S Corp Income + Sec.179

Q-1:

Subject: S Corp. buisness income limit for section 179Hi-My husband is a sole shareholder of an S corp. The S corp. is planning to purchase a SUV (< 6,000, < 14,000) to take the $25,000 section 179 deduction for 2006. His W2 wage from this S corp. is $35,000. How can he determine the taxable income of the S corp. to figure a business income limit?My understanding of publication 946 is that he can add back his wage of $35,000 from this S corp. to figure a net income of the S corp. Does this mean the S corp. can go up to net loss of $25,000?Thank you very much in advance!

A-1:

You are correct that the wages paid by the S corp to your husband can be added back to the corp's net income or loss in determining its income limit for purposes of Section 179 at the S corp level.

Section 179 expenses do not actually show up as a regular expense on the 1120S. They are passed through to the shareholders separately and directly on their K-1s.

This is the kind of thing that should be discussed with a professional tax advisor. S corps are too complicated to try to do the tax work and planning without the assistance of professional tax advisors. You are taking a very serious risk of screwing things up badly and incurring severe IRS penalties if you try to prepare your own 1120S and 1040.

I hope this helps. Good luck.

Kerry Kerstetter

Q-2:

Thank you so much again for your prompt response. I agree with you about the importance of hiring a qualified tax professional. My husband and I are not happy with our current tax preparer's qualification and considering hiring a new tax advisor for 2006. For example, she used 1065 to file 2004 and 2005 returns for my husband's single member LLC instead of 1040 schedule C.I wonder if we could hire you to file our tax returns.Thank you again for your great help.

A-2:

That is a little scary, for someone to be so unclear on the rules for single member LLCs. A change is definitely required.

I wish I could help; but I already have too many clients to take care of properly; so we are still trimming back on the difficult clients and are not accepting any new ones at this time.

Unfortunately, we don't have anyone specific to whom we could refer you. I did recently post some names and links for some like-minded tax pros around the country.

If you haven't already done so, you should check out my tips on how to select the right tax preparer for you at.

I wish I could be of more assistance; and I wish you the best of luck.

Kerry Kerstetter

Follow-Up:

Hello Mr. Kerstetter-We really wanted you to take us as your new client but I do understand your situation. We live in Las Vegas, so I guess I could talk to the EA in Carson City although we should not hire anyone just because they practice their business in the same state :)Thanks for your time and information!

Labels: 179

2007 Business Purchase

Q:

Subject: Section 179 question

Hello Kerry,

I just came across your website and noted that you respond to questions posed to you via Email. I too have such a question and hope you have a simple answer:

I was hoping to purchase a printing business for ~$60,000 before the end of 2006 and expense it under Section 179. It appears, however, that the transaction will not complete prior to mid-January 2007. Am I correct in understanding that I will not be able to take the Section 179 deduction for 2006? Any workarounds?

Do appreciate your response.

Best regards and Happy Holidays.

A:

For your individual income taxes, you are correct that anything not purchased and placed into service until 2007 may not be expensed on your 2006 1040.

You really need to be working directly with a tax professional because there are a lot of very important issues that need to be addressed, such as:

Only certain kinds of business assets may be expensed under Section 179. Depending on how much of your purchase price is allocated to movable equipment, the full price may not be eligible. Any costs allocated to such normal parts of a business purchase as real estate, inventory, leaseholds, goodwill and covenants not to compete, are not qualifying property for Section 179.

You should also discuss with a professional tax advisor the feasibility of using a corporation to buy and operate the business. For example, a C corp could select a fiscal year that would actually allow the Section 179 deduction at an earlier time than waiting for your 2007 1040.

As I said, there are a lot of critical issues to consider; and trying to make such important decisions without the assistance of an experienced tax professional is tantamount to fiscal suicide before you even start your business operations.

Good luck.

Kerry Kerstetter

Follow-Up:

Kerry,I am impressed with your prompt response - to someone out of the blue!Thank you - and wish you a super successful 2007.

Labels: 179

Unoccupied Rental

Q:

Subject: Question from Maryland: Rental to Primary

Hi Kenny,

Hope you can find the time to help.

My wife and I purchased a home in December 2005 with the intent of using it as an investment rental property. We tried , unsuccessfully, for about 3 months to find a tenant. During this time, we made repairs to the property. After about 3 months, we received an unsolicited offer from a buyer to purchase our PRIMARY residence. The offer was simply too good to refuse. We sold our PRIMARY and moved into the investment property. The investment property was only an investment property for 3 months. Can I deduct my expenses this year for depreciation and repairs made to the property during that 3 month period?

Thanks a bunch!

A:

This is the kind of issue you really need to work on with your personal professional tax advisor because it involves a lot of judgment calls, including taking into account your other rental experience.

For example, if this is the only rental property you would be reporting on your 1040, I would be much more hesitant to claim anything as a rental expense than if you already had dozens of other rental properties.

First off, you always need to keep in the back of your mind the fact that the burden of proving that you are entitled to each specific deduction is 100% on you and you need to be ready to defend your position if IRS were to challenge it.

In a more general sense, you should be able to deduct the direct costs of specifically trying to rent the home, such as ads you paid for.

On the other hand, repairs and capital improvements that you ended up using personally would be very difficult to justify deducting as rental expenses.

Similarly, claiming depreciation would also be inappropriate.

Again, your personal professional tax advisor should be able to address each specific expense more intelligently in relation to your circumstances.

Good luck.

Kerry Kerstetter

Follow-Up:

Kerry,Thanks so much for the fast answer!

Last-Minute Tax Gifts From Congress – From Gail Buckner

Slim financial books offer (mostly) wise advice – Some book reviews from Lynn O’Shaughnessy. I’ve added all six of these books to my Amazon store.

The Payroll Tax Trap. Will Bush's legacy be a huge new burden on the most productive Americans? - For anyone who has been putting off the use of corporations and other techniques to save on payroll taxes, you only have yourself to blame when those taxes eat up an even larger share of your income.

SUV Weight Rules Haven't Changed

Q:

Subject: Section 179I read your article which states that as of Oct 2004, the maximum amount that can be claimed for SUV's weighing between 6,000 and 14,000 pounds is $25,000. Has this law changed for 2006? I'm hearing conflicting stories that the vehicle has to weigh no less than 14,000 pounds in order to take the deduction of $25,000.Can you please clarify?

A:

That particular provision has not changed and is still in effect for as long as Section 179 is.

Kerry Kerstetter

Labels: 179

Starting A Corp In the PRC

Q:

Subject: CA Corporation filing feesHi Kerry,Could you please elaborate a little on your statement below since I am reading on the CA. Secretary of State website that the CA filing fee is $100.What I have found is that it is much easier to just set up a brand new virgin corporation, especially in states like Arkansas and Missouri where it only costs $50 in filing fees. In states like California, where the filing fees are in the thousands, this strategy is a bit more expensive and needs to be evaluated a little more closely.Thanks

A:

It's been a few years since I've been involved in setting up a new Calif corp; but it used to be required that new corps submit non-refundable payments for their first and last minimum taxes along with the paperwork filing fee. That was an additional $1,600 up front cost, which other states that don't have minimum taxes don't require.

A tax pro who is more current on the costs of setting up a new Calif corp can give you more specifics for the actual cost nowadays.

I hope this helps.

Kerry Kerstetter

State politicians are creating a de facto national sales tax. - No surprise here. We all knew that sales taxes on internet purchases were inevitable.

Beware of Wash Sales

Don’t Take a Bath By Ignoring the 'Wash Sale' Rule on Stock Losses – From Gail Buckner

Numerous Changes Show Up on the New Form 1040—and More Are Coming – From the latest Intuit ProConnection Newsletter

State Kiddie Tax

From a reader:

Subject: partially dodging the revised Kiddie taxCalifornia has not adopted the increase to age 18 for the Kiddie Tax. This gives Californians an opportunity to realize gains this year and pay only 15% federal tax. That's more than the 5% it would have been without the retroactive tax increase, but it's less than the 24.3% it would have been had California conformed to the new federal rule.If California conforms for 2007, people with teens aged 14 to 16 this year will wish they had realized those gains in 2006. Taking the gains now avoids another 9.3% tax hike.You might want to check out which states have conformed and which have not, and advise your readers. Please don't quote me on this one if possible. I'd rather you take the credit, since you'll be the one doing the research and writing.

My reply:

That's a very interesting loophole for people to consider. I don't have time to research each state's conformity with the federal law, but I hope tax pros around the country are checking on whether their states will allow for a similar maneuver.

Thanks for writing.

Kerry Kerstetter

SUV Under 6,000 Pounds

Q:

Subject: section 179Dear Sirs,I know this is a subjuect that you've probably grown tired of years ago but I must ask. I am buying a used SUV(Ford Expedition) I know it says the vehicle only has to be new to you but what if the vehicle does not weigh 6,000lbs? The vehicle is a 1999 model and the price is $10,000. I would like to make this purchase before the end of the year to put on my taxes for 2006. Thank you.

A:

This is the exact kind of issue you should be discussing with your own personal tax professional. However, for the benefit of others, I'll explain a few things.

Most people don't have a clue where the 6,000 pound issue originated. Starting with a law passed by our rulers in 1984, the depreciation deductions (including Section 179 expensing) for vehicles were severely limited because so many big-mouths were going around bragging about buying and fully depreciating $75,000 cars every three years. That is why the allowable depreciation for vehicles is so low, currently only $14,160 over five years for a 100% business vehicle.

Back with that law in 1984, there was a need to distinguish between regular passenger vehicles, which were subject to these new luxury car limits, and utility vehicles that were supposedly not being abused as much. The break point was a gross vehicle weight of 6,000 pounds or more. Any business vehicle weighing more than that was not subject to the luxury car limits and the full cost of the vehicle was eligible for depreciation over five years and the applicable Section 179. This is basically what we still have today.

In your case, with an SUV weighing less than 6,000 pounds, you would have to use the normal vehicle depreciation schedule, which allows only a $2,960 first year depreciation deduction, prorated by the business percentage.

Again, your personal professional tax advisor can explain how this affects your particular situation in more detail.

Good luck.

Kerry Kerstetter

Labels: 179

Summaries of New Tax law

There have been plenty of people writing about the recently passed tax law that we have been referring to as the “Extenders Act” instead of its technical name (Tax Relief and Health Care Act of 2006).

What I always find useful with new legislation are short and sweet summaries that can be passed along to clients more easily than the verbose analyses that we practitioners have to study.

While I know many of such summaries are currently in the works by the normal sources, the first one I’ve come across is this one from Spidell, which includes the excellent warning that California law currently doesn’t conform with this new Federal legislation.

This non-conformity will be a mess for all states, as some pass their own last minute or retroactive conformity laws, while others leave their tax systems as is and force us to make the appropriate adjustments between Federal and State tax returns.

I will post links to other similar summaries of the new law as I learn of them.

Updates:

QuickFinder has posted two items related to this new law:

Four-page PDF summary of provisions in new law, with helpful references to page numbers in the QF books.

One-page PDF on IRS guidance on how to adjust tax return prep to the fact that the 2006 tax forms were already printed before this law was passed.

The folks at TheTaxBook have posted their summary of the new tax law, also including page references to where each subject appears in their books.

Deloitte Tax:

PDF (8 Pages)

Documenting Expenses

Q-1:

Subject: Substantiation of ExpendituresTax Guru,I appreciate your musings and advice on the U.S. Tax regime and have a question for you that I've been unable to see a post for on your blog.Is there a de minimis amount for which a receipt is not required to substantiate a deduction for income tax purposes. My former employer required us to provide a receipt only for expenses of $25 or more. Has the IRS adopted an similar policy?

A-1:

For several years, IRS had a $25 threshold for when an actual receipt was required to document a particular travel or entertainment expense. A number of years ago, this was raised to the current $75 threshold.

While IRS can't demand an actual receipt for individual travel & entertainment expenditures of less than $75, you do still need to keep records showing the time, place, business purposes and amount of each separate expense. Documentary evidence is still required to substantiate expenses for lodging. See IRS Publication 463 for more details.

An even easier way to account for out of town expenses is to use the IRS's per diem rates, as published in IRS Publication 1542.Your own personal professional tax advisor should be able to provide more specific assistance for your particular situation.

Good luck.

Kerry Kerstetter

Q-2:

Thanks for the input Kerry. Turbo Tax, my tax advisor, has been silent on the matter. I've been keeping receipts for everything $25 and over. But have been throwing away all receipts under $25 not just travel and entertainment. Should I be keeping receipts for items under $25 that are not travel and entertianment?

A-2:

Now I can't tell if you're legit or pulling my leg here. No computer program can seriously be considered as a professional tax advisor. That goes for all software, from the $5,000 plus Lacerte programs I use to the $30 TurboTax you are using. The role of an advisor can only be handled by an experienced human.

The rules for record keeping need to be tempered with real life. While technically, you are supposed to have receipts or other suitable documentation for every penny you deduct (other than the special $75 rule I mentioned previously), the real life need for such detailed records may never materialize. If you are audited by IRS for those deductions, the auditors have the discretion to either demand to see detailed documentation for every single penny or just those expenditures over a certain dollar figure. It usually depends on the number of individual transactions and the total dollar amount being deducted. For example, I am currently handling an IRS audit where the auditor agreed to only look at documentation for individual expenditures over $100 after I gave him a several page QuickBooks listing of all of the items included in the expense accounts he was interested in examining.

So, your self defined $25 threshold for keeping receipts may work out to be fine, as long as you don't encounter one of the IRS auditors who doesn't believe in the concept of materiality and demands documentation for every penny.

Again, if there are large amounts of money involved, I would advise working with an experienced human tax professional for setting up your record keeping systems, preparing your tax returns and representing you with IRS if you are one of the lucky ones to be selected for their examination.

Good luck. I hope this helps.

Kerry Kerstetter

Follow-Up:

Very helpful. Thanks for the real life advice.I'm pulling your leg. I've done a bit of research on my own and don't rely on TT as an authoritative source for tax law. My consulting work isn't sufficiently complex enough or large enough, at least yet, to require a tax advisor, at least I think don't think so. Maybe one moreyear of Turbo Tax and then I might need to seek more professional help with my taxes.Thanks again for taking the time to personally respond.Happy holidays.

The Virtual Taxman Cometh – Will IRS come looking for real tax dollars from people earning online virtual money? Will IRS accept virtual money as payment of taxes? We’ll have to wait and see.

New definition of Santa Claus?

Allowing people to keep more of their hard earned income is now considered the same as a gift from Santa?

(Click on image for full size)

A Way for Mom and Dad to Give More Generously – From Gail Buckner

Your Mortgage: Pay Now, Or Hold Off to Invest? -From the free WSJ.

Tax Leads Americans Abroad to Renounce U.S. – An extremely drastic way to save on taxes.

Accounting for Start-Up

Q:

Subject: Business Startup QuestionsTo the TaxGuru~Hello! Somehow in a random search for relevant tax based website information I stumbled across your site. First let me introduce myself. Im 27 y/o and in the process of forming a corporation that provides auction & import services. I am somewhat business savvy, but when it comes to tax - its over my head! And of course my funds are meager to begin with. So my questions are below....1 Do you provide tax help for povery stricken student ha.

2. Do you know of any non profit orgs that will answer your tax questions for a small fee.3. What is the process for taking the home based office deduction? I have the form i just dont know how i would lease an apartment upfront.I imagine thats what i would have to do? Then from what i understand(let me know if this is wrong). You *rent* the office to the corporation which you keep the money from and the corporation deducts the office costs as a business expense? I would be utterly grateful if someone could walk me through this process there is so much i dont understand about this. I need to start this business away from the stress of my home situation. But i cant afford an apartment unless i can qualify for the office deduction.Kerry any advice you can give me is respectfully appreciated.Seasons Greetings!

A:

While this may sound harsh and self-serving, tax and accounting advice isn't the place where you want to cut corners. Nowhere is the "you get what you pay for" maxim more appropriate than in this area.

There are far too many options to consider and possible scenarios that can be used to achieve your goals for me to even begin giving you specific advice via this medium.

You will need to work directly with an experienced tax pro who can analyze your unique circumstances. I wish I could help; but I already have too many clients to take care of properly; so we are still trimming back on the difficult clients and are not accepting any new ones at this time.

Unfortunately, we don't have anyone specific to whom we could refer you. I did recently post some names and links for some like-minded tax pros around the country.

If you haven't already done so, you should check out my tips on how to select the right tax preparer for you.

I wish I could be of more assistance; and I wish you the best of luck.

Kerry Kerstetter

Kidney Income?

Q:

Subject: So how would you advise them?

Dear Mr. Kerstetter,A friend and fellow lawyer pointed this article out to me and I thought you'd find it interesting.Basically, can you be taxed on receipt of a kidney?What I wonder is, if you and I each have a car of equal market value and we trade them, would we be taxed? Beyond the obvious bio-ethics issues, I don't see the difference.

A:

As learned and entertaining as Professor Maule is, this is a perfect example of how ivory tower academics (and some attorneys I have known) love to let their imaginations go wild and conjure up scary tax scenarios out of what are actually innocent events.

If I were advising these people from my real world perspective on tax matters, I would have them sell their kidneys to each other for one dollar each and completely avoid the entire subjective valuation of a bartering transaction. While the black market price for kidneys may be as much as $50,000 (per a recent episode of Nip/Tuck), each person is actually entitled to establish her own price. While some cold-hearted bastards might say they should auction the kidneys to the highest bidders, basic private property rights allow us to set out own prices for things we own; so who is to say one dollar isn't appropriate?

They can each prepare a bill of sale for one dollar and report the transactions on Schedule D of their 1040s, with a cost basis of zero. The tax on one dollar of long term capital gain (acquisition date = date of their birth) will be the least of their worries.

Thanks for sharing that.

Kerry Kerstetter

No Change in IRS Interest Rates for the First Quarter of 2007 - The main rate stays at 8.0% for at least another three months. I’ve updated this on my Quick Reference page.

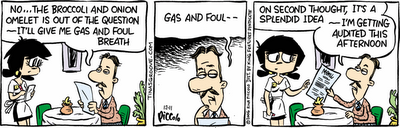

Preparing for an audit?

I have heard of people actually trying this strategy.

(Click on image for full size)

Simpler Taxes?

As if this has a snowball's chance in Hell of ever happening.

Referring to this article.

Generosity?

I'm sure it's just my perspective, but every time I hear about a new generous government program, I can't help worrying about the people who will have their money confiscated by our oh so generous rulers to pay for it.

Beware of wasted deductions

From a reader:

Subject: Re: ACAT's Year End Tax TipsFirst, thank you for all the help & information you give your readers throughout the year. The links to new tax changes & rates are especiallyhelpful.Here's a counter-intuitive tax tip for individuals:We often hear or read tax advice near the end of the year telling us to pay deductible items by Dec. 31st to cut our current year's tax bill. Many of us may be tempted to reach for our check books, but for those in AMT territory because of an unusual income item such as a large capital gain, this can be the wrong advice. Paying before year's end the final state estimated tax installment &/or property taxes which are not due until the following year in order to increase itemized deduction may be the wrong strategy. The tax benefit of those early payments is mostly wasted as the AMT may disallow large chunks of certain deductible items. By waiting to pay them on their normal due date when AMT is not expected to be a factor, the full value of those tax deductible items can be realized.

My Reply:

You are correct that more and more people each year are being ensnared by the insane AMT and literally penalized for having too many itemized deductions. Since the AMT thresholds haven't been adjusted for inflation, this is only going to get worse.

As Joe Kristan covered in his blog recently, year end tax planning does need to cover AMT issues, or else what seemed like a good idea at the time (prepaying state income taxes), could become an expensive waste of a deduction.

Thanks for writing.

Kerry Kerstetter

Follow-Up:

Thanks for the quick reply. Glad that Joe Kristan pointed out the links to the draft 6251 forms & instructions that you supplied. One daily surfing stop I make is to the irs draft tax form site where the latest gems from the IRS are posted for download.

Imagine no taxes...

Neal Boortz is looking for new lyrics to John Lennon’s Imagine song. One of his listeners, obviously a fellow Libertarian, sent in these, which include the following:

Imagine there's no taxes

It's easy if you try

No IRS to hound us

No need to dodge or lie

Imagine all the people

Keeping all their pay...

ACAT's Year End Tax Tips

I just received an email from ACAT with an attached doc file of tax tips to be shared with clients and local media outlets. Since this blog is my local media outlet, I am sharing those tips here.

The Twelve Tips of Business Year-End Tax Planning

Before business owners celebrate the Twelve Days of Christmas, they should first take a moment to review these Twelve Tips of Business Year-End Tax Planning. These could save the average business thousands of dollars!

It’s important to act quickly – once the bell tolls for the New Year, these opportunities for potential savings will be gone!

1. Accelerate deductions from 2007 into 2006. A business can do this by making payments this year for expenses such as office supplies, repairs, maintenance, and advertising.

2. Consider setting up a qualified retirement plan. It is one of the best ways for businesses to save on taxes. There are many options, so picking the right plan for your business is the key. Some plans are required to be set up by year end.

3. Reduce or defer year-end income. For cash basis businesses, deferring billing for services until the end of December or January can shift the income into the next year, as the income is reported in the year it is actually received. Also, delaying shipping of merchandise until January moves income into the next year.

4. Accelerate purchase of equipment. If you anticipate business income to be higher in the current year versus next year, it makes sense to accelerate the purchase of equipment and other assets into this year. The benefits of Section 179 depreciation can mean large tax deductions, thus making the tax savings significant. Businesses can elect to “expense” part or all of qualified assets purchased during the year, up to the annual limit of $108,000 for 2006. There is a limit based on taxable income and an annual purchases threshold amount to qualify.

5. Review fringe benefit plans. A Section 125 “cafeteria” plan can benefit both the employee and employer with pre-tax savings for health and dental insurance, out-of-pocket medical costs, dependent care, and other benefits.

6. Write off bad debts. Businesses that use the accrual basis method of accounting may have uncollectible past-due accounts. These businesses can deduct these bad debts when they become partially or totally worthless. These accounts should be identified before year-end and the business should keep a detailed record of the debt-collection efforts.

7. Write off old inventory. Review the business inventory for obsolete and un-sellable items. A business may write down inventory below market if in the regular course of business the company has offered the merchandise for sale at below-market prices.

8. Review building depreciation. If your business has purchased or substantially renovated a building in the last 10 years, conduct a Cost Segregation Study. The study analyzes the components of a building or renovation to gain larger depreciation deductions based on shorter depreciation lives.

9. Explore like-kind exchanges. If you are considering replacing old equipment or buildings with newer ones, take advantage of the like-kind exchange rules. Trading assets is one of the best tax shelters available to businesses and investors. The section 1031 like-kind exchange rules are very strict and must be followed exactly.

10. Review your business entity classification. Check to see if your business classification (sole proprietorship, C-corporation, S-corporation) and your accounting method options (cash basis vs. accrual basis) are the most advantageous for your business. Tax laws change constantly and reviewing the alternatives could significantly impact your taxes. Any change in ownership of the business is also a good time to review your options.

11. Finalize the budget. Compare income and expenses for the current year to the previous year and prepare a budget for the coming year. A budget will help a business reach its goals.

12. See your accountant or tax advisor. There are many ways to save tax dollars and consulting with a tax professional who is experienced and familiar with the latest tax law changes can help you minimize taxes and maximize your bottom line. Effective tax planning can make a material difference in your company’s cash flow.

This information is provided as a public service, and should not be construed as individual accounting or tax planning advice. For information on how these general principles apply to your situation, please consult an accounting or tax professional.

Heed the Top Ten Year-End Tax Tips To Save on 2006 Taxes

“If I had only known about that new tax law, I would have done something before the end of the year!” This common lament of taxpayers is often the result of simply not staying on top of the latest changes to the increasingly complex tax laws. But it doesn’t have to be that way!

Avoid surprises and maximize tax savings with these “Top Ten Year-End Tax Tips”:

1. Take stock of your stocks. Review your current year stock and mutual fund sales to determine if you have a net gain or loss. If you have a net gain, then selling stocks that would produce a net loss may make sense. A net capital loss of up to $3,000 can be deducted against other income, such as salary. Any excess losses can then be carried forward to future years.

2. Watch out for the estimated tax penalty. The IRS requires individuals to pay their taxes throughout the year with quarterly estimates, tax withholding, or both. If you don’t pay enough during the year, you can be hit with an estimated tax penalty, which is equal to the interest rate for underpayments. Although it may be too late for this year, adjusting your income tax withholding can eliminate or reduce the penalty.

3. Consider stock donations. If you want to donate to your favorite charity but are short on cash, check out your stock portfolio. If you own stocks that would produce a large capital gain, consider donating them before you sell them. You can deduct the market value of the stock as a charitable contribution and you pay no tax on the appreciation.

4. Reducing the tax on Social Security benefits. People who receive Social Security benefits can be taxed on a high percentage of their benefits. Investing in T-Bills or CDs that don’t mature until next year can lower the provisional income in the current year and lower the tax rate. Also, investing in growth stock that produces little income can have the same result.

5. “Kiddie Tax” update. The new tax law raises the age threshold for the “kiddie tax.” For 2006, any unearned income (interest, dividends, capital gain, etc.) received by a child under age 18 (previously age 14) that exceeds $1,700 is subject to federal tax at the parents’ top marginal tax rate. You might want to shift investments into growth stocks that produce little income, tax-free municipal bonds or municipal-bond funds, Series EE bonds, or CDs that mature in the next year.

6. Installment sale of property. If you are considering the sale of real estate property that was held for investment purposes, you could spread out the tax hit over several years with an installment sale. If you structure the sale into two payments, one in December and one in January, you spread the tax over two years instead of one. The second benefit may come from a lower adjusted gross income.

7. Shift timing of deductions. Consider maximizing your itemized deductions by “bunching” deductions. In order to get a tax break from itemizing deductions, you must have more in deductions than the standard deduction allowed by the IRS. For 2006, this is $10,300 on a joint return and $5,150 on a single return. If you are close to the standard deduction each year, consider accelerating all possible deductible expenses into every other year. Shift payments of medical expenses to the year they will exceed 7.5 percent of your adjusted gross income, pay two years of personal property tax and real estate tax in one year, or double up on your charitable contributions into one year.

8. Watch business expenses. If you deduct employee business expenses, your deduction is reduced by 2 percent of your adjusted gross income and you may lose the deduction totally because of the alternative minimum tax (AMT). The best strategy is to set up an “accountable plan” with your employer to cover all your business expenses in lieu of wages for the same amount. The reimbursements you receive will be tax-free, not subject to payroll taxes or alternative minimum taxes.

9. Defer income until next year. If it is possible to defer receiving income until the next year, you not only defer income tax on that income for another year but you may increase the value of your deductions for the current year if you have adjusted gross income limitations. Consider postponing bonuses, investment gains, or elective distributions from retirement accounts.

10. See your tax professional. Make an appointment with your tax professional before year end. Opportunities missed can mean cash in the bank. Don’t be one of the many taxpayers that look back and say, “If I only knew about this before the year end.”

Tax laws change every year, so it’s always a good idea to review all your options while there’s still time to take action,” explains Paul V. Thompson, EA, ABA, ATA, ECS, Senior Tax Manager for Shaw & Sullivan, P.C., Alexandria, VA. “You should also not assume that your tax withheld from your W-2 wages or the tax estimates you are paying are enough to cover your tax liability or avoid a penalty.”

This information is provided as a public service, and should not be construed as individual accounting or tax planning advice. For information on how these general principles apply to your situation, please consult an accounting or tax professional.

Delay on Tax Breaks Affects Millions – Our lame duck rulers have better things to do during their last month in office, such as lining up million dollar lobbying gigs, to actually worry about doing something to help the taxpayers.

Corporate Tax Forms

Since I have always been a big fan of using tax years other than January through December for corporations, I have long encountered confusion with clients who see what they think is the wrong year on their tax forms. That’s to be expected; but with someone whose official job is to review tax returns for a bank’s lending department, that’s a little scary.

Q:

Kerry ,I need to know if the last tax return you did for me is for the year 2004 or 2005 on my business. The bank is wanting a copy of 2005 and I took them the last one you sent me back in September, but they said it was for 2004 . If it is for 2005 I guess I'm ready for 2006. I also need to know if you have anything showing my federal I.D. number . I know i should have a certificate of some sort, but all I have is what the bank filed which is a {Corporate Authorization Resolution }.Thank You ,

A:

I pulled your files and confirmed that we are actually completely up to date with both your personal and corporate income tax returns.

It sounds like your banker is inexperienced with how corporation taxes work. They are required by IRS to use the forms for the year in which the corp tax year starts. In your case, the year going from 12/1/04 through 11/30/05 is reported on tax forms designated as 2004. If you look at the top of the first page of the 1120, you will see that it shows the tax year as 12/01/2004 through 11/30/2005.

After the current year is over (after 11/30/06), we will be able to do the corporation return on 2005 forms. In other words, you already have the most current corporate tax returns possible.

The same thing goes for your 2006 individual income tax returns. We can't work on those until after your personal tax year ends, 12/31/06.

Your corporate Federal ID number is on every page of the corporate tax returns.

I hope this clears things up for you. It sounds as if your bank needs to give its loan officers better training.

Let me know if you need anything else.

Kerry

Selecting Corporation Type

Q:

I'm sure you realize this, but some of your readers may not - your statement that "Once a corp is established, it is not required to limit itself to its original type of business. It can operate any kind of legal business enterprise." is not technically correct, at least here in California (also where the questioner and corp in question were based), as general business corps cannot get into those lines of work, legal though they may be, where a professional corp is required.

That said, I wonder, since you apparently once lived/worked here in California, and I am small business attorney always on the lookout for a tax guru with your beliefs and approach here in Calif to recommend to my clients - if you have any such recommendations. I see that your rec page lists none in Calif, but I thought I'd double check, given, like I said, your past history in this state, and the number of questions you seem to receive from here. Perhaps there's some you might recommend privately but are not ready to endorse on your web page?

I have worked with a number, and have not been too impressed so far.

Thanks, and keep up the good blogging work,

A:

Thanks for pointing out that distinction with PSCs.

Unfortunately, the number of tax pros that are on my recommended list is extremely small, only including Russell Fox out there in the PRC. I wish I had some more names to add to my page; but hopefully I will learn of more over time.

Good luck.

Kerry Kerstetter

The Push to Close the Tax Gap: Will Small Businesses Pay?

Last Minute Tax Breaks for Parents of the College Bound

Donating via Paychecks

As mentioned previously, starting in 2007, the record-keeping requirements for being able to deduct charitable contributions are being tightened up. Some people donate to charities via having their employers withhold money from their paychecks and then send it on to the charity. Since the employee won’t have a canceled check for the actual charitable payment, there may be some confusion as to whether that person has proper documentation to be legally allowed to claim the contribution as a deduction on his/her tax return.

To the rescue, IRS has just announced what will suffice for proper records. It really isn’t hard.

For a charitable contribution made by payroll deduction, a pay stub, Form W-2, or other employer furnished document that sets forth the amount withheld for payment to a donee organization, along with a pledge card prepared by or at the direction of the donee organization, will be deemed to be a “written communication from the donee organization” that satisfies the requirements of § 170(f)(17).