Tax Guru-Ker$tetter Letter

Saturday, August 31, 2002

Keeping Up the Fight

I have to congratulate fellow Libertarian Karl Kimball for his persistence in working his butt off to allow the voters of Arkansas an opportunity to express their opinion about having to pay sales taxes on human foods and medicines. Animal food is already exempt. Karl has been spear-heading the effort to obtain enough petition signatures to satisfy the Secretary of State. Several thousand signatures were recently tossed out for ridiculous reasons. Now, Karl has come back with 27,000 more, which should be plenty.

As always, the fight isn't even close to being over. The fans of high taxes are scared to death to allow voters to have any power when it comes to taxation. They will definitely be pulling several more dirty tricks and spending huge amounts of tax dollars to get the initiative kicked off of the ballot, as they have done dozens of times for similar tax cutting measures just in the nine years we have been living here.

The bureaucrats and other fans of big government have good reason to worry, if this poll is accurate. 72 percent of respondents have said they support the repeal of the sales tax on food and medicine. In typical fashion, the tax supporters claim that the respondents are too stupid to know what they are talking about.

KMK

Talking Tax Forms

Making sure that the tax system is accessible by everyone, IRS is planning to post on its web site talking tax forms for blind people to use in preparing their tax returns. Interesting; but I doubt that I would trust it. Many of the forms are so poorly designed and utterly confusing for those of us who can read them and their instructions, I can only imagine what the verbal equivalent will sound like.

KMK

Sinking Deeper

One of the main reasons I decided almost ten years ago to leave the PRC was the continuous steady erosion of freedoms and property rights. Having owned rental properties myself, as well as working with hundreds of clients who also were landlords, I knew all too well that the laws in that state were all slanted in favor of tenants and against the rights of property owners. The State Rulers in Sacramento operate under the assumption that all landlords are so stinking rich that they don't need any rental income. Professional tenants who know how to work the system can easily live in a home for six months rent free, and can often actually make money by extorting landlords to pay them to vacate.

The scariest movie ever made from a landlord perspective is Pacific Heights, with Michael Keaton as the tenant from Hell who goads property owners into attacking him and then he brings charges and gets the property. These people actually exist. We had a psycho tenant on our Palomares Canyon ranch who used that movie as his guide and was actually telling people that he was going to get our property. Luckily, we were able to get him out without losing the property; but we are still so gun-shy about having tenants that we have refused several offers to rent the extra houses on our current ranch. Even though the laws in Arkansas aren't as heavily biased in favor of tenants, we still don't feel comfortable.

What triggered this rant is this article from the PRC that they have now passed yet another law allowing tenants to live rent free for even longer. Property owners have no rights. It is no coincidence that many of my clients have been liquidating their California rental properties and reinvesting tax free into rentals in other states, where private property rights are given more respect. It is also yet another confirmation that leaving the PRC was the smartest move I could have ever made.

KMK

Friday, August 30, 2002

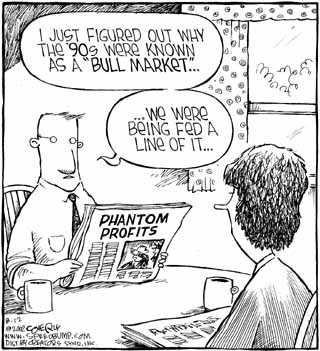

Media CheerLeaders

So, who is really shocked to hear that business reporters only like to write good positive things about their subjects, giving readers the impression that the companies are well run and therefor good investment opportunities? This is a story I know all too well.

During the entire time of the dot-com boom, I received so much hate mail for pointing out that those businesses were doomed to failure and anyone stupid enough to buy their stocks would take it in the shorts. However, since all of the big business press were describing the business world as different and the normal business cycles as non-existent, I was out-numbered and ridiculed for sticking to the old fashioned basics of financial analysis.

How many of those so-called financial experts, who were doing nothing more than parroting company press releases, are still considered credible today? Unfortunately, most of them are still out there and they don't seem to be tarnished by their incompetent and downright irresponsible cheerleading for ridiculous business plans and insanely over-valued stocks.

KMK

Voting To Eliminate Income Taxes

If they can keep it from being kicked off the ballot, as always happens here in Arkansas, voters in Massachusetts will have the unique opportunity to vote to repeal their state income tax. Predictably, the doom & gloomers are out in full force forecasting the end of the world if the initiative actually passes. According to this piece from Fox News, the pro-tax forces are ahead in the polls, with 49% of people favoring keeping the tax and only 39% supporting its repeal. With over two months until the election, anything is possible. As always, I am rooting for the elimination of a tax and hoping that the Mass. voters will show people in other states that such a positive change is in fact possible.

KMK

Thursday, August 29, 2002

Taxing Rain

As I have described before, state and local governments have recently shown the highest level of creativity in coming up with new ways to squeeze money out of the little people. They are even amazing grizzled old veterans like me.

This is the first time I have heard of a property owner being taxed on the amount of rainwater that s/he doesn't hold onto and allows to run off into the sewer system. Jonathan Adler of NRO has a good analysis of the pros & cons of this. He comes to the proper conclusion; that the main purpose of this new tax is for the money; not to encourage people to capture rain water.

This is in Winona, Minnesota. I can't wait to see how they top this in the PRC (People's Republic of California). How about a tax on earthquakes? It could be based on the Richter Scale reading.

KMK

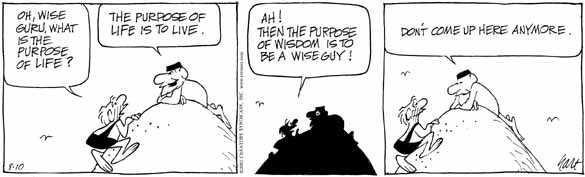

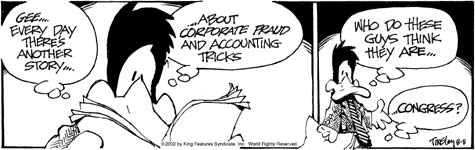

Accounting Rock Stars

I like Edwin J. Feulner's analogy of the corporate accounting scandals being similar to a typical episode of VH-1's Behind the Music show about drugged out rock stars.

He again reminds us that no corporate accounting scandal comes anywhere close to the corrupt accounting being done by our rulers in DC. Rather than stopping their hi-jinks, as most corporate crooks have, our rulers will continue, with ever more money.

KMK

All Money Belongs To Our Rulers

Larry Elder has a good summary of the mindset of our rulers in DC, as enunciated by that pathetically whiney Senator from Connecticut, Joseph Lieberman. He and his Fellow Travelers actually consider any reduction in tax rates to be government spending. This is a not very subtle way of stating that all income generated by everyone in this country automatically belongs to our rulers and they will decide how much of it we are allowed to keep for ourselves. The similarity between this thinking and how they handle things in Communist countries is frightening.

KMK

Stay In The Real World

This time of year, leading up to a big election, always causes a lot of confusion for people who fail to distinguish between the real world of actual tax laws and the fantasy world with scads of changes promised by our rulers and wannabe rulers.

Case in point: there is a lot of discussion about tax breaks for investors, such as making some dividend income tax free and increasing the capital loss deduction from the insanely low maximum of $3,000 per year to a higher amount, such as $20,000. Nobody is even mentioning the possibility of eliminating the ceiling on the deduction in order to make it consistent with the unlimited amount of capital gains that are taxable per year. That would be just too fair for our rulers to ever consider.

While these would all be great improvements in the tax system, it would be completely idiotic to modify your investment strategies based on these promises. There is very little chance of most of these changes making it through the liberal controlled Congress, who will portray them as just more tax breaks for the evil rich. Their Fellow Travelers in the media will echo those lies, as they always do.

Any changes that do survive and become real will most likely be watered down quite a bit. There is also the issue of the effective date of any change. Will it be retroactive to January 1, 2002 or will it only apply to sales after the law is enacted? There is no way to know because our rulers have never been consistent in regard to effective dates.

KMK

Out of Sight, Out of Mind

While it's a great idea, there is no chance that our rulers will agree with this idea of eliminating tax withholdings and requiring people to actually write checks for their taxes. That would let too many people understand exactly how much they are paying and possibly cause them to rebel against higher taxes. This scam has been extremely effective in confusing most people as to their actual tax burden. As long as they receive a refund when they file their 1040s, they think they are coming out ahead.

My prediction is that, instead of reducing or eliminating withholdings, we will be seeing more types of transactions subject to it, such as sales of stocks and real estate (which are already required for some sellers).

KMK

Sneak Peek

This is the time of year when IRS works on revising its multitude of forms & schedules. If you're interested in previewing what to expect, you can download the new forms from the IRS's website here.

KMK

Value of MBA

It has long been debatable whether or not an MBA degree is worth the investment it requires. I don't have a definitive answer to this because there are so many examples of where it pays off and plenty of others where it doesn't. I have always believed that the school of real world business experience is worth a lot more than theoretical book knowledge. It's really hard to counter the example of Bill Gates, who dropped out of college and became the richest person in the world by building a real world company.

I must admit that I went back to school five years after earning my BS to get an MBA in order to distinguish myself more in the financial world. Since I was in the corporate world at the time I started, just having a CPA wasn't as attractive as having a CPA and an MBA. Ironically, I left the corporate world and went into full time self employment half-way through my MBA courses. I finished it up; but have to honestly say that having an MBA in the CPA profession hasn't really impressed anyone.

I think it is good to have the debate over the value of an MBA, as in this article. As can be expected, the colleges that offer MBA programs don't take kindly to this skepticism and consider it sheer blasphemy to question the conventional wisdom that an outrageously expensive MBA is always a quick path to riches.

KMK

Tuesday, August 27, 2002

Crooks In Charge

At election time, try to think of the candidates, especially the incumbents, as officers of a corporation of which you are a shareholder. If they continue to pull tricks like this, do they deserve to be running our lives and squandering all of our money?

KMK

Monday, August 26, 2002

Attacking Tax Cuts

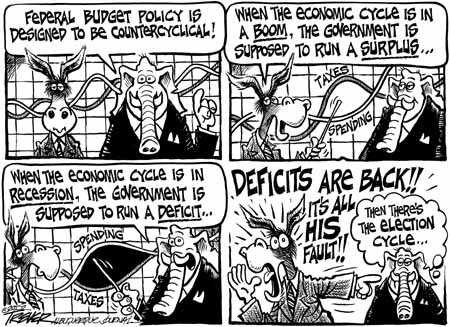

It's been amazing, but no surprise, to see & hear all of the liberals blame the Bush tax cut for the demise of the great Federal budget surpluses that the Clintons supposedly gave us. As always, the media continue to parrot the party line of "irresponsible tax cuts for the evil rich" that their Fellow Travelers espouse. Of course, the only solution is to repeal the tax cut.

As Bruce Bartlett discusses, this entire argument is wrong on so many levels as to not warrant any serious consideration by those of us in the real world.

The effects of the Bush tax cut haven't even been felt yet because the entire law was skewed to the back end, with the real cuts not taking effect for up to ten years away.

As I have explained on too many occasions, there never was a real Federal budget surplus. It was a complete fabrication by our rulers in DC. Contrary to the impression that they try to give of being able to predict future finances for the government, that is a completely impossible task. It can't be done and is just a matter of making up numbers. Even the supposedly non-partisan Congressional Budget Office (CBO) does nothing more than guess. Any publicly traded corporation that used the same kind of financial forecasts would have its officers in prison.

Tax cuts are despised by our rulers for one very important reason. They reduce the power of the rulers to control how money is spent. Money is power and the more that private individuals are allowed to keep is less power for our megalomaniac rulers.

KMK

Thursday, August 22, 2002

Circling The Drain

Our Founding Fathers thought like CPAs when they set up the Federal government with three official plus one unofficial (the press) branches, and established checks and balances and division of duties so that there would be less likelihood of collusion among them against the best interests of the people. If they had a crystal ball back in 1789, and could see how such collusion has occurred, I imagine they may have divided things up even further, with a dozen or more branches.

The ultimate check on ensuring compliance with the Constitution was supposed to be the Supreme Court. With justices appointed for life terms, they were supposed to be immune from the forces of public opinion and stick to a rigid defense of the Constitution. However, as described by Howard Bashman, that last bastion of defense has fallen. Our current Supreme Court is using popularity polls on which to base its decisions. I would call for impeaching the justices who think it's more important to please the ignorant people than support the Constitution; but that would obviously garner little support; especially since so few people in this country have even a clue as to what the Constitution says. Very sad for the USA.

KMK

Adjusting Capital Gains For Inflation

History repeats itself yet again. There is a lot of discussion of changing the tax law to allow capital gains to be adjusted for the effects of inflation. The underlying assumption is that Congress has to pass such a law. That is not true. Bush doesn't have to wait for Congress to change the law to adjust the cost basis of capital assets for inflation. He has the power to do this on his own.

Back in 1992, Bush 41 was encouraged to do just that; but he wimped out because it would have been too confrontational. I am afraid that Bush 43 is just as timid. While he talks tough on the war on terrorism, he is scared to death to take on the liberals on domestic issues, such as taxes.

I have written extensively about this topic, including this.

KMK

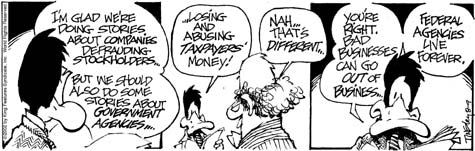

Diversion Trick

Just as magicians need to divert the audience's attention from the real action, our rulers are ever so glad to make sure everyone is paying close attention to the funny accounting tricks being played by some large corporations, while they continue doing things that are much more corrupt and that affect many more people than any corporation does.

Wednesday, August 21, 2002

Nanny State

Our Founding Fathers are definitely spinning in their graves over how the Federal government has grown so big & invasive as to dictate every little detail of what we can & can't do with our personal lives. It is the very reason why I have long been referring to the people in government as our Rulers. They sit up on their thrones and tell all of us little people how we are to live our lives; while exempting themselves from all of the rules they force us to obey.

There is no end in sight as to how much our rulers in DC insist on micro-managing our lives. One of my contemporary heroes, Walter Williams, has a good take on this sad state of our country, for those few of us who still respect the Constitution.

KMK

Tuesday, August 20, 2002

Optimistic Budgeting

A topic I frequently discuss is how our rulers at all levels of government use methods & techniques for their financial planning that would never survive in the real world. One of the most idiotic methods they use to predict revenues is to take a windfall year, such as a few years ago when the stock market was doing well and there were tons of capital gains taxes coming in, and make the assumption that such revenues will continue forever. It's the same illogical reasoning as assuming that you will hit the jackpot on a casino slot machine every time you pull its arm, just because you won once.

That is how the Clinton Gang was able to predict Federal budget surpluses. When reality hit, and the capital gains taxes dried up, Bush is now being blamed for squandering the fictitious budget surpluses by his enemies in the JackAss Party and their propagandists in the media.

State rulers also use this optimistic extrapolation of revenues to justify new spending programs. When the predictions fail to come true, they scream about the terrible budget shortfall. However, their reaction is again different from what it would be in the real world. If you or I had planned to buy a new car based on an expected bonus from work, we would scratch that plan if the bonus didn't materialize. However, with most government programs, once they are established, they will last until eternity. The result is the need for our rulers to squeeze more money from the people, which is what they are going crazy doing right now. Chris Edwards has a good explanation of this budget gap problem on National Review Online.

KMK

Monday, August 19, 2002

All For Show

Some people are prematurely optimistic about our rulers in DC actually doing something properly. Just because the CBO allowed proponents of dynamic analysis of tax law changes to speak at a recent conference doesn't necessarily mean that they will change their completely bogus static analysis procedures.

How many congressional hearings have there been about such things as government waste and IRS screw-ups? What remedial actions have been taken as a result? None. Enough said. Our rulers don't like to actually fix problems. They just like to give the gullible populace the impression that they care about them and then go back to business as usual.

KMK

Saturday, August 17, 2002

Only One Party Supports Lower Taxes

Unfortunately, in spite of the GOP's image as being against taxation, they never seriously support eliminating taxes, and in fact actively fight against such attempts. Here in Arkansas, the only party that has supported eliminating property and sales taxes has been the Libertarian Party.

In Massachusetts, the LP is supporting the repeal of the state income tax and the two monopoly parties are panicking because the less money they are able to take from people, the less power they will have.

State Rulers are petrified of allowing the people to have a direct vote on tax matters; so they will pull out all stops to prevent the issue from even appearing on the ballot, as they have done several times here in Arkansas.

KMK

Wednesday, August 14, 2002

Democrat Party Move Leftward

I am by no means the only one to consider the modern Democrat Party as virtually indistinguishable from the followers of Karl Marx. Because the transition has been so gradual over time, I find this contrast with John F. Kennedy quite illustrative of how far the JackAss Party has evolved.

In stark contrast to his brother today, John F. Kennedy was a big believer in reducing income tax rates. According to David Horowitz, if JFK were alive today, the Washington Post would describe him as a right wing ultra-conservative Republican because of Kennedy's tax cutting economic policy and his staunch anti-communist foreign policy

KMK

Surprise To Arrogant Rulers

Just as it is in Washington DC, the mindset of our rulers in the State Capitols is that they can continuously raise taxes & fees all they want and everybody will just gladly pay them without altering their behavior. This is the infamous "static analysis" method of predicting tax revenue that I so often mention.

With many states in financial peril, they see an easy solution by making tobacco addicts pick up a bigger share of the burden. They figure addicts are a captive audience and will have no choice but to pay in order to continue getting their fix. Again, I am not a smoker; but I have always supported the freedom for people to do stupid things, such as using tobacco. I have long wondered why smokers have allowed themselves to be persecuted so harshly by those who want to force their personal opinions on everyone else (aka Tobacco Nazis).

This is why I am glad to see stories about smokers refusing to buckle under to the State Rulers and find ways around paying their extortion, such as bringing in cigarettes from low-tax states and buying them over the Internet. Unfortunately, I expect this opportunity to be short lived. It shouldn't be long before our rulers in DC levy huge Federal taxes on cigarettes, making it expensive to buy from anywhere in the entire country.

I guess the only real way around the high taxes would be to grow your own tobacco and roll your own cancer sticks.

KMK

Tuesday, August 13, 2002

Why I Don't Invest In Stocks

Many people seem to be confused why I, a very staunch & unabashed capitalist, do not believe in investing in the stock market. There are several reasons why I have never invested in the stock market & can't sincerely recommend it for my clients. I'll cover a few of the main ones.

Profitability

First is obviously the odds of making money in the stock market. As I mentioned below, it is really a crap shoot. Anyone who claims to have the secret formula for guaranteed honest profits is a liar. No such thing exists. The only way to make consistent profits is by using insider information; which has side-effects, as Martha Stewart has discovered. The market is susceptible to too many rational and irrational variables to allow any kind of accurate prediction.

Control

I have always been a big believer in owning one's own business, which you can control. Investing in the stock market is not even remotely close to that. Even if you buy 10,000 shares in a large corporation, your ownership percentage is a tiny fraction. You have absolutely no say in what the business does and are at the complete mercy of the people running the company. As has been shown, this can be disastrous for small investors. None of the recent revelations of corporate accounting fraud have surprised me in the least and just go to show how powerless an investor is.

Best Vantage Point

One of the side benefits to being in the tax business is the ability to see what other people do to make or lose money. While I don't have an exact count, over the past 26+ years, I have prepared and reviewed at least 15,000 tax returns. Over that time, the number of people who consistently make profits on stocks is extremely tiny. The number who lose money in stocks is huge. The only ones who make consistent profits in stocks are the stockbrokers who earn commissions and often churn accounts just for that reason.

So, if stocks have proven themselves to be unreliable income generators, what kind of investment has the best track record? Real estate. In fact, it's almost the complete inverse of stocks. The percentage of people making large profits in real estate is huge, while the number losing money is very small.

Tax Breaks

It is also a very real fact that the tax laws make accumulating large amounts of wealth via real estate much easier than with stocks. Gains on stock sales are taxable, even if the money is plowed right back into other stocks. Contrast that with sales of real estate. Up to $500,000 per couple of tax free gain is possible every two years from the sales of primary residences. Gains from other kinds of real estate don't ever have to be taxed if their disposals are set up as like kind exchanges, where the proceeds are reinvested into new real estate within 180 days. I have seen hundreds of people parlay a few thousand dollars into hundreds of thousands through this technique. Not having taxes eat up the return makes the investment grow much faster than if gains had to be shared with our rulers.

Having access to cash is actually easier via real estate investments. Loan proceeds secured by real estate are tax free and much easier to obtain than a loan using stocks as collateral.

KMK

Monday, August 12, 2002

Gambling In the Market

I've lost track of the number of times over the past 25+ years that clients said they would play the stock market if they only knew more about it. My reply was always that the more you understand how the market works, the less you will want to take part in its irrationality.

I used to also say that if I were in a mood to gamble, I would much prefer to do it in a casino for some very good reasons. First is the fact that the odds of winning or losing in a casino game are statistically known, while the odds of making a profit in the stock market are completely impossible to determine. Another big difference is that there are plenty of free drinks and cheap food buffets in the casinos; amenities that few (if any) stockbrokers provide.

Along this line comes this suggestion to just turn over the stock markets to the casino (aka gaming) companies.

KMK

Higher State Taxes & Fees

This should be no surprise, with all of the news of state governments unable to balance their budgets. Whether they call them taxes or fees, they are pulling out all of the stops in trying to think up creative ways to squeeze more money out of as many people as possible. The Beatles song, TaxMan doesn't seem as farfetched any more. Parody becomes reality.

With cigarettes rising to $7.00 per pack in the PRC, it seems like importing them from other states will become a very lucrative business.

KMK

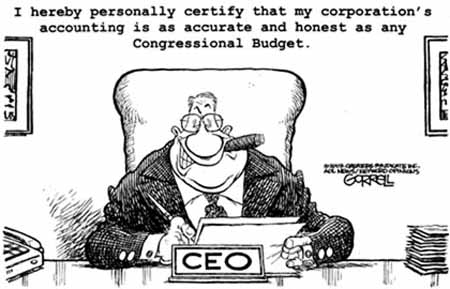

Shady Accounting

Here's another piece on the crooked accounting long done by our rulers in DC. They have the luxury of being able to declare almost everything as emergencies and thus not counted in the annual operating budget. That is how they can claim to be running a surplus, while still borrowing money. If any real world corporation tried such fraudulent accounting, its executives would be in the slammer. So, what else is new?

KMK

Saturday, August 10, 2002

Drive-By Audits

Here's a good explanation of how the big CPA firms have been cutting corners in their auditing assignments and letting their clients get away with some seriously improper accounting. There are also some good suggestions for improving the quality of certified audits.

We'll have to leave it to the courts to decide if this qualifies as official malpractice; but it sure sounds like it. When I was in college, there were the Big 8 CPA firms. I'm not sure how many of them will be left in a few more years after paying out for their lousy auditing.

KMK

Cutting My Own Throat

In spite of the fact that I make a very good income from helping people play the tax game, I have always supported the Libertarian Party's platform policy of eliminating the income tax entirely, as described in this article by Harry Browne, the LP's presidential candidate in 1996 & 2000.

KMK

Drunken Sailors

In typical fashion, our rulers, of both parties, are on a spending spree; and not just on the area that is crucial, defense.

KMK

Friday, August 09, 2002

Still Feel Patriotic?

I always get a ton of criticism for helping people pay less in taxes. I am constantly being called unpatriotic by those who think that any attempt to send less money to our rulers in DC borders on treason. For those folks, just read this story and tell me how patriotic you feel by sending your hard earned money to DC.

The U.S. Customs Service is admitting to losing 2,251 computers between 1999 and 2001. This report comes just one day after the FBI said it had "misplaced" 317 laptop computers. Customs agents also lost 59 weapons, 613 badges and 572 government credentials

Will anything be done to better control assets bought with taxpayer money? Why should they? There's plenty of money from patriotic taxpayers to just keep buying more things to replace the ones that mysteriously disappear.

KMK

Dirty Money

There has long been an interesting pattern with the Clinton-Rodham family. On several occasions, they have been exposed as having taken illegal money from criminals. Both Bill & Hillary's brothers were selling pardons. Hillary has been taking money from several of the corporate executives that are in the news for illegal stock trades and corrupt bookkeeping. She is now promising to donate that money to some charity, to be named later.

I have mentioned the stupidity of this logic on a number of occasions. Since when is it okay to expect no punishment just because you give back illegally obtained money after you have been caught? Can bank robbers just give back the loot and expect no criminal charges?

Here's where the media double standard (aka bias) kicks in. If these had been Republicans, you can bet that the media would be accusing them of being as crooked as the donors. The media would also be following up to verify that the money had been actually given back. However, with Democrats, they are given full credit for just saying that they intend to give it back. The media never follow up to see that the money is actually returned.

In fact, I have seen seen several stories over the past year or so saying that none of the Clinton-Rodham brothers actually carried out their promises to give back the money they took for selling pardons. I would bet anyone that Hillary will not give back any of the money she has taken from crooks either. At the most, she may move it from one of her slush funds to another, such as from her Senate campaign war-chest to her Presidential one.

KMK

Thursday, August 08, 2002

Delete All Spam

What kind of idiots are actually stupid enough to buy things advertised in spam that is by its very nature designed to hide who it's from? Whoever is patronizing these scum merchants, stop it right now so they will no longer be able to afford to send out their garbage.

It would also be a good idea if someone could visit these guys in person and do a number on their computer equipment with a good old Louisville Slugger. Such a person would be a true hero in the cyberspace world.

KMK

This Is News?

Rich Hollywood lefties want taxes to be higher for everyone. They're always so generous with everyone else's money.

KMK

Bush Spending More Than Clinton

One of the mantras that we in the Libertarian Party have long used is that there isn't a dime's worth of difference between the two major political parties. While the JackAss Party has a well deserved reputation for big tax & spend programs, the Bush administration is doing everything possible to blur the distinction between the two parties. According to this article, Bush is currently out-spending Clinton.

While I'm sure he is doing this to attract normally Democrat voters in 2004, he is just sealing his fate as another one term Bush presidency. Most Demonrats have such a visceral hatred of Republicans that nothing will cause them to vote for Bush. Likewise, many Republicans will sit out the election or vote for someone else as a way of punishing Bush in the same way as they punished his father in 1992 for breaking his "No New Taxes" pledge. The presidency of Hillary Clinton is looking more and more like a certainty.

KMK

More Budget Fraud By Our Rulers In DC

I have discussed on several occasions why the numbers released by our rulers in relation to the effects of tax law changes are completely bogus because they use static analysis, which says that people's behavior doesn't change as a result of law changes.

All attempts to switch to the more realistic dynamic analysis, which takes into account real life demonstrable behavior changes, are beaten down. This means that any official government figures should be considered as credible as a Bill Clinton denial of sex with Monica or any of the hundreds of other women he has used for his perverse pleasure.

KMK

Best Investment Possible

I have long explained that the most lucrative investment possible for a business is a political donation. For a mere $100,000 contribution (aka bribe) to one of our rulers in DC, s/he will gladly repay you with millions of dollars in tax breaks or government contracts. There is no higher rate of secure return possible anywhere. Similar rates of return are common practice with donations to State & local politicians.

This is how the game is played in DC as its power and scope continue to grow. It hasn't changed any under the control of the supposedly fiscally conservative GOP, who just funnel the same government largesse to their donors. It won't change a bit with the recently passed unconstitutional campaign finance reform measures.

What triggered this reminder of that fact of life is this story about a casino company that is in bankruptcy and is pleading to the bankruptcy court to allow it to continue paying out its political campaign contributions (bribes) as an essential business expense.

KMK

2001 Extensions

The first extensions for 2001 1040s expire on August 15. It is a simple task to obtain two more months, by sending Form 2688 to your IRS service center. If it is postmarked by August 15, you will be considered as timely requesting the extension.

The 2688 is a little different than the first extension (4868) that was sent in by April 15. The 4868 is for an automatic four month extension, and is supposed to include a payment for any tax expected to be owed with the 1040. It also has no place for a signature.

No money needs to be sent with the 2688. It extends the filing date by two months, to October 15. It needs to be signed by you or your representative. It also needs a reason. While many people think they need a fancy reason, the following language has been working well for the past 20+ years.

We are unable to assemble and compile all of the information that we require to prepare a complete & accurate tax return by August 15.

For a number of reasons, I am filing a lot more 2688s this year than I normally do. Because of months of computer problems, as well as several client emergencies that dominated my working time, I am extremely far behind with 2001 tax returns. I also have some clients who don't want to send IRS their tax returns until October so that they won't be among the 2001 tax returns from which IRS will be selecting 50,000 at pure random for its excruciating in depth examination, as I described here.

If you need more time after October 15, you may be able to receive official permission from IRS if you have a very good reason, or if a blanket extension is given for everyone affected by a big disaster, as was the case after the terrorist attacks last September 11.

If the next attacks don't come before this October 15, valid reasons accepted by IRS include most events that seriously affect your life, such as changes in marital status, deaths, health problems, and moves where your records are still boxed up.

KMK

Clinton Cooked The Books

This isn't news to anyone who has been following my writing; but now others are finally realizing that the Clinton Gang completely fabricated the Federal budget numbers. With the Federal Debt never decreasing, I am still amazed that anyone believed that there ever was really a surplus. It was all a scam, supported by the media propaganda machine.

Queen Hillary and her Fellow Travelers have been exploiting this lie to the fullest, claiming that Bush has squandered the financial discipline that the Clinton Gang had established with his (Bush's) "enormous & irresponsible tax cuts for the evil rich." There was never any financial discipline; just fabricated numbers to fool the American public.

Don't expect to see this mentioned by the mainstream media, who still worship the Clintons and are doing everything they can to help Hillary get her own two terms in the White House.

KMK

Tuesday, August 06, 2002

Accounting Fraud By Our Masters In DC

We can only hope that if enough people continue to harp on this point, that the accounting frauds perpetuated daily by our rulers in DC make any corporate shenanigans pale in comparison, that maybe some candidates will start using that as a campaign theme: clean up the accounting garbage in Washington.

I'm not holding my breath, though. Just as we have been exposed to endless stories about government waste for decades ($600 toilet seats, etc), it generates a chuckle in the populace & then it's back to business as usual. Until voters start kicking out the crooks in Congress for these misuse of our money, nothing will ever change.

KMK

Monday, August 05, 2002

Double Standard

Bush and the media are getting a lot of PR mileage out of their attacks on corporate crooks. Does it strike anyone else besides me and Deroy Murdock as a bit hypocritical that nobody, including Bush, seems to care that the same kinds of crimes are being committed right under their very noses, by employees of the Federal Government, and none of them are being paraded around in handcuffs?

KMK

Saturday, August 03, 2002

Out of Sight, Out of Mind

I couldn't agree more with this article on how the withholding tax has allowed the government to get away with its massive growth. It's why most people don't understand how much they are really paying in income taxes.

If everyone had to write actual checks for their taxes, rather than have it held back from their paychecks, they would become much more interested in seeing taxes reduced. I also like the idea to make tax payment day the same as election day so that people can better make the connection between the two events.

KMK

Anti-Tax Message Resonates With Voters

I do relish the opportunity to point out the few bits of good news that occasionally appear. As some of you may know, there has been a big fight over the past several months in one of the states that doesn't have an income tax, Tennessee, to start taxing all kinds of income. There have been near riots at some of the rallies involving this issue.

Last Thursday, TN had its primary election. While the issue of implementing an income tax was not explicitly on the ballot, it was implied in many of the candidates' platforms. The excellent news is that many of the incumbents and candidates who have been advocating the income tax were defeated.

I have always wondered why more candidates haven't used an aggressive tax cut as a main rallying point. Mr. Viagra's (Bob Dole) impotent 1996 campaign promise to cut everyone's taxes by a whopping fifteen percent doesn't qualify.

As a point of accuracy, I do want to clarify the true income tax status of TN. While almost all kinds of income are not subject to a State income tax, there is a six percent tax on interest & dividend income above $1,250 per person ($2,500 per married couple) per year.

KMK

How Should Tax Dollars Be Spent?

Back during the VietNam War, one way that Joan Baez & her fellow war protestors used to fight the US military was to withhold from their taxes the percentage that they believed was used for what they considered to be immoral warfare. Some of them supposedly deposited the money into escrow accounts or donated it to charity. Most of them probably used the money to buy more LSD or pot. Their approach was illegal then and IRS continued to exercise its awesome powers to make sure all taxes were paid.

According to this story in the NY Times, current opponents of the US defending itself against terrorists are resurrecting this idea and are advocating that people hold back the 50 percent of their taxes that they claim is used by the military. This entire concept is so wrong for so many reasons, that I will limit my discussion to just a few.

First is the issue of whether or not the Federal government should be spending money on military actions. As a Libertarian, I have always believed that the Federal government should limit its actions to just those few areas as designated in the U.S. Constitution, which includes the defense of this country's borders and its people. If we Libertarians had our way, no Federal tax dollars would be spent on anything not authorized in the Constitution.

The very sad fact of life is that most of what our Federal tax dollars are used for is well beyond anything that our founding fathers envisioned being handled by the Federal government. Many of us truly believe that if our rulers in DC would spend more time and energy on defense matters and less on the unconstitutional issues that dominate their agendas, we may not have been attacked last September and wouldn't currently be twiddling our thumbs waiting for the next attacks.

Which brings us to the next issue. Do we Libertarians, and anyone else who similarly respects the Constitution, have a legal or moral right to withhold tax payments for those things that we don't believe are properly within the scope of the Federal government? While I wish such were the case, that just isn't proper.

Contrary to the ignoramuses who say that the United States is a Democracy, it is in actuality a Representative Republic. We (those of us who vote) select people to go to Washington to decide how our tax dollars are spent. While very attractive in concept, if every person had the right to decide where each of his/her tax dollars goes, we would have an even more chaotic mess than we have with our 535 elected rulers making those decisions for us. The answer, for those who don't agree with how the Federal government spends our money, is to elect those people who share our views on what the Federal government should be doing and how tax dollars should be spent.

KMK

Class Warfare

Here's a good explanation of how the JackAss Party [referred to as the National Socialist Democrat Party (NSDP)] relies on class envy and attacks on the wealthy as its core philosophy. By their definition, as well as their allies in the media, anything that is good for the evil rich is automatically bad.

Is it true that when Democrats recite the pledge of allegiance, they say "one nation under Marx?" I'm sure their patron saint (Karl Marx) is so proud of what they have been able to accomplish in the United States. Their platform is almost a perfect match for his Communist Manifesto.

KMK

Friday, August 02, 2002

Maybe There's Hope

Some optimistic political news from the Left Coast, in the PRC (People's Republic of California). Democrats assumed that everyone shares their love of high taxes and expensive government programs. When they ran some ads attacking their Republican opponents for favoring lower taxes and cuts in government programs that can't be afforded, the public support for the GOP candidates increased. Amazing. Let's see more of this around the country.

KMK

Thursday, August 01, 2002

Taxachussetts

The rulers in the cradle of our country's liberty, Massachusetts, have the same disdain for the wishes of the lowly peons as the rulers of Arkansas have. They do everything possible to prevent the people from voting on tax issues.

KMK

Spitting Against the Wind

As it is in every State, here in Arkansas it is an extremely difficult & practically impossible task to reduce any kind of taxes. The full power & force of the government is utilized to stymie any attempts by the peons to in any way limit the amount of money that is sent in to fill the troughs of our rulers. I have only been living here for nine years; but I have already seen several attempts to remove property taxes met with a slew of dirty tricks by government employees and officials. They are so scared of allowing the people to vote on any tax reduction issue that they pull out all stops to prevent any such issue from appearing on a ballot.

The latest attempt to reduce taxes in Arkansas is an effort spearheaded by some fellow Arkansas Libertarians to have the sales tax removed from food and medicine. Rather than just benefiting the evil rich landowners, as a property tax repeal was portrayed, this would save everyone money. This effort is even endorsed by the Arkansas Democrat Gazette, the first time I have seen a newspaper in this state side with less taxes. Who could possibly be opposed to such an issue of fairness as not taxing the necessities of life (food & medicine)?

Government officials are scared to death to allow this to show up on the ballot and have gone through the petitions and tossed out several signatures based on technicalities that are never used to scrutinize ballot initiatives to raise taxes or increase the size of government. Luckily, the Axe The Food Tax group has until August 30 to acquire replacements for the signatures that the Secretary of State tossed out.

You can check out more info on this measure, and find out where to sign the petition at the group's web-site: www.FoodTax.org

KMK

No Sales Tax

Although sales tax is really a small percentage of the total price paid for an item, areas such as Texas, are able to generate a lot of sales activity by having tax free days. It again makes my point that anyone who says that raising or lowering taxes doesn't influence behavior (static analysis) is an idiot.

KMK

Government Accounting Standards

With the media and our rulers in DC piling on the story of creative accounting in the private corporate sector, it is important to put it into perspective. No corporation has been doing anything even closely approaching the insane accounting that has been routinely done by the people who control our lives in DC. Likewise, no corporation can possibly affect nearly as many people as the Imperial Federal Government does.

FoxNews has another good piece with some examples of how corrupt and incompetent the accountants are in DC, who handle trillions of dollars of our money every year. How soon do you think it will be before any of those responsible for these accounting frauds are paraded before the cameras in handcuffs, as are corporate executives? How about never? In fact, instead of prison time, which would be the fate of anyone in the private sector doing what our rulers do every day, our masters in DC will continue to receive raises and be re-elected forever.

KMK