Using Section 179

Q:

I appreciate your web site. I am trying to complete a homework assignment and have found your web site a great help for my income tax class.

This is my problem,

Lori, who is single, purchased a copier (5-yr class property) for $31,000 and furniture (7-yr class property) for $42,000 on May 20, 2003. Lori expects the taxable income derived from her business (without regard to the amount expensed under sec 179 to be about $100,000. Lori wants to elect immediate sec 179 expensing, but she doesn't know which asset she should expense under sec 179.

a.) determine Lori's total deduction if the sec 179 expense is taken with respect to the copier.

b.) determine Lori's total deduction if the sec 179 expense is taken with respect to the furniture.

c.) What is your advice to Lori?

This assumes that sec 179 is at $25,000 not the increased $100,000.

According to your site, there is a limit of one maximum. Does that mean Lori can claim either the copier or the furniture and not both even if the cost for both were below the maximum?

I would appreciate your help if you have time.

Thanks,

As a rule, I don't answer homework questions. However, you mentioned something that has me concerned that others may also be misunderstanding the rules for claiming the Section 179 expensing deduction.

I'm not sure where you are getting the idea that it can only be claimed on one asset per year per tax return. That is not the case at all. In fact, I often prepare tax returns where the Section 179 section of Form 4562 says "See Attached Schedule" and several different items are listed on a backup schedule.

Whatever the limit is for the year ($25,000 or $100,000), it can be used to cover the cost of dozens of individual assets for the year.

It is also not an "all or nothing" application. As an election, you have the right to claim nothing under Section 179 for the year, or perhaps only part of the total that can potentially be claimed.

You also have the option of dividing the allowable deduction among the different assets acquired during the year. For example, you could claim $10,000 against the copier and $15,000 against the furniture. You would then depreciate the remaining cost basis of each asset over its useful life.

Normally, if maximum deductions are the goal, when one asset has a longer class life than another (such as seven vs. five years), it makes more sense to use Sec. 179 on the asset with the longer life.

I hope this clears things up for you. Good luck in your class.

Kerry Kerstetter

Labels: 179

Selling Converted Exchange Property

Proving once again how tax laws are so wide open to different interpretations, I received the following from a 1031 exchanger on the Left Coast in response to my earlier posting on this topic.

Hi, saw your post in the blog re the change in the new tax bill that just went into effect, disallowing the capital gains exclusion for sale of a personal residence within 5 years of its acquisition via 1031 exchange. I am wondering how you interpret the language "...sales or exchanges after..." the effective date of the act. Why mention exchanges? Are they trying to say that if the exchange took place prior to the effective date, this doesn't apply? If the intent is to make it apply immediately to all such sales, regardless of when the 1031 exchange took place, why mention "exchanges" at all in this phrase?

Regards,

My reply:

I have to agree with the FEA's interpretation of this provision (which I will forward to you) that it would apply to any residence disposition after the 10/22/04 enactment date of the new law. My guess is that the law mentions "sales or exchanges" in relation to the disposal of a residence in order to include non-cash transactions, such as someone swapping a residence for another property. Such a deal would be considered a taxable event based on the fair market value of the other property received and would not be eligible for the Sec. 121 exclusion, even if the original property was acquired prior to 10/22/04.

It would obviously be nice if properties acquired prior to 10/22/04 could be grandfathered in and allowed to use the tax free exclusion; but I have never seen any language allowing that to happen.

I hope this helps.

Kerry Kerstetter

Labels: 1031

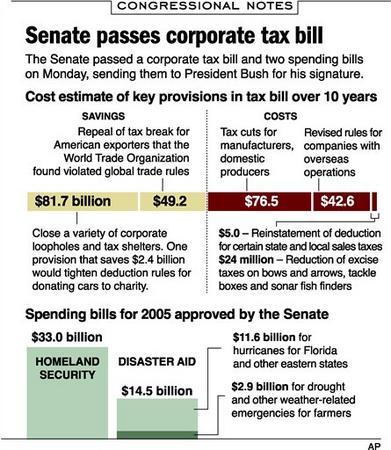

USPS Gets Nothing From Senate Tax Bill - Could it be because an organization that already has a legal business monopoly, can raise its prices in the face of declining quality of service, and can already count on taxpayer dollars to bail out its ineptitude, doesn't really deserve any more breaks?

Deductions For Hybrid Fuel Vehicles

Q:

Dear Tax Guru: Could you please advise whether you are aware of whether the clean fuel deduction for hybrid vehicles is or will be available in 2005 for the Ford Escape hybrid? I know that the Toyota and Honda hybrids are eligible. Thank you in advance for your time.

A:

As you probably know from the IRS website, they have only officially endorsed the Honda and Toyota models for this special deduction. I'm not aware of which other vehicle models IRS is working on for future eligibility. If anyone would be extremely interested in having the Ford Escape qualify, it would be Ford. I checked their website and can't find any mention of their working toward this goal. I would think that this would be a big selling point for them; so if they aren't discussing it as a possibility, they are probably not pursuing it.

After my earlier message to you, I did a search on www.AutoBlog.com and found several articles about the Ford Escape; but none of them mentioned it qualifying for the special tax deduction.

That's all I can see on this issue.

Good luck.

Kerry Kerstetter

IRS probes NAACP leader's speech - Don't expect anything to happen here. Leftist charities are allowed to get involved in politics without any repercussions all the time. If it had been a conservative organization doing this, it would obviously be a very different story.

Check 21 Takes Effect Today

Snopes.com has a good explanation of how the new rules are supposed to work.

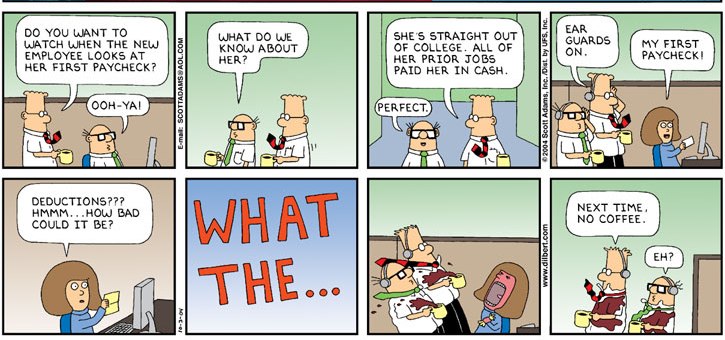

It Was A Surprise To Some People

Not everyone was aware that the Section 179 deduction was going to be reduced for SUVs, as per this email I received.

Kerry

I was reading your tax law on section 179 that was updated on Oct 27. I was surprised to see that there is a limit of 25,000 on the claim for SUV's I thought this would have been valid through the end of the year. I am to purchase a 6008 lb vehicle tomorrow and my friend told me that this deduction has gone away but from your article it was reduced from the full

amount to a max of 25K.

If this correct and how did this get passed so quietly... I have not heard of this change at all till reading your document and my tax advise was not aware of it.

Please feel free to call or reply.

My reply:

The issue of limiting the amount deductible for buying SUVs wasn't actually a new thing. Ever since the Section 179 deduction was increased from $24,000 to $100,000, and people discovered its ability to be used for business vehicles weighing more than 6,000 pounds (a rule actually passed in 1984), environmental wackos started screaming bloody murder that this was encouraging people to buy evil gas guzzling SUVs.

Several months ago, there was a bill passed by a Senate committee with this new $25,000 limit for SUVs, but it never became part of an actual law. The law that was just signed by President Bush last week was mainly a stimulus bill, with several tax reductions. In order to achieve the normal goal of being "fiscally responsible," our rulers in Congress had to take away some tax breaks in order to offset the new ones they were establishing. This limit on deducting SUV purchases was just the thing to fit that need.

I guess the issue of adequate advance notice regarding this change is somewhat subjective. I know that for well over two full weeks prior to its enactment, there were all kinds of discussions about this very topic on several tax and vehicle websites. There was so much discussion of just this one item, that most people were ignoring the several other parts of that tax law, many of which are very good for those of us who believe in lower taxes.

Having been in this profession for as long as I have, I have yet to figure out any consistent rationale for the effective dates that our rulers in DC use for new tax laws. Sometimes, it is at the beginning of the following year, while on other occasions, it's as of the date the law is signed by the President. We actually have to consider ourselves somewhat lucky that we were given until Bush signed the law, because I have seen several laws over the past decades where similar kinds of restrictions were established effective as of some date several months prior to the signing, based on when a congressional committee inserted that provision into the law.

I hope this clears up any confusion you had over where this new restriction on deducting the cost of SUVs came from.

Kerry Kerstetter

Labels: 179

Donating Vehicles

I received the following from a client earlier this week:

My husband has acquired a truck that he would like to give to a church as a donation. The value of the truck is $10,000.00. He is wanting to know if we can donate about half of the value and except payment from them for the rest. Also, I can't remember if there is a cap on the amount of charitable contributions per tax year. I believe year to date we have given approximately $5,000.

My Reply:

There is no dollar limit on deductions for charitable donations. There is an annual limit of 50% of your AGI, with any excess carried over to the next year.

The rules for donating vehicles were just changed a bit last week in order to cut down on people claiming high Blue Book values for vehicles that were sold off by charities for much less. They don't actually take formal effect until 1/1/05; but following them now wouldn't be a bad idea as protection against IRS challenge.

If the charity turns around and sells the vehicle after you give it to them or sell it to them at a discount, they must give you a written statement of what that sales price was, which will become the fair market value for your donation. If you sell the truck to them for less than this amount, the difference can be claimed as a charitable donation.

If the charity actually keeps and uses the vehicle, the value will need to be based on an appraisal if more than $5,000 is being claimed, and other methods (Kelly Blue Book, newspaper ads) if the value claimed is less than $5,000.

Let me know if there are any other questions.

Kerry

Calif. Prop. 13 Update

Of the 58 counties in California, there are only seven left that will allow people to transfer in their lower property tax base from other counties.

|

|

|

|

|

|

|

The Fair Tax supporters have rebuttals to the arguments being used against their proposal to replace Federal income and estate taxes with a national sales tax.

CBO Releases Cost Estimates of ETI Repeal Bill - As with any such analysis, any resemblance to real life is purely coincidental. Their static analysis methodology has long ago been so discredited that believing any of their predictions is crazy. Their entire presumption that tax rates cuts always cost the government money are ridiculous because the Reagan tax cuts proved that lower rates encourage more taxable economic activity and higher overall revenue.

Group Asks IRS to Investigate Use of American Heart Association Logo - More proof that some people have way too much time on their hands.

IRS Nails More Tax Scammers

JUSTICE DEPARTMENT SEEKS INJUNCTION AGAINST OHIO MAN WHO ALLEGEDLY SELLS IRS "DOCUMENT DECODER" SCAM

"Free Money" From the Government

For those who don't recognize this guy, it's that wacko Matthew Lesko who does commercials promoting his books on how anyone can get free money from the government. The fact that the more money our rulers give away to some people, the more they have to take from the rest of us, doesn't seem to be of any concern to Mr. Lesko.

For those who don't recognize this guy, it's that wacko Matthew Lesko who does commercials promoting his books on how anyone can get free money from the government. The fact that the more money our rulers give away to some people, the more they have to take from the rest of us, doesn't seem to be of any concern to Mr. Lesko.

Dems bash GOP on national sales tax plan - They don't like the idea of giving up the huge power over our lives that the income and estate taxes give them.

Summary of newest tax law

NATP has a good 13 page pdf summary of the tax law that was signed into law last week. Pages 7 & 8 have the changes in Section 179.

Labels: 179

Are Europeans Lazy? No, just overtaxed.

And John Francois Kerry and his Fellow DemonRat Travelers want us to be more like the "more sophisticated" Europeans.

CA Man Gets Prison Term for Harassing Female IRS Agent - Sending fake poisons through the mail is not the way to deal with a problem auditor.

Indiana group assists anti-war tax protesters - As I've discussed on several occasions previously, I don't advise anyone following the lead of War Tax Resisters Penalty Fund. There are plenty of things we all don't like or support in the Federal government's budget. What would happen if we each held back that portion of our taxes that paid for those things we don't believe in? We would have even more chaos than we already have. That is what our elected officials are supposed to be doing on our behalf; deciding how to spend tax revenues.

IRS News On OIC

Check Carefully Before Applying for Offers in Compromise - One of the many popular topics in spam is from scammers promising to wipe out past tax debts. They are as credible as the other kinds of spam.

IRS Revises Offer in Compromise Application Form; Now Available for Use

Thumbs Down For QB Simple Start

I finally had a chance to try out the newest version of QuickBooks, Simple Start. Unfortunately, it turned out to be even worse than I had suspected it would be based on the descriptions of its features.

Here are some of the notes I made as I was testing it, both with the program's sample data as well as a new company file I set up myself.

There are almost no setup preference options to customize things, which is a crucial feature of QB to allow it to work more efficiently, especially in regard to reports. Supposedly, some of the Preference settings can be changed in the full QB program by us professional accountants and then the file sent back to the client to use in Simple Start. This is just plain stupid.

There is no Accountant's Review feature; so clients have to stop using their company files while their accountants work on the copy they are given. This is no better than with Quicken.

No Classes, although the P&L screen says that you can show columns by Class. Even Quicken has Classes, which is where I learned how useful they can be.

Can't show more than one window.

No ShortCuts or Navigators windows.

The only good feature I could find was that the backup is as good as with regular QB; with one compressed QBB file.

Bottom line, this is just a crippled QuickBooks program, with fewer features than even Quicken has. I give it a thumbs down and advise staying away from this program and just using QuickBooks Basic.

Whichever geniuses at Intuit who thought this crappy program was a positive addition to the QuickBooks product line should get their resumes ready.

Expert Stock Pickers

This is similar to the dart board picks that the Wall Street Journal used to compare with those made by high paid professional advisors. More often than not, the dart board's picks beat the pros in terms of return on investment.

Bush's Tax Cuts Are Unfair ...To the rich.

Thomas Sowell takes on the Tax cuts for the rich! class warfare mantra of the Left.

Dealing With Life-Changing Events

For Libertarians, Candidates Offer Little Choice

The States Want to Tax a Tax! - This isn't an entirely accurate description of what some states are considering. They are proposing adding postal services to the definition of what is subject to their sales taxes. This is just one more item that many states are adding to the taxable side of the equation in their search for additional revenue. If some states had their way, every single economic transaction would be subject to the sales tax.

States Betting on Gambling Proposals - Stupid people deserve to pay their fair share of taxes.

Phony donor duped St. Mary's College in big scam. $121 million pledge tied to real estate scheme, report says - Not a smart move by the college; spending money before it has been actually received.

Money is Money?

Some less than ordinary cash payments that weren't very welcome to the recipients.

100,000 Pennies Saved Are 100,000 Pennies Spurned

Old bills create fuss at Taco Bell

SUV Deduction Limit Not As Low As Many Think

I was just reading the latest Federal Tax Bulletin from Kleinrock and their example of the new limited tax deductions for business SUVs illustrates that things aren't as bad as many have been worrying about.

The example in their newsletter is of a $70,000 SUV purchased new in 2005. On top of the $25,000 Section 179 deduction, the owner can also claim the 50% additional first-year depreciation of $22,500 based on the remaining $45,000 cost basis. With the normal $4,500 depreciation for a vehicle, the total cost of the SUV that can be deducted in that first year will be $52,000, with the remaining $18,000 deducted over the following four years.

The big differences to keep in mind are that the 50% additional first-year depreciation is only available for brand new business assets, while Section 179 can be claimed for anything that is new to the taxpayer, including items previously owned and used by someone else.

Labels: 179

Tough Call

It's hard to know which is more frightening; the thought of this elitist snob, who despises people who actually work for a living and considers herself a saint for spending money she inherited, as First Lady, or her gigolo husband in the Oval Office.

Tax Free Home Sales

There are obviously tons of items in the just signed tax law that are of interest to various groups of people.

One that is of great interest to us has to do with people who sell homes that were originally acquired as part of a 1031 exchange. Effective tomorrow, the tax free exclusion of up to $250,000 of gain per person is only allowable if the property was originally acquired more than five years prior to the sale. The seller would also need to meet the test of occupying the property for the requisite two years.

Here is the actual text from the new law:

SEC. 840. RECOGNITION OF GAIN FROM THE SALE OF A PRINCIPAL RESIDENCE ACQUIRED IN A LIKE-KIND EXCHANGE WITHIN 5 YEARS OF SALE.

(a) IN GENERAL- Section 121(d) (relating to special rules for exclusion of gain from sale of principal residence) is amended by adding at the end the following new paragraph:

`(10) PROPERTY ACQUIRED IN LIKE-KIND EXCHANGE- If a taxpayer acquired property in an exchange to which section 1031 applied, subsection (a) shall not apply to the sale or exchange of such property if it occurs during the 5-year period beginning with the date of the acquisition of such property.'.

(b) EFFECTIVE DATE- The amendment made by this section shall apply to sales or exchanges after the date of the enactment of this Act.

This doesn't change or even codify how long a property has to be used for rental, business or investment purposes before it can be converted to a primary residence with no tax consequence. It only says that the Section 121 exclusion is not available if the home is sold in less than five years after its original acquisition.

This will put the property owners in a tricky situation. If it is being used at the time of sale as a primary residence, the entire gain will be taxable, including the deferred gain that had been rolled into the property via the 1031 exchange.

Since primary residences being disposed of are not eligible for 1031 exchange treatment, my initial reaction to this scenario would be to advise the property owners to consider converting the home back to rental usage for as long as possible prior to the sale and then set it up as a 1031 exchange into new rental property that can then be later converted into a primary residence.

This game plan would obviously be a lot of hassle; but the taxes could be substantial if these steps aren't taken. Obviously, the property owners should work with their personal tax advisors to crunch their exact numbers to see if it makes sense.

Labels: 1031

Q:

Good Morning!

I have read some of your responses to the 179 deduction and I appreciate you taking the time to help others make wise tax decisions. I have had a stellar year as an employee I have paid a small fortune in taxes to federal and state. I have also been fortunate to sell some stock options and cashed out a deferred comp plan. My taxes due next year are quite significant. As of this week I have formed a single member LLC and will be purchasing heavy machinery over 6,000 GVWR. The business will no doubt take a substantial loss this year due to the lateness of the year and startup expenses. Is it possible that my gross income including the stock sale is too much whereas disallowing me the opportunity to use the 179 deduction to its fullest? Is it possible that AMT could limit the amount of deduction I can take for the 179 deduction.

Again thank you for being so helpful in sharing your knowledge.

A:

There is no high income phase-out for the Section 179 deduction that is claimed on the front of the 1040, as it sounds like yours would be. There is a phase-out for those who claim it on Schedule A, normally as an employee expense.

If you didn't catch the news today, the Section 179 deduction for business vehicles weighing under 14,000 pounds has just been lowered to $25,000 from the $102,000 maximum we had previously.

AMT is the most difficult tax to calculate without some actual number crunching. Capital gains and stock options can trigger the AMT. You should have your personal tax advisor run your numbers for you to see if that will be the case for you.

Another, probably less expensive, way to get a preview of your 2004 taxes is to get a copy of one of the cheapo 2003 tax programs, such as Turbo-Tax, and enter your 2004 figures. It won't be exact; but it will give you a pretty good ballpark idea of where you will be.

Good luck. I hope this helps.

Kerry Kerstetter

Labels: 179

The Wait Is Over

Bush Signs $136 Billion Corporate Tax-Cut Bill - The new limit for business SUVs under Section 179 will take effect tomorrow, October 23.

More Details: Bush Signs $136B Corporate Tax Cut Bill

Here is the actual text of the provision limiting SUVs to $25,000:

SEC. 910. EXPANSION OF LIMITATION ON DEPRECIATION OF CERTAIN PASSENGER AUTOMOBILES.

(a) IN GENERAL- Section 179(b) (relating to limitations) is amended by adding at the end the following new paragraph:

`(6) LIMITATION ON COST TAKEN INTO ACCOUNT FOR CERTAIN PASSENGER VEHICLES-

`(A) IN GENERAL- The cost of any sport utility vehicle for any taxable year which may be taken into account under this section shall not exceed $25,000.

`(B) SPORT UTILITY VEHICLE- For purposes of subparagraph (A)--

`(i) IN GENERAL- The term `sport utility vehicle' means any 4-wheeled vehicle--

`(I) which is primarily designed or which can be used to carry passengers over public streets, roads, or highways (except any vehicle operated exclusively on a rail or rails),

`(II) which is not subject to section 280F, and

`(III) which is rated at not more than 14,000 pounds gross vehicle weight.

`(ii) CERTAIN VEHICLES EXCLUDED- Such term does not include any vehicle which--

`(I) is designed to have a seating capacity of more than 9 persons behind the driver's seat,

`(II) is equipped with a cargo area of at least 6 feet in interior length which is an open area or is designed for use as an open area but is enclosed by a cap and is not readily accessible directly from the passenger compartment, or

`(III) has an integral enclosure, fully enclosing the driver compartment and load carrying device, does not have seating rearward of the driver's seat, and has no body section protruding more than 30 inches ahead of the leading edge of the windshield.'.

(b) EFFECTIVE DATE- The amendment made by this section shall apply to property placed in service after the date of the enactment of this Act.

Labels: 179

The Committee For Justice is giving away some very cool bumper stickers that will still be quite useful around here long after the upcoming election. You can order yours here.

This is an excellent analogy for the Social Security system. Fewer and fewer workers supporting more and more retirees can only have one result.

If he's so willing to give up all decisions over our national security to the United Nations, how is this not possible?

California-based “corporation sole” and “claim of right” programs halted - Another scammer out of business. The Feds are racking up a good number of scalps.

Buried treasure dug up - This woman's investment plan actually beat many stock market investors. She put $50,000 into a hole in her backyard in 2001 and got back $50,000 three years later.

Fair Share & More. The rich are doing their tax-paying part — and then some

Bush Has Until November 2 to Sign ETI Repeal Bill - But he could sign this into law as early as tomorrow, which means the new Section 179 limit for vehicles weighing less than 14,000 pounds will kick in.

Labels: 179

Exchange Questions

A number of issues came up in this email I received recently.

hello, i am writing from rural grayson county, virginia (mouth of wilson 24363). i own 3 small tracts of land. i would like to sell about 2 1/2 acres off 2 of these (5 - 6 A total)to get cash to begin restoring an old log house on one of them. it will either become my primary residence or a rental property. can i take profits from the sale of the land and put them into restoration and avoid capital gains? even though this is small stuff every penny counts!

also, the 3rd lot (2 acres) i just purchased last spring to protect the view from the old house--can one take capital gains exchange retroactively?

if so, for how long?

thanks for your help1 i am a wee small citizen who knows naught about this stuff.

My Reply:

I'm afraid I have to be the bearer of bad news in regard to your proposed plans.

1. The one kind of real estate that is absolutely not eligible as a replacement property is one that will be used as a primary residence.

2. Reinvesting exchange proceeds into improving existing structures is not allowable either. In some cases, the exchange proceeds may be able to be used to construct an entirely brand new structure on property that was previously owned; but even that is a gray area of 1031 exchanges.

3. Reverse exchanges, where the replacement property is acquired before disposing of the old one, are possible. There are different ways to structure them, including the IRS's safe harbor of parking the new property with an unrelated third party. Whichever way is used, it must be set up ahead of time. If you have already taken title to the property, it is too late to try to go back and change that to be part of a 1031 exchange. IRS calls that an "afterthought" because you thought of doing the reverse exchange after you had already bought the new property.

I'm sorry to spoil your plans. Remember that I don't make the tax laws. I just do my best to interpret them for real people in the real world.

You can see many more details on how to properly set up a legal 1031 exchange at www.TFEC.com

Good luck.

Kerry Kerstetter

Labels: 1031

Our fire department had its first chance to use the new foam sprayer in a real life situation this afternoon on a pickup truck that had caught fire while pulling a trailer with two horses on Highway 43. It took them only two minutes to put out the flames, saving the truck's bed and the trailer. The driver got the horses out as soon as he pulled off the road into one of our firefighter's driveway; so there were no injuries. The foam sprayer performed excellently and it was good not to see the same kind of results of a similar fire several months ago, when nothing was left but a burned out shell of an SUV.

By the time Sherry and I reached the scene, all of the flames were out, but there were still plenty of soap suds, as can be seen in these pictures Sherry took.

More Missouri Tax Fishing

It's not just from the IRS that we need to be on the alert for bogus tax notices. I just sent this email to a client, with a CC to the Missouri DOR:

Thanks for sending me the copies of the recent notices you received from the Missouri Department of Revenue claiming that you owe them taxes for the years 2000, 2001 & 2002. I'm assuming you sent me copies of everything you received from them, which makes these notices completely ridiculous and extremely unfair and illegal on their face.

When I have seen such claims of unfiled tax returns made by other states, such as California, they have included copies of W-2s or 1099s showing the income that they consider to have been earned inside their state. These Missouri notices give us absolutely no idea of how their tax calculations were made or what income they consider to be Missouri source.

It appears that the State of Missouri is increasingly desperate for tax revenues and is trying to pick on nonvoting out of state residents as an easy source of cash. Sending such bills without proper documentation of the underlying income that they are assuming is subject to their tax is insane. I'm sure they are banking on the shotgun approach to this scheme, assuming that enough people will just send them the money without taking the time to demand a proper explanation.

To straighten this out, I advise calling them at the number on their notices, or writing to them, and demanding that they send you complete written documentation of what they consider to be Missouri source income. We can then review your records to see if they are correct or not and take any steps that may be appropriate to correct the situation. This may possibly require us to prepare one or Missouri non-resident income tax returns, along with amended Arkansas returns to claim credits for the Missouri taxes.

I would contact the Missouri DOR myself, but they would probably insist on having a formal power of attorney authorizing me to act on your behalf, which I would be glad to do; but your contacting them directly would be faster. I am sending them a copy of this email and will be posting this on my blog to let them know that we will not just send them money without proper documentation.

To refresh your memory, here is my blog posting from earlier this year about similar notices some of my clients had received from the Missouri DOR. Those notices didn't have actual dollar amounts of taxes shown.

http://www.taxguru.net/2004/08/missouri-tax-fishing.html

Please provide me copies of whatever information you are given and I will check it against your tax return records.

Good luck.

Kerry

No Secrets After Death

I've often discussed the benefits of using a living (aka revocable) trust instead of a will to take care of things after passing away. Saving on probate costs alone makes it one of the best investments around.

One of the other big differences is the ability to keep your very personal information private. Living trusts are confidential documents and are not available to the public. That's not the case for wills, which become public record after a person dies.

TaxProf Paul Caron has an excellent page of links to celebrity wills that anybody can check out. While we may all get a kick out of gawking at the private lives of celebrities, how would you feel if your will were open for scrutiny by anybody in the world, including your neighbors, friends, co-workers, and relatives?

Myth About Section 179

I received this follow-up to my earlier message on Section 179 deductions:

Thank you very much for your reply. There are some accountants out there that think section 179 expires December 31, 2004. Was there any truth to this?

Thanks again.

My reply:

There was never any chance that the entire Section 179 was going to be eliminated.

Before this new law, the schedule was for the maximum Section 179 deduction for 2005 to be $102,000 + a COLA for inflation. It was then scheduled to drop to $25,000 in 2006.

I'm not sure how the rumor that Section 179 was ending on 12/31/04 got started, but I have heard it a lot; not just from you.

You can see more on this on my website:

http://taxguru.org/incometax/Rates/Sec179.htm

Kerry Kerstetter

Labels: 179

New Issue of Tax Watch Now Online From Tax Foundation - You can download this interesting eight page newsletter here as a PDF file

More states explore tax breaks to benefit organ donors

Teresa's Taxes, Continued. The super-rich really are different.

Tax Relief Awaits Owners Of Commercial Property - There has been too much focus on the negative aspects of the soon to be signed tax law (limiting vehicle Sec. 179 to $25,000). There are some good things in it, such as this change in the depreciation life of leasehold improvements from 39 years to a much more reasonable 15.

And the Budget Says . . . the supply-siders were right all along. - Larry Kudlow.

The tax man and the debt collector team up

THE HEINZ KERRY TAX MYSTERY

Labels: 179

Retirement Planning

The following email I received hit on a hot topic that I have discussed on several occasions; but warrants another warning.

Hello, I've been enjoying your site the past few weeks after I stumbled upon it. I think I originally hit it when reading up on the impending doom of Social Security.

I live in Northern CA (Bay Area), married with 1 child and another on the way. I'm 35, so still planning on at least 20 yrs until "retirement."

I bring that up, b/c I've recently come to the conclusion that my 401(k), while not a bad deal, is a sweet tax "scam" for the govt if I continue building on a nice nestegg...i.e. all these tax "savings" on pre-tax contributions will be quickly wiped out by taxes during the distribution years. So I've been thinking that although the Roth isn't perfect, I'd be better off only doing 401k up to max of employer match, then going other after-tax routes, particularly the Roth.

But you do raise some concerns re: Roth. With that being the case, are you a proponent of retirement vehicles like annuities, or various whole life products?

Just curious...and again, I enjoy your site.

Regards,

My Reply:

I'm glad you are finding my websites useful.

I'm afraid that advising on the best retirement savings vehicles is far too personalized a task to be able to be accomplished in this forum. You do need to work with an objective (not receiving a commission on product sales) financial advisor who can evaluate your family's needs and situation to come up with the best plan to meet your needs. Each type of retirement product has its own pros and cons to balance out.

While Roth IRAs are fine as just one part of an overall retirement plan, putting everything into them would be very foolish. My initial concerns from when the Roth IRAs were first enacted remain the same. Deferring current tax deductions - or worse still, paying actual taxes on IRA conversions - based on the promise of free pay-outs decades down the road is too much of a gamble for me to feel safe with.

Believing that our exalted rulers in DC will not tinker with that rule between now and when you retire is very naive. Maybe for those who are already in their late 50s or early 60s, that isn't as big of a risk. However, if for anyone younger than 50, I would be very careful trusting that you will ever see completely tax free Roth IRA benefits. I cringe every time I see someone set up a Roth IRA account for a very young child.

I hate to sound like a broken record, but the Social Security system was originally founded with the exact same premise. No deductions were allowed for the payments in, based on the promise of completely tax free benefits later on. As you may know, that was changed by our rulers with no regard for fairness and we currently have Social Security recipients paying Federal income tax on 85% of the benefits they receive, if they qualify as "evil rich" in the eyes of our masters in DC. Since that definition was set as any single person earning over $25,000 per year or married couple earning over $32,000 per year, a lot of evil rich people pay taxes on what was supposed to be tax free income.

My prediction is that there will be a similar "means test" established for owners of Roth IRA accounts, where benefits will be taxed for those qualifying as evil rich, a favorite target of our rulers.

I obviously don't have a crystal ball and do hope that I am wrong in this prediction; but past behavior by our rulers in DC leads me to no other conclusion.

Good luck in setting up your retirement plans.

Kerry Kerstetter

Section 179 Total Not Being Reduced

As with all tax changes, the misconceptions are flying around, as with this question I recently received.

Question: Could you let me know when will section 179 decrease from the current $100k deduction?My Reply:

The overall Section 179 deduction is not going to be reduced at all from its current level of $102,000 per year.

What is going to change is how much of that $102,000 that can be used for vehicles weighing between 6,000 and 14,000 pounds. As soon as President Bush signs the law, it will create a limit of $25,000 per year of the Section 179 that can be used for those vehicles. The new limit will take effect as of the date of signing.The other $77,000 can still be used for any other kinds of qualifying business equipment, including vehicles weighing more than 14,000 pounds.

I haven't yet seen an announcement of the exact day Pres. Bush will be signing this into law; but I'm guessing it will be very soon.

I hope this clears things up for you.

Kerry Kerstetter

Labels: 179

Deficit declines $100 billion - From Jack Kemp. People keep forgetting that deficit and surplus predictions are nothing more than WAGs (wild ass guesses) and really mean nothing. As I've said on too many occasion, the supposed Clinton surpluses were nothing more than pie in the sky forecasts based on the assumptions of no more economic downturns ever and a double-digit increase in the stock market for all eternity. Anyone who considers any predicted budget figures to be anything close to reliable is crazy.

Social Security Gets 2.7 Percent Boost - This could end up in a net loss for SS recipients because of the increased Medicare premiums that will be deducted, as well as the income tax on 85% of the full benefits (before Medicare deductions).

sKerry says the presidential election will decide the fate of Social Security - This may very well be true; but not in the way that Lurch means. If anyone's plans will destroy the Social Security program, it is the DemonRats'.

COURT STOPS FRAUDULENT TAX-RETURN PREPARER. Norfolk Preparer Used Sham Trusts to Claim Improper Deductions

L.A.'s Scary 'Cop Tax' Campaign Angers Critics - Different groups use different tactics to encourage new taxes.

Social Security Increase Announced - Not receiving as much publicity as the increased benefits is this bit of news:

The Social Security Administration also announced Tuesday that 9.9 million workers will face higher taxes next year because the maximum amount of Social Security earnings subject to the payroll tax will rise from $87,900 to $90,000. In all, an estimated 159 million workers will pay Social Security taxes next year.

People forget that the Social Security system is set up as a Ponzi Scheme, where all benefits being paid out come from the pockets of current workers. Higher benefits = higher taxes.

Give More to Your Heirs and Less to the Government - A good explanation of charitable lead trusts that I saw in the latest newsletter from the Institute For Justice.

Gambling Goes International on the Internet - Local jurisdictions have very little power to control their citizens' access to gambling over the internet.

COURT HALTS COLORADO COUPLE'S TAX SCHEME - The Feds nail another promoter of the Corporate Sole scam.

CALIFORNIA TAX-SCAM PROMOTER ARRESTED FOR CONTEMPT OF COURT - The Feds are finally getting tough with these promoters of scam tax evasion trusts.

The bogus $65 billion - It looks like Washington State politicians like to toss around completely fabricated statistics just like their DC counterparts.

Vote to give yourself relief from sky-high property taxes - In Washington State.

Donating a clunker won't be as good a deal after Jan. 1 - New law tightens up on abuses of charitable donations.

SCOURING TERESA'S TAXES

Club For Growth has a great little video ad, called "Fair Share," about how John & Teresa pay a much smaller percentage of their income in taxes than most Americans do. In typical DemonRat fashion, the billionaire Heinz-Kerry answer to that disparity is to raise the taxes even more on people other than themselves.

Everson Bullish on IRS Enforcement Despite Bleak Funding Outlook

Luxury SUV Loophole Curbed in ETI Bill - Remember that it doesn't actually take effect until President Bush signs this into law, which will probably be next week. The auto dealerships should be crowded this weekend with people trying to get in under the wire.

Educators Should Save Receipts for Reinstated Deduction - This small but useful tax deduction was extended retroactively to the beginning of 2004. The best way to make sure you are able to properly claim the appropriate amount is to keep track of all of your expenditures (cash, checks, credit cards, etc) with QuickBooks.

2005 Toyota Prius Certified for Clean-Fuel Deduction; New Law Restores Full Deduction Amount for 2004 and 2005 - This is one of the only deductions available for purchases of non-business vehicles. However, with the reinstatement of the itemized Schedule A deduction for sales tax for some people, there will be more tax breaks for individuals buying non-business vehicles.

QuickBooks 2005

As always at this time of year, a new annual version of QuickBooks is just around the corner from being released to the public. You can see what is new and improved in the 2005 programs here. As always, my advice to anyone considering taking the wise step of upgrading from an older version to hold off for another three or four weeks and then buy the 2005 program rather than getting the 2004 and being a year behind in state of the art.

I did receive my free trial CD of the new Simple Start version of the program a few weeks ago; but was too busy with the October 15 crunch. I'm hoping to take it for a test spin this weekend and will report on whether it makes sense or not. Believe it or not, as big a fan of many Intuit products as I am, they do put out their fair share of crappy programs that are a waste of time and money. My first impressions of this new program are not good; but that could be wrong.

Additional Extensions For 2003

As I've long said, it's much better to take your time and file as accurate an original tax return as possible than to rush and do a half-assed job that requires filing an amended return later.

This is even more important now than ever because I have noticed a recent trend in IRS starting full blown audits of tax returns where an amended return was filed requesting a refund of overpaid taxes. I will write more later about my experiences with this tactic, which is nothing more than an abusive and punitive fishing expedition by IRS, hoping to find other errors that can be used to offset the refund request.

So, rather than whip together an erroneous 1040 to meet today's deadline for the first additional extension request, it's best to send in another Form 2688. We just sent off 75 of them to the IRS service centers, requesting a new filing date of December 15.

We will probably be sending another 30 or so 2688s by Dec. 15, moving the due date to February 15, 2005 because of traumatic events in the lives of those clients (deaths, illnesses, etc) that have made it impossible to even start working on their 2003 income taxes.

QuickFinder has a good summary of the October 4 tax extender law. They also sent a new revised summary chart for their new Tax Planning book to take into account these recent changes. It was in the package with the CD-ROM version of the book, which I will install as soon as I finish the October 15 extensions.

IRS asked to probe sKerry appearance during church service

IRS Reminds Educators About Reinstated Deduction

Taxpayers in Non-Income-Tax States Could Benefit Under Federal Bill - Return of the itemized deduction for sales tax.

Dead Man Keeps Paying Bills - A downside to automatic payment plans. They don't stop when you do.

Nobel laureate calls for steeper tax cuts in US - Finally someone who understands the basic concept of tax rates. Lower rates give people more incentive to earn taxable income and thus produce higher overall revenue for the government.

More On Ownership Of Sec. 179 Assets

This is from early August (I said I was far behind in my postings).

Q:

I am starting a home business selling Herbalife nutritional supplements. I am a sole proprietor , but they send me a 1099 at the end of the year. Can I purchase a used minivan and a laptop for my business and then claim the whole amount on my taxes using the form 4562 section 179?

Can my name and my husband's name be on the title of the minivan, if he is not a partner on the retail merchant certificate ? Or does the title have to have the Doing Business name on it?

This is all new to me. I hope to hear from you soon. Thanks again

A:

How the assets are titled doesn't matter for tax deduction purposes. What matters is how they are used. You can deduct the cost of business equipment based on its percentage used for your business. For computers, it's based on time used. For vehicles, it's based on miles driven.

If the van weighs more than 6,000 pounds and is used more than 50% for business, it is eligible for the Section 179 immediate expensing election for the business portion. If it weighs less than 6,000 pounds, you have to depreciate it over five years.

You really should be using the services of a tax pro to make sure you do everything properly. Most tax pros who understand small business will save you many times more in taxes than their fee.

Good luck.

Kerry Kerstetter

Labels: 179

New law on its way to reality

It looks like the new law restricting the Section 179 deduction for vehicles weighing less than 14,000 pounds will be signed into reality this week.

Just a reminder that one way to double the allowable amount is still by using a C corporation.

Labels: 179

Sec. 179 Assets Placed In Service

From early September:

Q:

I have a sno cone trailer and equipment (about $10K in capital) that has been down two years out of three I have been depreciating (because the truck I was using died on me). This is a seasonal business, about 6 months of year (I do events in Texas).

Now I see this Section 179 thing and am wondering if I can buy a truck at end of year (2004) and take the deduction in 2004 for the entire thing ($30K). I will be able to get the business going again in March 2005.

A:

The Section 179 expensing election has been around for several years; but it's just recently been increased to the current level of $100,000+ per year.

One key requirement that has always been part of Section 179 is that the asset must actually be placed into service during the year for which you are claiming the deduction. In other words, you can't buy the new truck and claim any depreciation or Sec. 179 on your 2004 tax return if you don't actually start using it in your business until 2005.

What you may want to consider doing is reactivating your business before the end of this December and use the new truck to run business related errands, such as buying supplies.

I hope this helps. You should obviously consult with your own personal tax advisor for the best customized strategies for your case.

Kerry Kerstetter

Labels: 179

Disposing of Sec. 179 Assets

Q:

Dear Guru,

We had a good year in the business, and with no other equally plain and speedy remedy, have utilized the section 179 business equipment section to shed some excess income. We have purchased a good, but big, vehicle for business use. It burns a bunch of gasoline, and though it is a perfectly good vehicle in all other respects (Lexus), it is not at all fuel efficient. How long do we have to keep this vehicle? Does the IRS care?

A:

If you have a profitable business, you really should have a personal tax pro who can advise you.

In regard to disposing of your gas guzzler, the issue isn't how long you own it. If you deducted its full cost under Section 179, it now has an adjusted cost basis (aka book value) of zero. Whatever you sell it for, at any time, anything you receive for it will be taxed as ordinary income as depreciation recapture.

There is a way around this. If you trade the vehicle in on a new one valued at least as much as this one is worth, and don't receive any money back, you can roll the gain over into the new replacement vehicle. This would be a Section 1031 tax deferred like kind exchange, reported on Form 8824.

Good luck.

Kerry Kerstetter

Word Spreads

Q:

I heard that the section 179 maximum was being lowered right now by vote in Congress. Is that true and if so, how much?

Thanks,

A:

The overall limit of $102,000 for the Section 179 deduction isn't being changed.

What is looking like a possible change is the amount of that $102,000 that can be used for vehicles weighing between 6,000 and 14,000 pounds. That would be capped at $25,000 per year if this current bill makes it into law.

The remaining $77,000 would be available for other kinds of business equipment, including vehicles weighing more than 14,000 pounds.

Stay tuned to TaxGuru.net for the latest on this topic.

Kerry Kerstetter

Labels: 179

Ownership Of Section 179 Assets

I'm cleaning out my "To-Post" box of questions regarding the Section 179 expensing election, since the proposed change in the amount allowable for vehicles has attracted so much attention in the past week.

From a reader:

I am a partner in a LLC - does the automobile need to be titled in the LLC's name or in my name. Thanks

My reply:

It depends on where you want to claim the Section 179 deduction.

If you are claiming it on the 1065 for the LLC, where it will be divided among all of the members via their K-1s, the vehicle needs to be in the LLC's name.

If you own it personally and use it for LLC work, you can claim it on your 1040 based on the percentage of miles driven for that business. This will give the full deduction to you and it won't be shared with the other LLC members.

I hope this helps. Your personal tax advisor can be more specific for your situation.

Kerry Kerstetter

Labels: 179

Section 179 & Trade-Ins

This Q&A from about a month ago would be a little different if the pending law goes into effect limiting the Section 179 deduction for vehicles between 6,000 and 14,000 pounds to just $25,000 per year.

For anyone who hasn't picked up on it, I am dead set against this new limitation - not because I'm a fan of buying big vehicles just for their tax benefits (I am not) - but because it is unnecessary meddling by our DC rulers into the operations of small businesses. If small businesses are allowed to expense up to $102,000 of new business equipment per year, the owners should be able to decide how to allocate that amount. If they choose to blow most of it on big trucks and SUVs rather than other kinds of machinery and equipment, that should be their right. I know I'm being an idealistic capitalist here, in wishing for our rulers to stop trying to micro-manage our business decisions.

A reader asked:

Thanks in Advance for the advice.

In 2002 I put a vehicle into service and took the 24k first year deduction. I am interested in trading it in for a newer vehicle that would also qualify. Can you tell me how that is interpreted? Do I have to recapture my deduction?

Here are basics

2002 purchase $36,000

2002 deduction $24,000

2003 deduction $ 3,000

Value is approximately $23,000 now, but I have depreciated it to $9,000 (is that correct?)

Does this mean if I get rid of it now I would have to claim a $14,000 gain?

And if so, assuming I purchased something for $50,000 that would qualify for sec 179 would my first year write off be $36,000.

Thanks so much.

My response:

There is a difference between whether you trade your old vehicle in or sell it in a separate transaction.

Assuming a half-year's depreciation ($1,500) for 2004, your book value of the old vehicle would be $7,500. If you sell it for $23,000, you will have taxable depreciation recapture of $15,500.

If you were to trade in the old vehicle towards the new one, there will not be any gain or depreciation recapture to worry about. Assuming the vehicle is over 6,000 pounds and is to be used 100% for business, you will be able to claim the Section 179 deduction for the additional amount paid for the vehicle on

top of the trade-in value. In your example, that would be $27,000 (50 - 23).If you were to sell the old vehicle and buy a new one for $50,000, you would have the $15,500 of depreciation recapture gain; but you could claim the full $50,000 as Section 179 on your Federal tax return. While at first look, this might seem like a better deal than a trade, there are some issues to consider.

First is the maximum Section 179 deduction. While the Federal limit of $102,000 is more than most people need, many states haven't conformed to that higher limit and are still using the old limits of around $24,000 per year.

Another issue is that if you bought a lot of new business equipment, this option would only leave $52,000 of Section 179 for other items. The trade-in approach would leave $75,000 (102 - 27) available to be used on other items.

I hope this helps you work out your game plan. As always, I strongly advise working with a tax pro who can crunch your actual numbers and tailor a strategy that's best for your situation.

Good luck.

Kerry Kerstetter

Labels: 179

Social Security election fantasy

Taxing Capital Gains in the States - This reminds me of the way that has been available for decades for the President, as well as most Governors to reduce the effective capital gains tax rate, indexing the cost basis of assets for inflation.

If Arnold or any other governor who wishes to cut the tax burden and encourage investment in their states wants to, they could issue an executive order redefining cost basis of assets to be adjusted for increases in the cost of living. Opponents to this would have to formally pass legislation to specifically define cost basis as historical dollar amounts, with no inflation adjustment.

We shouldn't hold our breath waiting for this to happen. We all know how our Presidents have wimped out on this matter, starting with George H.W. Bush, and continuing with George W.

John Kerry isn't that business friendly - What DemonRat is nowadays?

John Kerry's class warfare: Wrong war, wrong enemy, wrong means - DemonRats don't know how to do anything else.

Wanna Bet? No Problem - Interesting look at gambling in the USA by Gail Buckner.

Trust Funds on Empty

Small Government Is So 1990s - The GOP's abandonment of this former plank of their platform is why there is still a strong need for the Libertarian Party.

Edwards for Tax Reform - More typical DemonRat tax hypocrisy. They use the loopholes, but condemn anyone else who does the same thing.

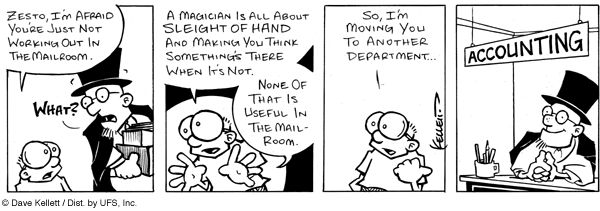

Newest QuickFinder Book

As I have written on several occasions, I have long been a big fan of the QuickFinder reference books. I've been buying them for myself and my staff for well over the last 20 years. Every so often, they add a new book to their library. This year's new offering is called Tax Planning For Individuals QuickFinder Handbook. I recently received my copy of the 2004 printed edition, and had a chance to look through it over the past few days as I've been waiting for my computer and network problems to work themselves out. I must say they have hit another home run with this book.

It is jam packed with reference materials and tips for just about every aspect of individuals' lives, including small businesses. The tabs include:

Tab 1: Tables and Worksheets

Tab 2: Form 1040 Roadmap

Tab 3: Residences and Vacation Homes

Tab 4: Sole Proprietors

Tab 5: Compensation

Tab 6: Stocks, Bonds and Mutual Funds

Tab 7: Real Estate (including a lot of info on 1031 exchanges)

Tab 8: Children and Education

Tab 9: Divorce

Tab 10: Charitable Giving

Tab 11: Retirement Plans

Tab 12: Alternative Minimum Tax

Tab 13: Elderly

Tab 14: Estate and Gift Tax

I wholeheartedly recommend any tax practitioner add this new book to their library and if you are like me, it will be right next to your desk and referred to several times a day. For nontax professionals, it is a super bargain for all of the useful information it contains. At just $43 (less if multiple books are ordered), it costs the same as about 13 minutes of my time; so if it answers one question that you would normally have to pay your advisor for, it's paid for itself. I've never understood why books such as the J. K. Lasser tax guides are big sellers every year, when the QuickFinder books are so much more useful.

I also ordered the CD-ROM versions of all the books for this year. None of them have arrived yet, but I'm looking forward to that. I haven't been using the CD-ROM versions as often as the paper versions. However, there are often times when clients ask questions about certain topics and it's easier for me to cut and paste from the CD version into an e-mail or a letter than to make photocopies from the printed version.

As some people may know, the original founder of the QuickFinder company passed away a few years back and there were concerns about whether the company would stay in business and the quality would stay as high as it's been, especially after it was purchased by Thomson PPC a short while ago. This newest book is the first one I have received that has the Thomson PPC logo on it. You literally cannot tell that there was a change of any kind of the ownership or management of this company. The format and layout, even the little cartoons, are exactly how they've always been shown. There is definitely no slippage in quality.

The biggest problem in any forward looking tax book is the cloudiness of the crystal ball, especially in light of the expiring tax provisions and even the recently passed extender bill. Many of the 2005 and beyond figures will have to be revised in this book. QuickFinder has been great about putting updates on their web site, which I try to check at least once every couple of days.

Labels: 1031

SUV Tax Break For Businesses Is Likely to End - This isn't actual law yet; but it may make it into the final bill.

National Sales Tax Continuing to Outpace Other Reform Proposals

Who really benefits from the Bush tax cuts?

State sales tax deduction gains support - There has long been a desire to reinstate the sales tax deduction for people who live in states with no income tax.

House Budget Panel Mulls Tax Reform Options - The scariest thing here is the discussion about having combined consumption and income taxe to replace the current system. The only way the Fair Tax proposal makes sense is if the 16th Amendment is repealed and the Federal income tax is completely eliminated and replaced with a national sales tax. Having a national sales tax on top of the income tax is just making things worse. Even if the Federal tax rates were to be dropped as an offset to the new sales tax, just keeping the income tax system in place guarantees future rate increases. It is humanly impossible for our rulers to resist.

The 2004 Tax Law - Kaye Thomas' summary of the recently signed law.

MAXIMUM SEC. 179 DEDUCTION FOR SUVs TO BE SLASHED - This isn't an actual law yet, but the environmental wackos seem to have been successful in forcing their opinions of suitable transportation on the rest of us. Of course, with a new threshold of 14,000 pounds, you may want to buy something like this. If you're worried about that weight qualifier being pushed even higher, this one will more than cover it.

169 Business School Profs Criticize Bush Tax Policies - In case anyone was under the false assumption that business schools were immune from the Marxist infiltration of college campuses in this country. Let's see how many profs sign a comparable letter supporting capitalism.

A New Strategy For Giving Away Your Money. IRS Blesses Accounts That Let Donors Keep Managing Money They've Given to a Charity

Labels: 179

Solutions for debt crisis go far beyond tinkering

JUSTICE DEPARTMENT SUES TO SHUT DOWN ALLEGED TAX SCAMS. Sham Trusts, False Claims of Tax-Exempt Status Allegedly Used to Hide Income and Assets - And the people stupid enough to fall for this scammer's schemes will be hearing from IRS as well.

sKerry's Social Security Plan

Instead of paying tax at gas pump, someday you may pay by the mile - Which is pretty much how it currently works, except that evil SUV owners pay much more than do owners of fuel efficient econo-boxes.

Bush Signs Tax Bill in Swing State of Iowa

Tax vote splits centrist group

Bush Signs Fourth Tax Cut in as Many Years - It's really not accurate to consider this a new tax cut. These are really just extensions of some of the expiring provisions of the 2001 tax law that was passed in such a Mickey Mouse fashion.

The NATP has an eight page summary of the new tax law in pdf format

Bush Signs Tax Cuts in Battleground Iowa

The looming national benefit crisis - Any private company executives who don't fund their employee benefit plans would be thrown into prison; but it's acceptable practice for our rulers in DC.

Ruling on property search favors IRS. Agents had right to seek evidence on bookkeeper tip

How Not to Outlive Your Savings

Tax hikes how high from John Kerry?

JUSTICE DEPARTMENT SUES TO HALT ALLEGED TAX SCAM. Complaint Alleges that Wheat Ridge, Colorado Man Claims to Exempt Customers From Federal Taxation

Tax Professionals to Send Certain Tax Returns to Different IRS Centers Than Last Year - This is becoming an annual shuffling of addresses.

TIGTA Report Draws Strong Rebuttal From Taxpayer Advocate

Taxpayer Advocate Olson Finds Fault With Offer-in-Compromise Program

GOP Continues to Inch Toward Tax Code Overhaul