is to come to an agreement somewhere in between.

I'm sorry I can't be more definitive; but that just isn't possible with a business purchase.

I'd be glad to discuss the various options in more detail if you want.

This reminds me of the controversies around business values during the dot-com stock bubble of the 1990s. I wrote several articles decrying how insane and unjustifiable the prices were, and I was severely criticized by some financial pros who claimed that old valuation methods were obsolete for the new modern era. I stuck to my guns and was obviously proven right.

If a company has no hard assets or profits, the only reason to pay anything for its stock is based on pure speculation, or what is often called the "greater fool theory." The only way you can ever expect to recoup your investment is if someone more ignorant than you are can be found to buy the stock from you. The entire run-up in the dot-com stocks was based on that premise and as was inevitable, the supply of fools eventually ran out.

Unfortunately, we are destined to see this exact behavior again, as the collective memory of the public is so short and the ability to learn from past mistakes is very limited.

Federal Court Bars Tennessee Man From Promoting Home-Business Tax Scam - I don't recall hearing about Dan Gleason before this; but it sounds as if he and his company have been a little over aggressive in regard to tax deductions for their clients.

What Middle Class Squeeze?

Debate on small government gets swept under the rug

GOP Hopes For More Tax Cuts, 'Ownership' In 2nd Bush Term

A Poor Critique: Personal Retirement Accounts and Transition Costs

The Miracle Economy

$9 Trillion Didn't End Poverty -- What to Do? - Of course, the DemonRats' answer to everything is to throw more money on it, even when it's a proven failure.

John Kerry Will Raise Taxes

Kerry Will Massively Increase Spending

Snow Says Bush Tax Reform Will Be `Bold,' Nothing Ruled Out

Playing With The Numbers - Lying about the economy is as commonplace for John sKerry as is lying about his military records.

Income Gapology 101 - One of the most insidious beliefs held by many in our society is that it's wrong for any person to have even one dollar more than anyone else; and until every person has the exact same amount of wealth, it is important for the government to continue its redistribution programs by taking from those who have more and giving to those who have less.

The coming fiscal civil war - The Social Security house of cards can't survive much longer.

Store Clerk Accepts Fake $200 Bill, Makes Change - As if there is any doubt that the dumbing down of the American populace is proceeding.

The supply-side Governator nailed it

'Human piggy bank' spills all in Thailand - Even if you don't trust banks, there are plenty of safer ways to protect one's money than by swallowing it.

The Real Debt - Whether or not the Federal Debt is at dangerously high levels is frequently debated, depending on the objective of the arguer. Besides being subjective in terms of size and percentage of the overall economy, the issue of its cause is also frequently debated. While the Left insists on blaming any deficits on too little revenue, caused by tax cuts, the better case can be made for too much spending being the direct link to the red ink.

Bloomberg Tarnishes GOP Tax-Cutting Image - It was obvious from the beginning that he is a classic RINO (Republican In Name Only.

Millions won't make you happier

The Richer Are Getting Poorer

The power of the rich

New tax increases to take effect in Virginia

Your checkbook just became obsolete - I just noticed the "Check 21" changes in how banks can process checks as of October 28 in an ad I received for the new 2005 version of the VersaCheck program I have long been using to print checks.

Sharing Data Over the Web - Includes an interview with me a few months ago on how I use the Xdrive service.