Tax Guru-Ker$tetter Letter

Thursday, July 31, 2003

Businesses find it's better to own - Beware of "one size fits all" approaches to lease or buy decisions. Something as expensive as buying a building should be scrutinized closely with a good accountant.

Senate Panel Blocks Taxes on Web Service - This is just to prevent taxes from being levied on the Internet service. Sales of products over the Internet are still very tempting targets for State sales taxes.

Embracing the welfare state - Bush's brand of compassionate conservatism is getting awfully close to morphing into a clone of the DemonRats' cradle to grave control of our lives.

The DemonRats Want To Cut the Tax Cuts

From a very selfish perspective, I will be very glad when John F. Kerry drops from the race and we no longer have to see headlines such as these. It's embarrassing having my name associated with any mention of higher taxes.

Kerry, Dean at odds on Bush tax cuts. Candidates clash on costs, benefits

Kerry, Dean Sharpen Debate Over Tax Cuts. Candidates Spar on How Much to Repeal

Life In A FishBowl

There are plenty of very legitimate reasons to despise presidential wannabe John Edwards. However, I can't get worked up over being a whole four months late on his property taxes. Big deal! I guess that goes with the territory of running for high office. You have to live your life under a microscope.

Edwards is 4 months late on taxes

Report: Sen. Edwards Owes $11,000 in Taxes

Let's not hold our breath waiting for the media to discuss Al Sharpton's tax scam, where he has a supposed vow of poverty and his church pays for all of his expenses. He's used that ruse to avoid paying off the judgments from his slander conviction, as well as to avoid any income taxes on his very large speaking fees. He gets the same kind of free pass from accusations of wrong-doing as one of the most the corrupt politicians in the PRC, Willie Brown, who is currently ruling as mayor of San Francisco. Anyone who dares to point out that these gentlemen are crooks is automatically branded as a racist.

Wildlife refuge rescued from tax problems - Turpentine Creek dodged a bullet this time. Hopefully, they will get some pro bono legal assistance to overturn the block-headed decision that they can't be exempt from property taxes as with properties owned by other local charities. A refund of the extorted taxes they have already paid in will be a very useful boost to their cash flow. Thanks to Dennis Schick, Executive Director of the Arkansas Press Association, for helping to spread the word about Turpentine's crisis. It was also timely that the APA had their semi-annual convention in Eureka Springs last week.

Mandatory E-Filing

I've written often about the reasons why electronically filing tax returns is an unwise move and I have resisted all attempts by IRS to start using that program for my clients. So far, IRS efforts to make e-filing mandatory have been shelved. However, that hasn't stopped some State tax agencies from taking a more aggressive approach to what they perceive as a cost saving technique.

Living up to its name as the People's Republic of California, that state's rulers have just passed a law requiring any professional tax preparation office that prepares more than 100 individual income tax returns with computer software to file their clients' tax returns electronically as of January 1, 2004. This requirement has been in the works for several months, with debate over the break point. There is going to be a $50 penalty for every paper return submitted by preparers who should have used e-filing.

What I will find personally interesting is the definition of 100 tax returns. Since leaving the PRC ten years ago, and transferring my 700+ California tax clients to new CPAs, I don't prepare that many PRC returns any more. My current clientele is spread all over the country, with only about a dozen in the PRC. However, overall, I am preparing tax returns for about 150 individuals each year. The FTB has more info on this new law, but it isn't clear as to whether or not someone in my circumstances would be covered by this new requirement. I wrote to the FTB asking for clarification.

I did notice a sort of Catch-22 in the FTB rules. In order to sign up for e-filing of PRC tax returns, a preparer has to already be enrolled in the IRS's e-file program. It's working out that the rulers of the PRC are doing some of IRS's dirty work by forcing the use of electronic filing.

I have seen indications that other states are also considering requiring that their taxpayers submit tax returns electronically. I'm sure if it goes smoothly with the PRC, other states will be quick to enact such requirements.

In the meantime, I can't help but ponder ways for people to avoid undue audit potential by continuing to file paper returns with plenty of explanatory material. Some options that come to mind at this early stage include the following.

This new rule only applies to professional tax preparers; so people could prepare their own tax returns, or have a pro do their 1040 and do the 540 themselves. Another option would be to use a tax preparer who falls under the 100 returns per year limit. Another choice would be to continue filing paper returns and pay your preparer an additional $50 to cover his/her FTB penalty. This last one will probably be my approach, if the FTB considers me to be subject to the new rule.

Hiding Behind Corporations

As I've constantly described, using a C corporation is the best way for most people to minimize their tax burden.

Another big benefit of corporations is their ability to give some protection from the ever increasing number of frivolous lawsuits. However, some people think that using a corporation automatically gives them complete immunity from any legal attacks for their actions. That is not the case. Your personal actions will be your personal responsibility with or without a corporation. There are constant stories about doctors who screw up, such as cutting off the wrong leg or removing the wrong kidney. Many doctors are incorporated. It would be a travesty of justice to allow them to hide from the consequences of their actions by forcing the damaged parties to sue their corporations.

What corporations are great at is shielding you and your personally owned assets from the legal consequences of other people and of property. If you have employees or co-owners, using a corporation will allow you to be protected from legal actions caused by their acts. They will be sued, as will the corporation. However, unless you were also personally involved in the activity that caused the injury, your personal assets should be safe.

Likewise, if someone slips and falls on property owned by your corporation, they will have to pursue litigation against the corporation and you should be safe on a personal level.

What brought this issue up is the latest news on the Harrison Abstract collapse. Dian Brown, the owner, who has allegedly admitted improperly taking money out of the company accounts, and her attorneys, are trying to hide behind the corporate shield from litigation. This is ludicrous and will hopefully be laughed out of court. If she stole the money, that is as much a personal action, for which she will have to be personally accountable, as is a botched surgery by an incorporated physician.

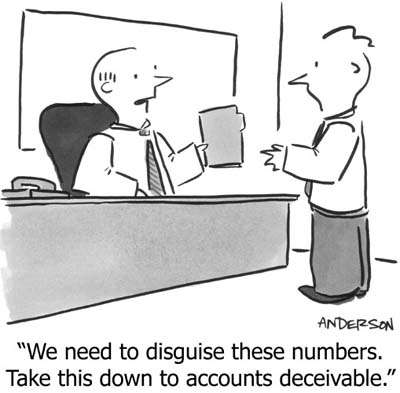

As a side note on the investigation into the extent of Dian Brown's misuse of Harrison Abstract money, this is a text book case for the skills of an independent CPA firm with experience investigating frauds.

Geographic Illiteracy

Since moving to Arkansas ten years ago, it's been amusing to see how many people and media outlets are unaware of the postal abbreviation for this state of AR. I have even seen normally accurate outlets, such as the Wall Street Journal, use AK and AZ to signify Arkansas. We were watching some TV show a few weeks ago and one of the guests was shown as being from Little Rock, AK. As far as I know, Alaska doesn't have a city named Little Rock.

Back in early June, I gave an interview to a reporter from MyBusiness Magazine about my blog. I didn't think to point out that I am in Arkansas, so she attributed me as being in Harrison, Arizona.

Wednesday, July 30, 2003

Financial Privacy

There are fights going on over how much of our private and confidential information financial institutions can share with other parties, and what kind of permission, if any, they have to receive from us, their customers, to do that. Some recent articles on this debate.

Judge limits local privacy protections. Banks may still share financial data with their affiliates

Judge limits banks on sharing customer data. Opt-In' Laws OK'd For Third Parties

Parts of Laws Upheld That Limit Banks' Sharing of Personal Data

Tax increase a tough sell in Alabama - The governor is trying to sell the concept of a massive tax increase as everyone's Christian duty.

Alabama governor calls tax hike Christian duty

The odd tax dodge - Another idiotic tax protestor trying to twist the language of the tax code to nullify the entire income tax system in this country. These tax protestor morons are just like religious fanatics who take one passage from the Bible and establish an entire cult based on those few words, even though the rest of the bible says the complete opposite.

Grab Bag

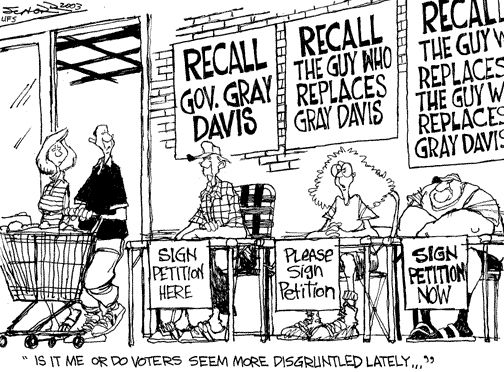

I've long believed that ballots for elective office should have an option of NOTA (None Of The Above) so that people don't have to choose the lesser evil. With the coming free-for-all in the PRC, where the highest vote-getter wins the governorship without needing over 50%, it will be as close to a NOTA opportunity as I can recall. Perhaps someone will add his/her dog's name to the ballot, as has been the case with some other elections, so that voters who don't like any of the human candidates can have a real alternative.

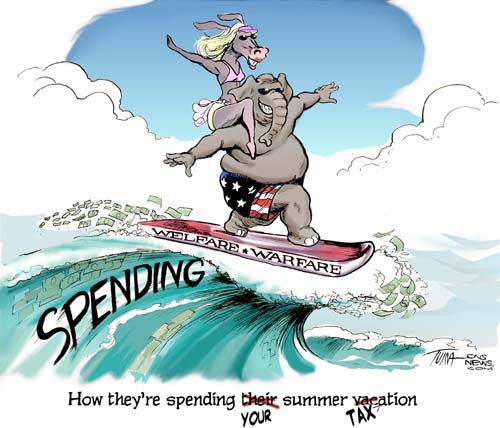

Hey, Big Spender. Ted Kennedy wants to give a subsidy to people who've already had a tax cut. Seriously. - The Oldsmobile submarine captain has become a walking cliche as the icon of bloated big government.

Man Wins 'Dream House' Raffle - A million dollar house for a $300 investment in two raffle tickets. This brings up all sorts of tax issues that I hope he is working on with his tax advisor. He will have to report a million dollars of gambling income for 2003, whether he keeps the house or sells it. However, this opens up the door for him to deduct gambling losses of all kinds up to a million dollars. He should be asking all of his friends to save their losing lottery tickets for him for the rest of the year.

Scam Alert: ATM thief does his work with a smile - We may be seeing some new racial profiling here based on this new scam, called the Lebanese Loop. If your ATM card gets stuck in the machine and their is a Lebanese-looking person standing behind you, calling the cops may be a good idea.

Committee Highlights $200M in Waste, Fraud in Federal Programs - With a multi-trillion dollar annual budget, this is a mere drop in the bucket; but there are easily thousands of government programs where this kind of money is flushed down the crapper. Maybe I'm overly naive in cases like this, but I can't help considering this to be money that is taken out of our pockets, and not from some big magical pot of gold in the sky, as too many people envision government largesse.

With the similarities between the attacks on tobacco and fast food, this may not be very far from what is heading our way. Nicotine addicts have been forced to pay huge taxes on their drug of choice. Food addicts shouldn't be surprised to find the same kind of bull's-eye on their wallets. Recent stories claiming that junk food is as addictive as heroin are too reminiscent of the discussion of nicotine to be anything other than the opening salvo in treating food users in the same manner as tobacco users have been.

Tuesday, July 29, 2003

IRS upgrade hits another glitch - IRS has a long tradition of flushing millions of dollars down the toilet in attempts to modernize their computer systems. Having the deep pockets of the Federal taxpayers to bail them out prevents the IRS from suffering the same fate that private companies would have met under similar incompetencies.

The unachievable goal of a perfect trading market for stocks and other things is that everybody has access to the exact same information as everyone else has, so that nobody has any advantage over anyone else. As Martha Stewart has discovered, what constitutes illegal insider info is a very subjective assessment.

Radio Interview

This morning's interview with Baltimore radio station WBAL was moved up at the very last minute. I'm not a morning person, and was up much earlier than normal for the original interview time of 7:25 our time. Luckily, I got up at 6:30, with the goal of browsing the current news beforehand. However, a call came in from the WBAL producer before I could even check the first site. She said they were running behind and needed to put me on earlier than planned. We ended up only having three minutes for this interview.

Since it's not likely many of you heard the interview at the time, we recorded it off the WBAL Internet feed and I have posted it in standard MP3 format on my site. It runs just over three minutes and the file size is 2.3mb, which is much smaller than the 17mb original wav file.

For anyone interested in how to record things like this, I have been using the Total Recorder program for a few years now and have been very happy with its ability to record anything that is playing through our computers.

Monday, July 28, 2003

Democrats Not Shying Away From Tax Talk. Candidates Discuss Raises, Not Cuts - Just one of many reasons to despise DemonRats.

Why Medicare Expansion Threatens the Bush Tax Cuts and Undermines Fundamental Tax Reform - As with all government programs the actual costs will be several times what the proponents claim they will be. As with such boondoggles as MediCare, the big government fans know that once people are hooked on the program, it will be impossible for it to be scuttled just because it costs a hundred times as much as they told us it would at the beginning.

CNBC Disclosure Stirs Ethics Debate in Business Media

It's always been a dilemma in regard to financial writers who tout certain stocks. While many media companies have rules forbidding their writers from covering stocks that they personally own, if it's such a good investment, it does give one pause if that person doesn't put his/her own money where his/her mouth is. On the other hand, there is also the concern that the writers are using their clout to stimulate buyers to run up the prices so they can be unloaded; pump & dump. I don't have a preference for either; but I think it is a god idea to have writers disclose their personal ownership.

I always get a big kick out of the hot stock tips that come via email. They imply that the analysis is objective, yet the fine print at the end often says that the writer was given several thousand dollars or several thousand shares of the stock for sending out the emails. I always wonder how many people are stupid enough to actually buy those shares regardless of the obvious blatant conflicts of interest.

Brown enters not guilty plea - The reported size of the theft from Harrison Abstract has grown since earlier accounts. The original estimate of $400,000 has been revised to a million dollars. I doubt if the entire scheme has been unraveled yet, so that figure will most likely be changing.

On The Radio

We've finally worked out the time for a live on-air interview on Baltimore radio station WBAL, triggered by my FoxNews.com article from last week. I am scheduled to be on Dave Durian's Morning Show for about ten minutes, starting at 8:25 am EDT tomorrow, July 29. For those not around the Baltimore area, the station has online broadcast capability. I tried it myself this morning and it actually started up and played a lot more easily than the other radio outlets that I listen to online.

Sunday, July 27, 2003

IRS Given More Power To Break Laws - IRS's PR program to convince our rulers that they can't do their job without breaking laws that would put regular people in the slammer seems to have worked. The more we hear about the deficit, the more pressure there will be to unleash the IRS Gestapo and let them do whatever it takes to squeeze more money out of people. It's classic ends (money for government) justifying the means (whatever it takes). As I've documented on several occasions, the infamous "tax gap" of supposedly uncollected taxes, is a pure guess (on the very high side) by IRS. They have admitted that to me when I pushed for documentation of how they calculated their numbers, which are used routinely to justify their collection tactics.

Sound fiscal advice for families should apply to state budget - With all of the focus on creative accounting done by large corporations, it's interesting to note how practically all of the fiscal shenanigans played by our rulers at pretty much all levels of government would put corporate executives in the slammer. This means that corporate shareholders are legally given more recourse over fiscal mismanagement than are taxpayers.

Pension Problems, Pension Politics. Many plans aren't solvent but Congress shouldn't make the problem worse.

Seven Rules for Investing Young

Protect disabled with special needs trust - when discussing estate planning, I've long suggested that people imagine themselves as being in the position of puppeteers from the other world after they pass on. However, to ensure that one's wishes, including special arrangements for family members, and even pets, are actually carried out, everything has to be properly spelled out in proper documents. I have yet to hear of the terms in a deceased person's will or living trust being changed based on conversations from beyond the grave, regardless of the popularity of people who claim to speak with the dearly departed. I advise people to project ahead to when they are gone and write down what they would like done with their assets. A good estate attorney can usually draw up documents that will ensure that those things are actually accomplished.

Saturday, July 26, 2003

A (Less) Taxing Time. Experts Say Breaks Help But Don't Merit Change in Your Plans. - From the AARP Bulletin

Friday, July 25, 2003

The tax-rebate check is in the mail - If you receive one of these checks, make sure to properly identify it in your checkbook and/or QuickBooks. Also, be sure to tell your tax preparer next year how much you received so we can all avoid the confusion that the 2001 rebate checks caused. I had dozens of clients swear that they hadn't received their 2001 rebates, only to have IRS catch them and have to change their 1040s accordingly. That was one (of many) reasons we started requiring everyone to have all of their personal accounts set up on QuickBooks; so that we can check for the rebates.

Hey, Mom and Dad: Don't Fall for This Tax Scam! - No need to pay anyone to get the IRS rebate checks. Any time there is money being tossed around, you can be sure there will be vultures trying to take it.

Thursday, July 24, 2003

Building wealth

Kids Rally for Tax Credits and 'Stuff Like That' - Exploiting kids for their big government goals is nothing new for the lefties. "It's for the children" is considered a bullet proof argument for anything.

The Government Budget Folly

Real problem is not the deficit

The deficit distraction

Have Backups

With many of our clients involved in real estate investing, as well as consulting with Sherry's exchange company, we often see people make unwise moves (aka screw-ups).

A frequent mistake people make comes in identifying the replacement property for an exchange. In classic putting all of one's eggs in a single basket, too many people set their sights on a single property and don't have any backup properties listed by the end of their 45 day identification period. Anyone who has been around real estate transactions knows that deals can fall apart for any number of reasons and at any time, including at the very last minute. The Harrison Abstract fiasco is a perfect example of completely unexpected circumstances scuttling real estate deals.

If the original target property collapses before the 45th day, you can add new properties. However, if the deal for that intended replacement property falls apart after day 45, and there are no others listed, the exchange is canceled and the gain that could have been deferred becomes fully taxable. The moral of the story is so simple. Have at least one backup property, ideally two, listed by the end of the 45 day identification period.

Wednesday, July 23, 2003

Progressive?

One of my long time pet peeves has been the use of the oxymoron "progressive" to describe the graduated income tax rate structure that charges much higher percentages for those people who earn more than others. In this country, it is considered progressive to stick the upper income folks with an overly high share of the total tax burden. I'm not the only one who considers this a penalty on success and achievement.

People don't like my mentioning the connection between the concept of progressive taxes and the Communist Manifesto, but check out item two in Marx's platform and tell me why such a comparison isn't relevant. Perhaps our rulers didn't use the actual manifesto as their blueprint, but sick minds think alike.

On the flip side, it is considered to be "regressive" when lower income people pay a higher percentage of their income for certain taxes, most often sales taxes, than do the evil rich.

What is completely missing from the dialog on taxes is the concept of fairness or uniformity, such as each citizen paying the same dollar amount of taxes to support the government, or even the same percentage of their income.

Measuring the degree of progressivity can be done in a couple of ways. One way would be to just compare the lowest tax rate with the highest. For example, on a nominal level, the 2003 rates range from 10% to 35%, for a progressivity index of 3.5 to 1. For 2002, the rates ranged from 10% to 38.6%, giving a progressivity index of 3.86 to 1. Due to the phase-outs of tax deductions and credits at upper income levels, the actual effective tax rates can be much higher than the top scheduled rate.

The more commonly use measure of progressivity looks at the actual dollars paid by the various income levels. As in this 2000 chart, the top one percent of taxpayers paid 37.42% of all income taxes, for a progressivity index of 37.42 to 1.

I was recently asked if the newly passed tax rate cuts will increase or decrease the overall progressivity of the income tax system. As shown above, the progressivity of the nominal rates has dropped from 3.86 to 3.5. However, while we won't know for sure until after the fact, I am confident in predicting that the shift of actual income tax dollars to the higher earners will be even more lopsided. As can be seen in the debates over the increased child tax credits, more people will be paying zero income tax. By definition, this will put more of the overall tax load on the remaining taxpayers, who are in the higher income ranges.

Curing Tax Code Could Cure Health Insurance Woes, Citizen Group's Study Concludes

Dealing with the President's right flank - Bush's big spending agenda is not sitting well with those of us who want smaller government.

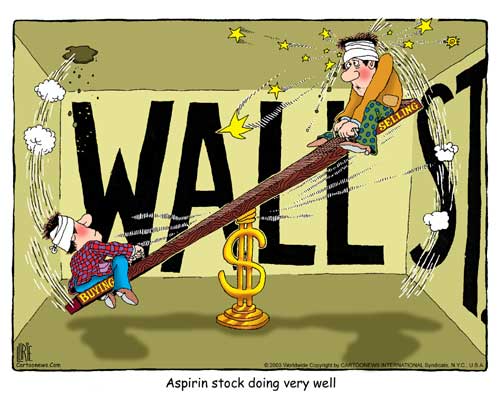

Wall Street and the States - There is quite a jurisdictional battle going on over who is going to regulate publicly traded corporations and how best to protect investors. You can be sure that scammers will exploit whatever discrepancies develop between the various jurisdictions, much as Delaware has long been used as token corporate headquarters in order to take advantage of the shareholder unfriendly rules in that state.

One of the biggest fears many people have is outliving their wealth. Knowing how much money a retiree needs is difficult to quantify, unless you are like one man at one of my seminars in Hot Springs, Arkansas a few years ago. He claimed to have already set the date for the end of his life and was basing all plans accordingly.

What's In A Name?

The most common feedback to my FoxNews article seems to be regarding the nickname I often use for the political party with a JackAss as its mascot. Many people are lobbying for other variations of the name, rather than the DemonRat term I have been using for the past several months.

Popular alternatives offered include: Dems, Dims, and Dumbocrats. I'm not sure about that last one, considering the association with Dumbo the elephant and the GOP's mascot. The most impassioned case sent to me was the following, which I hope the sender doesn't mind my quoting verbatim.

I must respectfully disagree with your use of DemonRat in your recent blog posted on FoxNews.com. I believe the term you are looking for in this case, referring to Wesley Clark, is DemonCrap. This is important! DemonCrap is incapable of effecting change in and of itself. It only serves as fertilizer for the seeds of bad ideas. DemonCrap is generally understood in academic circles to be the intestinal by-product left behind by the larger DemonRats like Terry McAuliffe or Hill and Billary Clinton. However, DemonCrap may also be used to refer to the stool of the lesser known, better disguised GreenRat, or even the once-thought extinct RedRat. I must ask that in the future you be more careful to make this distinction.

Financial probe into Harrison company hits Carroll County Realtor - The ripple effect of the Harrison Abstract collapse goes well beyond Boone County. In fact, I was speaking with Larry Montgomery last week and assumed that his deals were safe from the Harrison Abstract fiasco, when he told me that he did have clients who were caught up in that mess.

Residence Sales

I know that it takes a while for new tax laws to filter out into the public consciousness, especially when they represent a huge change from a long standing practice. Over six years ago (in May 1997), the tax laws regarding home sales were changed dramatically. Still, to this day, I am constantly seeing and hearing people, including some tax professionals (extra scary), working under the impression that nothing has changed and that a home seller has to buy a new more expensive home in order to avoid capital gains taxes.

I can see why some Realtors would love for this misconception to persist. The old rule requiring people to buy more expensive homes was a great stimulus for the market; especially in areas like here in the Ozarks, where home prices were driven up by transplants like us from more expensive parts of the country. Under the "new" six-year old law, a seller has no requirement to buy any new home of any price.

Tuesday, July 22, 2003

Interesting Feedback

As happened the last time FoxNews.com featured my blog, the response has been quite heavy. Depending on the topics discussed and the number of individual emails I receive, I may be able to respond directly or, more likely, will use the incoming comments as the starting points for future articles.

Redefined Benefits (link to article expired) - Un and under-funded pension accounts and other accounting tricks make future benefits not as dependable as most people would like.

Don't Sweat the Deficit. That is, if spending restraint emerges.

Guess Who Hates Taxes In New York? - Sometimes stereotypes can be misleading.

Dare to Live Dangerously: Passing On Some Insurance Can Pay Off (link to article expired) - Risk management; deciding whether it's better to self insure or pay premiums to someone else, is a kind of gamble we all do in various ways.

You'll never know how many "friends" and family members you have until you come into a financial windfall.

Unfortunately, the actual reality is that having taxes taken out ahead of time creates more of an "out of sight, out of mind" situation. By the time next April 15 rolls around, this guy will have completely forgotten how much he has paid in for taxes and will consider it some kind of victory when he receives some of his own money back as a refund. The best reality check for increasing awareness of the tax burden would be for everyone to have to write a check to IRS; ideally about a week before Election Day.

Thanks to FoxNews.com for selecting this blog to be featured on their site again this week. It's an honor. I'm not a big fan of traveling; but I would be willing to drive up to the Springfield, Missouri Fox affiliate to go on air and discuss any of the tax or financial topics covered here.

Waste Not, Deficit Not. A key congressman wants the government to stop throwing money away. - One out of 535 isn't going to make a big dent in the out of control spending; to say nothing of a president who is an even worse spendaholic.

Senate GOP Makes Move on Higher Welfare Payments To Non-Taxpayers

Wall Street Settlements For Dummies - More of the growing victimology in this country. Nothing we do is our fault. Just claim you were too stupid to know that you could lose money in the stock market, and you may be entitled to a settlement.

Russert Rails Against Deficit, Then Demands More Spending - In typical DemonRat economics, all government spending is good and all tax cuts are evil.

Money doesn't mean happy parenting

Careful, Your Bank Is Watching (link to article expired) - People normally associate Big Brother with the government; but many businesses have more intrusive capabilities than any government agency.

Hotel Guests Are Asked to Pay Higher Charges for Amenities (link to article expired) - Travelers are desirable targets for exploitation by companies, as well as by local governments with their growing tourist taxes. The double whammy of having higher hotel bills will be the extra taxes that are based on the higher underlying charges.

Wall Street Plays Numbers Game With Earnings, Despite Reforms (link to article expired) - There are still a lot of creative approaches being used by corporate accountants.

Independence of Directors Is Elusive Goal of Reform (link to article expired)

Critics Say Sarbanes-Oxley Law Hobbles Stocks, Chills Risk Taking, but Upshot Is Less Dramatic (link to article expired)

Before white collar crime as we know it today. It's a different take on "the pen is mightier than the sword."

Monday, July 21, 2003

Arkansas Rulers Can't Escape The Sales Tax - This quote says it all: "A constitutional quirk, as Sen. Jim Argue, D-Little Rock, called it, makes it relatively easy to raise the sales tax and nearly impossible to raise other taxes."

Those tax cuts beginning to work (Stephen Moore)

UC eyes surcharge for rich students - I can already see where this is heading; more impoverishment planning for parents to make them appear on paper to be below the "evil rich" threshold. It's one more reason to use a C corp instead of an S.

Ugly Money - An interesting look at what some people like to do with their cash.

The best Congress money can buy

Out of Balance. Bush's next challenge is to get spending under control.

Campaign Donations Sway Lawmakers' Vote - As I've long said, the highest potential earning investment with the lowest risk is campaign contributions (aka bribes) to our rulers. While the first gut reaction is to consider the donors to be the bad guys here, that's not how I see it. The problem is that our government has grown so large and so involved in too many aspects of our lives that our rulers have influence over areas that our founding fathers never envisioned. If our government were scaled back to only what it is constitutionally allowed to do, there would be no need to give money to our rulers to buy favors.

Bush sees tax cuts spurring job creation - We'll have to see if this happens. However, the quadrupled Section 179 deduction (to $100,000 per year) is a very big incentive to buy new business equipment. I know that a lot of people are checking the weights of new vehicles more closely than ever to make sure they are over the 6,000 pound threshold that makes them eligible for the full Section 179 expense.

Teen says he learned how to print fake money in magazine - It may seem to be nit-picking, but there really is a difference between "making" money and earning money.

Labels: 179

Harrison Abstract Update

They are trying to freeze many of Dian Brown's assets and are having a hearing today (7/21) to discuss it. She and her attorney are still trying to claim that her personal assets should be exempt from any action since the problems were with her corporation. This is a ridiculous argument that will hopefully be tossed out by the judge. It's been reported that Brown admitted transferring $400,000 of client money from the corporate accounts to her personal accounts. That makes an easy connection to why her personal assets should be frozen ASAP and used to pay off her victims.

The news accounts of this case have given the impression that all funds held by Harrison Abstract have been frozen since the end of June. I just learned from some clients whose funds were part of this mess that their money was released after pressure was exerted by a Harrison bank and it was explained that there may be additional damages due to the failure to complete a 1031 exchange. Hopefully, other people who had their money in Harrison Abstract's account when everything was frozen will also be able to close their deals without having to wait months or years.

Labels: 1031

Friday, July 18, 2003

Bush's Bigger, Fatter Welfare State. Administration spending plans are out of control.

A Tip on TIPS. You need to understand the real interest rate.

Anti-tax groups vow to fight easing voting rules for budget - It's good to see there are still some folks in the PRC with the anti-tax fever.

The Pension Time Bomb

New Kids on the Block. Under-25 Crowd Buys Homes In Ever-Growing Numbers. (link to article expired) - This is great for their future, building equity in real estate rather than wasting it on rent.

Bush becomes 'big government conservative' - Just like his father, Bush 43 is alienating his conservative base by trying too hard to buy DemonRat votes with taxpayer money.

Deficit politics

Thursday, July 17, 2003

Panel looks at ways to reform Arkansas state tax code - A laundry list of tax hikes.

Who's Rich? Part II - Different perspective from Thomas Sowell on the "hate the rich" stories regarding the recently released IRS stats on the 400 tax returns with the highest incomes. An interesting fact is that between 1992 and 2000, there were 2000 different people in that top 400. It's not as cut and dried as the stock complaint of the lefties that the same rich get richer and the same poor get poorer. There is more up and down mobility between the wealth levels in this country than anywhere in the world.

Running on Tax Hikes: Presidential Candidate Releasing Fiscal Plan - Not exactly a novel idea for a DemonRat.

It's a strange mental condition found in Demonrats and RINOs. To them, there is no such thing as a good tax cut and they can be blamed for anything and everything that they don't like. On the other hand, they never see anything wrong with more government spending, unless it's on an investigation of Clinton crimes.

If Bush doesn't take the scalpel to spending, we who understand how tax cuts work (and don't cause deficits) will not be able to defend him against criticism over the growing deficits.

Turpentine Creek Property Tax Problem

Here is an article in the local paper on the back taxes issue. They don't dig into exactly what the motivation is for refusing to allow this legitimate charity to have the same exemption from property taxes as do other charities. It's probably the classic case where some snake wants to steal the property away for his/her own profit. It is in a very desirable and scenic location.

Just the fact that they charge admission is no reason to claim that Turpentine Creek is a for-profit business. It's hard to find a zoo, museum or park that doesn't have an admission fee, including government owned ones, which are technically already subsidized by our tax dollars. Hopefully, Turpentine Creek will be able to locate an attorney to do some pro bono work and appeal this bone-headed decision to a higher authority, and allow them to have the taxes they pay refunded.

Big Story In Little Harrison, Arkansas

Sherry & I were walking into the Harrison Wal-Mart yesterday and saw this headline (Brown surrenders to police ) screaming out from the newspaper box. It didn't show up the paper's website until this morning.

I'm not a criminal attorney, but it seems odd that she was able to stay free by posting only $5,000 cash, considering the amount she has allegedly already confessed to taking ($400,000), plus whatever additional amounts are discovered after a complete audit.

Brown loses real estate title issuing license - Her name is mud in this town; so she will probably have to relocate to another state in order to find a new job.

The chain reaction ripple effects from this mess are spreading very wide. It's not just the people who had money in Harrison Abstract's account that are suffering the consequences. The sellers whose money is tied up were normally planning to use those funds to buy something else, delaying or canceling that deal. The sellers of those properties are then without the proceeds that they may have been planning to use for another purchase. It goes on for several levels.

This is going to be a field day for lawyers. Even after everyone is hopefully compensated for all of their direct monetary losses, there will be litigation over the other deals that fell apart because of the inability to access the funds in a timely manner.

Wednesday, July 16, 2003

Less Tax, More Paperwork (link to article expired) - As always, our rulers in DC have guaranteed more work for us professional tax preparers by making everything even more complicated than ever. Some might suspect that they worry about a lot of unemployed tax practitioners and are just looking for ways to create more work for us.

How you can pay bills in blink of an eye - Just like in spy movies, we'll soon be able to do all kinds of things just by having the irises in our eyes scanned.

The Politics of Pension Promises (link to article expired)- It's not just the Teamsters and their Mafia pension plan scams that employees have to worry about. Many companies have been allowed to fund pension contributions with IOUs. Of course, this is similar to what Social Security is; but comes as a surprise to many employees, especially if the employer goes belly up.

House Panel Approves Permanent Ban on Internet Taxes - This refers to State taxes on the actual Internet services. It doesn't put a damper on State sales taxes on retail purchases made over the web, which is still a very hot issue.

States Losing Billions Due to Corporate Tax Shelters

Rich politicians can't understand the needs or ordinary Americans - A word from Mr. Obvious.

Budget deficit: What me worry?

Insider trading - As Walter Williams explains, it's rare when a transaction doesn't have one side knowing more than the other.

I Think, Therefore I Owe. New York's mayor wants to tax everything that moves. Here are some things he forgot.

Deficit Yoga (link to article expired) - Just looking at the dollar amount isn't a proper analysis.

A Tax On Fat (People)?

A Dog Running For City Council - It's hard to imagine a Canine-American screwing things up any worse than the HomoSapien-Americans who traditionally hold elective office. Maybe it's because of the environment in which they have been raised, but I have never sensed any attraction for tax increases in any of the dozens of dogs we have had here. I don't think such a mind-set is possible for Canine-Americans; but we may find a different attitude in dogs raised by lefty DemonRats. This isn't unprecedented. Sunol, California, near where we used to live, had a dog for a mayor, who did as fine a job as any human.

Farmer Offers Rental Cows on Internet - It will be interesting to see if this idea pans out. It's hard to imagine anyone paying $276 for the cheese produced by one cow over a Summer.

As I've always said, stocks are great investments if you like the excitement of never knowing how you stand until you check that day's stock prices. Other kinds of investments, such as real estate, are just too boring for investment thrill sekers.

More On Harrison Abstract Case

Suit asks to freeze sale of Browns' personal assets - This obviously should have been done before last weekend's auction.

Harrison Abstract analyzed

Aug. 26 deadline for submitting claims against Harrison Abstract

Why You Waste So Much Money. Research Says People Don't Use Services Like Gyms Enough to Justify Their Cost (link to article expired)

It's not hard to come up with dozens of examples of of how things that look like bargains up front turn out to be big wastes of money. Buying a gallon jug of mayonaise may reduce the per ounce price you pay over a standard size bottle; but the actual cost for what is used works out to be much higher when you have to toss three quarters of the contents away.

The other frequent example that comes to mind is timeshares. The promoters sell the concept based on how much you would save over hotel costs. Real life almost always works out the other way. With the annual maintentance fees, and missed usage, along with the terrible resale values, hotels are much cheaper ways to stay in resort areas.

Tuesday, July 15, 2003

Turpentine Creek Property Taxes

I have long been a supporter of the big cat wildlife refuge outside of Eureka Springs. One of the first projects I was involved with when I first started working with them was to try to put together a loan package for them to refinance the original property purchase loan with a new bank loan. Another goal was also to clean up the name on the title for the property from that of the foundation's president, Tanya Smith, to the foundation itself.

The true non-profit nature of Turpentine Creek's finances made it impossible to satisfy the banks' loan criteria. As the old banker's joke goes, they only want to loan you an umbrella when it's not raining and money when you can prove that you don't need it.

The title issue has created a problem with the county property taxes. If the foundation's name were on it, the property would be tax exempt. However, with Tanya's name on it, they have been assessed the full amount of taxes. They are in a very real Catch 22 situation. Tanya can't transfer the property to the foundation without triggering the original seller to demand payment in full for the loan, which obviously can't be afforded.

The Carroll County ruling authorities have been complete jerks about this situation and are threatening to sell the property at the end of July if the $26,000 in back taxes for the past five years aren't paid. I'm not involved enough in local politics to understand why they are being this nasty to a charity that has been filling a very real need; but it's obvious that some people have ulterior motives for trying to shut them down.

Here is Tanya's explanation of the problem. She is absolutely right that they should be exempt from property tax and the county is being completely unreasonable in not taking into account the difficulties in straightening out the title issue.

Who's Rich - As we all should know by now, if our superiors, the rich lefties, don't need a tax cut, then none of us common folk need one either.

Court activism makes Balanced Budget Amendment a bad idea

Climbing Deficit Renews Battle Over Tax Cuts Versus Spending

Hillary's Scheme: Inside the Next Clinton's Ruthless Agenda to Take the White House - People have been calling me crazy over the past few years for claiming that Queen Hillary has always been planning to run in 2004 for a third term in the White House. Actually, I have always explained that her plan was for the rest of the DemonRats to field such a pathetic bunch of losers that she will be "drafted" to save the party, and the country. That plan is right on schedule.

Five Financial-Market Fallacies

The Sixth Supply-Side President. Bush is in league with Grant, JFK, Reagan, and more. - However, spending like Teddy Kennedy is not an admirable trait in Bush.

1031 Exchanges

Based on some recent email exchanges, I've updated some of the FAQs regarding 1031 exchanges on TFEC's website:

Dealing with property owned in a partnership

Reverse exchanges

Labels: 1031

Sitting Ducks

Needy local, state governments tack more taxes onto travelers - Tourists are popular targets because they can't vote and punish the rulers who nail them with those taxes.

Monday, July 14, 2003

Tax Surcharge on Wealthy Reaching Middle Class - More on the insidious AMT.

Future power of personal accounts - Allowing the little people any control over any portion of their Social Security money is going to be a tough battle.

State spending seen increasing despite nationwide fiscal crisis - State Rulers are like drug addicts when it comes to spending money.

In all fairness, the governor isn't alone in incompetent leadership. Toss everyone out and replace them with names randomly picked out of the phone book. They couldn't do any worse than the professional politician clowns in Sacramento have been doing.

The reason for high taxes and deficits.

Bush is disappointing a lot of his earlier supporters by continuing to feed this fat pig and not putting him on the starvation diet that is the only way to save his life.

Defunct Title Company

Sherry said a friend saw a story about the FBI involvement in investigating the Harrison Abstract case on TV; but I haven't been able to find any mention of it on any of the websites for the Springfield, Missouri or Fayetteville, Arkansas TV stations. The Harrison Times is still doing a good job covering the story.

FBI probes firm

Brown's assets listed - Per the Boone County Assessor's office. This only includes motor vehicles and doesn't show other assets, nor anything located outside of the county.

Brown auction sees 500 attend

I'm not involved in the investigations, and I hesitate to comment from the sidelines without knowing all the facts. However, having worked on several cases like this, I can't help wondering why the authorities are allowing the Browns to keep the proceeds from their auction. The claim that the things sold were personally owned and not part of the corporation that was shut down is ludicrous. It's been reported that Dian Brown admitted transferring $400,000 of client money from the corporation's bank account to her personal account. She obviously used the money to buy a lot of things. Those auction proceeds should have been taken by the authorities and placed into an honest escrow account, pending resolution of the restitution of the embezzled funds. Allowing the Browns to take possession of the auction proceeds just seems like exactly what they need to be able to flee the jurisdiction before the matter can be resolved properly.

Sunday, July 13, 2003

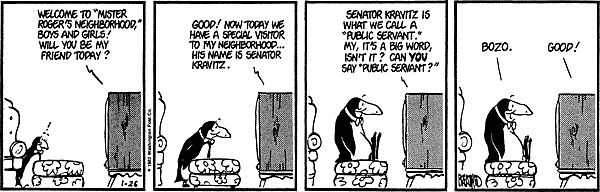

Evolution

This is a term we don't hear much any more; public servants. It used to be that the people we elected into office were there to serve us, the public. Just like the frog in hot water, it's evolved to the point where they now sit on their thrones and tell us how we are to do their bidding. We are controlled by the very kind of unaccountable royalty that our founding fathers revolted against and tried to prevent from happening here. Forgetting to include a provision limiting the number of terms served was probably the biggest mistake they made when they drafted the Constitution. They were simply too optimistic about the character of people who would run for office.

Blogs breaking logjam of journalism - Between Fox News and the growing blogosphere, the mainstream liberal media are having conniption fits at their loss of monopoly power over what we little people are allowed to know.

Cat fight - Good look at how the disorganized GOP in the PRC will almost certainly mess up the opportunity to exploit the possible recall of Governor Gray-out Doofus.

Daniel Weintraub: California's sales tax is the ultimate roller coaster - As I've always said, any revenue projection made by our State or Federal rulers is nothing more than a WAG (will ass guess). It's not possible to be anything but that because the actual dollar amounts generated by some kinds of taxes are just impossible to predict with any level of accuracy. It's always been one of my many pet peeves with the media that they just willingly accept any forecasts as gospel and never challenge the underlying assumptions. They're still crediting Bill Clinton with producing a five trillion dollar surplus which they then blame Bush for squandering. The Clinton numbers were complete fabrications and were based on the underlying assumption that the stock market would increase by over 20% per year forever, with a continuous flow of taxes from those profits. This may sound like a joke, but is exactly where those projected surpluses came from. Only the biggest mind-numb morons (aka Clinton worshippers) could swallow that load of crap.

The real problem with government budgets has long been that our rulers construct big expensive government programs based on the assumption of their overly optimistic revenue predictions and are later all confused when there is a short-fall.

Farming In NorthWest Arkansas

Some interesting articles on changes in the farming environment here in NorthWest Arkansas. Since we still have a small farming operation here on the KMK Ranch, and many of our clients raise cattle and poultry, we need to stay on top of current and upcoming changes.

Efficient Facility Key for Poultry Growers

Farmers Face Changing Life

Regulatory Creep Affecting Farmer's Property Rights

The ABCs of tax cuts - Peter Jennings may have become a dual USA-Canada citizen; but that hasn't slowed his use of the Anti-american Broadcasting Company to spread his hatred of capitalism and love of socialism and high taxes.

Saturday, July 12, 2003

Oregon Is Looking At Tax Hikes

Lawmakers debate the feasibility of a sales tax

Tax reform hearings end with no immediate fix in sight

The shorter list would be of States not looking to raise taxes.

The alternative tax whammy - Our rulers in DC are taking their sweet time fixing the AMT monstrosity. Remember to check out the only group I am aware of that is addressing this insane tax, ReformAMT.

Nevada is considering a new gross receipts tax.

Don't like the tax cut, don't keep it! - One vision of an ideal world is one where liberals mind their own business and keep their nose out of ours. If they think that the central government is entitled to every dime of their income, let them send their money to the IRS. For the rest of us, who believe in controlling our own money, the more of it we are allowed to hold onto, the better.

Friday, July 11, 2003

Federal Officials Grapple With Misuse of Social Security Numbers

Panel takes on Virginia tax-code reforms

Accounting involves a lot more creativity than most people, who think everything is cut and dried, realize.

The Bible Says To Raise Taxes?

This is a new one on me. The governor of Alabama is claiming that the Bible is telling him to raise everyone's taxes in his State. There are a few more ironies to this story.

The governor is referred to as a conservative Republican, who just happens to be proposing a huge ($1.2 billion) tax hike.

In typical liberal hypocrisy, the lefties, who normally come unglued and scream bloody murder any time anyone mentions religion, aren't protesting this action. For them, separation of church and state takes a back seat to more money for the government.

Some Would Call It A Form Of Slavery

Americans Work Until Today to Pay for Government - On average, every penny of income you have earned from January 1 until today was for the government. What you earn the rest of the year will be for yourself.

Government Costs More than You Think

Today, We Start Working for Ourselves

Norquist Says Battle Over Taxes Won, Spending Is Next

Not Good - The Nevada Supreme Court has tossed out a voter mandated limit on taxes and is forcing the legislature to raise taxes.

New Proposal to Shrink Government: Term-Limit the Big-Spending Appropriators - What I've always been saying. We need a continuous turnover of elected rulers in our capitals. The longer anyone stays in office, the more corrupt and disconnected from the real world they become.

The New Tax Law's Effect on Trusts and Home Sales

Flat Tax Fever - In a strange irony, Russia and some other former communist countries are adopting flat income tax rates, while we here in the USA continue to use Karl Marx's progressive tax rate scheme to heavily penalize the more productive in our society. To show how insidious this is in our society, DemonRat presidential wannabe retired general Wesley Clark defended the concept of progressive tax rates as something our nation was founded on during a recent interview with Tim Russert. It's no surprise that Russert didn't challenge Clark on his idiotic claim. It's not NBC policy to make DemonRats look stupid. That's only used for GOP guests.

More On Harrison Abstract

The Harrison Daily Times seems to be the only one covering this story. My guess is that someone high up at the Times was among the many victims. New details:

Harrison Abstract receiver files report - It doesn't sound good, especially for the people who had their recently deposited money frozen when the company was seized.

Harrison Abstract audited

Couple awaits closing - These people lost the money they deposited into escrow on Wednesday, two days before everything was frozen. This is exactly what happened to our clients, who deposited their money into the Harrison Abstract bank account on Thursday, one day prior to the shut-down.

These kinds of things are extremely messy and can drag on for several years. It reminds me of a case back in the PRC, where a savings & loan in which my parents had an account was seized by the government for mismanagement. It took years for the depositors to get any of their money back; and that was only spurred along by threats of violence by some very upset depositors. With Harrison's love of lynchings and other forms of vigilante justice, that may be what it takes in this case to ensure a speedy resolution.

Thursday, July 10, 2003

The rich are already paying their fair share

Unpaid Taxes Take Their Toll. FirstPay Customers Learn the Dangers of Passing the Buck - I have seen this kind of thing happen on several occasions during my career. Payroll processing services keep the tax money instead of forwarding it to the State and Federal tax agencies. When the charade is exposed, the employers are then forced to pay the same taxes a second time.

State tax follies - Luckily, the higher State taxes aren't wiping out all of the savings from the recent Federal tax cuts for most people.

Low-Income Tax (aka Welfare) Break Loses Steam

Tax Credit (aka Welfare Payment) Is Forced to Vote to Embarrass Republicans

Tax cuts inflationary? That theory should be ancient history.

Left Turn. Is the GOP conservative? - A lot of us are wondering if the GOP is abandoning its conservative roots in pursuit of the moderates who are turned off by the increasingly communistic DemonRats.

Firms Had a Hand In Pension Plight (link to article expired)

Social Security numbers key to identity theft

More On Harrison Abstract Collapse

Here are some more stories on the investigations underway over the collapse of one of the busiest title companies in Harrison, Arkansas. We have several clients who have used their services, including some who did lose money when the company's bank accounts were frozen; so we are following the developments quite closely.

Police asked to investigate abstract co.

JP asks AG to review abstract co.

Original Article on the Seizure - Check the recent reader comments, including one person proud of Harrison's reputation for lynchings; except that this time it's not a racial KKK thing.

Wednesday, July 09, 2003

2002 Extensions

While the first extension for 2002 1040s doesn't run out until August 15, there are some that are up on July 15. The first extensions filed by April 15 for Fiduciary (1041) and Partnership returns (1065) are only for three months. These always have a way of sneaking up on me since I am usually so focused on 1040s.

Three more months of time can be obtained by filing Form 8800 by July 15 for both 1041s and 1065s. This brings their due dates into synch with the second extension date for 2002 1040s, October 15.

Senate Panel Hears Proposal to Reduce Pork - This is as likely to have an effect on the out of control spending as it is to expect Bill Clinton to keep his hands to himself while visiting Hooters. Some temptations are too strong for weak-willed people to resist. The only solution for those rulers who consider the Federal Treasury to be their private piggy banks is to check the spending scorecards of all incumbents next year and vote the ones out who have been spendaholics, regardless of party affiliation.

Besides violating their avowed dislike for big government spending, the GOP rulers in DC have abandoned their hatred of government regulation. The latest Federal Register is the longest in history (75,606 pages for 2002), to accommodate the flood of new regulations promulgated by our rulers.

Anyone who is truly a fan of low taxes, less government spending, and fewer regulations can't be very satisfied with the performance of the GOP. There is still a political party that hasn't abandoned those principles. Sending a few more Libertarians to DC would surely send a wake-up message to the RINOs who take their conservative base for granted.

The cliche used to be that the deficit was caused by the Demonrat controlled Congress spending like a bunch of drunken sailors. Are we better off now that the drunken sailors are Republicans?

Tuesday, July 08, 2003

State Income Tax Break May Pass Congress - A possible return of the itemized deduction for sales tax for those people who don't have State income tax to claim.

Those Notorious IRS 400 (link to article expired) - IRS stats on the 400 tax returns with the highest AGI.

Democrats and Fat Cats - Debunking one of the many lies the leftist media spout as gospel; that the GOP are a bunch of evil rich fat cats and the Demonrats are just hard working little guys. As with most of the "truths" per the media, the reality is 180 degrees off.

Boomer Bummer: Retirement May Get Ugly for Generation (link to article expired) - Planning for retirement has never been a simple task because calculating whether you will have enough money to live on or not depends on how long you'll be living after you stop working. For most people, this can't be known with any certainty, in spite of what some actuaries may claim.

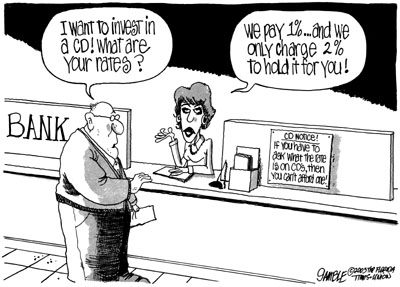

As Fed Cuts Rates, Retirees Are Forced to Pinch Pennies (link to article expired) - Interest rates have always been a double edged sword. Lower rates are obviously great for borrowers; but it's not just banks that see their income pinched when the rates drop. People, often retirees, who have their money in cash type accounts (savings and CDs) see their interest income cut drastically.

Is Buying a Larger Home A Wise Financial Move? - A good look at how to decide how large & expensive a home to purchase.

What You Should Know About Buyer's Agents - I've always liked the idea of having a Realtor who looks out for the buyer's best interest, especially after having been burned by one who I thought was looking out for my interest, but had to side with the seller in a dispute because of the way most commissions are structured. The sharing arrangement among Realtors makes the buyer's agent a sub-agent of the listing agent, and thus required to work more on behalf of the seller than the buyer. As this article discusses, there are various strategies being used by so-called Buyers' Agents to avoid this conflict of interest problem.

Monday, July 07, 2003

SEC's Own Accounting Requires Tightening, Internal Audit Says (link to article expired) - This is more of the typical government "do as I say, not as I do" philosophy. It's just like the annual reports that the IRS's books are a mess and they can't account for something like $60 billion each year.

Sunday, July 06, 2003

As Companies Shave Aid, Nonprofits Suffer the Sting

The Billing Of America - Bill O'Reilly takes on Bill Clinton's love of high taxes.

Saturday, July 05, 2003

How Audits Must Change. Auditors face more pressure to find fraud - The old CYA engagement letters that we used to have, where we disavowed any responsibility for rooting out fraud, but would report it if we accidentally tripped over it, are not going to be good enough any more, if we CPAs expect to be taken seriously any more as independent verifiers for investors.

Friday, July 04, 2003

Voters must face Gray consequences - Jonah Goldberg has a good look at why the PRC voters must be forced to live with the consequences of falling to remove the governor at the appropriate time last November. They need to understand how important regularly scheduled elections are and it's not right to expect a do-over when they screw up.

Thursday, July 03, 2003

Income Tax Gives Feds Open Checkbook - Having taxes withheld up front has been the sneakiest way for our rulers to prevent people from feeling their true tax bite. People would be much more supportive of large tax cuts if they had to write checks for their taxes rather than have them taken out ahead of time.

A Significant Tax Break From the New Tax Act - Some ideas of how to capitalize on the new lower tax rates for dividends and long term capital gains.

Draft Tax Forms - It's that time of year again, when IRS starts designing the forms for next year's tax season. You can get a preview of what to expect and even provide some feedback to IRS if you think something should be shown differently.

High Wisconsin taxes rooted in state history, study says

Trim that tree, and you risk jail - Just another reminder why we are so glad to be out of the PRC. A $1,000 fine for trimming trees on your own property. That kind of control over every aspect of people's lives was the big reason we made the move to the Ozarks ten years ago. We can do absolutely anything we want with the 150+ acres of trees we have without needing anyone else's permission.

New Zealand Farmers Threaten Rebellion Over 'Flatulence Tax'

The Wisdom of Pollack (link to article expired) - The judge who wisely concluded that the so-called victims of stock market losses were really nothing more than high risk speculators

Web sites can help financial neophytes

How to Help Your Credit Before Applying for a Loan (link to article expired)

Garrett and Russert Note Biggest Tax Cuts Go to Middle Class

Your Body May Be Worth More Than $45 Million - Just like parting out a car, where you can make a lot more money selling it piece by piece, someone has concluded that the components of a human body can be worth quite a bit. I've always thought it very unfair that, when people donate their organs, they (or their families) are not allowed to receive any payment; yet the hospitals literally sell those organs for huge amounts.

As I've always said, playing the stock market is no different than gambling. People who risk their retirement funds that way are being very irresponsible.

This is the reason why, even though I think Governor Gray-Out Doofus is a terrible ruler of the PRC, I haven't been a supporter of the recall idea. There was an election last November, where the voters had a chance to make a change in administration. Nothing is really very different now. It would also set a very risky precedent if new elections can be called willy-nilly every time people are upset about a certain issue. That is how other countries operate; but our system, with regularly scheduled elections, is a more stable way to make changes. The GOP wasn't able to unseat Doofus last November. They had their chance and they should just have to wait until 2006 for the next election to do it properly.

Wednesday, July 02, 2003

IRS Adjusts Tax Tables to New Schedule - A little more take home pay for most employees.

Dot-Com Losses Not Broker's Fault - It was the fault of the idiots who fell for the line that stock prices would go up forever and ever.

IRS Targets Tax Shelter For Stock-Options Income (link to article expired) - Some of the big CPA firms were selling bogus tax avoidance schemes that are now blowing up on their clients.

Refusal to Hike Taxes, Not Soaring Spending, Behind State Crises - How the left-wing mainstream media interpret the problem.

GOP Files Challenge to Tripling of PRC Car Tax - Maybe it can be stopped before it takes effect on October 1. I still fail to see how Governor Doofus thinks this is a good idea in the face of a recall election.

Dan Walters: Car tax arbitrary, irrational; reinstating it makes perfect sense - to some sick people. If the higher car tax does become real in October, there will be a lot more vehicles with Oregon plates driving around in the PRC.

Tuesday, July 01, 2003

Most State Budgets Take Effect July 1

Market Flop, Overspending Led to State Budget Calamities, Say Analysts

States borrow record amounts & raise taxes

Budgets prompt refrain: 'We ran out of money'

Smokers Face July 1 Cigarette Tax Increases - I should amend my earlier comments on acceptable targets for persecution by our society to include nicotine addicts.

Private tax collectors get nod from Washington - A chance for people like Tony Soprano to apply their skills in support of our rulers in DC.

Is Taxation Theft? - If Robin Hood was considered to be a thief for taking from the rich and giving to the poor, how does that differ from what the IRS does?

Harrison Abstract shut; assets frozen - With the largest part of my practice involving real estate tax issues, I have always warned people that a deal isn't real until it closes and the money is actually received. This shocking case, where an escrow company is seized, shows that a deal isn't even real when it closes, if the funds haven't been disbursed to the sellers. This case hits more close to home for me than similar cases that happen all the time around the country. Many of our clients used Harrison Abstract for their sales and purchases. In fact, Sherry had just delivered some exchange trust funds to Harrison Abstract last Thursday, the day before the seizure took place. We're still waiting to see if that deal was completed in time. From another perspective, Harrison Abstract had been handling the collection of our loan payments for the purchase of our ranch. I have already been in direct contact via email with the one of the sellers to see if they lost any money from this embezzlement. From our early communications, it seems that may be the case, with some of our payments not being forwarded to the sellers. This will be a messy situation for quite a while.

Judge Tosses Out Big Stock Case(link to article expired) - A little common sense in the courtroom. As I've always said, stock market investing, especially during the dot-com bubble, is no different than playing the games in a casino. If you lose, be mature enough to take your lumps and stop trying to force someone else to pay you for your bad luck.

Most Workers Are in Dark On Health of Their Pension (link to article expired) - Unfortunately, things are often much worse than just being in the dark for many employees and former employees. That is why, whenever possible, it has always been my preference that clients have retirement accounts that they can control and monitor closely. When leaving an employer, it's best to opt to roll any pension funds over into a self controlled IRA rather than leave them with the former organization.

There are actually lots of people who believe this is a good thing from the employee's perspective; that it's better to refuse additional income so as to not be pushed into a higher tax bracket. That is crazy. More often, people turn down opportunities for employer reimbursements of expenses, thinking they will be better off by just deducting it on their personal tax returns. Nothing could be further from the truth.

First, any tax deduction is only going to result in a small percentage of that amount in actual tax savings, depending on your tax brackets. A 100% reimbursement is always a much better thing than a tax deduction.

Second, IRS does not allow any deduction for an expense that could have been reimbursed, but you chose not to claim. There was an interesting case about ten or so years ago, where an IRS auditor was denied travel deductions because he could have submitted them for reimbursement, but didn't because he was afraid of upsetting his superiors and harming his chances for promotion.