Estate Planning Info

Some useful and informative short articles from the latest Nolo Press email newsletter:

How Living Trusts Avoid Probate

Using Life Insurance to Provide for Your Kids

What You Can't, or Shouldn't, Do in Your Will

Labels: Estates

Idiot Tax

Over the years, many people have described lotteries as taxes on stupidity and taxes on people with no math skills. I still got a kick out of this scene from the most recent episode of Reaper, where Ray Wise as the Devil claims that he invented the lottery and has a familiar nickname for it.

Rebate Confusion

As I’ve pointed out on a few occasions, there is a lot of confusion regarding the effect of the stimulus checks on the 2008 tax returns. Not surprisingly, the IRS website has completely contradictory information regarding this, saying both that the rebate will be factored into the net tax on the 2008 1040 and also that it will have no effect whatsoever on the 1040’s bottom line. Obviously, both those claims can’t be true.

It has been my contention from the beginning that this will be handled just as we had to do with the similar advance rebate checks a few years ago. People who did not receive their rebates via checks were able to have that amount credited on their 1040s so that they ended up receiving the same net benefit as those who receive actual checks.

I was browsing the latest H&R Block newsletter and saw that they have also come to the same conclusion as I have:

The tax rebate is an advance credit for 2008 and will be calculated on your 2008 return. Now this is important: you are receiving a portion of your 2008 credit EARLY and if you receive it once, you won't receive it again when you file your 2008 return.

And, this is important too: if you're due a higher tax rebate, you'll get the remainder next year when you file. If you received a higher rebate than you should have, you DO NOT have to pay it back. So far, so good.

A tax rebate is not interest, it's not income, it's not a dividend. Pure and simple, and this is worth saying again, the tax rebate payment is an ADVANCE CREDIT for tax year 2008 and will be calculated on your 2008 return when you file in 2009.

Labels: Rebates

Evaluating Entity Types

As I’ve explained countless times, there is no reference material in existence, on the web or off, that can substitute for the services of a good professional business advisor, who should analyze the pros and cons of the various business entity types in relation to the exact situation at hand. However, some review of the basics beforehand can save a lot of expensive time with the professional. I always feel bad about charging clients almost four dollars a minute for explaining the basic concepts of corporations and LLCs, that they can read about on their own. Before I meet with clients to discuss what kind of entity or entities makes sense for a particular situation, I strongly encourage them to read over the materials I have posted on my website.

I just came across some new reference materials on the basics of selecting a business entity from the Intuit company, MyCorporation, which can be downloaded for free.

WMV video “Selecting the Right Business Entity” showing how to use a decision tree method of selecting an entity. This is 29.5 minutes long and the file is 21.3 mb in size.

20 page PDF file “Guide to Forming Corporations & LLCs” File size is 1.8 mb.

Labels: corp

Working with C and S Corps...

Q-1:

Subject: business tax question

Hi,Thank you for your article on sub s vs. c corp. I am a licensed professional in healthcare and have a sub s. I have a sub s, as years ago when I started it, my profession did not have a license in my state and my attorney at the time advised me to start this type of corp. I do not remember the specifics. Here we are 13 years later and several attorney and accountant later. As I make another accountant change, I am advised to consider starting a c corp. To keep my sub s to do my business so I do not have to change contracts etc. To have the sub s provide management services for the c corp, which will really have the clients have the c corp be profitable and the sub s operate at a loss. This is a new way of thinking for me. Is it legal? It sounds a bit on the edge?Thanks for responding. Each new person seems to add something and it becomes very confusing.

A-1:

Using both an S and a C corp together has been a very useful tactic for decades for exercising more control over business owners' taxable income. Too many people make the mistake of thinking everything has to be all or nothing with everything run through a single entity. Depending on your unique situation, using an assortment of entities can result in huge tax savings, as well as better liability protection from nuisance lawsuits.

Working with a creative professional tax advisor who understands how to properly utilize multiple entities is essential, as is up to date accurate accounting because many of the income shifting decisions depend on knowing how much income you have at any point in time.

Good luck.

Kerry Kerstetter

Q-2:

Thank you for your reply. Would you indulge me in another question or two?

Your reply certainly confirmed the advice of my new accountatnt. But, I am still skeptical. There are so many dishonest people, I am apprehensive!! These are my concersn or things I notice.

This new accountant, John Anderson, does not market himself as a CPA. His business card says CEO of his consulting company. When I asked if he was a CPA, he said yes. I checked AZ licensing, but he is not. I confronted him and he said he had a PA license. I checked PA and it expired in '86. Is that a big deal? If you have the info and knowledge, I guess you do not need a license to give advice and or prepare taxes. I am feeling like his answers are not necessarily honest. Further, he asked for POA to be able to sign to get c corp and do other things for the company. I am reluctant to give him that power. Is that usual? Finally, he mentioned that under the c corp we could in some way deduct our life insurance premiums. He discussed the keyman policy or by/sell. It makes sense to me, but my bother in law who sells life ins in TX is adamant that you cannot deduct life insurance. So, I am confused and apprehensive.

Thanks for your time.

A-2:

Anyone you work with should be completely open and honest about the status of his/her licensing. I'm confused as to which PA you are referring to. Do you mean licensed as a CPA in Pennsylvania or licensed as a Public Accountant, which is a designation similar to CPA that is rarely seen any more?

While CPAs, attorneys and EAs (enrolled Agents) are automatically eligible to prepare tax returns, each state has its own rules regarding the special licensing of others.

Asking for a power of attorney up front to submit incorporation papers on your behalf does sound very unusual and is not something I have ever requested from any clients, nor would I advise you to do. While the amount of personal involvement you choose to have in the business transactions is up to you, I would be very careful of delegating too many things to other people. There are too many things that could go wrong.

There are so many varieties of life insurance policies and ways in which to handle them that there is no easy answer in regard to the deductibility of premiums or whether company paid premiums are taxable as income to the beneficiaries. There are ways by which to have the ownership of the policy vested in a special trust or in the employer's name that may be useful. You need to work with an experienced advisor to see if there is a way to structure things so as to accomplish your specific goals.

No offense to your brother in law, but the claim that life insurance premiums are never deductible is wrong. There are various occasions when they are. For example, one that I encounter quite often is when a lender requires a life insurance policy as a condition of making a loan. For decades, I have been showing those premiums as deductions on client tax returns, with descriptions that they are required by the lenders. IRS has never had any problems with any of them.

I hope this helps.

Good luck.

Kerry Kerstetter

Labels: corp

Tax free home sale?

Q:

Subject: Buying a new home, 2 tax questions

1) is the sale of my current home a tax-exempt event? We’re in our 40’s and are moving to a larger house (if any of that affects the answer)

2) at closing, the sellers will bring prop taxes up to date (a little over a year’s worth of taxes). Shortly after that, spring 08 taxes will be due and paid by us. Do we get to deduct that property tax payment on Schedule A? Do the taxes they gave us at closing to get current count as income or offset the prop tax payment?

Thx

A:

Whether any or all of the gain on your home sale is taxable will depend on a number of factors that you need to review with your own personal professional tax advisor.

To get yourself up to speed on the rules, you should check out this article on the rules for home sales.

You will see that both your age and your plans to buy a new home are completely irrelevant to the taxability issue.

Settlement statements from both property purchases and sales are filled with tax deductible items, such as loan costs and property taxes. This is why any good professional tax advisor will request that you supply him/her with copies of those statements. S/he will know who to report the prorated taxes.

I hope this helps. Good luck.

Kerry Kerstetter

Follow-Up:

Thx for the quick response!

Labels: 121

Deducting website costs...

Q:

Subject: Deducting Website Expenses

What is the accepted protocol among CPA's for deducting the costs of building, updating, and maintaining a website and is there a difference beteween the costs of an ecommerce vs. a branding site?Thanks,

A:

There is no universal answer for this because too many variables need to be taken into account.

Your own personal professional tax advisor should be considering such things as how much the design of the website cost, when it started generating income, and how long it will be before it needs another expensive overhaul, in order to determine whether it makes more sense to immediately expense the costs or amortize them over the expected useful life of the design.

That would only apply to the up-front design cost. Monthly maintenance costs, including hosting services, would be expensed as paid or incurred, depending on whether you are on the Cash or Accrual tax basis.

Good luck.

Kerry Kerstetter

Follow-Up:

Thanks for the info.

Labels: Deductions

How assets paid for irrelevant to Section 179

Q:

Kerry if I finance the tractor will I still. Get same write off.

A:

Both the Section 179 expensing and depreciation deductions have nothing to do with how the new asset is financed. It is the exact same deduction whether you pay cash or take out a loan.

The only difference will be no interest expense deduction for a cash purchase.Kerry

Labels: 179

Offshore-Account Holders Bite Their Nails - I've never been a fan of the concept of hiding money outside of the country; but those who have been doing that will need to straighten out their act ASAP.

Labels: OffShore

Blue Floyd's TaxMan

It's been a few months since I've posted any newly discovered versions of George Harrison's classic TaxMan song.

I recently came across a bit torrent download of a concert from 1/20/02 by Blue Floyd. Instead of their normal set list of Pink Floyd songs, this over three hour long concert was all Beatles music, including TaxMan. The entire download is 1.1 gigabytes. Before listening to the entire show, I was anxious to check out the almost seven minute long TaxMan, which is very good.

As are most bit torrents, the original file is in the lossless FLAC format and is 45 megabytes in size. To make it easier to upload and store on my website, as well as for quicker downloading, I made an MP3 version that is only 6.5 mb. Playing the two versions back to back on my computer, I couldn't tell the difference.

Labels: Music

Gas Tax Holiday Comcs

This campaign scheme by the candidates has generated enough press that Daryl Cagle has set up a new section for many of the editorial cartoons it has inspired.

Opting out of stimulus checks?

Q:

Subject: Blog related question

Hi Kerry,Even before your first blog post about the "stimulus checks", I had learned what a misleading routine that whole thing is.I've been wondering - is there any way to file a 2007 1040 on time (before 10/15/08 w extensions) and still AVOID being issued one of these checks?If they issue one, even if a person doesn't cash it - won't they still say you owe that amount when you file for 2008?And it seems like it might even be possible that they would charge interest on the amounts issued as stimulus checks now. If so, you would end up paying back even more next year... ?

Thanks for all the info and insights you offer in your blog.

A:

I hadn't heard of any way to opt out of the stimulus checks other than to file your 1040 after 10/15/08. I just spent some more time browsing the IRS website pages related to these payments and couldn't see any mention of how to have them hold the checks if the 1040 is in by 10/15/08.

In another example of how disorganized this program is, I saw one page where they claim that the stimulus checks will not reduce the 2008 refunds or increase the tax due, while another page says exactly the opposite, and that those who don't receive stimulus checks because they file their 2007 1040s after 10/15/08 will receive credit for it on their 2008 1040s.

I have to believe the latter to be more accurate because this whole project is just like a similar one we had a few years back, where IRS sent out advance checks for one of Bush's tax cuts and then we had a mess accounting for it on the 1040s for that year because many clients who didn't have good records couldn't recall whether or not they had received their advance checks. That resulted in IRS having to change the bottom lines on several 1040s. I sense that we will be in for similar adjustments with the 2008 1040s.

Giving IRS the benefit of the doubt, I am hoping that if someone were to end up being underpaid for their 2008 taxes, the 2210 penalty on the amount of the stimulus checks would be waived if requested. They probably won't be as generous with interest charges, given their track record on this matter.

I'm glad you are reading my blogs. I wish more clients would so that I could avoid having to repeat myself so often.

Kerry

Labels: Rebates

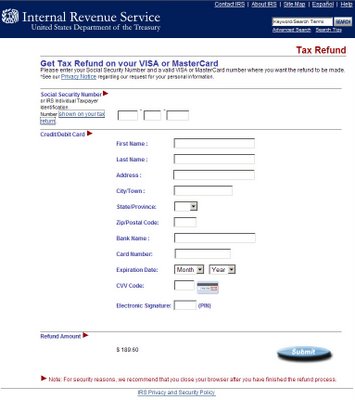

More Scam IRS Emails

While IRS does offer to deposit refunds directly into taxpayers' bank accounts, they have never had any facility to post refunds to credit card accounts. Anyone claiming that IRS will apply some money to your credit card is a crook who intends to levy a charge against your credit card account.

Likewise, IRS never sends out refund notices via email. NEVER.

I mention these warnings again because I just received the following email from a client.

Subject: Fw: Notice From Department of the TreasuryI just received another one of these e-mails from the IRS.When I received the last one I guess I deleted it and could not forward it to you, so here it is.----- Original Message -----From: Internal Revenue ServiceSent: Monday, May 05, 2008 2:33 PMSubject: Notice From Department of the TreasuryAfter the last annual calculations of your fiscal activity

we have determined that you are eligible to receive

a tax refund under section 501(c) (3) of the

Internal Revenue Code. Tax refund value is $189.60.

Please submit the tax refund request and allow us 6-9 days

in order to IWP the data received.

If u don't receive your refund within 9 business

days from the original IRS mailing date shown,

you can start a refund trace online.If you distribute funds to other organization, your records must show wether

they are exempt under section 497 (c) (15). In cases where the recipient org.

is not exempt under section 497 (c) (15), you must have evidence the funds will

be used for section 497 (c) (15) purposes.

If you distribute fund to individuals, you should keep case histories showing

the recipient's name and address; the purpose of the award; the maner of

section; and the realtionship of the recipient to any of your officers, directors,

trustees, members, or major contributors.To access the form for your tax refund, please click here

This notification has been sent by the Internal Revenue Service,

a bureau of the Department of the Treasury.Sincerely Yours,

John Stewart

Director, Exempt. Organization

Rulings and Agreements Letter

Internal Revenue Service

I wrote back:

Thanks for sending me a copy of that scam email. It's the same concept, but slightly different from the one I recently discussed on my blog.

Let me know if you receive any more and definitely do not respond to any of them.

Kerry

I was curious to see what the actual scam web page looked like, so I went to it. The URL tells you it is obviously an outright scam; but the crooks have designed it to look quite a bit like an official IRS page.

For those who may not want to risk visiting this site, I snagged a picture of it:

(Click on image for full size)

Labels: scams

Calif. Man Accused of Targeting Christians in $25M Nationwide Ponzi Scheme - The classic Ponzi style of scam never goes out of style. And of course, there never seems to be a shortage of fools who fall for what should be obvious con games to anyone looking at them objectively.

Labels: scams

Wesley Snipes in Jail - Freaking News currently has a PhotoShop contest starring the current top billed celebrity tax cheating moron. Be sure to check back over the next few days, as new entries are posted for us to laugh at this idiot.

Labels: Morons

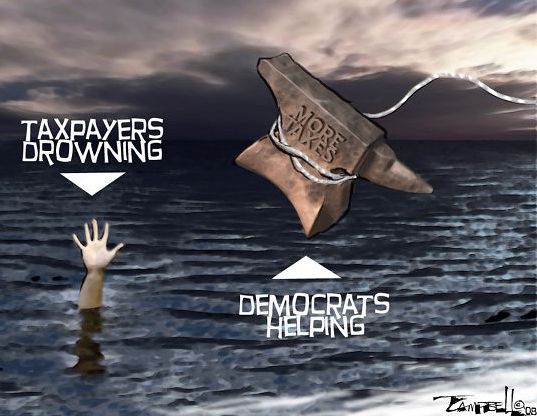

Our rulers prove once again why the most common oxymoron is "Government Efficiency."

(Click on image for full size)

Miracle Cars Fraud – Snopes.com looks at an interesting scam that had over 7,000 people paying $1,000 each for non-existent vehicles. In hindsight, most scams look so obvious; but the fact that these people were suckered in by their own religious leaders who were too naive to recognize con artists, gives this a different twist.

Labels: scams

Actual 1040 required for rebate check...

Q:

Subject: gov tax award

Hi Kerry"

Hey just a line, I was wondering if our extension suffices for filing and do we qualify for a stimilus tax award. Thanks

A:

The amounts of the stimulus checks depend on the info on the 2007 1040; so IRS can't start that process until they have actually received the 1040 for 2007. The extensions don't have any of that pertinent info; so IRS can't determine the amount amounts of the checks from those.

As I said in an earlier post on my blog about this very issue, these rebate checks are not free money. Whether you file your 2007 1040 in time (by 10/15/08) to receive a check or not, it will all equal out.

The people who receive these special stimulus checks will end up with smaller refunds when they file their 2008 1040s, or possibly even owe money that they wouldn't have if IRS hadn't sent out these advance checks.

In another typical example of keen government intelligence, many people who receive these stimulus checks in the next several months will just end up having to repay that same money to IRS when they file their 2008 tax returns.

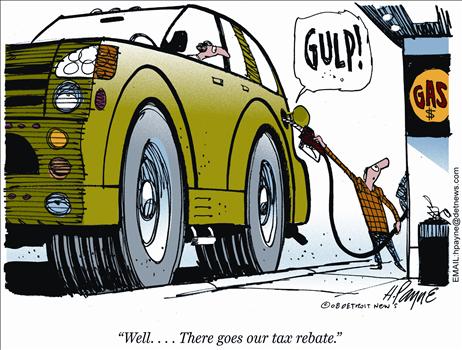

This whole thing is a Mickey Mouse tactic to try to get people to spend their way out of the recession, when the actual result will be that this money won't even cover the increased cost of fuel for their vehicles, which is the real cause of the recession.

I hope this answers your question.

Kerry

A good illustration of why fuel prices are so high, courtesy of Lucianne.com: