Tax Guru-Ker$tetter Letter

Friday, October 31, 2003

Don't do it Arnold!

Could Fire Cause Schwarzenegger to Void No Tax Hike Pledge?

Gov.-elect may consider tax hike to pay fire costs

Gov.-Elect Urged to Keep Car Tax Hike

End of the Free Ride on 'Net Taxes?

Another Bailout for the States? Wouldn’t be prudent

IRA Withdrawal Wisdom

Why Democrats are wrong on taxes

Maybe tax cuts do work

Time For An Apology From Tax Cut Critics

Economy puts on a surge. Fastest leap in 19 years tied to Bush tax cuts - The worst fears of the DemonRats, and their number one reason for opposing the tax cuts, are coming true.

IRS HALLOWEEN

The door bell, rings, and a man answers it.

Here stands this plain but well dressed kid, saying, "Trick or Treat!"

The man asks the kids what he's dressed up like for Halloween.

The kid says, "I'm an IRS agent."

Then he takes 28% of the man's candy, leaves, and doesn't say Thank You.

Wednesday, October 29, 2003

Bill would drop excise charge on clunkers - Interesting potential tax break for Massachusetts owners of vehicles worth less than $5,000.

Property taxes leap in Mass. as state aid falls

Fake $20s Showing Up In Massachusetts - So much for the theory that the new colored note would discourage counterfeiters.

Tax plan may beget Net effect. Congress ponders ways to collect online sales levy

Tax Laws Protect Illegal Workers - IRS and our rulers in DC care more about the tax money from illegals than in enforcing immigration laws. Terror cells with illegal aliens are free to operate around the country as long as they keep sending their payroll taxes to IRS. There's definitely something wrong with that picture.

Battle Brews Over Expiration of Internet Tax Moratorium - Mark Belling, substituting for Rush Limbaugh today, spent an impressive amount of time discussing what a nightmare it will be if the ban on Internet taxation isn't renewed in a few days. He mentioned how the long running urban myth of a five cents per email tax could very easily become a reality if our rulers in DC don't get with it and make the ban permanent.

Some machines turn up noses at new $20 bill

The DemonRats' tax cut gamble

Oakland cell phone users may get tax hike - Maybe those people should change their ring tones to George Harrison's "TaxMan" song so they can be reminded that they will be paying an extra 7.5% to Jerry Brown's city government on each call.

Tuesday, October 28, 2003

Americans for Tax Reform pushes for last minute vote to save Internet tax moratorium

Simplify tax system. Complex tax code, not individuals, needs to be targeted.

Raising taxes - Bruce Bartlett thinks the trend of Bush tax cuts has bottomed out and that tax increases will be coming soon from the Bush team.

Support Making the Internet Tax Moratorium Permanent!

Keeping Priorities Straight

I just received announcements from IRS and the California Franchise Tax Board that they are giving the victims of the fires in Southern California a break from any tax notices and filing requirements. As I always tell clients who are having personal crises, tax matters should be very very low on the list of things they worry about. For people who have lost everything in the fires, I doubt that the two week reprieve FTB is giving will be anywhere close to enough time to get back to even caring about taxes. It will also be tough for IRS and FTB to send notices to homes that no longer exist.

IRS Announcement

FTB Announcement

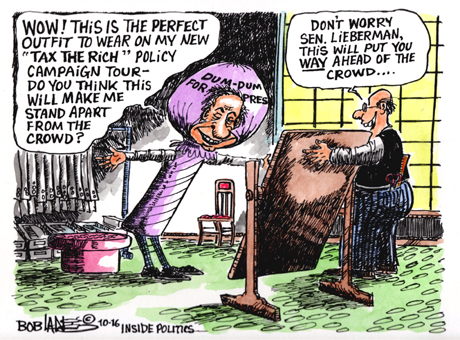

Lieberman's Secret Tax Hike - As if we need another example of how the JackAss Party has gone over the cliff of insanity. Lieberman's the most conservative of the DemonRats and he sounds like a rabid Marxist in his calls to persecute the evil rich.

Mike To Biz: Drop Dead - The RINO mayor of NYC hasn't finished his financial rape of businesses.

Tax issue angers parents - What nerve! Parents who receive special tax breaks have to prove their qualification for those breaks.

Monday, October 27, 2003

California's 'circus' hurts recall efforts n Nevada - I thought everybody loves circuses. Heck, Las Vegas is just a big circus for adults.

GOP Puts Stock In 'Investor Class'

Tax-Cut Plan to Aid Ailing Industries

DNC fat cats: Taxpayers pick up tab for Dem honchos' $alaries - Isn't America great? There are so many opportunities to feed from the taxpayers' trough.

Gov.-elect Arnold committed to avoiding tax hikes - As I mentioned during the campaign, Arnold's hesitation to sign the "No Tax" pledge because of the possibility of a huge disaster, was bogus. Even the lame duck governor didn't call for new taxes today during discussions of the fire storm in SoCal. He acknowledged that costs for dealing with something that large are going to be picked up by the Federal taxpayers via FEMA.

Schwarzenegger's adviser hits the books - I don't envy her that task. The only thing worse would be trying to decipher the Federal government's accounting.

Ohioans may revolt against higher taxes and spending. - More on the efforts in Ohio to slap down the governor's recent tax hike.

Tax Troubles: How Did We Get In This Fix? - There are a number of tax reform options on the table for the voters in Maine. There is a lot of coverage of the various issues at the Portland Press Herald's website.

Senate to ponder permanent Net access tax ban - This debate seems to be going on forever. Obviously the states hate the idea of the Feds telling them what they can and can't tax.

QuickBooks 2004

I find it amusing every year when people, including professional accountants, wonder if there will be a new version of QuickBooks each year. The answer is "duh." Does General Motors ever skip a year when remodeling their cars? Neither does Intuit for Quicken or QuickBooks A new version is released every year.

The changes from year to year aren't usually that dramatic; so not everyone needs to buy the new version each year. However, it is a wise move to upgrade every two or three years. That's when you will notice the big improvements over the version you had been using. Intuit has its own way of encouraging users to upgrade their software. They orphan any version more than three years old, not providing any more support for them.

The variety of different versions of QuickBooks available with the 2004 upgrade gets even more confusing than ever. However, for at least 95% of the people we have been working with, the least expensive Basic version is just fine. Very few people need the functions available in the more expensive versions. I haven't ever used many of them, and I spend a lot of time doing a lot of things with QuickBooks. Anyone considering upgrading from an older version of QuickBooks or buying it for the first time should hold off for a few more weeks. It doesn't make much sense to buy the 2003 version now, when the 2004 version will be available on November 10.

Sunday, October 26, 2003

Saturday, October 25, 2003

Keep your own wits about you when investing.

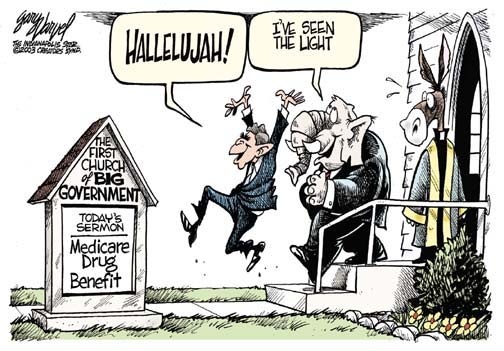

Medicare Using Blimp in Ad Campaign

Uncle Sam Spends $32 Million to Promote New Currency - It's always struck me as odd when monopolies waste money advertising their products and services (i.e. utiltities, Post Office, etc). It's not as if there are other types of currency we could be using than the bills produced by our government. They have a term for alternatives - counterfeiting.

Taxes and hard work - A familiar theme that bears repeating as often as possible, to counteract the lies told by the Left. Lower tax rates motivate people to work more and higher rates make them work less.

Why The National Debt Matters To You

Americans Stake Claims in a Baja Land Rush - There's nothing wrong with this, especially as the PRC is swallowed up by Mexico. One thing to remember - property in Mexico (or any other country) is not considered to be suitable like-kind as an eligible replacement for USA real estate under Section 1031. This means that investors who want to sell off USA real estate and reinvest into Mexican property will have an additional expense; the capital gains taxes that could be avoided by replacing with USA property.

Abusive shelters targeted by IRS

Calendar Showcases Accountants' Inner Wild Child - You can see more about this calendar from the Louisiana Society of CPAs on their website.

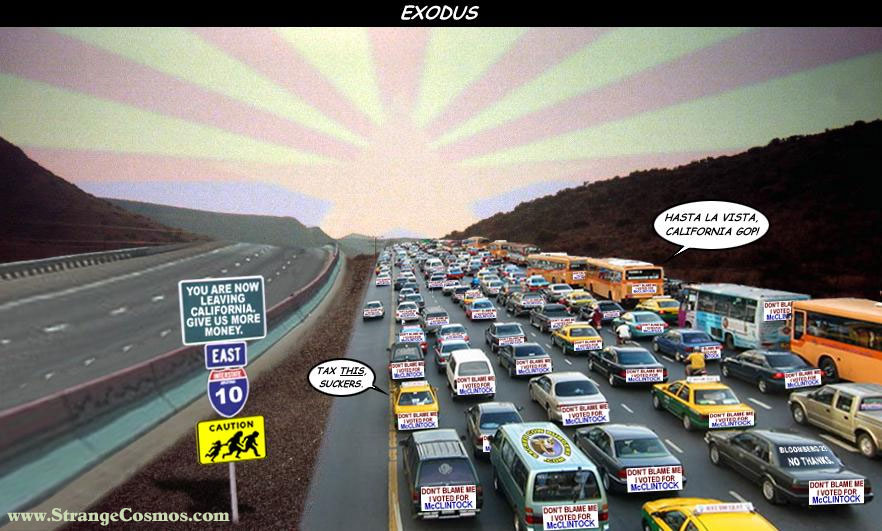

States Try to Poach California Businesses - That shouldn't be very difficult. The whole recall circus was a huge commercial for Anywhere But California to operate a business.

Labels: 1031

Friday, October 24, 2003

The Senate voted itself a pay raise for the fifth straight year - For the excellent job they've been doing running our country - not!

Motorcyclists blows $7,000 to winds - We all have our own ways of blowing our money. This guy just let his blow out of his pocket as he was driving down the freeway.

Vehicle sales plunge 35%. Tripling of state's registration fee blamed - In spite of what our rulers claim, taxes do directly influence behavior. The ruling elite think they can just arbitrarily jack up the taxes and fees and everyone will just gladly pay them. As always happens, the actual results of tax hikes are completely different from the stated goals. Davis' tripling of car registration fees has now deprived the state, counties, and cities of the huge sales tax dollars they would have received from new car sales, as well as the state income tax on the car dealers' profits. Someone should kick such an incompetent and ridiculously stupid governor out of office for compounding the state's fiscal problems. Oh yeah, they did. Of course, he still has over a month to do everything is his power to screw things up even more. I know it's too much to ask for; but it would be awesome to see Arnold play the part of a club bouncer and physically pick old Gray up and toss him out on his butt before he can do any more damage.

AmeriDebt To Layoff Most Of Their Workers - The scam's up for one of the credit counseling fronts for the credit card companies.

Another Look at Retirement Savings

Implementing car tax cut would take 3 months. Time needed to make change, DMV warns - As always, our rulers have set things up so that it's much easier to increase taxes than to reduce them.

46 tax ideas include hikes, cuts for Arizonans. Proposed reforms will affect nearly everyone- The Tax Game is the extreme example of trying to do things while the targets are constantly moving, at all levels of government.

Wednesday, October 22, 2003

Stars not feeling charitable toward fund-raiser - Ah, the benefits of great wealth. Big celebrities are just too busy to check out the people they give their money to; so they end up being ripped off.

Can the Dems Win on Taxes? - Unfortunately, hating the rich (defined as anyone with more than anyone else) is a very popular theme in this country. They're as unpopular in our society as smokers, and thus easy targets. There is also no shortage of politicians willing to exploit this hatred.

What Alabama's Low-Tax Mania Can Teach the Rest of the Country

Social Security: Where Do the Candidates Stand? - Anyone who is holding his breath waiting for any of our rulers to repair a system as structurally flawed as SS is a fool. There are plenty of very easy legal methods available, especially for the self employed, to avoid having to pour the thousands of dollars down the SS toilet that most people do. The sooner a person starts holding onto that money for himself, the larger the amount of wealth can be saved for future years.

Boomers Unprepared For Retirement - Defining exactly what constitutes being prepared for retirement is as subjective as the defnintions of poverty in this country. Most such studies base their conclusions on the amount of cash in an official retirement account (pension or IRA). I've even had clients tell me they are all worried because they don't have any such cash accounts. I have to explain to them that their multiple business and real estate investments will be more than adequate to provide for their retirement years. I've seen it hundreds of times with real life people. They buy around one rental or investment property each year until they are about 60 or 65. They then sell off a property each year and carry back most of the sales price. The monthly payments they receive from those carryback notes are far and away much larger than anything they receive from the SSA. The notes are also tangible assets that can be sold for lump sums if needed. They can also be left to their heirs, something that is not possible with the Social Security Ponzi scheme.

Plan seeks to double Illinois state income tax on wealthy - And they expect those people to just sit back and let their bank accounts be drained by the tax vampires in Springfield. There are already some town here in Northern Arkansas that are referred to as "Little Chicago" due to all of the immigrants from Illinois. This kind of attack on the rich will just motivate more refugees.

Estate Debate. Taking the wealth of rich men is neither moral nor efficient. - Amen to that.

Tuesday, October 21, 2003

Senators to Probe Stories of Tax Shelter - There are plenty of very legal ways to minimize taxes. Many of the schemes cooked up and marketed by some of the big CPA firms were outright scams that wouldn't even pass my smell test.

Phantom Tax Bills Finally Stop - The stupidity isn't only with the county that was charging taxes on nonexistent property. It was also with the people who paid that bill for years. Think about it. What is the penalty for not paying property taxes? The property is sold at auction by the county. Let them try that with the imaginary property. They would have to find someone with even less intelligence to bid on non-existent real estate.

Monday, October 20, 2003

Backwards Thinking

Government makes up for lost revenue by borrowing - Typical leftist lies from the New York Slimes' official Marxist economist on how the deficits are caused by the tax cuts and not by reckless out of control spending. If his idiotic advice to roll back the Bush tax cuts were to be implemented, it would compound the deficit problem by really reducing revenues.

A fact of life that the lefties refuse to acknowledge is that lower tax rates increase incentives for people to earn taxable income, resulting in higher dollars being sent to our rulers in DC. Higher tax rates create very real disincentives to show taxable income, resulting in fewer dollars for DC. A lie doesn't become true just by continuing to say it. The Left's persistence in trying to link tax rate cuts with budget deficits just shows how incapable they are of telling the truth about anything.

Section 179 Confusion

The Section 179 expensing election really isn't that complicated; but it still confuses people, especially those who want to save a few bucks and try to navigate the perilous waters of the tax system on their own, as in this recent email exchange.

Question Received:

Last year I purchased a truck and tractor for my business. I used Section 179 deduction on the truck ($35k) assuming I would use the deduction on the tractor this coming year. But I am reading that these deductions only apply to purchases on that year. Can I still use section 179 on the tractor that I purchased last year?

My Reply:

The Section 179 expensing election has always been available only for assets purchased and placed into service during the tax year in question. It has never been available for assets acquired in a previous year.

What many people do is stagger their asset purchases by year, so as to be able to expense each asset. For example, if you had purchased the tractor in one year and the truck in the next year, you could claim the Sec. 179 for each.

Another common strategy is to buy one of the assets in your personal name so you can Sec. 179 it on your 1040; and buy the other one through a C corp, so it can expense it on its 1120. That's how I often advise clients who want to buy more than the year's Sec. 179 maximum in one year.

Not to sound too self-serving, but this is a very basic concept that wouldn't have been a surprise if you had consulted with a tax pro before you bought those things. The money you would have spent for knowledgeable advice would have been more than offset by tax savings from structuring things appropriately.

Good luck.

Kerry Kerstetter

Labels: 179

Sunday, October 19, 2003

A tax revolt hits Buckeye State Republicans - This is a free non-subscriber link to the Wall Street Journal article I linked to earlier.

The Tax-Cut Expansion - This is why the DemonRats were so forcefully opposed to the cuts. Their only hope of success in the November 2004 elections is to continue their sabotaging of the economy. They love and do everything they can to perpetuate misery wherever possible.

Social Security to Increase Benefits - Recipients will be getting 2.1 percent more next year. As a continuation of the Ponzi M.O., the official eligibility age for starting to draw benefits will increase by two months, to 65 + 4 months of age.

Let 50 Recalls Bloom - Let's see how the PRC's plays out in terms of actual results before jumping to the conclusion that using recalls is more effective than just running good candidates during the normally scheduled elections.

News From The Left Coast

Budget auditor may target social services - This is a good sign; that the new regime in Sacramento is planning to address the spending side of the equation rather than doing what DemonRats instinctively do, and just raise taxes.

Why Arnold is unlikely to raise taxes and spending

Even Democrats are seeing the light about repealing the tripling of the car tax.

Get ready for higher fines, fees in state in '04

Gov.-Elect May Seek a Cap on Spending

Huffington mired in campaign debt - Not that she's asked for any advice from me; but if I were her tax consultant, I would recommend deducting all of her out of pocket campaign costs as promotional expenses since her only purpose was to generate future income from writing and speaking.

Saturday, October 18, 2003

Friday, October 17, 2003

Stumbling on Tax Reform. Why Don't Democrat Leaders See the Obvious Need for Reform of the Tax Code? - We need to be careful of the language. The DemonRats do want to re-form the tax system, so as to soak the evil rich even more than they already do. Reform doesn't mean improve or make fairer. It just means change the current form, which is what the Dems always want to do because the rates can never be high enough to suit them.

ACU Continues to Stand in Way of Tobacco Tax Hike on Consumers - It will be a tough fight because nicotine addicts are extremely popular targets of taxers, as well as the most dreaded of pariahs in almost every part of our society nowadays.

Thursday, October 16, 2003

Car-tax detour confronts gov.-elect - Arnold is discovering the double standard of

taxation. It is very easy for our rulers to raise taxes; yet it's much more difficult to lower them. This is by no means an accidental arrangement by our rulers.

Some timely quotes from The Quotations Page

"Politics is the art of looking for trouble, finding it whether it exists or not, diagnosing it incorrectly, and applying the wrong remedy."

-- Ernest Benn

"Money frees you from doing things you dislike. Since I dislike doing nearly everything, money is handy."

-- Groucho Marx

The Deficit’s Falling - Another example of why I've always said that projected Federal budget figures are nothing more than WAGs (wild ass guesses) and not to be trusted as anywhere close to accurate predictions of reality. Anyone who cites these numbers as legitimate is either an idiot, a liar, or both.

Fighting Back In Ohio

One of my underlying beliefs has always been that just complaining about things isn't as productive as doing something about them. Everyone likes to complain about taxes, but few want to make the effort to do something about keeping the lid on them. This is why I have always made a strong point about taxes being the symptoms of other problems, namely irresponsible people in positions of high power in our various levels of government. People who claim that discussions of politics have no place in tax news are too short sighted to themselves be trusted for any real tax advice.

In this spirit, I do feel good when I hear news of people fighting back against the ruling elite who have no qualms about shoving ever higher tax bills down the throats of their subjects. Some Ohio taxpayers have reached their breaking point when their RINO governor broke a promise to not raise taxes without a vote and unilaterally increased the state sales tax by 20%. The anti tax forces have an ally in high places, Ohio's Secretary of State, Ken Blackwell, who the Wall Street Journal refers to as Arnold of Ohio

Tax-and-spend Republicans are strangling Ohio

Citizens for Tax Repeal - The group circulating the petition to repeal the sales tax increase.

Ohio Taxpayers Association - A watchdog group over State taxation abuses.

Wednesday, October 15, 2003

2004 IRS Mileage Rates

IRS has gotten faster in releasing its standard mileage rates. They just announced what they will be for 2004. Employers and others who base their company rates on the IRS's have plenty of time to set things up for next year.

The optional standard mileage rate for business use of an automobile (including vans, pickups and panel trucks) in 2004 will increase to 37.5 cents a mile from the 36 cents this year. You can also use this rate to calculate business-travel deductions instead of figuring out your actual costs.

As I've mentioned several times before, IRS bean counters long ago discovered that vehicles use less fuel and depreciate less when driven for charitable or medical purposes, as well as when you are moving your residence. Their official standard rate for using an auto for medical reasons, or for calculating deductible moving expenses, will increase to 14 cents a mile next year from 12 cents this year.

However, the standard rate will remain at 14 cents a mile when using your vehicle on behalf of charitable organizations. This is another example of the fact that, while deductions for charitable deductions are useful, those costs can generally save you twice as much in taxes if they can be deducted on your business schedule.

I haven't yet seen one of these new bills in person. However, the theme of the comments on its new look is interesting. It makes me wonder - Who would be designing the currency of the PRC if it were to do what many people want and secede from the union and become the Left Coast version of Cuba?

Not-for-Profit Credit Counselors Are Targets of an IRS Inquiry - Many people who are already in poor financial shape fall for these credit counseling scams. Many of them are nothing more than fronts for the credit card companies trying to prevent people from discharging their debts through bankruptcy, while many others are outright frauds; receiving payments from their "clients" (aka suckers) and skipping town without forwarding any of that money to the creditors. Here is the IRS's official news release on credit counseling agencies.

Tuesday, October 14, 2003

Same Old Class War Game Plan

Gephardt's high-tax agenda

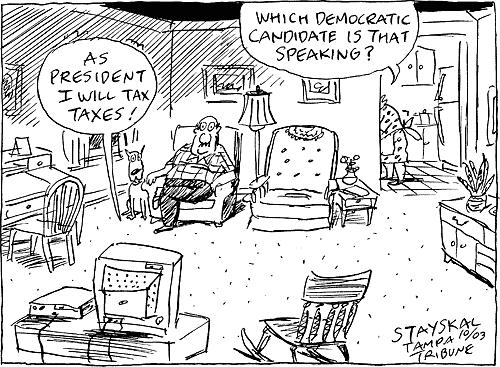

Democrats disagree over handling taxes - The only disagreement is over how high to raise them.

Lieberman proposes raising taxes on wealthy

Soak the rich is Lieberman's new tax tack

Citing Fairness, Lieberman Proposes Tax-Rate Changes - He sure has a twisted interpretation of what is fair. It's not enough that the top 50% of wage earners pay 96.03% of all income taxes. He wants to make the evil rich pay even more. What is the donkey equivalent of mad cow disease to explain how someone could think such reasoning makes any sense whatsoever ?

Lieberman's Wallet Politics

Lieberman Proposes Tax Hikes on Wealthy

The DemonRats, who are obviously too wimpy and chicken livered to ever be entrusted with the physical security of this country, are also not even close to being mature enough to be in control of our economic security. The old soak the evil rich class warfare has come out in full force from the presidential wannabes. Little Dick Gephardt has always been openly socialist with his standard mantra that anyone who has anything did so by "winning life's lottery." However, when the person widely considered to be the most conservative of the JackAss Party takes to calling for even more persecution of the rich (defined as anyone having any more than anyone else), you know it's time for them to retire the good old donkey as their mascot and just use the hammer and sickle that formerly symbolized the USSR.

The Double Benefit of Tax Cuts. They restrain government growth and promote investment. - Which is why the DemonRats oppose any cuts and are working overtime to rescind the ones that were recently enacted.

Isn't It Rich, Being Rich? - Excellent reply to the class warfare talk by Neil Cavuto.

My new computer is slowly growing in capability as I install and transfer many of the hundreds of programs I use from my crippled computer. With FrontPage finally working for me, I am once again able to work on my main website.

I posted an article I wrote a month ago on how to handle loan origination costs on tax returns.

I've also strengthened the warning not to send us anything via Airborne Express. That company does not deliver to our area.

Monday, October 13, 2003

Schwarzenegger's policy compass is clear - and conservative - Larry Kudlow is optimistic that Arnold is more than just a RINO. Let's hope that turns out to be true, in spite of the influence of the Kennedy Klan on his policies.

Remind me again which political party is in favor of lower government spending. There is only one such party that I know of.

Sunday, October 12, 2003

In spite of the removal of the incompetent and terminally corrupt governor, the chances of the PRC ever arresting the slide into more and more socialism are extremely slim; especially with a RINO in the top GOP position. New York City is a perfect example of that, with Nurse Bloomberg raising taxes and removing personal freedoms more than even any DemonRat would dare attempt.

Governor taxinator? - Let's hope not. You can already sense the efforts to push Arnold in the direction of raising taxes, as if that is the only choice. Those efforts are for a couple of reasons by the Left. They obviously love high taxes; but they also want to discredit and smear the GOP by making Arnold break one of his key campaign promises - not to raise taxes unless after a humongous natural disaster. Although some may disagree with this, I don't think Arnold was referring to the damage Gray Davis has done to the PRC. That was anything but natural.

Davis may sign hundreds of bills - His last chance to use taxpayer money to pay off his campaign contributors.

Friday, October 10, 2003

A sinking ship, with the departing governor drilling holes in the bottom, would also be an appropriate analogy for what Arnold is getting himself into.

Thursday, October 09, 2003

A Wake-Up Call To Our Rulers

It was great to see Gray-Out Doofus kicked out of office and Arnold survive the smear campaign. I'm hoping this is a long overdue slap in the face for arrogant career politicians who take their omnipotent powers to run our lives for granted. The clip on Fox News yesterday of Nancy Pelosi moaning about how terrible it is that elected officials should have to worry about what their constituents think is a perfect example of the royal mentality of the ruling elite.

The recall campaign was very entertaining and just the right length, unlike the current two-year long run for the presidency. The blatant hypocrisy of the DemonRats when it comes to inappropriate touching of women, in the light of what Bill Clinton has been allowed to get away with, has been something like an old Saturday Night Live sketch.

Obviously, the U.S Constitution prevents Arnold from ever becoming President. I don't see any need to amend the Constitution to change that rule. We have well over 300 million people in this country. To claim that any one person is the only one capable of serving as president is ridiculous. The only reason we would need to amend the rule to allow foreign born persons to occupy the White House would be if every US born person over 35 were to all of a sudden drop dead and we had nobody to fill that office. There are plenty of high offices that foreign born people can hold if they want.

My guess is that Arnold will be like some other actors (i.e. Fred Thompson of Tennessee) and serve a few terms in public office and then go back to show biz. That's actually what our founding fathers wanted for our elected officials; a high turnover of people from all professions who serve for a little while and then go back to normal lives, letting others have a chance. The monopolization of power by career politicians like Gray Davis and Bill Clinton has led to the problems we now have with the over-reaching government control of our lives.

Wednesday, October 08, 2003

NYC Budget Monsters

Oregon Anti-tax campaign alleges harassment

Seeing Greenpeace. The IRS may board the Rainbow Warrior.

- Maybe eco-terrorists shouldn't receive the same tax free benefits as real charities have.

Tuesday, October 07, 2003

The California Stakes. See what happens when you put liberals in charge?

Sending a Message. It's not a waste to vote for Bustamante or McClintock.

Monday, October 06, 2003

Guess who's to blame for state budget problems?

Class warriors are playing politics with poverty numbers - What else is new?

The whole notion of poverty is extremely subjective.

- A repeated posting; but now with links to the actual studies.

New governor can't just toss car-tax hike - Typical double standard by our rulers. It's insanely easy to raise taxes, while almost impossible to lower them.

The Real Patriot Act - This moron wants to instigate a dollar per gallon of gas "Patriot Tax" as a way of supposedly making OPEC pay for the rebuilding of Iraq. That is so stupid it barely deserves a response. Consumers pay the taxes; not the producers. Donald Luskin also considers such a proposal to be lunacy bordering on incompetency.

Targeted tax cash is spent elsewhere. Governments often dip into special funds despite ballot pitches. - Tax hikes are always sold as being "for the children" yet end up being used for all the same standard boondoggles. It's too bad our rulers are never held accountable for violating their stated uses for new tax revenues.

Employers expected to fight new worker health insurance law - Gray-Out Doofus is determined to do as much damage as possible to the PRC in his final days in office. Sticking employers with an additional expense of $14.2 billion is a classic parting gift from the soon to be ex governor. If you didn't know that he's just an incompetent boob, you could make a good case for his being on the payroll of other states looking to lure in employers.

Middle Class Tax Bill Shocker

- More victims of the evil AMT. Our rulers are continuing to keep their heads in the sand when it comes to doing anything about this insane tax.

Sunday, October 05, 2003

Spendaholics

It's good to see others recognizing how out of control spending is by our rulers of both parties in DC. Unfortunately, the ruling class couldn't care less what conservatives and supporters of the Constitution think. They are going overboard trying to buy votes. The fact that the level of education on exactly what the government is allowed to do under the Constitution gets worse every day doesn't help our cause. That subject matter has been removed from the curriculum of the government schools just for this reason; so our rulers can continue to tax, spend and meddle in parts of our lives that a constitutionally aware populace would be less willing to tolerate.

Self-inflicted wounds

Bush's socialist sympathies

Friday, October 03, 2003

Drunken Sailors In Charge

Our rulers in DC are drunk on their power to spend without limit in their efforts to buy votes. Their utter and complete disregard for the limitations on such over-reaching of their power as described in the Constitution should be grounds for impeachment and removal, if anyone cared about the Constitution any more. Neither Bush nor the Congress seem to remember it even exists.

Passing the Buck on Spending

Marching toward fiscal Armageddon

Thursday, October 02, 2003

The tax-and-spend 10 - Jack Kemp's more descriptive name for the DemonRat wannabes than the more widely used "ten dwarves." Whatever we call them, there isn't a snowball's chance in Hades that any of them can be elected President.

Another P for Your Pod - I had always understood James Glassman to be rather intelligent in matters of finance. You wouldn't know it from this article, where he claims that a company's sales figures are more important than its net profit. He mentions how easy it is for corporate accountants to manipulate numbers, yet fails to realize that inflating sales is a whole lot easier to do than inflating the bottom line. What investors really need to see when evaluating a company's profitability is what is reported to IRS.

Accountants, Regulators Knock Heads Over Audit Workpaper Rules

What is poor? - As with practically all government statistics, the definition of poverty is extremely subjective, depending on the objectives of the users of those stats. It reminds me of the debate over what constitutes a millionaire. Is it someone who earns a million dollars in a year? If so, is it based on gross income, or net after expenses and taxes? Is a millionaire someone with a net worth over a million dollars? Since most people, especially in the PRC, have a huge chunk of their net worth tied up in their homes (a relatively illiquid asset), shouldn't a true millionaire be someone who can lay his/her hands on a million bucks with a moment's notice?

Tax cuts are good for you! - Well, duh!

Property sales out of this world - P.T. Barnum's legacy lives on. Suckers have paid this guy over six million dollars for worthless deeds to acreage on the moon. It's like the Pet Rock fad all over again.

The Cost of California’s Health Insurance Act of 2003 - Forcing employers to spend more than $11 billion more each year is just going to give them more incentive to move to more tax friendly states. As I was saying last week in the discussion of which states have the highest taxes, just looking at the direct taxes doesn't tell the whole story. The costs of regulations and government mandates can increase the effective total expense due to government to much higher levels than any nominal tax rate.

Postings are sparse this week due to computer & network meltdowns here at the ranch. Many of our crucial programs are refusing to work until we do a complete reformat and reinstall of Windows. A new computer is on order and I'm hoping to have it by this weekend. Needless to say, these problems have put me even further behind on the tax returns I am trying to finish by October 15. There will have to be more extensions filed (to December 15) than I had planned on.

Wednesday, October 01, 2003

Judge Orders Ohio Accountant Barred From Preparing

Federal Tax Returns and Representing Clients Before the IRS - It's not just amateur self proclaimed tax experts, like Irwin Schiff, who are stupid enough to fall for the idiotic tax protestor arguments.