Online Corp Services

Going through some old emails in my in-boxes, I came across this short piece from PC Magazine, reviewing some of the main online services for setting up a corp or LLC.

The article glosses over the critical issue of consulting with a qualified professional tax advisor before deciding which particular entity is appropriate for a particular situation. The following generalization is completely wrong and misguided.

For most small businesses, the C corporation option isn't in play, given its complexities and required reports and other filings, along with corporate taxes.

As I’ve explained frequently, C corps are very often much better fits than S corps and are actually much less complicated to handle than are S corps and LLCs.

Labels: corp

22 Tax Breaks That Expire in 2009 - Handy recap from Intuit of many of the tax law changes that are currently scheduled for the end of this year. As we have seen quite often in the past few years, this is subject to change at the whim of our rulers in DC.

Labels: NewTaxLaws

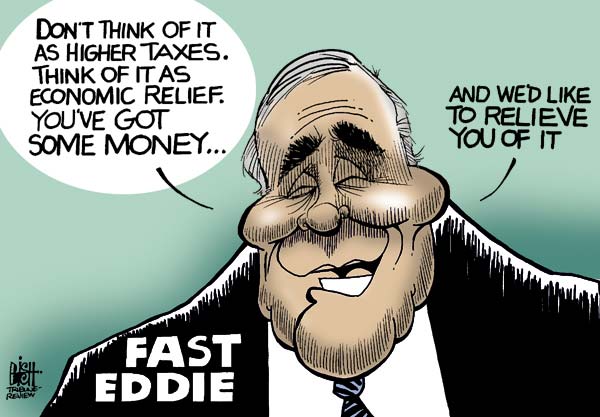

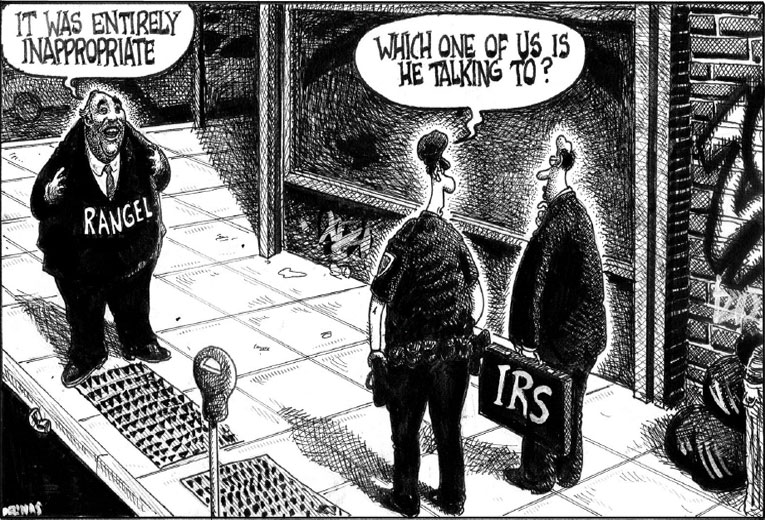

Living with less...

While we in the private sector are expected to make do with less, our rulers in government are never expected to make any kinds of sacrifices.

Labels: comix, StateTaxes

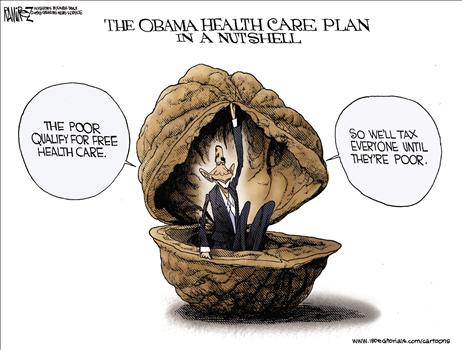

Class Warfare Tax Policy

Thanks to Veronique de Rugy at NRO for this excellent video from the Center For Freedom & Prosperity on the stupidity of 0bambi's plans to soak the evil rich even more.

Labels: comix, Commies, TaxHikes, video

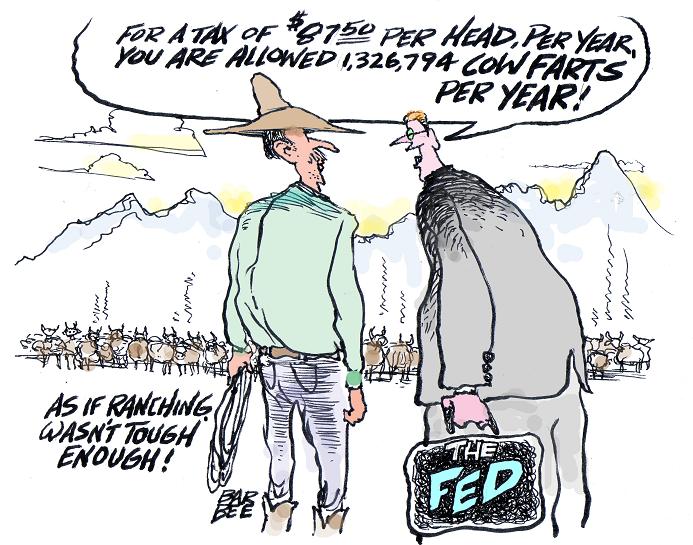

Taxing Cow Farts

As many of us have been warning, the real agenda behind the Global Warming scam is to deprive people of their private property and to raise taxes, such as this actual proposal. Wait until you see the IRS forms for reporting these and the auditors who will have to verify their accuracy.

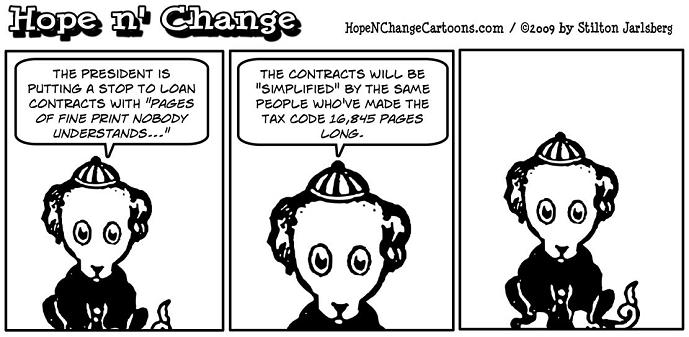

New reporting requirements ahead...

Tax Crackdown Will Cost Small Business – Interesting look at some of the new rules being proposed by IRS to tackle their perceived tax gap.

These include:

Businesses would have to report their payments to other corporations to the IRS.

Business would have to verify Taxpayer Information Numbers (TINs) of contractors and withhold taxes when they can't be verified.

Penalties for lapses in information reporting would be increased.

More individual taxpayers would have to file information reports.

Local governments will have to report too.

Again, these only go to prove my contention that there will always be plenty of work for us tax practitioners. Tax Simplification is something that we will never see, as our rulers in DC continue to make the system ever more complicated.

Tax on inherited property?

Q:

Hey Kerry,

My sister & I are still fighting with my dad's girlfriend for our share of the house she said she'd buy from us two years ago. My sister talked with a former classmate of ours who said that we will have to pay gains taxes on what our share of the house was worth when my dad died....well, we haven't received any cash, we haven't received any interest on our "share"..in fact we paid his girlfriend $800 a month (because Dad was contributing that much) until last October when she walked away from the escrow she opened and the contract she signed to buy us out. Since then she's gotten her own attorney who told us..."so go ahead & sue"...and our lawyer said he'd want $40K of the $65K he'd recover for us....so we haven't done that.....My sister & I believe we have a plan that will cause the girlfriend to buy us out or the mortgage co will force the sale of the house right now and we'll be lucky to receive $65,000 cash for me & my sister to split.

So will we have to pay gains on the $112,000 or the $65,000 ? can we collect $65,000, pay gains on that and write off a loss on the difference between the $112,00 and $65,000 ??

A:

That sounds like quite a mess. When I give speeches and seminars on estate planning, I always say that Hollywood movies are accurate in their often cartoonish portrayal of the family infighting that results from a relative passing away as everyone fights for what they consider to be their fair share.

I have no idea what that former classmate of ours is doing in regard to the tax profession, but what she told you about paying taxes on your dad's property is 100% wrong. Is she perhaps working for the IRS? The only possible tax would have been if the net estate was worth more than one million dollars, and the tax would only be on the amount over $1,000,000. That would have been payable by the estate. You and I discussed the valuation and you were confident that the gross estate was well below the million dollar threshold for even filing an estate tax return.There are only a few things in this country that are statutorily exempt from tax to the recipient. Gifts, life insurance pay-outs and inheritances are the most common tax free items for recipients. The only kind of inheritance that is taxable is tax deferred retirement accounts, and those can usually be rolled over tax free by the heirs.

Other assets received as inheritance are completely tax free to the recipient. The big issue then is to establish the heir's cost basis for when s/he later sells it to see if there will be a taxable gain or loss. That is the asset's fair market value as of the date of death. As long as you don't move into the house and convert it to your personal use property, you are looking at a deductible loss when you do sell your share. The critical thing to protect against any IRS challenge is to get documentation from a Realtor or Appraiser of the property's value as of the date your dad passed away. When you finally succeed in selling your share of the property off, we can report the net loss. As investment property, the loss will be netted against your other investment capital gains and losses and subject to the ridiculous $3,000 net deduction against other types of income, with any excess carried over to future years.

I have no idea why she would tell you that the property was taxable to you as the heir. That has never been the case as long as I have been in this profession; so this isn't even a new change.

I hope this helps.

Good luck.

Kerry

Follow-Up:

Kerry

Thank you for your complete answer and clarification on the matter.

I remembered the 1 million exemption after I sent you the email. It was my sister who contacted our former classmate, no she hasn't been working for the IRS.

We did have an appraisal done within 90 days after dad's death.

Thank you, Thank You,Thank You.

States propose $24 billion in tax hikes – Minimizing state taxes is a game with constantly changing rules.

Labels: StateTaxes

IRS considers regulating tax preparers – Long overdue quality control over those of us who are not already regulated as CPAs, attorneys or Enrolled Agents. (Thanks to the always useful Lucianne.com for this.)

Labels: preparers