IOUs From IRS?

I must admit that I hadn’t heard this rumor that Snopes.com debunks regarding all 2009 Federal tax refunds being in the form of US Savings bonds. However, after last year’s ridiculous situation in the PRC, where they did actually issue IOUs in place of refunds for state income tax refunds, it would be a natural progression to think that this nutty idea would be used by the IRS and our imperial rulers in DC.

For better and usually worse, there is a long history of California starting ludicrous tends that soon become national. Who knows? If the Chi-Coms refuse to loan us more money, it could very easily evolve into mandatory loans from the taxpayers. Again, as I’ve mentioned before, the PRC has been doing a similar thing with mandatory over-withholding of taxes from employees as a means of extracting interest free loans from them.

Labels: IRS

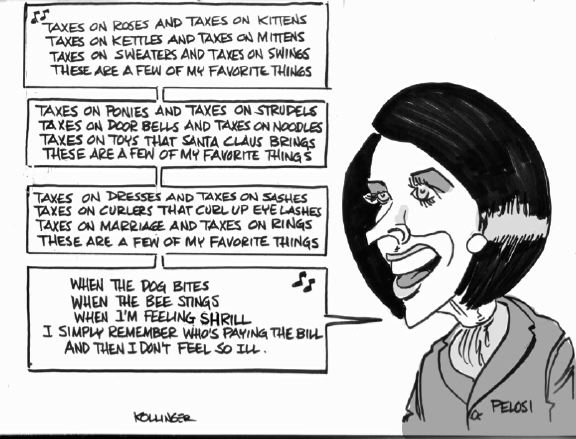

Prospects of Tax Hikes In the Near Future?

Good News:

Democratic Tax Dissent. Not everyone wants the Bush tax rates to expire. – The ridiculous use of the expiration date for the Bush tax cuts is still a ticking time bomb that will result in a humongous tax increase if they are not extended or made permanent by our imperial rulers in DC.

Bad News:

Voting for Higher Taxes. The real takeaway from Oregon’s recent referendum. – Proving once again that the Left Coast isn’t just California in regard to supporting suicidal Marxist policies.

Labels: TaxHikes

New 1040 Mailing Addresses For Some People

Taxpayers in Nine States and the District of Columbia File with Different Centers this Year – IRS’s annual re-shuffling of the Service Centers. The annoying thing is that, although our tax software usually gets this right for the current tax year, the previous years programs are still set up for the old Service Centers, so we need to remember to manually over-ride them.

This latest change affects taxpayers currently living in the following states:

Maine

Maryland

Massachusetts

New Hampshire

Vermont

Virginia

Indiana

Michigan

Alabama

District of Columbia

Remember, it’s where you live when you are filing the tax return that matters; not where you were living during the tax year of the 1040.

Labels: IRS

Building an Accounting Practice

Q:

Subject: Accounting Business Question

Mr. Kerstetter,

I read some of your blog posts by reading up on tax strategies on the internet and found your blog and posts very informative and interesting to read through. My question is less accounting based than many of your other readers.I guess a little background might help first, I am a single dad and currently a CPA who was a financial auditor in my former life. Not even a year after I received my Masters in Accounting I found myself at the brunt of a fairly awesome child support dispute at the worst time possible (due to the state of our economy), it effected my work product and I lost my job. I decided not to waste my education and find a way to begin my own accounting business providing bookkeeping and tax services.Long story short I was able to mediate a successful workable support agreement with the mother which will allow me to move to Nashville to be close to my son and to attend a night law school to bolster my legal and tax background so that I will be able to offer additional services in the future and potentially save my a** in case I encounter any additional legal troubles in the future (I was not prepared for how fathers are treated in family court).Anyway, In the mean time I will begin the slow task of acquiring new clients in Nashville. My question is this, can you give me any good tips on how to attract clients. I use TaxACT as my tax software and have began familiarizing myself with Quickbooks Accountant and Pro. I have a few clients but they were acquired simply by luck almost. I have a basic fee structure but how do I know if this is competitive or if I'm under/over charging, I was used to billing myself out at $200 an hour at BDO Seidman but that seems a bit much for a new CPA on the block plus it was audit work. If you know of any good books I could read or could offer any advice I would be more than appreciative. Also, how did you go about getting your own domain address for your email? Is it expensive?Thank you for any help you can give, it means a lot.

A:

I have discussed this a number of times in my blog; so you should search past postings.

I haven't changed my opinion that having an online presence, such as a blog, is the best way to develop a nationwide client base.

Giving free speeches to local service clubs is still the best way to grow a local client base.

Paying a marketing firm to steer clients to you is a waste of money. Those services are scams.

The right billing rate isn't an easy answer. I would probably start in the middle of the current rates for other CPAs in your area. That will give you room to raise your rates in future years as you become more proficient and the clients become more dependent on you.

In regard to the email address, most web hosting companies allow you to have 20 or more email addresses for each domain that you host with them. It's obviously a subjective issue, but I have always felt that someone is more professional who has an email address based on his/her own domain rather than using one of the freebie email services.

Good luck. I hope this helps.

Kerry Kerstetter

Follow-Up:

I will definitely look through your blog posts for the information you mentioned. Thank you very much for responding so quickly!

Labels: Accounting

Haiti Relief Donations Qualify for Immediate Tax Relief – IRS clarifies this recently enacted law.

People who give to charities providing earthquake relief in Haiti can claim these donations on the tax return they are completing this season, according to the Internal Revenue Service.

Taxpayers who itemize deductions on their 2009 return qualify for this special tax relief provision, enacted Jan. 22. Only cash contributions made to these charities after Jan. 11, 2010, and before March 1, 2010, are eligible. This includes contributions made by text message, check, credit card or debit card.

They also remind people:

Taxpayers have the option of deducting these contributions on either their 2009 or 2010 returns, but not both.

Of course, a year from now, there will be plenty of people who will very innocently accidentally deduct these same payments on their 2010 1040 as they total up payments made during the 2010 calendar year.

Labels: Charity

Making fun of the IRS Commissioner

From Late Night with Jimmy Fallon via NewsMax:

During a recent interview on C-SPAN, IRS Commissioner Douglas Shulman said he doesn’t do his own taxes because he finds “the tax code complex.” That’s like a surgeon saying, “You guys, blood grosses me out. So I don’t wanna . . . ”

From The Hill:

IRS commissioner doesn't file his own taxes – This is actually a misleading headline because the writer doesn’t seem to understand the difference between preparing tax returns and filing them with IRS. The Commissioner does file tax returns, but he uses a paid professional to prepare them. As embarrassing as this may be for the person in charge of enforcing this country’s tax laws, it doesn’t seem to be as bad as a Treasury Secretary or the Chairman of the House Ways and Means Committee who both intentionally cheat on their tax returns by omitting thousands of dollars of income.

Labels: IRS

Working with erroneous 1099 amounts

Q:

Subject: Taxable Prizes

Hi Mr. Kerstetter,

I won a prize during July 2009. The official rules posted in June stated the value of the prize to be $5,084. I received part of the prize in October 2009 and on that day I priced that model at a nearby store to be $3,010. About a month later I received the final part of the prize and I again valued it at the same store, $599. A total fair market value of $3,609. I contacted both the sponsor and the fullfillment company regarding the 1099 they will send me later this month. Both stated it would be for the amount posted in the rules and that if I disagreed I could dispute it with the IRS. I requested a copy of the invoices to see the actual fair market value of what the spent and they declined. The 1099 instructions state the FMV of any prizes should be used. So I am not sure how they are getting away with the fraud using average retail value when they had to actually order these items. Is my only recourse to wait to have the 1099 in hand and call the IRS to issue them a 4589?

Thank you

A:

You must either be trying to prepare your own tax returns or are working with a new inexperienced professional tax advisor because this is a very easy situation to deal with. I have had several similar cases over the years exactly like this.

There is no need to get into a fight with the company that awarded you the prizes over the 1099. It is standard practice for them to use as high a value on the prizes as they can justify for their own publicity purposes. They couldn't care any less about any tax problems this may cause you.

Only fools accept the figures on 1099s as gospel and use them unchanged on tax returns if there is good reason to suspect that they are incorrect.

As you should know, the legal burden of proving the accuracy of the figures on your tax return is on you. If you have done your homework and properly documented the true fair market value of the items you won as of the same dates, you can use those figures as your actual prize income. In fact, I would even attach copies of the documentation to your 1040 to avoid any IRS need to ask for it later on.

The way you avoid any problems with IRS not matching up their 1099 figures to your tax return is to use a backup schedule for Line 21 (Other Income) of your 1040. On it, your professional tax preparer should enter the full amount shown on the 1099 you received as a positive number. Below that, enter "Adjustments to reflect real world retail values per attached documentation" and enter negative numbers that will bring the net value into line with what you have determined to be reality.

I have done this literally dozens and dozens of times on client tax returns over the years, and IRS has never once disputed our adjusted values.

What you didn't mention or ask about are the deductions that you can claim due to your reporting this prize income. Prizes of the kind you received are in the same category as Gambling income. When you report gambling and prize income on Line 21, you are eligible to deduct gambling losses on Schedule A of up to the amount of the reported net winnings. Of course, these have to be legitimate and reasonable.

You can count all different types of gambling losses, including office pools, lottery tickets, raffle tickets, casinos, race tracks, as well as any entry fees for the drawing you won and other similar ones during the year. If you do a thorough enough job of documenting your losses, you may well be able to completely offset the income you are reporting on Line 21.

Again, you should be working with an experienced professional tax advisor who can ensure that these items are all properly shown on your tax returns.

Good luck. I hope this helps.

Kerry Kerstetter

Follow-Up:

Thanks Kerry - this is a great big help!Sincerely,

Let's all try 71% worth...

It’s long been a stupid cliche when athletes and others promise to give an impossible 110 or more percent effort towards their goals. I found it funny that IRS is only promising to try to answer 71 percent of calls from the tax paying public and that is considered a great goal.

If you are lucky enough to have your phone call answered after their expected average wait time of 12 minutes, there is then the issue of whether you will get the correct answers. The odds of that happening are most likely going to be the same as in the past; 33% to 50%. It’s like a lottery.

Of course, the double standard is firmly in place. If you were to file a tax return with the stated goal of being 71% accurate in your figures, guess what hell you will be faced with.

If that were acceptable, the fine print info above the taxpayer’s signature on Page 2 of the 1040 would need to be modified to read as follows.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are 71% true, correct, and complete. Declaration of preparer (other than taxpayer) is based on 71% of all information of which preparer has any knowledge.

There are a couple of lessons to be learned from this IRS announcement.

1. Those people who foolishly try to save a few bucks by not utilizing the services of professional tax preparers will be risking their necks even more than ever.

2. This same philosophy of striving for a 71% rate of answering the phone is what we can expect for our health-care after that entire segment of our society is socialized and IRS employees are put in charge of administering our medical treatment. A 29% death rate will be considered as a success.

Labels: IRS

IRS Regulating More Tax Preparers

H&R Blockheads. The IRS wants to save you from your rogue tax accountant. - Being subject to extensive regulation and continuing education requirements as a CPA, I can't share this writer's sentiment that IRS is overstepping its bounds by requiring other "mom and pop" tax preparers to be regulated and take update courses.

I do share the writer's sentiment that the trend towards having the State and Federal governments prepare tax returns for people is not a positive development because of the extreme conflict of interest that entails.

Urban legend still floating around...

I have addressed this hoax previously, but it is still being passed around the net, as in this email I recently received from a client in the PRC.

Subject: Senate Bill 2099

Kerry

Senate bill 2099 will require us to put on our 1040 federal tax form all firearms that we have or own. Do you know anything about this?

My Reply:

That's a hoax that's been floating around the net for about a year now. The 2009 forms are in place and they don't have anything for reporting firearms.

Snopes.com has a good explanation of it.

In case you haven't seen a copy of the actual 2009 1040, here is a blank one you can look at. You'll see that there is absolutely nothing about firearms.

Kerry

Follow-Up:

Thank you for the info.

Changing a corp tax year

I’ve been teaching myself how to improve the vidcasts, and here is the first one with the semi-new style. The built-in hyper-link to my article on corp fiscal years doesn’t seem to be working, so here it is.

Cash-rich real estate investors trigger bidding wars, frustrate other buyers – I knew that this eventually had to happen, as the large pools of investor money moved from the intangible and often phony assets in the stock markets to the real tangible assets such as precious metals and real property. This is a very good sign during these extremely confusing economic times.

Labels: realty

Lack of Estate Tax in 2010: Now Cheaper to Die? – Others are picking up on what I predicted back in 2001; that unless the law is changed, there will be a lot of mysterious deaths in 2010 as some heirs become overly aggressive in their desire to avoid the Death Tax.

Labels: DeathTax