Tax Guru-Ker$tetter Letter

Wednesday, December 31, 2003

The Power of Profits - Another good lesson on the importance of a strong capitalist system

Calif. Proposition 56 draws fire from tax research group - A pretty safe prediction for the PRC; higher taxes.

Life in California found very taxing - The winner of the headline award for stating the obvious.

Tax refunds come at a high cost - More of the typical left wing propaganda claiming that allowing people to keep more of their own money costs the government money. They never tire of distorting the truth about the Reagan tax cuts and are doing the exact same thing with Bush's.

Tuesday, December 30, 2003

Blogging Economics - As Mr. Bartlett observes, one of the big benefits of the blogging revolution is the growth in information available directly from people actually working in various professions (economics, law, taxes, etc.) and less of a need to rely on uninformed professional journalists. No offense intended towards professional journalists; but on whom would you rather rely for information on technical topics, such as the law or taxes; a reporter with no real life experience in those areas or an attorney or CPA with decades of real world experience? Media outlets do have a reason to worry about their loss of clout as more people learn that they can obtain real world information straight from the horse's mouth instead of having to suffice with third hand coverage from non-specialists.

Don't Spend Money Needlessly

As I've discussed on several occasions, prepaying for some kinds of operating and other deductible expenses before midnight tomorrow will allow you to deduct them a year earlier than otherwise. There are some kinds of expenditures for which that strategy doesn't work.

Inventory - Stocking up on items that are going to be resold does absolutely nothing for tax savings. Whether you use the Cash or Accrual method of accounting, the cost of unsold inventory has to be carried over to the next year's tax return.

Equipment - As indicated by the dozens of postings I have made on the issue of the newly expanded Section 179 deduction, there is a lot of interest in this; especially in regard to vehicles weighing more than 6,000 pounds. One of the big misunderstandings I have been noticing is that people think they can just send in a check for some new equipment and claim the deduction on their 2003 tax return, even though it won't be received until next year. That is not correct. You need to be careful here. You can only claim the Section 179 expensing election for equipment that has been received and actually placed into service by December 31, 2003. It's not good enough just to prepay for new equipment. Anything that doesn't arrive until 2004 can't be deducted until that year's tax return.

I have seen many people make these mistakes over the years by spending all of their money on inventory and future deliveries of equipment in the final weeks of December. It's one of the unpleasant tasks of this job to have to break the news that they can't deduct those expenditures, They then have to try to sell the inventory quickly enough to come up with the money to pay their taxes by April 15.

Labels: 179

Rumbling on the hard-line right - As I've been saying for a long time, Bush is losing a lot of support from those of us who are disappointed in his embrace of larger more expensive government. Rather than sit out the 2004 election, a stronger message could be accomplished by supporting the party that has always believed in the constitutional limits on government, the Libertarian Party

With election on the way, latest tax cuts likely won't be the last - I don't want to sound overly negative about Bush. Cutting taxes has been an excellent move and I'm glad that he plans to continue that trend. He just needs to start exercising some restraint on spending for things that are not authorized by our Constitution.

Monday, December 29, 2003

Some changes by IRS in the battle for tax dollars.

IRS Speeds Corporate Tax Audits

IRS Unit Will Focus on Lawyers and Accountants

From MSN Money

10 last-minute tax moves for 2003 - Plus, don't forget to prepay your tax preparer by December 31 to receive the tax savings from that a year earlier than normal.

2003 Tax Law Changes

Five tax myths that can cost you money

Saturday, December 27, 2003

Oakland Mayor Brown Suggests Tax on Unhealthy Behaviors Could Generate Much Needed Revenue - His protege may be out of office, but Governor MoonBeam is still as crazy as ever.

Prosecutor: Humbug to Jurors' Holiday Cheer - She likes to pick juries when everyone is the worst mood possible; during tax season. Unfortunately for her, she can't choose from professional tax preparers during that season since we are exempted from service during our busiest time of the year.

Notorious e-mail scam snares Volusia retiree's nest egg - It's practically impossible to have any sympathy for someone stupid enough to fall for the long running Nigerian money laundering scam. The fact that this idiot lives in South Florida shouldn't be much of a surprise either.

Bush committed to combating budget deficit - He sure has a funny way of showing this. He hasn't vetoed any of the drunken sailor spending bills passed by Congress and has in fact himself been championing record levels of new programs, such as the expansion of the already screwed up Medicare system. I'm a big believer in actions speaking louder than words; so I can't buy into Bush's sincerity regarding fiscal conservatism until he implements controls over the size and cost of government.

Last Day to Sell - This is a good explanation of the often confusing issue of the effective dates of stock transactions for tax purposes. This is also a good time to remind everyone that a stock has to be actually sold by December 31 in order to claim a loss on your 2003 tax return. Just because it has dropped in value from your original purchase price does not entitle you to claim it as a capital loss. This is completely consistent with the way you handle stocks that have gone up in value. Those gains aren't taxable until you actually sell the stocks.

Friday, December 26, 2003

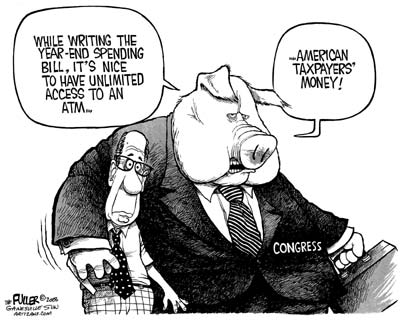

No limits for House appropriators who pile on pork - Our rulers think they're a bunch of Santa Clauses.

Child abuse in government schools - It's not hard to see why the principles of capitalism are dying off in this country, with school kids being indoctrinated in socialism.

Standard Is Set: No New Taxes For Texans

The Taxman Clicketh

Teaching the Gift of Giving to Children

The Stock Market and ... Saddam Hussein? - I've always gotten a kick out of newscasters who try to explain the stock market's movement on a particular day by connecting it to something that happened in the news. They have no grasp of the difference between causality and coincidence. As I've always said, there is very little rhyme or reason to how the stock market moves. Anyone who claims to have the magic formula for predicting stock prices is nothing but a con artist.

Wednesday, December 24, 2003

Tennessee Urges Net Purchasers to Pay Tax - It's nice to start this on a voluntary basis. However, I'm not sure how much money this will generate. Although, with virtually no collection costs, anything they receive would be pure profit to the State government.

Profits without honor - The concept of profits is considered obscene by too many ignoramuses in our poorly educated society. - Part 2 -- Part 3

Tuesday, December 23, 2003

Monday, December 22, 2003

Radical U.N. tax target - It's bad enough that the rascals in DC monkey with the tax code. It would be much worse if the USA-hating United Nations were allowed to assess higher taxes on us in order to equalize the playing field with the rates in the even more socialist countries. As crazy an idea as an international tax might seem at first, it's probably not far off now that our own Supreme Court is basing its decisions on international popular opinion rather than on our Constitution which they consider to be outdated and no longer relevant for our society.

States Have Chance to Tax Internet After Moratorium Expires - If our rulers in DC don't hurry up and reinstitute the moratorium on Internet taxes, that opportunity will be gone forever. As soon as some jurisdictions start relying on those revenues, they will scream bloody murder if that money pipeline is shut down. Look what happened in the PRC. The cities are predicting the end of the world after Gov. Arnold repealed the higher car license tax that had only been in effect since October 1 of this year. New tax money is like highly addictive crack cocaine for our rulers.

It's wise to know when it's a good idea to consult with your tax advisor and when it's really not appropriate.

Sunday, December 21, 2003

Why it feels so much better than ever to be an Ex-Californian.

California Failing. Spending -- same as it ever was.

True Lies. Shades of Clintonism in California.

City sent late notices to thousands of residents who never got their tax bills in the first place. - I hate when that happens.

Alaska Governor Proposes Cruise Ship Tax - He must be in seventh heaven; taking money from people who can't vote him out of office.

Weather Futures Popular With Investors Ahead of Tricky Winter - As if betting on the stock market isn't enough of a thrill for risk takers, they can now bet on the weather.

Saturday, December 20, 2003

Bolten's Fuzzy Math. His budget figures are misleading and suspicious. - Trying to distort the fact that Bush is wildly increasing the size and cost of government.

Some good articles from MSN Money

Trash your financial records

How the tax code rewards the soldier

Cut your taxes from cradle to grave

Taxpayer Watchdog Demands Ethics Probe of Republican Senator - Corporate executives are prosecuted when they plunder their companies. When our rulers do the same thing, it's considered just another perk of the job. Anyone who wasn't already wealthy before going to DC is almost guaranteed to come out stinking rich when they leave. How many more reasons do we need to see how important term limits are?

Watchdog: About 400,000 Use Tax Dodges - I have no idea how many people are using offshore accounts to hide income; and the truth is that the IRS has no idea either. Whenever I have contacted IRS personnel to ask how they calculate their estimates of the tax gap of uncollected taxes, they admit to me that they have no way of knowing any such thing with any level of certainty and their figures are just SWAGs (scientific wild ass guesses). I'm sure this 400,000 figure is nothing more than that and is intended to attract more attention (and money from Congress) than the more probable figure of something like 10,000. Luckily for the IRS, they are never required to substantiate their figures by any of our rulers or anyone in the media who just accept everything they are given as gospel.

Friday, December 19, 2003

Last Minute Tax Deductions

In additional to scrambling for Christmas presents this time of year, many people are also on the lookout for tax deductions. Dealers selling heavy trucks & SUVs should be swamped until New Year's Eve as people scramble for that huge deduction.

It's also time for my annual reminder of another less expensive year-end tax deduction -- prepaying your tax preparers for next year's work on this year's tax returns. Sending them a check before January 1 will allow you to get the tax savings from that deduction a whole year earlier. Unless you plan on sending your preparers a huge amount (such as $100,000), it shouldn't cause them any tax problems because that money will almost certainly go right back out for expenses on their books. Traditionally, this time of year is the leanest for income in tax prep offices, yet high in expenses as payments are required for next year's software, forms, classes and reference materials.

Thursday, December 18, 2003

Vehicles Weighing More Than 6,000 Pounds

I am still receiving a lot of requests for a list of vehicles that weigh more than 6,000 pounds and thus qualify for the very generous $100,000 per year Section 179 expensing election. I did another Google search and found several pages, including the following, with such lists.

Jerry Reynolds Dealerships

Hanson, Bridgett

Meyer & Associates

Wolter & Raak

Briggs & Veselka

Bankrate.com

Detroit News

Kiplinger - Most comprehensive lists.

To dispel another misconception about the Section 179 deduction, it is not only available for corporations. Any business, including Schedule C sole proprietorships, can claim it.

Labels: 179

Wednesday, December 17, 2003

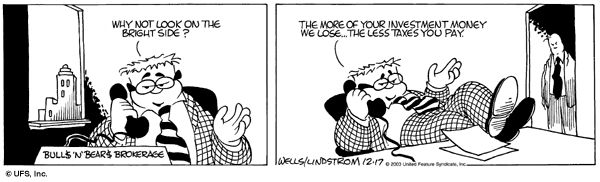

Amazingly, there are lots of people who think this way. They like to flush money down the toilet just so they can deduct the loss. There is a very appropriate name for such people - Idiots.

A looming tax battle in Virginia

Social Security Reform: Saving the system, saving grace

Online Financial Crime Headed From Bad to Worse

Spitzer overboard - Not everyone is impressed with the NY Attorney General's rampage against mutual funds.

Pricey House for Salvation Army Official Assailed - Not very consistent of the image most of us have of the SA.

Generalized Welfare - The terribly exploited phrase that big government fans use to justify their control over every aspect of our lives in this country.

The party of big spenders - Bush and the GOP are doing everything they can to co-opt the traditional DemonRat issues, including earning this nickname.

The Right to Shut Up and Pay Your Taxes - Removing freedom of speech from the Constitution is a very dangerous trend. It's not just the treasonous Supreme Court that's responsible. All of the rulers in Congress who voted for this muzzle on free speech are equally to blame, as is George W. Bush for signing it into law instead of vetoing it as he is obligated to do under his oath of office. Our founding fathers are definitely spinning in their graves over this desecration of their First Amendment. When it's become illegal to criticize our elected officials, the American Revolution against tyranical rule by royalty sort of seems like a wasted effort.

Tuesday, December 16, 2003

Tax cuts may push some families into AMT trap - Actually, it would be good if more people saw what an insane tax this is and demanded that our rulers eliminate it. It seems that until the number of victims reaches a certain critical mass, it will just be perceived as a tax on the evil rich, who deserve no tax breaks according to "popular wisdom" (an oxymoron if there ever was one). Another plug for the Reform AMT group seems appropriate right here.

Monday, December 15, 2003

Don't give them any ideas.

The bad thing about publicizing new kinds of crimes and financial hanky-panky is that it does tend to give ideas to people looking for a fast dishonest buck.

Sunday, December 14, 2003

Off the Mark - More on one of my big pet peeves - how people trust the Federal budget predictions from the CBO when they are nothing more than WAGs (wild ass guesses) and they never come true. I have long said that anyone who claims to believe those numbers to be anything close to real is either a liar, an idiot or both. Any media person who quotes CBO figures as if they were authoritative also has a credibility problem.

Potomac Fever - Why term limits are the only way we can have any hope of saving the Constitution. Even the most idealistic folks become corrupted by their royal powers in DC.

Governor Arnold will face pressure to increase taxes or make cuts - If he's smart, he'll choose the option of cutting spending. If the people of the PRC had wanted higher taxes, they would have let Gray Davis finish out his term.

Saturday, December 13, 2003

Del. Sen. Proposes Internet Sales Tax - Interesting attempt to use the tax laws to maintain a sales tax advantage for one state over others.

Companies Test 'Contactless' Credit Cards - The concept of having all of our personal and financial information on a tiny chip that is embedded under our skin is getting closer.

Higher Virginia Taxes Soon

It Pays to Be a Star on Charity Circuit - More hypocrisy from the Hollyweirdos.

Top Democrat urges Texas Governor Perry to abandon 'death business' - When I first saw this headline, I thought it referred to Texas' position as the country's leading user of capital punishment. It's actually about the state government doing what a lot of big corporations (such as Wally World) have been doing for several years. They have been taking out life insurance policies on current and former employees, without their knowledge, and then cashing in when those people pass away. I'm still waiting for the Hollywood movie using this as a plot point. If John DeLorean was willing to deal in drugs to save his floundering company, is it much more of a stretch to imagine a fiscally unstable company knocking off former workers for the tax free insurance benefits?

Friday, December 12, 2003

The Cost of Doing the Right Thing - More disappointment at the GOP's abandonment of limited government principles.

Charitable Contributions Brave Economic Uncertainties

Follow the Rules When Inheriting an IRA

Closer Look at Deductions for Donations to Charity - The examples of overstated deductions for things such as donated vehicles sound familiar. I have often been asked about the tax benefits of donating used vehicles to charities. The questioners usually tell me they can claim a higher amount for a deduction, based on the Kelly Blue Book value, than they would be able to actually receive if they were to sell the vehicle themselves. I have to break the news to them that what they could sell the vehicle for is its true fair market value (and the legally deductible amount) and not what Kelly shows.

I have had similar experiences with people proposing to donate real estate to charities so they can deduct what some appraiser or Realtor claimed was its fair market value because if they were to actually sell the property, they could only get about half that amount. When I was doing my real estate seminars, I used to really offend appraisers when I stated that the values they come up with are nothing more than SWAGs (scientific wild ass guesses) and can't hold a candle to what a property really sells for. Anyone who wants to claim a higher appraised value for a donation than the item would actually sell for is not going to prevail in a dispute with IRS.

This is also applicable to values used on estate tax returns. If an item has been sold between the time the decedent passed on and when the 706 is prepared, using any amount other than the actual sales price for the estate valuation is asking for trouble. IRS does audit a very high percentage of estate tax returns, especially the very large ones. I have had my share of them examined and so far, every one has been accepted as filed because I used actual sales prices for values and not the often quite different appraised values.

Artists Vie to Coin America - With more changes in the design of our currency in the works, it may become harder to know what is real and what is fake money.

Wednesday, December 10, 2003

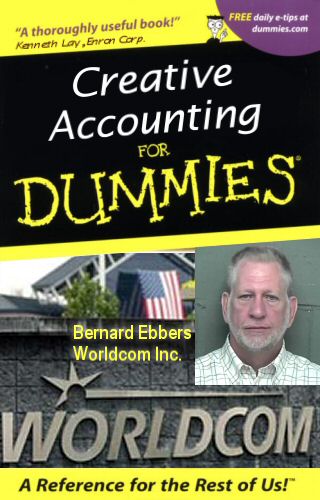

This reminds me of the old joke about how to find a creative accountant. When you ask him/her what two plus two is, s/he will respond with "what would you like it to be?"

Protecting the Integrity of Our Tax System - The comment about the need for a probability of a tax pro's position having at least a 33% chance of success is accurate. However, the idea of who is the arbiter of the odds is up for grabs. A guess as to whether or not a position has greater than a 33% chance of succeeding is as subjective as anything can be in most areas. Where it does have application is with the standard idiotic tax protestor arguments, such as taxes are voluntary, income is all tax free, or the 16th Amendment is invalid. Those are obviously well below the 33% threshold.

The issue of SE tax on LLCs is still well above those odds, so those of us who have been considering it voluntary aren't crossing the line. While it is a controversial topic, with those who side with IRS claiming that LLC income should always be subjected to the 15.3% SE tax, those of us on the other side have several cases where IRS has accepted our method of reporting it. Until a new law is enacted mandating SE tax on LLC income, I will continue to predict that my position on this matter has a 100% chance of prevailing.

Tuesday, December 09, 2003

Why "Government Intelligence" is one of the most often encountered oxymorons. Whenever a government program has been proven to be a failure, the response is to make it bigger and spend even more money on it. It's S.O.P. for the education system and is no different than someone driving in the wrong direction just going twice as fast. We end up blowing a lot more money and being even further off course.

How our rulers see us little people.

Of course, they don't do the stealing themselves. They rely on their hitmen at the IRS to do the dirty work of supplying them with plenty of money to spend on buying votes from people who have no respect for the Constitution.

Tax breaks for saving stir debate. Critics say only the wealthy benefit. - Hate the rich class warfare never goes out of style in this country.

Republicans Indulging in Pork Along With Power

Man Cashes Penny Stash For $10,060 - A drastic style of the slow and steady savings strategy; 37 buckets full. As ridiculous as it sounds, he has a lot more to show for his "investment" efforts than most people who bought overpriced dot-com stocks.

Under Bush, spending soars - Very inconsistent. On one hand, Bush recognizes the power of letting people keep and spend more of their own money. On the other hand, he is enlarging the size and scope of government beyond even what the previous administrations did.

Taxes governed by people's will - Supposedly, Governor Arnold will raise taxes if enough people ask him to. It won't be hard to get a majority of people to "demand" higher taxes on the heavily despised evil rich. Let's hope that Arnold has enough sense, in spite of input from from his Marxist advisors (Warren Buffett), to see that such an approach would be more of what already created the massive outflow of tax refugees. If he has any hope of attracting people to return to the PRC, he has to reduce the punitive taxation of success and not make it worse, even if the lefty media claim that is what the people want.

Monday, December 08, 2003

Used Vehicles Qualify For Section 179

One of the most common questions I am still receiving is whether the Section 179 expensing election is only available for the purchase of brand new assets or whether things such as used vehicles qualify. The answer is still the same. The asset just has to be new to you. You can claim the deduction for items purchased from anyone other than yourself or an entity controlled by you, such as a closely held corporation.

Labels: 179

Treasury Renews Campaign for Tax-Free Savings Accounts - This kind of thing makes sense for various capitalist and fairness reasons. It's also another perfect example of how fluid the tax environment is. Long range tax and financial planning has more unknown future variables to contend with than the weather has. However, it's still very premature to count on these proposed breaks becoming real. They still have to survive the guaranteed onslaught of "tax breaks for the rich" propaganda from the lefties who want us all to believe that only evil rich people can afford to put anything into savings accounts.

Sunday, December 07, 2003

One of the reasons I've never been a big fan of investing one's life savings in the stock market. It can't be good for a person's health to have to wonder day by day whether you are broke or doing well.

2 Sides Differ on Size of Government

Republicans mock Gov. Warner's sales tax plan

$20,000 per Household: The Highest Level of Federal Spending Since World War II

IRS auditors visit the NEA - finally

GOP Divided Over Pushing Reform of Social Security

The high cost of busybodies: part IV - More on the idiocy of our rulers meddling in the forces of the free market. Such efforts to thwart the natural market forces are no more successful here in the USA than they have been in more openly Communist societies around the world.

Congress 'Piles on the Pork,' Group Says

Fight the Tax Abusers - With plenty of very simple and very legal methods of minimizing taxes, you won't find me defending the big CPA firms for selling scam tax shelter packages to their gullible clients.

Friday, December 05, 2003

SUV loophole/A gift from U.S. taxpayers - A little jealousy on the part of those who can't deduct the cost of their vehicles. Those W-2 wage slaves should just shut the heck up, start their own businesses and then they can get the same tax breaks as the people brave enough to be self employed.

How Individual Social Security Accounts Can Work - An even better approach is to not pay anything into the SS system and have complete control over that money.

Why Tax Cut Critics Got It Wrong

Thursday, December 04, 2003

Although it would be nice to let sailors off the hook, I doubt if "spending like drunken elephants" will catch on, even though our GOP rulers can't say no to any new funding requests.

Wednesday, December 03, 2003

Tax Cuts for the Rich - Bill O'Reilly

Social Security Reform Back on the Table

Someone will have to pay for Bush's reckless spending sprees

Tuesday, December 02, 2003

Social Security Breakout. How Bush can vindicate his Medicare giveaway.

Virginia Governor Mark Warner's Fixation On Raising Taxes

How to make next April 15 less taxing

Time for last-minute tax tweaks

More D.C. Property Tax Relief

Governor Arnold clarifies no taxes

Net Taxes: Here Comes a Battle Royal

Memo to Virginia Gov. Warner: Sixty-Five Spells Defeat

The high costs of busybodies - As macabre a topic as this may be, I've always thought it very unfair that hospitals and the medical community are able to charge huge sums of money for organ transplants, yet the donors and their families aren't allowed to receive a dime.

Easy Christmas Shopping

Shopping doesn't get any more convenient and efficient than doing it via the web. Sherry has been working like crazy over the past week stocking up on new unique items, such as this specialty bracelet for Realtors, and taking pictures for her Mother Earth's Treasures website. Check out all the new goodies she's posted.

Some conservatives are unhappy with the president. Will they stay home in November? - Rather than sitting out the November 2004 election, Bush will get a stronger message of how disappointed people are in his support of bigger more expensive government if they vote for a candidate who believes in the limits on government as enumerated in the US Constitution, such as a Libertarian.

The GOP's new drug benefit is a serious policy error.

Stop GOP 'spending' spree

My goal is good policy - Obviously, I strongly disagree with Mr. Bartlett's characterization of the Libertarian Party as worthless.

U.S. Vehicle Sales Rev Higher in November - It's funny that there's no mention of the tax related motivators for people to buy new vehicles: Governor Arnold's repeal of the tripled car tax in the PRC and the quadrupling of the Section 179 expensing allowance for heavy (over 6,000 pounds) vehicles.

Smart Tax Laws Would Put More Money in California's Pocket - The L.A. Slimes hasn't slowed down in its attacks on Arnold. This argument that people are better off with the higher property taxes on their vehicles, because they could deduct them on their income tax returns, is complete idiocy. This is the same widely held fallacy that tax deductions are equivalent to a full reimbursement. They want their readers to believe that taxpayers are better off paying $1,000 in higher property taxes so they can claim them on their Schedule A. The fact that the actual income tax savings would be only about $270, resulting in a net cost to the taxpayer of $730 is something the Slimes hopes people are too stupid to notice. In fact, anyone who thinks big tax deductions are a good thing can send me a check for a fully tax deductible $1,000 for tax advisory services and I will provide you with an IRS acceptable receipt. And for anyone who believes the L.A. Times that this is good deal, think of how much better your tax deductions would be if you were to send me a check for $10,000. You would save ten times as much in taxes. Be sure to get those checks in the mail before December 31 so that you can claim them on your 2003 tax returns. This offer is not limited to residents of the PRC. It makes just as much sense for anyone in the USA.

Labels: 179

Monday, December 01, 2003

Underclaiming Section 179

I received the following question earlier today, giving me a good opportunity to address one more misconception about how to properly utilize the Section 179 deduction.

I got your email off your tax website and have a question about the 179 deduction I can't seem to find the answer to.

How do I claim the section 179 deduction on property that I have borrowed to buy? Can I use the section 179 form each year to write off only the amount I have paid back on the loan that year or do I have to write off the full amount in the year I put the property into use? And if I write off the full amount in a single year, how do I handle the subsequent years when making payments on the property?

My Response:

As I have contended for decades, most people routinely overpay their taxes because of poor bookkeeping. This specific issue is an area where I frequently see people short changing themselves out of very legitimate deductions. In fact, just a few days ago, I was working on a tax return where the client had booked $5,000 as a down payment on a backhoe and was under the impression that was all that could be claimed for that year. I informed her that we need to set up the full cost of the asset, including the loan for the additional portion of the purchase price, and we can deduct Section 179 based on the full cost.

The Section 179 deduction, as with normal depreciation, is based on the full cost of the asset. How you finance it makes no difference to IRS. It is treated the same whether you pay cash for the full amount or if you put zero money down and take on a loan for the full cost. In fact, for decades, I have been advising people that you can literally go out at the end of December, use your credit card to buy $20,000 of computer and business equipment, take it back to your office and set it up. You can then deduct the full cost on your 2003 tax return, even though you won't even receive the bill until 2004 and may even take several years to pay it completely off.

The bookkeeping entry is very basic. When you buy the asset, you will debit the fixed asset account for the item's full cost and credit your bank account for any down payment and credit the loan or credit card for the financed portion.

Payments on the loan are also booked conventionally. The loan balance is debited for the principal portion of the payment and interest expense is debited for the interest portion of the payment. Payments on the loan have no effect on the cost basis (and depreciation - Sec. 179 expense) for that asset.

I hope this helps you understand the concept & procedures.

Labels: 179

Some tax knowledge can make for a happier New Year - Some standard year-end tax tips.

IRS Set to Resolve Disputes Online - I signed up for this service about a month ago after receiving an invitation from IRS. They said it would take six to eight weeks to activate my account; so I will report on how well it works once I am up and running with it. My big hope is that this will allow us to better track how IRS applies payments. It has long been frustrating trying to prepare tax returns when IRS has applied estimated tax payments to the wrong tax year. This has been happening more often, even when the clients have been writing the year on the face of their check. If this new system works as advertised, I may start verifying each payment with the IRS's computer before posting it to my clients' tax returns.

McCain says Congress spends 'like drunken sailor' - McCain knows that all too well. He also has a good point that Bush's support of this reckless spending earns him the drunken sailor description as well.

Special-Interest School Tax - Rob "MeatHead" Reiner is at it again, trying to raise annual property taxes in the PRC by $4.5 billion.

Do the fund scandals merit regulatory intrusion? - The free market does have a way of cleaning itself up without the need for more idiotic regulations.

Social Security reform breakthrough - A novel idea - allowing people to put their retirement money into real accounts rather than the phony baloney Ponzi scheme that is the current SS system

Let the Campaign For Social Security Reform Begin

What Should Reaganites Do Now? - Bush and the GOP have abandoned the principles of smaller less expensive government.

Medicare expansion and the mirage of fiscal responsibility

A look at the 25 House Republicans who voted against Medicare expansion.