Tax Guru-Ker$tetter Letter

Wednesday, March 31, 2004

IRS Increasing Audits Of Largest U.S. Pension Plans - What I find so amusing about this story (thanks to Janell Grenier) is how those in charge of the biggest pension plan in the country (Social Security) are allowed to do so many things that are completely illegal in the private sector, such as commingling retirement funds and not having actual money or assets in the accounts (unfunded accounts). It's more of the typical "do as we say, not as we do" hypocrisy from our rulers in DC.

The first rule of holes - Excellent points on how our rulers' out of control spending is digging an ever increasing hole for all of us.

IRS Warns of “Corporation Sole” Tax Scam

Stiff Court Penalties for Frivolous Appeals to Delay IRS Collections

Any time there is serious discussion of reforming our tax system, so many options are put forward that no single one can achieve an adequate level of popular support. The result is always to just stick with what we have - "the devil we know..."

Schwarzenegger says raising taxes may be unavoidable - As if nobody could see this coming when a RINO was elected as governor of the PRC.

House Defeats Democratic Tax Cut Curbs - The DemonRats will never give up in their efforts to make it harder to reduce taxes than to raise them.

Casino Pulls Ad Aimed at Those in Debt - While I agree that it's disgusting to promote gambling as the quick and easy way out of debt, there is a double standard here. The Missouri Lottery has been running tons of TV commercials for getting into Lucky Town by playing their game, as I'm sure is done by other State lotteries.

Tuesday, March 30, 2004

Cheney pegs John Kerry taxes at $1.7 trillion - It's quite timely to connect John Kerry to higher taxes this time of year, but I still worry that the very easy (like shooting fish in a barrel) attacks could cause his candidacy to implode before the DemonRats officially make him their candidate for November, in which case Queen Hillary steps in to save the country.

My platform - If I were to ever run for President, my agenda wouldn't be much different than what Thomas Sowell proposes here.

Good news on the State tax front - Thanks to Andrew Roth:

Colorado, other states consider tax-and-spend limits

South Carolina Business Leaders Endorse Governor's Tax Cut Plan

How State and Local Taxes and Services Affect Economic Development

Monday, March 29, 2004

Second Opinion

One of the more frustrating aspects of the tax game are the IRS auditors who think it's their job to micro-manage and second guess the businesses of their victims, without having a clue as to how the business should be run in the real world that we live in, as contrasted with the "Alice In Wonderland" realm many of them inhabit.

Cheney blasts John Kerry as tax fan - How dare Cheney refer to how John Kerry actually voted in the Senate. Doesn't he know that DemonRats are never to be judged on what they actually do, but only on what they say they want to do? The media will remind him of that, I'm sure.

Deducting Sales Taxes - It is true that there is an inequity in regard to the fact that people who live in states with no income tax, but high sales taxes, have lower Federal Schedule A deductions since our rulers killed off the sales tax deduction in 1986. Finding the perfect balance between types of taxes and deductions is a never ending quest.

Sunday, March 28, 2004

Virginia Political Shocker: Republicans for High Taxes - We have a classic case of the RINOs versus the true conservatives.

From MSN Money:

Readers love refunds -- but they're wrong - As I've always explained, anyone bragging about getting a huge tax refund is just telling everyone how ignorant they are at handling money.

How many exemptions can you take? - The goal should be a breakeven on your tax return. Use the worksheet on the back of Form W-4 to refigure this any time things change. Contrary to popular belief, there is no maximum number of times you can submit a new W-4 to your employer.

What if you can't pay the IRS? - The worst thing you could do is to hold off sending in a tax return just because you don't have the money to pay it off in full. Besides the fact that the late filing penalties are much higher than the late payment penalties, if you don't file a tax return and show IRS what your actual tax bill is, they will use the information they have (1099s and W-2s) to calculate a much higher tax than even the most incompetent tax preparer would come up with. A tax return is a self defense tool where you have a chance to declare what your actual tax obligations are and prevent IRS from accusing you of owing hundreds of times more than that.

Friday, March 26, 2004

Thanks again to Andrew Roth for the following:

John Kerry's Math - Reflecting his education at the Karl Marx School of Finance

Tax Fairness versus Tax Morality - Two oxymorons in one headline. There is nothing fair nor moral about taxes.

Bush “Attax” in Kerryland - For some reason, it's wrong for the Bush team to tell the truth about his opponent; yet it's perfectly acceptable for the DemonRats to fabricate complete lies about Bush and the GOP.

Thursday, March 25, 2004

I liked these quotes from Thomas Sowell

Some seem to think it is wonderful when super-rich people say that high taxes are not so bad. True, taxes are not so bad if you already have more money than you can spend in your lifetime, especially if you inherited it. But most people had to work for what they have and have things that they want to spend it on, rather than have politicians grab it to use to buy votes.

The fraudulence of the left's concern about poverty is exposed by their utter lack of interest in ways of increasing the nation's wealth. Wealth is the only thing that can cure poverty. The reason there is less poverty today is not because the poor got a bigger slice of the pie but because the whole pie got a lot bigger -- no thanks to the left.

Bush Casts John Kerry As Tax Raiser in TV Ad - If the shoe fits...

Grand Jury Indicts Anti-Tax Author - It's about time the government took serious action about tax protestor scammer Irwin Schiff, his support staff, and the people stupid enough to follow his lead.

I have no idea how many people keep track of all the taxes they pay during their lifetimes; but if such a tally were possible, I am certain we would see a lot less passivity in the face of constant tax increases, especially the hidden ones, such as on phone and utility bills.

Wednesday, March 24, 2004

Tax hawks cooling to Norquist - Dissension among the ranks of tax fighters.

Price gouging - The laws of supply and demand can be cruel at times. However, government attempts to stifle the natural market reactions usually leads to the inevitable shortages.

New Limits May Drive Away Used-Car Donations - This would be a law that makes a lot of sense, a rare thing in the fairy tale world of DC - limit the deduction for vehicle donations to the actual selling price rather than the inflated Blue Book figure. I'm just a big believer in the power of the market to set prices; so what a buyer actually pays for a vehicle is a much more reliable indicator of its true dollar value than some generic pricing guide.

Too Trusting

Medicare to go broke by 2019, trustees say - There are a couple of key issues to consider when reading a story like this.

First is the erroneous use of the term "trust fund." There is no such thing as a trust fund for any of the Medicare or Social Security taxes being paid in. All money taken in is spent immediately. In fact, as I've mentioned countless times, the kind of commingling of funds done by our rulers in regard to these supposed trust funds would put regular people in prison if they tried it with private sector insurance or retirement accounts. It's always been a pet peeve of mine, and cause for low credibility towards anyone (in government or media) who refers to the existence of a trust fund when discussing Medicare or Social Security. Such people are either dishonest, stupid, or both.

The other big problem I have with stories like this is the implication that the bean counters in DC can predict with certainty such things as when the Medicare or Social Security system will go broke. Just as with their perpetual misses on predicting the annual budget deficit or surplus, those accountants can't even get it close one year ahead of time, much less decades from now. Again, it's another pet peeve of mine when any kind of financial figures are spouted by our rulers in DC and anyone takes them seriously instead of recognizing them as the WAGs (Wild Ass Guesses) that they are.

Maybe I'm being overly sensitive about the improper usage of the term "trust fund." Perhaps it's just more ignorance on the part of the media, like the story in our local paper a few weeks ago, where the reporter referred to a living trust as a trust fund. However, I am certain that the widespread pervasiveness of the "trust fund" concept among so many people is really an attempt to make taxpayers feel more financially secure than they really are and hide the fact that all of their tax payments are going right back out the door and not into any kind of bank account on their behalf.

Quicken or QuickBooks?

I am constantly being asked which program is better, such as in the following email I received today:

My question is if your remark would apply to my new small business that I am starting. (least expensive basic version is sufficient)? The accountant that I talked to said that Quicken would be enough but I have had some people debate that. I actually an familiar with QuickBooks but not Quicken. Thank you in advance for your reply.

PS: What is the least expensive way to acquire QuickBooks? I can't believe the prices I am seeing!!

My response:

For a business, there is no contest. QuickBooks is far superior to Quicken for all of the reasons I spelled out here.

The absolute lowest prices I have seen are from eBay sellers. Next best is through the link on my website.

Next best is from the warehouse clubs (Costco, Sam's). If you buy the Basic version, it will be much less expensive than the fancier ones, and will work just fine for you.

Good luck.

Tuesday, March 23, 2004

AARP fears competition, not confusion - Keeping the payers straight in the fight for Social Security reform just became more confusing. Battling the big government loving AARP is a new group, called ARP (Alliance for Retirement Prosperity).

Defend the Bush Economy, Stupid! - The gutless wonders in the GOP are so cowed by the liberal opposition that they can't even speak up for the Bush programs when they working out well.

Shareholder Group Releases Report Detailing John Kerry's Record on Investor Issues in the Senate - And it isn't pretty for anyone who believes in capitalism.

Extensions

We have already started preparing and submitting the first extension requests for 2003 1040s. Every year, as more people learn the benefits of filing their returns after April 15, I seem to do fewer tax returns by the normal April 15 due date. In fact, right now I am working on several 2002, as well as a few 2001, 1040s that have had their due dates extended to April 15, 2004.

You can download the official Federal extension form directly from IRS.

Each state is different in regard to whether or not you need to send in a special form. Most states will simply honor the IRS extension and only require their own form to be sent in if you are including a payment.

Monday, March 22, 2004

On the State Tax Front

Teaming up for higher taxes in Virginia

Critics of Fletcher's Kentucky tax plan attack its 'revenue neutrality'

Your own people may be the problem - This report of poor computer security and lack of computer skills at the IRS really shouldn't surprise anyone. Their computer systems are literally from the Kennedy Administration, as are many of their procedures.

Bill would let Colorado taxpayers share excess state money - While at first blush, this sounds like a good idea, it's not as practical in reality. I have seen a few times with the PRC, where the State spent millions of dollars sending out tiny refund checks to taxpayers in order to distribute a budget surplus. Then, a few years later, they are running a big deficit and are doing everything they can to raise taxes.

A wiser move would be bank the surplus for the inevitable "rainy day" when black ink turns red. The very legitimate worry that many taxpayers and critics of government have is that the rulers will be unable to resist the urge to spend any excess money if it's not sent back to taxpayers. It would be more cost effective to pass legislation requiring any surplus to be placed into a special reserve fund.

Sunday, March 21, 2004

States turn to sales tax to compensate for revenue shortfalls - Our rulers can raise sales taxes much quicker than income taxes, as they just did here in Arkansas.

Bush Declares John Kerry a Serial Tax-Raiser - Well, duh. What else would we expect from a Socialist Senator from Taxachusetts?

Death, taxes, airline food - As usual, Dave Barry has a slightly different take on the tax law changes than we normally get from the more conventional tax experts. For example, I don't know how I missed the following new tax credit:

If you or any of your legal dependents saw, or heard about, Janet Jackson's Super Bowl halftime-show performance, you may claim a special one-time Traumatic Unexpected Nipple Gander Tax Credit of $250 for each eyeball that was exposed, up to a maximum of seven eyeballs per family unit for joint taxpayers filing singly.

The learning never stops in the tax game, where the rules are constantly changing.

Saturday, March 20, 2004

Fire Department

Besides my CPA type work, pretty much the only other thing I do, and the only reason I leave my office, is to help out with our local volunteer fire department. After a recent class we took at the local college on arson investigation, Sherry has started bringing her camera along on calls. We've set up a mini website with some of the pictures she has taken, including several from last night's work on a controlled burn up the road from our place. That was a strange experience for us, since we are so used to trying to put fires out and this time, we were trying to burn the place down.

Child tax credit causes 1.35 million return goofs - This exact same problem happened a few years ago, when people forgot whether or not they had received an advance refund check from IRS during the year. I had a few dozen clients where IRS jogged their memory by adjusting their tax returns to account for the fact that they had indeed already received those payments and weren't entitled to them again with their tax returns. That kind of sloppy bookkeeping was one of the reasons we have been forcing more and more of our clients to enter everything into QuickBooks; so that we can look for those advance refund checks before preparing the tax returns and avoid the embarrassment of having IRS catch this mistake.

Web Site Shows Neighbor Campaign Donations - You can type your zipcode into this site and find out what people in your area have legally donated to the various presidential candidates. The illegal donations and laundered ones, where employers give their workers money to donate, take a little more digging to uncover.

Mental-health tax drive advances - The rulers of the PRC never tire of thinking of new ways to squeeze money out of people and giving them reasons to move to other, less hostile, states. A plan to add a new tax of one percent of gross (not taxable) income over one million dollars to fund mental health is itself bordering on insanity. Of course, it plays directly to the DemonRats' main constituency, the "hate the rich" crowd; so it could actually have a chance of becoming law if Governor Arnold doesn't veto it.

Friday, March 19, 2004

Bush Zeroing In On Budget Waste - We can all now say "it's about time!"

John Kerry Votes for New Tax Hike

Bloated government, not the tax cut, is to blame for the deficit

Thursday, March 18, 2004

22-year-old pleads guilty in million-dollar con - As with most stories like this, it's very difficult to come up with much sympathy for "victims" stupid enough to believe they were actually going to earn 450% returns on their money.

California Weakening - Even with Governor Arnold in power, things are not looking good for the PRC. I've come to the exact same conclusion when working with clients; that California would be just about the worst state in which to locate a business because of all the taxes, regulations, and litigation for everything imaginable.

House panel leaves tax cuts intact - A little sanity, recognizing that the deficit is caused by over-spending and not by tax cuts, as the DemonRats are saying.

Tuesday, March 16, 2004

Lying Is Job One For Leftist Economists - With the mainstream media promoting leftist causes, along with widespread economic illiteracy in this country, their lies are widely accepted as gospel.

John Kerry's Economic Beliefs - As with all issues, he supports and opposes everything, depending on the audience he is with. He is the true poster boy for political pandering. I don't have time to dissect the presidential campaign, but I do think it's still too early for the Bush team to use the big guns and nuke John Kerry.

Until the DemonRats' convention, John Kerry isn't the official party nominee and could be replaced by someone else (Queen Hitlary) if he's considered too unelectable. With the way he's already imploding on himself, I have doubts that he will be worth nominating at the convention and the Bush team will have to redirect their focus.

Cutting State Government Spending (and Living to Tell About It) - Some positive news for taxpayers at the State level.

Monday, March 15, 2004

Man held in Google stock fraud - Playing the stock market is too risky for most people under normal circumstances. Paying someone for stock that doesn't even exist is just insane.

Enough Talking about Fiscal Responsibility -- Let's Cut Spending - Another often overlooked fact - the number one cause of high taxation is government spending. Control the spending by our rulers and we all save money.

Entrepreneur's Son Gives Government an Economics Lesson - Including the often overlooked fact that lower taxes for business owners allows them to invest more in their companies' employees and equipment.

Congress, Please -- Feel My Tax Pain - The sad reality is that every time our rulers try to simplify the tax system, they end up making it much more complicated, as I showed in my poster. My answer to this is the classic "end it, don't mend it."

Sunday, March 14, 2004

Thanks to Ben Cunningham for passing along the following:

IRS 'exam' is something no taxpayer cares to take

Imagine Uncle Sam's Mitts Off Your Paycheck - A good report on the status of the Fair Tax Act, which would replace the income tax with a national sales tax.

Tax collection, IRS served up with a wicked smile

Privacy And Loan Applications

I received the following email in regard to this article explaining how lenders often require borrowers to sign IRS Form 4506, allowing the lender to obtain personal tax info directly from IRS.

Kerry...Were you aware of form 4506?? I was not even aware this existed...scary as hell. This means the govt has essentially become a partner in coercion to give up privacy rights. Ben

http://www.miami.com/mld/miamiherald/living/home/8170552.htm

"Case in point: Kathie Street, a mortgage broker in Bellingham, Wash., recently was ordered by a national lender to instruct her loan customers to sign -- but not date -- an IRS Form 4506 as a condition of funding their loan. If the clients refused, the loan would be canceled.

IRS Form 4506 grants lenders access to multiple years of private tax returns for up to 60 days after the borrowers sign and date the form. Widely used in the mortgage industry to combat fraud, the form directs the IRS to provide either full returns or transcripts showing key details of the taxpayers' filings.

The form carries explicit instructions that taxpayers must date and sign it. . By signing, but not dating, Form 4506, mortgage applicants essentially allow unknown persons to date the form and receive up to four years of IRS tax filings, no questions asked. There are no controls over their subsequent use of the income and tax information."

My response:

Ben:

I am well aware of the use of that form by lenders for the past 15 or so years and I have a lot of experience with this matter. It's the lenders' method of verifying that the tax returns provided as part of a loan package are the same ones that were sent in to IRS. It was a reaction to a very real problem, where people were making up dummy tax returns in order to qualify for loans, and later they defaulted on those loans. That kind of thing does still happen nowadays and is even easier for people to do with do-it-yourself software, such as TurboTax. Over the 28 plus years I have been a tax pro, I have had several requests to prepare dummy tax returns for lenders, and I still receive occasional such requests; however not as many as previously, since I chewed out several loan brokers for sending their clients to me for this illegal action.

It is similar to lender verification of tax returns with the preparers. I often receive copies of tax returns that I had prepared from lenders asking me to verify that it was the same as what I had prepared. The only time I can recall it not being correct was about a dozen years ago when a lender sent me a copy of a tax return I had allegedly prepared for a married couple. It had my name as preparer; but when I compared it to my copy of the return I had prepared for that couple, it was very different. Their loan broker had dummied up a tax return, using my name and completely different numbers. To say the least, I was outraged at this and filed complaints with every regulatory board imaginable to nail that loan broker. I also terminated all connection with those clients. To the best of my knowledge, nothing was ever done to that loan broker and the lender didn't call in the loan, which was their right after discovering such false information from the borrowers, my former clients.

While it may seem to be a violation of personal privacy to have borrowers sign Form 4506, I really can't get too worked up about it. With all of the personal financial info we are forced to provide to lenders, as well as the open access they have to our credit histories, the 4506 isn't that dangerous.

I hope this real world perspective on this matter gives you a better understanding of this issue.

Kerry Kerstetter

Saturday, March 13, 2004

Impending Tax Increases

Last year, when our rulers in DC were crafting the tax cuts, they played fast and loose with the effective dates for the various provisions of that bill. In their classic smoke and mirrors style, they set up most of the tax cuts to be temporary, with varying expiration dates.

At the time, they claimed that they would later go in and make them permanent. However, they still haven't done so, and the first part of that bill turns into a pumpkin next year, 2005.

Regardless of who wins the November election for the White House, if our rulers in Congress don't do something to either extend these tax cuts - or better still, just make them permanent -- everyone's taxes will go up next year. We all should be pestering our CongressCritters to act ASAP on this matter. Doing nothing is tantamount to raising all of our taxes.

Thanks to Andrew Roth of MoveRight.org for posting this PDF version of the impending tax increases. I thought it was so important, that I converted that to HTML and posted it on my website so that we can refer to it often. I've also added a link to it in my BlogRoll on the right side of this page.

Criminal Money Makers

Big-bill bearer: Just a mistake - The idiot woman who tried to use a million dollar bill to buy things from Wal-Mart claims it was a mistake, but that she thought the bill was real. Definitely a John Kerry voter.

Pals tell all about counterfeiting - These idiots even burned up some of their fake twenties while cooking them in a microwave oven.

Dialing For Dollars - I'm always interested in creative ways people try to make money. Of course, some of those ways aren't exactly kosher. These guys scammed the phone company out of half a million smackers by auto-dialing two million 800 numbers and receiving a commission of 24 cents for each call.

Friday, March 12, 2004

Tax Protestor Arguments

It never ceases to amaze me how useful the QuickFinder books are. As I've said on several occasions, I have been buying them for each of the past 20 plus years and refer to them a number of times each day.

They add new features every year, but I generally don't have time to check out every page when the new editions arrive. I was looking through the 1040 book for something today and came across this excellent two-page summary of idiotic arguments used by tax protestor morons, and the reasons why they are wrong. I pulled out my QuickFinder book from last year, and confirmed that these pages are new for the 2004 book.

Counterfeit Stamp Use on the Rise - With the cost of postage always going up, and higher denomination stamps being issued (we buy lots of $3.85 stamps for Priority Mail), this shouldn't be a surprise. Postage stamps are just like cash, and I can remember back when people did use them as a means of sending payments through the mail. I've long wondered why IRS didn't include postage stamps as a "cash equivalent" on Form 8300, where cash transactions of over $10,000 are to be reported.

Thursday, March 11, 2004

Sales Tax Complications

Anyone who thinks income tax laws are overly complicated and impossible to follow, doesn't know the half of it when compared to sales tax laws. My concerns over requring sales taxes to be collected for transactions over the Internet have not been just about the money involved for the customers. As I've explained before, I see it making a bigger impact from the perspective of the retailers having to keep straight what things are taxed and the appropriate rates for over 7,500 jurisdictions around the USA. The expense and hassle factor of just complying with all of that will be tremendous for web based businesses, most of which don't have huge accounting departments.

I came across this interesting article about this burden in the same isue of Accounting Technology that I referenced earlier today. I liked their list of weird sales tax laws as an illustration of how tricky this issue is.

• In Minnesota, non-edible cake decorations are taxable, but edible cake decorations are exempt.

• In Tennessee, the sale of a good is subject not only to the state sales tax of 7 percent, but a local sales tax on the first $1,600, plus an additional state sales tax of 2.75 percent on the second $1,600.

• In Illinois, cooking wine is taxable as an alcoholic beverage, even though it only contains a nominal amount of alcohol.

• In Texas, plain nuts are an exempt food, but once a candy coating is added, they become taxable.

• Missouri does not impose a state-level tax on utilities, but some localities impose a "domestic utilities tax" at a rate that is different from the local sales tax rate.

• In Rhode Island, fruit juice that is less than 100 percent pure is taxable. But cranberry juice cocktail, a mixture of juice and water or concentrate, is exempt.

• In Massachusetts, a clothing item costing up to $175 is exempt from sales tax. However, any item costing $175.01 and above is subject to the 5 percent state sales tax.

• In New Jersey, naturally carbonated water is exempt, but artificially carbonated water is taxable.

• Maryland's unique rounding rules can potentially result in the collection of a sales tax rate as high as 8 percent, instead of the statutory 5 percent.

• In Pennsylvania, state and U.S. flags are not subject to tax, but if either is sold with a pole, the entire purchase becomes taxable.

Labels: 179

America Mired in Morass of Laws and Regulations - In a purely Socialist or Communist nation, the government owns all property. However, when the use of privately owned property is heavily regulated by the government, as it increasingly is here in the USA, the net effect is almost exactly the same. That kind of over-regulation and micro-managing of everyone's lives, is the very reason I decided to leave the Left Coast eleven years ago, and is why I refer to my former home state as the People's Republic of California.

Outsourcing Jobs To India

I was reading a recent copy of Accounting Technology magazine and noticed a half-page ad on the inside back cover for Accountants In India promoting "$8.00 An Hour For An Experienced College Graduate Accountant - For Hire."

I have no idea how well this would work for an actual USA accounting practice. I have no intention of trying it. It's tricky enough working with the accountants I use around the USA to have to mess with other countries.

Don't Repeal Tax Cuts for the "Rich," Cut the Spending Stupid - Another bit of the truth that the deficit has almost nothing to do with the tax cuts and everything to do with out of control spending.

Tax Policy Experts Warn of Federal Spending

How to put Social Security back on solid ground - Ed Feulner's ideas.

Social Security Reform Can No Longer Be Ignored - The Cato Institute's take on it.

Wednesday, March 10, 2004

Kerry's wife defends husband's lack of charisma - Why did this seem like it was about me? It must be the decades of being a geeky CPA.

John Kerry Asking Wealthy to Pay Old Tax Rate - This guy is such a moron. His claim that the middle class are paying higher taxes due to Bush's tax cuts for the evil rich is just more donkey droppings. And he must be smoking some more of that wacky weed if he expects people earning over $200,000 to voluntarily send in the higher Clinton rate taxes.

Senate Kills Move to Make Tax Cuts Harder

Republicans Fight Assault on Tax Relief

Ease corporate tax load - The high rates in the US do often make it more attractive to base operations in other nations.

How Does Virginia's Tax Climate Compare?

Top officers of Trial Lawyers, Inc. haul in sky-high fees for little work. - $30,000 per hour for legally sanctioned extortion has to make people like Tony Soprano jealous.

Tuesday, March 09, 2004

Senate Kills Move to Make Tax Cuts Harder - But it's still an uphill battle to make the tax cuts permanent. If that doesn't happen, we will be facing the largest tax hike ever when the tax cuts expire, which the DemonRats would love to see happen.

Lotto winner fails to claim $28.5 million. 6-month window closes; schools share in prize - Most other states allow a full twelve months to claim lottery winnings. Even the IRS gives people three years to recover overpaid taxes.

In stock market, US senators beat averages - Obviously, this is nothing but a coincidence. Elected officials profiting from private information and special connections? Perish the thought! Martha Stewart couldn't ever have obtained a tiny fraction of the insider information in her entire lifetime that our rulers receive each and every day. It is no coincidence that most our rulers mysteriously become hundreds of times wealthier than when they first took office.

Woman Tried to Pass Fake Million Dollar Bill - Every idiot is looking for an even stupider person to con. Wal Mart may make billions of dollars in sales every day; but to expect them to accept a million dollar bill at the cash register definitely earns this Georgia woman a spot on the "Stupid Criminals" list. The Smoking Gun has a photo of this moron, as well as a small one of the million dollar bill.

They also have a reminder of an earlier case where a guy in North Carolina was actually able to use a $200 bill with George W. Bush's picture on it. What is it about the South with funny money?

Ohio Sales Tax Repeal Efforts Could Effect Bond Rating - Thanks again to Dana Stahl for passing this along. Dana shares my disappointment that CPA societies are frequently lobbying in favor of higher taxes and against efforts to reduce them.

Change the State Budget Game - Dick Armey pushing for a State Taxpayer Bill of Rights. I like his quote, “Three groups spend other people's money: children, thieves, politicians. All three need supervision.”

What’s Wrong with Insider Trading? - Stephen Moore has an interesting look at the issue of insider trading.

Harrison Abstract Case

Because I know many of the people involved in all sorts of ways in this mess, I have been following this case closely. This article in the Harrison paper, claiming that Dian Brown gave up all ownership rights to the properties she bought with the stolen money, is a completely wrong interpretation of what it means to deed property into the name of a living trust.

I wrote a response to the paper's editor yesterday, and as of last night it hadn't been posted to their website. However, it is up there as of this morning. I don't like repeating myself, but such misunderstandings regarding living trusts and asset protection strategies are very common; so here is my letter regarding the Dian Brown case.

Your description of the new ownership of Dian Brown's property as a "trust fund" is misleading. A living (aka revocable) trust is an estate planning technique used to avoid probate on a person's assets after they pass away. While the individuals are alive, the tax and other ownership rights are exactly the same as if the properties were owned directly in the individual's name.

While many people believe they can hide assets from lawsuits and judgments by titling them in the name of a living trust, that isn't the case. Using a separate legal entity, such as a corporation, LLC or FLP (family limited partnership) is more effective at providing that level of protection.

In either case, Dian Brown's transfer of her ownership in property in an attempt to avoid repercussions from her alleged thefts could very easily be classified as a fraudulent conveyance and set aside if needed to make any restitution as may be ordered by the court.

I just wanted to clarify the misleading impression that your story gave; that Dian Brown has been able to hide her property from any action in this case.

Just as the term "public servant" no longer means that our elected officials work for us because they rule over our lives...

The impossible reform - William F. Buckley is skeptical of the idea that anything positive will come from all the talk about fixing Social Security.

How to Get Federal Spending Under Control

Plan to Reform Virginia's Tax Code Pushes Sales Tax Repeal

Monday, March 08, 2004

Buying power: Tax law changes give boost to new equipment purchases The DemonRats can deny it all they want, but the fact of the matter is that people will buy more equipment when they can deduct the cost quicker.

Another twist to consider when playing the stock market.

As I've said many times before, I don't invest in the stock market because there are too many uncertainties involved, and the only way to eliminate those unknowns is to have some special insider info, which is generally considered to be illegal.

Sunday, March 07, 2004

Explaining the Federal Deficit

Often times, the most illustrative explanations of fiscal matters come from people who are not financial professionals, such as this analysis of the budget problems in DC by Dave Barry. Unlike most of the mainstream media, who want to blame the deficit on tax cuts, Dave understands that the real culprit is reckless spending. He really hits the nail on the head with these observations:

Congress is as trustworthy with money as a crack addict who is experimenting with heroin.

They're being total slime-weasels. They're spending MORE. They're pandering their brains out.

Our so-called ''leaders'' are buying senior citizen and Baby Boomer votes by piling massive debt on future generations. It's like going to a fancy restaurant and ordering everything on the menu, secure in the knowledge that, when the bill comes, you'll be dead.

Saturday, March 06, 2004

Budding Entrepreneurship - Some good tips on running your own business and thus being more in control of your destiny.

Nine Out Of Ten Financial Advisors Recommend Mutual Funds That Cheat - This is satire, in case any DemonRats (who are generally brain dead and devoid of common sense) might think this is real.

Earth to Planet Corzine -- Tax Cuts Are Working - A little counterbalance to the Left's lies about the effects of tax cuts. With the DemonRats, it's like the classic "who are you going to believe, us or your lying eyes?" when they try to claim that the tax cuts are not responsible for the improving economy. That direct cause and effect was the very real reason the lefties were fighting so hard to prevent the passage of the tax cuts in the first place. They knew that, with an improving economy, Bush couldn't be stopped from winning a second term.

Effort to dump income tax gains steam - This would be a major step forward, but only if a national sales tax replaces the income tax and isn't just added on top of it.

Friday, March 05, 2004

Always File Corporate Tax Returns

Proving once again that too many people are setting up corporations without having a clue as to what they are doing, I received the following question via my AnswerWay.com account.

Hello,

I am president of an s-corporation in Florida and I have not had any income or expenses as I did not use that company yet. I would like to make sure I have filled in properly my 1120S income tax return.

Having had no activity I have put zeros in all the fields and I am declaring $0 for tax due.

My questions are :

Is this ok?

Is there any other form or schedule that I have to send in with?

What about my personal 1040EZ income tax return? Do I have to mention anything about the s-corp. on it?

If I had had some income, where would I have mentioned it?

I thank you very much for your help.

My answer:

You are correct in sending in an 1120S with zeroes in the appropriate places. Even if a corporation has no activity, you must file a tax return with IRS telling them that fact. If you don't, IRS could very easily come back years later and accuse you of failing to report huge amounts of income.

As a shareholder of an S corp, you should not be using 1040EZ for your personal taxes. You need to use the regular 1040 and attach Page 2 of Schedule E to show your S corp and its pass-through income for this year. Even if it's zero, you should show it on your 1040.

I hope this helps.

Good luck.

Kerry Kerstetter

Compassion

I like these quotes from Thomas Sowell

No matter how much people on the left talk about compassion, they have no compassion for the taxpayers.

To liberals, "compassion" means giving less productive people the fruits of the efforts of more productive people. But real compassion means enabling less productive people to become more productive themselves. That way, the poor have not only more material things but also more self-respect, as well as more respect from others, and the society as a whole has a higher standard of living and less internal strife.

The third rail - Good overview of the Social Security house of cards by George Will.

DeMint calls for tax changes - If anyone needs a concise explanation of why many corporations have shifted operations out of the US, it's this:

America's corporate tax rate -- about 35 percent -- is the second-highest in the world, DeMint said. That makes it more expensive for U.S. companies to export products than it is for companies in other countries to export them, he said.

Our rulers think they can just raise taxes on businesses and they will just gladly pay them without making any changes in how they conduct their operations. The truth with businesses is the same as it is for everything else in life. When costs go up, management looks for less expensive alternatives. It's not rocket science; but such common sense evades our rulers who are driven to raise taxes and then are shocked when their targets take steps to avoid paying them.

Thursday, March 04, 2004

Is this why more people aren't self employed?

I've never kept it a secret that I have little patience or sympathy for people who whine about having terrible jobs, or no jobs at all, as if they are entitled to being handed a well paying career on a silver platter. Whether it's the salary, the fringe benefits, the retirement plans, or the work location, the only way you can be sure it's to your liking is if it's your own business. Of course, it has always been very obvious that many people are just not cut out to be more than worker bees in the business world.

How to Stop Receiving Credit Card Offers - These steps should reduce the volume of snail mail solicitations; but won't do much about the millions of offers sent out by spammers because those scumbags don't obey any rules or do-not-solicit lists.

Former Harrison Abstract owner faces theft charges - Dian Brown's trial for stealing a million dollars from escrow funds is currently scheduled to begin next week, March 12. It will probably be postponed again for any number of procedural or technical reasons.

States Bent on Collecting Internet Taxes - States are trying to get their residents to voluntarily report purchases made via mail order and pay the Use Taxes on them, which are the same rates as normal Sales Taxes paid in the buyers' local jurisdictions. Here in Arkansas, I noticed the DFA has put out news releases asking people to do this; but they aren't making it as easy to do as many other states are. Rather than add a schedule that can be attached to individuals' annual income tax returns to report the untaxed purchases, DFA is requiring people to obtain a completely different tax form. If they are truly serious about making it easy for people to volunteer those taxes, the DFA needs to make it a routine part of the annual income tax filing, as several other states are already doing. That way, we professional tax preparers can add a question to our annual tax organizers to capture that info.

Wednesday, March 03, 2004

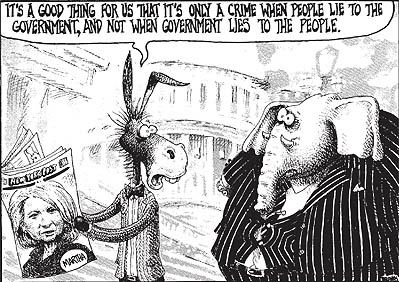

Crime Priorities

As Al Capone and other gangsters have learned over the years, murder and other violent crimes take a back seat to what is considered the most heinous offense that can be perpetrated against our society - tax evasion.

It is also an ironic fact that most of the tax scofflaws, such as some reformed tax protestors and delinquents with whom I have worked, end up owning much less in taxes when they voluntarily file their professionally prepared returns than by letting the IRS and State tax agencies do the calculations based on the one-sided information they have for non-filers. In many cases, there have even been overpayments that had to be forfeited because of the statute of limitations on claiming refunds.

IRS allows tax deduction for doctor-approved weight-loss - But not for the cost of the diet food - a common misconception I have encountered.

Tuesday, March 02, 2004

Warning to do it yourself creative tax accountants.

Remember; we are trained professionals. Do not try this at home.

As Virginia mulls a tax hike, all Americans should guard their wallets.

Isn't That Rich? - Good review by Neil Cavuto of how multi-millionaire elitists like John Kerry & John Edwards try to pretend to be just like average Americans.

Ex-governors slam Virginia tax boosts

Some GOP Lawmakers Aim To Scale Back Bush Tax Cuts - It's bad enough, and to be expected, that the DemonRats would oppose tax cuts and want to raise taxes as much as possible; but now we have to worry some more about about RINOs joining them.

Cutting Social Security benefits isn't the answer - Jack Kemp weighs in on the SS mess.

Dr. Kevorkian's Social Security Solution: Cut Seniors, Not Benefits - I've long thought that it would make a great plot for a thriller for someone in power to try "fixing" the Social Security mess by killing off older people. Since uncollected benefits are forfeited at death, it would work miracles at balancing that system the way it is currently set up. Letting people control their own money and leave it to their heirs would avoid such motivation by over-zealous budget balancers in DC.

Monday, March 01, 2004

Other People's Wealth Benefits All of Us - A refreshing counterbalance to all of the "hate the rich" rhetoric that is so popular nowadays in this country, especially among pathetic idiots like John Kerry and his Fellow Traveler DemonRats.

Social Security SOS

Bush Boom Better than Clinton Economy

John Kerry on the Record: The Tax Man Cometh - It is just so embarrassing to see so many news stories associating my name with the concept of raising taxes.

IRS Interest Rates Increase for the Second Quarter of 2004 - IRS is raising its rate on late payments to five percent as of April 1. I've also updated this info on my Quick Reference page.

IRS Updates the "Dirty Dozen" for 2004: Agency Warns of New Scams - This year's list includes the Corporation Sole scam, which I have noticed has been receiving a lot of attention lately. It's no different than the Pure Trust scam. Quatloos has a good debunking of the Corporation Sole scam.