Bill Clinton's AMT Bomb. Why millions in the middle class may see their tax bill explode. – Hopefully, we will soon reach the critical mass in terms of the number of people forced to pay this insane tax and our rulers in DC will get off their butts and do something about it; such as repeal it completely.

Barkeep, Give Me a Beer, a 1040 and a Schedule D – What could be more conducive to getting accurate information from tax clients than working on their returns while they and/or the preparer are drunk at a bar? How long until those tax returns come bouncing back from IRS?

Better ways to crunch retirement numbers – Just another reminder of how impossible a task it is to predict exactly how much money is needed for retirement. There are too many unknown variables to enable any real precision.

The Shifting Calculus Of Workplace Benefits – You may have to shop for your own insurance.

Starting a Biz Expands Deduction Possibilities – It’s absolutely true that the number of legitimate types of deductions is exponentially larger for small business owners than for W-2 wage slaves.

Home Sales by Surviving Spouses

Q:

Subject: Joint returns after death of spouseI ran across <http://www.taxguru.org/re/TaxCoachHomeSales.htm> while searching for something else; this line - "Since you can file jointly for two years following their death, you can exclude up to $500,000, on top of the new basis, during that two-year period." jumped out at me.I think it is perhaps overstated - I don't know if the author is thinking of the qualifying widower filing status, or the case where one taxpayer passes away after the end of a tax year, but before a return is filed, meaning that two additional tax returns will be filed for the decedent.(e.g., one spouse passes away on Jan 10, 2007 - the surviving spouse will be able to file a 2006 joint return, and a 2007 joint return, assuming other tests are met.)Of course, two tax returns are not two years, so I'm still not clear how to get the "two year period" for filing joint returns after death.I am also a Tax Coach subscriber but can't seem to get to their website at the moment; I saved a copy of a plan I produced with their system a few days ago and it does seem to include the above text.Do you have any insight?

A:

That was a good spot on your part. I can also only assume that they are referring to the qualifying widow(er) status, which should be better explained in such a way as "some people can file jointly..."

I'm passing this along to Ed & Keith at TaxCoach in case they want to elaborate on that text. Their system was down yesterday, but they are back up today.

Thanks for spotting that and passing it along to me.

Kerry Kerstetter

From Keith at TaxCoach:

Hi Kerry -Thanks for copying us on your email. The piece you quoted out of TaxCoach is referring to qualifying widow(er) status, but Ed has done some further investigation. QW status does apply for the two years after the spouse dies, but at issue is whether the surviving spouse can still exclude gain during that time. What Ed's dug up thus far is inconclusive. For now we've updated the module to clarify that section and remove the reference to the two following years. Depending on what else Ed is able to find out about it, we'll revise it further.Thanks for bringing that to our attention. Also, sorry about the day we were down - our host had a major issue with the shared server that affected nearly 1000 of their customers! We've since migrated to a dedicated server, so we should have uptime percentages a lot closer to 100.Best regards,Keith

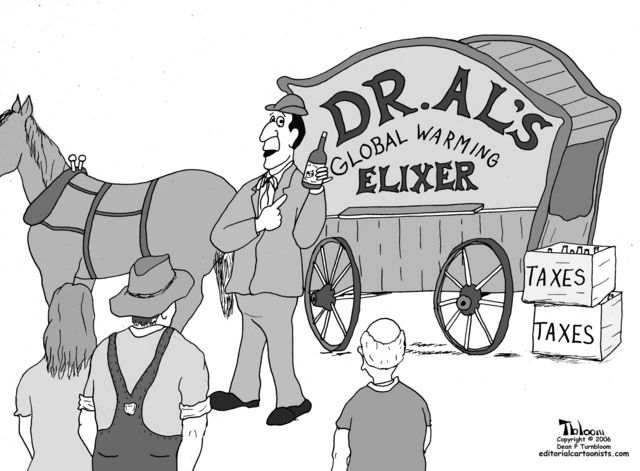

Global Warming Taxes

The real motivation for AlGore and his enviro-commie buddies pushing their global warming scam so hard.

Corporate owners hide assets, identities – Some of the reasons why Nevada corporations are so popular.

Pension gap divides public and private workers – Government employees do seem to have much more set aside in their retirement accounts than those in private enterprise companies. Not that all private company plans are like Enron’s; but the fact that governments don’t go bankrupt (they just raise taxes) makes their pensions funds a lot more secure than with private companies. Who will be surprised to see the auto workers’ pension funds disappear?

Don't do it yourself

Q:

Subject: TaxesHi Kerry,My fiancee and I are thinking about attempting to do our own taxes with tax software. Have you had any experience with it? I am worried about things like how to show the house and interest from our joint checking account. Also, I switched jobs last year and was on unemployment for a couple months... not to mention I received financial aide and paid some tuition. Do you think we should just go get them done or attempt it on our own with the tax software.Thanks for your help. I'm sure you're really busy with tax season. Hope things are going well for you guys.

A:

Nowhere is the term GIGO (Garbage In, Garbage Out) more relevant than with tax prep software. This applies as much to consumer programs like TurboTax as it does to the very powerful and expensive programs we tax pros use.

You absolutely need to work with an experienced tax pro who can locate all of your tax deductions, including the many that are right on the settlement statement for your home purchase. It can also get tricky when you split the house payments and the bank's 1098 only has one of your SSNs on it. An experienced tax pro will know how to show the deductions on both owners' tax returns without creating a problem with IRS's document matching system.

A good tax pro should have no problem saving you much more than his/her fee; to say nothing of the peace of mind in not having to worry about screwing things up and having problems down the road from IRS; which would almost definitely happen if you try to prepare your own tax returns.

This means you need to work with a tax pro who will spend the time necessary to properly understand your situation and not just do your return as fast as possible, as is the case with the big assembly line franchise operations (H&R Block, Jackson Hewitt, Liberty Tax, etc).

Besides the fact that I am still too back-logged to accept any new clients at all, we learned a number of years ago not to mix business with family and friends; so I don't want to get too specific with tax tips for you. If you haven't already done so, you should check out my tips on how to select the right tax preparer for you.

Good luck.

Kerry

Sales Tax On Machine Resale

Q:

Hi Kerry,Sorry to bother you, but could you answer one more question for me? I'mworking on selling my machine tool in California and I would like toprint out the sales tax law regarding collecting sales tax on the saleof capital equipment. A lot of people are surprised when you tell themthere is sales tax on the sale.Thanks for your help, I really do appreciate your time.

A:

Basically, any sale of an item is subject to sales tax unless it is specifically exempted. For Calif. sales tax purposes, the exemptions are detailed in Publication 61, which can be downloaded from the BOE.

Depending on where and how the equipment will be used by the buyer, there may be an exemption. Unless you can find a specific reason to exempt the sale from sales tax, you need to collect it and pay it to BOE. If a buyer feels s/he qualifies for some kind of obscure exemption, you should make that person document that fact either in the BOE regs or by obtaining a written statement from the BOE stating that fact. The regs are also on the BOE website.

If you were to not charge sales tax and the BOE ever checks you out and discovers that you should have charged it; they will require you to pay it plus penalties and interest.

Your personal professional tax advisor should be able to give you more specific advice.

Good luck.

Kerry Kerstetter

Follow-Up:

Hi Kerry,Thank you.

Convert S Corp To C?

Q:

Subject: converting an S corp question

Dear Mr. Kerstetter,Thank you very much for your article. It is very helpful. I have a question and wondered if you'd be kind enough to answer.I started out with a C corp, and later our accountant suggested I change it to an S corp, which we did. It was stupid but I felt intimidated and asked the accountant why it be to our advantage, and he assured me it would becasue of the "double taxation". Now I realize we might be screwed since I can't change it back to a fiscal year ending in the middle of the year.Is there anyway I can say my accountant advised me wrongly and change it back to the way I had it in the first place?And if I can't, this is our company that is now just starting to take off. Does that mean I have to change the name? Or is there anyway I can keep the name the same and change it back to a C corp?Thank you very much,

A:

It sounds like the first step you need to do is to find a tax pro who isn't one of the many who believe that S corps are a one size fits all solution for everyone, as yours seems to be.

As I've written on many occasions, switching from a calendar to a fiscal year for your corp is pretty much an impossible dream, even if you try to use the excuse that you were misled by a shortsighted accountant. IRS isn't in the business of helping you save money on taxes and will consider your experience with your current tax advisor to be your own fault.

Once you have a new tax pro, you and s/he need to see if a C corp really would be in your best interest. If so, it will probably be most efficient to just set up a brand new C corp for which you can use any fiscal year you want.

Then, you and your tax pro should look at whether you need to keep the existing S corp or dissolve it. Depending on what kinds of businesses you are operating, as well as several other factors, there are plenty of very legitimate reasons for having both a C and an S corp. I have seen this work out quite well for many people; especially if there are opportunities to shift income between a taxable and non-taxable state.

Good luck.

Kerry Kerstetter

Corp Estimated Taxes

Q:

Subject: Quarterly Tax Filings with a C CorporationMr. Kerstetter,Our company just became a full C corporation on 01JAN07 after being an LLC from start of business. I am currently working with an outside accounting firm that is compiling our financials for 2006, I have recently come on board here (first day was 05FEB07) since the company has decided they needed a Controller since converting to a C Corp. and have to advise the owner as to his tax liability and payments.My question to you is this: After working with our Accounting firm we are about to realize $ 375,000- for 2006 before taxes. In preparing for the 2007 tax year, I am currently accrueing for taxes based on 2006 Net Income. On the quarterly filings what can I expect to pay out to the IRS???? I would think that the minimum would be $ 93,750- ($ 375,000 / 4) to avoid any penalties or charges. Is there some way we can mitigate this payment to the end of year since we just became a "New" corporation and really don't have a strong performance record in earnings??? Any advice would be helpful.Thanks,

A:

I'm a little puzzled as to why you are asking me this because this is really the kind of thing that should be discussed with the corp's professional tax advisors.

Basically, as with individual income taxes, there are two main options with estimated tax payments. You can pay in what you expect the actual taxes to be for the current year in four quarterly installments so that there is a zero balance due with the 1120; or you can pay in the least required by law so as to avoid late payment penalties, and then pay any remaining balance by the due date of the 1120.

For most corporations, those that have taxable income of less than one million dollars, it generally works out for the second option that you can pay in the lower of the previous year's tax or the expected current year's tax.

If 2006 was a boom year and 2007 looks as if it will have a much lower taxable income, there is no sense in paying in the same as the 2006 tax was. You should calculate the actual tax for each portion on the current year and make payments accordingly.

IRS has Form 1120-W for calculating corp estimated taxes. It does allow for annualization of income, in cases where profits are not earned evenly throughout the year, with corresponding adjustments in the estimated tax payments.

Good luck.

Kerry Kerstetter

Follow-Up:

Mr. Kerstetter,Thanks for your valuable time in responding to my question. I will be working with the company's tax preparer's but wanted to get a little insight into how I can minimize our tax payments in the next couple of months. I was really impressed with your website and knowledge on the subject matter. Too bad you are not accepting any new clients or I may make a pitch to have our company work with you. Please let me know if you are going to allow new clients anytime soon.Thanks,

Too much paperwork?

Q:

Subject: Frustrated in Missouri

Dear Kerry,

I am a professor at a nice Midwestern state university. To save my university embarrassment, please do not include my email address or last name if you elect to post this on your blog (as you are welcome to do). I am writing because I am frustrated by all the steps my bureaucratic organization has placed in the way of quickly accomplishing some tasks under the guise of following the law. If my university is correct, then I have been doing something wrong in my part-time business. Therefore I am asking for your guidance.When an organization hires someone to perform a service (in this case our department decided to hire two guest speakers for the benefit of our students), what are the legal obligations of the organization to obtain their social security number or other tax identification number? Is there a cut off (in dollars) where this is necessary? If so, what is this amount?

I can understand the IRS requiring us to obtain this information once a certain threshold has been reached (say $5,000 or more) so my organization could issue a 1099-Misc. However, this seems a very poor use of time for small expenses like the $175 stipend we are trying to pay our guest lecturers. In my own small business, I do not ask for a SSN or a TIN when I hire a consultant. I recently paid an independent contractor $550 to design a website for my business. When he finished the job, I simply paid him. Did I break the law or a IRS regulation by doing so? If not, is there one rule for private businesses and another rule for public (or semi-public) institutions?

If you tell me that there is no IRS requirement to collect this information for small services (and please be specific), I will take up the quixotic challenge of trying to change my institution. On the other hand, if you tell me my institution is simply following the law by requiring us to collect this information (and then requiring a formal contract for even the smallest service), then I will apologize to my administrators and bring this up with my legislators.

Thank you,

A:

You really should check the IRS's instructions for filing 1099 forms to see the official requirements.

Basically, for payments to most unincorporated individuals for services, a 1099-MISC form is required to be filed with IRS if total payments during the calendar year are $600 or more.

From a logistical perspective, when to use Form W-9 or other means to ascertain a payee's tax ID number is a little tricky. Some businesses do require that info before any payments are made because it is too much hassle for them to keep a running total during the year and only ask people when they are close to reaching the $600 threshold. That is probably the case for your school and does seem to be fairly standard practice around the country.

While this information gathering may technically be unnecessary for persons who will definitely not be receiving at least $600 during the calendar year; convincing them to stop asking for it is going to feel like spitting in the wind. It has become so accepted a practice that you will have a very tough time convincing them to change. It is unfortunately the case in this country that people (your school administrators) are so petrified of offending the IRS that they do go overboard and over-report payments made. IRS actually likes this and will be of no help in persuading them to reduce their record keeping in this regard

As the 1099 instructions do explain, most payments to corporations are not required to be reported on 1099s. Payments to attorneys are the main exception to this rule. I have seen cases where both the payers and payees have only conducted business with other corporations. If you are pursuing this on behalf of friends, you may suggest that they consult with their personal tax advisors regarding incorporating their businesses.

If you have been following the discussions of how IRS is supposed to close the tax gap, the main culprits they are after are small businesses who have all been tarred as being tax cheats. This means that it's only a matter of time before that $600 threshold is reduced to just 51cents (which rounds up to one dollar) and the exemptions for payments to corporations is removed. This will make your entire crusade to reduce the ID gathering requirements at your school a moot point.

Although I'm obviously not being very helpful in your goal of reducing the bureaucratic paperwork at your school, I hope I have at least helped you understand more about why they are doing things that way.

Good luck.

Kerry Kerstetter

Follow-Up:

Kerry,Thank you for a fast and clear reply. I found you (and your blog) today when I was searching for a CPA blogger in my frustration. While I am still not happy about the paperwork (and may still aim at my school's need to have contracts in place for basic services), you have convinced me that I would be wasting my time asking them to quit asking for ID numbers.You've also gained a new reader.Best regards,

Understanding Child Support

Q:

From: "Marian Crenshaw" <mariancontrarian@gmail.com>Subject: Child Support: 29% isn't even enough. Try 50%Dear Kerry,I came across your web site while doing some academic research. I just wanted to let you know that there is a simple and obvious reason why child support is based on a percentage of the non-custodial parent's income----it's because your children are entitled to the lifestyle that you can afford whether you live with them or not. Otherwise, why not just provide the bare minimum they need to survive? Or why provide anything at all?Think about it: they are, after all, YOUR children, not just your ex-wife's. They deserve to have what you are able to provide for them and if that happens to result in a slight improvement in what your ex's lifestyle might otherwise be, well tough toenails. Maybe you should have tried harder to work things out. Child support is about providing for YOUR kids (you know, the ones who are carrying YOUR name and YOUR DNA), not about spiting your ex.Clearly, you are not thinking straight enough to consult with anyone on taxes. Perhaps you should re-consider whether a web site is appropriate.But then, who would seriously take tax advice from the Ozarks?Marian Contrarian

A:

Marian:

Thanks for sharing your opinion on this matter.

I still can't accept that as valid reasoning; especially in the context of the example I had written about. In that case, as it is with countless other parents, the client was required to pay 29% of his tax return's adjusted gross income, most of which consisted of purely paper income which was not in any way available for him to live on, much less for the benefit of his children.

Your tone implied that I wrote my comments from a selfish perspective. Nothing could be further from the truth. I have never had any children, nor will I ever have any. My comments were purely based on a sense of fairness. To use the force of law to require a parent to share a fixed percentage of his/her wealth with his/her children is not right. If a parent wants to voluntarily do this, that would be great. It's much like the issue of charity versus taxation that I posted on my blog yesterday.

You are obviously entitled to your own opinions on matters such as this, even if they are clouded by bigotry towards those of us who choose to live here in the beautiful Ozark Mountains. I can assure you that my opinions wouldn't be any different if I were still living in the more sophisticated San Francisco Bay Area, where I spent the first 38 years of my life.

Thanks for writing, whoever you are with your Nom de Plume.

Kerry Kerstetter

Converting C to S Corp

Q:

Subject: Quick Tax questionWe formed an Corporation in 1999 (C corp) and bought a parcel of Land in October 2003. After the purchase we have had No income or activities in the prior years and no tax forms were filed.

In 2006 we got approved from IRS as an S corp for the tax year starting Jan 1, 2006. How do we handle the transfer of the parcel from the "C" to the "S" corp? What tax consequences will this have January 1, 2006.? We have income from a option on the land in 2006 and are preparing to file tax return on this, you understanding is that the "profit" of this income will be passed through to the partners?

Appreciate your comments.

A:

This is an issue that you must work on with an experienced tax pro. If it is the same corp that is now being converted to an S, you aren't technically transferring the land.

However, there is a potential for what is called the Built In Gains Tax of 35% for IRS when there are appreciated assists in a corp that has converted from C to S and the assets are sold or distributed within 10 years after the conversion.

You really should have discussed this entire mater with a tax pro before making the conversion; but hopefully a good tax pro can help you minimize or at least reduce the tax hit after the fact.

Good luck.

Kerry Kerstetter

SIMPLE SEP?

Q:

Subject: question....

Dear kmk:

I overheard a conversation about a corporation or a savings plan the other day regarding a SEP vs. SIMPLE. What were they talking about? Thanks

A:

SEP = Simplified Employee Pension

SIMPLE = Savings Incentive Match Plans for Employees

These are just two of the rapidly growing number of types of retirement plans that small companies and self employed individuals can set up for themselves and their workers.

The rules, limits and basic pros and cons of each type are varied.

You should work with your personal professional tax advisor, as well as an experienced employee benefits consultant, if you are considering offering retirement plans for your employees and/or setting one or more plans up for yourself.

As I constantly have to remind everyone, there is no such thing as "one size fits all" in tax and financial planning. Everything needs to be set up based on the unique circumstances and plans of those involved.

Good luck.

Kerry Kerstetter

Sec. 179 & IRS Math Skills

Q-1:

Subject: Looking for Section 179 2007 NumberDear Mr. Kerstetter:I am interested in finding the upper dollar limit for 2007 Section 179 property. In 2005 the upper limit was $525,000 and in 2006 it was $535,000 -- do you know the limit for 2007? I understand that presently the rules change for 179 in 2008 and upper limit will be $200,000 (b/c max section 179 deduction drops back to $25,000). Thanks for your help, I saw your article on the web in looking for a source for this number. I had no luck in IRS sources. Thanks in advance for any help.Regards,

A-1:

Your info is out of date. A tax law was passed last year extending the fall-back in Sec 179 amounts to 2010. I have had this on my website since the day that law was enacted.

In regard to the phase-out, check the numbers at the bottom of the above referenced page. For 2007, it starts at $450,000 and goes until $562,000, with the $112,000 maximum deduction allowed for 2007.

These numbers will be adjusted upwards for 2008 and 2009 based on the official cost of living calculations, before dropping in 2010 if our rulers don't extend it again.

Good luck. I hope this helps.

Kerry Kerstetter

Q-2:

Dear Mr. Kertstetter:

Thanks so much for writing and the information this is what I was looking for. Especially thanks for updating my old information -- good to hear there was an extension passed. Thanks so much again!!

Just as an FYI. What was confusing me was the Year 2006 max amount. See paragraphs from IRS pub 946 below, which I just copied and pasted off of www.irs.gov:"Dollar Limits

The total amount you can elect to deduct under section 179 for most property placed in service in 2005 generally cannot be more than $105,000 ($108,000 in 2006). If you acquire and place in service more than one item of qualifying property during the year, you can allocate the section 179 deduction among the items in any way, as long as the total deduction is not more than $105,000. You do not have to claim the full $105,000.Reduced dollar limit for cost exceeding $420,000. If the cost of your qualifying section 179 property placed in service in a year is more than $420,000 ($430,000 in 2006), you generally must reduce the dollar limit (but not below zero) by the amount of cost over $420,000. If the cost of your section 179 property placed in service during 2005 is $525,000 ($535,000 in 2006) or more, you cannot take a section 179 deduction."

In 2005 the max deduction was $105,000 -- with a dollar for dollar reduction in that amount above $420,000. This means that you run out of deduction at 420+105 = $525,000 (which is the figure in the IRS text).

In 2006, the max deduction is given as $108,000 and the phase out starts at $430,000. From that one would think that the top-end number is 430+108 = $538,000. However, in the IRS pub you see the number is $535,000 ???

Your top-end number for 2007 makes sense (450+112 = $562,000), but is it the REAL number ??

Do you have any insight on the 2006 number and the source for your 2007 number? Perhaps the 2005 number is a typo (smile)?

Thanks so much!!

Regards,

A-2:

That $535,000 figure is either a typo or a reflection of the quality of the basic math skills of IRS employees.

The numbers on my page are accurate and obviously more reliable than those in the IRS publications.

Kerry

Follow-Up:

Hi Kerry!Being a state employee of NC (university professor) I didn't want to make a comment about government workers (smile) -- but I assumed that it was a typo/error of some sort. It only makes sense that once you run out of dollar-for-dollar reduction (i.e. it goes to zero) then you have hit to top-end. But, one never knows what goes through lawmakers, lawyers and accountants minds sometimes (I can say that b/c I have several in my family -smile). Thanks so much for your info and good cheer. It has been my pleasure, and if there is anything that I can ever do for you please do not hesitate to write. Thanks again!Regards,

Labels: 179

Generosity

Mallard Fillmore, with the well documented fact that conservatives are much more generous with their own money than are liberals; while liberals are much more generous with the money they have their IRS henchmen confiscate from the taxpayers.

Cash-Hungry States Eye Business Tax - Why the cat and mouse games of income sourcing between states with different tax rates will never end, guaranteeing a steady stream of income for those of us in the tax minimization profession.

Inherited IRA Rollovers

Ed Slott has a handy explanation of the latest on the IRS’s confusing application of the new tax law regarding IRA rollovers by non-spouse beneficiaries.

State Due Date

I just received an email from the Arkansas DFA announcing that they have recently passed an emergency rule setting the due date for 2006 individual income tax returns as Tuesday, April 17, 2007; the same date as for Federal 1040s.

Section 179 Flattery?

Q:

Subject: plagarism

Kerry,

Dont know if this concerns you or not but it looks like your site is being plagarized word for word here:

http://www.groco.com/readingroom/sec179_businessequipment.aspx

Anyway I was sending you this email cause I wanted to know if you could provide me a site to prove that section 179 can apply to used items as long as they are "new to you." Look at the code and regs and cannot seem to find anything. Thanks.

A:

Since I created that page on Section 179 from scratch, with the occasional update for new developments, I am flattered that other tax pros want to use it. I am aware of others on the web who have made use of my info, but they generally give me credit as the author. Obviously, not everyone has the same good manners. This copy that you found was obviously made several months ago because it doesn't include some of the updates I have made to my page.

In regard to the issue of whether used equipment can be expensed under Section 179, I guess the fact that I have been claiming that on thousands of clients tax returns since Section 179 was born, with zero problems from IRS, isn't adequate substantiation for you.

Oftentimes in interpreting laws, it isn't whether every single item allowed is spelled out; but whether or not something is specifically designated as not being allowable.

If you check IRS Publication 946 under the Eligible Property heading, you will not see one mention of any requirement that it be brand new or that the taxpayer be the first owner.

Similarly, under the heading "Excepted Property" nowhere does it include any mention of an item that is not brand new.

From QuickFinder Online:

"It must have been acquired by purchase from an unrelated party."

There is no mention anywhere of any requirement that the asset be brand new.

A similar review of the Section 179 discussion in The TaxBook reveals not a single mention of a requirement that the asset be brand new.

Good luck. I hope this helps.

Kerry Kerstetter

Labels: 179

The Tax-Gap Chimera. Are the costs of hunting down the ordinary American tax cheat worth it? Maybe not. - From Bruce Bartlett. It wouldn't hurt to toss in a reminder that the amount of the Tax Gap is no more than a WAG (wild ass guess) used by IRS to scare up more power and resources.

Tax Rappers

I’ve never been a fan of the quasi-musical format called crap (the C is silent); but obviously a lot of people love it based on the amount of money it generates.

I just learned of a contest TurboTax is running for people to upload their own tax related rap videos and possibly win $25,000. I sampled some of them and so far, I couldn’t bear to hear any of them a second time.

I’m just passing this along as one more tax related tidbit. The contest runs through April 15; so if anyone notices a video with some actual creativity or humor, let me know. I don’t have the stomach to watch many more of them.

How Much Sec. 179 To Claim

Q:

Subject: SECTION 179 QUESTION

Hi Kerry,I read your section recently and was wondering if you could answer a question for me? I purchased a milling machine new in 2006 for 72,000. rigging and taxes pushed the expenditure to 78,000. I would like to sell the machine in 2007,probably in march. Under section 179, How much can I depreciate the machine? I will probably sell the machine for 60,000. Things just didn't quite work out.Hopefully this makes sense, Thanks for your help.Cheers,

A:

How much you can legally claim for Section 179 on your 2006 1040 and how much you should claim may very well be two completely different numbers. You should work out different scenarios with your personal professional tax advisor as s/he works on your 2006 tax returns.

Basically, any amount you claim in Section 179 and normal depreciation on the machine in excess of $18,000 will end up being taxable recapture income on your 2007 tax return. This may not necessarily be a bad thing because it could very easily be the case that you could save more on your 2006 taxes by claiming a lot of Section 179 than the taxes you will have to repay on your 2007 1040, in addition to the time value of the one year difference in tax dates.

I have no way of knowing if that would be the case because it depends on so many other factors that only your professional tax preparer can know about. That is the kind of "what-if" analysis you and your professional tax advisor need to do before completing your 2006 1040.

Good luck.

Kerry Kerstetter

Follow-Up:

Hi Kerry,Thank you for the explanation, I appreciate your input very much.Best Wishes,

Labels: 179

Look before you leap..

The trend of people filing for S corp elections before knowing what that entails continues, as in this case.

Q:

Subject: Quick S Corp QuestionHello Kerry,I have been reading through your blog recently, and I have mostly been interested in your opinion regarding S Corp vs. C Corp.My question is simple. We incorporated Feb 14 2006, and filed and received our S corp election from the IRS. I would like to review this choice with a local accountant. We HAVE NOT filed yet for 2006 either personally or for the S corp.If we never file as an S corp, but as a C, does the S corp quietly go away, or will we have to formally change with the IRS?Thanks,

A:

Check out this post from last Summer.

Good luck.

Kerry Kerstetter

Claiming Daughter?

Q:

Subject: daughter's taxesKerry, Our daughter is a student at NAC in Harrison. She has lived in Harrison since July with my mom and has worked part time at Home Depot since July. So this year she will have her own W2 form. I am guessing that she will need to file her own taxes? I just want to be sure before I tell her to do it.

A:

That's not necessarily the case. It's a bit of a gray area.

Since she was a student, you are still allowed to claim her as a dependent if you have been paying for more than half of her living expenses during the past year, even if she isn't in your home. If you've been giving her money for living costs while she was at your mom's, you can count that as part of your support contribution.

If your mom has been covering your daughter's living costs while she was there, and you covered them for the early part of 2006, it may be that neither of you paid more than 50% of her living costs for the entire year of 2006; which would mean that your daughter would have to claim her own personal exemption.

The real test that make most tax sense is based on how much she earned during the year. If she made more than $5,150, she will save on taxes by claiming herself. If she made less than that, there is no need for her to claim herself and it would be better tax-wise for you to claim her, as long as you met the more than 50% support test.

I hope this isn't too confusing.

Kerry

Recording Stocks In QB

Q:

Subject: Quickbooks for InvestingI noticed that you stated QB is fine for recording investments and don't need Quicken's ability to track fluxuating values in the stock. I agree, and from a business point of view, your costs don't change daily and remained fixed. When you sell the stock, you derive your COGS from this data.However, I noticed that you didn't mention other costs associated with the purchase and sale of individual blocks of stock, such as commissions paid on purchase and on sale? How well does QB record this information. Do I have to do a PO every time I buy and a Invoice every time I sell, just to have a place to add commissions to the costs, or does QB have an easier way to handle this?Thanks!

A:

When you make the entries for stock purchases, you need to post the total cost, including commissions.

When you sell stocks, you can either post the gross sales price to the SalePrice Income account and the Expenses to a sub-account for selling costs under that; or just enter the net sales price (gross less commissions) into the SalePrice account. Since more and more 1099-Bs from brokers are reporting the net sales price instead of the gross price, the latter approach may be easier when it comes to reconciling the QB reports to the 1099-Bs.

Your professional tax advisor should be able to help you set up the accounts and sub-accounts in your QB file that will enable him/her to more efficiently prepare your Schedule D.

I have been posting these transactions through checks, deposits and general journal entries. I have never used POs or invoices to do this.

Good luck. I hope this helps.

Kerry Kerstetter

Labels: QB

Section 179 and Trade-Ins

Q:

Subject: Guru neededHello,I found your site and have read a good portion of it -- and learned quite a bit. Thank you!I was wondering if you could answer a question regarding 179 vehicle expensing:In 2004 I puchased a new Chevy Suburban (GW > 6,000 lbs) for my business (real estate investing) and depreciated the entire vehicle in that year (~$50k).Since then, the limit has been reduced to $25,000, but (I think) there remains some additional accelaerated depreciation available.My question is:If I trade-in (or sell) my 2004 suv in 2007 for a new (>6,000 lb gw) suv in 2007, what are the tax consequences with respect to cost recovery and depreciation of the new vehicle?I understanding I'll be trading up, no cash received (substantial cash out), and that it will be a like-kind asset exchange. I'm hoping there'll bemore/new depreciation to take (over a short period of time).Thank you,

A:

I have covered this issue in a number of posts over the last few years; but a quick review would be useful for new readers.

While many people don't see much difference between a vehicle trade-in and a sale, it can make a huge difference tax-wise.

If you have depreciated (via Section 179 + normal depreciation) the cost basis down to an amount much lower than the vehicle's current fair market value, a sale will trigger taxable recapture of some or all of the depreciation and Sec. 179.

If you trade the vehicle in for one with a value of equal or higher amount, there will be no taxable recapture. Per Form 8824, the remaining undepreciated cost basis of the old vehicle, plus any additional amounts paid via cash and debt will become the cost basis of the new vehicle.

In regard to claiming Section 179 on the new vehicle, the rollover cost portion is not eligible; but the newly paid (via cash or debt) amounts are. Normal deprecation is available for the amount not deducted under Sec. 179.

The opposite would be the case if the vehicle is worth less than the depreciated coat basis. A sale would enable a deductible loss; while a trade would require the loss to be rolled over and added to the cost basis of the new vehicle.

This is why I always give my clients a copy of their next year's depreciation schedule along with their tax returns, and advise that they check the asset's depreciated cost basis (Book Value) before deciding whether to trade a vehicle in or sell it in an independent transaction.

Your personal professional tax advisor should be able to run the numbers for your vehicles and show you the consequences of both options.

Good luck.

Kerry Kerstetter

Labels: 179

Corp Double Taxation

Q:

Subject: Question regarding C corporations and double taxation

Hi Kerry,I just visited your web site and found it very informative. I'm sure you've heard this before but I attended a Real Estate Investors seminar and they spoke of setting up a C corporation for asset protection and tax savings purposes. And of course, for a fee, they would help us do that.Later, another investor from the seminar and I decided to purchase a Mobile Home Park in Mabelvale Arkansas. I am from Connecticut and my investment partner is from California. We decided to go ahead with setting up a C corporation as had been suggested at the seminar. So now we each have C corporations set up in Nevada. Those two C corporations manage XYZ LLC. That XYZ LLC is then the single member of another LLC that ownes the Mobile Home Park.The reason why I am writing to you is to get your opinion on the whole thing. In my opinion, it seems to be overkill. It seems to be very layered and I'm not sure if we will gain any tax savings from it. I think we probably could have just created an LLC that owns the Mobile Home Park and get some good insurance and be done with it.I understand that as the rental income profit from the Mobile Home Park is placed into the two C corporations we will have to pay tax on that income. However, how do we get money out from the two C corporations without having to pay tax again (double taxation)? If there is double taxation then what is the purpose served by the C corp? Or is that not an issue in this case?Anything you can offer on this subject would be greatly appreciated.Thanks,

A:

There are far too many options to consider and possible scenarios that can be used to achieve your goals for me to even begin giving you specific advice via this medium.

You will need to work directly with an experienced tax pro who can analyze your unique circumstances. I wish I could help; but I already have too many clients to take care of properly; so we are still trimming back on the difficult clients and are not accepting any new ones at this time.

Unfortunately, we don't have anyone specific to whom we could refer you. I did recently post some names and links for some like-minded tax pros around the country.

If you haven't already done so, you should check out my tips on how to select the right tax preparer for you.

You definitely need to make sure whoever you work with has experience in multi-state taxation. Even though your corporation may be chartered in Nevada, which has no State income taxes, the fact that the property is located in a taxable state (Arkansas) means that your corp and/or LLC will have to file income tax returns with that state. This applies to any state in which you have property or are physically present to earn money. You may not have to actually pay any Arkansas tax if the net income has been shifted out of state properly; but you do have to file an income tax return or else the State DFA will assume that all of the gross receipts are pure profit.

Any good tax advisor can help you avoid double taxation of C corp income. There are many ways to do that.

I wish I could be of more assistance; and I wish you the best of luck.

Kerry Kerstetter

1031 Identification Deadline Is Firm

Q:

Subject: Exchange QuestionNew question from a client, that I have not encountered before. If 3 prospective replacement properties were identified for an exchange within 45 days of the sale of a property and none of the 3 remain available for purchase, can my client substitute a replacement prospect, close on it within the 180 day time frame and still defer the capital gains tax consequence?

A:

Based on the way in which you described your client's situation, the answer is a very big NO.

The only statutorily eligible reasons for an extension of either the 45 or 180 day deadlines are when the property has been affected by a Presidentially declared disaster or if the taxpayer is on active duty in a combat zone.

If the taxpayer just dawdled and let other people buy up those listed properties, IRS has no sympathy for him.

This is why we have always advised working diligently on the acquisition phase of the exchange as early in the process as possible; ideally while the disposition phase is still in progress.

Hopefully, this lesson won't be too expensive for your client and he will be more on top of things the next time he attempts an exchange. If the potential tax bill is substantial, your client may want to make the new owners of the properties substantially increased offers so that he can still acquire them within the 180 day deadline.

Kerry Kerstetter

Labels: 1031

What Is The IRS Thinking? – Forbes magazine looks at how IRS has been implementing the new more generous rules for non-spouses to roll over inherited IRA accounts.

Basic common sense tips from Nolo Press.

From the latest Intuit ProConnection Newsletter:

Numerous Tax Changes Now in Place for 2007 and 2008 – Good look at what’s in store for the next two years; at least until the next tax law. Includes a handy summary for clients in MS Word format.

They have this same solution planned for Social Security:

From the latest issue of Debt-Proof Living

From the free WSJ:

For Bush, Saving Tax Cuts Is a Tough Balancing Act

Choosing type of corp

Q:

Subject: Tax Question, Of Course

Hi Kerry,

I read your blog and really enjoy your information. I am hoping you can lend a little guidance. While I know you probably need more information, I will provide as much as possible.

I am 35, single, no children. My business is organized as a C Corp in Washington State. The company's income last year was $69, 000.I visited a "tax pro" today who advised that I file my corporation as an S corp. I have been reading many differnt tax authorities, such as yourself including Sandford Botkin and Diane Kennedy, so I disagree with his recommendation, but I could not effectively explain it to him. Interestingly, he was not familiar with Botkin or Kennedy.

When I explained to him that I wanted a C corp because of the deductions of healthcare, and income splitting, he indicated that the deductions I would get from healthcare would not outweigh the deductions I would get from an S corp and that the benefits of a tax year ending earlier than Dec would disappear after 2 years.

Last year was the first year of the business. I anticipate my income to at least double this year. Can you give me any guidance as to what your recommendation is??

A:

I'm not a fan of second-guessing the advice of other tax pros without knowing all of the same facts that they have at their disposal. However, if you are quoting your tax pro accurately, it sounds like he may not be right for you due to the all too common belief that S corps are a one size fits all solution for everyone.

Quick rebuttal of some of the points you mentioned. Generally, an S corp only makes sense tax wise if it will be generating losses for several years. A profitable business can save huge amounts as a C versus adding its income to everything else on your 1040. The income shifting opportunities with a different C corp fiscal year can actually go on indefinitely. To claim that everything balances out in two years is extremely short sighted.

Tax free fringe benefits are much more lucrative with a C corp than an S, including health care, childcare, and education assistance, things you may want to provide for your nephew, who you could set up as an employee if he helps you around the office. A good tax pro can assist you with these.

There are far too many options to consider and possible scenarios that can be used to achieve your goals for me to even begin giving you specific advice via this medium.

You will need to work directly with an experienced tax pro who can analyze your unique circumstances. I wish I could help; but I already have too many clients to take care of properly; so we are still trimming back on the difficult clients and are not accepting any new ones at this time.

Unfortunately, we don't have anyone specific to whom we could refer you. I did recently post some names and links for some like-minded tax pros around the country.

If you haven't already done so, you should check out my tips on how to select the right tax preparer for you.

I wish I could be of more assistance; and I wish you the best of luck.

Kerry Kerstetter

Follow-Up:

Dear Kerry,

I apologize that it has taken me so long to thank you for taking the time to make such a quick response to my question. I assume that you are very busy, and I appreciate you taking a moment out of your hectic schedule to share your opinion with me. Thank you for making this kind of education and advocacy readily available in a friendly and easily understood format.

I look forward to reading your blog and recieving the updates in my email.

IRS Puts a Stingy Spin on Pension Protection Act – From Gail Buckner

IRS to focus more on small businesses – Because of their bogus assumption that everyone is a tax cheater. One more reason to use corporations, which have a much lower audit profile than do Schedule C sole proprietorships.

Calif Tax Update

Some interesting items in the latest FTB newsletter:

20 Questions On the new Real Estate Withholding rules

Real estate withholding - compute estimated gain or loss online – Including new Form 593–E to calculate the actual profit on real estate sales rather than be forced to have the standard 3.33% of the gross sales price withheld..

Filing Deadline – FTB hasn’t wasted any time adopting the IRS’s recently announced extended filing date for 2006 income tax returns of Tuesday, April 17, 2007. Other state tax agencies are not as quick to address this one day discrepancy.

Explaining how tax cuts work

The big argument from the Left against tax cuts is the fact that most of the savings go to the richest people, and under their logic, it’s pure evil to ever allow any fat-cat to keep more of his own money.

Brian at Seadog Bytes has just posted this excellent analogy between tax cuts and refunding ticket money from a rained out baseball game. I’m sure the irony of this example will go right over the heads of our tax loving rulers.

Section 179 Income Limit

Q:

Subject: Section 179 - Please helpHello TaxGuru. I came across your website after searching google and I think my situation is similar to what you describe in the following link regarding sole proprietorships and taking the Section 179 deduction…

http://www.taxguru.net/2004/07/limits-on-section-179.html

I just wanted to briefly describe my situation and ask you if I am interpreting things correctly.

My wife started a photography business at the beginning of 2006. For the year, the business will have a net loss of about $16k due to photography equipment purchases. I wanted to deduct all of these business assets using Section 179. We are filing married-jointly and we both have W2 income which resulted in positive taxable income both before and after applying the section 179 deductions. Is this OK to do, or do I need to depreciate the assets?

Thank you for your help!

A:

You seem to be understanding the issue correctly. Your W-2 income can be used to determine how much Section 179 can be claimed on your wife's Schedule C. The net loss, including the Sec. 179, on her C will shelter some of your W-2 income, most likely resulting in a larger refund of taxes withheld from your paychecks.

As I mentioned in that post, as well as in practically every other one, you should work with a professional tax advisor and not try to prepare your own tax returns. There are so many ways you could screw things up on your own that it would be extremely reckless on your part to do your own 1040. Practically any tax preparer should be able to save you much more in taxes than his/her fees; so you should end up with more money, in addition to the peace of mind that IRS and your State won't be coming after you.

Good luck.

Kerry Kerstetter

Labels: 179

Quicken and Multiple Files

Q-1:

Subject: Multiple Quicken filesDear kerryI read your web site and blog with great interest. I use Quicken 2006 DeLuxe for my personal finances on one machine, and I also use it on an older machine to keep books for our home owners association. The old machine is on it's last leg and I was thinking of trying to do them both one one machine. I couldn't find anything in Quicken help on how to do it. I first thought I could create a seperate directory and do a backup and restore, but was afraid the data would get comingled. Would this work? And what about all the saved reports, and categories, etc. I hope you can help. thanks.

A-1:

You can have an unlimited number of company Quicken files on the same computer and switch back and forth between them. Before I made all of our clients upgrade to QuickBooks, most of them were on Quicken and I had hundreds of their files on my computer. I like to set up separate folders for each client just for ease of locating; but each client folder had multiple Quicken data files, covering their personal and corporate finances, as well as multiple years. As long as each company file has a different name, the program doesn't mix them up.

So, all you need to do is copy the Quicken data files to your new computer, either directly or via Backup & Restore.

Good luck.

Kerry Kerstetter

Q-2:

KerryI really appreciate you quick response. Thanks so much. Do the reports, categories, etc follow the data files? That is, are the reports, categories, etc. for my personal quicken file seperate from the ones for the homeowner reports?

A-2:

Each file will have its own saved reports and other data, with no reference to any of the other files. There is no commingling of any kind between the data files because you can only have one open at a time.

As I said, I used to have literally hundreds of different Quicken client data files on my computer and would switch back and forth between them with no problems. It's that way currently with QuickBooks data files.

Good luck.

Kerry

Follow-Up:

KerryThanks a lot for helping. If I could, I'd steer some business your way.

Labels: QB

Why should we expect our imperial rulers to take the simple approach to dealing with the mystical Tax Gap, when they can use their voodoo to make the tax system even more complicated and impossible to comply with?