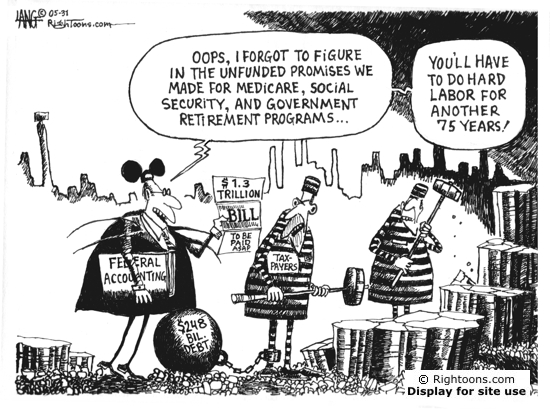

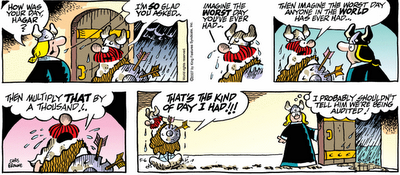

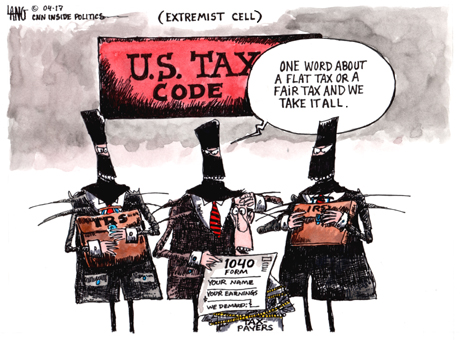

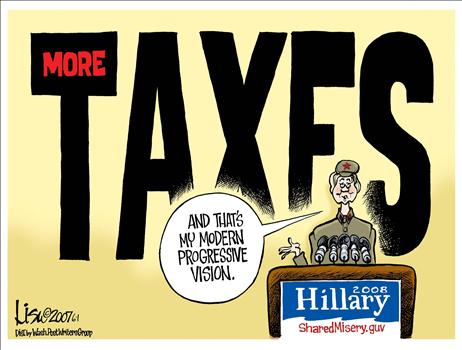

Hitlary's Tax Plans

Her recent Marxist rants leave no doubt as to the accuracy of this.

The Manchurian Candidate?

Labels: comix, Commies, Hitlary

Working with QB on multiple computers

Q:

Subject: transferring dataI use Quickbooks Pro 2005 and just got dsl at home. I have it on my work computer also and want to transfer data to my home computer via the internet. Can I transfer the data on the internet, I have been using pcAnywhere to transfer via phone line, but it takes forever. Thanks for any information.

A:

I assume you are wanting to access your QB data from both your home and work computers. Trying to do that over the internet is going to be a slow and messy process. Even the official online QB service, which is designed for this kind of direct access, is much too slow for my tastes; one of my many complaints about the online service.

What you need to do is work with the QBW file directly on each computer. This will require that after each time you work in the file, from either computer, you backup the data into a compressed QBB file. There are several ways for you to do this and have access to the QBB file from both of your computers.

One way would be to backup the QBB file onto a portable storage medium, such as a CD-RW disc or thumb flash drive, which you can carry with you back and forth between home and work. You would then restore the data onto the computer you are using.

Another way, and the one we use with most of our clients, is to store the QBB file on an online storage service, such as XDrive or MyDocsOnline. You download a copy of the latest QBB file to the computer you are working on and restore it into your QB program and then work on it all you want. When you're done, you make a new QBB copy that you upload to your online storage. This gives you the speed of working on the file locally, with access to the data backup file from anywhere in the world.

These obviously aren't the only ways to work with a data file on multiple computers, but they are the ones that we have been using for several years.

Good luck. I hope this helps.

Kerry Kerstetter

Labels: QB

Employing Family Members

Q:

Subject: c corpHello,

I own my own design company...(architecture w/out a license yet).I make about 50,000 a year up to this point. I am getting much busier and will probably double what I have been making.I am about to file to be incorporated. It sounds like to me from reading your article that I should stay a c and not go to an s.I realize that I need a professional to figure all of this out....but I was wondering how a couple of things will affect me.One is employing my wife part time...employing my children ( under 12 years old )and working from home..Do you have some suggestions on this..

A:

There are far too many options to consider and possible scenarios that can be used to achieve your goals for me to even begin giving you specific advice via this medium.You all will need to work directly with an experienced tax pro who can analyze your unique circumstances. I wish I could help; but I already have too many clients to take care of properly; so we are still trimming back on the difficult clients and are not accepting any new ones at this time.

Any good tax advisor should be able to assist you with the details of hiring family members, including how best to do it through a corp, as well as through a Schedule C business, which is generally a bigger tax savings for employing kids under 18. As I've said before, if you work with a tax pro who uses the TaxCoach Software service, s/he will be able to produce some very informative reports on the employing of family members.

Unfortunately, we don't have anyone specific to whom we could refer you. I did recently post some names and links for some like-minded tax pros around the country.

If you haven't already done so, you should check out my tips on how to select the right tax preparer for you.

I wish I could be of more assistance; and I wish you the best of luck.

Kerry Kerstetter

Section 179 Confusion

Q:

Subject: questions Sec. 179 expensing

Kerry,

Have read your Sec. 179 info online. But have a couple of questions:

a) If I expense, say, $70,000 under Sec. 179 for a $100,000 equipment buy, can I straight-line depreciate the remainder (i.e. $30,000)? Or am I precluded from depreciation if I write off some costs via Sec. 179?

b) The $450,000 limit. Is that ALL the equipment i bought in 2007 that qualifies for Sec. 179 treatment, or just the equipment I bought that I am opting to apply Sec. 179 to?? (I.e. -- if I buy $600,000 worth of equipment that would qualify for Sec. 179 expensing, but only choose to seek the deduction for $100,000 of the equipment, does the $450,000 limit apply to just those expenses I am seeking to expense, or to the amount of all the equipment i bought, regardless of whether I plan to expense or not????)

thanks for any insight here.

A:

a) Whatever part of the cost basis that hasn't been expensed under Section 179 is to be depreciated over the appropriate class life and using whichever method (straight line or accelerated) you and your personal professional tax advisor deem best for your unique situation.

b) Our supreme rulers in DC have decided that any business that has acquired more than $450,000 in new Sec. 179 qualifying equipment will be claiming large enough normal depreciation deductions that they don't need the full Section 179 expense that "smaller" businesses need.

Again, if you are spending this amount of money on business equipment and you are trying to do your own taxes, you are taking a very irresponsible risk. Focus on what you know and do well in your business and retain the services of a qualified tax pro.

Good luck.

Kerry Kerstetter

Labels: 179

Convert S Corp to Non-Profit?

Q:

Subject: Changing from an S-CorpHello,I just read you blog this morning and had a very interesting question for you. Have you heard of and is it possible to change from an S-Corp to a Non profit of 501(c) organization. I am really curious about this type of change

Thank you for your time

A:

The short answer is NO.

The types of entities involved are not compatible for such a switch.

A C or S corp is a legal being chartered by a state as a for profit entity.

To qualify as a non-profit organization, you need to have your state charter a non-profit corporation, which is completely different from a for-profit corp and involves different paperwork.

You should be working with a professional tax advisor to straighten things out for your particular goals.

Good luck.

Kerry Kerstetter

Follow-Up:

Thank you so much for your information.

Labels: corp

Gifting Limits

Q:

We want to give our grandkids some money. Is it true that we can’t give them any more than $10,000 without triggering tax problems for them?

A:

The current limit for gifts without the need to file any gift tax returns is $12,000 per donor (giver) per donee (recipient) per calendar year.

I have this explained on my website.

I hope this helps.

Kerry

Labels: Gifting

Choosing Proper QuickBooks Program

Q:

Subject: Quickbooks on your wesbite...Kerry,

You mention to stay away from Quickbooks Online and Quickbooks Simple Start, however, it seems in 2007, Intuit has only three options for Quickbooks now, QB Simple Start (I believe it replaces Basic and is $80), QB Pro ( $169) and QB Premier ($319). Which would you suggest I use then?

A:

It was pure greed on Intuit's part that made them drop the relatively inexpensive Basic version of QB, which was perfectly suitable for most users. So, now you are correct that the least expensive version is the Pro, which is what you should buy.

I don't even consider Simple Start to be a version of QB, so stay away from it.

Having just finished a messy partnership return for clients who use the online version of QB, my disgust and hatred of that service is at an all-time high right now. The "convenience" of having the file simultaneously available to several people ended up costing the clients a lot of money for the extra time it took me to clean up the data over what it would have been if I had been able to work on a normal desktop version of QB.

Of course, any decision as to which accounting program is best for you should be made in conjunction with your personal professional tax advisor; so be sure to check with him/her first.

Good luck.

Kerry Kerstetter

Labels: QB

Special Tri-State Depreciation?

Q:

Subject: re 2002 2003 sec 179

Kerry:

in the tristate area for 2002 and 2003, there was a ruling to spur capital investment and businesses could purchase a vehicle and depending on the cost could take $25K + 10% dep + that year's depreciation. Can you enlighten me on the nuances of this rule and how to best apply it?

Thanx

A:

This doesn't ring a bell with me. I checked in my 2003 references and didn't see it mentioned.

Are you perhaps confusing that with the special depreciation deductions allowed for New York Liberty Zone property? This is for almost all kinds of business equipment, not just vehicles and is only for the specific part of Manhattan, not the full Tri-States, and covers assets acquired and placed into service from 9/11/01 through 12/31/06.

If it's a State tax break you are referring to, you should check with your state tax agency for more specifics.

I'm sorry I couldn't be more help. Good luck.

Kerry Kerstetter

Labels: 179

Gifting Options

Q:

Subject: Capital Gains Taxes Aren't for the 'Kiddies'

Let me see if I understand this in a real world application:My 80-yr old mother, living on welfare, needs to pay for something (home repair, what have you) but doesn't have the money (say $5,000).I could sell some stocks and give her the money, but we'd both be better off if instead of giving her the money I gave her the stocks that she could then sell.Sound right?

A:

Decisions like this would obviously be on a case by case basis. However, if you have highly appreciated assets, such as stocks, that would trigger a large capital gain tax, shifting that tax to someone in a lower tax bracket could result in some tax savings.

This obviously needs to be balanced out with the hassle and cost of transferring the title to the asset, as well as the possible cost and hassle of having to prepare Gift Tax returns if the total current fair market value of gifts to any one person during a calendar year exceeds $12,000.

Kerry

Follow-Up:

Oh. I forgot to mention it was merely a hypothetical. I wasn't seeking actual advice.I knew something was off from the article. Apparently it was that the writer never mentioned the cost of transferring title to the assets.

Labels: Gifting

Increased Section 179

The Section 179 expensing election is one of the most common topics on which I receive questions; so this is a bit of good news.

As our imperial rulers in DC love to do when they pass laws to control our lives, they toss in a load of items unrelated to the main purpose of the bill. The Iraq war funding bill that President Bush signed yesterday has its share of unrelated items affecting businesses.

Bad News: Increasing the minimum wage to screw up the natural supply and demand market forces for labor.

Good News: Increasing the 2007 limit for Section 179 from what was $112,000 to $125,000 and increasing the phase-out for this deduction from the previously COLA adjusted limit of $450,000 of newly acquired equipment to $500,000.

Here is the actual text from Page 179 of the 249 page law.

SMALL BUSINESS.SEC. 8212. EXTENSION AND INCREASE OF EXPENSING FOR

(a) EXTENSION.—Subsections (b)(1), (b)(2), (b)(5), (c)(2), and (d)(1)(A)(ii) of section 179 (relating to election to expense certain depreciable business assets) are each amended by striking ‘‘2010’’ and inserting ‘‘2011’’.

(b) INCREASE IN LIMITATIONS.—Subsection (b) of section 179 is amended—

(1) by striking ‘‘$100,000 in the case of taxable years beginning after 2002’’ in paragraph (1) and inserting ‘‘$125,000 in the case of taxable years beginning after 2006’’, and

(2) by striking ‘‘$400,000 in the case of taxable years beginning after 2002’’ in paragraph (2) and inserting ‘‘$500,000 in the case of taxable years beginning after 2006’’.

(c) INFLATION ADJUSTMENT.—Subparagraph (A) of section 179(b)(5) is amended—

(1) by striking ‘‘2003’’ and inserting ‘‘2007’’,

(2) by striking ‘‘$100,000 and $400,000’’ and inserting ‘‘$125,000 and $500,000’’, and

(3) by striking ‘‘2002’’ in clause (ii) and inserting ‘‘2006’’.

(d) EFFECTIVE DATE.—The amendments made by this section shall apply to taxable years beginning after December 31, 2006.

Joe Kristan has a good summary of these and other tax related changes in the new law on his blog.

Labels: 179

Whistleblower Law Scores Early Success – Rewarding tax cheat informants 15% to 30% of the amount recovered is a powerful motivator. Use Form 211 to turn in your exes (friends, spouses, employers, etc.).

Labels: IRS

Be careful when choosing 1031 service

I can’t help using the old cliche – Penny Wise, Pound Foolish - to describe how so many supposedly intelligent people can risk literally millions of dollars in order to save a few hundred.

It’s no secret that my wife owns and operates a company to handle Section 1031 like kind exchanges for real estate investors. She frequently mentions that potential clients try to get her to lower her fees based on lower rates being charged by newbies who don’t know what they are doing. Of course, she is just like I am and refuses to participate in such a “whore’s market” and doesn’t work with anyone who doesn’t understand that quality comes with a price.

As these articles covered by Paul Caron indicate, cutting corners on a 1031 fee can end up costing much more in the long run, as several 1031 facilitators have filed bankruptcy while holding 151 million dollars of investor funds. I wonder how many of those investors chose to use those companies based on lower fees than what reputable firms charged. They are each now looking at the very likely prospect of losing hundreds of thousands of dollars because they wanted to save a few hundred dollars.

This reminds me of a similar situation when I owned an exchange company back in the Bay Area. We were losing a lot of exchange business to a new company that wasn’t charging anything for its services, supposedly as a means of getting a foot-hold in the area’s real estate market. The fact that they were operating out of a motel room should have been a dead tip-off to the end result. The slime-balls amassed a few million dollars of investor funds and then skipped town.

I hate to sound cruel, but anyone who is willing to entrust his/her real estate equity with a stranger rather than someone who has been successfully handling 1031 exchanges for decades, just to save a few hundred dollars on the service fees, doesn't have much chance of being considered a “sophisticated investor.” Short-sighted fool would be the more appropriate description of such a person.

1031 Tax Group files for Chapter 11

Labels: 1031

DEMS' BIG TAX LIE – Not extending the soon to expire Bush tax cuts is exactly the same as enacting a humongous tax increase.

Capital Gains Taxes Aren't for the 'Kiddies' – Interesting look at shifting tax burden to kids, who are probably in a lower tax bracket than the parents. Also includes a reminder of the one year zero capital gains tax rate for small profits in 2008, a topic that has been coming up quite often in my discussions with clients contemplating sales of properties.

Incorporating increases IRS suspicion?

Q:

Subject: S Corp. question

Hello:

I know you are not in California. However, I was wondering if you could shed some light on a question.

I am an independent contractor (personal trainer), I have been filing a schedule C and paying city tax as well for the last 8 years. I have grown my clientel where I personally earn +$150,000. I think if I form an S Corp. I may be able to limit some of my tax liability. For example, if I draw a $60,000 income, I can same on SS Tax, be only taxed (income wise) on the $60,000 and only pay a corporate profit tax on the remaining $90,000.Does that seem correct to you?I am just worried that the IRS will come back and say, "Hey, last year you made +$150,000 and now you're claiming $60,000. Where's the rest?" And I am afraid they won't see the extra $90,000 as profit.Any thoughts would be greatly appreciated.Thanks,

A:

As long as you handle and report the corp and personal income and expenses properly, IRS shouldn't have any problem with the fact that your business has gone through the normal transition from a Schedule C sole proprietorship to a corp. I have worked with thousands of such businesses and I can't recall one incident where IRS audited a tax return just because the taxpayer moved his/her business to a corp entity. While there are obviously huge tax savings opportunities by using a corp, there are also other important reasons to do so, so IRS doesn't automatically suspect a business owner of anything wrong just because s/he chooses to make that change.

Generally, in the first year or two, there is some overlap with ID numbers used on 1099s and other documents that could cause an IRS matching problem. An experienced tax professional will know how to report these items in such a way as to avoid any actual problem with IRS and/or the State tax agency.

In regard to what particular steps you should be taking, there are far too many options to consider and possible scenarios that can be used to achieve your goals for me to even begin giving you specific advice via this medium.

You will need to work directly with an experienced tax pro who can analyze your unique circumstances. I wish I could help; but I already have too many clients to take care of properly; so we are still trimming back on the difficult clients and are not accepting any new ones at this time.

Unfortunately, we don't have anyone specific to whom we could refer you. I did recently post some names and links for some like-minded tax pros around the country.

If you haven't already done so, you should check out my tips on how to select the right tax preparer for you.

I wish I could be of more assistance; and I wish you the best of luck.

Kerry Kerstetter

Labels: corp

Park Donations

Q:

Subject: Botanical Garden Sec. 179

May I ask you 2 questions?

Would a person, or cooperation I'm soliciting for donations in order to transform a parkway into a Botanical Garden be eligible for Sec. 179? If not is there another tax deduction for donations that I can remind them of in my sales letter to them?

Thanks,

A:

Section 179 is not in any way applicable here. That is only for companies that actually purchase business equipment that they own and use in their business activities.

In your case, if the group doing the rehab work is a qualified charity, the donors would be ale to claim payments as charitable contributions.

If the donors are going to be listed or publicized somewhere, a better way for them to claim their payments for this project would be as advertising and premonition expense. That normally works out to provide a better tax savings than charitable donations do.

Good luck. I hope this helps.

Kerry Kerstetter

Labels: 179, Deductions

Profiting from tax returns?

Q:

Subject: a tax refund isn't a profit

Hi Kerry,

In regards to the cartoon with the subtitle "A tax refund isn't a profit...", couldn't it be argued that a tax refund is in fact a profit for those who qualify for the EIC?

Keep up the great work on the site!

Thanks,

A:

That is an excellent point. While I was obviously echoing the cartoonist's point that recovering taxes you had paid in during the previous year isn't a net profit; the EIC welfare program does allow many people to receive thousands of dollars more than they originally paid in.

Referring to the EIC as a profit from a tax return is actually a valid description, as anyone will understand who has finessed Schedule C expenses. Often, going light on expenses results in a much higher net refund on the 1040 because of the ridiculous way by which EIC is calculated.

Thanks for writing and pointing that out.

Kerry

Labels: EIC

Income Shifting

Q:

Subject: Fiscal Year on your websiteHi Kerry,I am starting a new LLC and C-Corp to move money back and forth based on this fiscal year principle, however, after reading on your website, I'm not sure I understand your comments "Toward the end of your personal fiscal year (12/31), you bleed off some of your taxable income to your C corp by paying it for something like rent or marketing services." I was not aware rent or marketing services is tax deductible on a personal level, correct? I understand how you can do such a thing between entities, but not between entity and personal. Could you please explain further? Thanks.

A:

The payments from your personal funds do need to be deductible in order to make the income shifting plan work. They should be deducted on whichever schedules apply to the kinds of income you have, such as C, E (Page 1 or Page 2) or F. If all of your income is from W-2 sources, these payments can be deducted as unreimbursed employee expenses on Schedule A.

Do not try this on your own. Any properly experienced professional tax advisor should be able to help you set this kind of thing up to work most efficiently for your particular circumstances.

Good luck.

Kerry Kerstetter

Labels: corp

Sec. 1031 & 121

Q:

Subject: Exchange QuestionWe are considering doing a 1031 exchange on a single family rental, which has been held for 32 years, and is owned free and clear.The idea would be to exchange this rental home for TWO single family homes, and use them as rentals (like/kind). Then, after 3 years, move into one of the rentals and live in it for two years, meeting the five year holding requirement & 2 year residency requirement .... Then we would sell new Rental Property #1 as a personal residence, and then move into the Rental Property #2 as a permanent residence, and live in it indefinitely.Each of the newly exchanged properties would be rentals - the first one for 3 years (then move in for 2 years), for a total of 5 ... and the next exchange property would be a rental for 5 years until we could meet the time requirements.This is hard for me to explain, but I hope you can get a grasp of what I'm trying to do. Trade one rental for two, and live in the two rentals (over a period of five years before moving into rental #2) so as not to pay capital gain taxes. Would these time lines work?

A:

That plan could work, assuming our rulers in DC don't mess with the tax laws over the next five years to change any of the timing details, which you have correct for the laws as they stand now.

I have one very big word of caution for you. Keep your intention to reside in one of the new rentals to yourself. Blabbing around to a lot of people that you had that plan from the beginning could jeopardize your 1031 exchange because an aggressive IRS agent could classify the house as personal at the time of the exchange. I have seen and heard of cases where people shot themselves in the foot by bragging about plans such as yours. All it takes is one jealous person to turn you in and you're cooked. The decision to move into the rental has to appear to be made long after you take ownership of it.

Other than that, it sounds as if you are looking at things creatively, which is what makes the tax game so much fun.

Good luck.

Kerry Kerstetter

Section 179 For Large Employers

Q:

Subject: Section 179

Hi,Is there a Section 179 phaseout on the # of employees a business has?Thank you,

A:

No. There has never been a direct link between Section 179 and the number of employees.

It is generally assumed that companies too large to be eligible for this special "small business" tax break will automatically lose it via the $450,000 of new property rule.

Kerry Kerstetter

Labels: 179

QB Classes

Q:

Subject: Using classes with Quick BooksIt sounds like you deal a lot with rental property. I read your article on classes. I am a HVAC contractor and would like to know if this can be useful for my business? I need to track my service, replacement and new construction jobs for residential and commercial accounts and split the labor materials and equipment to each profit center.I am taking a quick books class on line FridayAny help would be appreciated

A:

It should be fairly easy to set up QB in such a way as to give you the types of reports you need.

I don't have time to give you details on this because that process will require some one on one consulting. You should look for a QB pro advisor on the QuickBooks.com website and see if you can find one with some experience dealing with similar situations as yours. S/he can then help you set up the file appropriately and train you on how to enter data and produce the reports you need.

Good luck.

Kerry Kerstetter

Labels: QB

Revoking S Election

Q:

Subject: quick S Corp question

Want to revoke S Status for corp. Never filed a corp return. Am three years behind in filing. Want to file as C with fiscal year ending in March 31. Is this possible. I believe we filed 2553 in 2004.

Tku

A:

It won't be as easy as you think for various reasons dealing with both IRS and your state tax agency.

You need to work with an experienced tax pro to work out the best method to resolve this matter.

Some possible issues you will encounter:

IRS and the State will probably refuse to accept the revocation until you file all of the past due 1120S returns. Even with no activity, you have to let IRS and the State know that. You didn't say what state you're in; but if you are in one with a minimum annual tax, such as California's $800 per year, you are looking at some large past due amounts, including penalties and interest.

Since an S corp is required to have a tax year ending on December 31, you will need to formally request a change. As I've mentioned several times before, IRS is not friendly to the concept of non-December tax years; so they are not very likely to honor your request. Also as I've said on countless occasions, it may very well be much easier to set up a brand new C corp, where the fiscal year is completely open, than to try to adjust what you already have.

Again, an experienced tax pro should be able to help you straighten these issues out.

Good luck.

Kerry Kerstetter

Labels: corp

Creative Tax Saving Strategies

Q:

Subject: FW: To Kerry, Seeking Your ServicesHello Kerry, I have been reading up on your site and also on Drew Miles, have you heard of him? Both of you seem to really understand the secrets and strategies on using LLCs for Tax Reduction, and Asset Protection.Drew Miles is very expensive, and I need a tax pro office like Drew Miles (just like Drew Miles) but without the extremely high price of $4,000.

I set up an LLC this year in January, and I have it taxed as an S-Corp. I am wondering if you could please give me a call to discuss you helping me with Income Shifting into another Corp, maybe a C Corp, protecting me from Lawsuits, etc.

Call me. I didn't see your number listed, I really want to talk with you Kerry, thanks.

In Regards,

A:

I am very familiar with Drew Miles and his tax savings strategies. His techniques are very useful; but what rubs me the wrong way about him is his claim to be the only person on Earth who knows about them. There are several of us tax pros around the country who are very experienced using the exact same techniques as does Mr. Miles, usually for much lower fees. In fact, the tax plans prepared by the TaxCoach Software include most of the exact same things as Mr. Miles' plans, for a fraction of the cost.

There are far too many options to consider and possible scenarios that can be used to achieve your goals for me to even begin giving you specific advice via this medium.

You all will need to work directly with an experienced tax pro who can analyze your unique circumstances. I wish I could help; but I already have too many clients to take care of properly; so we are still trimming back on the difficult clients and are not accepting any new ones at this time.

Unfortunately, we don't have anyone specific to whom we could refer you. I did recently post some names and links for some like-minded tax pros around the country.

If you haven't already done so, you should check out my tips on how to select the right tax preparer for you.

You may want to ask any potential tax pros if they use the TaxCoach Software service in order to locate someone who can give you similar service to Drew Miles.

I wish I could be of more assistance; and I wish you the best of luck.

Kerry Kerstetter

Follow-Up:

Thank you so much Kerry! I have the list of the referrals for people that are similar to you and Drew Miles. That's basically what I am looking for, someone who knows what Drew Miles knows but is a little cheaper lol.Thanks alot, and God Bless you for this buddy.

Avoiding Audits

From a Reader:

Subject: For the Entrepreneur: How to Avoid Being AuditedHi Kerry -I just would like to pass along this link. It's an article I recently published over at Ask the Advisor titled "How to Avoid Being Audited if You're Self-Employed". I thought you and your readers over at Tax Guru-Ker$tetter Letter might be interested in having a look. Let me know what you think if you have a moment.Thanks,Jimmy AtkinsonAsk the Advisor

My Reply:

Jimmy:

While not covering all of the ways in which to lower one's profile on the IRS audit radar, you have addressed some good points.

I will post a link to this on my blog.

Thanks for sharing it.

Kerry Kerstetter

Follow-Up:

Hey Kerry. Thanks!

Labels: audits

The Fine Line Between 'Entrepreneur' and 'Tax-Dodger' – Interesting look at the Hobby vs. Business issue by Gail Buckner.

IRS Leans On Auction Sites to Spill Customer Information - More on the IRS plan to draft more companies as its deputies in the income reporting system.

Illinois Tax Picture

Illinois House overwhelmingly rejects business tax proposal

Labels: comix, StateTaxes

Homeowners Wage a Rebellion As Property-Tax Assessments Rise – It’s always good to see stories about people fighting back legally against tax increases. Too many people just roll over and let their rulers rape them financially.

IRS Kicks Homeowners While They Are Down – Relief of debt is just as taxable as winning the lottery. The big difference from a practical viewpoint is that there is no actual cash with which to pay the IRS and State tax agencies.

Depreciation Errors?

Q-1:

Subject: Salvage / Basis Reduction; Special Depreciation

Hi Kerry,

I can’t express how much I have appreciated all the knowledgeable responses you have posted. Hope you can answer my questions.

I have been taking a stronger interest in my financial affairs. I recently reviewed my taxes and am attempting to educate myself on the in and outs of the 1040. My question is in regards to Depreciation. My former accountant made a few decisions that I am unclear on. I own two rental houses and a R.V. He listed my rental houses as residential throughout my return except on form 4562 where he depreciated them under classification (i) Nonresidential real property, which is depreciated over 39 years (MM S/L) as opposed to classification (g) which is subject a 27.5 year schedule. He also placed $50,000 of the $200,000 Cost / Basis (purchase price) under Salvage / Basis Reduction, which reduced the Depreciation Basis to $150,000.

For my R.V. which I purchased in 2002 he placed almost $17,000 above the purchase price in the Special Depreciation Allow column, which increased the Cost / Basis by that same amount but reduced it Deprecation Basis back down to the purchase price. Then in subsequent years he used the larger Cost / Basis figure as the Deprecation Basis.

I no longer work with him, but I just wanted to ask him some informed questions about my return.

Thank you in advance for your time,

**Please note that you have my permission to reword or break my questions into multiply post. In fact, I would appreciate it if you would not use my actual figures but rather replace them with any figure you deem appropriate of useful. Thank you again for providing such a valuable service.

A-1:

These are really questions that you should be going over with your new tax advisor. In fact, it would a good item to use in screening potential new tax pros; having them review your depreciation schedules and explain to you what happened and what they would do about it. You can compare their responses to mine below.

If the properties are residential, it sounds like a computer coding error, if the 39 year life was used instead of the proper 27.5 years. The net effect for the prior years wouldn't be enough to justify going back and filing amended tax returns. However, from this point forward, I would start using the correct 27.5 year life.

There are several methods used to determine the value of the non-depreciable land to set up as the property's salvage value. Your prior accountant may have a standard percentage of the total purchase price that he uses or he may have used the percentage from one of your property tax bills. If you think that you have a better more accurate way to calculate this, use it and change the salvage value from this point forward. Again, this is too minor to justify filing amended tax returns for previous years.

On the RV, if you look on the 4562 and detailed depreciation schedule attached to your 2002 1040, you should see the $17,000 of first year bonus depreciation. This number is simply being carried forward by the tax software and is standard procedure. Most tax programs prepare detailed depreciation schedules that reflect the historical amounts for each item. There shouldn't be anything to be concerned about, unless there was no bonus depreciation in 2002, and your most recent tax preparer didn't also prepare 2002 and made a mistake when entering carryover assets into his tax program.

It sounds as if you are not reading the depreciation schedule properly. The actual depreciable basis of the RV should be the purchase price less the bonus depreciation and any Section 179 that was claimed. Again, your new (or potential) tax preparer should have no problem deciphering the schedules and explaining them to you, including any changes that need to be made. S/he will need to see the actual printed schedule rather than rely on your narrative of what it says.

I hope this helps.

Good luck.

Kerry Kerstetter

Q-2:

Kerry,

Thank you for your incredibly quick and informative response. I learned more in reading your email than I have in hours researching on the internet and speaking with accountants!

Unfortunately, my accountant made few large errors in my 2003 return. He forgot to include $11,000 in interest payments on my house and he forgot to include my CA state tax paid. I also reviewed the depreciation schedule for my RV in 2002 and he did in fact add the $16,950 bonus deprecation to the cost basis (so my depreciation is based on an inflated figure).

Anyways, I'm relieved to know that I can switch my depreciation schedule for my rental properties to 27.5 years. Do you think I should file amended returns for the $11,000 interest and CA state tax that was left out?

Thank you in advance for your time. I know you must have a million emails to respond so I understand that if in the process of allocating your time you are unable to respond. Please note that I really appreciated your useful advice and I will not take any more of your valuable time.

Regards,

A-2:

Financially, depending on your tax brackets, going back to pick up $11,000 of missed interest expense could very well be worth it to you. You have three years after the return to file it, and you are earning 8% interest on the refund all this while, so there is no immediate rush to do this.

However, you need to consult with your new personal tax advisor as to the climate in your area regarding IRS's processing of amended returns requesting refunds. As I have written about over the past few years, they had been automatically initiating full blow audits on all amended tax returns claiming refunds. From isolated reports from some tax pros around the country, IRS seems to have eased up on this in the last few months; but your new tax pro should be more up to date on this for your specific area and IRS Service Center.

I hope this helps.

Good luck.

Kerry Kerstetter

Labels: 4562

1031 of LLC Property

Q:

Subject: Exchange Question

Dear Tax Guru,

I own a residential rental property in AZ under an LLC with a partner. We are in the process of selling it after two+ years of ownership.

Am I able to do a 1031 exchange with the proceeds of this sale into a commercial property that I am looking to invest in under a different LLC with another partner?

Thanks for your help.

A:

It depends on the official ownership title for the property. If it's in your individual names, you can each use your share of the proceeds for whatever you want, 1031 exchange or taxable sale.

If the property's title is in the name of the LLC, and you don't all want to reinvest into new property, you will need to get your share out of the LLC's name and into your own name before the disposal, so that you can do a 1031 with your share of the proceeds. This is a common event and any experienced title company or abstract attorney can handle this.

You also need to coordinate with your and the LLC's tax preparers to keep track of the property's cost basis, the distribution to you, and the reporting of the 1031.

Good luck.

Kerry Kerstetter

Jointly Owned Property

Q:

Subject: Sale of home question

Hi Tax Guru,

Found your website while browsing for an answer to my question about a sale of a home I own with my parents. Here's the situation:

Here are the circumstances:

My brother and I own a property with my parents. We are all on title as joint tenants (1/4 undivided interest to each of us and 50% undivided interest to my parents). The house was bought in 2000, my parents supplied the down and my brother and I have payed for the mortgage and taxes since. We've split the deductions every year between the two of us. My parents have used this as their primary residence since 2000 while my brother and I do not. We have considered it our 2nd home as we each own our own primary residence. We are now interested in selling the home and are wondering what is the best way to reduce the tax implications for everyone. I estimate the capital gains on the home to be approximately 300K.

Since my parents use it as their primary residence, would they be able to "claim" all the capital gains (300K) or do the gains have to be divided equally among the 4 owners? If it has to be divided, is there any way to get off the title so that my parents can take advantage 500K exemption without triggering gift tax consequences for my brother and I? Any suggestions on how we can either structure the title or the sale such that taxes are minimized for all parties? My parents income is low while my brother and I are in much higher brackets if we had to pay taxes.

Appreciate any insight you might have on mitigating the tax burden.

Thanks very much!

A:

This is an issue that you all really need to work on with the assistance of an experienced professional tax advisor because there are a number of ways in which it can be handled and several factors that need to be considered, such as the following.

It is obvious that your parents can qualify for the Section 121 tax free exclusion of the gain on their one half of the home's net gain. The gain on the half that you and your bother own is a much more complicated issue.

Let me address the gifting option. You and your brother could gift your shares of the home to your parents. However, this would require you both to file gift tax returns to report it and either pay gift tax or use up part of your million dollar lifetime exclusion. Your parents would assume your cost basis in the 50% of the home they are given and would essentially be accepting full responsibility for your and your brother's gain.

The half of the home that your parents are given will not qualify for the Section 121 tax free exclusion because the law requires the seller to both own and occupy it is their primary residence. While your parents have obviously met the occupied test, they would fail the ownership test and would thus be required to report the gain on their "new" 50% share as taxable long term capital gain (LTCG). Because they had been using all of the home for personal purposes, its sale cannot be structured as a Section 1031 like kind exchange, which is only available for business and investment property.

If you and your brother keep your share of the house, the gain is potentially taxable, depending on how you and he are classifying its ownership, which should be consistent with how you have been reporting the deductions for interest and property taxes on your 1040s.

If you have been treating the home as investment property, you can structure your disposal of your share of the home as a Section 1031 like kind exchange, which will require you to use the services of a neutral third party facilitator to reinvest the proceeds into new (to you) business or investment property within 180 days. These rules are all explained at tfec.com.

If you have been reflecting that you have been personally using the home, it will not qualify for Section 1031 and you will have a taxable LTCG.

You and your brother don't necessarily have to report this in exactly the same way. The strategy for each of you and your brother could be different depending on your unique situations. For example, one of you may qualify for a Section 1031 exchange, while the other may not.

The actual tax hit on any taxable gain could be spread out over several years under the installment method if part or all of the sales price is carried back. Your personal professional tax advisor can show you how that would work with your numbers and sales terms.

I hope this gives you some idea of the various details that you all need to be evaluating with your personal professional tax advisors.

Good luck.

Kerry Kerstetter

State Tax Shifting

Shifting income from high tax states to those with low or zero tax rates has long been part of any aggressive tax saving strategy. I've been helping clients exploit these differences for decades.

I am amazed at how many people still live in a fairy tale world and deny that taxes at all levels (local, State, Federal) are very powerful motivators for behavior and thus think they can arbitrarily raise taxes with no consequences in the form of taxpayers leaving their jurisdiction.

There is a good explanation of how this works in real life in today's National Review Online. Purely by coincidence, the town discussed is half located here in Arkansas.

Labels: StateTaxes