Tax Guru-Ker$tetter Letter

Wednesday, July 31, 2002

IRS Violations Of Privacy

I'm glad to see that more people are taking seriously the issue of the IRS making public personal income tax information that is supposed to be kept under the utmost secrecy and I wasn't the only one who was alarmed by this illegal action by IRS personnel. However, don't hold your breath expecting anyone at the IRS to actually be disciplined for this obviously partisan attempt to damage Bill Simon. They are routinely exempted from having to obey the laws that we peasants are forced to abide by.

KMK

Tuesday, July 30, 2002

Too Undependable

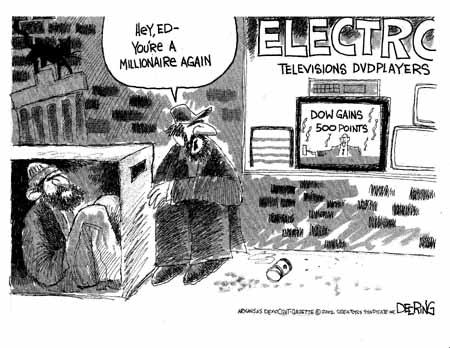

Even with the stock market on the way back up, there is no guarantee that it won't dive again. In fact, odds are good that it will be a virtual roller coaster for the next several months at least. This is the very reason I have never liked stock investments, because one's personal fortune can gyrate too drastically. It's not a good secure feeling to have to check the stock markets on a daily basis to see if you are well off or broke.

Monday, July 29, 2002

What's The Right Number?

As I've explained on several occasions, accounting is much more of an art than the cut & dried science that most people think it is. Even with the new Federal requirement that CEOs sign a statement swearing for the accuracy of their companies' figures, there will still be plenty of room for different assumptions and methods of portraying a business's finances.

Contrary to popular belief, GAAP (generally accepted accounting principles) don't dictate just one way of doing things. They encompass a very wide variety of choices, making the side by side financial comparison of different companies literally impossible to do. This is how it has always been and how it will still be when this new rule kicks in in a few weeks.

KMK

Stock Market Gurus

It never ceases to amaze me how the so-called stock market gurus can stay in business and have even a single follower when their predictions consistently fail to come true. Even these bozos, who predicted a Dow at 36,000 are covering their bets by claiming that they never said when it would reach that level. The problem is that most investors don't have the luxury of holding out to the year 2525, or whenever the Dow does make it that high.

KMK

Merit Pay For Our Rulers

I have long bemoaned how unfair it is that our rulers are not made to suffer for their incompetent actions. They pass laws and do other things to screw up life for everyone else. As a reward, they receive huge salaries and fringe benefits. When they ever decide to step down from their thrones, they receive huge pensions. Even proven crooks & perverts, such as Traficant & Condit are going to be receiving very handsome pension checks.

Contrast that with an owner or officer of a business that fails. They often have to file for bankruptcy protection. That's why I like this theory of how to link the pay of our rulers to the results they are able to achieve. Of course, the chances of ever seeing this are non-existent.

KMK

Economic Cycles

Every economist has his/her own theories as to what causes the ups & downs of the economy. Often, they take events that happened and try to link them as cause & effect, when in fact they were just coincidences. For example, Clinton worshippers have continuously claimed that his huge tax increase in 1993 caused the good economy of the late 1990s. The truth is that the economy did well in spite of the tax increases, not because of them.

As Bruce Bartlett explains here, economists can't even agree on the effect of the current stock market gyrations.

I don't claim to have the ultimate economic formula, and I don't believe anyone else has it either. Such a predictor would enable its followers to become the wealthiest persons in the world. I am more inclined to believe the thesis of this study, which claims that luck is a big factor in how our economic cycles go. Despite their claims of omnipotence, our rulers in DC couldn't fine tune the economy, no matter what tricks they try.

KMK

IRS Political Audits

It has been frequently discussed about how viciously the Clinton Gang used the supposedly non-partisan IRS to attack its critics. This is all very true. Several people and groups who were critical of Clinton policies were coincidentally selected by IRS for audits, as were Paula Jones, Gennifer Flowers, and other women who revealed their personal involvement with the crooked one. Shortly after publishing one of my hardest hitting exposes of the Clinton Organized Crime Family in my newsletter, I was notified of an audit of my personal taxes. What a coincidence.

However, just because the Clintons aren't currently living in the White House doesn't mean these kinds of things have subsided. The IRS is still filled with Clinton cronies, who are still as dedicated as ever to their mission of attacking critics of the Left. The illegal public release of Bill Simon's personal income tax data by IRS personnel was an obvious indication that the Clinton moles are still on the job. It will only get worse when Queen Hillary moves back into the White House.

KMK

Sunday, July 28, 2002

What the Heck Happened?

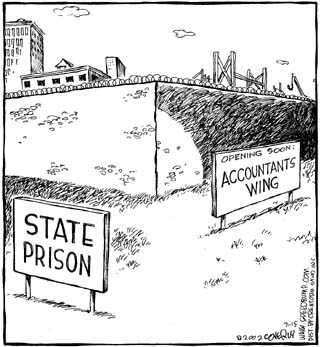

That renowned investment philosopher, Dave Barry, has another of his insightful analyses of the stock market. This time, he admits that we accountants are not as boring as the ages old stereotype would have you believe. He refers to accountancy as the Limp Bizkit of professions.

KMK

Part of the Game

Anyone who gets into the nasty arena of politics has to know that revealing one's income tax returns to the public is standard practice, even though not legally required. Why did Bill Simon think that he would be able to make it through an election in the PRC without having to conform?

KMK

Thursday, July 25, 2002

State Budget Problems

As has been discussed here on a number of occasions, almost all of the state governments are having budget shortfalls. I found an extensive report on how they are addressing these problems from the National Conference of State Legislatures. It's long and only really interesting to other numbers geeks like me.

However, what I found interesting is this summary of how the states are planning to deal with their shortfalls.

Cutting spending (26 states)

Tapping a variety of state funds (23 states)

Using tobacco settlement funds (16 states)

Increasing taxes (16 states)

Tapping rainy day funds (12 states)

Raising fees (10 states)

I was actually quite surprised to see that 26 states would even consider cutting their spending, because normally that side of the equation is untouchable. Obviously, since we don't yet have 103 states, some states are planning more than one approach. Many people would consider raising fees and raising taxes to be essentially the same thing.

KMK

Privatizing Social Security

As we all expected, the opponents of allowing people to have any control over their own retirement money are exploiting the stock market drop as an excuse to keep all of the power in the hands of our rulers in DC. As I have explained before, and Matt Moore discusses here, that is complete garbage.

KMK

Truth About The Reagan Tax Cuts

Jeff Jacoby has a good & accurate description of the very positive effects the Reagan tax rate cuts had on the country.

It makes me sick every time I hear those rate cuts blamed for the deficit, when that was completely the fault of rampant spending by Congress. It makes me doubly sick when even so-called Republicans, such as Warren Rudman, consistently parrot this liberal lie. When will the GOP stand up against this historical revisionism and smack down anyone who perpetuates this lie?

In fact, if Bush weren't so afraid of offending the liberals, he would take steps to reduce tax rates right now and we would see the benefits to the economy very quickly. As I have explained on several occasions, he has the power to unilaterally chop the effective tax rate on capital gains by redefining the cost basis to include adjustments for the effects of inflation. Unfortunately, he is too wimpy to use that power, exactly as his father was.

KMK

Wednesday, July 24, 2002

Let Us Control Our Own Retirement

It is good to see that so many people want more control over their future retirement funding rather than trusting our rulers in DC. According to this recent Cato Institute Zogby poll, 68 percent of likely voters support allowing workers to invest a portion of their Social Security taxes in personal retirement accounts.

You can download the actual study in pdf. I noticed that it no longer includes the comparison between how many people believe in UFOs and the likelihood of actually receiving any SS benefits.

While this skepticism over the SS program is a good sign, I fear that too many people will take that as a sign that they don't have to do anything on their own because our rulers will fix everything for them. Nothing could be further from the truth. In a best case scenario, our rulers are only discussing the possibility of allowing a small portion of the SS taxes to be diverted to privately controlled accounts. The major portion of the tax will still have to be sent to the SS Ponzi scheme. Also, any change in the current system is still several years away.

In the meantime, people who don't take steps on their own to reduce the amount of SS taxes they are paying will just continue to flush thousands of dollars down that toilet every year. There are several ways to legally reduce or eliminate the requirement to pay in SS taxes. The easiest way continues to be by using a corporation.

KMK

Tax Cuts Are Needed Now

In typical fashion, the leftists are telling their lies and trying to blame as many problems as they can (budget deficit, stock market crash, corporate bankruptcies, etc) on the supposedly huge & irresponsible tax cuts passed last year. Many are calling for a repeal of the cuts.

As Stephen Moore very eloquently explains, this is complete hogwash for several reasons. First is the fact that we have actually only seen a very tiny fraction of the tax cuts. The main parts aren't going to take effect until 2005 & 2006. Blaming anything on a future promised tax cut is insane. This is why I have never trusted any tax break that is delayed. There is always the very real likelihood that our rulers will change their minds before the tax breaks kick in. It has happened too many times in the past to deny the probability.

I have to agree with Mr. Moore that the economy and market are suffering more due to the uncertainly surrounding the future tax cuts. The solution is to have our rulers pass a law making all of the tax cuts permanent and effective immediately.

KMK

Tuesday, July 23, 2002

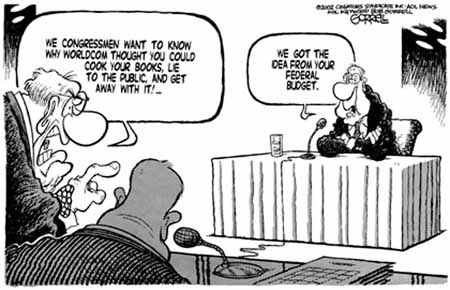

Exposing Federal Creative Accounting

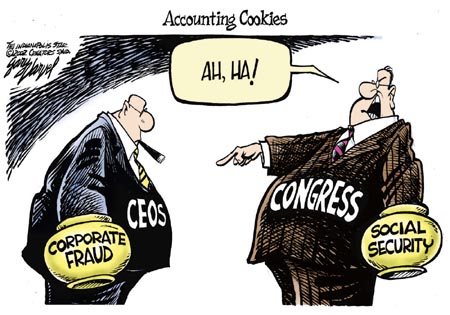

The only member of either house of Congress who truly respects the U.S. Constitution is Ron Paul, from Texas. It's no coincidence that he was the Libertarian Party's 1988 Presidential candidate since the LP is the only political party that officially recognizes the Constitution as a sacred document.

Unlike his colleagues, who are getting a lot of face time with the media criticizing the creative accounting in large corporations, Mr. Paul explains that nobody is more creative and outright fraudulent with their bookkeeping than our rulers in DC.

KMK

Bill Simon's Taxes

Journalists are crying about the limited time they had to review Bill Simon's tax returns, looking for more dirt on him. Despite the ban on cameras & recording devices, I still say some were snuck in, and we'll be seeing much more in-depth coverage of the tax returns soon. Have you seen how small cameras & microphones are nowadays?

KMK

Nailing Jello To the Wall

Here is a good explanation of how the complex tax code in this country makes improving & simplifying corporate accounting an impossible goal.

KMK

Monday, July 22, 2002

Income Redistribution

The Federal tax system is nothing less than income redistribution. Our all knowing and all powerful rulers take as much money as possible from the people who have it and then dole it out as only they are able to.

The Tax Foundation has statistics as to how all of the states do in terms of paying more to DC then they get back or vice versa. Some states, such as Tennessee, are net winners, while others send more money to DC than they get back.

KMK

Facing Reality

As I predicted back in April, Bill Simon had to cave in to the media hounding to release his personal tax return data to the press. It didn't help things that some Clintonites inside the IRS broke the law and violated Bill Simon's personal privacy by releasing charges that he was using questionable tax shelters.

While he is trying to limit that disclosure to a few hours, that won't happen. I'm sure some of the reporters will be bringing digital cameras or small scanners with them. Politics is a dirty business and leftist journalists will stop at nothing to help their candidates.

KMK

Low Cost Accounting Lessons

Some good analogies illustrating what some corporate accounting departments did to artificially beef up their balance sheets.

While everyone is expressing shock & surprise at these tricks, I can remember a lot of good coverage of them years ago; especially AOL's bogus accounting for the millions of freebie disks they were littering the nation with. It was no surprise that eventually they would have to be written off against income.

KMK

Whose Fault Was It?

In hindsight, almost everyone is now admitting that the high values placed on stocks during the dot-com frenzy were wrong. I took a lot of flack for saying just that during the market run-up by people who fell for the con that the old fashioned business & market cycles were permanently extinct.

The cartoon below actually illustrates the situation in that crazy market. However, the blame for the market bubble is a different story. The cartoonist, Ted Rall, is a proud leftist and is trying to give the impression that the evil corporate executives were at fault. As always, I see this from a completely different perspective.

Those stocks couldn't have been sold if there hadn't been people willing (stupid enough) to buy them. I have yet to hear a story of a corporate executive sticking a gun to the side of an investor's head and forcing him to purchase stocks at inflated values. I lay the blame squarely at the feet of the idiot investors. While many of them were simply following the leads of the media and stupid financial advisors, common sense should have alerted them to the folly of their advice.

KMK

Are MBAs Worth The Cost?

Some people are casting doubt on the assumption that an MBA degree will automatically return a much higher salary.

KMK

Sunday, July 21, 2002

Back In Fashion

Hopefully, this story is true and the operating style and creative accounting tricks of the new generation of businesses have run their course. I like the idea of bringing back the wisdom & experience of the older veterans who were put out to pasture rather than try to teach new dogs old tricks.

It reminds me of the SCORE program (Service Corp of Retired Executives). My clients and I have found them very useful in giving advice that can't be found in any book. And the price is right (free).

KMK

Making Money Without A College Degree

One of the commonly held beliefs in this country is that a college degree is essential for a career that will earn a good income. A college degree is required for many occupations; but luckily, there are some that have pretty good hourly & annual pay rates, as shown in this chart.

I haven't independently verified the figures in this chart. Where the work is being done in an employee (W-2) status, they are probably correct. However, for jobs that are normally handled on an independent contractor (1099-MISC) basis, there really is no such thing as an average. I am specifically referring to real estate brokers, since I have been working with hundreds of them for the past 25+ years.

As I have often said, the real estate profession, while potentially very lucrative, is one of the biggest gambles of any occupation. Because they are only paid if they succeed in making a sale, brokers & agents can work their butts off, spend a ton of their own money, and not earn a dime in income if a deal doesn't come together. I have seen real estate brokers who go several years with no income, and then have a bonanza year, earning hundreds of thousands of dollars, if they have been able to hold out that long. This feast or famine income stream is most extreme in the world of commercial real estate, which is why most Realtors opt for the slightly more dependable residential side of the industry.

Either way, I could never hazard a guess as to an average income for a Realtor, much less the $47,700 that chart shows.

KMK

Saturday, July 20, 2002

Getting To The Bottom Of The Stock Market Problems

Two different analyses of the underlying reasons for the recent drop in the stock market.

A satire, with an element of truth:

Stocks were dropping precipitously last week as investors realized that corporate leaders, thought to be working for the good of humankind, were actually busy trying to make a lot of money for themselves.

The serious truth:

Stock options were not a new development in the early 1990s. However, they became a much more important part of corporate compensation plans as a direct result of the Democrats' exploitation of class envy by disallowing any tax deduction for salaries of corporate executives of more than one million dollars per year. As always, the Dims exempted this rule from applying to their leftist pals in the entertainment industry.

As always happens when tax laws are changed, people and companies change their behavior in order to minimize their personal pain. Stock options as an alternative to salaries over a million dollars were as natural an answer as any I can think of. Because stock options are worth more based on the market value of the stocks, executives often took shortcuts (aka creative accounting) to give the investment world the false impression of higher profitability than existed. It doesn't take a rocket scientist to connect these dots.

KMK

Investment Advice

A good friend from the Bay Area, Bruce Howland, who has been an active stock trader for the past few years, passed on this bit of advice.

If you had bought $1000.00 worth of Nortel stock one year ago, it would now be worth $49.00.

With Enron, you would have $16.50 of the original $1,000.00.

With WorldCom, you would have less than $5.00 left.

If you had bought $1,000.00 worth of Budweiser (the beer, not the stock) one year ago, drank all the beer, then turned in the cans for the 10 cent deposit, you would have $214.00.

Based on the above, my current investment advice is to drink heavily and recycle

Ironically, Bruce's second avocation, music, is now starting to look like the more dependable and less risky one. His group, The Living Water Band, has its own section on mp3.com. They describe themselves as Christian Country. With Bruce's mandolin, it also has a touch of good ole bluegrass.

Fortunately, Bruce's daughter, Catherine has inherited his passion for music instead of gambling in the stock market. I downloaded some songs from her section on mp3.com and was very impressed. Her music is completely original; but does remind me a little of Jewel. Catherine, who also has her own stand alone web site, definitely has a much more dependable and lucrative future ahead of her in the world of music than in stock trading.

KMK

Friday, July 19, 2002

Gambling With Retirement Dollars

With so many people taking it in the shorts with the decline in the stock market, I just wanted to cover a few of the most common questions that come out in times like this. For those of you who are relatively new to stock investing and are experiencing your first big market downturn, welcome to the real world. These cycles of up & down have happened since the beginning of time and if you were under the impression that the stock market was a guaranteed no-lose proposition, consider this to be your lesson in Investing 101. In spite of what our former president & his worshippers claimed, he did not permanently erase business & market cycles.

Retirement Accounts

Whenever market values decline, people want to know how they can deduct the losses for their retirement accounts decreasing in value. I have to break the news that no such immediate tax deduction is allowed. I have never been shy about pointing out unfair aspects of the tax laws; but this one is perfectly legitimate, which I will explain.

Deductible losses are based on the amount of your cost basis in the asset. Pre-tax retirement accounts, such as IRAs and 401Ks have a cost basis of zero for income tax purposes. They are designed to produce taxable income when the funds are withdrawn, normally during your retirement years. If these accounts are heavily invested in risky stocks, you will actually receive a kind of tax deduction later on because there will be less money to withdraw and pay taxes on. This is why I have always advised conservative investments with retirement accounts.

A related subject is the taxation of capital gains in retirement accounts. All withdrawals from retirement accounts are subject to ordinary income tax rates, even if the funds were from long term gains. This is a big difference from investments made with after-tax dollars. In those cases, long term gains (assets held over 12 months) are subject to lower income tax rates. You should keep that in mind when deciding whether an investment should be made with a pre-tax retirement account or with your own money.

Capital Loss Limits

Here is a very big and very unfair double standard in the tax code. If you have an overall net capital gain for a year, it is all added to your other kinds of income and subject to income tax, with no dollar limit. On the other hand, if your capital losses exceed your capital gains for the year, the most you are allowed to deduct on the current year's 1040 is $3,000 per person or per couple (marriage penalty). The unused losses are carried over to your next year's Schedule D, where you can use them to offset gains earned during that year. Again, only a maximum net loss of $3,000 can be used to offset other kinds of income per year.

Suppose, you have a net capital loss of $300,000, which I have seen on some actual tax returns. How long will it take to use up all of the extra $297,000 of excess losses? While they can technically be carried forward indefinitely, that really isn't the case. What if the person passes away before s/he has utilized all of his/her capital losses? Can those unused losses be passed on to his/her heirs? Nope.

If you agree that this is adding insult to injury to investors, I can only encourage you to contact your elected rulers in DC and tell them how you feel.

KMK

One Set of Books

Victor Canto has some good ideas here. Rather than add so many new rules for corporate bookkeepers that they end up needing to maintain three completely different sets of books (for investors, IRS & regulators), he recommends that the figures given to IRS be the sole figures to report a corporation's finances. Sometimes, the simple approach is the best.

KMK

Life's Certainties

This is the comic from the New Yorker that was mentioned in Tom Herman's Wall Street Journal Tax Report yesterday.

Thursday, July 18, 2002

Just Say No To New Laws

I hope more and more people get the message, as described in Forbes, that the stock market will heal itself if our rulers in DC keep their hands off. New laws and regulations will only succeed in making things worse. Consistently, whenever our rulers try to fix a problem, it's as if they are aiming a bazooka at it. Unfortunately, it's always aimed backwards.

KMK

Lies About Social Security

Would the Democrats actually stoop so low as to tell outright lies about the Social Security system? Does the sun rise in the East? Scaring everyone by claiming that they will lose their benefits if any changes are made to the system is standard practice for the JackAss Party. They even tout phony "scientific" studies to back their case.

The main reason they continue to get away with these lies is the very real and very overt bias in the mainstream media, who act as nothing more than the propaganda arm of the Dims. Unfortunately, most people in this country - especially senior citizens - are too trusting of the media. Many of them can still remember when journalists actually acted as a check & balance on the government by assuming the duties of a quasi fourth branch of government. The concept of the media colluding with one political party and intentionally distorting the news is unfathomable to them.

KMK

Wednesday, July 17, 2002

Act In Haste, Repent In Leisure

What are the chances that our rulers in DC will be able to take Jonah Goldberg's advice and resist the urge to pass a lot of idiotic laws in response to the corporate accounting scandals and let the market deal with it on its own?

Fat chance of that. As always, they will succeed in making everything much worse, as they do every time they try to simplify the tax system.

KMK

Counting Chickens Too Soon

David Broder confirms my explanation of how the Federal budget estimates were based on bogus assumptions of capital gains taxes.

Such figures are impossible to predict with any accuracy, which is why any official forward looking figures from DC should be ignored. They are completely fictitious. This is why I have always been a supporter of using dynamic analysis to predict the effects of proposed changes in tax laws. The static analysis that our rulers do use makes the idiotic assumption that changes in the tax laws have no effect whatsoever on the behavior of us working slaves. Nothing could be further from the truth.

KMK

Tuesday, July 16, 2002

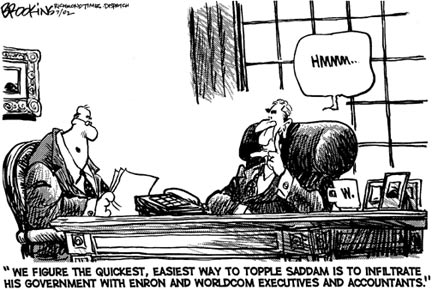

Lectured To By Cartoons

The very idea of our rulers in DC dictating how corporations should be run and how to deal with the bad apples makes me think of the Keystone Kops. This more contemporary comparison to Dudley Do-Right is just as valid and will probably be understood by more people. We could probably even come up with plenty of even more modern examples, such as Mr. Magoo and Homer Simpson.

We'll know that we've hit the extreme of idiocy when they appoint a special blue ribbon committee to investigate corporate wrong doing. An appropriate chairman would be Dan Rottenkowski, who was the Chairman of the House Ways & Means Committee for several years, prior to his stay in prison for fraud and other criminal mischief.

KMK

Monday, July 15, 2002

Sunday, July 14, 2002

It Takes One To Know One

Even the AP is picking up on the hypocrisy inherent in the outrage our rulers in DC are expressing over the creative accounting in the corporate world. They even give some examples of the shell games that our rulers routinely play with the Federal budget, on a scale that dwarfs any corporation. Any corporate executive who tried any of the tricks our rulers use would be in prison for a very long time.

While this exposure is good to see, I do have serious doubts as to whether there will ever be any changes. The same crooks keep getting reelected every time.

I had high hopes for fellow MBA George W. Bush to start cleaning the DC cesspool; but these are fading fast. It seems that his solution to every problem is more agencies and bureaucracies that will just compound the problems. Giving more money & power to the same incompetents who caused the problems in the first place has historically been the DemonRats' answer. Is Bush so concerned about not being another one-term president that he is willing to morph his administration into what an AlGore presidency would have looked like?

KMK

Dealing With Spam

Checking e-mail has become a much more time consuming process lately, with all of the viruses and spam filling in-boxes. Rather than just download our mail into our main Eudora e-mail program, we first look over the in-box contents via Mail2Web. It's not uncommon to delete over three-quarters of the messages before even starting up Eudora.

Dave Barry has a good take on this spam influx in today's column. While he claims that if he were to meet an actual spammer face to face, he would take him to lunch at his company's industrial waste cafeteria, I'm not so sure I would be as polite if I ever meet one of these low-lifes. A swift kick to the groin would be an irresistible reflex reaction. In fact, I'm amazed that we haven't had more vigilante justice to deal with these spamming scumbags. A visit to their computers with a baseball bat would do wonders for reducing the outgoing volume.

KMK

Not Tax Filing Exempt

Just because an organization is recognized by IRS as exempt from taxation doesn't mean that no tax returns have to be filed with IRS. In fact, as this rescue unit in Alabama discovered, there are very steep IRS penalties for not filing their 990 forms. They were nailed with $57,000 of penalties for not filing since 1997.

Filing requirements do vary; but normally a 990 is required to be filed with IRS if the organization had gross receipts of more than $25,000 during the year.

KMK

Estate Tax Debate

I hope this article is true, that the issue of the estate (aka death & inheritance) tax will be a part of the campaign process before the elections this November. Let's see if anyone has the guts to point out the true source of the estate tax.

KMK

Latest Victims

The media are wasting no time in trotting out poor helpless victims of the stock market decline. I don't mean to seem heartless, but this is nothing new. The stock market has always had risks. Anyone who believed the Clinton lie (perpetuated by his sycophantic worshippers in the media), that the stock market would always go up, deserve the losses they are now faced with.

Stupidity should have a price such as this or else nobody will learn. The fact that some idiots put their retirement plans on the roulette wheel of speculative stocks is their fault, pure & simple.

KMK

Remembering Our Pets

One of the most complicated areas of our profession deals with estate planning. This is the one area where competent professional assistance is essential because there are so many variables to address and it is so easy to permanently screw everything up.

For those of us without any human offspring, the main issue is who to leave our worldly possessions to. If we have non-human companions (aka pets), how do we make sure that they will be cared for after we leave? While many people may ridicule this idea, I am glad to see more people taking formal legal steps to establish trusts to see that there are resources available to care for the surviving pets.

The biggest concern is with a conflict of interest with the remainder heirs, who are named to receive the remaining estate after the pet passes away. How do you protect against those heirs speeding things along?

KMK

Saturday, July 13, 2002

IRS Violating Privacy Rights

I'm glad to see more coverage of the IRS's underhanded and illegal tactic of publicizing the confidential income tax data of private citizens. Here's a story in the Washington Post, and another in the Sacramento Bee.

Now is the time to let our rulers in DC know that this will not be tolerated. Stay quiet and don't be surprised if everyone has a chance to examine your personal tax returns.

KMK

Big Surprise

It never ceases to amaze me how stupid so many of our rulers are in regard to human nature. They just love to tack on new taxes and fees and are shocked that people will take steps to avoid paying them.

I've never been a smoker; but have long been amazed at how they allow themselves to be so persecuted. How can it be news to anyone that the huge extra taxes being aimed at smokers will result in smuggling from low tax states? I'm just surprised that more smokers aren't growing their own tobacco.

KMK

Bone-Headed Forecasts

Emily Sedgwick has a good explanation of why the State governments are faced with unexpected budget shortfalls. As I've explained several times before, State & Federal government budget forecasters are complete idiots who would never succeed in the real business world.

They took a windfall year of tax receipts, when the stock market was going gangbusters and people were reporting huge capital gains and extrapolated that those kinds of gains would continue forever. As I said a few years ago, when I explained why all government budget forecasts are pure garbage, this is the same as someone who happens to win a lottery or a big casino jackpot adjusting his spending patterns under the assumption that he will continue to win the same amounts year in and year out.

Why shouldn't the government accountants assume that tax revenues would be consistently high for as long as could be imagined? Their spiritual leader, Bill Clinton, proclaimed that he had tamed the business cycle, so that markets would always go up and never go down.

KMK

Is Accounting An Art Or A Science?

People often ask me how I could survive in the supposedly boring cut & dried accounting profession for so long. I have to explain that accounting and tax work have always had a lot of room for creative efforts. Some of the less legal creative efforts have made the national news recently.

It's well known that a dozen different tax preparers can take the exact same set of facts and come up with well over a dozen completely different looking tax returns. That is why I have always considered the tax returns I prepare to be works of art, requiring a lot of time and consideration.

It also means that this spoof from SatireWire, claiming that the U.S. Supreme Court ruled that corporate earnings statements should be protected as works of art, since they "create something from nothing," isn't as far fetched as it may seem at first blush.

KMK

Fear Mongers Are Out

Every time the stock market has problems, the fans of big government use that as an argument against any attempt to change the Social Security system. Their arguments are wrong on several levels; but I only have time to cover a few here.

First is the assumption that any money diverted from SS would automatically be invested in the kinds of speculative stocks that have suffered. I'm sure some idiots would do that and they would deserve any loss from such a stupid move. Most people would invest the money more wisely. A savings account would still be preferable to the SS Ponzi Scheme. While it may not make a spectacular return, it will still be real money that can be left to heirs; something that is not possible with the IOUs in the imaginary nonexistent SS trust fund.

These assume that money is deposited in actual retirement accounts. While that may be Bush's plan for changing the program, that isn't the most effective way. In fact, it's not even necessary to wait for our rulers to make any changes. The opportunity has already been available for decades.

For example, I was speaking with some new clients a few days ago on how setting up a new C corporation would enable them to very easily reduce their personal SS taxes by anywhere from $10,000 to $15,000 per year. They are in their late 40s, early 50s. Over the next 20+ years, the amount of money they will not have flushed down the SS toilet will amount to a huge sum. We won't waste time crying over the hundreds of thousands they already flushed away.

I wouldn't expect them to put that money into an actual account anywhere. Instead, they will invest it into their business or possibly buy some real estate. When time comes to retire, I can guarantee that they will be many times better off than if they had sent that $10,000 to $15,000 per year to DC. Contrary to Socialist Missouri Congressman Dick Gephardt's advice from his imaginary billionaire friend to invest in SS, I would trust just about anybody to do a better job controlling their own money than our rulers in DC would. As the messiah of big government, Bill Clinton, said in a speech about possible tax cuts, "the people are just too stupid to know how to spend their money." Only he and his fellow travelers know how to spend it wisely.

A big misconception I often hear is when people moan about not having a retirement account. They envision being destitute in their later years if they don't have an actual bank account sitting there waiting for them. This isn't true. All assets a person has are essentially their "retirement account." They can sell them off or borrow against them and use that money.

Real estate is still the best long term reliable investment I have ever seen. I have seen so many people do quite well for themselves by buying a rental property each year until about the time they reach 60 or 65. They then sell a property each year and carry back the paper. The cash flow they receive each month makes Social Security benefits look anemic in comparison. And as I have said countless times, the properties and the notes that are left behind when they pass away are real assets that can be passed on.

KMK

Friday, July 12, 2002

So Much For IRS Confidentiality

Nobody seems to be picking up on a much bigger & scarier issue with this story about the news that certain people have been using tax shelters that IRS doesn't like. The income tax system is based on a degree of privacy & confidentiality. People are supposed to reveal their financial matters to IRS with the understanding that it will not be made public. IRS has violated this understanding in a big way here.

Whether you agree with what these people have done or not is beside the point. How would you like it if all of your personal tax info were opened up to the public for scrutiny and ridicule and use by political opponents?

If IRS is allowed to get away with this approach of trying to publicly humiliate people by revealing their tax returns, it will reduce their already low regard even further. This will only result in less disclosure to IRS. People won't stop doing these kinds of things. They will just set up additional layers of organizations to hide behind.

I encourage anyone who is as upset about this underhanded IRS strategy to let your elected rulers in DC know that they must take action right away to cease all such disclosures. If this isn't nipped in the bud soon, don't be surprised if your personal tax info finds its way onto the front page of your local paper in the near future.

KMK

Thursday, July 11, 2002

State Tax Refunds

A while ago, I commented on the fact that the State of Missouri was short on cash, making people wait for their income tax refunds. I predicted that more states would be trying this trick.

According to this story, Illinois is in the same boat as are several states in regard to much lower tax revenues than their crystal balls had foreseen, and is making people wait. However, rather than wait until the next wave of expected estimated tax payments arrives in Springfield, the Illinois rulers are borrowing money to come up with the refund cash. That's only right because it's what a person would be expected to do if s/he owes money to the State.

This is also a very clear reminder of how stupid it is to overpay your taxes and expect a big refund check next year, as far too many people do.

KMK

Wednesday, July 10, 2002

The Pot Calling the Kettle Black

I'm glad to see so many others pick up on the sheer hypocrisy of our rulers in DC lecturing corporate executives on proper accounting techniques.

New Secret Weapon

I told you that we accountants have now become a prime target of jokes. It promises to be a funny Summer.

Pay To Be On Scam Reality Show

I happened to open a piece of spam that was an invitation to apply to be on a new reality show called Rally Racer, where contestants can supposedly become race car drivers and compete for a million dollars.

When you check out their website application, they are requiring that applicants pay them $11.95 now by credit card or $14.95 by online check. I'm sure the discount for using a credit card is because it allows the scammers to make future charges against the card.

With all of the people in this country desperate to be on TV, it's a good bet that they will rake in a ton of money before the authorities shut this scam down.

KMK

Not Going To Take It

Too many of the people in power, at all levels of government, are under the impression that they can just arbitrarily raise taxes & fees on various groups with complete impunity. That's why it makes me happy to see the victims of new taxes fight back, such as these department stores in New Jersey, who will move more of their operations out of that state in order to avoid a new tax aimed at them.

If enough tax targets of over-reaching government rulers will take explicit action against unreasonable taxes, rules & regulations, I'm hoping the real people will eventually wise up and kick those jerks out of office.

I have been reading about how the rulers in my former home state, the PRC (People's Republic of California) are demanding that the auto manufacturers only sell vehicles that put out a ridiculously low level of emissions and get impossibly high miles per gallon. My dream is that the car companies will tell the PRC despots to stick those rules where the sun doesn't shine and refuse to sell any new vehicles in that state. Sooner or later, the people will demand that they be allowed to buy those vehicles and will boot their rulers out the door.

This is a good illustration of how to deal with tax laws that we don't like. Rather than just refuse to comply with them, as the tax protestors I so often discuss advise; there are two better ways; which will keep you out of prison. First, you can arrange your matters so as to legally avoid the taxes, such as move your operations to a less hostile jurisdiction. The best way is to go to the source and have the law officially changed by our rulers, which most often will require electing new ones who respect the Constitution.

KMK

Tuesday, July 09, 2002

Corporate Tax Returns

Bruce Bartlett expands on my earlier comments on the different accounting methods used by large corporations on their income tax returns versus the financial statements that are provided to investors. He has some additional good ideas to ponder.

Statistics

The US Commerce Dept's GDP (gross domestic product) statistic, one of the most often used barometers of the nation's economic activity, is compiled from data that had been submitted to IRS. On the other hand, the S&P (Standard & Poors) 500 earnings reports are based on the investor financial statements as submitted to the SEC. In an ironic twist, this means that the GDP figures are actually the more accurate representation of true corporate profits because corporations do everything they can to tell IRS that their profits are truly as low as possible.

Release Corp Tax Returns

Because of the more accurate nature of corporate tax returns, Mr. Bartlett recommends that corporations be required to open them to the public as a condition of being listed on the major stock exchanges. As someone who prepares several corporate tax returns each year, I had to mull this idea over for a bit. At first blush, tax returns are privileged information between the taxpayers and the IRS and the public has no business prying into it.

However, on the other hand, stockholders of a corporation are entitled to complete fiduciary responsibility by the corporate officers. When I prepare corporate returns where there are multiple stockholders, I have always taken for granted my obligation to make copies of the returns for each owner. When a person is considering the purchase of a small corporation, some of the most essential documents to review are previous corporate income tax returns. Extrapolating out to the world of huge corporations, any investor or potential investor should be entitled to the same level of disclosure.

KMK

Monday, July 08, 2002

Where Does the Money Go?

With all of the talk about the decrease in the value of the stock market and the huge losses that people are suffering, I thought I would share the following question & answer from a few weeks ago on AskMe.com.

The point is that the wealth that disappeared never really existed. The way the numbskull media are reporting things, you would think Martha Stewart and her gang of delinquent CEOs were breaking into old folks' homes and stealing the cash that they had stuffed under their mattresses for their retirement years.

Anonymous asked this question on 6/21/2002:

When the stock market drops significantly, such as the drop for the past two years, there are a lot of investors losing money. Where did the money go? I know before the market drop, the high price level was supported in part by margin buys. Therefore, the high price level is partially inflated by margin loans. However, for the past two years, it is said that trillions of dollars disappeared in the stock market. After the margin factors are adjusted, where did the trillions of dollars go? Do the trillions line up the pockets of some smart investors who took the money out before the market plunged?

TaxGuru gave this response on 6/21/2002:

You are confusing cash and wealth. The value of the stock market isn't actual cash. It's just an estimate of what people would pay for those shares at a certain point in time. If those perceived values decline, the overall value of the stock market drops accordingly. No cash changes hands.

It's the same with other assets, such as real estate. If your home is considered to be worth $200,000 today and its perceived value drops to $150,000 next year, your wealth will have decreased by $50,000. However, nobody is receiving that $50,000 in cash.

It's the exact same thing with the stock market. Perceived values don't equate to any actual money changing hands.

Kerry

Saturday, July 06, 2002

QuickBooks Resources

I am such a big fan of the QuickBooks programs that I am devoting an entire section of my main website to it. Since I have to do all of the website stuff myself, this area is as far behind as so many of my other projects. However, I was finally able to set up a page with links to some handy resources for QuickBooks users; online discussion boards, file transfer utilities, and password recovery programs.

If you have ideas for other resources that should be included in this section, please drop me a line. Please include hyperlinks whenever possible.

KMK

Friday, July 05, 2002

New IRS Study

IRS has let out the fact that they need to do detailed examinations of 50,000 tax returns in order to update their info for profiling of potential tax cheats. This is the same program that was cancelled a few years ago after IRS and Congress received so much flack over the plan and the IRS morons, in the most ridiculous example of negotiating strategy, threatened to call them off if Congress refused to allocate more money for IRS.

Basically, the 50,000 tax returns to be selected will be chosen from the earliest ones received, and will proportionately represent all types of returns. Because most tax returns are 1040s, they should represent 90% or more of the returns selected.

50,000 returns out of the 100 million returns filed every year is a small percentage; but even that possibility is too scary for many people. It's like the "being hit by lightning" analogy. My advice is the same as it was last time. We prepare the returns as early as we can, especially if there may be some taxes due, and then we file extensions (with payments if needed) to put off the actual date that IRS actually receives the return until 8/15/02 or 10/15/02. The only downside will be for those people who are overpaid and need the refund money. The only way we can get that back is by submitting the actual tax return.

For more details, see IRS News Release 2002-05(News Release IR-2002-05) and IRS fact sheet (News Release FS-2002-07) on the National Research Program.

The best explanation of this I have seen so far is this one from Tom Herman of the Wall Street Journal.

Although IRS admits that this is a research project for its benefit, they haven't changed their policy of requiring the lucky selectees to foot the bill for their professional representation, which could run into several thousand dollars. That is plain wrong on so many levels that I would encourage anyone concerned about this to lobby their elected rulers to require IRS to reimburse for these fees. It is true that IRS is using very out-date statistics in its tax cheat profiling and should update that data. However, why should innocent people be forced to pay for that out of their own pockets?

KMK

Swearing That Numbers Are Accurate

Here's an interesting concept, having the CEOs of big corporations sign affidavits, under penalty of perjury, that their financial statements are accurate. I'm sure most people thought this was already being done; but there have been so many ways for the top execs to deny responsibility for the numbers, that this is a good step in the right direction.

This doesn't sound any different from the penalty of perjury statement that we sign on our tax returns before submitting them to IRS.

In actuality, it may not make a lot more difference because it will only apply to corporations with over $1.2 billion in annual revenue. Companies that big have such large accounting departments and multiple levels of bureaucracy that it won't be difficult for the CEO to effectively deny any knowledge of the details of the figures.

KMK

Wednesday, July 03, 2002

Donating Stock To Charity

Gary Klott has a good introduction to the concept of donating capital gain assets to charity.

However, this is a perfect example of where you should work with your tax advisor to crunch the numbers with your tax situation because there are far too many variables for there to be anything close to a one size fits all strategy.

For example, capital loss carry forwards should play a big part in a decision as to donating appreciated stock or selling it and reporting the gain. A few minutes ago, I finished an income tax return where there is a capital loss carry forward of over $68,000. That client can literally receive up to $68,000 of capital gains tax free in the next tax year; so a donation may not be the best approach.

KMK

Phony Figures

As I have explained on so many occasions, the numbers that are used by the media and our rulers in DC when discussing taxes and the Federal budget are treated as gospel; when in fact, they are completely fabricated using phony assumptions and other techniques that make Arthur Andersen's tricks pale in comparison.

Here, Bruce Bartlett shows how such phony numbers have been used in the current discussion of the cost to the Feds of a permanent repeal of the estate tax.

It's very revealing of the mindset of those in power that any portion of our own wealth that we are allowed to retain is considered to be a cost to the government. The implication of that is no different than in communist countries, where they are just slightly less subtle about the fact that everything belongs to the omnipotent central government.

KMK

Root of Big Government

Just because I don't believe that the suspicious circumstances surrounding the ratification of the 16th Amendment justify refusing to file income tax returns, doesn't mean I approve of the amendment. I have long supported that it be formally repealed.

As this article explains, the power it gave to our rulers in DC is directly responsible for the unconstitutional growth in the size, power and cost of our Federal government, all of which are completely at odds with the original intentions of our founding fathers.

KMK

Cooking The Books

I have mentioned several times how hypocritical it is for our rulers to be shocked by the creative accounting tricks coming to light from WorldCom, Enron, Xerox, et al. Here, Walter Williams explains how our rulers in DC are hiding more than $30 trillion of debt in much the same way as Enron was doing. Which scheme do you think affects more people in this country, Enron's or Congress's?

KMK

Current Extensions

Most people know that the extensions (Form 4868) they filed for their 2001 1040s expire on August 15, 2002. If you need more time, just send in Form 2688 by 8/15/02 and IRS will give you two more months (until October 15, 2002).

What often sneaks up undetected is the deadline for partnership, LLC, trust & fiduciary tax returns (Forms 1065 & 1041). The first extensions which were filed back before April 15 for these types of returns were only for three months. That means they will expire on July 15, 2002. Not to worry. IRS has forms to allow another three months of time (until October 15). Why the geniuses at IRS don't make all extensions consistent (four months for the first and two months for the second) is a mystery.

If you need three more months for your 2001 partnership, LLC, or trust tax return, file Form 8800 with IRS by July 15.

If you need three more months for your estate fiduciary tax return (Form 1041), file Form 2758 with IRS by July 15.

2000 Tax Returns

Due to several personal emergencies, as well as computer virus & other problems, I am still behind in finishing off a number of 2000 income tax returns. I am trying my best to get them out ASAP. As I explained earlier, because of the current war, these aren't officially delinquent until after October 15, 2002.

As always with the IRS, their right hand doesn't know what their left hand is doing and they have been sending out erroneous late notices for 2000 tax returns. Those can safely be ignored.

KMK

Tuesday, July 02, 2002

Does Giving Away The Loot Cancel Out The Crime?

If a friend of yours robs a bank and gives you some of the money, are you off the hook if you donate an equal amount to a charity after the police track you down?

Our rulers in DC think that strategy works as they try to distance themselves from the campaign contributions (aka bribes) they received from the corporations that were caught cooking their books.

KMK

Can't Please Everyone

As happens every time I expose the idiocy of the various tax protestor arguments, I am attacked and labeled as a fan of the IRS by their cult-like followers. It really cracks me up because, for decades, I have been one of the most outspoken critics of the IRS in the country. However, there is a big difference between working within the system, as I have always done, and advocating breaking the laws, as the tax protestors do.

This almost balances out the harsh criticism I receive all the time for being "unpatriotic" because I help people legally reduce their taxes. None of my clients has ever been charged with any criminal tax violations; a claim the tax protestor promoters can't make since they and their clients are filling plenty of prison cells. Who should you trust?

KMK

Tax Protestors

It's time again for one of my periodic warnings against following the alluring siren song of tax protestors. There are literally dozens of them, most of them with their own websites. Luckily, this number is finally starting to drop, as IRS stops ignoring them and tosses them in the pokey.

That is why I always make a big distinction between reducing taxes through creative and aggressive interpretation of the tax laws (what I do) and the illegal evasion of the tax laws by such promoters as Irwin Schiff and Bob Schulz (to name just a few). Bob Schulz is currently on a foolhardy campaign to encourage everyone to refuse to file tax returns and employers to refuse to withhold taxes from their employees' paychecks. Anyone following this stupid advice will deserve their prison stays.

I have written very long analyses of the tax promoter arguments before; so I will just summarize the most popular ones here.

No Conflict of Interest

While some people may think that I am defending the IRS and the current tax system in the USA as a means of job protection for myself and fellow tax practitioners, nothing could be further from the truth. I have always been very vocal in my support for the platform of the Libertarian Party, including the absolute elimination of all income and estate taxes. However, we need to bring about such a change through the normal legislative process. Just refusing to obey the laws that we may disagree with, as the misguided Bob Schulz advocates, will accomplish nothing more than earn Mr. Schulz and his followers room & board in the Federal Grey Bar Hotel.

Taxes Are Voluntary

Irwin Schiff has received a lot of publicity with this idiotic limited reading of the tax return instructions. He and his cohorts read that the US tax system depends on voluntary compliance and interpret it to mean that we have a choice as to whether or not to voluntarily file all of the required tax forms. What they ignore is the rest of the story, as Paul Harvey likes to say. If someone refuses to voluntarily comply with their tax reports, IRS is more than willing to do it for them and take extremely aggressive actions, up to and including deadly force, to get the money they think the US government is owed.

Taxes Are Illegal

Many tax protestors, such as Bob Schulz, Joe Banister and WorldNet Daily, have stuck their lives on the line based on the assumption that the 16th Amendment was not actually properly ratified back in 1913. As I have said before, I have reviewed some of the documentation for this argument and believe that they make a fairly convincing case. However, any argument that the amendment was improper should have been made back around 1913; not 80 to 90 years later. It has been accepted as law for too long by too many people to now claim that it is illegitimate. It has in effect been de facto adopted by the American people long before most of us were born. Again, it would require a new constitutional amendment to repeal the 16th.

Bob Schulz & his ilk are living in a fairy tale world. I have never been shy about pointing out examples where our rulers in DC routinely violate the Constitution, especially when it involves tax money. I wish with all of my being that our rulers would take seriously their vow to protect & defend the Constitution. However, we need to be realistic and deal with the real world with the people who are continuously elected and sent to DC to rule our lives. Acting as if the reincarnation of George Washington and Thomas Jefferson were currently in power is just nuts.

I have worked with several cases over the past few decades, trying to untangle the messes misguided tax protestors created for themselves. The ironic thing is that, in every single case, when my staff & I prepared the tax returns, the clients ended up owing much less than the IRS was claiming, and in most of them, would have been due refunds. However, in many of those cases, the IRS double standard kicked in. While an IRS debt lasts forever and beyond, a request for refund must be made within three years or else the overpayment is forfeited to the government. I've seen clients lose thousands of dollars because of this.

In Conclusion

While there may be some tax protestor promoters who sincerely believe their arguments will succeed, most of them have been around long enough to see what the results are for anyone following their advice; prison. Why Irwin Schiff has any credibility, after spending so many years in prison for tax evasion, is a mystery to me. Of course, any country that heeds family values advice from the likes of Hillary Clinton obviously can't expect to come anywhere close to an ability to distinguish between right and wrong.

KMK

Monday, July 01, 2002

Latest Discrimination Victims

One of the never-ending quests Sherry & I have long had is trying to make our forms & paperwork idiot proof. Every time we think we've gotten close to accomplishing this goal, along comes a bigger idiot. You don't know how disheartening it was to read Jonah Goldberg's latest, on how colleges are dumbing down the SAT so as to not discriminate against stupid people.

KMK