2009 Tax Rates

Q:

Subject: 2009 Tax Rates

Dear Mr. Kerstetter,

The 2009 Income Tax Rates for Married Filing Jointly on your web-site link are not consistent with the rates published in the IRS Publication 15 Circular E for 2009.

Is this due to publication date differences? Which is the correct 2009 tax rates?

Thanks.

A:

You have me a little confused. I downloaded the new Pub 15 that you linked to and I don't see an income tax rate schedule that is comparable to the one I posted on my website. There are withholding tables, which are calculated slightly differently than the actual tax calculation schedules. If you were trying to equate the two, that's not really possible.

The figures on my schedule do match exactly with the IRS's official release of the inflation adjustments for 2009, Revenue Procedure 2008-66.

Here is a copy and paste from Page 6 of that pdf file:I also double checked with the update from The TaxBook.It is pasted below:I hope this helps.

If you can let me know where in Pub 15 you are trying to match the rates to, I can better understand your confusion.

Kerry Kerstetter

Mr. Kerstetter,

Thank you for the explanation. It clarified my confusion.

Labels: TaxRates

States set to impose bevy of new taxes - and the State rulers will be shocked when more and more people take steps to avoid paying all of the new taxes, including physically leaving the high tax states.

Labels: StateTaxes

Tax Day e-Cards

This company has cards for just about every holiday you can think of, including Tax Day.

My favorite:

Labels: humor

IRS Interest Rates Drop for the First Quarter of 2009

The main IRS interest rate will be 5.0% for at least the first three months of 2009.

Labels: IRS

Vehicles exempt from luxury car rules...

We frequently discuss the 6,000 pound exemption from the luxury car depreciation limits that have been around since 1984.

There has recently been some confusion regarding whether the vehicle needs to be constructed on a truck chassis to qualify for the exemption. According to this analysis from CCH, that distinction regarding the chassis may have been removed by IRS.

The IRS announced the applicable 2008 luxury car depreciation caps in Rev. Proc. 2008-22, I.R.B. 2008-12, 658. For the first time since the release of Rev. Proc. 2003-75, the language indicating that an SUV should be considered to be a truck if it was built on a truck chassis was omitted.

In an informal response to a CCH inquiry, the IRS indicated that the language in Rev. Proc. 2003-75 (and the subsequent annual depreciation cap update) was only intended to represent a safe harbor that taxpayers could use to determine whether an SUV qualifies for the higher depreciation caps that apply to trucks and vans with a GVWR of 6000 pounds or less. The IRS either has or will eliminate language in its publications and form instructions that equate an SUV to a truck if it is built on a truck chassis.

Since I have noticed that CCH news stories have a tendency to disappear from their website after a few weeks, I made a PDF copy of this one that you can download.

Labels: Vehicles

New tax prep tool?

For those folks who work on taxes by hand, Neal Boortz believes this special "Spread the Wealth" pencil sharpener would be appropriate.

When you're ready to send your tax return off to IRS, how about sticking it into this mailbox?

Outdated tax advisor?

Q:

Subject: Lifetime exclusion for gift taxes?

Dear Tax Guru,

On your website you say that the lifetime exclusion for gift taxes is 1 million dollars. My tax accountant in California says that the IRS publications say that it is 1 million dollars for estate taxes but $385,000 for gift taxes.

Can you enlighten me on this matter.

Thank you,

A:

Your accountant is obviously using reference materials that are seriously out of date. That is very scary in the ever changing world of taxes to think that a tax guide from at least five years ago is still relevant today.

You can see the exemption amounts on my website.

You can also download the IRS's forms and instructions from the IRS website.

Good luck.

Kerry Kerstetter

Follow-Up:

Dear Mr Kerstetter,

Thank you very much for responding to my e-mail.

Sincerely,

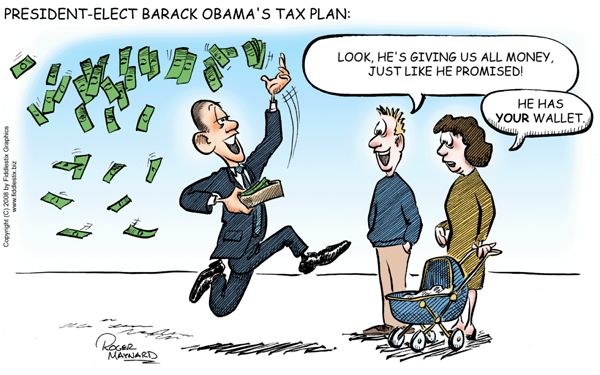

Obambi and Joe the Plumber

I don’t know how I had missed the following joke during the election season, but I’m grateful to one of the Gear Up tax seminar speakers yesterday for sharing it with the class. I actually found this via a Google search.

Barack Obama discovers a leak under his sink and calls Joe the plumber to come and fix it.

Joe drives to Obama’s house, which is in a very nice neighborhood where it’s clear that all the residents make more than $250,000 per year (or $200,000 per year or $150,000 per year, depending on who’s speaking and when).

Joe arrives and takes his tools into the house. He’s shown the room that contains the leaky pipe under the sink. Joe figures it’s an easy job that will take less than ten minutes. Obama is standing near the door and asks Joe how much it will cost.

Joe immediately says, “$9,500.”

“$9,500?” Obama replies stunned. “But you said it’s an easy job!”

“Yeah, but what I do is charge a lot more to my clients who make more than $250,000 per year so I can fix the plumbing of everybody who makes less than that for free,” responds Joe.

Obama tells Joe there’s no way he’s paying that much, so Joe leaves.

A week later the leak gets so bad that the Obamas have had to put a bucket under the sink, and it fills up every two hours, so they call Joe back. Joe goes back to the Obamas’, looks at the leaky pipe, and says, “It’ll cost you about $21,000.”

Obama exclaims, “A few days ago you told me it would cost only $9,500!”

Joe explains, “Well, a lot of rich people are learning how to fix their own plumbing, so there are fewer of you paying for all the free plumbing we’re doing for the people who make less than $250,000 - and I refuse to charge the lesser income people for plumbing work.”

Obama tries to straighten out Joe. “But don’t you get it? If all the rich people learn how to do their own plumbing and you won’t charge the poor people, what will you do for money?”

Joe immediately replies, “I guess I’ll run for President.”

Labels: Obambi