Former communist countries lead the way in adopting flat tax rates – This seems to be a healthy repudiation of the “progressive” tax rate structure that is part of Karl Marx’s Communist Manifesto. It’s too bad we can’t seem to get rid of it here in the USA.

Due Diligence Is Essential With Latest Loan Pitches – Check that fine print because a lot of dastardly lenders will sneak all kinds of expensive traps in there.

IRS Announces the 2005 Dirty Dozen Tax Scams – For the benefit of morons such as Adam, who continues to write me insisting I am wrong and Irwin Schiff is a tax genius, here is number two from the IRS’s list:

Frivolous Arguments. Promoters have been known to make the following outlandish claims: that the Sixteenth Amendment concerning congressional power to lay and collect income taxes was never ratified; that wages are not income; that filing a return and paying taxes are merely voluntary; and that being required to file Form 1040 violates the Fifth Amendment right against self-incrimination or the Fourth Amendment right to privacy. Don’t believe these or other similar claims. Such arguments are false and have been thrown out of court. While taxpayers have the right to contest their tax liabilities in court, no one has the right to disobey the law.

Southern States See Green in Cigarettes – Might as well squeeze some more money out of the nicotine addicts before they die off.

‘Accidental’ Landlords Face Headaches, Costs – There are more potential hassles than most people think, especially in landlord hating states, such as the PRC. Even though we have two extra houses on our ranch here in the Ozarks, we have refused to rent any of them in spite of several requests. We are still smarting from the terrible experience we had renting the second home on our California ranch back in the early 1990s to a psycho who was trying to steal our property by following Michael Keaton’s character’s strategy in the movie Pacific Heights, the scariest movie ever made for landlords or property owners.

Are Foreclosure Deals Too Good to Be True? – They’re not as easy to do as touted by the hucksters on late night TV, who make their money selling books, tapes and seminars, and not by actually doing real estate deals. (I used to prepare tax returns for some of them; so this is fact and not speculation.)

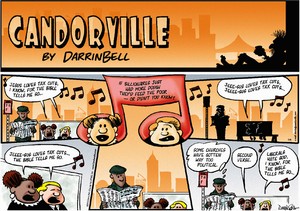

Offending Tax Protestors

Deep down, I know it’s not politically correct to make fun of people with low intelligence and learning disabilities; but these morons who continue to hold onto the idiotic tax protestor arguments deserve it, especially this time of year.

Adam, the tax protestor whose letter I shared yesterday, wasn’t happy with my response. It sounds as if he is a lonely fellow and has a lot of time on his hands, so I’m sure he would love to hear from others on this matter as well.

From: Kungfurez@aol.com

Subject: name calling

Kerry,

I understand your frustration after having dealt with this issue for so long. While I can see that you no longer want to deal with this issue, I found it a bit insulting that you would respond to my questions with more name-calling. I did file taxes last year and don't need you telling me that I'm a "protester" because I have some legitimate questions that your webpage didn't answer. This is the same name-calling that labels someone protesting our government's position in Iraq as "unamerican." I have written to acknowledged tax protesters and asked them a slew of questions as well, often challenging their less than adequate answers. Perhaps your ideal client is one who just hands you a check and doesn't ask any questions.

I've gone to quatloos. They questioned whether Joe Bannister actually even attended the college he says he did, which is just plain stupid as a 2-minute call to the university could verify or disprove that information. Again more name calling and less factual information. You could have responded to me with something like, "I no longer deal with this issue. Here is a webpage you can go to for more information." Yet more name calling to someone asking legitimate questions--whether you heard these questions before or not--does not in my mind strengthen the argument. I would suggest you remove your webpage which contains no information and just name calling if you don't want anyone to pursue any questions regarding it.

Adam

My Reply:

Adam;

I'm not sure what you consider to be name calling. If it's referring to tax protestors like Irwin Schiff as "nut jobs," that is simply a statement of fact.

If you are upset about being considered as a tax protestor just because you sent me the exact same letter as hundreds of other tax protestors have, that's your problem. You could have phrased things in a more original fashion so as not to be lumped together with the rest of your ilk.

I was actually quite lenient with you in my earlier email. Anyone who is more than 12 years old who doesn't understand that income taxes are not voluntary has some intelligence problems that I didn't want to be insensitive to.

If you don't like my web sites, just don't visit them any more. There are millions of others that will more than keep you occupied. Most of them use words that are simple enough even for folks like you to understand.

Kerry Kerstetter

Tax Protestors Still Upset With Me

Q:

From: Kungfurez@aol.com

Subject: question from your website about a "voluntary income tax"

Hello,

Thank you for your website's attempt to help clarify some questions regarding the income tax. I was looking into and researching a lot of these "voluntary income tax" claims, including statements made by ex-IRS agents, CPA's and lawyers.

My conclusion is that I am certain that there are many scam artists around. I have not come to a conclusion if the income tax is voluntary or not. You say how if someone fails to file tax returns the IRS "is willing to use force." This doesn't answer anything regarding the issue of whether the filing and paying of income taxes are voluntary and only raises the question of whether or not the IRS is correctly applying the law or, in Irwin Schiff's words, are behaving like a "federal mafia."

I have researched the constitutionality of the income tax as well. What I don't understand, and I hope you can clarify for me, is this: if the Constitution allows for direct apportioned taxes and indirect unapportioned taxes, and if the 16th Amendment, according to a Supreme Court Case, offers "no new powers of taxation," where does the income tax fall? It is clearly a direct, unapportioned tax, isn't it?

You said that mentioning these arguments in front of an IRS employee will result in an automatic $10,000 fine and that constitutional protections are "null & void when it comes to taxes for the federal government." Can you show me where it says that a Citizen's constitutional protections regarding taxes for the federal government are null and void? I personally am not proud of a system that will result in a $10,000 fine for just posing a question, much like the questions I've posed for you in these emails. In the mission statement of the IRS it states that one of their goals and duties is to make the code clear to the Citizens. If asking questions results in large monetary fines then this is clearly a bogus statement.

I remember seeing a report where a New York Times reporter asked the IRS Commissioner to respond to the claims that the income tax is voluntary and if he could directly answer where in the IRS code it says that one is liable and he answered with, "Ever since I was a young man and started working I felt the desire to contribute my share to the country..." While this can tug on a few heartstrings, any investigator like myself can see that that didn't answer the question.

I don't want you to think I am being difficult or a "tax protester." Like Commissioner Rossini, I too have paid income tax since I started working. But I am not satisfied with simple name-calling and would like it if you could provide me with some answers--if you are capable--starting with:-The question of the constitutionality of the income tax with respect to the 16th Amendment providing "no new powers of taxation," and

-Where it says that all constitutional protections are null and void when it comes to the issue of federal government taxation.

-why does the IRS constantly use the term "voluntary compliance" when the word "compliance" would imply that it is done voluntarily anyway?

Thank you so much for your help.

Sincerely,

Adam

A:

Adam:

I am very familiar with the tax protestor movement's long running attempts to muddy the waters by trying to force us tax practitioners to answer a slew of ridiculous questions, such as those you posed here. I did go through those motions several years ago and do not have the time to do any more of that. It is not my place in the big picture, or that of any tax practitioner, to defend the IRS or the tax code against every crazy argument that can be conceived by nut jobs who seem to be more interested in selling their books, tapes and seminars than in actually affecting real change in this country's tax system.

If you are serious about researching the tax protestor arguments, you should start with the info on the Quatloos website.You claim to not be a tax protestor yourself, yet your letter resembles exactly hundreds of others I have received from tax protestors over the past decades, each claiming to be doing independent research on the legality of the tax system. You need to come up with a new angle because this one is worn out.

Kerry Kerstetter

State Tax Refunds

Q:

Subject: Taxing Tax ReturnsMr. Kerstetter,

How is it that a personnel tax return from the previous year can be taxed? This seems like double taxation on the income. Am I off bases here?

Love your web site. Thanks for taking the time to keep it up.

A:

I think you are misinterpreting things in regard to the taxation of tax refunds.

There is no taxation of federal income tax refunds because there is no deduction for federal income tax payments. Occasionally, IRS does include some interest with their refund checks, such as from amended returns. The interest portion only is required to be reported on the taxpayer's Schedule B for the year in which it is received, as is interest from banks and most other sources.

It is a different story for state income taxes. Payments are deductible on the federal Schedule A for the year paid and withheld. Under the long standing tax benefit rule, if any portion of the tax payments that were deducted on one year's tax return, and actually resulted in lower federal income tax, is received back as a refund from the state, it is required to be reported as income on the 1040 for the year in which the refund was either received or applied against future year state taxes.

I am as vocal a critic of the tax laws and the IRS when things are unfair as anyone. In this regard, there really is no double taxation. If they didn't have that requirement to pick up the state tax refund as income, it would be possible to literally manufacture bogus deductions. A person could send in a bunch of state tax payments, deduct them on his federal Schedule A, and then get that same money back from the state tax free. That wouldn't be fair.

State tax refunds aren't always taxable. Obviously, they wouldn't be for people who don't itemize their federal deductions. Likewise, for 2004 1040s, people who choose to deduct their sales tax instead of state income tax won't have to pick up any state tax refund as income. I have also seen several cases where people have had large negative taxable incomes on their 1040s. Since the taxable income would have been negative even without the deduction for state income tax, any subsequent refund of those state taxes is not subject to federal income tax. This is a classic illustration of the tax benefit rule. If the deductions didn't result in any tax savings (benefit), its refund is not required to be included in future taxable income.

I don't want to imply that the current system is a perfect offset. Deducting too much of something on Schedule A is not accurately repaid by picking that same amount up on Page 1 of the 1040 (aka above the line adjusted gross income). As I constantly mention, increases in AGI trigger dozens of additional ways in which taxes are increased because so many phase-outs and denials of tax deductions and credits are based on AGI, including the taxation of Social Security benefits. To be perfectly fair with this, the state tax refund would be entered as a negative amount on the following year's Schedule A. However, I'm not holding my breath for that to ever be the case.

I hope this adequately explains the issue of taxation of tax refunds and allays your fears of double taxation.

Kerry Kerstetter

Follow-up:

Wow. Thanks for taking the time. It is much appreciated.

Handling Cash In 1031s

Q:

Quick question.Can an investment property be sold for cash and then the proceeds be used to purchase another investment property to qualify under 1031?

If the answer is yes - why would a facilitator be needed?Or does the property actually have to be traded to defer the gain.I am somewhat confused about the rules.

A:

Under Section 1031, you are not allowed to touch any of the proceeds from the disposal leg, even for a second. If you do have actual or constructive receipt of any cash, it is taxable to you, regardless of what you do with the money.

The facilitator parks the cash for you so that you won't be considered to have had access to it.

We don't make the rules. Congress and IRS do that part. We just help you understand and comply with them.

Kerry Kerstetter

Labels: 1031

Use Of 1031 Proceeds

Q:

Subject: Exchange QuestionCan I payoff raw land I currently own with a 1031 exchange?

A:

Absolutely not.

Proceeds from 1031 exchanges may only be used to acquire new like kind property.

Kerry Kerstetter

Follow-up:

thank you, I'll have to go to plan B ! We might can do some businesssometime. Thanks again.

Labels: 1031

Section 179 & Depreciation For SUV

Q:

Hi Kerry -Section 179 deduction :Purchase price of SUV (over 6000 lbs) $50,892. minus trade-in of 17,892. total sales price is 33K which was purchased 12/2004.I use my vehicle 80% for real estate. Does this mean I can deduct 80% of 33K up to 25K (or 80% of 25K)?Also when calculating basis for future years deductions would that be $4000. (half of the difference between 33-25K)?Thank you for your time!

A:

First, my standard admonition that anyone in the real estate profession, who is serious about minimizing their taxes, should be working with a tax pro, who would be able to answer questions such as these very easily.

In the example you gave, there are a few different things to consider.

First is the amount that is eligible for the Section 179 deduction. For this, you can only count the additional cost paid for the vehicle, without counting the trade-in value. In this case, it would be the $33,000 figure you mentioned (50,892 - 17,892).

Next is the maximum Section 179 which you may claim. As you stated it was used 80% for business miles during 2004, we multiply $33,000 by 80% to arrive at $26,400. Since you bought it after the law regarding SUVs changed in October, you may claim only $25,000 of the cost.

Next is the issue of the remaining cost basis for depreciation purposes. You were on the right track, but you forgot to add in the adjusted cost basis of your trade-in vehicle. Whenever there is a trade, the cost basis of the previous vehicle is added to the additional amount you pay for the new one to arrive at its cost basis. You will need to refer to the depreciation schedule for your old vehicle to determine its adjusted cost basis at the time of the trade. From that total, you will subtract the $25,000 Sec. 179 to arrive at the remaining cost for depreciation purposes. From the other direction, that would give your new SUV a cost basis of $8,000 (33 - 25) plus the adjusted basis of the traded in one.

I hope this helps. I also hope this illustrates why you need to use the services of a tax pro.

Good luck.

Kerry Kerstetter

Follow-up Q:

Thank you!!!

Do you know of good tax professional in the Boston (Billerica/Burlington) area? I don't even know where to start......

A:

Unfortunately, we don't have anyone else to whom we could refer you. If you haven't already done so, you should check out my tips on how to select the right tax preparer for you at:

http://taxguru.org/incometax/prepare.htm

Good luck.

Kerry Kerstetter

Labels: 179

Tax schemes saved 61 top firms $3.4B – The use of the word “scheme” is intended to imply illegality. I’m not vouching for these tax savings tricks. However, what may be a nasty scheme to some is just wise business management to others. To people who love big government and high taxes, anything done to reduce one’s taxes is inherently bad.

Property Sale

Q:

I was wondering about the tax on a land sale. I own 10 acres which I currently live on. If I sell all the land except for the parcel that my home sits on, what would my tax be considered? LTCG or income tax?Thanks for any help.

A:

There are a number of issues to consider here.

As I explain on my website, if you also sell your house within two years of selling the surrounding land, you may be able to consider the land sale as part of the residence sale, which could have up to $250,000 of tax free profit. This would only apply if you weren't using the land for business or rental purposes.

If you are not going to sell your home, you are looking at a taxable event with the land sale, assuming you are selling for more than you paid for it. If you bought the property as one single transaction, you will need to allocate your cost basis between the land being sold and the house and land you are keeping.

You didn't say how long you have owned this property. If you have a gain, it will be taxed at the special long term capital gain rate (5% or 15% Federal) if you have owned it more than 12 months. If you are selling after less than 12 months of ownership, it will be taxed at ordinary income tax rates (up to 35% for Federal). State tax will be additional, unless you live in a state with no income tax.

If you will be selling for a loss, there will not be any deduction allowed if the property was only used as part of your personal residence. The tax law is very unfair in this regard; but that's how it is.

For more details on how this will affect your taxes, you should consult with a tax pro where you can work with actual numbers.

Good luck.

Kerry Kerstetter

What Is Due to Expire Taxwise – It’s not bad enough having to know all of the new laws. We have to keep up on which existing ones are expiring at all different dates.

SUV Sec. 179 Recapture

Q:

I bought a 2004 Chev Suburban loaded to the max in December 2003, took a huge section 179 writeoff, 100 pc. We can call that purchase price 'X'.

Unfortunately I have had to file Chapter 13 and the truck will be turned in this year (2005), probably

being sold at auction in the 20s...you say on tax guru the following

'If you sell the previously deducted vehicles, you need to report the sales on Form 4797 and show

anything that you get for it above its depreciated book value as depreciation recapture ordinary income.

A sale only makes sense tax wise if the price you can get for it is less than the adjusted depreciated book value, so that you can claim the loss on Form 4797.'

I think I sound safe but and way you can clarify would be greatly appreciated...

A:

From what you have said, you will need to report the sale of the Suburban on your 2005 1040 via Form 4797. If you did write off its total cost on your 2003 1040, its book value is zero; which means that whatever you receive for it is taxable recapture gain.

If you are in bad enough financial shape that you had to file for bankruptcy protection, odds are that you have other losses that will more than offset the 4797 gain; which will make the actual tax hit on the disposal of the Suburban zero.

I'm sorry I can't be of more assistance. Good luck.

Kerry Kerstetter

Labels: 179

Rules Are DIfferent For Primary & Second Personal Residences

There has never been a shortage of misinterpretations of tax law, such as in this question we received the other day.

Help me with this one.

I understand that a vacation property can be classified as a second home. By this I mean that it actually qualifies for tax exemption as your residence when you sell it.

Is it possible to do a tax free exchange from a duplex to a condo and then sell this after a period of time, like five years, as a second home per my understanding above?

The duplex is pure rental property. The condo will be used by us and rented by a property manager when we are not using it.

My Reply:

You are correct that a vacation home can be considered as a second personal residence, which allows you to deduct its mortgage interest and property taxes on Schedule A.

You are wrong, however, in regard to the tax free exclusion of gain. That is only available for the sales of primary residences. Second homes have no tax free sale treatment. Any gain is taxable, and any loss is not deductible.

You can see the rules for tax free sales of primary residences at:

www.taxguru.org/re/primary.htm

I hope this clears this matter up for you.

Kerry Kerstetter

Top 5 Audit Myths – One person’s opinion. I am one of those who disagree with him on the issue of filing later to reduce audit potential. I still stand by what I have been saying for decades.

IRS hopes $2 million basic bid for '67 Ferrari not too taxing – Would you buy a used car from the IRS? (courtesy of AutoBlog)

Visit City Hall to Reduce Your Home's Assessment

Roth IRAs

Q:

Thanks Kerry for your detailed response. One other potential issue: In addition to the Voluntary Contribution Plan, I also participate in the Government's Thrift Savings Plan (TSP). This is the Government equivalent of a 401K. When I retire, I am eligible to rollover the balance of my TSP to a regular IRA. I want to do this at some point. I realize that when I convert my regular IRA (including VCP contributions) to a Roth, I must pay ordinary income taxes on any portion of the contributions and earnings which resulted from pre-tax contributions. I am OK with this. So it appears that I should not rollover my TSP until after my planned Roth conversion. Is there any way I am risking taxation on my TSP as long as I wait until after the Roth conversion to perform the rollover? ThanksRegards,P.S. Love your websites

A:

I don't see a problem whether you do the TSP rollover before or after you do the Roth conversion. Roth conversions aren't an all or nothing situation. You can decide the specific amount from your regular IRA account to convert to a Roth and pay taxes on. What would make things easier for you in terms of record keeping would be to have different rollover IRA accounts to keep the pre-tax amounts separate from the after tax money. If you commingle those two types of money, it will be more of a task keeping straight your tax free cost basis.

As I mentioned before, I do still have the very same serious concern about paying out very real tax dollars now for promised tax savings several years down the road that could be taken away at any time by our rulers in DC, as I mentioned in my 1999 letter that was published in the Wall Street Journal . If you're willing to take that chance, that's your call.

Good luck.

Kerry

Follow-up Q:

Hi Kerry,I understand that partial conversions can be done. However since my TSP consists of all pre-tax contributions and earnings (my VCP and IRA mostly contain monies which have already been taxed) having any part of it included will increase the taxable amount of any amount which is converted to a Roth.

I appreciate your concerns regarding depending too much on the tax-free status of Roth withdrawals. While it is true that the amount of tax code tinkering we are all subjected to seems to increase every year, the extent and nature of any changes is unpredictable. I have enough trouble reacting to what I already know to be true. I agree that the future holds higher taxes (and probably higher inflation too). I feel that it is an easier sell to raise general tax rates rather than do a complete about face on the Roths. Do you feel that Roths are a bigger target?

Regards,

Follow-up A:

The burden is on you to keep good records of your after-tax cost basis in the retirement accounts, so you can recover that much tax free when you make withdrawals.

Across the board tax increases are not as politically feasible as just nailing a group of people that everyone is stirred up to hate, such as evil rich retirees. Our rulers have already done this very thing to people receiving Social Security, so I find it hard not to imagine the very same thing happening to people with Roth IRAs whose income is over a certain arbitrary level.

I'm not as concerned with people putting new money into Roths and missing out on the current deduction that a conventional IRA has. I am mostly concerned with people paying out real tax money on converted IRAs with the hope of receiving tax free benefits several years or decades down the road. I just do no trust the bozos in DC to be fair with this.

I hope I'm wrong; but their past screw-jobs on retirees tell me otherwise.

It's your call.

Kerry

Q:

Subject: Exchange QuestionHi,I am writing from Maryland. Last year I sold a piece of land in West Virginia to purchase a primary residence in Maryland. When I originally purchased the land 6 years ago my intent was to build a primary residence on it. I had some financial troubles and deferred building the house. My personal situation changed and I needed to buy a home in Maryland closer to family and work. I ended up selling the land and used every penny as a down payment on my new house which is worth about 10 times the price of what I sold the land for. It doesn't seem fair that I have to pay capital gains tax, I never intended to keep the land as investment to make money. In addition, I paid out over $1800 in West Virginia property tax over 6 years.

Thank you,

A:

As I'm assuming your personal tax advisor has already told you, the fact that you didn't originally intend to hold that land for appreciation purposes isn't relevant. All IRS cares about is how the property was actually used and the fact that you sold it for more than you bought it for. You should have already been deducting the property taxes on Schedule A in the years in which they were paid.

It's too late now to change the consequences for you; but for future reference, as well as for others in similar circumstances, there was a way in which you could have legally avoided taxes on the land sale. I'm assuming that you didn't bother to consult with a tax pro prior to selling the land, or else this idea would have been brought up.

While a 1031 exchange directly between an investment property and a primary residence is not legal, a two step approach is frequently used in situations similar to yours. You could have used Sec. 1031 to reinvest the land proceeds into a rental house. After renting the home out for a reasonable period of time, you could then convert it into your primary residence.

I hope you have better luck next time, tax wise.

Kerry Kerstetter

Labels: 1031

Depreciating Living Beings

Q:

Subject: can i deduct myself?I'll assume you've already seen this link:I particularly like the concept of depreciating an ostrich during it's reproductive period. I have successfully produced two children. Do you think I could depreciate myself over 82.5 years (or whatever the going rate is nowadays)?

Thanks for your wonderful website (taxguru.net). It is the first thing I read every morning.

A:

I did see that article. Depreciating breeding animals is really nothing unusual. I have prepared hundreds of returns doing just that, including horses, cattle, llamas, dogs, and even some kangaroos and wallabies for some clients here in Arkansas.

I realize that you were making a joke about depreciating yourself. However, never missing an opportunity to clarify mystical and arcane tax issues, I do want to comment.

First is the reason for depreciating an animal or any other asset on tax returns. This is only allowable for business assets which are being used to earn potentially taxable income.

When we set up animals for depreciation, we need to establish the appropriate cost basis to use. For animals that were purchased, we use the amounts paid. For animals that were born on the client's premises, there is no new out of pocket cost, so those animals can't be depreciated.

So, assuming you were in the business of professionally breeding humans, I'm afraid that your own body has a cost basis of zero. You didn't pay anything for it, as it was a gift to you from our creator.

To follow that chain of thought a little further, if a person were to pay for a body part that is to be used in a business enterprise, that cost could be depreciated on the person's tax return. I'm sure this is done for show biz celebrities for their cosmetic surgeries and other enhancements that help them earn more money.

Thanks for writing and giving me an interesting topic to discuss.

Kerry Kerstetter

Depreciating Living Beings

Q:

Subject: can i deduct myself?I'll assume you've already seen this link:I particularly like the concept of depreciating an ostrich during it's reproductive period. I have successfully produced two children. Do you think I could depreciate myself over 82.5 years (or whatever the going rate is nowadays)?

Thanks for your wonderful website (taxguru.net). It is the first thing I read every morning.

A:

I did see that article. Depreciating breeding animals is really nothing unusual. I have prepared hundreds of returns doing just that, including horses, cattle, llamas, dogs, and even some kangaroos and wallabies for some clients here in Arkansas.

I realize that you were making a joke about depreciating yourself. However, never missing an opportunity to clarify mystical and arcane tax issues, I do want to comment.

First is the reason for depreciating an animal or any other asset on tax returns. This is only allowable for business assets which are being used to earn potentially taxable income.

When we set up animals for depreciation, we need to establish the appropriate cost basis to use. For animals that were purchased, we use the amounts paid. For animals that were born on the client's premises, there is no new out of pocket cost, so those animals can't be depreciated.

So, assuming you were in the business of professionally breeding humans, I'm afraid that your own body has a cost basis of zero. You didn't pay anything for it, as it was a gift to you from our creator.

To follow that chain of thought a little further, if a person were to pay for a body part that is to be used in a business enterprise, that cost could be depreciated on the person's tax return. I'm sure this is done for show biz celebrities for their cosmetic surgeries and other enhancements that help them earn more money.

Thanks for writing and giving me an interesting topic to discuss.

Kerry Kerstetter

Tax Panel Seeks Public Comment

- Headaches, unnecessary complexity, and burdens that taxpayers - both individuals and businesses - face because of the existing system.

- Aspects of the tax system that are unfair.

- Specific examples of how the tax code distorts important business or personal decisions.

- Goals that the Panel should try to achieve as it evaluates the existing tax system and recommends options for reform.

Estate Tax Repeal Advocates Giving It Another Go – Of course there will be same opposition to such a change from the usual suspects, such as Bill Gates, Sr. and Warren Buffett, who along with their Fellow Travelers, still idolize Karl Marx and his philosophy of having the central government confiscate and redistribute wealth.

Slavery Tax Credit

I’ve already written several times about how IRS has gone overboard in scrutinizing refund claims by auditing the returns as an over-reaction to their incompetence in actually paying out huge sums for nonexistent slavery tax credits.

Perusing the recent Tax Court cases, I saw that this slavery credit came up in a case that was decided yesterday, Hyler v. Commissioner (T.C. Memo 2005–26). Kleinrock has a good summary of it in their bulletin.

To summarize, this couple filed a 2000 1040, where they claimed a “Black Investment Credit” of $92,861 by using Form 2439, which is for something completely different, Notice to Shareholder of Undistributed Long-Term Capital Gains. Any competent tax pro would see that such a claim is ridiculous. However, when the IRS received the 1040, they actually sent these people a check for $93,071, which included this bogus credit and the excess of their withheld taxes over their actual tax.

After IRS learned of their own stupidity in paying out these kinds of claims, they had to try to recover them, such as the deficiency notice they sent the Hylers in March 2004. The Hylers used the standard Willie Nelson defense, that it was all the tax preparer’s fault and the IRS should recover the money from him, even though the Hylers’ 1040 had no paid preparer listed.

It was no surprise that the Hylers lost this case and will have to repay the bogus credit, plus penalties and interest. Escaping scot-free with no punishment are the morons at the IRS service center who okayed the payment of the credit back in 2001. In fact, they’ve probably already been promoted by now.

Lookout for the sucker-punch tax – Another appropriate name for the insane AMT.

Class-Warfare Death Wish – I wish I could be as optimistic as Larry Kudlow is on this topic, but I still see a very pervasive hatred of success in this country that is exploited by the DemonRats.

Mileage Deductions

Q:

Subject: mileage deductions

Can you tell me if the new rate of 40.5 up from 37.5 a mile can be used in my tax returns filed now feb of 05 for my 2004 income tax. Or do i have to wait till the end of the year to apply the new rate

A:

That is a new, but very wrong, interpretation of the rules for claiming business mileage deductions. When you file the tax return is irrelevant. Business miles driven during 2004 can use the 37.5 cents per mile standard rate, or the prorated actual expenses, whichever gives you the best total deduction.

The new rate of 40.5 cents per mile is only available for business miles driven during 2005, which will obviously be calculated on your 2005 1040 some time after the end of 2005.

It sounds as if you could benefit from the services of a tax pro to help make sure you interpret the tax rules properly.

Good luck.

Kerry Kerstetter

More On Section 179 Recapture

I received the following email from a CPA in Michigan in response to my most recent post on recapturing Section 179 expense deductions.

Subject: Your Blog Article On Section 179 Recapture

The sale of an asset that taxpayer had originally taken Sec. 179 deduction is more complex than this.

How it is handled depends on the entity (I am ignoring trades)Section 179 recapture is ordinary income subject to self-employment taxes for self-employed/partners. The recapture adds to basis creating smaller gains or larger losses. The losses are 1231 losses subject to 5 year lookback on 1040s etc.Milt Baker CPA MichiganP.S. I enjoy your Blog site on which you post great information and fabulous cartoons.THANK YOU

Milton:

Thanks for the additional info. I always have the dilemma of how technical to make my answers for non tax pros. In this case, I was just trying to let him know that there were potentially expensive tax consequences to his scheme of buying and selling new vehicles each year. As I'm sure you encounter in your practice, there is no shortage of people who think they've discovered a way to game the system, only to make things worse for themselves.

I hope that everyone who reads my postings gets my point that they need to consult with a tax pro before embarking on their tax savings plans.

Thanks again for writing and feel free to contribute anything else that you feel is appropriate.

Kerry Kerstetter

Labels: 179

Avoiding Taxes On Sales of Mixed Use Homes

IRS is issuing a clarification on how to best avoid taxes on homes that have been used as both a primary residence and business or rental. Utilizing a combination of the Section 121 tax free exclusion and Section 1031 like kind exchange is not anywhere close to a new idea. We have been doing just that for decades with tax and exchange clients, including long before 1997, with the old rules requiring a new residence to be purchased within a certain time frame and the measly once in a lifetime exclusion of $125,000 of gain per person or couple. This new ruling will just make those who feel uneasy about doing anything that is not explicitly spelled out for them a little more comfortable.

Labels: 1031

Double Crossed By Debt Counselors. Many Consumers Have Found Themselves Defrauded by Companies Offering Debt Help – There are cozy seats in Hell waiting for these scammers.

Life Imitating Art

States Mull Taxing Drivers By Mile – Not exactly a surprise that this idea comes from the appropriately named Left Coast. Whenever I see stories like this, I can’t help but think of the part of George Harrison’s “Tax Man” where he says:

If you drive a car-car I'll tax the street

If you take a walk I'll tax your feet

The full lyrics to this still very timely song, courtesy of SeekLyrics.com

Let me tell you how it will be

There's one for you, nineteen for me

'Cause I'm the taxman

Yeah, I'm the taxmanShould five percent appear too small

Be thankful I don't take it all

'Cause I'm the taxman

Yeah, I'm the taxman(If you drive a car car) I'll tax the street

(If you try to sit sit) I'll tax your seat

(If you get too cold cold) I'll tax the heat

(If you take a walk walk) I'll tax your feetTaxman!

'Cause I'm the taxman

Yeah, I'm the taxmanDon't ask me what I want it for

(Ah, ah, Mr. Wilson)

If you don't want to pay some more

(Ah, ah, Mr. Heath)

'Cause I'm the taxman

Yeah, I'm the taxmanNow my advise for those who die

(Taxman!)

Declare the pennies on your eyes

(Taxman!)'Cause I'm the taxman

Yeah, I'm the taxmanAnd you're working for no one, but me

(Taxman!)

Certain Tax Returns Go to Different IRS Centers than Last Year – IRS continues its annual reshuffling of the Service Centers.

Republicans are struggling to extend the Bush tax cuts – The toughest part is fighting the left’s lies that claim the tax cuts caused the deficit.

Lenders Should Pay For Title Insurance – Title insurance has long been one of the biggest rip-offs in real estate. It’s especially unfair having to pay several thousand dollars each time you refinance, even if it’s only been a few months since the last title insurance policy was issued.

Health Savings Accounts - When Tom Sullivan was guest hosting today's Rush Limbaugh show, he had an excellent discussion of the new HSA as a way to saving up real tax deductible money for future health costs. These plans are actually quite similar in concept to the new personal savings plans that President Bush is proposing as an alternative to Social Security for younger (under 55) workers. They are invested by the owners and anything in them when the owners die can be left to their heirs. The website Tom recommended for more info is HSAInsider.com I checked this site out and it has a lot of information on this very new program, including the ability to search for providers by state.

Social Security Choice

If you’re not making it a daily habit to check the Club For Growth’s special website on the current debate over changing the way the current Social Security system is set up, you’re missing the best resource currently available. Because there are so many people contributing, it has much more content than I can ever hope to post here.

If you have noticed fewer comics here on my blog than normal, that is because most of the really good ones I have been seeing are about the Social Security mess. To avoid duplication, I’ve just been posting those on the Social Security Choice site, where they have been so popular that a special page has been set up just with them. The comics have actually been so effective at combating the leftist propaganda on this issue that liberals have been trying to stop me from posting them.

Tax Reform Panel

They’ve set up a new website to publicize their activities at: http://taxreformpanel.gov/ I’ve already added it to my preset group of tax sites that I pop up and check every day.

I’m still waiting for them to discuss the various reform issues with some of us real life tax practitioners. They’re starting off with a number of bureaucrats and academicians.

Section 179 Recapture

Q:

Hi,

Was perusing your site and saw the wealth of information you provide. Clarifying question I did not find referenced:

If you purchase a qualifying vehicle (6,000 LB+ SUV) and take the $25K deduction in 2005 (regardless of if the vehicle is financed), can you sell that vehicle in ’06, purchase another qualifying vehicle, can you take another $25K deduction in ’06 (assuming the guidelines and limits remain unchanged)? My question is, if the guidelines for weight and maximum allowable deduction remained the same for the next five years, could you sell your vehicle annually, replace it with another qualifying vehicle annually, and take an annual 179 deduction each year?

Thanks for any insight you can offer.

Regards,

A:

You can buy new vehicles each year and claim the Section 179 for them, as long as each one meets the weight and over 50% business usage tests.

If you sell the previously deducted vehicles, you need to report the sales on Form 4797 and show anything that you get for it above its depreciated book value as depreciation recapture ordinary income. A sale only makes sense tax wise if the price you can get for it is less than the adjusted depreciated book value, so that you can claim the loss on Form 4797.

If you trade the old vehicles in on new ones, you will avoid having to report the gain because that will be rolled over into the new replacement vehicle on Form 8824. In regard to them claiming Section 179 deductions on the new replacement vehicles, you will only be able to do so on the additional amounts paid for the new vehicles after the trade-in allowance. To count the full cost before adjusting for the trade-in would be effectively double-dipping.

This is why it's so important to keep tabs on the depreciation schedule for your business vehicles and why I am so upset when I hear that tax pros are not providing their clients with detailed depreciation schedules with their tax returns for both the year being prepared, as well as the following year. Most tax prep programs will print out both years' schedules automatically. To not provide clients with those detailed schedules is wrong.

Good luck. I hope this helps. Your personal tax pro should be able to give you more specific advice for your circumstances.

Kerry Kerstetter

Labels: 179

Refinancing Prior To Exchange

Q:

Kerry,

I ran across your website online and I like the way you think. I have a tax question and I was wondering if you mind answering it. It is my understanding that you do not pay taxes on borrowed money. Well what if you know you are about to sell property and have a bundle of equity built in. Traditionally this would be capital gains and we don’t like those so we would put the money into a tax deferred account (1031 exchange) but with a tax deferred exchange we are not allowed to touch one red dime—it must go towards the purchase of property. What if I was to refinance this property pulling a portion of my equity out. At this point it is equity and borrowed money. Would I have to pay tax on this for the year as income or would it be considered borrowed money of which tax is not owed?

Thank you,

A:

While there have been occasional discussions about making cash taken out of a property's equity in anticipation of an exchange taxable, those have never gotten very far. As it stands, if you borrow money against your rental or investment property, the proceeds are not taxable as long as the refi is a completely separate event from the exchange transaction.

However, if you sell the property, and don't do a 1031 exchange, the relief of debt (paying off the loan) is treated the same as cash proceeds. Many people make the mistake of assuming that only the actual cash received is counted.

If you do a 1031 exchange after having refinanced, there will obviously be less cash to reinvest via your facilitator. This means that the additional amount of the cost of the replacement property will have to be financed with a loan. Basically, the loan on the new property should be at least as much as the loan on your old property. As with any exchange, whatever you miss your target replacement price by will be taxable as boot.

Your personal tax advisor should be able to help you with more specifics for your situation.

Good luck.

Kerry Kerstetter

Labels: 1031

The Flat Tax Debate

Q:

Subject: Stephen Moore's Tax Plan

Mr. Kerstetter,

First let me say thanks to both answering my question about DoD Social Security contributions for military members and then for posting the letter "In the Same Boat" on 2/2 on the socialsecuritychoice.com blog.

Secondly, I went over to your personal blog site and saw three posts about Stephen Moore's postcard tax plan. The original one on 1/30 linking to his WSJ article

The second one on 2/2 by Bruce Bartlett at the Washington Times was negative

The third one on 2/4 by Terry Savage at the Chicago Sun Times was positive.

I was curious about your opinion on the matter or to any other flat tax proposals.

I know you're busy, but would appreciate hearing from you. If you already have a published opinion on the matter, that would be fine if you could send the link.

Thanks

A:

I don't seem to be able to find the time to discuss the various pros and cons of a flat tax in as much detail as I would like. If you do a search on my blog, you will find several previous mentions of flat tax ideas.

As the articles you cited mention, there are plenty of pros and cons to every taxation scenario, including the various flat tax proposals.

As should be very obvious in all of my writings, I have always been a big opponent of the graduated tax rate structure in this country that penalizes success. I have never been shy in pointing out that such a method of wealth redistribution has its roots in the Communist Manifesto, in spite of claims by many on the left claim that it is from our Constitution. Replacing the punitive rate structure with one single rate would be a great step towards fairness.

What I have long warned about is that it is a fallacy to think that any flat rate tax system would put the IRS out of business or reduce the workload for us tax pros. The fun and games are with arriving at the taxable income figure. Figuring the tax, whether with a single rate or the current sliding scale, is the easy part. To keep everyone honest would still require the IRS to operate just as they do now. The only way to really get rid of the IRS would be to repeal the 16th Amendment and replace the income and estate taxes with a national sales tax, as proposed under the Fair Tax plan.

Stephen Moore's idea of allowing people to compute their taxes under two different methods and then choose the lower one is an interesting concept that could be a way to make a smoother transition to an easier method. From my perspective as a tax preparer, I can see that such a plan would create even more work for us, since we would have to prepare two different returns for clients.

If any of the big tax reform proposal ever makes it further than just idle talk, I will probably pipe up with more commentary.

Thanks for your interest.

Kerry Kerstetter

Figuring deduction for sales tax mostly a waste of time – I haven’t actually done any 2004 1040s yet, so I’m curious as to how this will end up working out for those clients in taxable states. It will obviously be a bonus for the several we have in the states with no income tax.

Three Ways to Find Real-Estate Bargains – Maybe it’s just because I’ve always somewhat specialized in real estate issues; but I have seen so many more people make good money in real estate than in the stock market.

Understanding Small Business Tax Deductions

Selecting a Tax Preparer is as Important as Choosing a Doctor – An analogy I frequently use when people ask for one size fits all advice. Diagnosing a tax problem in a general forum doesn’t work.

IRS Has $2 Billion for People Who Have Not Filed a 2001 Tax Return – One of the worst double standards in the tax system. If you owe tax, that debt follows your forever and beyond (your heirs). If you have a refund coming to you, it’s forfeited if you don’t file a tax returns and claim it within three years. It becomes a gift to Uncle Sam.

TV Commentator Arrested Over $130 Mln Stock Fraud – Another reason to be cautious about following the lead of so-called stock picking wizards. Conflicts of interest are much more common than the public knows.

The Top 10 Personal and Business Insurance Tax Do's and Don'ts

Rapid Refund Loans – Scams that actually make up a huge profit for the assembly line tax prep firms that prey on the lower income, lower intelligence clientele.

A Successful Subdivision Can Boost Your Profits – It’s long been one of the most effective ways to profit rather quickly in real estate. Buy a huge parcel and then sell it off in smaller units. Contrary to popular perception, including among many tax pros, doing this doesn’t automatically make someone a real estate dealer, who is subject to regular tax rates plus self employment taxes, and is unable to use 1031 exchanges. I have worked with this issue for decades and have seen that the deciding factor over whether someone is a dealer or not involves the time spent doing the subdividing. If it becomes a full time occupation, the person is most likely a dealer. However, if it is a part time side activity, it is an investment, with all the tax benefits of that (lower long term capital gains tax rates, no SE tax, 1031 exchanges, and installment method).

Calculating the Real Rate of Return on Investments

Labels: 1031

Bush's Fiscal 2006 Budget Pushes Tax Cut Permanency, Budget Process Reform

White House Budget Leaves Heavy Lifting to Tax Reform Commission

IRS Enforcement Gets Budget Boost; Service, Modernization Not So Lucky

Proposed Treasury Budget for FY 2006

Statement of IRS Commissioner Mark W. Everson on the FY 2006 Budget

Elderly Are Skeptical Of Reverse Mortgages – I have always had problems convincing elderly people that there is no sin in having a mortgage on their homes and dipping into their equity in order to enjoy the fruits of their investment. A home with a mortgage is still a windfall to their heirs. When I crunch the numbers, it often works out better to have them take out a large mortgage at one time rather than use a piece-meal reverse mortgage approach. It usually works out that they can deposit half of the tax free loan proceeds into the bank and it will make the payments for their rest of their lives. The other half can be spent on fun stuff, “I’m spending my kids’ inheritance” style.

Tax-Free Home Sale Combinations – Thanks to TaxProf Paul Caron for the lead on this summary of ways in which to use 1031 exchanges and the Section 121 up to $250,000 per person tax free home sale rules to save a lot of tax money. The serial home selling strategy of moving into rental properties and then selling them each two years has been a popular technique to legally avoid capital gains on residential properties for almost eight years now.

BUSH BUDGET DIRECTOR BRAGS OF SHIFTING TAX BURDEN TO RICH – We must be in some kind of time warp here. This is the kind of thing that Clinton and his Marxist gang loved to brag about. It’s not very logical coming from a capitalist President.

Labels: 1031

Jesus Loves Tax Cuts?

Many people have long wondered why ten percent of income is enough for God, yet our earthly rulers demand many times that much.

New LLC K-1 Form

This is the latest installment of an ongoing discussion I have been having over the past few years with Ohio CPA Dana Stahl regarding the question of whether LLC members are required to pay the 15.3% self employment tax on their share of the LLC net income.

DS:

Mr Guru - I can't remember if I asked you about this previously. If so, I apologize for asking again. Anyway, the new 2004 K-1 has a check box for "general partner/LLC member manager" and another for "limited partner/other LLC member". As you know, we've discussed repeatedly about the LLC member/SE tax issues, in that those who are Members of a multi-member LLC can opt out of SE tax. Therefore, how would you recommend we handle which box to check for someone who is actively making a living in an LLC, but not paying the SE tax? Just go ahead and check the limited partner box? Let me know.

DS, CPA

Mr Guru - oops, had an additional thought on this. Is this new set up on the K-1's just an IRS trick to get LLC Members to start paying SE tax who have previously opted out? Seems like it to me.

DS, CPA

KMK:

Dana:

Good point about the new descriptions next to the K-1 boxes. Looking through the IRS's instructions, they don't specifically mention any change with LLCs and SE tax; but I think you are right that checking the General Partner box could possibly be used as an admission that the income is subject to SE tax if IRS ever decides to move beyond its current position of having it determined as such voluntarily.

I think it's best to stick with the descriptions that they show in the instructions:

It defines general partner as someone who is personally liable for partnership debts.

Limited partners - Members of LLC can be treated as limited partners for certain purposes.

Since one of the big benefits of LLCs is the protection from personal liability, we can honestly check the limited partner box, which is what I will be doing for those clients who don't want their LLC income classified as SE.

Kerry

Simplifying the code – Good summary by George Will of the pitfalls and obstacles facing any attempt to simplify the tax system. I thought I used flowery language when discussing the insane tax mess we have. However, I have to admit that, after 30+ years in the tax profession, Mr. Will is the first person I can recall referring to income tax as “Satan’s fingerprint.” I guess that makes my lifelong quest to reduce everyone’s taxes a true fight of good versus evil.

Leasing Vehicles To Corp

Q:

I have a small electrical business. I have been told by my CPA that my taxes could be lowered overall if I were to purchase the trucks I use for my business, in my name, and then lease them to the company. The company is a C-Corporation. How could I deduct my the depreciation on these personal vehicles that are leased to the Corp?

A:

That is a very common strategy that can save a lot of tax money by avoiding the payroll taxes that a salary would entail. It is also a popular technique for people who are receiving Social Security income and have a limit on how much earned income they can make without having their benefits reduced. Lease income is not classified as earned income.

The lease income is reported on your Schedule E (or Sch. C as some people use) and the expenses of the leased item that you pay personally, including depreciation and Section 179, are deducted on that same schedule.

What I am most curious about is why your personal CPA didn't explain these basic facts to you and you had to ask a stranger on the internet. Tax pros should always be prepared to explain the pros and cons of any strategy that they advise for their clients.

I hope this helps. Good luck.

Kerry Kerstetter

Labels: 179

Multiple Heads of Household Under One Roof

Q:

Dear Sir, I was wondering for head of household if there are 2 separate families living in one house ( address ) can both claim head of household? Sincerely

A:

That is possible. However, the burden of proving that you both qualify is on you, so keep plenty of documentation.

Here is the relevant explanation from page 1-7 of my new CCH 1040 Express Answers book:Multiple heads of household may share the same address if they maintain separate households and can provide documentation of that fact.

Gray Area. Persons sharing the same living quarters are subject to special scrutiny by the IRS if more than one files as Head of Household. Documentation of separate households is required if two persons with the same address file as Head of Household. The same qualifying individual may not be used by both. Records must clearly show which person made all rent, mortgage, utility, and other relevant payments to substantiate the claims.

You didn't say what state you are in, but my experience has been that some state tax agencies (i.e. California) are actually much tougher in regard to verifying eligibility of taxpayers to claim the HoH filing status.

I hope this helps. Your personal tax advisor can better evaluate your particular circumstances.

Kerry Kerstetter

CCH's Answer To QuickFinders

As I’ve mentioned several times over the past many years, my most frequently used reference books are those produced by QuickFinders, which I have been buying for each of the past 20+ years. With the never ending growth in the tax laws and rules, having a handy easy to use book is obviously a growth market for the tax practitioner community.

Several weeks ago, I ordered a copy of CCH’s brand new 1040 Express Answers. It arrived yesterday and I’ve had a chance to flip through it to see what all it contains. I was very impressed with it and expect to be using it quite a lot. They've actually included a lot of additional info that the QuickFinders books don't have, such as factors to use when calculating the prices of stocks that have been through a lot of splits since their purchase.

The one thing I was wondering about is how CCH intends to provide the inevitable updates to the book’s content during the year for their customers. I looked around their website and couldn't find an update page comparable to the one that QuickFinders has. I wrote to them about this and am still awaiting a response.

Deducting Business Expenses

Q:

I am a self employed, Realtor. I purchased a SUV last July, 2004. It weighs more than 6000 pounds. When I first discovered Section 179 I also read that you receive 35% the purchase price back as depreciation. Can you instruct me as what exactly to inform my CPA when doing my taxes this year?I would appreciate any advice you have for me.Thank you,PS Did I also read somewhere that you can deduct more that 50% of meals this year? I thought I read was increase to 60%???

A:

I'm not sure if I'm understanding what you are asking me. Do you actually want me to tell you how to calculate the depreciation and Section 179 deductions on your new SUV so that you can pass that along to your CPA? If that's the case, you really should be looking for a new tax preparer because these are very basic calculations that have been around for decades.

The 35% figure you are mentioning sounds like a rough guesstimate of how much tax you would save from the deduction of the SUV purchase. Many people do make the erroneous assumption that every dollar deducted on a tax return results in a dollar for dollar tax saving. That might be the case if the effective marginal tax rates were 100%. However, the actual tax savings from a deduction is lower than 100% and is based on your personal effective tax rates. What I have frequently seen, when counting Federal and State income tax rates, plus the 15.3% self employment tax, an effective combined tax rate of over 50%. This would mean that deducting $40,000 for the purchase of an SUV would reduce your taxes by around $20,000 for that year.

When setting up the new SUV on your depreciation schedule, there are a number of possible ways to claim the expense, which your tax preparer can work out to the best advantage for you. There is the Section 179 expensing election. There is also a possible 50% bonus depreciation as long as you were the first purchaser of the SUV, and there is normal depreciation, which can be computed using either the straight line or accelerated methods.

So in regard to what you need to provide your tax preparer for your 2004 returns, I would start with a copy of the purchase invoice. That will provide him with the date purchased, its cost, any trade-in info, whether the vehicle was new or used, and how it was financed (cash and/or loan). You also need to provide him with the total number of miles you drove the SUV during 2004, as well as how many of them were for your real estate business. If you are going to be claiming the Sec. 179 or bonus depreciation, you will be using the actual cost method of calculating that vehicle's expense instead of the standard mileage rate. This means that you will also need to provide him with all of the vehicle's operating costs for 2004, including fuel, repairs, insurance, registration, washing, and interest on the loan, if you didn't pay cash for it.

Be sure to provide the totals for these costs. Your preparer will apply the business usage percentage against them. A common mistake I find some of my clients making is self reducing the vehicle expenses they report to me. For example, if their business usage was 80%, they only report 80% of their costs to me. Unless I catch that, our tax program will multiply the total costs we enter by 80%. This ends up giving them a deduction of only 64% (80% X 80%).

In regard to the deduction for business meals, it is still 50% for most businesses, including Realtors. The allowance is 70% only for some kinds of transportation workers, such as pilots, truck drivers and railroad worker. There is always talk about increasing it for the rest of us, especially when the restaurant business is slow; but nothing new has made it into law.

Again, just as with the vehicle costs issue I mentioned above, tell your tax preparer the total you spent and his tax program will reduce that by the 50%. I occasionally discover clients thinking they are helping me out by only entering 50% of their business meals and entertainment costs in their organizers. If I don't catch what they've done, their actual deduction will be only 25% (50% X 50%) of their actual costs because my tax prep program reduces whatever I enter by 50%.

Good luck. I hope this helps.

Kerry Kerstetter

Follow-Up Q:

Thank you for your response. I was under the assumption that you deduct the entire amount of purchase price from your gross income. (ie: gross income 100,000 SUV 50,000 then I only owe taxes on the remaining 50,000 of which all expenses (meals, dues, cell phone, advertising etc) and depreciation would apply. What kind of mileage log is needed. Mine is very generic, as my past tax preparer only asked for total miles per month.What is your charge for tax preparation?

Thank you,

A:

It's not quite that straight forward. Your business vehicle expenses will go on your Schedule C. along with your Realtor income and other related business expenses.

There are several ways to keep records of business driving that will satisfy IRS requirements. At a bare minimum, you need to record the odometer at the end of each year so that you can document how many miles the vehicle was used for that year. Then, you can either back out the purely personal miles to arrive at the business total or you can total up the business miles for the year. This can be done either trip by trip or by the average method; such as average number of business miles per day (or week or month) multiplied by the number of days (or weeks or months) worked in the year. Use whichever method fits you best.

We are not currently accepting any new tax clients and are in fact still trimming back on the ones we have to arrive at a level that I can better handle. You can see my tips on selecting a preparer here on my web site.

Good luck.

Kerry Kerstetter

Labels: 179

Lifetime Earning Credit

Q:

hi , i check your web page and it look great. i am preparing the tax return for my girlfriend father, the father put her as his dependent, she is 26 years old the father pays part of the tuition for her to go to college. can he claim the lifetime learning credit|?

thank you

A:

As long as your girlfriend meets all of the tests to qualify as her father's dependent, he would be able to claim the credit for her education costs. I can't find any age limit on qualifying dependents in the rules for the credit. Of course, the father's AGI would also have to be under the "Evil Rich" phase-out threshold in order to qualify for the full credit.

Kerry Kerstetter

Taxes Are No Joking Matter

Matt Drudge had this story about an Ohio city tax superintendent who was suspended for trying to add some humor to the tax instructions, such as:

If we can tax it, we will.

Free advice: if you don't have a profit in a five-year period, you might want to consider another line of work.

It seems that these are more like candid looks at the attitudes of the officials, especially the first one.

How to Track Down Foreclosure Properties – Some good tips for real estate investors.

Bush calls for fairer tax code – Since the words “fair” and “taxes” don’t go together in any logical sense, the most we can ever really hope for is “fairer.”

Tax reform that would flatten the opposition – Some more support for Stephen Moore’s postcard tax return proposal.

The Psychology of Raising Taxes. The method is to reduce our consciousness of pain. – Out of sight, out of mind, through withholdings, has made it impossible for most people to have any idea how much they pay in taxes.

Homeowners Revolt Against Tax Assessors – As it should be. The increases will never be controlled if the property owners don’t speak up. 1978’s Proposition 13 in the PRC was a perfect example of this. Silence equals assent to our rulers, who will continue to financially rape anyone who accepts it without an argument.

Alternative maximum tax gimmick

Social Security Pushing Taxes to Back Burner

More Money For IRS

Bush to Propose $500 Million Funding Increase for IRS Enforcement

President Bush's 2006 Budget to Request Boost for IRS Enforcement

Court: Taxpayers can ignore IRS summonses. Ruling says action has no teeth without federal court order. – We’ll have to wait and see if this ruling has any actual effect on aggressive IRS collection actions.

Tax rates vs. revenues – It’s amazing how the left continues to deny reality, that lower rates generate more taxable activity an thus more actual revenue.

Converting To S Corp

Q:

Hello,

I have found your information to be very helpful and was wondering if you can point me in the right direction. All along I thought our corporation was set up as an S corp., I have been filing 1120 returns since 1999 and the

income of the corp. has been low to min up until our 2004 tax year. If I send the form to elect an S status with the IRS, can I use this S status for our 2004 return? Any response would be helpful. I am sure you get many requests...Thanks again...

Thank You,

A:

First thing, you should be working with a tax pro. If you have been trying to handle corporate taxes on your own, you have been asking for trouble.

If you have seen the S corp election form 2553 and its instructions, you should know that it's too late to file an election now and make it effective for 2004. You need to file the 2553 by March 15, 2005 if you want to make it effective for 2005.

IRS does have provisions for late S elections for special circumstances. However this is usually only allowed for new corporations where no tax returns have been filed. I seriously doubt whether your case will qualify for the IRS's permission on this.

If you do try for the special late election, you should be working with a tax pro and you need to get your story straight. You claim to have been under the impression that you were already an S corp; yet you were filing 1120 forms, which are used for C corps. That doesn't make sense to me and it won't for IRS.

Sorry to be so hard on you; but this is either a classic example of the dangers of not using a tax pro; or if you were using one, the repercussions of using an incompetent one.

Good luck.

Kerry Kerstetter

Cost Basis Mistakes

Overstating Of Assets Is Seen To Cost U.S. Billions In Taxes – This claim that most people overstate the cost basis of their assets in order to reduce their capital gains is a load of crap; but is consistent with the Left’s propaganda that everyone cheats on their taxes. News stories like this are used to justify more IRS power.

As I’ve constantly said, rather than underpay their taxes, most people overpay through either ignorance, incompetence (their own and their tax pros’), or a desire to just keep IRS away from them (fear). What I have seen too many times to count are large understatements of the proper cost basis of assets, leading people to report too much taxable profit. In fact, when I was traveling all over the place teaching my seminars to Realtors on real estate tax issues, my very first topic was the proper determination of cost basis because it has so often been done incorrectly by so many people.

Common mistakes I see all of the time include

Assuming that the cost basis of an item received as a gift is zero because the recipient didn’t pay anything for it. The truth is that the cost basis for the recipient is the same as it was for the previous owner.

Forgetting to step up the cost basis of assets that were inherited to its fair market value as of the date of death. I have prepared dozens of amended returns for this very reason, where the clients’ previous tax preparer used the original cost of an asset when reporting a capital gain, although there had been a death since then. This is even more critical with surviving spouses in community property states, where the entire property’s cost basis is stepped up; not just the inherited half, as it is in non-community property states.

I know I am a lone voice compared to the big media machine of the Left; but stories claiming that everyone cheats on their taxes and that we need a tougher more powerful IRS are completely wrong. Of course, my claim is only based on working with thousands of real people over the past 30 years. How can that compare with ivory tower theory and distrust of the commoners by our superiors?

More On Donating Vehicles

As I’ve mentioned previously, one of the most indispensable programs I have used for probably the last 20 years has been Tax Tools from CFS Software in California. I have also been buying their Small Business Tools program for as long as it’s been offered. A few years back, I bought their Financial Planning Tools program; but I didn’t renew it after two years because it was their most expensive program and the only parts of it that I used were already included in the Tax Tools and Small Business programs.

I had noticed their Tax Corresponder program, but had never seen a need to buy it because I was under the impression that it only covered letters to IRS and FTB, and I already have my own decades old files with the letters I have written to them. When I was preparing my renewal order for the 2005 programs, I noticed that the Corresponder program also includes a lot of letters to be sent to clients on a huge variety of topics. I figured if it saved me time on just one explanatory letter to a client, it would have more than covered its $39 cost. After receiving the 2005 CD last week, and scrolling through the list of 319 master letters it contained, I noticed several right off the bat that would come in very handy around here, including an excellent CYA letter to send to the clients that we are letting go.

Short story long, as I was setting up one such letter this morning, I again noticed two letters for advising clients on the proper procedures for documenting the donations of vehicles to charities. One is for donations prior to the new 2005 change, and the other is for the new rules. Since I had just covered this topic in a posting last night, I though it would be interesting to show how CFS explains the differences.

For Donations Prior to 2005:

Donating a vehicle to charity has real tax advantages if you itemize your deductions, but you need to follow a few simple rules to take the deduction. How much you may deduct depends on whether you used the vehicle in a trade or business. If you did use the car in your business, the allowable deduction is the fair market value reduced by the amount that would be ordinary income if the car had been sold (this is generally the adjusted basis of the vehicle). If you used the vehicle for personal use only and you owned it for more than one year, the amount of the charitable deduction is the fair market value of the vehicle at the time of the donation.

If the value is $5,000 or more, the IRS requires an appraisal of the vehicle. If the value is less than $5,000, to determine the value, start with the used car ads or a price guide such as Kelly Blue Book. You should then adjust the value according to the vehicle’s condition. If the vehicle’s condition is excellent, you may be able to deduct more than book value. A beat-up car is worth less. Take pictures of the vehicle for substantiation of your deduction.

I have one word of caution for donations of $250 or more. A written receipt from the charity is required, and this receipt must be in your hands by the time you file your tax return (including extensions). The receipt must include the organization’s name, date, location of the donation, a description of the vehicle, and the value of the vehicle. If the value of the vehicle was greater than $500, you must also provide the IRS with information as to how the vehicle was acquired (e.g. purchase or gift), the date it was acquired, and what you paid for the vehicle.

As you can see, you may be able to take a sizeable deduction. Because of current scrutiny by the IRS of this particular deduction and the potential abuse by taxpayers, it is imperative that you follow the rules to avoid an audit. I hope this explanation is helpful and that you will feel free to call me if you have any questions.

For Donations After 2004:

Even though the law changed for the donations of vehicles valued at more than $500 as of January 1, 2005, if you itemize your deductions, donating a vehicle to a charity will benefit you. How much you may deduct depends on the use of the vehicle by the charity.

I have a word of caution for donations valued at $500 or more: you must follow the new IRS rules. A written receipt from the charity is required, and this receipt must be in your hands within 30 days of the charity's sale of your vehicle or 30 days of your contribution. The charity's written receipt must include your name and tax identification number and the vehicle identification number. If the charity sells the vehicle without significantly using it or materially improving it, your deduction is limited to the gross proceeds of the sale. The charity is required to certify in writing to you whether your vehicle was sold or if they intend to sell it (limiting your deduction to the gross sales price) or whether the charity intends to use the vehicle and will not transfer it in exchange for money, other property, or services.

As you can see, you may be able to take a deduction if you follow the new rules. Because of current scrutiny by the IRS of this particular deduction, it is imperative that you follow the rules to avoid an audit. I hope this explanation is helpful and that you will feel free to call me if you have any questions.