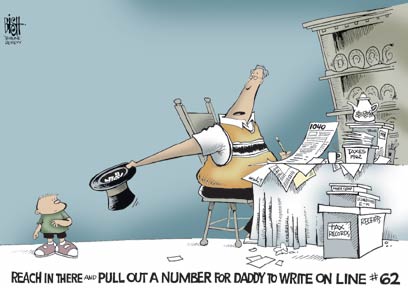

Reacting To Tax Increases

Thanks to Ben Cunningham for passing along this story about how some folks in Tennessee are reacting to receiving notification of large increases in their property tax assessments. Specifically, the following quote from one property owner whose assessment went from $70,000 to $200,000:

It was worse than getting an IRS audit. It was like getting a heart attack in the mail.

I'm guessing this woman hasn’t actually been through an IRS audit.

Jesus recruited to fight tax cheats – While this is in Sierra Leone, how long will it be until our IRS starts a similar PR campaign?

Q:

Subject: "C" vs "S" and Home Office

Tax GuruI have been following the "C" vs. "S" debate in your blog with great interest. My tax guy hasn't brought it up yet, but I have two questions before I ask him about it.

Is there a net income amount where a "C" corp would be better than an "S" corp (my business is at $150,000 presently).Also as a sole proprietor now, on what form would my office in the home expenses go for my 100% at home business? I've heard you can't take it and since this amounts to several thousand dollars before depreciation now, I wouldn't want to lose it.Your assistance will be greatly appreciated.

A:

If your business is making $150,000 per year, you're asking to be raped financially by trying to do your own taxes and not using the services of a tax pro who understands the very simple techniques of minimizing taxes.

As I said in my article on S vs C corps, an S corp only makes sense tax wise if it has a net loss, or you have plenty of other deductions and losses on your 1040 to offset its income. If you have a positive taxable income before counting the S corp K-1 pass-through, you will just be pushing yourself into the higher brackets. The best approach is to use a smoothing technique of spreading income between the 1040 and 1120 so that the overall effective tax rate stays as low as possible. Having good up to date QuickBooks data for both your corp and personal finances is essential to accomplishing this goal.

Form 8829 has long been the official home office schedule, as any tax pro would know.

Kerry Kerstetter

I frequently receive email similar to this:

REREAD YOUR INFO. DAMN IT! WAS HELPFUL.KEPT ME FROM MAKING YET ANOTHER DUMB MISTAKE. WHEN MY AZ CORP MAKES ME RICH, I'M GONNA OFFER YOUA FREE FISHING TRIP.

I usually reply with the following warning, which I hope everyone will heed.

I'm glad that you found the info useful.

However, I hope you realize that it is dangerous to use any such info, from my website or any other source, without the additional counsel of a tax pro in order to ensure that you come up with a strategy that works best for your particular circumstances.

Good luck.

Kerry Kerstetter

Q:

Subject: capital gains on personal residencejust finished reading your post, and wanted to ask this: How does the IRS define the purchase of the one’s personal residence – is that the day that the title is transferred? What if you leased with the option to buy for some time before exercising the option, does that time count?

Thank you for your informative blog!

A:

To qualify as owning it, your name must be on the title for the property. Leasing it does not qualify, whether you have a purchase option or not.

Kerry Kerstetter

Arkansas Corporate Franchise taxes due earlier this year – May 2 instead of June1, as it had been for several years. The minimum tax has been tripled, from $50 to $150, as our rulers in Little Rock squeeze every dollar they can out of small businesses in this state.

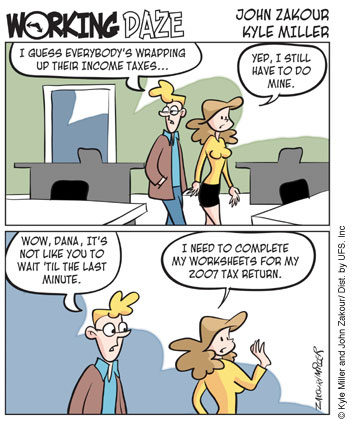

Letterman's Annual Tax Day Top Ten

Top Ten Signs Your Accountant Doesn't Give A Damn Anymore

10. Tells you to expect a refund in three weeks and an audit in five.

9. Does all calculations on the TV remote control.

8. Tells you to deduct yourself.

7. No longer gets that magical glint in his eye when he talks about deferred contributions to tax-favored annuities.

6. He says, "I thought the 1040 was EZ until I met your wife!"

5. Keeps asking when he can do your kitty's taxes.

4. Whenever someone mentions a joint return, he whips out his special brownies.

3. Recently moved office to cave in mountainous region of Afghanistan.

2. Instead of working on your taxes, he's reading lame jokes on Letterman.

1. Constantly trying to arrange a threesome with H and R block.

The estate tax made Paris Hilton what she is today. – If the thought of more of her kind around doesn’t scare everyone to support repealing the communistic estate tax, we have a tougher battle than I thought.

Q:

I have just finished reading your comparison on the S vs C corporations. I currently have a $ 12 million computer supply business that is a C corporation. I have repeatedly been told by attorneys and others that I should be an S corp because of the large bonus that I take at year end. They say that the IRS could say that this is a dividend. I don't understand because as it is now I pay full taxes on the bonus also. After reading your comparison, I believe I should stay C. for the reasons you explained. Am I missing the point here? Thank you for your very enlightening article.

A:

I would say that keeping at least one C corp would have more tax saving opportunity than running all of your income through an S corp. Just having an S corp piles all of your income into just the individual income tax brackets, missing the chance to use the lower C corp brackets.

How to pull the income out of the corp with the lowest tax hit is always an adversarial game between you and the money hungry IRS. IRS would love for you to consider the payments nondeductible corporate dividends because that would allow them to actually tax the same income twice, once on the 1120 and again on your 1040.

The best plan is to use a combination of deductible corporate payments, such as wages, interest, leases, and royalties, in order to avoid the double taxation.

Fringe benefits paid by the corp and which are tax free to the employees, are also much more lucrative with C corps than with S.

The term "reasonable" is subjective and the cause of skirmishes with IRS, which obviously wants that number as low as possible in order to classify everything above that as double taxed dividends. Good documentation of how your numbers are calculated, as well as good records, and consistent treatment between the 1120 and 1040, are the best was for you and your tax advisor to make this immune to IRS challenge.

Having both the corp and your personal taxes use the cash basis of accounting is also an important aspect to avoiding IRS problems. If the corp uses the accrual method, that is so open to abuse that IRS auditors will have a field day ripping apart the accrual methods used.

Of course, when a business become large, I am a big believer in not putting all of your eggs in one basket and using multiple entities at the same and in staggered levels of ownership to help reduce your tax burdens, as well as the inevitable liability and lawsuit exposure that success brings. These can include an assortment of C and S corps, as well as LLCs and trusts.

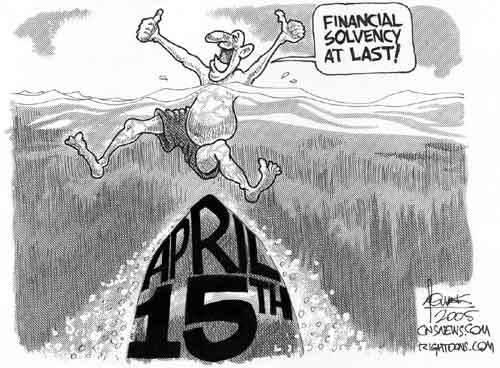

These are a just a few ideas I had, as I unwind from the April 15 crunch.

Good luck.

Kerry Kerstetter

Q:

Subject: forfeited $12,200 by withdrawing from RE purchaseDear Tax Guru,My 92 yr old dad put up $12,200 in May 2003 to buy a house but decided to withdraw from the purchase in March 2004 and forfeited the $12,200 -- how does he claim the loss for tax purposes?

A:

It depends on what kind of property it was for. There is a long standing double standard in our tax code that losses on personal property are not deductible, while profits on them are taxable.

On the other hand, if the house was being acquired to be used for rental or investment purposes, the loss would be deductible on Schedule D (investment) or Form 4797 (rental).

If the loss qualifies as deductible, it should be claimed on your father's 2004 1040, since that is when the deposit became worthless.

Good luck. I hope this helps.

Kerry Kerstetter

Q:

Subject: Personally paid corp expense articleWould the same technique described in option 2 be kosher for a corporate member of an LLC? The corporation has its own business credit lines and it would like to extend their benefit to said LLC.I assume then the books would look like this:Corp:debit Loans to LLC, credit Corporate MastercardLLC:debit expense, credit Loans from Members

A:

You can do it that way or through the capital contributions account.

Kerry Kerstetter

Amortizing Loan Costs

Q:

Kerry,Thanks for the information in url http://www.taxguru.org/re/loanorigincosts.htm. I am glad i found the link. I have one question. I was filling out Section IV in form 4562. I am not able to find the proper Code Section (Column d) to use for the 'Loan expenses' for my rental property. I am not sure if i should use 195. Any help would be much appreciated.Thanks

A:

I have always used Section 461, and IRS has never complained.

Kerry Kerstetter

IRAs and Bankruptcy

Shortly after I posted the item about IRA accounts being off limits in bankruptcy, I received this from a reader.

Subject: Re: Supreme Court: Creditors Can't Seize IRAsI find it interesting that, like most, you focus on OJ's exemption of his *residence* equity when OJ also used Florida law to fully exempt another large asset: his NFL pension. I assume the $1 million cap on exempt pension assets in the bankruptcy bill is an anti-OJ provision, since I can't think of any other high-profile cases where a wealthy debtor used Florida's or Texas' unlimited pension exemption. Note that unlike homestead it has no safe harbor after which state law applies.Given the defendant's modest means, I suspect this is a result-driven decision. I doubt the SC would have ruled the same way had a debtor with a $2 million IRA came before them even though the decision technically protects them too. Given that, I doubt they will give any relief for the BK bill's $1,000,000 cap, should it pass and a suitable case come before them.I should note the BK bill has a serious flaw: the new federal caps on homestead and pension exemptions are not inflation-indexed. It won't take long for their value to be eroded significantly, and I suspect political will to revisit the bill and raise the exemptions will be quite lacking.

My Reply:

You have some very good points.

I guess the reason we focus on the homestead exemption more than the one for pensions is that it is easier for lawsuit fugitives, such as OJ, to plow money they want to shelter into the purchase of an expensive home than it is to legally add it to an existing pension plan.

Kerry Kerstetter

Moving For Education Reasons

Q:

Dear Kerry,I was reading your website and I hope you will be able to answer a question for me.I moved across country from my primary residence in order to go to a highly ranked school. I can't afford to maintain the property any longer and wish to sell it.I left my primary residence for school. Does that qualify as a change in place of employment so that I may get the tax break?Thanks.

A:

While the law and related IRS explanations don't specifically mention school related moves in relation to the reduced pro-rated tax free gain exclusion, such a justification should be eligible for at least a few reasons.

In many other parts of the tax code, being a full time student is equated with being an employee. This seems like a perfect place to do the same thing.

To qualify, you do need to be ready to prove if asked that the move to the school was unknown at the time you bought or moved into your residence.

Another way to justify it would be an unexpected change in your finances. If you had originally believed that you would be able to afford keeping the home, and the new schooling situation changed that capability, you have met that test.

This is definitely a good example of one of the many gray areas in taxation. Unlike most other tax pros, who want to interpret gray areas in favor of the IRS, I have always done the opposite. If the law doesn't specifically say that unexpected education related moves don't qualify, I say you should use it.

Those are just the thoughts that came to mind. You should work with your personal tax advisor for more specifics.

Good luck.

Kerry Kerstetter

Follow-up Q:

Kerry,

Thank you for the prompt reply. Proving going to school was unanticipated at the time I moved in is easy since I lived there for a couple of years and worked a couple different jobs before deciding to go to law school. I even though I'd go back, but didn't manage to get a job offer in California (where the home is) but did get one in Maryland.If you could point me to some other parts of the code that discuss full time students, I would appreciate it. I'll keep doing my own research but any support to convince my wife would be helpful. She thinks like the tax pros you refer to (though she's an engineer, not a tax pro).

Thanks again.

Follow-up A:

I don't have time to dig up all of the references to students as equivalent to employees. I have a ton of tax returns and extensions to finish by April 15.

The one that I do encounter quite often is Form 2441 for the credit child and dependent care expenses. In order to claim this credit, both the taxpayer and spouse need to have earned income. However, if either of them is a full time student, they are imputed a certain amount of income to qualify for the credit.

I hope this helps.

Good luck.

Kerry Kerstetter

States yearn to collect online sales taxes – The more money that changes hands via internet transactions, the more tempted our rulers will be to take their cut of the action.

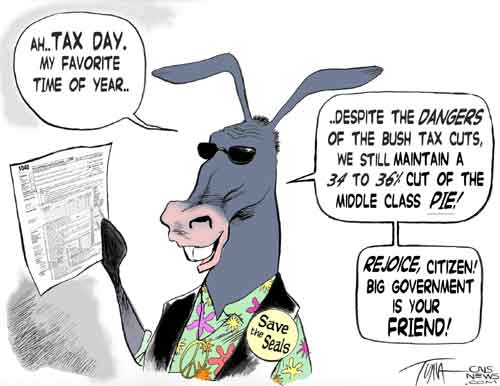

Income Redistribution Day 2005 – Excellent look at the history of the unrestrained growth in taxation in the USA, often in direct violation of the Constitution, which nobody in power cares about any more. This quote from John F. Kennedy shows how far left the DemonRat Party has evolved in the past four decades. JFK was more supportive of capitalism than are most current day Republicans.

Lower rates of taxation will stimulate economic activity and so raise the levels of personal and corporate income as to yield within a few years an increased -- not a reduced -- flow of revenues to the federal government. ... The present tax codes ... inhibit the mobility and formation of capital, add complexities and inequities which undermine the morale of the taxpayer, and make tax avoidance rather than market factors a prime consideration in too many economic decisions.

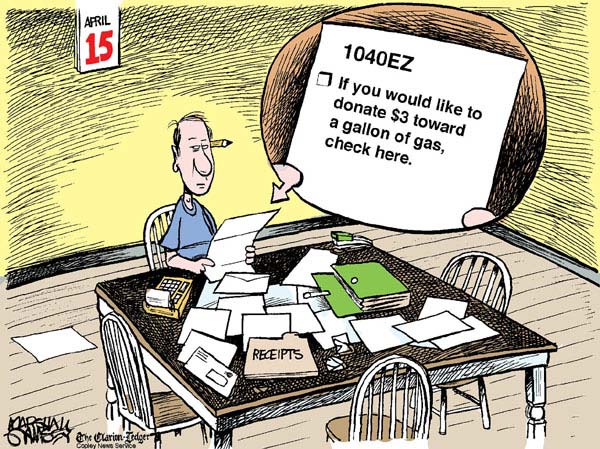

No earmarking allowed

All we are allowed to do is continue sending our money to our rulers in DC, who are the only ones smart enough to know how it should be spent.

IRS 'Outsourcing' Debt Collections – Of course, we all know that nothing could possibly go wrong with this idea. This sounds like a recipe for disaster. It’s not bad enough dealing with IRS employees. Now, we’ll have free-lance bounty hunters on the prowl.

Presidential Tax Returns Released – No privacy for the top rulers.

Favorite Movie Accountant

As a lifelong movie buff, I have long enjoyed the wealth of information on the IMDB website. I also enjoy its daily trivia quizzes and opinion polls, which often cover some very esoteric movie connections.

Today's poll is in the spirit of tax day, asking which movie accountant character would be most trustworthy in preparing your tax return. While the results will obviously change between now and the end of voting tonight, the one I chose seems to have an insurmountable lead.

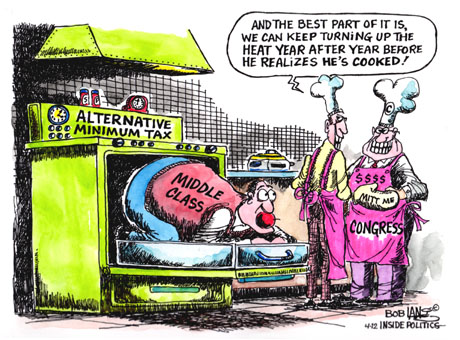

Cooked by AMT

The insane alternative minimum tax is fast becoming an equal opportunity punishment, something that doesn't just hit the "evil rich." I have seen it pop up on more and more 1040s each year. As always when discussing the insane AMT, I like to point out the most active group working to remedy its inequities, Reform AMT.

Reform Commission Preliminary Report

The President’s Advisory panel has issued a preliminary report with the ridiculously obvious title of AMERICA NEEDS A BETTER TAX SYSTEM. The full report on how everything will be fixed is due on July 31, 2005.

Six-Page PDF of preliminary report

State Taxes

Q:

Sir:I just had the opportunity to read your article on S and C Corporations, and I found it to be so interesting that I decided to ask I question, if i may.Can you shed some light on the obligation of NON RESIDENT SHAREHOLDERS to pay state taxes in states where the corporation has physical offices?If there is such a requirement, where can I obtain a list of the states that have that requirement?Your assistance will be appreciated, and thanks for writing articles that are really.

A:

As far as I know, this is required by every state that has its own income tax.

It's not just having an actual office inside the state that triggers the particular state to levy taxes on non-resident shareholders. It also applies where income is earned inside the state from services, product sales and other kinds of properties, such as rentals.

You can get to all of the individual state tax websites via:

www.sisterstates.com

Good luck.

Kerry Kerstetter

Amending Filing Status

Q:

Subject: Married filing Separately and Amended Return

If one spouse files separately and then the couple decides it's a mistake and want to file an amended return JOINTLY, is that allowed? In other words can a couple file an amended return filing JOINTLY when one spouse had already filed as Married but filing SEPARATELY?

A:

That is allowed. You can file a 1040X to go from MFS to MFJ.

The reverse is not true however. You are not allowed to switch from MFJ to MFS because IRS likes the joint and several liability aspect with joint returns. This allows them to go after either or both spouses for all of the taxes shown on the joint 1040.

Good luck.

Kerry Kerstetter

Not Safe For Do-It-Yourselfers

Q:

Kerry,I am over here in Georgia and I ran across your very informative article on the net. Last year I started my first small business I believe I filed S-Corp. Anyway I made under $20,000 and to my surprise after reading your article I believe I should definitely be either a C-Corp or maybe even an LLC. Anyway, I was wondering what sort of tax bracket would an S-corp fall under if it made under $20,000. I am just doing some math to see if it would make sense for me to change my corporate status or stick with what I am in.

Thanks for your time and I appreciate the informative information you post.

Sincerely,

A:

I'm glad that you liked my article. However, It looks like you missed the most important point, which is that you shouldn't be setting up any kind of business entity without the proper professional advice ahead of time. That's the same as prescribing your own medicine without having a doctor diagnose you.

One of the main big differences between S and C corps is that S corps don't pay income taxes, so there are no tax brackets to look at. Their income passes through to the shareholders' 1040s, and are thus subject to whatever your personal tax brackets are.

I strongly suggest that you consult with a tax pro before making any more decisions of this kind.

Good luck.

Kerry Kerstetter

Follow-up:

Thank you for the quick response.I am seeking that help right now.

Sincerely,

House Votes to End Federal Estate Taxes – Now if we can just get the Senate to do the same thing. It’s up to the RINOs to do something other than side with the DemonRats.

S Corp Taxation

Q:

Read your web article on s corps; very informative. However, I am confused about shareholders in an S corp who are on the payroll. If a shareholder is on the S corp payroll and receives a w2, would they not report and pay tax on that income also in addition to the Sched. K? Thank you if you have a chance to respond.

A:

It is correct that W-2 wages received will be reported on Line 7 of the 1040, and the net profit or loss from the S corp's K-1 will be reported on page 2 of the Schedule E.

If you are under the impression that this is reporting the same income twice, that is a wrong assumption. The K-1 income is the net after deducting all W-2 wages paid, for shareholders and everyone else.

While income taxes on both K-1 and W-2 income are the same, in terms of overall tax burden, the W-2 wages are taxed much higher because they are also subject to the various federal, state, and local payroll taxes. This leads to the constant game of having active shareholders taking out what they consider to be a "reasonable" salary as W-2 pay, and the rest of the profits as K-1 income. On the other side of the fence is the IRS, which wants to consider as high a figure as possible for W-2 wages just so they can squeeze more payroll tax money out of the business.

People can go overboard on this in both directions. What I have always felt was absolutely crazy are S corp shareholders who are so paranoid about IRS demanding something be classified as W-2 wages, when their corp is running net losses, that they actually borrow money in order to pay themselves a salary, which they then turn right around and loan back to their corps. That's insane, but IRS won't turn down the extra tax money they are volunteering to pay in under this strategy.

You and your professional tax advisor should work on the best game plan for your situation.

Kerry Kerstetter

Erosion of Estate Tax Is a Lesson in Politics – Let’s hope the GOP can show some backbone and repeal this communistic wealth redistribution system for real, and not just for one year, as it now stands.

Although Tom Briscoe has a point about many tax pros liking to keep things as they are, there are a few of us who support such radical ideas as scrapping the entire current tax system, dismantling the IRS, and replacing it with a national sales tax, as in the FairTax plan. I would really much rather be using my skills for something more beneficial to society than just helping people pay the lowest taxes.

Study finds property tax rolls often wrong – This story about New Orleans properties being assessed at much more than their actual market values for property tax purposes is a good reminder of how important it is to keep tabs on the local assessors and protest when they screw up like this. (Thanks to Ben Cunningham for passing this along).

$2 Bills – Snopes.com has more on the fact that some store cashiers don’t believe that there are actually two dollar bills in use in the USA. Should we blame the public school system or the stores’ managers for this ignorance?

Understand Taxes Before Buying Home – Good short summary of some of the income tax breaks of home ownership.

Man arrested, cuffed after using $2 bills – Another indicator of our great educational system in this country. If this guy ever makes the mistake of doing business with this Best Buy store again, he should pay those morons with loose pennies and make them beg for paper money.

Bad tax advice comes with a price – Thanks to Andrew Roth for this reminder that there are a lot of scam artists among the tax practitioner community.

Occupation On 1040

It is actually important to show the proper occupation in the signature section of your 1040. IRS screeners do review the income and expenses shown on the return for reasonableness in relation to the reported profession.

Block Offending CPAs?

In regard to the current H&R Block ad campaign claiming that their review of tax returns that were prepared by others yields an average of $1,500 in “found money,” I wasn’t personally offended in the least by this. I assumed it was referring more to people who prepare their own returns.

Well, I guess a lot of other CPAs thought the ads were referring to their professional expertise, so the AICPA has gone on the attack against Block for this ad campaign, even filing a complaint with the FTC because an ad refers to a mistake made by a CPA.

I guess the AICPA wants to preserve the myth that we CPAs are not human and never make mistakes. As has been obvious, I have never been a believer that Block is the most effective at finding ways to maximize the tax savings for their customers. However, making a federal case out of their attempts to drum up business seems like quite an over-reaction.

Thanks to reader George Storey for passing this along.

Supreme Court: Creditors Can't Seize IRAs – An interesting case involving some people from our neck of the woods. Just as Florida’s extremely generous protection of residence equity is popular with OJ Simpson and others who want to avoid paying on legal judgments, this new ruling gives similar protection for IRA accounts. This should be a good for the IRA business. It will be interesting to see how they use this case in their ads and promotions.

Do Taxes Thwart Growth? Prove It – Thanks to Ohio CPA Dana Stahl for the heads-up to this idiocy from the DemonRats’ official newspaper. I don’t read the Times, so I may have missed their story about freedom not being for everybody if that Dem. anti-Bush line has already been expounded on by our elite betters.

Minimum Corp Tax

Q:

One of your responses to a guy about incorporating included the observation that a minimum tax is due from corporations.My accountant is unfamiliar with such a Federal requirement. Were you referring to a State statute? Or is he in need of enlightenment?

A:

The $800 annual minimum tax to which I was referring is levied by the State of California on any corporation chartered in that state or chartered in other states, but operating inside the California borders. It means that even if a corp has no net profit, or even a huge operating loss, there is still a tax of $800 due to the rulers of the PRC.

Luckily, there is no similar thing with Federal corporate taxes. Those are based on net taxable income. If there is a loss or a break-even, there is no Federal tax due.

On a related issue, this is as good a time as any to once again remind people of how important it is to always file corporate income tax returns, even if there is a loss or no activity. Sending IRS the 1120 showing the actual financial results for the year is a prudent self defense measure that will prevent IRS from accusing the corp of evading taxes on millions of dollars of income several years after the fact. I have seen this happen on several occasions to people who didn't feel it was necessary to file 1120s when there was no tax due. That assumption turned into some very expensive messes when IRS came after non-filing corporations.

I hope this helps you and your accountant understand this aspect of corporate taxes.

Kerry Kerstetter

Do People Underpay Their Taxes?

From a reader:

H&R Block is running a commercial claiming that their free tax review of older returns, performed if you buy their tax prep service, saves the customer an average of $1500 in taxes. If true, and given that most taxpayers do their taxes themselves, I find it difficult to reconcile with IRS claims that taxpayers underpay their taxes.

Excellent observation.

In their own less direct way, Block is obviously agreeing with my point that most people are over-paying their taxes and not ripping off the government, as claimed by IRS and their lackeys in the press.

Thanks for sharing that.

Kerry Kerstetter

Daylight Saving Time: A bad idea – I’m not the only one who doesn’t care for the semi-annual clock shenanigans. I wouldn’t mind it as much if the “Spring Forward” were done after April 15. As it is now, this is the absolute worst time of year to be losing an hour for those of us in the tax profession.

A Taxing Settlement – Gail Buckner looks at tax implications of legal settlements from employers.

Dark Side of the Boom: Higher Property Taxes for Seniors