Tax Guru-Ker$tetter Letter

Monday, September 30, 2002

Sunday, September 29, 2002

Loan Points

As I have said on many occasions, tax returns are more a work of creative art than cold calculating science. This is why a dozen different tax preparers can take the exact same data and come up with a dozen different looking tax returns, and all of them can be legally correct. There can be huge differences in the bottom line taxes. Which tax return is the "better" one depends on who you ask. The reason I have never taken part in those contests is because they almost always have someone from the IRS judging the results. Since my objective has always been to come up with the best tax returns for my clients, there is no way IRS would award me any prizes for coming up with the lowest possible tax numbers, when someone else can take the same facts and have a much higher tax.

One of the many areas in which there are variations in how to handle them on a tax return is loan origination costs, usually in the form of points, buy-downs or discounts. With the recently dropping mortgage interest rates, this is once again a timely topic. It was even the subject of Tom Herman's tax column in the Wall Street Journal this week. Since he didn't include the more beneficial way to deduct loan points, I felt the need to explain it once again.

Loan origination costs incurred for the purchase of a primary residence are fully deductible in the year the home is purchased. The following discussion deals with other kinds of mortgages.

It has long been a requirement to amortize loan points for residence refi's and for the purchase of business & rental properties over the life of the loan. Most people assume this to mean the nominal life of the loan, such as the standard 15 or 30 year term of most mortgages.

Since almost nobody keeps a loan for its full term, using 15 or 30 years is not a realistic way to account for this. For at least the past 20 years, I have been amortizing those loan origination costs over the expected life of the loan. I usually ask the clients what their plans are for possible future sales or refi's. If they don't have any specific plans, I use the statistical average of five years, because most people will either sell or refi within five years.

What this allows us to do is to deduct one-fifth of the loan costs each year for five years, which works out to be a deduction that is six times as large as someone who amortizes over a 30 year life. For example, if you had paid $3,000 in loan points, the expected life method would give you a deduction of $600 per year for five years, while the nominal life method would allow only $100 per year to be deducted. Since the time value of money generally makes a deduction more beneficial sooner rather than later, this is in the best interest of the clients. If you were to use a 30 year expected life of the loan, you would get tiny deductions in the early years and then a big lump sum in the year the loan is paid off, usually five years out.

Since five years is an estimated life, we obviously have to eventually adjust to reality. If after five years, the clients still have the same loan, we just don't claim anything in years six and on. What happens most often is that there is a sale or refi before the full five years, and we deduct the remaining un-amortized balance in that year.

I have had this method of amortizing questioned a few times by IRS during audits. Every single time, they agreed with my logic and allowed the expected life to be used. Never once has such a deduction been denied by IRS, and I have prepared thousands of 1040s using that method of amortization.

If you have already started an amortization schedule using 15 or 30 years, you are not stuck with it. While it is not usually enough of a difference to justify filing amended tax returns, you can do that. What I normally do when taking on new clients whose former preparers used the nominal life is to change the amortization period from that point on, as of the first tax return I am working on. Again, IRS has never once had any problems with that.

KMK

Saturday, September 28, 2002

Fighting Off New Taxes

Just to the East of us, the lying Governor of Tennessee and his partners in crime have been trying to sneak in a new income tax. Luckily, the message was spread by some talk radio hosts, such as Steve Gill in Nashville and it was defeated, for now.

Congrats go out to the foes of the tax, along with the hope that they never let down their guard. Tax & spend politicians are very patient and very sneaky in pursuit of their goal, to take as much money as possible from their subjects.

KMK

Tax Simplification

A few days ago, IRS announced that they have raised the threshhold for needing to attach Schedule B to 1040 forms. For as long as I can remember, if you had interest or dividend income of more than $400 during the year, you have been required to list the payers on Sch. B. With totals less than $400, you could just enter them directly on your 1040 without any requirement to show the details.

I assure you, I'm not just looking for excuses to disagree with IRS. I have no shortage of those. However, while I applaud their efforts to simplify things for taxpayers, I can't endorse this new plan, for basically the same reason I don't advocate electronic filing of tax returns.

IRS has become very efficient at matching up information documents received from payers, such as W-2s and 1099s, with income tax returns, and automatically kicking out notices when too little income is being reported. If too much income is reported, IRS isn't about to alert you to that.

While it is impossible to completely avoid discrepancies with IRS figures, I have found that a good way to minimize that happening is to attach a lot of details to tax returns, especially when you have something a little out of the ordinary. For example, I frequently attach Sch. B when the total interest or dividends is less than $400 because I want IRS to see how we arrived at our total. This is very important for jointly owned accounts, where we need to back out a portion of interest that is being reported by someone other than the person whose name & SSN are on the 1099. It is also important for nominal accounts, such as minor children, where a parent's SSN is on the account, but we are backing out the interest on Sch. B.

While some tax preparers do charge a certain amount per schedule or form, my computer program does all of that work; so I have always charged purely based on my time, regardless of how many different pages we have. By including the details of interest & dividend income, even when they are lower than the required amount (now $1,500), there is a very good chance that IRS will be able to match everything up at the Service Center and not need to send you or your client a discrepancy letter and bill.

Again, I have found that there are some tax preparers around the country who have a shortage of work after April 15; so they intentionally avoid attaching too much explanatory documentation to tax returns just to generate some off-season work responding to IRS notices and handling the audits that this causes.

KMK

Friday, September 27, 2002

Breaking Promises

One of the main areas in which I differ from my fellow Libertarians is the issue of term limits. They make the point that we do have terms limits in the form of the ballot box. That would be true if there were anything close to an even playing field in elections. It has long been a job for life once a politician has made it into office. The power of incumbency is next to impossible to beat, which is why 99% of them win each time they run for re-election.

Over the past decade, there have been some politicians who have actually had the nerve to take a voluntary term limit vow. They swear that they will only serve two or three terms and then they will retire. When it comes time to actually honor that pledge, guess what. With very few exceptions, they decide that their vow is no longer relevant, such as this joker in Colorado, Tom Tancredo. Having tasted the awesome power of the throne, there is no way they are going to go back to the real world in which we peasants are forced to reside. They know that, with the vast powers of incumbency, they can easily overpower any resentment over the broken promise.

I sincerely believe that if our founding fathers had known how our elected rulers would refuse to leave, they would have included formal limits to prevent this kind of royalty. That is what the Revolutionary War was all about, being governed by average real world people instead of lifetime royal rulers.

We now have 280 million people in this country. It is such extreme arrogance to believe that there aren't enough talented people among them to allow a constant supply of fresh faces in the Capitol. To say that the 535 rulers we have in DC are the absolute only ones capable of doing the job of ruling us peasants is no different from any other society governed by an elite few. I have much more faith in the people than do the worshippers of professional lifetime politicians. In fact, I would prefer a lottery to draw names for people to serve a two year term and then move back to the real world than continue being subjects of the career politicians.

A voluntary term limit pledge is as legitimate as a promise by a Clinton (Bill or Hill) not to run for President. What we need is a Constitutional amendment to limit the time any person can sit on the throne.

KMK

Thursday, September 26, 2002

Equality

You can be sure that, when you start hearing stories about the income & wealth gap, or the rich getting richer & the poor getting poorer, there will be some push to make everyone equal. This is accomplished in the ideal minds of Communists by redistributing the wealth from the haves to the have-nots. This entire logic is flawed on so many levels as to make me sick.

Equality in a free capitalist society means the equal opportunity for each person to avail him/herself of what the free market offers. It in no way means that everyone's results will be equal. The people who bemoan the big disparity in wealth conveniently ignore that there are some very good reasons for that inequality. In most cases, it is based on the choices people have made. The best example is with people begrudging the money some doctors earn. The truth is that very few of those envious people have the persistence or strength of character to do what it takes to make it through medical school to become a doctor. Those are sacrifices that most people just wouldn't do.

Why then is it wrong to reward the ones who do make those sacrifices well for their efforts? Why does some high school drop-out, who sits on his butt all day smoking cigarettes and watching Jerry Springer feel entitled to the same financial rewards as someone who went into hock up to his eye-balls and spent a decade in school? Worse still, why do our rulers feel justified in confiscating what the hard worker has and giving it to the lazy bum?

For an interesting take on making everyone equal, P.J. O'Rourke covered it well in this speech from 1997.

KMK

Poor IRS

Joseph Farah echoes the points I made last week about the idiocy of newspaper editorials feeling sorry for the IRS as being victims of an unwarranted witch hunt. Since my last piece on this issue, I have been asked about the comments in some of the editorials that the claims of IRS abuse have been discredited as false. This is just not true. The horror stories that came out during the congressional hearings were true, but were only the tip of the iceberg of IRS abuses.

As I have mentioned several times before, the IRS is still filled with Clinton followers and they are still harassing people and organizations that criticize the Clintons and their Fellow Travelers. Congress has refused to do a serious investigation of this for a number of reasons. First, just as with the huge amounts of evidence against Bill Clinton during his impeachment, most Congress-critters just plain refuse to even look at the evidence. It is also true that many of our rulers are themselves afraid of IRS retribution, as well as the classified information about them that was in the FBI files that the Clintons copied for their own blackmail use. Mr. Farah knows this all too well, because he and his organization have been the victims of the Clintons use of the IRS to punish him for daring to criticize.

As with anything such as this, it has to make you wonder about the overall reliability and truthfulness of any newspaper or media organization that would tell outright lies in support of more power for the IRS.

KMK

Wednesday, September 25, 2002

Missing The Point

There are some things that adapt well to the power of the Internet, and some that don't. I have always believed that real estate sales are a perfect match, especially for long distance searches. I wish the web were as well developed as it is now ten years ago, when we were shopping for property in the Ozarks from 2,000 miles away in the San Francisco Bay Area. It would have made the process so much more efficient for us as buyers, as well as for the several Realtors we worked with who had to waste a lot of time ferrying us to properties that were not suitable for our needs. I preached the benefits of using the 'net in all of the seminars I gave to Realtors around Arkansas, Missouri & Oklahoma.

It seemed like the real estate profession had been slowly but surely adopting the web. That's why I was disappointed to read this article that claims the National Association of Realtors is backing away from its policy of making more information available to the public. In a move that can only be described as paranoia, it sounds like they feel threatened by this openness and are retrenching and trying to prevent the public from having free access to too much information without having to work through licensed Realtors.

Any profession that is so paranoid as to try to force clients to get information through them, including some in the tax practitioner community, is doing a disservice to its clients. I agree with David Coursey that the web is too pervasive to allow such a monopoly to succeed. Forward looking Realtors will set up their own sites and leverage it to their advantage without the NAR.

KMK

When It Rains...

As if things haven't gone badly enough for Arthur Andersen - convicted of obstruction of justice, losing all of their auditing clients, facing years of investor lawsuits - they now have the IRS on their butts for their overly aggressive tax shelters. The security of a Big 8 (what it was when I was in college) CPA firm doesn't seem as attractive right now.

KMK

Tuesday, September 24, 2002

Truth - What A Concept

This is the first time I have heard of a TV station refusing to run an ad attacking a GOP candidate with lies about Social Security. Unfortunately, I'm not holding my breath waiting for that concept, of being truthful, to be applied to the liberal propaganda inherent in the newscasts.

KMK

Less Stress

I have to agree with this article that having pets around keeps things mellow. One of the big benefits of working at home is being able to spend time with our kids, which currently consist of five cats & three dogs, plus one llama. We no longer have any sheep, so there are no more baby lambs in diapers in the house, or the office, as was described in this 1993 San Jose Mercury article about my office in Fremont, CA. It must be working, because so far, I haven't had any heart attacks or strokes, common occupational hazards in the tax profession.

Of course, it also helps to keep your mind off of things rather than dwell on them.

KMK

Missing Out

Any serious user of the Internet knows that the difference between connecting via dial up modem and a broadband method is night and day. Living up here in the boonies, we could only dream of having access to anything better than the one slow dial-up service that is available to us. In fact, I have always made very clear to everyone that the main criterion for selecting a new place to live, if we ever sell our ranch, would be some place with access to either cable or DSL Internet. Late last year, I even came very close to opening another office, in downtown Harrison, just to have access to the cable Internet.

Since this January, we have been using the DirecWay two-way satellite. Overall, it has been great, allowing us to do things that would be impossible over dial-up, such as listening to & watching Rush Limbaugh's show. This came at the perfect time, because we can no longer pick it up via over the air radio.

The satellite has been very reliable, except for times when there are heavy clouds, which does happen about once a week. We had been pestering our local phone company for years to make DSL available up here. Even with the satellite, we still want DSL as a backup. Although our phone company just started connecting some customers to DSL, we have been informed that our line is well beyond the distance limits of DSL technology from the closest switching station. So, we have resigned ourselves to being satisfied with and grateful for the satellite. At $69.95 per month, I consider it a bargain considering the huge increase in productivity it allows. That is why it boggles my mind to see that so many other people around the country are refusing to sign up for broadband service, often for even less than we are paying. Unfortunately, if more people don't sign up, more of the broadband companies will be going out of business.

KMK

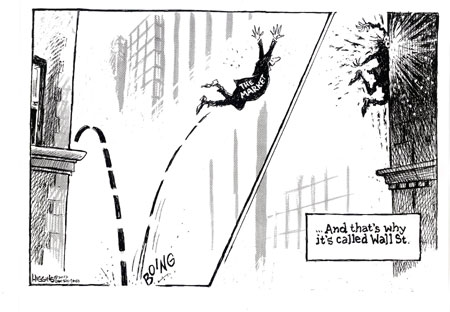

False Alarm

I have never taken seriously the concerns by the big government fans linking the stock market decline to the efforts to allow people to have some control over their retirement funds. As I have always said, and is echoed in this piece, only an idiot would put all of his/her retirement funds in high-risk speculative stocks. Practically any investment would yield a better return than the Social Security Ponzi scheme. In fact, in most cases, you could put your money under your mattress and still be better off than flushing it away with our rulers in DC.

KMK

Monday, September 23, 2002

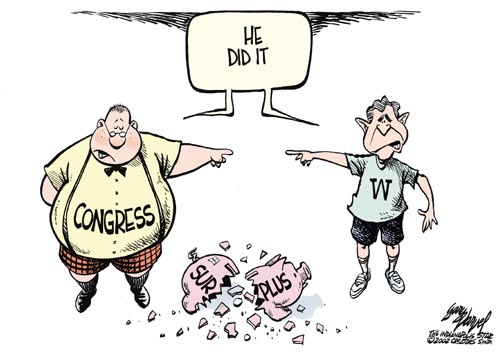

Tax Cuts Not Gonna Happen?

You can't say National Review doesn't have a breadth of opinion on topics, both on their main page as well as on their blog. Just the other day, they had an optimistic article by Bruce Bartlett on the likelihood of new tax cuts being enacted before the end of this year. Then, they have this piece from Joel Mowbray claming that there is no chance of that happening.

There couldn't be a better illustration of how disorganized our rulers in DC are than this. Of course, the possibility of heavy military action does change the national priorities somewhat. It also reinforces my constant warning to only act on tax laws that are really here and don't make plans on any that are promised.

KMK

Sunday, September 22, 2002

Governors' Fiscal Report Cards

The Cato Institute has just released its report card on the fiscal responsibility of each of the governors around the country. The report card's grading is based on 17 objective measures of each governor's fiscal performance. Governors who have cut taxes and spending the most receive the highest grades. Those who have increased spending and taxes the most receive the lowest grades.

This year, only two governors earned the highest grade of A: Bill Owens of Colorado (76) and Jeb Bush of Florida (67). Four governors received the lowest grade of F: Gray Davis of California (42), Don Sundquist of Tennessee (40), Bob Taft of Ohio (40) , and John Kitzhaber of Oregon (30). Our Arkansas GOP Governor Mike Huckabee scored a 52, for a "grade" of C.

You can also download the full 65 page pdf report.

KMK

Auto Leasing Exposed

Here is some more good information on why leasing vehicles is normally a big rip off for consumers, but very profitable for the leasing companies.

KMK

2003 Tax Rates

For those people who like to do some advance planning, I have posted the 2003 individual income tax rate schedules, plus the inflation adjusted amounts for personal exemptions and standard deductions.

I have also included more detail on the phase-outs of the personal exemptions and itemized deductions for the people who have been classified as unworthy evil rich by our rulers in DC. I also added this extra info for 2002.

This new info came courtesy of Research Institute of America.

KMK

Saturday, September 21, 2002

Equal Opportunity

I've been getting a kick lately out of Bill O'Reilly's rabid reaming of attorneys who defend slimeballs who they know to be guilty of heinous crimes, such as the recently convicted murdering pedophile in San Diego, David Westerfield. Bill's screaming fits are very entertaining and reveal a very real and passionate concern.

He has an excellent point and one that I have long agreed with regarding the morality of attorneys who see no problem assisting the scum of the earth escape justice for their vile actions. That is the very reason I stopped watching the David Kelly show, The Practice, a few years ago. The underlying theme of that show is that even the most disgusting dregs of humanity deserve the best legal defense possible. I just couldn't stomach rooting for the heroes of the show to use various legal tricks to help their evil clients go free.

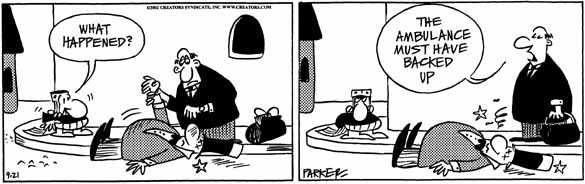

I have mentioned frequently that FoxNews is the only television network that has any credibility in terms of objective reporting of the news. As a relatively new network, they still have a problem attracting the top tier of advertisers and fill most of their ad slots with the same kinds of relatively sleazy vendors that are usually relegated to very late night on broadcast TV. So far, it seems that the ambulance chasing law firms that are recruiting clients for various negligence and class action cases haven't been very offended by Bill O'Reilly's crusade against unethical attorneys because they continue to buy time on FoxNews.

KMK

Auto Mileage Rates For 2003

Due to the slightly lower fuel prices as of June 30, IRS has announced the standard rate for business miles will be 36.0 cents for 2003. This is a half cent decrease from the 36.5 cents for 2002 business miles. Companies that base their employee reimbursements on the IRS rate have plenty of time to make the necessary changes.

In all of my almost 27 years in the tax business, this is the earliest I have seen IRS release their official mileage rates. It wasn't long ago that they were announcing their standard rates in late December or early January, causing a mad panic for everyone who uses that rate for such things as official reimbursement plans.

I don't mean to be a nitpicker here, but I'm not so sure that calculating the official deductible cost of operating a vehicle this early is realistic, especially in these uncertain times with the Middle East. The largest changes in the IRS rates have been caused by changes in the price of fuels. If a big war starts up in Iraq or other oil producing countries, and the price of gas skyrockets, IRS will either have to raise the official rate or people will need to use their actual expenses when calculating their vehicle deductions.

Of course, if there is a huge change in the price of fuels, we will probably see IRS issue a mid-year change in the rate, as they did in 1999, where it was 32.5 cents per mile from 1/1/99 through 3/31/99 and 31.0 cents per mile from 4/1/99 through 12/31/99. That makes taxes & accounting for vehicle expenses even messier than it normally is.

Likewise, there will be changes in some of the other IRS mileage deductions.

The standard mileage rate for use of a car for medical reasons will be 12 cents a mile. The 2002 rate is 13 cents a mile.

The standard mileage rate to use when computing deductible moving expenses will be 12 cents a mile. The 2002 rate is 13 cents a mile.

The standard mileage rate for the use of a car when providing services for a charitable organization remains at 14 cents a mile.

Again, this just illustrates the immense intellect of the IRS head honchos. They have been able to determine through their extensive research that vehicles cost less to operate for these other purposes than for business. This is quite different from the operating costs calculated by such unbiased sources as Hertz, who issue annual press releases claiming that it costs well over a dollar per mile to operate a car. Since my formal education in this area consists of nothing more than Auto Shop in high school, where we never covered this aspect of auto science, I have to trust the IRS brainiacs to steer us in the right direction.

KMK

Thursday, September 19, 2002

No New Tax Cuts

According to this USA Today article, Bush has admitted defeat in getting any more tax cuts through during this year. It doesn't say how hard he's going to fight to prevent the liberals from repealing the current 10-year tax reduction program.

KMK

AMT's Gonna Get Ya'

Those jokers who we've elected to run our lives from their thrones in DC are sure sneaky. The big humongous tax cut phases in over ten years. However, according to a recent study, most people will not actually receive any real savings because they will become subject to the dreaded evil alternative minimum tax. Originally designed to punish evil rich fat cats, it has slowly been creeping up to ensnare more and more middle income people.

This tax attacks W-2 earners more than those who are self employed; but it has the potential to be costly for almost anyone. Once again, the only group I'm aware of waging a serious fight against this insane tax is ReformAMT.

KMK

Wednesday, September 18, 2002

Fixing Social Security

Stephen Moore has another insightful look at the GOP's unwillingness to take on the necessary task of allowing people to have some control over their own retirement funds.

KMK

Terrorist Charities

I have frequently discussed how inefficient it is to donate money to a middleman charity, such as United Way, rather than directly to the organizations doing the real life charitable work. Even more important is the fact that those middlemen charities often pass your money on to groups that go completely against your personal beliefs.

A perfect example is PETA, which has been using some of its donations to fund outright violent terrorism. As an IRS certified charity, any political activity is technically illegal. However, with Clinton cronies still in charge of the upper levels of the IRS, there is little chance that they will be punished for this.

KMK

More Realistic Look At Tax Law Changes

I have ranted & raved for decades about how unrealistic are the analyses by our rulers in DC of the effects of tax law changes. They are always completely wrong, mostly because they use static analysis, which assumes that the real people in the country won't alter their behavior any in response to tax law changes. It's absolute garbage and only useful for the demagogues to do their own ranting & raving against letting people keep any more of their own money. Those are the imbeciles who, still to this day, blame the huge budget deficits on the Reagan tax rate cuts, when with perfect 20/20 hindsight, it is clear that those cuts stimulated the economy and generated twice as much in tax revenues as there would have been with the previous higher rates. Real life facts mean nothing to those people.

It has been a long uphill battle to convince our rulers to use a dynamic method of guessing future numbers, taking into account that people will change what they do as tax laws change, such as more business activity when rates are lowered. Now, it seems that some of our rulers will be looking at dynamic figures in addition to the worthless static ones that the liberals prefer. While this is definitely a step in the right direction, it must be pointed out that even the dynamic scoring models are nothing more than guesstimates. Changing from static to dynamic analysis will really be no different than changing from the WAG (wild ass guess) to SWAG (scientific wild ass guess) technique of financial forecasting. To date, nobody has come up with a truly accurate crystal ball to predict future government finances; which is why it will still grate on my nerves to hear people cite official government forecasts as if they are gospel.

KMK

Pyramid Schemes

Whether you call it a chain letter, a pyramid plan, or a gifting party, the concept is exactly the same. The first group of people will usually make some money, and then the supply of suckers dries up and the latecomers are out thousands of dollars.

There are technically laws against these kinds of scams, supposedly to protect the idiots walking among us. I'm a big believer in the Darwinism of finances and consider the rip-off to be a pretty effective punishment for being mortally stupid.

KMK

Slow But Steady?

Again, Bruce Bartlett is more optimistic than I am about Bush's commitment to lowering taxes. He thinks Bush is just being patient and taking his time to build an overall consensus for tax cuts, in the same manner as he's doing to round up support for the war on Iraq.

Maybe Bush is timing things for the two months at the end of the year when the GOP will control the Senate if Missouri can actually elect a living Republican instead of a dead Democrat, as they did two years ago.

KMK

Creative Way To Make A Point

Here's a group that came up with a creative way to illustrate their displeasure with the huge amounts of pork in the Federal budget, a rolling porkermobile.

In a perfect example of beauty being in the eye of the beholder, I can't say that I can agree with what this Socialist group, TrueMajority, considers to be pork and what is necessary government spending. They want to cut the defense department fat and move it to welfare programs, for a net savings to the taxpayers of exactly zero.

I have to take a hard line approach on this. If it's not something that is authorized by the US Constitution, then the Federal government has no right to spend any money on it. Defense of the nation is the number one responsibility of the Feds. Welfare is not something our founding fathers wanted the central government being involved in.

KMK

2002 California Tax Rates

The FTB has issued a revised tax rate schedule for 2002 individual income taxes. It's difficult to find on the FTB website, so I have uploaded the pdf file with the updated 2002 tax rates to my site. There is also a link to this schedule on my main website. I noticed several searches for it over the past few weeks.

I want to thank the fine people at Spidell Publishing for sending me the pdf file. They have long been the premier authority on taxes in the PRC.

KMK

Tuesday, September 17, 2002

Double Taxation

Bruce Bartlett is absolutely correct that the system of taxing profits from C corporations twice (first at the corporate level and again as dividend income to the shareholders) is completely immoral. The fair thing to do would be to either eliminate corporate income tax altogether or make dividend income tax free. That's not likely to happen, given the popularly held belief that corporations are inherently evil and not worthy of any tax breaks whatsoever.

Just a reminder, this is really only a problem with very large corporations that have a lot of shareholders who are not involved in the operation of the business. For small closely held corporations, it is easy to avoid double taxation by paying the shareholders in ways that are deductible expenses for the corporation, such as salaries, leases and royalties.

KMK

Nailing Scam Protestors

Lew Rockwell has ticked off many in the tax protestor movement by saying the exact same things I have always said; that they are idiot scammers whose advice will land you in the pokey.

KMK

Too Much Truth

Just when you think the GOP has sprouted a backbone and is willing to step up to the plate on serious issues such as the Social Security scam, they wimp out again. As I have explained on several occasions, one of the fundamental methods for the SS system to be able to stay at least partially solvent is for beneficiaries to die before receiving any payouts. That was why the official retirement age was originally established as 65 when the average life expectancy was just 57, when the SS system was established in the 1930s. Most people are supposed to pay into the imaginary trust fund throughout their working lives, and then kick the bucket before taking any money out. The unclaimed funds are not considered to be part of the decedent's estate and are essentially forfeited. This is why self controlled accounts are so much fairer.

Certain ethnic groups are known to have lower life expectancies than others, making the scam even worse for them. However, it isn't politically correct to actually point out this fact. Using the term "reverse reparations" may have been a bit over the edge; but it is technically correct. GOPAC has caved in to the PC Police and is shelving their ads on this point. And it looks like the entire GOP is again chickening out from even discussing any changes to Social Security, especially any mention of private control.

KMK

Pro IRS Propaganda

The current wave of slanted media hype to try to drum up support for more IRS power is underway. These two stories are fairly typical of the lies that the media tell in order to make the public feel good about an even more powerful IRS. Besides their love of big government, which obviously needs as much money as possible, my only guess for the motivation for these puff pieces is a desire to avoid IRS audits. I can only assume that it is working because, if one of these people is ever subjected to the same kind of torture IRS inflicts on millions of regular people each year, they would be sure to bitch about it plenty.

Cheating

The media love to portray everyone as a tax cheater, with a big powerful IRS the only way to prevent that, such as this piece that claims 24% of people don't consider cheating on taxes to be a mortal sin, based on some idiotic non-scientific survey. This is just pure crap. As I see every single day, rather than pervasive cheating, most people overpay their taxes because of ignorance of readily available tax savings breaks and/or sloppy bookkeeping.

Hamstrung IRS

This sob story for the poor IRS cracks me up. Supposedly, they were the innocent victims of a witch hunt in the 1990s and have been unable to do their job effectively ever since. This is another big fat steaming load of crapola. The big congressional hearings about IRS abuses only scratched the surface and, just like every disclosure of government waste, everyone has a big laugh and then it's back to business as usual. Have the Feds stopped paying $600 for toilet seats after that came out in a hearing? Not a chance. IRS is still operating in the exact same abusive and incompetent manner as when those hearings were held.

KMK

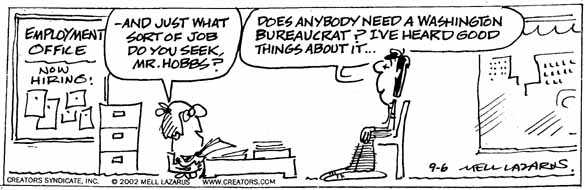

Bigger Government

It's often difficult to tell the two big parties apart, especially when Bush's solution for fighting terrorism is adding yet another big expensive bureaucracy. More Federal employees. Much higher costs and taxes to pay for them. Less effectiveness. How is this any different from what Gore would have done?

KMK

Simon's Tax Shelter

Some of the details on the kind of controversial tax shelter PRC gubernatorial candidate Bill Simon has allegedly used have been published. Note the tone of the article; that the shelter is an illegal fraud. The truth is that it has not yet been determined to be illegal. IRS is claiming that it is fraudulent, as they like to do with almost anything that can help people hold onto their own money.

I am not defending this particular shelter, and I have no hands-on experience with it. However, it is not right to automatically take the side of the IRS in disputes such as this. Unfortunately, that is the standard template for the media. With them, IRS is always right and anyone who tries to reduce his/her taxes is an evil scum sucking pig.

I'm still waiting to hear how the IRS personnel who illegally released the protected private information about Simon's tax returns will be punished. I'm not holding my breath. Of course, if an IRS employee had released private details about the liberals' man, Gray Doofus, the feces storm calling for the head of the IRS employee would be swift and loud.

KMK

Who's Better For Society?

This is an interesting look at the benefits of capitalism vs charity. It sounds a lot like the teaching to fish metaphor. Charity only helps a few people for a short time, while capitalism builds a structure to help others for a lifetime.

KMK

Cushy Retirement

Just as with the hypocrisy of our rulers in DC condemning the creative accounting done by some big corporations, while they themselves preside over the most corrupt accounting systems known to mankind, comes this similar contrast with expensive retirement perks. There has been a lot of press in the past few weeks over the former Chairman of General Electric, Jack Welch's very lucrative retirement package as recently revealed in a nasty publicized divorce battle.

I'm not about to defend such a lucrative corporate retirement plan for the top dogs. What has always frosted me is the misapplication of the concept of proper compensation for performance. A corporate executive who runs the company into the ground shouldn't be rewarded for that. He should be fired and never paid a dime more. The golden parachutes taken by the top guys from such failed companies as Enron and WorldCom are indefensible.

Likewise, it should be the same with our elected rulers. If they make things worse for their subjects, they shouldn't be rewarded with very expensive retirement benefits, paid for by the same subjects who were already screwed over when they were in office. However, life isn't fair, especially when the crooks themselves control the purse-strings of the treasury. Their retirement benefits are much more bountiful than most corporate executives can even dream of, including a much more generous payment plan than the Social Security Ponzi Scheme that the rest of us mere mortals are forced to participate in. This brings up the long running peeve of our rulers always exempting themselves from the laws they force the rest of us to abide by. Remember this when our rulers hold hearings in their efforts to dictate how private corporations should structure retirement plans for their executives.

KMK

Monday, September 16, 2002

PRC Third Parties

Things are getting even more exciting in the race for PRC Governor since I mentioned voting for a third party candidate. The Libertarian Party's candidate has been a bad little boy, spitting at a radio talk show host, and has had his official Party support removed. However, there are still some other choices available other than having to choose between Simon & Doofus.

KMK

Sunday, September 15, 2002

Tainted Donations

Charities that benefited from donations of pumped up stocks do have a bit of a dilemma. My take is that the idiots who paid such outlandishly high prices for dot-com & other fictitious businesses deserved what they got. Hopefully, the charities were wise enough to sell off those inflated shares as soon as they came in

KMK

Senators No Tax Pledge

While it is nice to see that some of the US Senators running for reelection, including our own Tim Hutchinson, are pledging to fight any tax increase, I have my doubts as to whether we can believe them. Doesn't anyone remember George H.W. Bush's famous pledge? As much as it pains me to say so, I think the Dems who refuse to make the no tax hike pledge are the more honest of the bunch on this issue.

KMK

Saturday, September 14, 2002

Not Everyone Is Scared

The GOP may be backing away from the idea of allowing people to control how some of their retirement money is invested; but there is a new coalition of business groups that is planning to fight for that choice. I couldn't find a website for this group, COMPASS. If anyone comes across it, please let me know.

KMK

Keeping Them Stupid

Continuing its erosion of personal freedoms, they are actually trying to make it a crime to home school kids in the PRC. They don't want to take a chance that some kiddies may reach adulthood without the proper indoctrination from the government brainwashers. If the PRC rulers get their way, any parents who actually want their children to receive a decent education will lose custody of those children. If this doesn't sound like Communist countries, I don't know what does.

In the small world category, the power mad California Superintendent of Public Instruction, Delaine Eastin, actually started her left-wing political career on the City Council of Union City, CA while I was living there in the 1980s. She was originally an analyst with Pacific Bell; but fell in love with running the lives of other people and controlling what all children are allowed & forced to learn.

KMK

Say No To E-File

IRS has ramped up its PR campaign to encourage us in the practitioner community to offer electronic filing of tax returns and will soon start a similar PR campaign aimed at taxpayers to pester their preparers to offer such a service. As I have written on several occasions, I do not believe that submitting an income tax return within the limited confines of the IRS's format is in the best interest of my clients; so I am once again refusing to participate.

KMK

Friday, September 13, 2002

IRS Audit Targets

I hope this announcement by IRS is correct, that they will start focusing their energy on going after those people who flagrantly violate the tax laws, such as tax protestors and users of off-shore accounts. It will mean they will have less time to harass those of us who obey the laws. Here are more articles about this IRS announcement from the New York Times and the San Francisco Chronicle.

Just another reminder that any mention of the "tax gap" of uncollected taxes is nothing more than a guess. By definition, such a number is impossible to know for certain. The bigger numbers attract more attention; so everyone latches onto them, when the real amounts could be just a small fraction of the $207 billion that they are guessing it to be. Of course, they could also be much higher; but that's not likely. When coming up with their numbers, IRS only uses gross revenues and ignores expenses and other costs that would reduce the actual unreported taxable income.

KMK

Leasing Vehicles

As I have described in depth before, leasing a vehicle is generally a big rip-off for several reasons, especially if you drive more miles than the meager allowances the leasing companies provide (5,000 to 15,000 miles per year). The leasing companies secretly build in an interest factor of between 20 and 30 percent, making it a much more expensive method of finance than a normal vehicle loan.

However, I did want to pass along a pretty good recap from the Wall Street Journal to use in deciding whether or not leasing your next vehicle is the best move.

KMK

Credits vs Deductions

As always in discussing tax matters, many people, including those in the media, don't understand the difference between a tax credit and a tax deduction. Even Rush Limbaugh, who is normally very accurate, frequently uses the terms interchangeably.

A tax credit is a dollar for dollar reduction in taxes. However, there are two types of credits. The most common type is the nonrefundable credit. This allows your income tax, but not your Self Employment tax, to be reduced to zero. Any credit above the amount needed to reduce the income tax to zero is essentially forfeited.

The other kind of credit is the refundable type. The most common example of this is the Earned Income Credit. With this, any excess credit after reducing your income and Self Employment taxes to zero can be refunded to you in cash.

Deductions, on the other hand, are used in calculating your taxable income. Your taxable income will determine the rates and amount of income tax you are assessed for the year. The amount of tax you save from a deduction is based on your marginal tax brackets. The higher tax bracket you are in, the more tax you will save. Conversely, if you are in a low tax bracket, your tax savings will be minimal. I tire of hearing people assume that a tax deduction will equate to a dollar for dollar reimbursement. That could only happen if they were in the 100% tax bracket, which thankfully doesn't currently exist in the USA. Of course, if certain people had their way, we would have tax rates that high.

Hybrid Vehicle Deduction

I mention this distinction yet again because of the recent IRS announcements regarding the special $2,000 deduction that is available to buyers of vehicles that use gas & electric hybrid forms of power. Too many people are treating this as if it's the same as a $2,000 rebate from the dealer. I'm sure people will, in their mental calculators, reduce their effective purchase price by a full $2,000, just as we are encouraged to do with mail-in rebates. Of course, I'm sure car salespersons will be misrepresenting this as equivalent to a $2,000 rebate in their sales spiel.

So, let's see how much a $2,000 tax deduction will actually yield a person in tax savings. As you can see in the tax rate schedules, the most common rates are 15% and 27%. Someone in the 15% bracket would have his/her taxes reduced by $300. A person in the 27% bracket would save $540 by claiming this special deduction. My understanding is that the three hybrid fuel vehicles that IRS recently certified for the special deduction sell for between $20,000 and $25,000; so the effective reduction in purchase price isn't really that much.

One of the reasons for the confusion around this special deduction is that there is also a special 10% nonrefundable tax credit available for the purchasers of qualified fully electric powered vehicles, with a maximum credit of $4,000. This is claimed with Form 8834.

IRS Announcement

Purchasers of the following new vehicles can claim the special $2,000 deduction. This one-time deduction must be claimed for the year in which the vehicle was first used.

Honda Insight for model years 2000, 2001 and 2002.

Honda Civic Hybrid for the 2003 model year.

Toyota Prius for model years 2001, 2002 and 2003.

Taxpayers can claim this deduction whether or not they itemize their deductions with Schedule A. For previously filed tax returns, taxpayers can file amended returns to claim this credit. There is no special IRS form for this deduction yet. You just write the $2,000 in the Adjusted Gross Income section on Page 1 of your 1040 (Line 32 on the 2001 1040) and attach a copy of your purchase receipt.

KMK

Thursday, September 12, 2002

Overly Optimistic

While I hope Bruce Bartlett is right about a chance for more tax cuts for investors, I don't see how that is very likely, given the attacks the current tax reduction plan is receiving. When so many of our rulers are calling for a repeal of the miniscule tax cut from last year, there isn't much chance for an additional tax break for the supposedly evil rich folks who make up the investment community, according to the mainstream media who do their best to influence public opinion.

KMK

Checking Your Own Work

Working pretty much independently, there is nobody to check my work for errors; so I have had to devise various methods to do that on my own. With tax returns, I will generally put the file down for a day & then pick it up later with fresh eyes as if I were reviewing someone else's work. It's amazing & a little scary how many small and sometime large errors I catch that way, especially on returns that were done very very late at night.

I have also developed a number of check figures with QuickBooks and Lacerte to make sure everything balances properly and nothing slips through the cracks. When adding up long lists of numbers, I always add from the top down and then again from the bottom up with a good old fashioned paper tape adding machine until I come out with the same total both ways.

KMK

Living Long Enough

This recent announcement that the average life expectancy in this country is 76.9 years shows that we have definitely made great progress in dealing with medical conditions. It also clarifies what a scam the Social Security system is for younger people. According to this, somebody retiring in 2030 would have to live to 110 just to get his own money back from the system. Maybe medical technology will allow people to make it that far; but not likely.

The only fair thing to do would be to make the participation in the Social Security system completely voluntary. However, as I have to repeated ad nauseam, don't hold your breath waiting for that to happen. If you want to protect your own retirement assets, and avoid flushing more money down the Social Security commode, there are steps that can be done on your own. While there is no one size fits all, I have found that the most effective way for most people, especially the self employed, is to utilize a corporation.

KMK

State Tax Problems

Victor Canto has an interesting look at the revenue shortfalls most State governments are facing and how they are poised to compound their problems by trying to raise tax rates rather than cut back on some of the spending programs that were established when their idiotic financial forecasters predicted an endless stream of increasing tax dollars for all time.

He also points out a very interesting observation. The states without a personal income tax have had either a much smaller decline in revenues and/or a slight increase.

KMK

Tax Heroes In DC

I'm not sure I would go so far as to categorize 202 members of the House of Representatives and 31 Senators as Heroes of the Taxpayer; but everything is relative in DC. The Americans for Tax Reform organization has tallied up how all of the Senators and representatives voted on the 20 most important taxpayer related bills in 2002. Those individuals with a "grade" of 85% or better are in the "heroes" ranks. You can see how your elected rulers stack up in this comparison.

KMK

IRS Differences

One of the many frustrating aspects to dealing with the IRS is how different things are handled between different areas of the country. For a national tax system, there is very little uniformity & consistency around the country. That wouldn't be a problem if you were always dealing with the same IRS offices. However, they have split their tasks up in such ways that contacting several different offices is just normal procedure nowadays.

For example, filing tax returns has long been broken up by geography. While I do work with clients in practically every state, most of them are located in the closest three states, each of which files with a different IRS Service Center. Arkansans file with Memphis, TN. Oklahomans file with Austin, TX. And Missouri residents file with Kansas City, MO.

Back about a month ago, I filed over 80 extension requests (Form 2688) for clients' 2001 1040s. As I always do, I separated them by Service Center and put the ones going to the same Service Centers in the same envelopes, which seemed like the common sense thing to do. Just yesterday, many of the approved extension forms came back to me via snail mail. A large envelope from the Kansas City Service Center contained ten approved 2688s. However, there were 54 separate #10 envelopes from the Memphis Service Center, each one containing a single 2688. As Sherry said when she saw that, "Our tax dollars at work." I know the Postal Service needs all the money it can get, but this is ridiculous. We obviously know which Service Center has more common sense.

I don't want to be completely negative about our friends at IRS. I do want to express my appreciation for the unusually quick turn around of the 2688 forms this year. Normally, they all come back marked as Approved some time around November. This makes attaching them to the 1040s that were due on October 15 a little difficult; so I normally just attach my photo-copy of the form that was mailed in. While some of the returns for which 2688s were received yesterday have already been completed, most of them haven't.

Appeals

If an IRS audit doesn't go well, that isn't the end of the line. IRS has long had an Appellate Branch that is supposed to allow a second, and impartial look at the facts of the case. While the Appeals Officer is technically an employee of the IRS, s/he is supposed to look at the facts objectively and give both sides equal consideration. Here is where I have seen a huge discrepancy between jurisdictions.

Before moving to the Ozarks in 1993, almost all of my work with IRS Appeals Officers was with those stationed in San Francisco. I have to say that those people understood the mindset they needed to review cases. I was able to present my clients' side of the case and in the 15+ years of handling cases there, I estimate I won about 98% of them at the Appeals level. Most of the time this was simply because the auditors were morons and the Appeals Officers knew it.

Since relocating to the Ozarks, and having to deal with Appeals Officers in Little Rock and Oklahoma City, there couldn't be a bigger difference in attitude. Rather than start from an objective open minded "Show Me" attitude, these Appeals Officers literally rubber stamp the opinions of the auditors, even those that are blatantly idiotic and wrong. Battling this built-in bias, I have only been able to win about half of the cases I have worked on with Appeals since moving here. While this may sound like I'm just being a sore loser, that isn't the case at all. It is a very real difference in attitude and approach that has severely hurt my faith in the entire Appeals system within IRS.

Ironically, I found that I'm not the only one upset with the Oklahoma City Appeals Office. I was speaking with an IRS Auditor out of the Fayetteville, AR office a little while ago and I was explaining to him how frustrated I was getting with the Appeals Officers. To my surprise, he said that he & his fellow Fayetteville auditors were also unhappy with the way they are treated by the OK City Appeals Officers after the merger a few years ago of control over Arkansas into the Oklahoma City office, in one of the IRS's many reorganizations (Titanic deck chairs?). He said that all of the policies & practices that had controlled the Arkansas offices were tossed out and replaced by those developed by Oklahoma. This is just like the situation in corporate mergers, when the dominating company crams its policies down the throats of the vanquished employees. However, it also illustrates how varied the policies for a national tax agency are.

I have recently spoken with other tax practitioners around the country who have noticed similar variations between Appeals attitudes in different IRS offices, often within the same state. We are trying our best to work cooperatively with IRS; but this sure makes it difficult when rules and procedures are interpreted so differently by so many different IRS offices.

KMK

Wednesday, September 11, 2002

Tax Cuts Or Out

I like the tone of this piece by Bruce Bartlett. The GOP needs to get off their collective butts and support tax cuts or they can expect low turnout of their supporters this November. That's exactly what happened to Bush 41 in 1992 after he raised taxes and refused to lower capital gains taxes. GOP voters don't take kindly to tax cut wimps.

KMK

Tuesday, September 10, 2002

Don't Hold Your Breath

As I have long warned, if you are waiting for our rulers in DC to fix the Ponzi Scheme called Social Security, you're nuts. It's money down a rat hole; and unless you take steps to structure things differently, you will continue to pour thousands & thousands of dollars right down that hole. True to its reputation as the deadly third rail of politics, our rulers, of both parties, are once again chickening out from the task of the major surgery that is essential.

KMK

Peter Jennings

I'm glad I wasn't the only one who noticed Socialist ABC NewsReader Peter Jennings' admission on David Letterman's show last week. Unlike most liberal media folks, who pretend that they have no bias, Jennings came right out & admitted that he dislikes the USA. He claims it was because his parents hated the USA and it was in his mother's milk. He also admitted that he is able to earn a ton more money here in the USA than he ever could in his dear homeland of Canada. When I didn't see any mention of this in the Wahoo Gazette's recap of the show, I thought I might have imagined it; but Brent Bozell heard it as well.

One of my vivid memories of last September 11 was Jennings' constant haranguing of George W. Bush; including outright calling him a coward for not returning directly to the White House as soon as the attacks started. That was before we got FoxNews on our satellite dish; so ABC was the clearest signal we received at the time. I now no longer watch any news except FoxNews and only have to see lefty journalists, such as Jennings, Brokaw & Rather, when they appear on Letterman's show.

I have been a huge fan of Dave's since the beginning of his NBC show in 1982. My only complaint is the constant stream of left wing Bush bashing newsreaders & politicians as guests. However, I realize it's Dave's show, and if he chooses to have slimeballs like SerpentHead James Carville or Bill Clinton on, that's what the Fast Forward button on my VCR remote is for.

KMK

There Is A Choice

The upcoming PRC election for governor is shaping up to be a real nose holder. Bill Simon's campaign is literally imploding by the day. NOTA isn't available. Rather than vote for the lesser evil or sit out the election, there couldn't be a better time to send a real message to the duopoly political parties and support a real alternative, such as the Libertarian Party.

Unlike most states, where the LP has almost no visibility on the ballot, the Libertarian Party of California has been growing and is fielding a candidate in almost every race, including Gary Copeland for Governor. Part of his campaign platform that is near & dear to my heart, and hopefully to my readers, is his call for an end to the state income tax. He wants the only taxes that the state may collect to be use taxes and fees for services.

To have that many Libertarian candidates on the ballot is still only a dream for us here in Arkansas. I hope plenty of people appreciate having an alternative choice out there on the Left Coast.

KMK

Monday, September 09, 2002

Not Feeling So Charitable?

Is it any surprise, after the scandals with charities misrepresenting their intentions for special September 11 donations, that fewer people trust charities nowadays? They received huge sums of money and money does bring out the worst in people.

I like the idea that some charities are drawing up a donors' bill of rights that assures contributors access to information about a charity's finances to determine, among other things, that their money is being used for the purpose for which it was given.

I have always been a big supporter of charity. However, my advice still stands. Give your money directly to those charities that are helping to solve the problems you are concerned about. Avoid like the plague giving anything to United Way and other middleman bureaucracies that do nothing but get in the way and waste money. Our rulers in DC already have those tasks covered.

KMK

Truth Hurts

It's always amazed me how brazenly liberals lie and change their stories, especially in this day and age where practically everything is recorded. Of course, they have the aid of their accomplices in the mainstream media, who assist in the lies by refusing to point out the inconsistencies. However, with the broadening of access to different kinds of media via the web, those cover-ups are no longer as airtight as they used to be.

Over the past few days, Bill Clinton & his allegedly anti-war Fellow Travelers have had their own anti Saddam Hussein quotes thrown back in their faces.

Many members of the Clinton organized crime gang are currently running for their own seats of power.

Clinton's little munchkin, Marxist Labor Secretary, Robert Reich, is seeking the office of Governor of Massachusetts. In an example of convoluted logic, he is actually categorizing the use of his own quotes by his opponents as dirty tricks. There is even a website devoted to the flip-flops Mr. Reich has done in the past few years, ActuallyBob.com. In standard liberal fashion of suppressing opposing opinions, Reich is trying to have it taken down. The ironic thing is that the opposing opinions he is trying to stifle are or were his own.

Clinton's little munchkin, Marxist Labor Secretary, Robert Reich, is seeking the office of Governor of Massachusetts. In an example of convoluted logic, he is actually categorizing the use of his own quotes by his opponents as dirty tricks. There is even a website devoted to the flip-flops Mr. Reich has done in the past few years, ActuallyBob.com. In standard liberal fashion of suppressing opposing opinions, Reich is trying to have it taken down. The ironic thing is that the opposing opinions he is trying to stifle are or were his own.

KMK

Sunday, September 08, 2002

Using Tax Dollars To Fight Tax Cuts

As was expected, the taxpayer supported bureaucrats have gone on the warpath to try to derail the efforts to remove sales tax from human food and medicines here in Arkansas. As they did with previous efforts to remove property taxes, they are hiring expensive law firms to try to get the initiative tossed off the ballot and prevent the voters from having any say in tax matters.

It has always been a cruel irony that government workers see no problem with using tax dollars to wage an outright battle against taxpayers themselves. It is definitely a David vs Goliath battle, with Goliath having full access to the money and resources of the government.

As they did in their previous fights against tax reductions, the next step will be to brainwash the kiddies in their classrooms. They will be taught that tax cuts and anyone who supports them are evil and that, if taxes are ever reduced, the kids will be sold into slavery and fed nothing but gruel. It may sound ridiculous, but that is what happened when property taxes were under attack.

KMK

Saturday, September 07, 2002

Real Beverly Hillbillies

CBS has already received a lot of publicity over its plan to transplant a real hillbilly family from the sticks to posh digs in Beverly Hills. I must admit to being a little interested in this since we live in the Ozark Mountains among real life hillbillies, the fictional Clampett family was from near here, and the real life DogPatch is just a few miles away.

The response to the new show has already run the gamut, from Rod Dreher, who thinks it is racial exploitation of poor white folks, to Dave Shiflett, who reminds us that we have already had a real life version of a low-life white trash family transplanted from Arkansas to the lap of luxury. It's just like this coffee cup Sherry bought me back in 1993, with a picture of Bill & Hitlary as the Capitol Hillbillies.

KMK

Friday, September 06, 2002

No Sense Of Humor?

I have seen tons of other parodies of eBay around the 'net that haven't met with lawsuits from eBay. Why then are the folks at eBay threatening legal action against the parody I linked to earlier, spoofing Gray Doofus' selling of PRC legislation?

Haven't they heard that imitation is the sincerest form of flattery; or are they covering their rear ends to avoid the wrath of Doofus and his supporters? Either way, the eBay threats are generating a lot of additional exposure for eGray. I don't know if this site is related to the Bill Simon campaign; but I hope it's helping him. He sure needs all the help he can get.

KMK

NOTA

In most elections, it's a matter of holding your nose and voting for the lesser evil. I have long been a fan of the concept of including NOTA (None Of The Above) on every ballot. They actually have such a choice in Nevada. [No income tax, NOTA. Nevada is looking more attractive all the time.] In Tuesday's Nevada Democratic gubernatorial primary, NOTA actually came in second.

The only problem with Nevada's ballot rules is that it's more symbolic than anything. If NOTA comes in first in a race, the seat goes to the next human in line. I have always thought that if NOTA were to receive the most votes, nobody should serve in that office until the next election. There are far too many people trying to run our lives. The world wouldn't stop turning if there were one less in power. In fact, when people start to realize how little things have changed with NOTA in office, the trend could snowball.

KMK

Thursday, September 05, 2002

IRS Prosecuting Tax Protestors

It's a good sign to finally hear that IRS is at last cracking down on some of those who flagrantly violate the tax laws and brag publicly about it, such as employers who refuse to withhold taxes from their workers' paychecks. However, IRS is still not nearly as aggressive as they need to be to stop the spread of this bogus information.

While I don't intend to pick on the feeble minded, this is just too good to avoid. For example, there is one person in Atlanta, Doug Kenline, who has set up his own blog to describe his resistance to the entire income tax system and refusal to file income tax returns. I admit that I have been following his adventures after he called me some nasty names a few months ago for not endorsing his idiotic tax protestor schemes. He has described himself as pea-brained; and I have to agree with that assessment. He has actually posted copies of IRS letters that show all of his identifying information, including his Social Security number. I guess he hasn't heard of identity theft.

As it is with most criminals, I always wonder why they spend so much time, money & energy pursuing illegal goals, when they could probably do just as well if they were to channel that into legal activities. Doug has actually done a nice job laying out his blog, with links to several others in the tax protestor movement. They now refer to themselves as the Tax Honesty movement because of the negative connotations of Tax Protestor. It's like the casino industry adopting the term Gaming instead of the more accurate Gambling to describe themselves.

My gripe has long been with the IRS reaction to these tax protestor idiots. By ignoring them and allowing them to publish their bogus information unchallenged, it gives the public the impression that they are right. Most people interpret silence to equal agreement. I am as big a supporter of freedom of speech as you will find. However, that freedom doesn't include an unfettered right to tell lies and encourage the willful violation of laws. I have passed these sentiments on to the IRS on several occasions and they haven't been interested in pursing the matter. As everyone should know, I am not a friend of the IRS. However, they have a duty to defend the tax law from people who are recruiting others to violate it.

KMK

Motivation

I've always been a big believer in the power of money to motivate behavior. I'm going to assume that it is merely a coincidence with this case in Miami, where, 15 years ago, an 85 year old man promised his doctor a free trip to Europe if he helped him reach 100. The man did make it to 100, and the doctor is going to take the trip.

I hope this doesn't start some kind of bidding war for doctors' services, such as "How much is it worth to live long enough to see your grandkids graduate from college?"

KMK

PRC Smoke & Mirrors

Nothing new here. According to the San Jose Mercury and the Sacramento Bee, the rulers of the PRC are using accounting tricks that make Enron and WorldCom look absolutley honest by comparison. The recently passed budget is a complete pack of lies. Sweeping bills and expenses under the rug just means they will pop out to bite the taxpayers next year, after Gray Doofus has been re-elected. I'm so glad we no longer live on the Left Coast.

KMK

Government Workers

It has long been frustrating to know how different things are for government employees versus those of us in the real world. They receive very generous benefits and their pay is completely unrelated to performance. Automatic raises are guaranteed every year. It's almost impossible to be fired, even when going postal.

As this editorial says, our taxes have to go up to cover the higher cost of lower quality service from our government agencies.

KMK

Spamming The Spammers

Anyone whose e-mail is filled with moronic solicitations will appreciate Michael Kelly's humorous response to them. I especially like the way in which he utilizes the Nigerian money scam to offset other ones. Very clever.

KMK

Zero Capital Gains Taxes?

Bruce Bartlett does another very fine job explaining why in a true capitalist society, there would be no capital gains taxes. That is in essence taxing the tree, when the proper item to tax should be the fruit.

He also acknowledges that there is almost no chance of having capital gains taxes removed in this country because the left has done such an effective job defining capital gains as something that only evil rich people receive. As we are told constantly by our moral superiors, it is unthinkable to ever grant a tax break to evil rich people.

KMK

High Tech Begging

New technology brings opportunities to adapt them to ages old endeavors. Rather than stand on street corners begging for money, many are jumping on the 'net, setting up websites and actually receiving a lot of free money.

With copycats jumping in, even directly copying other websites, this will burn out soon. It will also be eye opening to the gullible donors when their tax preparers break the news to them that these kinds of donations are not tax deductible. Gifts to private individuals are not deductible; only to charities recognized by IRS.

KMK

Wednesday, September 04, 2002

Taxing Your Butts

I couldn't improve on the Wall Street Journal headline for this story of how states are going to extreme steps to ensure that they get their high taxes on cigarettes, even when their residents buy them from other states over the Internet. This is also the start of states taxing their residents for other things that they buy over the 'net.

I have said this several times before; but it never ceases to amaze me how a large group of people (smokers) can sit by so mildly and allow themselves to be persecuted so harshly by our rulers. The fact that the rulers are literally exploiting addicts' need for their drug (nicotine) makes this doubly sickening.

KMK

Understanding Capitalism

Too many people think that the main functions of big companies are to provide places to work for people and to support charitable causes. Neither is true. Their purpose is purely to legally earn a decent rate of return for their owners, the shareholders. If they can't do that, they should shut down.

I obviously had these cold hard facts of the capitalist corporate world drummed into me in my business classes in college. I'm not sure exactly where Joe Bob Briggs (aka John Bloom) learned this, but he has an excellent discussion of it in today's column. He mentions that, rather than function as jobs programs, the best corporate officers do everything possible to avoid hiring new employees. He makes the very accurate point that an ideally run corporation, the epitome of perfection, would earn income for its owners with zero employees.

If I didn't know better, I would have suspected that Walter Williams, the premier economics professor in this country wrote this piece. Well done.

KMK

Gutless Wonders

It has long been axiomatic that the topic of Social Security is the third rail of politics. Anyone foolish enough to discuss changing it will be zapped with 50 million volts of electricity and fried to a crisp. Bush started his term in office with a proposal to allow people to divert a very tiny part of the money that would normally be flushed down the SS toilet into privately controlled accounts similar to IRAs. While it was a very wimpy approach to a very big problem, it was at least a step in the right direction.

As always, any possibility of even one dollar less money being sent to DC for our rulers to control is met with sheer gloom and doom reactions from the liberals and their propagandists in the media. Each time the stock market drops, they love to scream that privately controlled accounts would suffer. As I have explained before, this argument is ludicrous because it assumes that everyone will put all of their retirement money into risky stocks. While some people will do this, most prudent investors will opt for safer alternatives, such as bank CDs.

Bush's brave attempt to broach the subject of personal control of retirement money has been stopped dead in its tracks and his fellow Republicans have been banned from even bringing up what they call the P word, privatization. I must admit that the GOP has an uphill battle in overcoming the liberal media bias and the difficulties in getting the truth out to the people. However, it would be nice to see the GOP with a bit more backbone. They cave in all too easily to have any confidence in their leadership abilities.

KMK

Tuesday, September 03, 2002

Laws For Sale

I have mentioned on several occasions how the best possible investment any business can make is a political donation (aka bribe) to our rulers. A few thousand dollars results in millions back in special tax breaks or other consideration. Somebody has put up a parody of that in eBay style, eGray, with PRC Governor Gray Doofus auctioning off special legislation. Nice job.

KMK

Progressive Pricing

I have long said that the one of the biggest of many oxymorons in the government is the term "Progressive" to describe the income tax rates we are charged. In truth, they are actually penalties. If you do well enough to progress into a higher income level, our rulers confiscate a much higher percentage of your income than if you earned less. Joseph Farah has an amusing analogy to illustrate how idiotic & unfair this concept it; having car dealers charge you different prices for the same car based on your income.

Ironically, the normally very candid and hard hitting Mr. Farah fails to mention the historical derivation of the concept of using "progressive" tax rates. It is directly out of the Communist Manifesto. I guess it's the fear of being branded as a Joseph McCarthy that so many people, including Rush Limbaugh, are afraid to point out how many of the ten planks in the Communist Manifesto have been implemented in this country.

This is also a good place to mention the Flat Tax movement in this country. Many people are claiming that a single tax rate, as Steve Forbes proposed during his presidential campaigns, would be the ultimate panacea for all of the unfairness in our income tax system. While it would definitely be a big step in the right direction, I have refused to endorse this because it is a long ways from what we really need to fix things.

Forbes and his followers claim that a flat tax would allow everyone to file tax returns the size of postcards. That is so naive as to be laughable. While a single tax rate would make calculating the income tax on a specific taxable income figure a little easier, that won't make tax returns any shorter. All of the fun and games in the tax system are not in the tax calculation. They are in arriving at the taxable income number itself. What kinds of income are taxed? What kinds of things are deductible against the income? Exemptions for kids, etcetera, etcetera, etcetera. To believe that our rulers are capable of devising an income tax system without a ton of different rules for calculating taxable income is as realistic as believing that we can make the sun rise in the West. It is impossible.

The only solution to the current income tax fiasco is to repeal the 16th Amendment and completely eliminate all income and estate taxes. End it, not mend it; to borrow and twist one of that racist hustler Jesse Jackson's rhymes he uses whenever a government welfare program is threatened.

KMK

Monday, September 02, 2002

Libs Want Our Money

No surprise here. The liberals are predictably calling for higher federal taxes. The easiest way for them to raise taxes is to stop the recent tax cut law before it kicks in. Having a ten year phase-in was idiotic because it always left the opportunity available for the libs to stop it cold before it could really do any good. They are basing the alleged need for higher taxes on more phony deficit predictions.

I only hope that Mr. Bartlett is correct in predicting that Bush 43 will have more backbone than his father did in standing up to the tax hiking spendaholic Congress. Bush 41 wimped out in 1990 and broke his "read my lips, no new taxes" pledge big time; leading to his defeat by the Clintons. A similar cave-in by W will lead to the exact same result, Clinton 44.

KMK

Sunday, September 01, 2002

More Creative Accounting

While the corporate world has been receiving a lot of attention for strange accounting tricks, and I have been sure to remind everyone of even worse shenanigans by our rulers in government, the problems are even more widespread. Let's not forget about the big charities, such as United Way.

A few years ago, I triggered a ton of hate mail for daring to question the value of a middle-man charity that has no other purpose but to pay for a big bureaucracy and send some of the donations to smaller charities which are worthy in United Way's eyes. I still believe that donations are more effective if you cut out the expensive middlemen and send your money directly to the charities you believe in.