Tax Guru-Ker$tetter Letter

Thursday, October 31, 2002

Debate Recap

The debate at North Arkansas College in Harrison went well today. It was taped by the local television station, Channel 8. We are still trying to find out when it will be broadcast. The publisher of the local newspaper sat in the front row, taking a lot of notes and photos. That should be in their paper soon.

My fears of a hostile group were unfounded. The students and administrative staff were very courteous. My name tag is to the right.

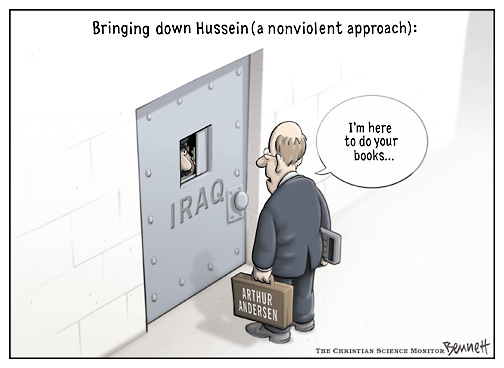

The biggest arguments against our proposal to eliminate the sales tax on food and medicine have to do with fears of the unknown. The fact that the measure doesn't specify exactly where the money will come from to replace the lost sales tax revenue scares people and they worry about what other taxes or fees will be raised as a result. This sounds like the old "the devil you know is better than the one you don't" dilemma that stymies any attempt at change. It's part of the problem Bush is having convincing other nations to oust Saddam.

There is also a great deal of fear of the greatly misunderstood Libertarian Party. You would think the Chamber of Commerce's Executive Director, Layne Wheeler, was describing a cult of of evil Satan worshippers when she described the LP's goals of smaller government and lower taxes.

In the face of accusations of being irresponsible for omitting details on replacement revenues, I explained that wasn't the purpose of this initiative. It was difficult enough to get it onto the ballot just addressing the one side of the equation. To micro-manage how our rulers adapt to the situation would not be fair and would very definitely excite other opposition groups. There is simply no tax that is universally liked by every group. The rulers in Little Rock have known that the little people have been upset about this issue and demanding a change for well over 21 years. They chose to sweep it under the rug. The LP simply stepped in to do what the other parties refused to. If this measure passes, it will bring the matter up front and center into their radar. They will have to make the appropriate adjustments.

While I long ago learned that the locals here hate to hear stories about how things were done in the PRC, I still think that the Proposition 13 property tax revolt in 1978 is a direct parallel to this sales tax issue. It rolled back property tax rates and cut the revenues to local governments by a considerable amount. It also did not specify how the revenues were to be made up. Each government entity had to do whatever it took to adjust, including cutting services and personnel. I have every confidence that the managers here in Arkansas will be just as capable in adapting to the situation they will face with the slightly lower sales tax funds. Some people in the audience expressed heavy skepticism over this faith in our leader to deal with matters. One person even called it an oxymoron to have any such faith in politicians (his words, not mine). I had to remind the audience that, if passed, the actual change in the sales tax rules won't take effect until July 4, 2003, giving everyone plenty of time to take appropriate action.

I heard that just this morning the Arkansas Supreme Court again refused the request by the government bureaucrats to toss this matter off of the ballot; so it is looking more and more likely that we will actually be able to vote on it next Tuesday. I'm sure this weekend will be filled with ads by the opposition with their phony numbers and horror stories about how terrible life will be in Arkansas if this measure passes.

KMK

Wednesday, October 30, 2002

Strange Bedfellows

It seems that the only GOP candidate with the balls to defend the issue of privatizing Social Security is Liddy Dole. Has she been taking Bob's blue pills?

KMK

Europeans Don't Know Better

Some people have the impression that the Europeans are more sophisticated and knowledgeable than we poor slobs in the States are, such as in matters of taxation. A Value Added Tax (VAT) may sound appealing as a replacement for the corporate income tax; but it needs to be evaluated a little closer first. I'm not so sure about following the lead of the Europeans. If they're so smart, why do they pay over four dollars a gallon for gasoline?

KMK

More Left Coast Socialism

California doesn't have the monopoly on Pacific Socialism. Marxist Hillary-Care could be available in Oregon soon, costing taxpayers and employers a fortune. Hopefully, it will give us an advance look at how government provided medical care works before President Hillary Rodham can force it on the entire nation.

KMK

Investing In Sin

For several years, there have been investment funds that only put their money into morally acceptable types of industries. It was inevitable that there would be special funds covering the other end of the moral spectrum, the Vice Fund.

KMK

Radio Interview

The radio interview on the food tax measure went well. The only awkward part was that I had to do most of the talking without much give and take. That's why I like doing seminars much more than straight speeches; the interaction with the audience makes a big difference. The host, Alan Archer, did an excellent job of staying on the fence and not advocating a particular side of this very controversial issue. But, that meant that he didn't say much.

My interview, along with one with the Harrison Chamber of Commerce covering their arguments against the measure, are scheduled to be broadcast this Sunday, November 3 at 8:00 AM after the ABC newscast on 96.1 FM from Harrison Arkansas. I'm not aware of any way to hear it on the web. We aren't morning people, so we will probably miss hearing it here.

KMK

Arkansas Sales Tax

I didn't intend for this issue to dominate my schedule as much as it has. However, since agreeing to participate in the forum at North Arkansas College tomorrow, it has become the main focus.

We have been receiving a lot of phone calls, many of which bring up some of the phony claims being made by the opponents of the repeal measure. They have pulled out all stops in their campaign to portray those of us in favor of this measure as evil cold-hearted Libertarians who want nothing less than to shut down every government program and kick every needy person out into the street to suffer and die. It's exactly how the DemonRats in DC, and their sycophants in the media, constantly portray Republicans.

A caller this morning said they were told that if this passes, all funding for public education will dry up and all of the schools will have to shut down. The fact that the schools receive almost all of their funding from property taxes, which have no relation whatsoever to sales taxes, seems to be overlooked.

I am scheduled to do an interview with a local radio station later this afternoon to present the arguments in favor of repealing the sales tax on food and medicine. They originally wanted me to drive into town, but they finally agreed to let me handle it over the phone.

I'm not going to bore everyone with every detail of this matter. However, since the issue is whether human food and medicine should be exempt from sales tax, I thought it would be interesting to see what kinds of things are already exempt from sales tax here in Arkansas. They don't have an easy way to see all of the hundreds of special exemptions that are spread throughout these 106 pages of official sales tax regulations. However, they run the gamut. The one that has long struck me as an extreme example of the unfairness is in Section GR-45 on Page 53, where all foods and medicines for livestock and poultry are exempted from sales taxes.

Interestingly, none of those exemptions, that I am aware of, was placed there by the voters. They were all instigated by legislators who were doing favors for their "special friends" (aka big campaign contributors). I actually saw this very process in action back in 1995 during a trip to the Capitol in Little Rock with the Leadership Institute I was taking with the Harrison Chamber of Commerce. We sat in on some committee hearings where they were trying to pass special sales tax exemptions for specific companies. They were threatening to shut down and leave the State if their special exemptions weren't granted.

If additional sales tax money is so important to the bureaucrats, maybe they can take a look at removing some of the esoteric exemptions that only benefit certain people and companies rather than penalize everyone for buying their food and medicine.

KMK

Tuesday, October 29, 2002

More On Food Tax Issue

Sherry was in Harrison earlier today and picked up some of the slick brochures the big government folks have produced (at taxpayer expense) to spread their lies about the ballot initiative to remove sales tax from human food and medicine. The cover pretty much says it all: "Their Axe Attacks Us All."

Inside are all kinds of lies and misrepresentations about the catastrophic effects awaiting Arkansas if tax revenues to the government are reduced by even one cent. It will be so terrible here in Arkansas that we might as well all pack up and move to a high taxing state so that all of our humanly needs will be taken care of. Remaining here would be suicide under the conditions we will be facing.

One line of reasoning that the opponents of the measure use is that removing the sales tax on food and medicine will start a chain reaction, reducing other sources of revenue, such as the Soda Tax, Hamburger Tax and Medicare Matching. Those taxes and payments are calculated differently than normal retail sales taxes, so there is no legitimate linkage. These issues were even addressed and found to be bogus in the Arkansas Supreme Court decision last week that allowed the measure to remain on the ballot.

Here's a new reason to vote against the sales tax repeal that Sherry heard from a client who happens to run a retail food store. He is planning to vote against it in order to save himself from the hassle of having to reprogram his cash registers.

KMK

Debating Taxes

Making an increasingly rare public appearance, I have agreed to take part in a debate-forum the students at the local community college are holding on the ballot measure to repeal the Arkansas sales tax on human food and medicine. Surprisingly, I will be taking the side in support of the measure. The arguments in favor of keeping the tax will be handled by the President of the Harrison Chamber of Commerce, Layne Wheeler. As a forum to present both sides of the issue, this should have a better turnout than the two people who showed up at a recent meeting in Berryville that was strictly against the measure.

I do realize that, being sponsored by students, this is a trip into the lions' den. It's a certainty that those students and faculty have been subjected to a constant brainwashing of propaganda proclaiming the end of their lives if the sales tax is removed from food and medicines. This has been done with students in all of the other levels of government schools.

The forum is scheduled to begin at noon on Thursday, October 31 in the Little Theater in the main building. It will also cover arguments for and against the other controversial measure on the Arkansas ballot, regarding animal cruelty. I am actually looking forward to hearing more about this measure because all I have seen are the lies being told by its opponents who are twisting the issue to say that it would outlaw all hunting and fishing, which is ridiculous. While I haven't made up my mind on how I will vote on this matter, the opponents haven't helped their case by resorting to obvious blatant lies. The opponents of the food tax repeal run the same risk with their outrageous doom and gloom end of the world arguments. Such obvious lies destroy any credibility the opponents could hope to have with objective voters.

KMK

Monday, October 28, 2002

Silent Treatment

Bush is keeping silent in response to the lies the DemonRats are spouting about Social Security. Unfortunately, most people assume that no response to a statement or claim means that it is true. The longer Bush waits to fight back against the lefties' misinformation campaign, the more entrenched the lies will be in the public consciousness.

KMK

Review and Overhaul California's Tax System

It has definitely been a stupid way to forecast revenues, based on asinine assumptions about capital gains taxes. Of course, our rulers in DC do the exact same thing. However, they aren't required to have a balanced budget, as the State rulers are.

KMK

Zodiac Business

I've always been a student of new and innovative business ideas. However, I'm not even close to endorsing the idea of basing business decisions on astrology. It shouldn't surprise anyone that this idea has a willing and gullible market out on the Left Coast in the city that they used to call Baghdad By The Bay. (Maybe they still call it that. I haven't been to SF in almost ten years.)

KMK

Don't Count Your Chickens

The fans of high taxes here in Arkansas are not giving up their fight to deprive the voters from having a say on the taxation of sales of human food and medicine. In spite of one defeat (for them) in the Arkansas Supreme Court last week, they are trying again to convince the Supremes to toss the measure off of the ballot before next Tuesday's election.

Even if the issue remains on the ballot, you can be sure that the bureaucrats will file even more lawsuits against it after November 5, if it wins, as they are certain it will.

KMK

Back Up On Backup Server

It's been almost two weeks since the Blogspot server hosting my blog stopped showing recent postings. I have been contacting the Blogspot administrators and monitoring the situation ever since this first happened.

While there have been some users theorizing that this was a plot by the owners of Blogspot to force them into paying for their more expensive service, that is not true. I have seen several free hosted blogs operating just fine, while others, such as mine, that use the most expensive upgraded Blogspot hosting service, are not yet functioning properly.

Rather than wait any longer, I finally decided to copy everything from my blog to a new folder I set up on my main website. I'm not very happy about this because the hosting plan for my main site has a maximum storage of 50 megabytes. The top of the line hosting service I purchased from Blogspot has 100 megs.

If Blogspot ever gets back up and running reliably, I'll see about moving things back and will make the appropriate adjustments and announcements.

KMK

Sunday, October 27, 2002

Saturday, October 26, 2002

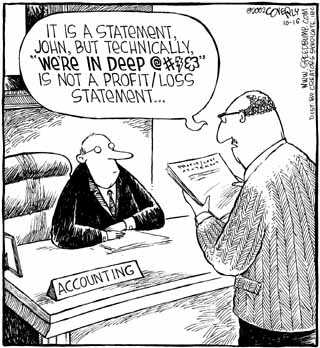

Over-Reacting To Accounting Scandals

Just because a few publicly traded companies played fast and loose with their accounting doesn't mean that draconian new laws and regulations need to be instituted for the thousands of law abiding companies. Just as with gun control, more laws and restrictions aren't the answer. Enforcing the existing laws will do the trick.

KMK

Making No Cents

It's a bit hard to have much sympathy for the financial woes of a school district that mails out checks for one cent to its employees. It's always been my belief that no government agency should be given one dime more until they can prove they are being good stewards of the money they already receive.

KMK

Friday, October 25, 2002

Finally A Chance To Vote On Taxes

Since we moved to Arkansas almost ten years ago, there have been several initiative attempts to put issues on the ballot that would allow voters to choose whether or not to reduce various taxes. Every time, they have been kicked off the ballot before election day by the worshippers of big government who have been petrified over the mere possibility of ceding any power over taxes to the little people, who they openly consider to be so stupid about such matters that they would probably vote to reduce taxes. Such critical matters should only be decided by our elite rulers.

I have written several times already about this year's effort by fellow Libertarian, Karl Kimball of Little Rock, to allow voters to decide whether Arkansas sales tax should be charged on human foods and medicines. Currently those items for non-humans are tax exempt, while the human varieties are taxed. I have mentioned several of the hurdles that Karl and his team have been able to overcome. In spite of the taxpayer financed efforts by government bureaucrats to prevent this measure from ever appearing on the ballot, it has narrowly survived a vote by the Arkansas Supreme Court. This means that we should actually be able to vote on a tax matter; a monumental first in our Arkansas history. According to some people, this issue will be the most important thing on the ballot. It's just wishful thinking by big government fans that the support for this tax reduction is slipping.

Of course this means that the mass hysteria will grow with horror stories and other propaganda about how this reduction in the sales tax revenues will plunge the entire State of Arkansas into the 18th Century, with people losing their lives and suffering terribly as a result. Editorials such as this one are already common place and will intensify. The only media outlet that I am aware of as supporting the measure is the Arkansas Democrat Gazette, which doesn't allow any linking to its stories. Everyone else is echoing the gloom and doom message about the extreme horrors facing the State if any less money is paid in taxes. It is all too similar to the dire predictions made about the dreaded Y2K bug before December 31, 1999.

KMK

Thursday, October 24, 2002

Counter-Attack

The GOP has put up an amusing rebuttal of the DemonRats' video showing Bush murdering old people. In this one, Bush is Superman. While his claim of saving Social Security is not 100% accurate, it is a lot closer to the truth than the sludge the JackAss Party has been spouting.

KMK

Class Warfare Not Working

I hope Bruce Bartlett is correct in his assessment that the DemonRats' standard exploitation of hatred of the rich is not working as well as it used to.

KMK

Ultimate Sin For A Politician

In Salinas, Calif, some union members are actually running a recall campaign against a college trustee for daring to support a move to eliminate a utility tax. Coincidentally, this official is a Libertarian, the only Party that actually works to eliminate taxes, as they are doing here in Arkansas, also with huge opposition from government employees.

KMK

Wednesday, October 23, 2002

Money In Trash

It's not just the Sopranos who make illegal money in waste management. Just like an episode of Seinfeld, where Kramer and Newman were going to make money by hauling cans and bottles from New York to Michigan, where the deposit was higher, some real life entrepreneurs have been doing the exact same thing. They were buying aluminum cans and bottles in Mexico and other states with lower than the PRC deposit rates. They were paying $950 per ton for aluminum cans and turning them in to recycling centers in the PRC for $2,490 per ton. Plastic bottles netted even higher profits; selling for $90 a ton out of state and bringing in $910 in California. They have been arrested for their creativity and are looking at some serious criminal charges.

The fact that this kind of thing would happen shouldn't surprise anyone. Money is like a liquid, finding its own level. Any time there is a disparity in taxes or prices between jurisdictions, people will try to find a way to exploit it. It's exactly what is happening with the differences in taxes on cigarettes in the various states. On Wall Street, this kind of financial scenario is called arbitrage and its practitioners usually receive huge compensation.

KMK

Tax Cuts For The Rich

I happened to hear Rush's show today, when a woman called in who claimed to work in a tax accountant's office. Her explicit envy of the rich and espousal of Democrat talking points made me wonder if she is Dick Gephardt's accountant. She even said that rich people are lucky, echoing Little Dick's oft-used description of the wealthy as "winners of life's lottery."

Her call reinforces how important it is to select a tax advisor who is in synch with your ideas about taxes. It never ceases to amaze me how many other tax practitioners actually think their clients should be paying more in taxes, as this woman admitted on national radio. Somehow, paying this woman's firm to prepare a tax return giving more money to the IRS doesn't seem quite right.

Rush has some good details from IRS on how the rich in fact pay much more than their fair share in taxes. By definition, any reduction in taxes would have to benefit those people who actually pay taxes in the first place.

KMK

Charity Fundraisers

It looks like more charities are raising funds by producing calendars with different groups of people who are willing to pose in various states of dress. Even some Libertarian candidates in North Carolina have gotten into the act with their Ladies of Liberty calendar. It sure beats bake sales and raffles.

KMK

Nabbing Scammers

It's surprising to see that the authorities are actually trying to catch the perpetrators of the long running Nigerian money scam that seems to lure in a steady stream of gullible idiots. Here's another quick recap of how pervasive and profitable these scams are.

KMK

Unreasonable Expectations

Over the past few decades, people have come to expect far too many things to be taken care of for them by the government. This Bill of No Rights is a good summary of how absurd those expectations are.

KMK

Making Money Off An Addictive Drug

With all of the demonizing of the tobacco companies, it's interesting to see who actually makes the most money from cigarettes; governments with all of their increasing taxes. Here is a similar take on it by an actual tobacco company executive.

I wonder if the same people who think it is unpatriotic to do the things I advise to legally reduce or eliminate one's tax burden would similarly condemn anyone who quits smoking and thus deprives government of revenue.

KMK

Tuesday, October 22, 2002

Protecting The Stupid From Themselves

The ongoing trend of nobody having to accept responsibility or suffer the consequences of their choices in life continues. Casinos are being held liable for catering to gambling addicts. This doesn't seem too different from investors suing their stock brokers when things tank. They weren't complaining or sharing the wealth while they were winning; but they're sure quick to make someone else cover their losses

KMK

SNAFU

Nothing new here. As usual, the Federal budget is an out of control mess, with no foreseeable sign of taming it, regardless of which Party controls Congress.

KMK

Online Filing For the Blind

Fellow computer geeks should be interested in this article on the recent project by IRS to enable blind people to fill in 50 of the most common tax forms online.

KMK

More AARP

It's amusing to see the AARP pretending that they are just as unhappy with a Democrat using their logo as they were with a Republican earlier. It's interesting that the Carnahan ads have been using that logo for months, and AARP is just now complaining about it.

KMK

Monday, October 21, 2002

What Will the Results Be?

The administration of liberal RINO New York City Mayor Michael Bloomberg has plans to raise property tax rates by either 10% or 25%. Their goal is to squeeze a few billion dollars more per year out of property owners. Doing something that politicians never do, I wonder about the long term consequences of this action. What do you think this will do for property values, as people sell off their real estate and move their investments elsewhere?

Property values only stay high or increase if there are willing buyers. On a purely economic scale, raising the taxes on a business or commercial property decreases its capitalized value right off the bat. The cycle will then continue as the lower market values cause reduced assessed valuations, causing lesser tax assessments, and so on. Of course, this is too much forward thinking for the likes of politicians intent on the short-term feeding of their pet bureaucratic projects.

KMK

Sunday, October 20, 2002

Quick Payback

If Proposition 51 passes next month in the PRC, its backers are looking to reap about a billion dollars a year in goodies from the taxpayers.

KMK

Saturday, October 19, 2002

Double Edged Sword

As always, whenever interest rates are low, they have opposite effects on different groups of people. It's great for borrowers, but not so good for people who receive annual cost of living adjustments, such as Social Security recipients. Let the whining commence.

KMK

Thursday, October 17, 2002

Wednesday, October 16, 2002

Social Insecurity

As these articles mention, the DemonRats are pulling out all stops to exploit the deadly third rail of politics by spreading their standard lies that the GOP wants to destroy Social Security and kill all old people.

Social Security Hypocrisy

Social Security an election hot potato

Misinformation Scheme

Being located near the border of several states, we are subjected to more political commercials than just our own state's. The Senate races are following the DemonRat playbook with the constant lies about Social Security. Jean Carnahan's team even has a website slamming Jim Talent on this issue.

KMK

Self Defense

For decades, I have been advising people that, even if you won't owe any taxes, or if your income is below the mandatory filing requirement, it is still a good idea to file a tax return as a self defense measure. Whoever told this woman that she didn't need to file a tax return to report a break-even real estate sale was dead wrong. If the advice was from a tax professional, there is a good malpractice case. If it was from an IRS employee, there's nothing that can be done because they are not legally bound by their advice and it is well known that they are wrong around two-thirds of the time anyway. Anybody stupid enough to rely on IRS advice deserves what they get.

To refresh the point. When real estate and stocks are sold, IRS is provided with a 1099 form showing the gross sales price. Taxes are computed on the net profit or loss after subtracting the asset's cost basis. IRS has no information on the cost basis. Providing that information to the IRS on an income tax return is the responsibility of the taxpayer. IRS computers, although 1960s generation dinosaurs, are very efficient at matching up gross income amounts from 1099s with the gross sales prices on 1040s. If a sale is not shown on a tax return, or if a tax return has not been filed, IRS assumes that this was unreported income and that the gross sales price also represents the net profit (cost basis = zero). A bill for taxes, interest and penalties is automatically generated, starting a chain reaction collection nightmare.

I have been accused of advocating filing tax returns where no tax was due just to generate revenue. Nothing could be further from the truth. I have never been at a loss for work and have always had far more projects than I could handle. It is simply to help clients avoid the kind of problem the lady in this story encountered when she failed to report the property sale. The truth of her story may be that she was either too lazy or too cheap to prepare a tax return for the year of that sale and she paid the price. Penny wise, pound foolish fits that situation.

KMK

Selective Impartiality

I find the fact that the AARP is protesting the use of their logo by GOP politicians more typical liberal hypocrisy. As a member of AARP for the past few years, I have read several of their publications in which they consistently endorse big tax and spend politicians and policies. Their political neutrality is a joke.

KMK

Tuesday, October 15, 2002

Bubbles Can Be Anywhere

As big a fan of investing in real estate as I am, I am still fully aware that feeding frenzies can happen with real estate, driving up prices beyond common sense, just as happened with dot-com stocks. I have seen it happen before and know that it is currently occurring in parts of the country. Any investment should be evaluated with a cold emotionless calculator.

Don't Ask Me

I just learned that the best online question & answer site, AskMe.com, is shutting down its consumer section. It came as a complete surprise to me. However, they have been nice enough to provide the shut down schedule. No more new questions or answers will be accepted after November 1. All of the previously posted stuff will be removed as of November 25.

You have over a month to check out the very useful info that is still up on the site, including the hundreds of answers that I have provided over the past two and a half years. The AskMe people say they will be providing a means for us experts to download our entire contents after November 10. If it works out, I will archive my content on one of my other websites.

KMK

Pot Calling...

If this isn't hypocritical, I don't know what is. It is castigating investment banks and their analysts for refusing to provide unflattering reports on their customers. This has been a very real conflict of interest. However, all forms of media, including newspapers, magazines, TV, and radio, have had the exact same kind of conflicts, where news coverage has been altered to please or avoid offending advertisers. To take this holier than thou attitude is ridiculous. Newspapers have been catering to advertiser whims since the beginning of newspapers.

Hired Guns

While the first reaction may be bad to the news that IRS is considering enlisting the services of outside debt collectors to bring in past due taxes, I see it a little differently. Unless the private companies are going to be deputized with IRS's awesome powers, it will actually be better for taxpayers to deal with them than with the Gestapo-like IRS, who have been allowed to do anything to take money from people, including several things that are unconstitutional and illegal for anyone else to do.

KMK

Sunday, October 13, 2002

Any Excuse Will Do

The pro income tax forces in Tennessee are still at it. Their latest attempt to enact a state income tax uses the classic "for the children" excuse. You can be sure that any new tax earmarked for something as specific as teacher payroll will find its way into being used for everything else. Government is consistently atrocious when it comes to using taxes and fees for their intended purposes. Trust funds and lock boxes mean nothing to our rulers, as they routinely dip into them for other uses. This happens all the way from the imaginary Social Security trust fund down to local dog catcher's fees.

The only way to keep a tax from getting out of control is to prevent it from ever being enacted in the first place. Here's hoping the anti-tax forces in Tennessee can keep up their fight. As always, they will be portrayed as evil enemies of children for daring to oppose an income tax that will be used to provide quality education.

KMK

Frontier House

I don't often make recommendations on TV shows; but I just noticed that PBS is replaying their excellent Frontier House series, starting tonight. Three families have to adjust to living for three months in a recreation of 1883 Montana. The only real problem they had with the simulation of that time was a ban on hunting. The show was filmed on a nature reserve where hunting was not allowed; and that did put a very big crimp on the food the families were able to obtain. Any real life family in 1883 Montana would have been harvesting wildlife for many of their meals.

Sherry & I watched and enjoyed the entire series when it was on earlier this year. We could relate to it more than most people because of the fact that we had to go through many of the same adjustments when we moved from life in modern civilized society to a very rustic existence on an isolated ranch in the boonies of the Ozark Mountains. Luckily we still have access to food stores, or we would have to start eating some of the wild deer, turkeys and squirrels that are always around us.

Check out Frontier House to see how many things we take for granted in today's world. It would be great for spoiled bratty kids to see for that same reason.

KMK

Saturday, October 12, 2002

Better Accurate Than Rushed

It is not necessary to remind me of the date. I am more aware than anyone that we are reaching the end of the second extension for 2001 1040s on October 15. I have been working as hard as I can to finish as many tax returns before then as possible. I am in fact also still working on some 1998, 1999 and 2000 tax returns.

I will be filing for a third extension, until December 15, for any tax return that I can't complete by October 15. Contrary to what many misinformed IRS employees and inexperienced tax practitioners may tell you, such an additional extension is possible if there is a very good reason. I file several of them every year.

Repeated calls and emails bugging me about the status of tax returns doesn't help the already very stressful situation around here. Your patience is appreciated.

I do not operate like a news service, where speed is more important than accuracy. It has always been my policy to prepare the highest quality tax returns possible, even if it requires filing them later than normal. The philosophy that some people have of just whipping anything together and then fixing it later doesn't always work. There are several things, such as tax elections, that can only be done on an original tax return. Too often, I have seen people short-changed by filing a tax return too quickly and haphazardly to allow them to prepare the best tax returns possible for their situation.

I have been delaying every possible project, both personal and business, until after October 15, including several updates and items that I want to post to my website and to this blog. We have also refused to accept any new clients until if or when I am able to get caught up with the huge backlog of tax returns still waiting for me. Before next year's tax season, we are also planning to trim back on some of the clients we work with, based on a number of criteria.

KMK

Trust Nobody

As slow as they are moving against illegal tax evasion schemes, it's good to see that IRS is at least doing something to shut down the promoters of scams such as this case in Florida, where people were paying almost $6,000 to a scamster to set up supposedly tax free trusts. Unfortunately for IRS, for every one of these con artists that they shut down, there are dozens more convincing gullible people to follow their lead with tempting but illegal schemes.

KMK

Labels: 179

Friday, October 11, 2002

Yo-Yo Wealth

Those financial gurus, who are proclaiming the fact that the stock market has jumped upward in the last two days' trading means that the bad times are over, are very naive, as well as idiotic about investments in general. Any investment with the kind of volatility of the stock market, that can increase or decrease in value by three to five percent in a single day, is not the way for anyone to accumulate wealth without incurring ulcers or chest pains. Multipy that by 365 to see what it is on an annual basis.

Just as with dieting, it's safer all around to get rich slowly than to shoot for the get rich (or poor) quick schemes. Just something to keep in mind as the roller coaster ride continues, as it will.

KMK

Cyber-Panhandling

The number and variety of people using the web to beg for money have grown considerably since I last mentioned it. I guess as long as both sides are being honest about what's expected from the other, there's no harm. As one person in the story says, it's better to see money go directly to someone in need than to a large bureaucratic charity that gives very little to real people with problems. That's a familiar sentiment.

KMK

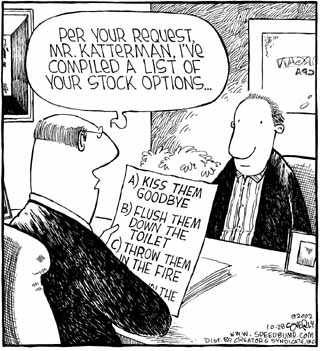

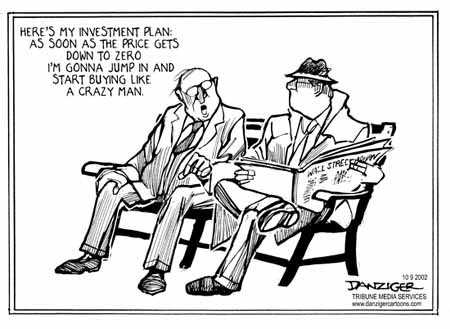

Same Picture, Different Message

I'm sure this cartoonist intended for this to be another jab at capitalism, with the obvious solution being more government control. I see a very different message here. It is is dangerous to trust your career and retirement to others, including corporate executives, politicians or government bureaucrats. The answer is to control your own destiny with your own business and your own self controlled retirement plans.

Thursday, October 10, 2002

Tug Of War

In typical political fashion, the campaign rhetoric is flying hot and heavy. There are people calling for more tax cuts, while others are calling for tax increases by stopping or rolling back the current phase-in of tax rate reductions. Illustrating the idiocy of our system, both sides actually claim to be solving the same problem of a slow economy with diametrically opposite solutions; tax cuts or tax hikes. I'm sure glad that medicine isn't as schizophrenic as political economics. One doctor would prescribe aspirin for a headache, while another would recommend a lobotomy.

When it all boils out, where will we be? In spite of calls like this to continue the momentum of tax cuts and to simplify the tax system, we will end up with no substantial change. SNAFU.

KMK

Wednesday, October 09, 2002

Crook Needed

It looks like Bush needs to do what FDR did when he created the SEC and appoint a big securities crook to head it. It took a crook to catch a crook, which is why Teddy Kennedy's father Joseph was the first commissioner of the SEC.

KMK

Calif. Real Estate Withholding

Spidell has come up with a handy chart showing the rules for withholding income tax from real estate sales in California, both under the current rules that only apply to sellers with addresses outside the state, and the new rules for 2003, which apply to everyone. You can see it on their website and download it as a pdf file.

KMK

Tuesday, October 08, 2002

Not Happy With PRC Withholding Plans

Here's someone who is actually a lot more upset than I am about the new rule requiring withholding of tax from sales of California real estate by residents of California. He gives the impression that it is a new additional tax, when it is really just an estimated tax payment that will either be refunded to the sellers or applied against their actual tax liabilities. We need to keep things in perspective here.

KMK

PRC Shell Game

(This is a little lengthy and, while specifically describing the situation in California, its points are relevant to other states that follow the PRC's examples.)

In their typical incompetent fashion, the rulers of the PRC have painted themselves into a corner with their budgets. When the dot-com stocks were flying high, the geniuses in Sacramento made the assumption that they would continue to rise in value every year from then until eternity, and then set up new generous government programs to spend that money. When reality hit, the capital gains taxes dried up and the revenues slowed accordingly. However, the spending is still increasing, putting them into a position of having a deficit of anywhere from $16 to $20 billion for the upcoming fiscal year. While this is a mere drop in the bucket for the Feds, California, as with most States, is required by law to have a balanced budget every year. They can't print money to cover their shortfalls, as can our masters in DC.

Another illustration of how incompetent the PRC rulers are at financial matters is with the few times when the State government has had a budget surplus, which has happened a few times over the past 25 or so years. Rather than hold the excess money over to compensate for future leaner years, they set up an inefficient multi-million dollar program to send taxpayers rebate checks of around $65 each. Then, a year or two later, when they are desperate for money, they have to raise taxes and fees; which is where they are right now. They are playing all kinds of financial tricks to try to get close to a balanced budget, almost every one of which would land a corporate executive in prison for doing the exact same things.

One trick that they are using to get interest free loans from the taxpayers is to force many people to prepay much more in taxes than they will really owe through mandatory over-withholding. Even though much of that money will end up being refunded back to the taxpayers, it will be in a later fiscal year than when the money was received. It's the same kind of classic shell game that has sent several corporate executives to prison. However, when our rulers do it, it's considered a work of genius. For those of you not too bored by such minutia, here are the details.

This latest trick that caught my attention was in an announcement from Spidell Publishing that the rulers of the PRC have widened the scope of mandatory tax withholding from sales of California real estate. This subject is something I have been very familiar with since it was first started in the mid 1980s.

During the mid-1980s, as California real estate values were skyrocketing, many people from outside of the state were making a lot of money by buying and selling property. The tax law had always required that they share those profits with the rulers of the PRC by filing Calif. non-resident income tax returns. However, many people didn't do that, either out of ignorance of the law or just the knowledge that there was nothing that the FTB (Franchise Tax Board) could do to them for not filing.

In what was actually a wise move, the PRC rulers passed a law requiring that income tax be withheld by the escrow companies from sales of Calif. real estate of $100,000 or more by people or companies that had addresses outside the State. The withholding was set at 3.333 percent of the gross sales price. I can still remember the panic this caused among the Realtor community because I was teaching real estate seminars around the Bay Area back then. They were freaking out, calling this a new tax on real estate. I had to explain that it was not a new tax; but a method of motivating real estate sellers to comply with the already existing tax law and file Calif. tax returns to report the sales.

Because the withholding is based on the gross sales price, when the sellers actually file their tax returns and report their net profit or loss on the sales, they normally get part or all of the withheld money back from the FTB. After the PRC blazed this trail, other states, such as Virginia, instituted the exact same kind of mandatory withholding for sales by out of state parties.

The rule had always had some exceptions to the withholding, such as a sales price of less than $100,000, use by the seller as a qualifying primary residence, and if the seller is doing a Section 1031 tax deferred exchange. This latter exception is one I have been very familiar with as part of my duties assisting Sherry in her exchange work. We have handled several exchanges where people disposed of rental properties in the PRC and reinvested the proceeds into properties in other States. We filed Form 597-E with the FTB to have them issue a waiver of the withholding. Overall, I must say that the FTB has been very cooperative with these requests.

Now for the change.

Beginning January 1, 2003, the mandatory withholding rule will also apply to sellers inside California. Escrow companies will be required to withhold 3.333 percent of the gross sales price of any real estate sold for more than $100,000 that was not a qualifying primary residence, and not part of a 1031 exchange, 1033 involuntary conversion or a foreclosure. The only exception to the withholding requirement is if the seller signs under penalty of perjury that there is a loss on the sale. This means that even if there is just one dollar of gain on a sales price of $400,000 (for example), the escrow company must withhold $13,332 and remit it to the FTB within 20 days following the close of escrow. Unlike current law for nonresident real estate withholding, the FTB cannot allow a reduced amount of withholding based on the true gain.

Some tips to deal with this:

Cost Basis

Keep track of the cost basis of your properties. I am constantly asked how much tax someone will have to pay on the sale of a property based on a certain sales price. My very first question is to determine what is the cost basis of the property. Almost nobody knows what the cost basis means; and if they do know what that means, they still have no clue as to the dollar amount. Income and capital gains taxes are calculated on the net profit or loss, not the gross sales price. The cost basis is the most important aspect of determining whether or not there will even be a taxable gain. With this new withholding rule, if you can prove that you are selling for a net loss, you will avoid having thousands of dollars needlessly withheld from your transaction. This is the reason I always give all of my clients a complete detailed depreciation schedule, showing the depreciated basis of all assets. It frustrates me to no end that so many other tax preparers refuse to provide their clients with this valuable information.

Accumulate Losses

I prepare several tax returns for people who have left the PRC, but still have rental properties there. With depreciation and other expenses, these normally generate net losses, with no State income tax. I still prepare California non-resident tax returns in order to show those losses and let them accumulate over several years. By the time the property is to be sold, there is often $100,000 or more of carried forward losses that can be used to offset the gain that would otherwise be taxable to the PRC, including recapture of depreciation. I consider this the long term approach to tax returns. While not required to be filed each year, the documentation of accumulated losses will pay off in the long run.

As I said earlier, you can be sure that other States will copy this trick and start requiring taxes to be withheld from more types of real estate sales by State residents.

Adjust Tax Payments

If you are caught by the mandatory withholding, and you have determined that those additional amounts will be more than enough to cover the tax on the gain from that sale, you should modify your other State tax payments, such as reducing your estimated tax payments or adjusting your W-4 with your employer to have less tax withheld from your paychecks. As I constantly have to remind people, getting a large tax refund is nothing to brag about. It just means that you loaned the government some of your hard earned money at a zero percent interest rate.

KMK

Labels: 1031

All Talk & No Action

While the chances of anything actually being done this year are slim to none, at least the subject of some tax breaks for investors will be out in the open for the next few weeks in the form of campaign rhetoric.

Rather than holding your breath waiting for our rulers to do anything to help you out, you will need to take steps on your own to reduce your taxes. Of main concern this year is the insanely unfair capital loss limit of $3,000 per person or couple. If you have a lot of losses that would otherwise go to waste on your 2002 1040, you may want to consider selling some assets that will show profits. The wash sale rule, which disallows capital loss deductions when equivalent stock is repurchased within 30 days, doesn't apply when the sale has a profit. Obviously, close consultation with your personal tax advisor is required to fine tune your strategy for dealing with capital gains and losses.

KMK

DC Fantasy Land

Faced with lower revenues coming in than expected, any business or family would cut back on their spending for non-essential things. That's not the case with our rulers in DC. Addicted to that vote-buying pork, they're increasing spending on idiotic projects at a record pace.

KMK

FrankenTax

Hopefully, we will hear more discussions like this on how the Alternative Minimum Tax (AMT) has grown out of control. It has evolved into a kind of blob monster, attacking & devouring everyone in its path, middle income people as well as the evil rich who were its original target. Try as they might, more & more people are drawn into its path just by normal inflation.

Another plug for the most active group battling the evil AMT: ReformAmt.

KMK

Monday, October 07, 2002

Pyramid Double Scam

These mild mannered suburban soccer moms in Sacramento weren't satisfied just running an illegal pyramid scheme. They actually rigged the charts so that they were able to steal even more money from the dupes they lured into their plan. They figured that anyone stupid enough to even participate in a pyramid scam wouldn't be smart enough to spot any shenanigans with the official record keeping. No honor among thieves.

KMK

Sunday, October 06, 2002

Investing In Politics

I have mentioned quite often how the best investment possible is with campaign contributions (aka bribes). For a few thousand dollars, it's often possible to receive millions of dollars worth of tax breaks or government largesse back.

Sometimes, people cut out the middlemen, often through the initiative process. Here in Arkansas, there are frequently ballot initiatives attempted to allow certain companies or families to have a casino monopoly. Just as with tax cut initiatives, these are always removed by opponents before the people are given a chance to actually cast their votes.

In the PRC, there is an initiative (51) that, according to this article, is a very similar thing. The people funding the petition drive stand to reap billions of dollars in immediate benefits if it passes. As can be expected, the rulers aren't happy about being out of the loop on this one.

KMK

Scam Profits

It's no secret that I despise most taxes of all kinds, including sales taxes, because they are used by our rulers to confiscate wealth from the little people and use for their dastardly projects.

As low as I consider tax and spend politicians to be, you can only imagine the level of disgust I have for people who use the tax laws as a means of stealing from the people to line their own pockets. I am specifically alluding to a scheme I have seen on a number of occasions that came up in a question I answered earlier today on AskMe.com.

The person submitting the question had been shopping at a store where things were marked down. He bought something for a big discount off the normal retail price, $25 instead of $200. When he was checking out, he was charged sales tax on the full retail price, not the actual price he paid. The store manager told him that was required.

My response to this is that the store manger is either an ignoramus or a thief. My guess is the latter. When he fills in his monthly sales tax reports for the State, he reports the actual sales made during the month at the actual prices paid by the customers. He calculates the appropriate sales tax on the actual sales volume and sends it to the State tax collector. What happens to the additional taxes that were collected by the store manager based on the inflated retail prices? I doubt that it's going to charity.

While the original questioner had only been overcharged by about $10.50 ($12.00 instead of the actual tax of $1.50), you can only imagine how much the grand total would be for all of the store's customers.

This kinds of thing happens quite often in another way. I buy almost everything over the Internet or from mail order catalogs. If the company doesn't have a store or other physical facility inside this state, they are not supposed to be charging sales tax. Often times, they do add sales tax to their invoices when they aren't supposed to. The impression most customers have is that that money will be passed on to their state just as their local merchants do. The truth is that those out of state vendors don't do any such thing and just keep that money. It's another source of bonus money, just like the outrageous shipping & handling charges many vendors add to bills.

What to do about it? Depending on my mood at the time and the amount of money involved, I have notified several out of state vendors that they were improperly assessing me sales taxes. About 75% of them adjusted their invoices accordingly. I have no idea if they stopped charging other out of state customers for sales taxes, but my guess is that they weren't about to kill a cash cow just because one person caught on. With the other 25% of the vendors, who refused to remove the sales tax charges, I forwarded the info to our state tax agency. I haven't heard how all of the cases turned out; but in some of them, the vendors were nailed with some hefty charges for years of unremitted taxes and penalties.

KMK

Nicely Feathered Nests

One of the many perks of being in power in DC is the very lucrative pension benefits our rulers have established for themselves. Coincidentally, it offers the best rewards to those who can stay in power the longest. What is completely missing from the benefits equation is any correlation to their performance. Crooks like Traficant and Torricelli are compensated exactly the same as those members who didn't take as many bribes.

I guess it's not much different from awarding the same retirement benefits to the law abiding former presidents as to those who committed perjury, raped interns and sold pardons.

KMK

Saturday, October 05, 2002

CD Prices

Anyone who has bought blank CDR and CDRW disks knows that their prices have plummeted in the past few years. I have been using CDRW disks instead of the old 3.5 inch floppies for backing up client tax and accounting files for about the past year now. I have seen blank CDRs for 25 cents each in packs of 25 and 50.

This just makes the prices the record companies charge for music CDs seem even more outrageous. As someone who has been buying hundreds of new CDs a year since they first came out, the prices long ago stopped appearing to be fair. When CDs first came out as a music format, it didn't seem strange for them to be priced higher than the vinyl LPs and cassette tapes. However, when the economies of scale kicked in, as they have long ago, it was natural to expect the prices to drop.

I happened to be reading a copy of PC Magazine and thought this column by John Dvorak hit the nail on the head on this issue. While I can't vouch for his figure of 25 cents for all of the manufacturing cost of a music CD, it is obvious that it is a tiny fraction of the $18 we paid a few days ago for the new Peter Gabriel CD (on sale at Wally World).

This kind of price gouging is why there is very little sympathy for the record companies as they complain about the various online file traders. I'll admit that I have used some of them to find obscure songs or ones that we need in a hurry (LimeWire is currently my favorite); but I still buy dozens of new CDs each month. Record executives are as oblivious to the real world of economics as are our elected rulers in setting tax policies. Just as lower tax rates result in more taxable economic activity and more revenues, lower CD prices would result in much more product sold and much less desire to download bootleg copies.

On a semi related note, has anyone else noticed how prolific the artists of the 1960s were compared to those of today? The Beatles produced a new album every six months or so. Nowadays, it's two or three years between albums for most recording artists. Is it because the quality is so much better now that it takes that much longer to perfect?

KMK

Privatizing Social Security

The JackAss Party is getting a lot of free publicity from its ad showing George Bush tossing wheelchair bound senior citizens off of a cliff. As with just about everything from the Dem's, this is a big misrepresentation of the truth. They claim that privatizing any part of SS accounts would subject poor retirees to the decline in the stock markets and reduce their benefits in synch with the market declines. This is an out and out lie.

It would be political suicide, and has not been proposed by anyone, to make any changes to the system for people currently receiving benefits. Any plan to allow alternative investments for SS taxes would be for younger workers, who will have plenty of time to accumulate substantial savings in the decades before they retire. As this column aptly describes, even with the gyrations of the stock market, investments there will yield a much more secure retirement than the Federal Ponzi scheme.

KMK

Stupidity On Both Coasts

Proving that the Left Coast doesn't have a monopoly on idiotic tax policy, New York City's RINO Mayor Bloomberg is suggesting that raising tax rates is under serious consideration. As this short article on Bloomberg's hypocrisy mentions, such a practice of raising tax rates to combat a recession will result in a type of financial death spiral. Tax revenues will drop due to changes in behavior. This will lead the geniuses in power to reflexively raise rates again, compounding the problem even further. It's too bad Rudy Giuliani wasn't able to groom a successor who could continue his conservative policies.

KMK

Friday, October 04, 2002

Debunking Lies

This is a good summary of the truth behind a lot of the lies being told by the liberals, blaming the current economic problems and Federal deficit on the Bush tax cuts. As with just about everything said by the Left nowadays, it is all a bunch of B.S. In their twisted minds, their hatred of Bush justifies a total disregard for the truth. As always, the mainstream media continue to use these same tactics as part of their agenda to demonize Bush and canonize the Clintons.

KMK

Thursday, October 03, 2002

Chasing the Ambulance Chasers

Per my earlier comments re: sleazy lawyers running ads to encourage frivolous lawsuits:

With Friends Like These...

Although the people at the Post Office claim to be independent from the Federal government, they really aren't. They are a quasi-governmental unit with monopoly powers that are blatantly illegal in the private sector. With their constant whining about losing money and raising their rates every six months, you would think that the various Federal agencies would help support each other. That is why I have always felt it strange that the IRS chooses to use other delivery services for its shipments. Back in the days before CD-ROMs and the Web, I used to order blank forms in bulk from IRS. They would always be shipped via UPS.

Last week, I ordered some free small business CD-ROMs from the IRS website and they arrived this morning via FedEx. My guess is that, just as before, the IRS doesn't trust the USPS. Next time the Post Office bigwigs demand a rate increase, why can't our rulers see that more Federal agencies use their service? It's not like their standards are that high (close enough for government work, etc).

KMK

Tuesday, October 01, 2002

Can't Afford It

Isn't it interesting how our rulers in DC can never afford to let any of their subjects keep more of their own money (aka reduce taxes); but they sure can always afford to add new programs and spending plans to the Federal budget?

KMK

Plenty Of Crooks Left

While the country will most likely be better off with that slimy crooked Senator from the Sopranos' home state bowing out, there are still hundreds of outright thieving skunks still on the ballots this November. That's why it's important to constantly remind everyone of how their accounting tricks in DC make anything even the most corrupt corporate CEO's have done pale in comparison. While the most corporate accountants can fudge is in the millions or possibly billions, our rulers in DC have routinely played fast and loose with trillions of our dollars. When will any of them be paraded in front of cameras in handcuffs for their accounting frauds? Don't hold your breath waiting for that to happen.

KMK

QuickFinders

For about the twentieth year in a row, I just ordered my 2003 editions of the QuickFinder books. They should be shipped out in mid-December. As I have discussed before, these are the absolute handiest reference books for anyone in the tax business. I refer to them several times each day. I've even decided to give the CD-ROM a try this year.

KMK