Insane Tax Protest

The nut job who "got even" this morning with the IRS in Austin for the results of an audit had published a ranting semi-explanation of why he took this drastic step; but it was taken down by his web hosting company. The Smoking Gun was able to snag a copy of it prior to its removal, and has it posted here.

From this passage on the fifth page, it sounds like his CPA, Bill Ross, should be very careful and on the lookout for booby traps, such as car bombs and suspicious packages in the mail. Any current tax clients of his should also be careful not to get caught in the crossfire from this dispute.

Labels: Morons

Debunking Tax Protestors

Long time readers know that one of my long running pet peeves is having to waste time debunking ridiculous theories espoused by tax protestors. For a long time, I felt like I was doing the IRS’s job because they refused to even acknowledge publicly that those arguments were floating around under the completely mistaken belief that to even mention them would in some way legitimize them. The promoters of those arguments used the IRS’s silence as an endorsement of their arguments.

Finally, after decades of ignoring the idiotic arguments used by tax protestors to convince others that they don’t need to file tax returns, IRS has been taking a more pro-active approach. They have recently updated their guide to most of these bogus claims, entitled The Truth about Frivolous Tax Arguments.

IRS Press Release – IRS Debunks Frivolous Tax Arguments

The table of contents below gives us a good idea of the growth in this segment of our society, as there have obviously been enough stupid people advocating these ridiculous theories to earn a spot on this list of morons.

THE TRUTH ABOUT FRIVOLOUS TAX ARGUMENTS

January 1, 2010

I. FRIVOLOUS TAX ARGUMENTS IN GENERAL

A. The Voluntary Nature of the Federal Income Tax System

1. Contention: The filing of a tax return is voluntary

2. Contention: Payment of tax is voluntary

3. Contention: Taxpayers can reduce their federal income tax liability by filing a “zero return.”

4. Contention: The IRS must prepare federal tax returns for a person who fails to file.

5. Contention: Compliance with an administrative summons issued by the IRS is voluntary.

B. The Meaning of Income: Taxable Income and Gross Income

1. Contention: Wages, tips, and other compensation received for personal services are not income.

2. Contention: Only foreign-source income is taxable.

3. Contention: Federal Reserve Notes are not income.

C. The Meaning of Certain Terms Used in the Internal Revenue Code

1. Contention: Taxpayer is not a “citizen” of the United States, thus not subject to the federal income tax laws.

2. Contention: The “United States” consists only of the District of Columbia, federal territories, and federal enclaves.

3. Contention: Taxpayer is not a “person” as defined by the Internal Revenue Code, thus is not subject to the federal income tax laws.

4. Contention: The only “employees” subject to federal income tax are employees of the federal government.

D. Constitutional Amendment Claims

1. Contention: Taxpayers can refuse to pay income taxes on religious or moral grounds by invoking the First Amendment.

2. Contention: Federal income taxes constitute a “taking” of property without due process of law, violating the Fifth Amendment.

3. Contention: Taxpayers do not have to file returns or provide financial information because of the protection against self-incrimination found in the Fifth Amendment.

4. Contention: Compelled compliance with the federal income tax laws is a form of servitude in violation of the Thirteenth Amendment.

5. Contention: The Sixteenth Amendment to the United States Constitution was not properly ratified, thus the federal income tax laws are unconstitutional.

6. Contention: The Sixteenth Amendment does not authorize a direct nonapportioned federal income tax on United States citizens.

E. Fictional Legal Bases

1. Contention: The Internal Revenue Service is not an agency of the United States.

2. Contention: Taxpayers are not required to file a federal income tax return, because the instructions and regulations associated with the Form 1040 do not display an OMB control number as required by the Paperwork Reduction Act.38

3. Contention: African Americans can claim a special tax credit as reparations for slavery and other oppressive treatment.

4. Contention: Taxpayers are entitled to a refund of the Social Security taxes paid over their lifetime.

5. Contention: An “untaxing” package or trust provides a way of legally and permanently avoiding the obligation to file federal income tax returns and pay federal income taxes.

6. Contention: A “corporation sole” can be established and used for the purpose of avoiding federal income taxes.

7. Contention: Taxpayers who did not purchase and use fuel for an off-highway business can claim the fuels tax credit.

8. Contention: A Form 1099-OID can be used as a debt payment option or the form or a purported financial instrument may be used to obtain money from the Treasury.

II. FRIVOLOUS ARGUMENTS IN COLLECTION DUE PROCESS CASES.

A. Invalidity of the Assessment.

1. Contention: A tax assessment is invalid because the taxpayer did not get a copy of the Form 23C, the Form 23C was not personally signed by the Secretary of the Treasury, or Form 23C is not a valid record of assessment.

2. Contention: A tax assessment is invalid because the assessment was made from a substitute for return prepared pursuant to section 6020(b), which is not a valid return.

B. Invalidity of the Statutory Notice of Deficiency.

1. Contention: A statutory notice of deficiency is invalid because it was not signed by the Secretary of the Treasury or by someone with delegated authority.

2. Contention: A statutory notice of deficiency is invalid because the taxpayer did not file an income tax return.

C. Invalidity of Notice of Federal Tax Lien

1. Contention: A notice of federal tax lien is invalid because it is unsigned or not signed by the Secretary of the Treasury, or because it was filed by someone without delegated authority.

2. Contention: The form or content of a notice of federal tax lien is controlled by or subject to a state or local law, and a notice of federal tax lien that does not comply in form or content with a state or local law is invalid.

D. Invalidity of Collection Due Process Notice

1. Contention: A collection due process notice (Letter 1058, LT-11 or Letter 3172) is invalid because it is not signed by the Secretary or his delegate.

2. Contention: A collection due process notice is invalid because no certificate of assessment is attached.

E. Verification Given as Required by I.R.C. § 6330(c)(1)

1. Contention: Verification requires the production of certain documents.

F. Invalidity of Statutory Notice and Demand

1. Contention: No notice and demand, as required by I.R.C. § 6303, was ever received by taxpayer.

2. Contention: A notice and demand is invalid because it is not signed, it is not on the correct form (such as Form 17), or because no certificate of assessment is attached.

G. Tax Court Authority

1. Contention: The Tax Court does not have the authority to decide legal issues.

H. Challenges to the Authority of IRS Employees.

1. Contention: Revenue Officers are not authorized to seize property in satisfaction of unpaid taxes.

2. Contention: IRS employees lack credentials. For example, they have no pocket commission or the wrong color identification badge.

I. Use of Unauthorized Representatives.

1. Contention: Taxpayers are entitled to be represented at hearings, such as collection due process hearings, and in court, by persons without valid powers of attorney.

J. No Authorization Under I.R.C. § 7401 to Bring Action.

1. Contention: The Secretary has not authorized an action for the collection of taxes and penalties or the Attorney General has not directed an action be commenced for the collection of taxes and penalties.

III. PENALTIES FOR PURSUING FRIVOLOUS TAX ARGUMENTS

Snipes Appeals Overly Taxing Prison Sentence – The Hollywood lunkhead’s tax planning strategy is still on course for him to stay at Club Fed for at least a few years.

Loose lips...

It’s long been an item of common sense that if you are hiding from the tax authorities or cheating on your taxes, the worst thing you could do would be to tell people about it. Eventually, that info will reach the tax authorities. This article explains how some State tax agencies are catching idiots who brag about themselves on such web services as FaceBook and MySpace.

Thanks to Stephen Spruielli at NRO for this.

Labels: Morons

Peeking behind the curtain...

A recent episode of South Park had the following bit on how our exalted rulers in DC are making the insane financial decisions they have been pummeling us with over the past several months. It can’t be any more ridiculous than what is really happening with blithering idiots like President 0bambi, Tax Cheat Geithner, Banking Queen Barney Frank and Corrupt Senator Christopher Dodd in charge of the USA’s financial systems.

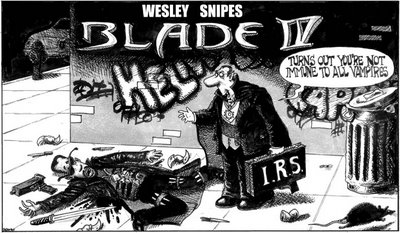

Wesley Snipes in Jail - Freaking News currently has a PhotoShop contest starring the current top billed celebrity tax cheating moron. Be sure to check back over the next few days, as new entries are posted for us to laugh at this idiot.

Labels: Morons

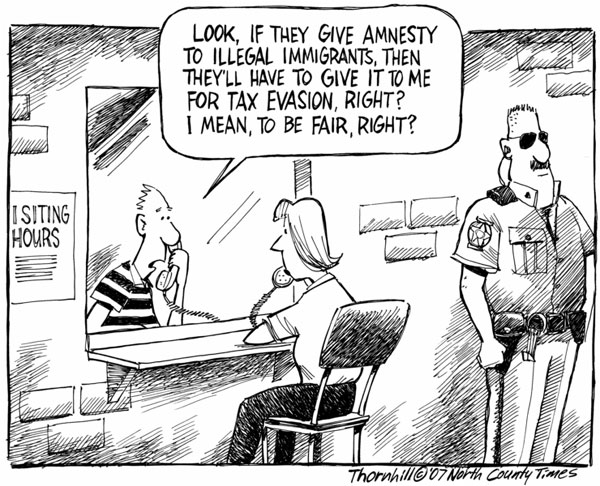

Other tax protestors...

A few weeks ago, I received the following email from someone who obviously wants to follow in Wesley Snipes’ footsteps in regard to taxes.

Subject: Tax Question

Hi My name is Frank

My Friend told me to check out you web page and that you are claiming that YOU MUST FILE at Tax return or else.

So if what you are telling me is true according to your web page then it should be very simple to SHOW ME THE LAW.

After all there has to be a Law, Right? If there is a law then I will send you an apology an I will also get a group that will actually PAY YOU MONEY should you find this LAW.

You are stating SCAM so if this is true then it won't be any problem for you to prove your point right?

Please refrain from double speak or dancing around the issue and show me the law, because after all that is what we base our constitution on isn't it? Unfortunatly I did NOT see where you were specific about the LAW on this issue.

Thanks

Frank

My Reply:

Frank:

It's been a while since I've received an email like yours, espousing the idiotic tax protestor arguments against the tax system. I used to receive several every day before the IRS started directly addressing these ridiculous claims on their own.

As many of your compatriots have done in the past, you have obviously mistaken me for someone else. I am a private citizen and have no responsibility for the administration of the tax law. I have no requirement to answer any of your stupid questions or waste any more of my time debunking your moronic theories about how the tax system works in this country.

I actually couldn't care less if you want to pretend that there is no law requiring you to file tax returns and spend the rest of your life fighting for your life in court and prison. In fact, the more time the IRS spends dealing with idiots like you and your cohorts, the less time they will have available to harass those of us who obey the laws.

You need to address your concerns to the governmental agency that handles tax matters, the IRS.

To save you time, they have a special web page dealing with the frivolous arguments that you are trying to use. You should start there if you truly care about the truth.

Good luck.

Kerry Kerstetter

Labels: Morons

Wesley Snipes Verdict In

Judge sentences Snipes to 3 years for tax convictions

Wesley Snipes Sentenced to Three Years in Jail

Labels: Morons

Wesley Snipes' claim to fame...

It's looking like Willie Nelson is losing his crown as the most famous celebrity tax screw-up; at least according to the Late Show writers.

From their Top Ten Ralph Nader Campaign Promises:

Fund universal health care by making Wesley Snipes pay his taxes.

From the 2/29/08 un-aired "Top Ten Dumb Guy Explanations For Leap Year:"

One of those things that happens every four years like Wesley Snipes paying his taxes.

I wonder if Snipes is scheduled to be on the April 15 show, where tax preparers give the Top Ten.

Wesley Snipes trial stays in Ocala, Fla. – It looks like his ridiculous Race Card strategy didn’t do the trick.

There used to be a saying warning not to take any wooden nickels. That has to be updated now to don't take any million dollars bills, after this idiot in South Carolina actually tried to deposit this bill into a bank account.