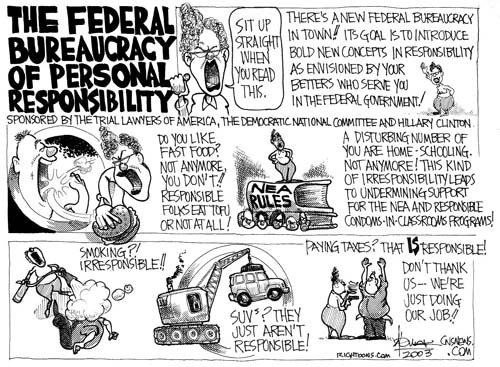

Firms' Prop. 13 Savings Are Coveted - Newer property owners resent the lower taxes paid by long time property owners. It's amazing how much energy is expended in our country in support of envy over what others have. Didn't envy used to be one of the seven deadly sins? We've evolved to the point in our society where it is very acceptable and literally drives official government policies, as I described below.

Acceptable Targets

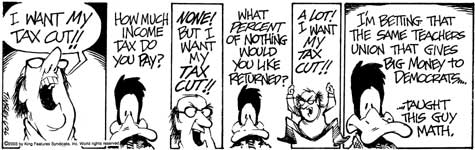

As I've pointed out on far too many occasions, it is considered acceptable to discriminate, penalize and do all sorts of nasty things to the evil rich among us. Once it is agreed that it is proper to do bad things to a certain segment of our society, it comes down to defining where the line is between those to have bulls-eyes painted on them and the others who don't deserve the harsh treatment. As I've described, in most areas, this line is defined by AGI (adjusted gross income) on 1040s. Those having income over the arbitrarily set amounts are to be penalized and persecuted.

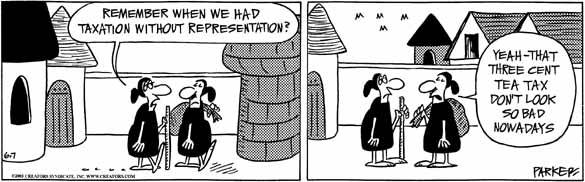

If it isn't obvious enough where I stand on this issue, it's that we should all be treated equally. I dislike the entire concept of someone on their throne in Washington DC deciding who has enough and who doesn't. That is just fine for communist societies; but has no place in a capitalist free market economy as established by our founding fathers.

For estate (aka death and inheritance) taxes, the defining point of who should have their family's wealth stripped away and who may pass it on is defined by the size of their net estate at the time they pass away. That is currently one million dollars per person and scheduled to increase over the next few years.

Those of us who believe that nobody should be deprived of the right to retain his/her hard earned wealth in the family are having to fight people like this who openly resent rich people and feel it is the responsibility of government to equalize everyone by force. There is a name for these kinds of people. Just the idea of one group of elitists dictating who is average and who is evil rich is disgusting and is no different than having the government mandating what size home is allowable for each person in this country or in other ways telling us how to live our lives.

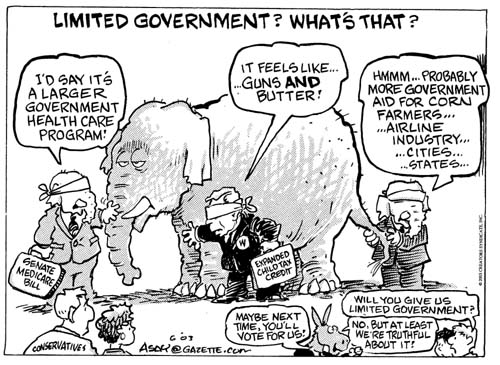

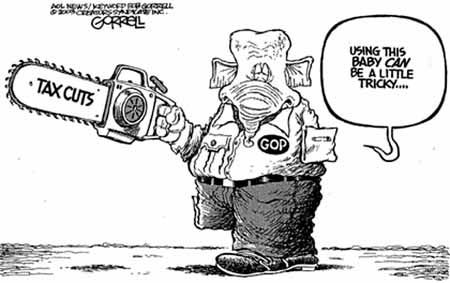

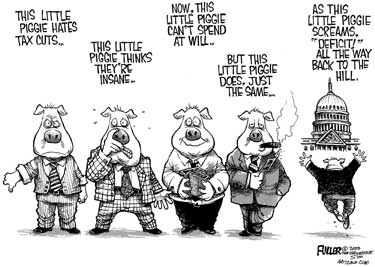

We have an increasingly unmistakable case of deja vu here. In spite of a huge approval rating after the 1991 Gulf War, Bush 41 alienated plenty of his conservative base by breaking his "read my lips, no new taxes" pledge, leading to his record as a single term president. Bush 43 is following the same path with his support of bigger government spending. Many conservatives are expressing their displeasure with this blatant and very unprincipled attempt to buy votes from the DemonRats' traditional constituency.

Let's hope that, in acting on this disapproval, disenchanted Bush supporters will vote for a real small government choice (Libertarian Party) in November 2004 rather than sit out the election or waste their votes on a crackpot like Ross Perot.

Our rulers have done such an excellent job in forecasting the costs of other huge entitlement programs, why not let them just keep on going?

Calif. Near Financial Disaster - They've been on the brink of collapse before, and always survive. They're trying to scare people into accepting higher taxes rather than cuts in the cost of government programs.

CBS Wails: "With Only $400 Billion to Spend"; NBC Rues Tax Cut - And the lefties still claim they need another news network to counter Fox News. They don't think they have enough outlets with just ABC, CBS, NBC, PBS, CNN and MSNBC to spread their socialist propaganda.

Very Richest's Share of Income Grew Even Bigger, Data Show - And the NY Times' answer to this disparity is to have our rulers in the government equalize everything by redistributing wealth from those who earn it to those who don't.

Drugs and the Deficits - The Libs couldn't care less about the deficit when it comes to more government spending programs; but they claim that the Earth will stop spinning if tax rates are reduced and people are allowed to keep a tiny bit more of their own money.

“Commuter Taxes” are Taking Many Workers for a Ride,Tax Research Group’s Study Finds - Just as with tourist taxes, government rulers love to be able to take money from people who are not able to vote against them.

The new decade of greed - The Clinton 1990s far surpassed the Reagan 1980s.

Time to retire General Washington - Has the one dollar bill outlived its usefulness in the USA?

Entitlements have history of cost overruns - Just as with projected effects of tax law changes, the numbers used to describe new government programs are complete fabrications. Our rulers have a long history of intentionally understating the expected costs of government programs. They know that nothing will ever happen to them when the truth materializes; costs hundreds of times higher than predicted. Most of the current rulers will be out of office by then. They also know that, just as with Medicare, by the time the true costs are realized, everyone will be so used to the system that there will be no political support for discontinuing the program. They are no different than drug pushers, getting as many people addicted to their government programs as possible.

Taxing retirement funds - Our rulers are literally salivating at the idea of getting their mitts on the trillions of dollars people have stashed away.

Social security imbalance sheet - There are still some in DC supporting the concept of allowing people to have more control over their SS money (aka privatization).

What Gives? The Possibilities of Private Charity - People are very generous in support of causes they agree with and efficient local charitable organizations can accomplish a lot more with a lot less than bloated corrupt government programs.

Mean Testing Is Standard Practice

I've often discussed how many of the tax deductions and credits are only available to those people whom our rulers consider to not be evil rich, as defined by the AGI (adjusted gross income) on their income tax returns. They refer to this as "means testing," implying that people with substantial income (means) don't need additional tax breaks. I prefer to call it "mean testing" as a penalty for being successful.

In the recent discussions over expanding the government medical programs to cover prescription drugs, I never bought for a second the argument that many people were raising that the taxpayers would end up paying for the medicines of the super duper evil richest of our country, such as Bill Gates, Donald Trump, Ross Perot and Rush Limbaugh. I knew that was a bogus claim because any new government program would have to have a means test to weed out the undeserving. As Robert Novak describes, that means that the medical establishment will be provided with our income data in order to know which of us are entitled to the government benefits.

I'm not in favor of expanding the size and scope of government control over our lives. However, I am also not in favor of using bogus arguments in discussions of those issues. Claiming that the taxpayers would be picking up the tab for billionaires was never appropriate and just makes opponents of the program look stupid for mentioning it as a realistic possibility.

However, allowing government bureaucrats to have more actual life and death power over us is very scary. Need I remind everyone that our rulers in DC have already established the cut-off between the deserving and the evil rich for Social Security recipients as $25,000 AGI for single people and $32,000 for married couples? Is it too much of a stretch of the imagination to foresee someone being denied life saving cancer medicine because his/her AGI is $40,000?

For anyone who thinks using AGI as a test of eligibility for benefits is a good idea, please check the AGI on your most recent 1040. It's the number at the bottom of Page 1. Now, ask yourself how much of that you have in actual cash with which to buy medicines or anything else. AGI has very little relation to the amount of actual disposable cash people have on hand and has never been a fair measuring stick for wealth. However, it has become enshrined in the mentality of our rulers in DC whenever deciding who may or may not participate in any new benefit.

$1 billion dot-bomb payout by firms. Internet companies to pony up for alleged inflation of IPOs - This is an unusually lucky break for those people foolish enough to invest in dot-com IPOs.

Nevada Turns to Brothels as a Budget Fix - The Holy Grail of taxation has always been to find one that is painless or that people enjoy paying. This idea might just be pretty close. There's just an interesting balance to the concept of having the tax collectors screw you at the same time as... Since the Nevada Constitution forbids a State income tax, this is an interesting revenue raiser and should be a bit more pleasurable than paying IRS. They plan to call this a 10% live entertainment tax on brothel services. Since many of the customers are most likely from outside Nevada, it's really no different than the various other tourist taxes already charged around the country, such as hotel and rental car taxes.

Record cuts, higher taxes as states struggle to survive tough times - Incompetent management and planning are much more realistic reasons for the deficits than simply blaming everything on tough times.

IRS: Over 2000 Big Earners Paid No Tax in 2000 - Let the class warfare and hatred of the rich commence. This is intentionally inflammatory and no more relevant than saying "Over 2000 blue-eyed fishermen paid no income tax." There are literally hundreds of very legitimate reasons why someone with a lot of gross income would have no Federal income tax. A business that has more expenses than income is the most common.

A Governor CBS Can Admire: Alabama's Tax-Raising Bob Riley

How the West Is Taxed

People should stop whining about taxes - Many of us wish it were possible to do what this ignoramus jokes about; voluntarily opt out of incompetent government programs, such as Social Security and MediCare.

A 'Financial Planning 101' Minus the Jargon

Corporate Choice - I'm still as big a supporter of using C corporations as before the new tax law, especially with the quadrupled Section 179 expense deduction. An owner of a C corp can claim up to $200,000 per year, while an S corp owner is limited to only $100,000. Many people, including Forbes, aren't looking at the big picture and are falling for the lure of the more taxing S corps and LLCs, which are basically identical to S corps.

Labels: 179

Governor's car tax hike faces court test - Not everyone is willingly accepting the unilateral tripling of the tax by Gray-Out Doofus

Democrats Urge Bush to Press Hard on Tax Credit - Unfortunately, in his zeal to co-opt as many of the DemonRats' issues as possible, Bush is very likely to once again abandon conservative principles and go along with this increase in welfare payments to people who already pay no income taxes.

This would be an obvious tip-off that you may be asked to be more creative with accounting than is legally acceptable.

Bill Clinton Likes Paying Taxes - In case there is anyone with any doubts that the Clintons are dyed in the wool Marxists. They are literally chomping at the bit for their third term in the White House, when they can undo all of the Bush tax cuts and raise rates even further than before.

The only hope the DemonRats have of capturing the White House in 2004 is to continue their sabotage of the economy by keeping unemployment high, taxes, high, and the stock market as low as possible.

Falling Through The GAAP

Another call for changes to the GAAP (generally accepted accounting principles) that have been used since 1921 in order to make the information provided to investors more practical. This debate, especially the focus on past data and lack of forward looking info, has been going on for decades. We discussed this 30 years ago in my college accounting classes. The conclusion then seemed to be that, until they can come up with the perfect answer to providing future information, such as a crystal ball or a time machine, it's best to just stick with what we have, which is really a mish-mash (technical accounting term) of methods of reporting past financial performance. I'm not very optimistic that these current calls for reform will be any more productive than those same demands 30 years ago.

Cost of Life Insurance to Drop As Life-Span Estimates Expand - The old joke goes that actuaries, who study mortality rates for insurance companies, are just like CPAs, but without the personality. I guess another difference is that actuaries don't have to be as on top of new developments as we CPAs do with the constantly changing tax and accounting rules. It seems that the official life expectancy tables in this country haven't been updated since 1980. Those tables are just now being revised to reflect the longer average lifespan.

The good news about this, besides actually living longer, is that the insurance companies will be dropping their premium rates. Even if you already have life insurance, it would be a good idea to shop around for the new rates. I doubt if rates will be dropped for existing policies because insurance companies are like the phone companies, where the best rates are only given to new customers and existing clientele have to explicitly threaten to leave before receiving any of the benefits of lower market prices. That's always bugged me about the phone companies and will most likely be the M.O. for insurance companies.

Hoary economic fallacies (Jack Kemp) - The left-wing propagandists so hate the idea of people having any control over their own money that they continue to distort the reality about tax rate cuts. Lower rates increase economic activity, increasing overall tax revenue. It's a fact proven by real life and anyone who claims otherwise is nothing but a liar, not to be trusted.

State spending (Rich Lowry) - State Rulers such as in the PRC, who are looking at record budget deficits, are trying to make everyone feel sorry for them and reach the only logical (to them) conclusion for a solution - higher taxes. As many of us have been pointing out for years, these financial crises have nothing to do with too few taxes. They have everything to do with out of control spending.

They believed the Clinton hype of the late 1990s that he had eliminated all economic cycles and that the stock market would rise by 20%+ per year until the end of time, resulting in an endless stream of capital gains taxes. I know it sounds idiotic now, in hindsight, that anyone would believe such crap; but they did, and they ramped up big spending programs to utilize that neverending stream of cash.

It wasn't just the States who fell for that garbage. It's the same logic that the Clinton gang used to project record Federal budget surpluses that the Left wants us to believe have now been squandered by the Bush tax cuts.

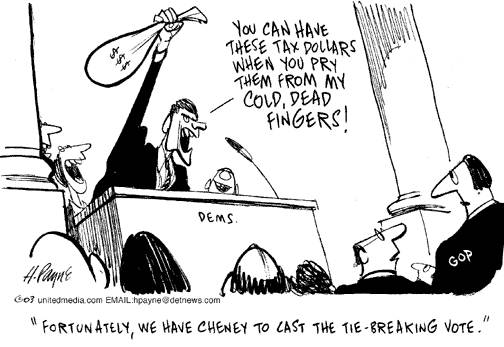

Bush Cites the Cost Of Tax-Cut Repeal - The evil DemonRats are still trying to roll back the cuts that have already passed.

If deficit hawks were serious, they'd curb spending

Tax Amnesty -- A Win-Win for Everybody - This idea comes up every ten years or so. It's a tough sell to people who have been paying their taxes all along. Of course, it does seem to be a trend to reward lawbreakers who can go long enough without being caught, such as the millions of illegal immigrants that are most likely going to be awarded citizenship in the near future.

Finishing Off the Death Tax - The Marxist class warriors will do everything they can to prevent this from happening.

Australians pay too much in tax, report finds - Very similar to the situation we have here in the USA. Tax rules are so complicated that most people end up paying more than they should be.

Dotcom exiles turn up at new charities - Putting their experience to good use.

Just Following Orders

The WSJ has a very interesting story of a corporate accountant with WorldCom who made the entries, under orders of her bosses, to artificially inflate the book income. Even though the idea to do this wasn't hers, she will be doing some prison time for just following orders.

It is definitely a tough spot for middle and low level employees to resist pressures to do illegal things. I saw a lot of this during my time as a internal auditor, investigating various fraudulent activities. If reporting these illegal things to the corporate audit committee or Internal Audit department doesn't do any good, the only smart move is to quit. When the house of cards collapses, you can be fairly certain that the top dogs will have stashed enough away to take care of themselves and will leave their underlings hung out to dry.

Link Between Death, Taxes Ending - Hopefully, this will come true, if it can make it through the Senate, which is still mostly controlled by RINOs and DemonRats; so it will be a very tough fight.

Boast of Refusal to Pay Taxes Leads to 27-Count Indictment - Maybe the Feds are finally cracking down on the idiots who claim taxes are voluntary.

Support for tax cut lukewarm at best - This is another obviously slanted poll, with questions such as "Do you think it's fair that Bill Gates has his taxes cut while poor little school children are starving in the streets?" The liberals should be ashamed of themselves for their lies trying to connect every penny of taxes saved by anyone as coming out of the mouths of starving little babies. Of course, the libs have proven on so many occasions (especially with their worship of the Clintons) that they don't understand the entire concept of shame.

Taxpayers still like Proposition 13's protections - But the balance of power is continuing to shift, as those who benefit the most from it die off.

PRC Car Tax

It sure looks like the Governor of the PRC (often referred to as Gray-Out Doofus) is either a complete idiot or is not in the least worried about the current recall effort. He may even have a political suicide wish and want to go out in a blaze of "glory." how else can you explain his recent decision to triple the license fees on vehicles? Everyone knows that Californians love their cars and many people have several.

The car tax is actually a property tax based on the book value of each vehicle. They are expecting this increase to cost an average of $158 per vehicle more per year, for an expected total take of $4 billion from those people who decide to stay in the PRC and not drive them to lower tax states. The new higher rates are scheduled to take effect on October 1 of this year.

As can be expected, this is receiving a lot of coverage around the PRC. Thanks to the CalNews.com website for actually locating all of these articles.

San Francisco Chronicle

San Diego Union Tribune

Los Angeles Daily News

Sacramento Bee

Los Angeles Times

Orange County Register

Contra Costa Times

Orange County Register - on how businesses with a lot of vehicles will be hurt hard by this tripling of the license fees.

Ventura County Star

San Jose Mercury

Oakland Tribune

It's just too bad that Arnold Schwarzenegger isn't serious about taking part in the recall election against Doofus and is only using such speculation as a publicity gimmick for his upcoming Terminator 3 movie.

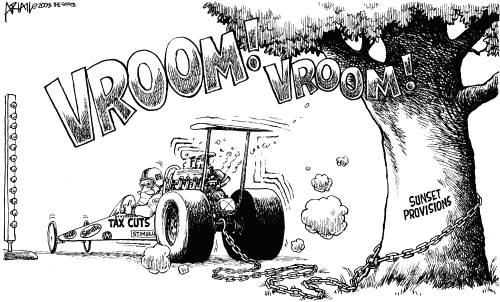

The Phase-in of the Bush Vision. The benefits are being delayed. But the future is bright.

More on the New, Lower Tax Rates on Stock Dividends

When the Check Isn't in the Mail

What's a nonprofit to do when a donor reneges on a pledge?

Balancing the Books - Tax cuts don't cause deficits. Spending does.

Buffet Can Talk Stocks, Not Taxes. His death-tax analysis is all wrong for a number of reasons. - As I've been saying for years, this capitalism guru preaches a lot of Marxism.

Saving Your Nest Egg. Retirement funds suffer if you go on disability. An insurance policy can help

SEC Can Accelerate Hiring After Congress Waives Rule - Good move by our rulers in DC. People like me, who can easily spot corporate accounting fraud, aren't going to put up with the normal civil service crap involved with working for the government.

Speaking of policing corporations, the WSJ has an interesting article on conflicts of interest when head honchos from non-profit organizations sit on the boards of for-profit companies. They see a tendency to look the other way from problems, as long as the corp contributes to the charitable organization.

More Bribes To Use E-Filing

To encourage more people to file their tax returns electronically (something I have consistently advised against), our rulers in DC are trying to give those people a special tax deadline of April 30, an additional 15 days beyond the traditional April 15. As always, this will make the tax system even more complicated and be as productive for our country as renaming French Fries as Freedom Fries.

IRS Workers Abuse Net Access - Why should IRS employees be any different than those of any other employer?

Walter Cronkite Declares: "We Ought to Be Increasing the Taxes" - For those who can remember the All In The Family TV show, Archie Bunker really had Cronkite pegged as a commie pinko who didn't deserve the moniker of "Most Trusted Person In America."

Supporting High Confiscatory Taxes

What's even more upsetting than just the fact that East Coast columnists such as this support Communistic redistribution of wealth in our supposedly capitalist society is the fact that I was alerted to this via a CPA oriented publication that often supports this kind of thinking.

I receive a lot of criticism when I bring this point up, but I have a very hard time believing that clients aren't being screwed over when the tax professionals they pay believe that our current tax rates are just fine and that everyone should be paying more. It's a conflict of interest that makes no sense. As I've always said in my advice for selecting a tax pro, it's essential to see if you both agree on whether or not it's a good thing to legally reduce your taxes. In fact, if you think that it is your patriotic duty to pay in as much as possible, why pay anyone to prepare your tax return? Just have the IRS do it for you for free. They'll make sure your wish comes true.

New Kind Of Gas tax

It's interesting how many of the ridiculous kinds of taxes, similar to those mentioned in George Harrison's classic TaxMan song, eventually become reality. We are all used to paying extra taxes while purchasing gas. Now, the New Zealanders are discussing taxing the bodily production of gas by livestock. Their argument is that burps and farts from farm animals contribute to the so-called greenhouse gas problem and thus must be taxed.

While this idea is half a world away from us in the USA, stupid ideas like this have a way of finding their way here. In spite of the fact that our real life temperatures are lower than normal and we have been having more precipitation than normal, there are still plenty of environmental wackos claiming that global warming will destroy the planet unless we stop driving our cars and shut down our industrialized society. They will jump at the chance to tax farmers for their cows' farts.

Automakers Push for Tax Breaks on Fuel Cell Cars - Another way our rulers in DC can try to manipulate our behavior. Who would be surprised to know about campaign contributions (aka bribes) from the car companies to encourage this kind of legislation to help them sell vehicles that they don't believe can survive in the marketplace without some taxpayer subsidy?

Keeping Up The Momentum

Stephen Moore has an excellent to-do list for the Bush administration to continue attacking some of the insanity in our country.

Too Much Of A Good Thing

It's often frustrating waiting for a tax refund check, from the IRS or the State. This guy in the PRC hit some kind of jackpot with the Franchise Tax Board. They sent him eight refund checks for the same tax return. He did the right thing and is giving the money back; but he probably dwelled on that decision for a while.

Divided dividend relief

Shocking news. The new tax rates on dividends will affect different people differently. Stories like this are just part of the Left's propaganda against any tax rate decreases unless they will benefit every single person by the exact same amount, an impossible goal. It's as relevant an argument against tax rate cuts as their claim that cutting tax rates during economic downturns is fiscally irresponsible and cutting them during good times is also fiscally irresponsible. So, when is a good time to cut tax rates in the mind of a DemonRat? No surprise there. Any reduction in tax rates is a reduction in the amount of power they have over us, and there is never an acceptable time for that to happen.

New Tax Scam Targets Potential Recipients of Advance Child Tax Credit

Like flies on poop, it doesn't take scammers long to figure a way to rip off people when there is a new change in the tax rules.

House Votes to Eliminate Estate Taxes

It still has a long way to go before becoming reality; but it's great to see them tackling this issue already. The hysteria from the opponents of repeal is already taking on the tone of their never-ending class warfare that was used in opposition to the recent tax cuts. Although I'm sure many of these people don't realize it, they are essentially defending the policies of Karl Marx when they fight to allow the government to redistribute people's wealth after they die.

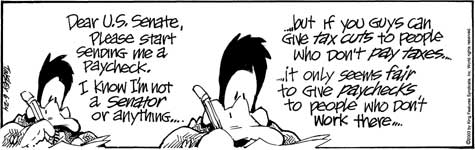

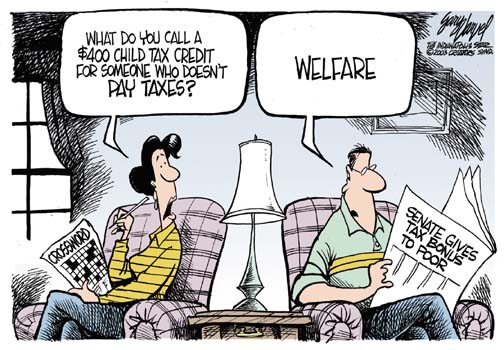

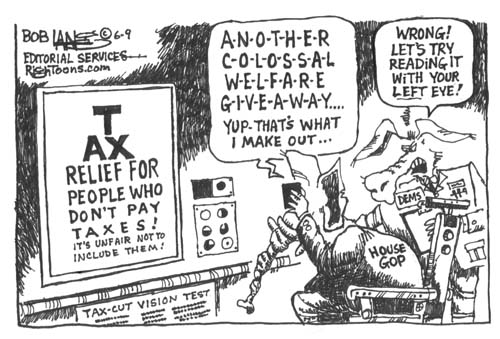

Tax Credit Windfall Provokes Conservatives - It looks like some people can't stomach the idea of calling a welfare payment a tax credit. Obviously not the politically correct way to look at this issue.

States levy fees to boost revenues - If they aren't called "taxes," they can't be considered tax increases by our rulers.

More Fund Disclosure Could Mean More Fund Expenses - If investors want mutual funds to do more work in disclosing detailed information, they will have to pay for it.

Where Tax Credit Is Due. Republicans are in a mess of their own making.

How to adjust your investing, loan and AMT strategies.

Fate of Tax Credits Rests With Houses Divided

Estate & Gift Taxes - I updated the info on my website regarding these taxes; including a much more detailed explanation of the gift tax, along with links to the actual gift & estate tax forms.

Anti-Tax Crusaders Work for Big Shift. White House Wary Of Broad Changes

Republicans and the Earned Income Tax Credit

Bush's spending binges - As I've said on several occasions, it's wrong to blame Bush's tax cuts for the Federal budget deficit, as the lefties are doing. However, if he doesn't start tightening the screws on the huge growth in spending, he will rightly deserve the credit for contributing to higher deficits and taxes. His strategy of posing as a DemonRat by spending like crazy to avoid criticism will not work. DemonRats will always hate Bush no matter what he does, and those of us who want to support him can't stomach his support of higher government spending.

The news has been pretty good lately for average taxpayers

House Approves Tax Relief Bill. $82 Billion Measure Aimed at 6.5 Million Poor Families

House passes its version of child tax credit

IRS Wants Proof Before Giving Tax Credit

House Boosts Child-Tax Credit, But Bill's Outcome Isn't Certain

How Arkansas Dem's sweetener soured Bush tax cut

House DemonRats Look for G.O.P. Votes to Defeat Tax Cut

Tax impasse is seen needing Bush input

A Reaganite Gone Wrong. Alabama Gov. Riley�s massive tax increase

States Craft Budget Plans, Tax Increases

Millionaire has-beens - Easy come, easy go for those who rode the stock market bubble and had paper profits that didn't materialize in the real world.

Small farming operations do have some very lucrative tax breaks.

New Tax Law Has a Catch: Depreciation Recapture Rate Is Unchanged - This catches a lot of people by surprise. The 25% Federal tax on depreciation recapture is usually higher than the normal capital gain tax. It is a crucial issue to evaluate when deciding to dispose of property as a taxable cash-out sale or to do a Section 1031 tax deferred exchange.

Sleep? Play Golf? Pay Your Bills Late? You May Be a Patron of the Arts - Hidden taxes are literally everywhere.

Lower Capital-Gains Tax Boosts Attraction of Custodial Accounts

Labels: 1031

G.O.P. Leader Brushes Off Pressure by Bush on Taxes

W pushes House GOP on tax cuts for poor

Defiant House GOP to Offer Broader Tax Cut Bill

The New York Times and the Tax Cut

Bush's stealth tax cuts are worthy of the Gipper

In revised tax plan, House leaders push bigger cuts

Tax Breaks Help Self Employed Decide on a Business Structure - As I've said on too many occasions, C corporations can still reduce taxes by huge amounts over using S corps.

None of us really know how we would react to receiving a huge windfall. However, I'm sure a lot of people are saying the same thing about this guy who just received a check for $24.2 million from winning the Texas lottery and is continuing his job at a trophy shop - "He's nuts!"

Schism Between Republicans Is Bared in Tax-Cut Debate

US Will See Benefit Of Tax Cuts By Year's End Says Snow

Mounting KPMG Tax Suits Reveal Vast Marketing Push

Foundations Decry Charitable Giving Changes

What Fiscal Discipline? George W. Bush is no Reagan when it comes to spending

Increased Spending, Deficit Produce Political Danger for GOP - Acting like DemonRats by spending more and more money just to make the media stop calling them meanies is a losing proposition for the GOP. The media will always hate Republicans and this out of control spending is alienating those of us who want to support them.

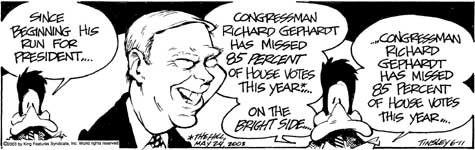

'No Work, No Pay' Should Apply to Lawmakers, Group Says - It's no coincidence that most people running for political office are already elected officials and can thus use the perks of their office to help with their campaigns. They can take all the time off they need to galavant around the country raising money and doing the other campaign tasks that those of us in the real world, who have to do actual work to earn our pay, can't afford to do. Most of the degenerates running against Queen Hillary for the DemonRats' presidential nomination have the worst attendance records of anyone in DC. Of course, they still receive their full salaries. What private sector job would pay its employees to spend all of their time campaigning for another job?

Buck Stops for Web Panhandlers - This fad of begging for money from strangers online actually lasted longer than common sense would dictate.

States of Disrepair - In spite of the $20 billion gift to States in the recent tax bill, they are still planning to raise their taxes to cover for their overspending and incompetent fiscal management.

Small Businesses Reap Benefits Of White House Tax Package - As the DemonRats feared, quadrupling the Section 179 expensing allowance to $100,000 per year, and allowing additional extra depreciation in the first year, is encouraging a lot of small businesses to make new purchases, giving the economy a healthy boost.

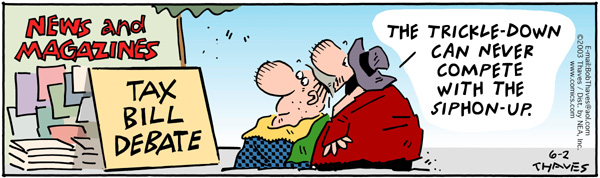

Secret Tax Hike - As I've explained on several occasions, our rulers have been very sneaky in adding much higher effective income tax rates than you can find in any of the official tax rate schedules. By phasing out several deductions and credits for people considered by our rulers to be evil rich, the effective marginal tax rates can be much higher than the normal top rates. They like to call it "means testing," indicating that those with increased means of support (income) shouldn't receive the same tax breaks as the little people. I prefer to call it "mean testing," indicating the practice of penalizing success. This new tax law is no exception to that concept, with several new phase-out rules. Class warfare is still a very real part of our tax system.

Labels: 179

Let's hope the GOP can actually hold up their end against the DemonRats' dishonest class warfare, such as calling increased welfare a tax cut.

How to Live Large, and Largely For Free - Interesting story of a woman who makes a living as a secret shopper. Interestingly, she hooked up with it through one of those spam solicitations promoting this.

State Tax Hikes Pick Up Steam, Undermining Bush Stimulus Plan - This was inevitable and predicted by just about everyone.

Eyman wants Washington State to slash property tax - Illustrating once again the different ways in which overall tax burdens can be measured, the Rulers in the State of Washington recently enacted a $4 billion hike in transportation taxes; so the effort is to offset part of that with a decrease in property taxes.

GOP Hopes to Start on Congress' Spending - The only way to really address the deficit problem is to cure our rulers from their spendaholic ways.

Fight or Flight? G.O.P. Split Over Tax Credits - Refusing to give away $400 per child of additional welfare to people who don't pay any income taxes would be a good step towards holding the line on spending. However, it will be hard for some in the GOP to avoid wimping out in the face of the media onslaught of their typical leftist propaganda claiming that the recent tax cut allows evil rich people to literally steal food out of the mouths of starving babies.

No such thing as 'perfect' investing

Money Talks and Everything Else Walks

The mercenary free market side of me really likes to see stories like this, where people who are in a hurry can pay for access to faster moving lanes on the highways. They are even looking at this kind of thing in England, to go along with their recently enacted "congestion tax" which charges a toll for people entering the city during its busiest hours.

As I've always realized, money is one of the absolute best ways to motivate human behavior. These ideas are very similar to an approach we have been using with clients who want their work to jump to the front of the line. If they are willing to pay double our normal rates, we will drop everything and work on their stuff right away. Not surprisingly, around 80% of the people in a panic rush are willing to wait their turn when presented with that choice. The other 20% are able to justify the doubled rate.

NBC Uses Military Families to Distort Tax Cut for Non-Taxpayers - Even with their fear over the growth of FoxNews, the leftist media outlets are not slowing down with their propaganda efforts on behalf of the DemonRats.

Jury: Texas Man Must Forfeit $12M Lottery Winnings because he used drug proceeds to buy the lottery ticket. There is just something very weird about this verdict.

Proposition 13 25th Anniversary

Having lived through the fights surrounding the property tax revolution in the PRC, and its aftermath ever since it passed, this is an issue on which I try to stay as current as possible. The lessons we all learned from the Proposition 13 battles can be applied to all tax jurisdictions around the country, as we tried a few years ago here in Arkansas. As I said then, it was a true case of deja vu, with everyone predicting the end of the world if government were to ever be deprived of even one less penny in tax revenue. Those arguments were used in the campaign against Proposition 13 in 1978, and we all know that the PRC is still in existence.

The First Shot. Proposition 13 is where the Reagan Revolution began.

Bill would allow local income tax. Backers say cities would benefit; foes say it skirts Prop. 13.

Editorial: Reform Proposition 13

Unexpected results. 25 years later, Prop. 13 still keenly felt

Editorial: Anniversary brings no joy

Jarvis troops still proud of '78 feat

Taxpayer rights. Prop. 13, 25 years later

Proposition 13 still popular as it marks silver anniversary

Prop. 13 facing attacks at age 25

True Fiscal Discipline. Congressional critics need a few lessons in economic reality.

The Bush tax-cuts have set the stock market on fire.

Democrats Pressure House GOP to Pass Child Tax Credit

Senate Approves Child Tax Credit in Lower Bracket - The Left's Class Warfare rants are working to shame the GOP into converting the nonrefundable child credit into a refundable one.

Iowa Touts Illegal Drug Stamp Tax - More on the unusual tax I discussed earlier. I never received a response back from the Kansas tax authorities as to the amount of tax revenues actually received from people willing to declare themselves drug dealers. According to this article, Iowa has received almost $4 million in taxes and penalties since 1990. They mention how difficult this tax is to enforce and how futile it is trying to collect taxes from people who have had everything they own confiscated during their drug busts.

The state budget mess should be blamed on the states. - Out of control spending and assuming that the stock market would grow by 20% per year and generate huge capital gain taxes for eternity were stupid maneuvers by the State Rulers, as well as by those in power in DC.

WELFARE IN THE TAX CODE - Giving people money back that they didn't pay in is nothing more than income redistribution.

TAX CUTS FOR TAXPAYERS - NY Post Editorial

Among the Tax Cut Losers: Biased Journalists

It's not ideological, just sound economics - Jack Kemp

Feds' tax plan is rich in savings

Partisan sniping kills debate on tax credit

DeLay Rebuffs Move to Restore Lost Tax Credit

Middle Class Tax Share Set to Rise

Who's fudging the budget? - As I've always explained, the numbers used by our rulers to describe tax law changes are complete fabrications and have no relationship to real life. Anyone who claims that they are legitimate is not to be trusted.

Hooray -- budget cuts and no tax increases - Doing things the right way in Texas.

The Federal Thrift Savings Plan: A Model for Social Security Reform

GOP Chief's Idea for Raising Alabama: Taxes - Stupid move

Driving While Intaxicated - In Oregon, fuel efficient cars are making its 24 cents per gallon tax inadequate to cover road maintenance costs, so they are considering using a GPS spy system to monitor how many miles each vehicle drives and add a per-mile charge to the tab when the owner fills up the tank. Obviously, Big Brother opponents aren't happy with this new invasion of privacy. They claim they remove the per gallon tax if this new system is implemented; but that is unlikely. New taxes aren't used to replace old taxes. They are added to existing taxes.

When a tax cut becomes a welfare check - The Left wants to give $400 per child to people who don't pay any income taxes.

The Bush stimulus is already driving up the stock market

Prop. 13 - Bruce Bartlett celebrates its 25th anniversary.

Here's an issue I've covered quite often. Does the First Amendment protect the right of people to publish materials on how to break the law? Tax protest scammer Irwin Schiff obviously thinks it does; but a judge in Las Vegas doesn't.

The legal system is now our enemy - How our lives have changed, and not for the better, because of the fear of lawsuits.

Proposition 13 Unraveling

Limits on taxes don't last forever and can't survive without constant supervision over the tax and spend fans of big government. It's been 25 years since the voters in the PRC set limits on property taxes that had become so bad that people were forced to sell their homes. Those limits, and their imagined effects on tax revenues, are now right smack in the bull's eye of PRC rulers desperate for money. As I mentioned earlier, the power of resentment between neighbors is reaching a breaking point, where new property owners are upset about having to pay current market value property taxes, while their neighbors may be still benefiting from Prop 13 limited taxes. Some proposals currently being discussed include:

Removing the limits just for commercial property. While this may seem like a good idea at first, to stick it to the evil businesses, that is very short-sighted, and will just make things much worse for the economy out there on the Left Coast. As anyone who truly understands how businesses works should know, companies don't ultimately pay taxes. They are nothing more than conduits which will either pass on their increased taxes to their customers or cut costs elsewhere to even things out. The most likely effect will be for more businesses to relocate out of the control of the evil rulers of the PRC and relocate elsewhere. Abandonments and sales of commercial properties will have the effect of lowering property values (based on basic supply & demand forces), pushing property tax revenues down again. Of course, avoiding these consequences requires considering the long-term effects, which is beyond the capability of most elected officials, whose long-term horizon is the next election.

Naysaying Times. The paper of record will never throw props to a tax cut. - Of course, given the NY Times' reputation for fabricating news and printing lies as truth, what good would their endorsing a tax cut do?

Six Important Rules for Real Social Security Reform

A company that loses money is socially irresponsible - A Peter Drucker classic

Economic Profit Vs. Accounting Profit

Why Smart Managers Do Dumb Things - Motivations for creative accounting tricks.

Give Us Disclosure, Not Audits - There have long been serious problems with the practicality of GAAP (generally accepted accounting principles) in audited financial statements as investors try to make reasonable decisions. This isn't a new problem by any stretch of the imagination. I can still recall this as a topic in my early college accounting classes, almost 30 years ago. One of the biggest surprises when I started learning about accounting is there is no such thing as one way to do things. GAAP includes a wide range of optional methods that can be used, making a truly useful side by side comparison of different companies' published financial statements impossible. I'm sure most people, including many financial planning advisors, are completely unaware of that fact.

States Use Gimmicks To Tackle Deficits - What's wrong with this picture? Our rulers are rewarded with awesome powers and benefits for using "creative accounting" tricks to balance their books; yet those in the private sector who do the same things are prosecuted and sent to the slammer. It's just one of the endless examples of the double standards by which we allow our rulers to stay in power.

Rethinking Prop. 13. Unintended consequences need attention

Debate over Prop. 13 still rages. Benefits are clear at tax time; the cost is harder to see

I always knew that eventually popular sentiment in support of the Prop. 13 limits and methods of reassessing properties would change when there would be enough people paying the much higher market value rates while their neighbors had the lower limited taxes, just because they have been there for several years. Resentment over someone else's lower taxes is a natural human tendency in this country.