Sec 179 For Truck

Q-1:

Subject: Sec. 179Dear TaxGuru,My husband and I have two sole proprietorships that is offset by his regular job salary. One is a farm that does not make money, but keeps vets and blacksmiths busy and the other is a new classic car business. We purchased a Ford F350 truck with crew cab that weighs 13000 lbs for the purpose of both businesses.Does this truck qualify for the full purchase price of $47,000 to be written off in one year under the Sec. 179 2005 rules. The truck was modifed to handle a gooseneck horse trailer, but also serves to pull a car trailer for restoration projects.I am thinking that if the full amount can be written off, I should put it under the farm as farms are recognized as not money makers. However, do I have the option of splitting the truck's cost between the two companies. Expenses are greater that profits for the car business as it takes a long time to restore the cars, find them, etc. The farm could show a very modest profit ($1,000 or so) if I do not use all allowable deductions.What is your suggestions, recognizing that I should consult a tax pro.Thank you.

A-1:

Check out this post from last month.

Any deductions for the truck would have to be allocated to the various business schedules that you are using, based on miles driven.

If you are actually using the same facilities and equipment for both your farming and car operations, you should consult with a tax pro as to the feasibility of combining them on the same business schedule with your 1040. It makes things a lot easier than having to split everything up. That's what I have been doing here for the past 12 years we have been living on this ranch for pretty much all sorts of different kinds of income (including sales of animals, hay, timber, jewelry and ceramics), except for my CPA work. IRS has never had any problems with that.

Good luck.

Kerry Kerstetter

Q-2:

Kerry,Thank you for your quick response. It sounds as though I should put the truck on the car business where the miles are at this time. This would prevent me from reporting the mileage deduction, so do I need to show business miles in order to support the truck?I wanted to confirm that my Ford F350 Crew Cab with a normal bed that a sheet of 4x8 plywood can fit into qualifies in 2005 for the full deduction of $47K?Thanks again.

A-2:

As you noted earlier, you really need to be working on matters such as this with a tax pro so that you don't screw things up on your own.

One of the most basic requirements for the Section 179 deduction is that the asset be placed into service before the end of the tax year. For vehicles, this means that it must be driven for business reasons.

You will need to get the specs for the truck you are looking at and compare them with the dimensions as specified in the tax law for qualifying for the larger deduction. In the post that I sent you earlier, the defining point was the length of the truck bed. I researched that specific case because it was for a long-time client who actually paid me for that time. I do not have time to do this for you; especially right now, as we close in on the April 17 crunch date.

I would be very careful of relying on the dealer's claim that the vehicle meets the specs for Section 179. I have seen dozens of cases where they will say anything the customer wants to hear just to make the sale, and the buyers are left holding the bag later on when they discover that the vehicle in fact didn't meet the requirements, most often for the 6,000 pound weight threshold; but the bed length is also a key factor. Needless to say, car dealers aren't exactly known for standing behind their tax opinions when push comes to shove. You would be much safer working with a tax pro who can make reliable determinations.

Good luck. I hope this helps.

Kerry Kerstetter

Labels: 179

Changing Between C and S Corps

Q:

Subject: S corp vs C Corp - HELPHi Kerry,Thank you for the information. I had started working with an accountant last year that told me some of this information (about C corp vs S corp), but she was not a CPA and unfortunately she abandoned me during my incorporation (didn't return phone calls). She recommended I start as an C corp. I was a sole proprietor (chiropractic offices -2 ) and was being eaten alive by Self employment taxes and also owe a significant amount of back taxes that has been compounded since one bad year in 2001 during which I was out of my practice for a couple of months from surgery and recovery and during which ex- stopped paying child support. Now I keep paying back taxes and never getting caught up with current taxes.The accountant that abandoned me thought that the different fiscal years and the shifting of funds might help me get caught up. My new accountant didn't see things this way and changed me to an S corp in November. He had an entirely different rationale that had more to do with the double taxation. Frankly, I'm highly confused and not sure where to turn. He also said I could pay myself dividends and avoid some of the self employment tax.What is your role? Would you be able to look over my situation and make recommendations? and at what cost?Sincere thanks for any light you can shed

A:

It's not quite right that your accountant can change your corp from a C to an S on his own. You have to sign the 2553 to request that change.

It sounds as if you do need some competent assistance with. I wish I could help you; but I already have too many clients to take care of; so we are not accepting any new ones at this time.

Unfortunately, we don't have anyone else to whom we could refer you. If you haven't already done so, you should check out my tips on how to select the right tax preparer for you.

Good luck.

Kerry Kerstetter

Starting Date For Sec. 121 Exclusion

Q:

Subject: section 121Kerry, I saw your article on the internet and would value your opinion on the following situation. I purchased land to build on 2 years ago. I built the home and moved in 1 year ago. My mail has always gone to a PO box. Could I sell my home based on the land purchase, or does the date I turned on the power at the new residence start my 2 years? (I did not sell a home in the previous 2 years)Thank you for your time,

A:

The two years for qualifying for the Section 121 tax free exclusion begins when you both own it and occupy it as your primary residence. Unless you were living on the lot prior to and during construction (tent, motorhome, etc?), this couldn't be possible until you actually moved into the completed house.

Kerry Kerstetter

Follow-Up:

Thank you for your response. I just may contact you again if my accountant doesn't feel confident about these issues. I appreciate your time.

Depreciating Property In Trust

Q:

Subject: depreciating donated property

Hi Kerry,Thanks for sharing obscure versions of George Harrison's Taxman.

Hopefully this question will have a quick answer. I'll be brief.

Can a piece of real estate that is donated to a land trust be depreciated by the land trust over 27.5 years? The property is one acre of lakefront property on Lake Ontario with a single family residence. I'm attempting to calculate the real costs after taxes if the trust were to hold the property unoccupied.

Thank you for continuing to provide a valuable source of information.

A:

If it is trust that files 1041s, the building portion of the cost should be able to be depreciated during the time it is being used to generate income based on the value used for the transfer into the trust. Obviously no depreciation could be claimed while it sits vacant unless a sincere effort is underway to lease it.

I'm glad you like the TaxMan songs. Sherry found a new live version by Nickel Creek last week and I was thinking of posting it.

Kerry Kerstetter

New Free QB Password Removal Service

The latest Intuit ProConnection newsletter had an announcement of their new free service to remove passwords from data files. To use it, you need to upload your data file and provide your registration license number. It currently only works with QB 2005 and older versions of the program.

I haven’t used it and probably won't because I have been very happy with the speed with which I have been able to unlock QB passwords with the QuickBooks Key program from LostPassword.com. I have used it several times when clients forgot to send me their passwords, which I usually don’t discover until 10 or 11 at night, when I’m working on their stuff. Since there is no file uploading required; so it only takes a minute or so to unlock the files. Unfortunately, they still haven’t updated their program for QB 2006, which more and more of my clients are using.

I have added info on this new free service to the QuickBooks Resource page on my main website.

Early Home Sale

Q-1:

Subject: Question on sale of primary residence owned less than 2 years

We are possibly in a situation where we may sell our primary residence that was purchased Jan. 6th, 2005. My wife (who was only applicant on the mortgage) is pregnant and has been forced to bed rest for a short period of time. She is a physician although not necessarily the primary wage earner, but due to bed rest is unable to 'moonlight' which drops here gross monthly income by roughly $4500 per month.Is this a qualifying circumstance to get a prorated discount on tax on sale? We purchased the home for $540,000 and are looking to sell for between $750k and $825k.Thank you in advance for your assistance.Sincerely,

A-1:

While it may be possible to justify the use of the prorated exclusion based on your description, I would feel nervous about your use of the term "short period of time" for the disruption in your wife's income flow. That would be a harder case to make than a long term reduction in her income due to the need to take off from work for the pregnancy and the post natal time to raise the baby. IRS could say that a short-term interruption in income could be dealt with without having to actually sell the home, while a longer term reduction would be a valid reason to sell.

You'll need to go over your facts and circumstances with your personal professional tax advisor to see if s/he will feel comfortable with claiming the prorated exclusion. If you do decide to claim it, attaching an explanation of the facts to your 1040 will make it slide though with less opposition from IRS.

Good luck. I hope this helps.

Kerry Kerstetter

Q-2:

Thanks for the advice....By the way what is the tax rate on a sale of property owned from 12-24 months?

A-2:

That would be taxed as a long term capital gain, which is a nominal rate of 15% for the Federal. The actual effective rate will be much higher due to the penalties applied to people with high AGI.

I have the 2006 Federal rates on my website.

State rates differ.

Kerry

Resources For Small Businesses

From WSJ’s free Startup Journal

A look at some small business accounting programs, including my long time favorite.

A list of recommended reference books.

The Feds continue their long, slow crack-down on charlatans in the tax prep community, as well as the people stupid enough to use their services.

North Carolina preparers using fake numbers

New Hampshire prepare of frivolous returns

Florida promoter of disabled access telephone tax scam

Cashing In T Bills

Q:

Subject: Zero Coupon Treasury ReceiptI received the proceeds from an expired instrument purchased at Merrill Lynch, in November, which I reinvested in a 6-month CD with ING. This was (is) listed in my name for the benefit of my grandson. I never received any 1099s over the 15 years of its run, and I don’t know if I should declare this as income on my FED and State tax returns.Any advice most gratefully received,

A:

It sounds as if you are referring to a US Treasury Bill that was purchased at a discount. If so, you had the option of either reporting a pro-rata portion of the interest as it accrued each year, or waiting until you cash it in and report the difference between what you received and what you pad for it as interest income on your Federal Schedule B. It would be tax free for state income tax purposes.

While there are some opportunities to avoid tax on some of the income by using it to pay for certain kinds of education expenses, it doesn't sound like that applied to you.

You personal professional tax advisor can assist you in more detail with this.

Good luck.

Kerry

Follow-Up:

Thank you so much for your assistance! I spent two hours yesterday pouring over Pub. 550 and other IRS ppgs. becoming more and more confused. (My algebra is VERY rusty).

Back Property Taxes

Q:

Subject: Condo

Kerry,

I purchased a condo in 2005 at a sheriff's sale as an investment. I sold it early in 2006 for a profit. I did not live in the condo at all (I already own a primary residence). My understanding is the gain would be treated as a short term capital gain subject to the 25% tax rate. I would like to verify something my CPA told me. As part of the purchase, I paid off the former owner's delinquent real estate taxes (about $6,000). According to my CPA, this amount cannot be deducted as the IRS only lets you deduct real estate taxes for the time the property is owned. Is this correct, or is this something that is equivalent to an "investment expense" I could put on my Schedule A, subject to the 2% of AGE floor? Or could I add that amount to my basis to offset my gain on my 2006 taxes?

I did not do many upgrades or "capital improvements" to the property - mostly just painted, cleaned the carpets, etc. My understanding is this is also not deductible on my 2005 return and also does not reduce my gain on my 2006 return (i.e. it does not change my basis). Is that correct? Just looking for a check on my CPA. Thank you for your help and for the great site.

A:

You seem to be misunderstanding several key points here.

First, there is no special 25% Federal rate for short term capital gains. Those are taxed the same as ordinary income, which has nominal rates up to 35%, plus the implicit rates of the phase-outs due to high AGI.

When you buy a property for back property taxes that had accrued under the prior ownership, it has always been the proper thing to add the taxes to your cost basis of the property, which will reduce your gain when it is sold.

The costs you put into the property, including paint and cleaning, should also be added to the property's cost basis.

These are all very basic concepts that any competent tax pro should understand. If your CPA doesn't, you may need to find one who is more experienced with this kind of thing if you will be doing more of it in the future.

Good luck.

Kerry Kerstetter

Choosing A Business Entity

Q:

Subject: Thank youHello,

My name is … and I own a few small companies, I have sought to incorporate and have read quite a few of Robert Kiosaki’s books on business. They all lean to becoming a C corp but every CPa I have talked to have tried to veer me towards a S Corp.

I have stuck to my guns on the issue and have read as many books on taxes as I could on the issue and have believed that the C corp was right for me. Thanks to you I now have the backing of a professional CPA. It is a shame that there are not more of you out there.

Thanks again

A:

I'm glad you found my info useful. You should keep in mind that there is no one size fits all arrangement that works for everyone. In fact, for most people who have multiple businesses, the best overall strategy is often a combination of different types of business entity, including C corps, S corps, LLCs, partnerships, trusts and sole proprietorships.

Working with a professional tax advisor who has experience with this kind of thing is a must when you are involved with so many businesses.

Good luck.

Kerry Kerstetter

Sale of Gifted Home

Q:

Subject: Primary Residence Questions

My husband and I where recently gifted a home valued at $700K. I just learned that unless I create a permanent residency status, I would have to pay a huge tax burden upon the sale of the home.

I do understand that if I where a primary resident in the home together we can take a $500 credit and taxes would occur on everything over $500K

My question is can I live in a secondary rental, and still create a primary residence on this home.

MY documentation is needed to constitute a permanent residence.

I still want my mail to come to my secondary rental.

A:

While I do have an explanation of the rules for residence sales on my website, this is the kind of thing you really need to discuss in detail with your own personal tax professional.

There are a number of issues that you will need to discuss with your personal tax advisor, including the following.

Cost Basis - When you receive a gift, your cost basis in the item is the same as it was for the person who gave it to you (donor). This should be documented on the Gift Tax Return (Form 709) that the donor filed with IRS. You should get that figure because that will be crucial in calculating your potential gain when you sell the home.

In regard to qualifying for a full $500,000 of tax free profit, you and your husband will need to live in it as your sole primary residence for at least 24 months out of the 60 months before you sell it. It cannot be a part-time residence or one of two primary residences. One primary residence per person is all IRS will recognize as legitimate.

As with all tax matters, the burden of proving that you actually did use the home as your primary residence rests with you. In the rare case that IRS questions your right to use the Section 121 exclusion, you will need to be able to provide an adequate amount of documentation of this fact. Such documentation can include such things as your voter registration, residential property tax exemptions (if applicable in your area), as well as use of that address for your normal mail. Since any such IRS challenge wouldn't happen until a year or two after you have reported the sale on your 1040, you should hold onto the documentation until the coast is clear for any IRS challenges (generally three years after filing your 1040).

Your personal tax pro can give you more customized advice for your situation.

Good luck.

Kerry Kerstetter

Selling SUV After Sec. 179

Q:

Subject: Question 4 GuruKerry,Your site is very informative and I extend many thanks.Would you have the time to field a question?I am considering purchasing a SUV ($30K) & tools ($12K) for the company (S-corp) in year 2006, all of which would be have 100% business use.I would like to make a sec 179 election for $37k ($25k+$12k).What would be the impact of selling the SUV in '07, '08 for:$20k?$15K?$10k?Please advise,

A:

If you are serious about running a business properly and staying out of trouble, you should be working directly with a professional tax advisor who can help you with basic concepts such as this.

If you expense the full cost of an asset via depreciation or Section 179, your adjusted cost basis (aka book value) becomes zero. If you ever sell that asset at any time for more than zero, the full amount is taxable gain (aka depreciation recapture).

If you didn't expense the full cost, whatever is left is your adjusted cost basis and any gain is the excess of the sales price over that amount.

There is no taxable gain if the asset is traded in on a new like kind asset.

I have covered this issue in several previous posts, such as:Again, any competent tax pro can help you with this kind of thing

Good luck.

Kerry Kerstetter

Follow-Up:

Kerry,I have a CPA who I is competent. However, I am concerned with 2 things 1) asset protection and 2) tax liability. I am interested in obtaining a second opinion and would be willing to pay for it. Would you consider fielding questions for hire?Please advise,

My Reply:

If your CPA couldn't answer those very basic questions you sent me earlier, you really should be looking for another tax pro.

I wish I could help you; but I already have too many clients to take care of; so we are not accepting any new ones at this time.

Unfortunately, we don't have anyone else to whom we could refer you. If you haven't already done so, you should check out my tips on how to select the right tax preparer for you.

Good luck.

Kerry Kerstetter

Labels: 179

C vs S Corp

Q:

Subject: S VS CHello Mr. Kerstetter,…I am an Optometrist in Miami slightly confused on which Corp is better. I am not sure if you answer personal questions but thought I would try.By your comments it seems that a C is better but most Optometrist have a S. I put my yearly income on about 130-150K and want to make sure I'm not paying the government more than I should.You mention that a C has a 15% tax bracket for 50K vs being taxed on the S corp total earning as sole owner . My only concern is that a C corp is taxed twice and don't know which one would be better. What are considered royalty payments that are not taxed twice? Also, I would be setting up a 401K but I'm limited to how much I can put in. Would I be able to put my wife as an employee even though she is not doing anything for the corp and start her on a 401K? Can I put money away in a term life insurance to prevent double tax or any tax?I hope that you may have some simple solutions for me.Thank You

A:

There are far too many variables involved for me to be able to advise the best entity and jurisdiction to use for your particular situation via this medium.

To work out the best solution for your particular circumstances, you really need to work with a tax pro who can help you set up a strategy that will work for you.

I wish I could help you; but I already have too many clients to take care of; so we are not accepting any new ones at this time.

Unfortunately, we don't have anyone else to whom we could refer you. If you haven't already done so, you should check out my tips on how to select the right tax preparer for you.

It does look as if you are confused over the issue of double taxation. This only happens when income that has been taxed at the C corp level is taken out by the shareholders as dividends. Since dividends are not tax deductible by the corp, and are taxable on the shareholder's 1040, it is being taxed twice. The solution to this is to only take money out in ways that are deductible by the corp. In fact, I advise my clients to banish the word dividends from their vocabulary. A good tax advisor should have no problem helping you use a C corp in the best manner to avoid any double taxation. It is not difficult at all.

Good luck.

Kerry Kerstetter

Corporate Accounting

Q:

Subject: Corp Tax Question

Can / Are principle payments made to shareholders who have loaned money to an S Corp considered / accepted by the IRS as a "cost of doing business" and therefore included along with other cost (material, wages etc.)?

Thanks for your insight

A:

The fact that you would ask a stranger such a question is a perfect illustration of how dangerous it is for anyone to try to run a corporation without competent accounting assistance.

This is basic accounting and nothing tricky. Principal payments on loans are balance sheet entries, which do not affect the profit and loss. Interest payments are deductible as an expense.

Another issue that you need to consider is that all payments being expensed on the corporate books will need to be reported as income by the recipients.

Get with an accountant ASAP before you go any further down the wrong road with your corporation.

Good luck.

Kerry Kerstetter

Sec 179 For Used SUV

Q-1:

Subject: Section 179 deduction for "USED" SUV over 6000 lbs.I have received information from my tax consultant who is not as versed in the business tax laws as I wish. I have just started my own consulting company and need to replace my old 1990 Jeep with something a bit more practicle for doing buisiness. I cannot afford a new $45,000 SUV (over 6000 lbs I know!) but would like to buy a clean SUV that's got a couple of years on it for a lot less. Your webpage news says as long as the SUV would be new to me it would qualify for the Section 179 deduction. I intend to buy something under the $25,000 mark and over 6,000 lbs. Would I be able to do a 100% writeoff this 2006 tax year???? This issue of a used vehicle qualifying has not been completely or clearly answered anywhere I can find on line and I need to go buy something shortly. I really need your "yes" or "no" on this one.Thank you,

A-1:

I'm not sure why you're so confused. The Section 179 deduction never required the asset to be brand new. Some other kinds of first year bonus depreciation did have such a requirement; but Sec. 179 never did.

Assuming you buy an SUV weighing more than 6,000 pounds, you would then need to multiply its cost by the business usage percentage based on miles driven during 2006 to figure how much you can claim under Sec. 179, up to the $25,000 limit for SUVs.

Good luck.

Kerry Kerstetter

Q-2:

Kerry,Wow, that is about the fastest response I've ever had to ANY e-mail!!

Your answer makes it clear, used is okay. Too bad I can't wait until Dec 30th and use the vehicle 100% for work. I estimate I'll be using it about 60-70% for business. That's pretty simple math. What is this about a "bonus 30% deduction"??

A-2:

The bonus depreciation is no longer available. When it was, it only applied to brand new business assets; so a used SUV wouldn't qualify.

It sounds like you really need to be working with a professional tax advisor to address issues such as these rather than floundering around on your own. Taxes are too messy and complicated to try to handle on your own.

Good luck.

Kerry Kerstetter

Labels: 179

Unforeseen Circumstances Causing Early Home Sale

Q:

Subject: Sale of residenceI appreciate the information found on your website, and would like your advice on the facts and circumstances surrounding a sale of residence.A client of mine had leased a home between 2001 and 2004, then purchased the home in 2004 because of its private wooded surroundings and park-like back yard. In mid 2005, a neighbor of there's offered to purchase every home on the street. His intent was to subdivide the land and fit new homes on the existing parcels...

My client turned the first offer down, but when approached a second time, the investor stated that the rest of the neighbors had already agreed to sell, and if they did not sell to him, they would end up with new construction surrounding there property that would diminish the quality of the surroundings. My client eventually sold, and purchased a similar property elsewhere.

I would greatly appreciate your advice on qualifying this as an unforeseen circumstance.

Thank you,

A:

The key requirement for using the pro-rated exclusion is that something unanticipated happened after the home was purchased that materially changed the living conditions in the house for its owner and other occupants. If IRS were to question the application of the exclusion, the homeowner would have to be able to convince them that, if he had known ahead of time what the change would be, he wouldn't have bought the place.

In your client's case, the change from a home with no big construction projects around it to one that is surrounded by construction is a material enough change to alter the living conditions enough to warrant a move. Construction sites are noisy (making sleep difficult) and dangerous, especially if your client has young children.

It seems that the only real burden your client would have is being able to convince IRS (in the unlikely event of a challenge) that he had no advance knowledge of the developer's plans for his neighborhood and it only came to light after he had taken ownership of the home. If that's the case, he should have no problem qualifying for the pro-rated tax free exclusion.

Good luck. I hope this helps.

Kerry Kerstetter

Income Eligible For IRA?

Q:

Subject: Class Action Settlement - IRA qualified?Kerry -I recently received a payment from a prior employer as a consequence of a class action discrimination suit. The payment had deductions made for Social Security, Medicare, Federal and State income taxes. This strongly suggest to me that the payment is being treated as "back wages."My question is this. Can I make an IRA contribution based upon the monies received in this settlement? I am presently retired and do not have earned income with which I might otherwise qualify for an IRA contribution.

A:

It certainly sounds as if they will be reporting the income on a W-2, which will make it eligible to be treated as earned income for IRA purposes.

You didn't specify your age. If you are or will be over 70.5 during this year, you will not be allowed to contribute a traditional deductible IRA; but a Roth IRA is still possible.

Your personal professional tax advisor will be able to provide you with more specifics for your particular situation.

Good luck.

Kerry Kerstetter

Converting LLC To C Corp

Q:

Subject: Tax Question RE: liquidation of LLC to c-corpHello Mr. Kerstetter, we have researched the web and the print world and found your most helpful and valuable information. Thank you for your contributions to the web. We have a few questions that we are having a difficult time finding answers to, and would like to ask you if you'll allow us. In our work, we've found we get what you pay for, so we are willing to pay for your advice. Let us know what arrangements need to be made for payment.A multi-member LLC has liquidated it's assets and each member is to receive distribution of the proceeds. If the member has not yet taken possession of the proceeds, how can the member direct the proceeds to invest in a c-corporation without receiving the proceeds directly?Thank you for your time.

A:

You definitely need to be working with a tax pro on matters such as this. In fact, you should have been working with one from before you even set up your LLC.

As you describe the situation, it might be too late to do anything to reduce your taxes, depending on how you had elected to report the LLC income.

If it has been taxed as a partnership or S corp, the gains from liquidating the assets are a done deal and are to be passed on to the members via their K-1s, whether they take any cash out or not. That is the main principle of pass-through entities.

If your LLC has been taxed as a C corp, there may possibly be ways to transfer the assets to a new C corp tax free. It could be relatively complicated.

It would have been a much better idea to work with a tax pro before liquidating the LLC's assets because there would have been more options available. By waiting until now to consider the tax problems, it may be too late.

If you have been operating your LLC for all of this time without the benefit of professional tax assistance, you have probably learned an expensive lesson.

As it says below, we are too swamped with client work to be able to take on any new ones.

Good luck.

Kerry Kerstetter

One more thing to be careful of when choosing tax preparers

Sale of Data by Tax Preparers Draws Protests – This is a ridiculous idea and is just one more aspect of your relationship with your tax preparer that you will need to keep on top of.

As I mentioned in my earlier discussions of tax prep offices outsourcing their actual work to outfits in India, it wouldn’t be a bad marketing tactic for USA tax prep firms to explicitly guarantee to their clients that their highly confidential data will not be released to anyone without the express written consent of the client. It used to be implicitly understood that such was automatically the case for CPA firms; but things have obviously changed.

As I hope everyone has noticed, I don’t like to waste time repeating what others have already written so well; so check out the excellent coverage of this issue by:

Sec 179 Via LLC

Q:

Subject: Section 179 deductionMr. Kerstetter, In your opinion, can I use my salary (wages, salaries, tips) that I earn from a separate company to meet the Business Income Limit for taking the Section 179 deduction? My situation is:I work for separate Company A and I earned $120,000 in 2005. My wife and I opened a small business (LLC) partnership (Company B) in May of 2005. My wife purchased $60,000 of new equipment to be used 100% in the new business and we were going to depreciate the $60,000 over time but we want to take a Section 179 deduction for the entire amount of $60,000 for the tax year of 2005. Even without using the one time deduction, the new business did not show a profit for 2005 and if fact, in had a small loss. My wife and I had no income from the new Company B, however, I had my salary from the separate Company A.As I interpret the IRS regs I may use my salary to pass the “Business Income Limit” and I feel I can take the $60,000 deduction, even tho the new business did not show a profit, because my Taxable Income of $120,000 is more than the 179 deduction.Do you agree?Thank you very much.

A:

You really should be working with a competent professional tax advisor with something like this.

From the way you described the situation, you may have screwed yourself out of the larger Sec. 179 deduction. It hinges on who actually bought the equipment.

If you and/or your wife had bought the equipment in your own personal name and set it up on Schedule C or E of your 1040, you would be able to use your W-2 income to justify a Section 179 deduction for the full $60,000 cost.

However, if the LLC actually bought the equipment, the income limit for Sec. 179 is first applied at the LLC's 1065 level. If there is no net profit, no Sec. 179 can be deducted on this year's tax return.

A tax pro may find something else after thoroughly analyzing the facts here; but it looks like you may be learning an expensive lesson by not consulting with a tax pro prior to purchasing that equipment.

Good luck.

Kerry Kerstetter

Follow-Up:

Thank you for you opinion on this. Appreciate you taking the time to get back me.R/

Labels: 179

Residence Rental

Q:

Subject: home rental by my own business

For years I have leased the garage portion of my personal home to my partnership for the purpose of storage. The garage is approx. 25 percent of the total square footage.I have taken 25 percent of my mortgage payments and utilities as business deductions.

Now I would like to know if it is legal to lease my entire home to my business, and then sublease it back from my business, so that my business can deduct the usual deductions for for rental property?

The home is presently titled in my name. I am hoping that I do not have to get a new title for the house, in the businesses name, to do this.

If yes, are there any federal taxes at the sale of the property?

Could you please email the answer in case I can't find it on your web site.

Thank you very much.

A:

There are ways to do this, most often by transferring the home to a corp.

You should really give this plan some deep thought, along with some in depth consultations with your personal professional tax advisor. Most of the people I have seen do this later regret it when they discover that the home no longer qualifies for the Section 121 tax free exclusion of up to $500,000 of profit. That exclusion is not available for rental property or for property owned by anyone other than an individual. More often than not, that tax free gain more than offsets the "lost deductions" from not being able to claim the home as full rental.

Good luck.

Kerry Kerstetter

Setting Up Corporation

Q:

Subject: C CorporationHi Kerry,Thank you for the excellent advice. I've met with at least 30 attorneys and CPAs to discuss setting up a corporation. Most tell me to start an S corp..and some an LLC...none of them understand the benefits of the C corp. Is there an an Accountant you recommend to people who write you? I would love to work with someone who just know what they are talking about!Thanks for your help.

A:

C corps aren't always the proper approach; but it is amazing how many tax pros don't even properly consider how they can be of use.

You will need to work directly with an experienced tax pro who can analyze your unique circumstances.

Unfortunately, we don't have anyone to whom we could refer you. If you haven't already done so, you should check out my tips on how to select the right tax preparer for you.

I'm sorry I couldn't be more help.

Good luck.

Kerry Kerstetter

Out of Sight, Out of Mind

Tom Briscoe's look at why most people have no clue as to their true tax burden. There really would be a much stronger push for tax reductions if there were no more withholdings and hidden taxes, and everyone had to write actual tax checks to pay their share of the cost of government.

Miles From Quasi Home Office

Q:

Subject: Business miles/Home office

Kerry,

Having an ongoing discussion on a message board regarding deductible business miles/home office.

For a self-employed taxpayer, with his home being his principal place of business. Does TP have to meet the rules for business use of the home to be able to deduct business miles? In the TaxBook Deluxe, page 5-13, it talks about Business use of home tax advantages. Seems to imply that if you can't qualify for business use of the home, then you can't deduct business miles, say from home to client A, etc. Am I reading that wrong? I thought a TP could deduct miles if his home was his primary place of business, from the minute TP leaves the driveway, say to pickup supplies or visit client A, etc. If some on the message board are correct, then say the TP uses the home office even 1% of the time (not exclusive) for personal purposes, then no deduction for business miles. Any feedback appreciated. Thanks.

A:

I checked out some of the messages in that discussion and saw the variety of opinions expressed there.

While having a space in the home that meets the exclusive use test for home office deduction would be perfect support for the premise of zero nondeductible commuting miles, I don't believe it to be a deal killer if the space is not exclusive.

There are plenty of people who don't have space in their homes that can be devoted 100% of the time to their businesses, but do run everything from their homes, such as on the kitchen or dining room tables. In those cases, where they truly don't have another office to drive to, all of their miles would be deductible in the exact same manner as for someone who has an 8829 compliant office.

As always, the burden of proving the legitimacy of this lies with the taxpayer; so attaching a statement to the 1040 explaining the situation would be a wise move to head off any IRS suspicion.

I hope this helps.

Kerry Kerstetter

Follow-Up:

Kerry,Yes, a big help. I very much appreciate your responding.

Fight building over Calif’s ReadyReturn tax-filing program – Anyone crazy enough to allow the FTB to prepare their tax returns for them deserves what they get. Can anyone say “conflict of interest?”

Making the Most of Capital Gains

Private Debt Collection May Be on Hold Until GAO Settles Bid Complaint – In trouble before they even start doing anything.

Feds bust Seattle scammer for setting up bogus offshore corporations

Sec 179 For Lighter Vehicles

Q:

Subject: Section 179 Deduction"Qualifying Property

Generally, the types of business equipment that qualify for this expensing election are the same kind that qualified for the now-defunct Investment Tax Credit. Most movable assets qualify. Permanent structures do not qualify. Business vehicles with a gross vehicle weight over 6,000 pounds qualify for the full Sec. 179, while lighter vehicles have a much lower dollar limit."

If a lighter-than-6000 pound vehicle does not qualify for the full Sec. 179, then how much do they qualify for? Or where can I find that answer?

Thanks!

A:

From the QuickFinder Depreciation handbook:

For 2005, the Sec 179 limit was:

$2,960 for passenger vehicles under 6,000 pounds

$3,260 for trucks and vans under 6,000 pounds

$8,880 for electric vehicles

The 2006 limits haven't been announced yet. They will most likely be the same as for 2005, or even lower, which happened between 2003 and 2004.

Kerry Kerstetter

Follow-Up:

Kerry, thanks!

Labels: 179

Feds bust Idaho promoter of Corporation Sole Scam – And IRS will be in touch with the 400 people who were stupid enough to pay him thousands of dollars for this ridiculous scheme.

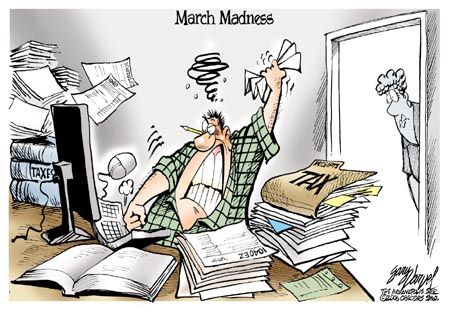

Tax Deadlilne Is Not April 15

The mystical date of April 15th has become so synonymous with “Tax Day” in this country that they are interchangable. I have been seeing all kinds of people, including tax scholars and pros, say that 2005 tax returns are due on April 15 this year. That is not true.

Ever since I have been in this business, IRS has had a policy of automatically extending tax filing deadlines if the statutory one falls on a weekend or a holiday. Since April 15, 2006 is a Saturday, the normal deadline to file either the 1040 or the extension (4868) is on Monday, April 17.

For some states in the eastern part of the country, they celebrate Patriots’ Day on the third Monday of April, which just happens to be April 17 this year. This moves their tax deadline to Tuesday, April 18. The affected states are: Maine, Massachusetts, New Hampshire, New York and Vermont.

This may seem like a minor technicality to some people. However, any tax pro can relate to the experience of having hundreds of clients panicking at not having their 1040 or 4868 done by April 15, when there are actually two or three more days until the actual deadline. That extra breathing room is extremely valuable in the pressure cooker world of tax preparation.

Also, one more reminder that the Form 4868 extension that you file by April 17 is for six months, moving the 2005 1040 deadline to October 16, 2006 because October 15 is a Sunday. Even though we are including an explicit statement of this fact on the 4868s we are preparing, I’m sure we will be receiving a ton of panicky calls from clients around August 15 assuming that is the deadline. Old habits do die hard.

IRS Attacks On High AGI Increase

As I’ve pointed out for decades, the higher the adjusted gross income on your 1040, the more likely IRS will be to hassle you. This is in addition to the fact that our rulers also have you in their cross-hairs by phasing out deductions, exemptions and credits for those they consider to be evil rich, as defined by high AGI.

IRS Audits Increase By 21 Percent

IRS also says the number of audits of high-income taxpayers - defined as those with income of $100,000 or more - reached 219,208, the highest figure in 10 years.

2005 IRS Data Book Details Rise in Audits – From IRS, reminding us all that Big Brother is watching us more closely than ever.

What to do about this?

You can utilize income smoothing techniques, such as with C corporations, in order to keep your 1040’s AGI from reaching into the higher profile levels.

You should make sure your books are in good shape and can support everything shown on your tax returns. The best way to to do this is to have all of your records entered properly into QuickBooks. Audits I have handled where the clients had their stuff in QB were completed very quickly and successfully. Those for shoe-box clients drag on for years, costing huge amounts in fees and ultimately taxes.

Work with a qualified tax professional. It is too dangerous to swim in the IRS shark infested waters alone.

You also have the option to do nothing special to protect yourself from IRS hassles. Some refer to that as the “ostrich” or “it can’t happen to me” approach. These are often the same people whose retirement planning consists of buying lottery tickets.

Using Exchange Proceeds

Q:

Subject: Exchange Question

Hello,I own with another family member (50/50) some open land that is being developed.When it sells I expect cap. gains of about 250k. If there is a mortgage lein against the property does that loan reduce the net cap. gains? is the loan a cost?or do I pay off the bank and then the IRSotherwise would do an exchange or TICThank you,

A:

You and the co-owner of that property are looking at some huge tax bills if you don't start working with a professional tax advisor to work out the best plan for your circumstances.

Paying off loans against the property will have no affect on the taxable gain. Debt relief is considered the same as receiving cash in the eyes of the IRS.

If you are planning to do a 1031 exchange, you will need to reinvest a total amount equal to or higher than the net sales price, which will be close to the cash proceeds plus the debt relief. While for most exchanges, this means that you will need to take on an equal or higher loan balance on the new property as you had on your old one, there are ways to have less debt if you invest more cash from other sources.

If you and the co-owner have the current property in your individual names, you each have the option of doing a 1031 exchange on your share of the sale price regardless of what the other owner chooses to do. If the property's title is in the name of a corporation, LLC or partnership, either that entity will have to do an exchange or you will need to have the property's title transferred into your individual names first.

Again, any experienced professional tax advisor can help you work out the actual numbers for your situation.

Good luck.

Kerry Kerstetter

Labels: 1031

No Homework Questions

Q:

Subject: Corporate Tax Rate Schedule

Hey Kerry,I'm a student at Binghamton University and I'm trying to understand you're tax rate schedule after looking at the 1120-W form. What I'm having trouble with is how the rate resets at 335,000 and 18,333,334.

The first makes sense, but I do not understand either the $550,000 at the second to last bracket, or the reset rate for all income over $18,333,334.Thanks for any help,

Oh, and I'm doing this for a simulated 2% reduction in the corporate tax rate, just to let you know what I'm trying to do.

A:

This is a good time to repeat my long standing policy on not answering homework questions. This has always been my online policy, going back several years ago when I was answering questions on the old AskMe.com website.

I barely have time to address real life questions from many people; much less provide short-cuts for students who should be doing their own research and utilizing the resources they are paying for with their tuition.

The answers to your questions are very easy if you work through the figures in the tax rate schedules. If you can't figure it out on your own, you should ask your professor or his/her teaching assistant to explain it to you. That's what they are there for.

Good luck.

Kerry Kerstetter

QuickBooks Icons

Q:

Subject: In regards to something you wrote.....

"The most confusing thing about running so many versions of QuickBooks at the same time is that the icons that show up on your desktop and QuickLaunch bar look exactly the same for each year. I have to float the cursor arrow over them to find which is which, and even then I occasionally open the wrong program."

I am not sure if you are referring to your desktop icon, but if you are, you can change the icon by right-clicking it. Go to properties, and then select "change icon" Maybe that will help with the minor frustration of running multiple Quickbooks programs on your desktop.

A:

I had tried that years ago and was disappointed to find the icons that come with the program all look almost exactly the same, with nothing to distinguish their year. I'm sure it's because most people only have one version of QB installed, so have no need to worry about identifying different ones.

I launch most of my programs from the Quick-Launch tool-bar at the bottom of my screen, where I currently have over 80 tiny icons in alpha order.

I guess I could design my own icon for each version of QB; but that sounds too time consuming.

The icons that come with my Lacerte tax prep programs each have the last two digits of the year very prominently displayed in their tiny quick-launch bar icons; so I don't even need to float my cursor over them to know which is which, as I need to do for the QB programs.

Thanks for writing.

Kerry Kerstetter

Automating QuickBooks Payments

Q:

Subject: quickbooks tips

Hi Kerry,

I see you're a quickbooks expert, so here's a quick question for you. Is there an easy way to enter monthly recurring bills once so that they show up in the unpaid bills (or checks to print) automatically? I'm thinking of stuff like my monthly rental payment.

It's a total pain to have to enter the bill every month when it never changes.

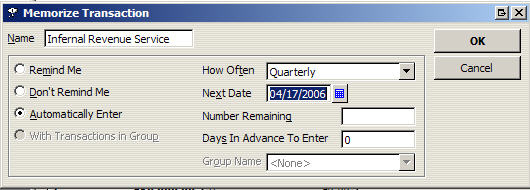

A:

It's quite simple. When you memorize the payment, you are given a choice to have it entered automatically on a variety of time schedules, including monthly.

Kerry Kerstetter

Many Americans Don't Take Steps To Minimize Income-Tax Liability – This is what I have always been saying when so many people make the assumption that everyone tries to cheat on their taxes. More often than not, people are too lazy, ignorant, naive or trusting to do things to reduce their taxes. Many even intentionally overpay in attempts to keep IRS out of their hair.

Buy or Build A Business -- Which Is Better for Beginners? – There are enough pros and cons to each approach to fill several books. Neither should be attempted without competent professional tax counsel.

Weighing Independence And Big-Firm Advantages – There are obviously some benefits to working for a large company,. However, every time I see a story about another big company reneging on its retirement or health care programs, I’m more confident that the only way to ensure our future is by doing it ourselves. Relying on any company or government program to take care of our future can lead to nothing but disappointment.

Is There Still Profit to Be Made From Buying Fixer-Upper Homes?

Mortgage Muddle Puts U.S. Consumers at Risk – Not surprising that people sign up for mortgages without understanding the terms. Too much fine print to be bothered with, which is why lenders toss in all kinds of sneaky provisions.

Claiming Parent As a Dependent

Phony IRS Refund Notification – Snopes.com looks at this phishing scam that has been circulating for the past few months. If the IRS really wants some good PR, they’ll track down the scum-suckers behind these scams and publicly hang them by their short and curlies. It’s not too hard to track down celebrities at the Oscars. Let’s see the IRS show off their investigative skills and locate the scoundrels behind these phony emails.

Employee Benefits

Q:

Subject: Corporation S vs. CDear Mr. Kerry,I would like to tell you that I really enjoyed reading your web site, I think it's very informative and knowledgable. It prompted me to do a research about the benefits of corporation C vs. S. Both, my husband and I currently own a corporation S, and as you pointed out there are a few downsides of such entity. Passed on taxes are obviously some issue which affects us in two ways:1. it inflates our income and that becomes an obstacle in applying for a student loan (I have 4 high school/college age children),2. The taxes that we pay on 1040 are partially owed by the corporation. At the end, the corporation "owes" us some money and it always takes a lot of time to pay ourselves back ( not to mention that the due taxes are higher because of the tax brackets).I've also learned from your web site that as a corporation C we would be able to benefit more with the medical reimbursement plan. I am curious though, if being an officer of the corporation, I can provide myself with a different level of medical reimbursement, than for the other two employees of my company. I'm not trying to be cheap, I just can't afford an extensive medical coverage for my employees yet. I work on this issue with my CPA but she wasn't sure if the reimbursement plan can be different for officers and other employees.She also wasn't sure if a part time employee is eligible for such benefit. So, I was wondering if you could provide some insights on this issue.Also, I was always wondering what is behind "royalty payments" that you mentioned on your web site.I would really appreciate your comments on this issue. ( I've already consulted two tax lawyers, but sadly they weren't very helpful)Thank you in advance

A:

IRS is very strict regarding discrimination in regard to employee benefits. This does mean that every eligible employee has to be allowed to have the exact same benefits as the top brass.

There are several long used ways around this that any experienced tax pro should be able to help you with. For example, I have seen countless doctors who don't want to provide full benefits to all of their staff; so they set up a separate management corporation, which only employs the doctor and his/her family members. The management corp has a generous benefit plan, while the other corp (with the non-family employees) doesn't have such a plan.

Another technique I have seen used is to only work with incorporated service providers. Payments to corporations cannot be considered employee payroll because corporations are not human, a basic requirement for employees.

The employer can establish the eligibility thresholds for inclusion in the benefit plans, such as age, full time vs. part time and years of service. These have to be reasonable and in compliance with your state's labor laws.

Royalty payments are similar to what franchisees pay to the main franchise HQ for the use of the company name and operating standards. For example, if you set up a corporation and design its operating manual and provide it with certain key technology and customers, you can license the use of those to the corp. The income would be reported on Schedule E of your 1040 and would not be subject to SE tax. The amount or rate would need to be reasonable. I have seen people use flat amounts per month or year, as well as percentages of gross revenues, which is more like conventional franchise agreements.

None of these concepts are new or out of the ordinary. Any experienced tax pro should be able to help you set things up in the best manner for your situation.

Good luck.

Kerry Kerstetter

Follow-Up:

Dear Mr. Kerry,I just wanted to say thank you for your quick and detailed respond. After many thoughts I decided to revoke my S status and I hope that in my situation I could benefit from this decision. I will continue using your resourcefull web site, where I can find great amount of practical knowledge. I know that you don't accept any new clients but maybe in the future you will consider organizing some seminars? I'm pretty sure it would be very popular and you'd have an audience from all over the country. Maybe one day?Thank you again,

IRS Debunks Frivolous Arguments on Paying Taxes - IRS has finally abandoned their previous ostrich approach to tax protestor scams and is addressing them head on. This is a very welcome change in strategy for those of who have long been frustrated by their silence in the face of scam promoters who claimed that IRS silence equaled agreement.

Feds Bust More Crooked Tax Pros:

Southern Cal. Firm Alleged to Claim Phony Home Mortgage Deductions

Soul Version Of TaxMan

Over the past decades, I’ve amassed quite a collection of different versions of various musical artists performing George Harrison’s classic (and still very timely) TaxMan song, some of which I have posted on this blog.

Thanks to Andy Roth of Club For Growth for finding this slow soul version by Junior Parker, which he found via the Soul Sides website. I just downloaded it and added it my collection.

Would Donald Trump have change for a one billion dollar bill? Who would be stupid enough to believe that such things actually exist?

Suit: H&R Block Swindled Customers With Retirement Account – Just one more example of Block getting into legal trouble by straying from their core business.

IRS Debt Collection Contractor Has Questionable Legal History – And who’s surprised by this?

From WSJ:

Swapping Mixed-Use Properties: Can Capital Gains Be Deferred?

Tackling Tax Questions About Vacation Homes

Tax Flubs Vacation-Home Owners Make When Selling Their Houses

Setting CPA Fees

Q:

Subject: clients and billing

Hi,

I am a CPA in CA and was searching on the internet regarding billing rates and came across your letter re fees and services. Did you really send this to your clients and how did they respond. How many did you lose?Just curious as I need to raise my rates and trying to figure out how to do it.Thanks for you time.

A:

If you're referring to the Client Guide, we have been sending the most recent version to clients for several years. We now include it with each year's organizer.

It isn't announcing anything new, except when we raise our rates every few years. The main purpose is to lay out how we work so that nobody can claim that we didn't tell them.

Back when we were taking on new clients, we did send it to them so they could see what they were getting themselves in for. We wanted to weed out up front the clients who wanted someone they could call or drop in on without advance warning because we have never allowed that.

In regard to losing any clients over rate increases, I don't recall that happening. They recognize that they are paying for our knowledge and not just for filling in forms. As our knowledge and experience grow, its value increases as well. While I may sound egotistical here, I have always believed that any client who was too stupid to recognize that fact, I don't want to waste my time on. There are plenty of clients out there who look at us CPAs as just clerks who fill in forms. I won't work with people who hold that attitude.

From the very beginning, I would never quote fees or play the games with potential clients who were obviously basing their decision strictly on price. Such people can't be loyal and will leave you for someone cheaper at the first opportunity. I have seen plenty of other CPAs make this critical mistake. If your goal is to match the fees of big assembly line outfits (H&R Block, Jackson Hewitt, Liberty, et al), you will never be respected for your unique skill set. There is an unflattering term for that method of setting fees (whore's market).

If you are good at what you do, and have expanded your knowledge and skills, you shouldn't have any problem convincing your clients that you are worth more money that you were in previous years.

Good luck. I hope this helps.

Kerry Kerstetter

Follow-Up:

Hi,

Thanks for taking time out of your busy day to respond to my e-mail. My husband has been on my case for years that my fees are to low. I have been trying hard to raise them, but I guess I just lack the confidence...e-mails and information that you have provided help me to see the light...I have been a CPA for 20 years and consider myself good...so I definitely should be charging more....Thanks again....

Tax Withholding

Q:

Subject: Question for the blog siteHow does anyone find time to do this stuff? Anyway I’ll try out a question on you.

On 31 Dec 05, I was terminated from my position at a major telecommunications company. I was given a severance package that provided me to be paid at my old salary for approximately 10 months this year, payable bi-weekly as normal. This allowed me to get involved with a startup company I had always wanted to try - at zero salary for at least the next several months.

Since my former employer is no longer taking out my 401K deduction, my life insurance deduction, my flex pay deduction etc, I was anticipating a larger cash flow from my severance check. On receiving my first severance paycheck, I found to my dismay that my old HR department was now taking out THREE times as much for Federal income tax. The explanation from the company was that the IRS requires this since they assume I have another new job that pays similar in addition to the severance! This will cost me cash flow of approximately $12,000 this year until I can get a refund in ’07.

This sounds pretty fishy to me though I wouldn’t put it pass the IRS. Do you have any knowledge of such a requirement or is this perhaps an example of a corporation bureaucracy ineptitude instead of government bureaucracy ineptitude?

Thanks for any info.

A:

That is just one method of calculating withholding on out of the ordinary payroll checks.

Depending on how your relationship is with the payroll department, there is a lot of flexibility in how the withholdings are calculated.

I have seen cases where the former employee submits a written request to the former employer stating that he is aware of his tax situation and is making a formal request that the taxes either be taken out based on the standard withholding table at a certain number of W-4 exemptions, or at a certain specified percentage. You should work with your personal tax advisor to figure what would be appropriate for your situation.

It really shouldn't matter to the former employer how much money is taken out for income taxes because any shortfall will be your responsibility when you file your 1040

Good luck.

Kerry Kerstetter

Follow-Up:

Much obliged Kerry...thanks very much for the reply...didn't really expect one ....I would think you would get tons of mail after the WSJ mention.All the best man.

Tax Preparer or Form Filler?

Q:

Subject: false choice

It seems like every year I'm faced with a false choice: fill out my own taxes with the help of tax software like TurboTax or work with a professional.

This isn't CPA bashing. $200/hr to fill out forms seems pretty steep, but I would pay double that for advice that really saved me money. I would vastly prefer to work with a tax accountant who adds value by improving my tax return.

So is there a way to work with a CPA in combination with a package like TurboTax?

A:

You're exactly right, and that is precisely what I tell other tax pros who are worried about TurboTax and other DIY tax software costing them a loss in business. It is a waste of time to pay someone to just fill in tax forms without adding any of their knowledge and expertise, when you can just use TurboTax to do that.

As I've also said on several occasions, I have had some clients use TurboTax instead of my normal organizer as a means of sending me their year-end data. When I am finished, the final returns usually bear little resemblance to the original TurboTax version because I move things around and fine tune the return to be both legally correct, as well as coming up with the lowest tax possible.

If you haven't already done so, you should check out my tips on how to select the right tax preparer for you.

Good luck.

Kerry Kerstetter

IRAs and 401(k)s

Q-1:

Subject: Question about contributions to an IRAMy question has to do with the contribution to a spousal contribution. Here is the background. My spouse does not work, and every year I have been making a contribution to her IRA because my salary was under the limit. I took that amount as a reduction to my AGI. In March 2005, I made a contribution to her IRA. I now may have a problem for the tax year 2005.Last year (2005), I got laid off from my work in August. When this happened, I took a large part of my pension, and this caused our taxable income to go to $164K. My question is whether I can take the contribution to my spouse's IRA as an adjustment to my taxable income on line 32 of Form 1040. I think I can. I am basing this on the fact that I was still unemployed at year end, and so neither my spouse nor I was covered by an employer retirement plan from August through December, and I thought the rule was that I can take a total deduction for the contribution as long as I nor my wife had an employer retirement plan for any part of the year. Am I correct, or does my income level this year mean that I have to treat the contribution as a non deductible IRA contribution?.Thanks for your help.

A-1:

Unfortunately, your interpretation of the rules regarding being a participant in an employer sponsored retirement plan is completely opposite from the way the IRS and the courts interpret it. If you or your spouse were covered for even one single day during the year, the elimination of the IRA deduction for evil rich people applies to you.

I have always hated this rule, especially when it applies to people who are unwilling participants in company plans from which they will never receive much of any actual retirement benefits.

You should be working with a professional tax advisor, who may be able to help you get your AGI below the magic $150,000 level where the evil rich penalty is assessed. For example, a loss from a side Schedule C business would help move your AGI in the right direction.

Otherwise, as you noted, you are limited to the nondeductible IRA since the Roth IRA has the same penalty on evil rich people.

Sorry to be the bearer of bad news. It is very unfair; but that is how our tax code is set up.

Good luck.

Kerry Kerstetter

Q-2:

Dear Kerry,Thank you so much for this answer. As a follow up question if I may, I want to know how to report the withdrawal from my employer's 401K plan that I had to take when I got laid off. Do I report it as "pension and annuity income" on line 16 on the 1040, or do I report it as an IRA withdrawal I don't think it is an IRA withdrawal, because I think a 401K plan is not a traditional IRA, so I was going to put it on line 16. Am I correct?I want you to know that I enjoy your blog site. It is one of the best that I have ever seen.By the way, I totally agree with your comments in the attached e-mail.Have a wonderful day.

A-2:

A 401k is different than an IRA; so it is reported on Line 16 of the 1040. Put the full amount in Box 16a and the portion that you didn't roll over into an IRA or other retirement plan in Box 16b.

You didn't say how old you are, If you are under 59.5 years old, you will also need to include the taxable 401k withdrawal on Form 5329 (as well as state equivalent) to compute the early withdrawal penalty, which will then go on Line 60 on Page 2 of your 1040.

Again, it would be wise to work with a tax pro, who may be able to help you reduce the taxes and penalties.

Good luck.

Kerry

Owning Multiple Corporatoins

Q-1:

Subject: Taxing of Mulitiply CorporationsQuestion: Are there any tax rate consequences of owning 100% ownership of two small corporations. In other words, are profits stacked on top each other for income tax rate purposes?

A-1:

In cases such as that, referred to as a controlled group of corporations, you need to allocate such things as the lower tax brackets and the Section 179 deduction among them. The corporations' tax preparer needs to attach a statement to each 1120 explaining the allocation of these items with the names and FEINs of each controlled group corp listed.

Kerry Kerstetter

Q-2:

Thank you....I'm just setting up the second corporation. Would it be better if I owned....say only 80% of the second corporation ...or would that not make any difference?

Thanks again.

A-2:

As I constantly have to say, it's extremely dangerous to try to run one corporation without the advice and counsel of an experienced competent tax professional. With multiple corporations, that danger is multiplied many times.

If you take a look at the applicable Code Section 1563 definitions, you can see how tricky this can get. It's not just an 80% ownership by a single party. There are also attribution rules to consider, where ownership by related parties can be attributed to you, as well as the brother-sister controlled group rules with a 50% threshold among five or fewer owners.

Just because each separate corp may not be able to utilize the full benefit of the lower tax brackets and Section 179 deductions doesn't make owning multiple corporations a bad idea. There are several other reasons to do so, including liability protection, state income sourcing and payroll issues, to name just a few.

A good tax and or legal pro should be able to help you structure things in the best manner to achieve your goals.

Good luck.

Kerry Kerstetter

Labels: 179

Corporate Accounting Mystery

Q:

Subject: Great S vs C articleHi,This is a very good article. But I still don't know if I should covert to S corp or not. I work full time. And I also have a C corporation. I have been doing very little business since I got my full time job, this year the business made about 5300 and I actually had to put in 3500 from my pocket into it. I just finished doing the Turbo Tax Business for it, and it turned out to be 1300 loss.So if I understand this correctly, and this was an S corp, I could somehow show that loss on my personal return?Do you think it would be best for me to convert to S corp? Would it make any difference at such a small level and I'm the only owner.Also is there anywhere I need to say on my personal or corporate return that I loaned my business 3500 last year?Thanks,

A:

If you are serious about operating a business, you absolutely need to be working with a tax professional who can properly guide you. No information on the internet or from strangers like me can do the proper job for what you need. Neither can a tax prep program like TurboTax substitute for competent professional guidance. This is especially true with corporations, about which you obviously don't understand the fundamental basics.

As I've explained on my website, C corps pay taxes, while the net income or loss from S corps is passed through to the 1040s of the shareholders.

The other thing you need to do ASAP is get your corporation properly set up on a double entry accounting system, such as QuickBooks. Corporations are required to include balance sheet info as well as a P&L with their annual income tax returns. Loans from shareholders will be disclosed in the Liabilities section of the Balance Sheet.

Good luck.

Kerry Kerstetter

Locating Good Tax Help

Q:

Subject: Help. I am lost.HELP!!!The following is taken directly from this page address on your web site."{The following information is not intended to replace the services of a professional qualified income tax consultant who can better understand how these issues fit into your particular circumstances. Trying to set up and/or operate a corporation of any kind without competent professional guidance is asking for serious trouble.}"I continue to hear attorneys and other allegedly knowledgeable authorities recommending the use of Subchapter S corporations, when that ends up costing the clients a lot more in tax dollars."In the first paragraph, you are telling me (an owner of a C corp.) to operate without competent professional guidance is asking for serious trouble. Then, in the next paragraph, you tell me about "allegedly" competent professional guidance that could end up causing me serious trouble.How in the world do I discern between the competent professional guidance and the alleged knowledgeable professionals?!I have been in business for just over a year. I need a competent attorney and accountant who understands C corporations...particularly a C corporation that is just me...who is an artist. So how do I find that COMPETENT attorney and accountant? The phone book??? Referral by someone who does not really know if the attorney or accountant is competent or competent in regard to C corps??? Utilization of the VLAA (Volunteer Lawyers and Accountants for Artists) who may or may not be competent...at least in regard to C corps or my particular situation???Like the characters on the hit ABC tv show...I am lost.

A:

That has always been a dilemma.

Unfortunately, we don't have anyone to whom we could refer you. If you haven't already done so, you should check out my tips on how to select the right tax preparer for you.

Good luck.

Kerry Kerstetter

Follow-Up:

Kerry, thank you for the reply -- much appreciated! I checked out the link you sent -- good stuff.All the best,

Tax Training

Q:

Subject: nice to have found you

Kerry,

I have a rather unusual background. I am a CA CPA who left the field about six years ago after getting my audit hours from KPMG and then went to work as a Longshoremen at the Port of LA. I still work at the docks but my very flexible schedule allows me to pursue other interests. I am currently working for a small tax firm 35 hours a week helping prepare all types of tax returns. I am pretty rusty and was wondering if you had any suggestions of tax courses you can recommend that will help me improve my tax & acct skills.

God Bless America

Thanks

A:

While the H&R Block class does a good job of covering the basics, there is no training of any kind that can beat hands-on real life experience. Your best bet would be to work with a tax prep office that does a wide variety of different kinds of tax returns.

My current favorite reference book is The Tax Book. Having a copy of that with you will speed up your learning process tremendously.

Good luck.

Kerry Kerstetter

No mixing of religion and politics allowed.

The IRS threatens church leaders who talk about politics.

Installing Latest QuickBooks Versions

With the frequency of software updates nowadays, it is a major pain to reinstall a program from the original CD and then have to spend additional hours going though all of the updates that have been released since the original disc was produced. This has long been the case with QuickBooks.

I just received the latest copy of the QuickBooks ProAdvisor Newsletter, and it looks like they have addressed that very issue. According to this announcement, they are making it possible to download and install the most current version of the 2006 programs directly from their website. Of course, this will only be useful for those with very fast broadband internet service since the files will be humongous.

As an experiment, I clicked on the link to download the current version of QuickBooks Pro, the least expensive QB flavor. (The Simple Start version doesn’t count because it is not a true QB program and is a big waste of money.)

It shows the file size as 463 MB, which would take all night on the slow DSL service we have up here on our mountain top. Those with fast cable access should be able to download the file in much less time.

Alternative Minimum Tax – Not Just for High Earners Anymore

Unless things change, the nonpartisan Congressional Budget Office estimates that by the year 2016, AMT will affect 33 million taxpayers to the tune of $81 billion.

Our rulers' refusal to address this insanity is a blatant dereliction of duty, which is nothing unusual for that bunch of incompetent bumbling bozos in power, of both parties.

No Change in IRS Interest Rates for the Second Quarter of 2006 – Staying at 7.0%. I’ve updated this info on my Quick Reference page.

IRS Selects Three Firms to Take Part in Delinquent Tax Collection Effort – The Sopranos will have to wait until 2008, when IRS will contract directly with ten collection firms. Of course, that doesn’t stop them from sub-contracting for these three who won the initial contracts.

Consumer Groups Contend Regs Would Allow Return Preparers to Peddle Taxpayer Info – In response to the trend of tax prep firms outsourcing the actual work to cheaper workers in India, a topic I have commented on several times.

Senate Budget Proposal Follows White House on Tax Cuts; Would Double IRS Enforcement Funding – IRS’s Tax Gap propaganda campaign, hyping SWAGs as real figures, is paying off quite well for them.

Feds Getting Rid of More Bad Eggs From Our Profession:

Alabama preparer inflated $61,000 of expenses to almost $244,000

Sec. 179 Income Limit

Q:

Subject: sec 179We are having trouble getting an answer on a sec 179 question. Some accountants are telling us that you can only use sec 179 if your business has a profit of larger than the 179 deduction. Some are saying that all income, even if it from other than the business, can be considered. How can we find out if our business can take use sec 179 for last year if our business did not make a profit but we had income from other sources and paid more taxes than the 179 deduction we would like to take?Thanks for your help.

I answered a similar question in this post.

I assume you're referring to an unincorporated Schedule C or F business.

In that case, other kinds of earned income, including that from W-2s and general partnership K-1s, as well as other profitable Sch. C & F businesses on your 1040, will increase the limit on the amount of Section 179 that is deductible on your 1040 for that particular year.

This limitation calculation is done automatically by my Lacerte tax software. I have heard that some of the other less sophisticated tax prep programs aren't able to factor in other earned income in their Sec. 179 deductions. You should be working with a tax pro who both understands this procedure and has software than can calculate the proper deduction, accounting for all income shown on the 1040, not just from that particular business.

Good luck.

Kerry Kerstetter

Labels: 179

Material Partcipation

Q:

Subject: material participation