Another attack on Sec. 121 exclusion?

From a reader:

Subject: An End to the Beach House Loophole?

Kerry-

Didn't know if you had seen this, as always anything helping, not punishing, the "rich" is a loophole. Chuck Rangel's grand scheme may have pushed this off your radar.

My Response:

Thanks for pointing this out. I hadn't seen it.

However, while I have long believed that there should be zero tax on all capital gains, it is long overdue that our rulers in DC go after "evil rich" folks who have been following our tips to exploit the tax free residence sale rule by converting rentals and vacation home into primary residences. I'm actually amazed that it's taken them this long, over ten years, to attack this popular and very legal tax savings trick.

If they do succeed in plugging up this loophole, we'll have to figure other ways around the tax bite, such as more uses of Section 1031 exchanges.

The Tax Game never ends, as long as the rules are constantly being changed.

Thanks again for sharing that article.

Kerry

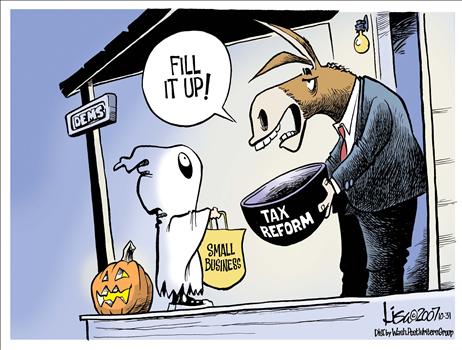

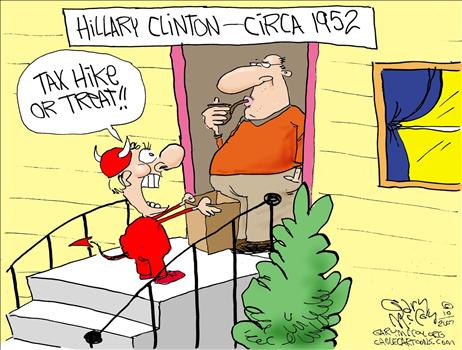

As always, the Dims have plenty of tricks, but very few treats for us capitalists...

Labels: comix, Commies, Hitlary, TaxHikes

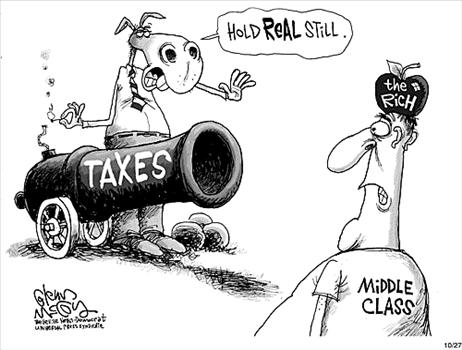

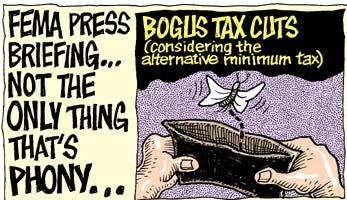

Rangel explains his NAMT

Rush Limbaugh and Paul Shanklin had this clip of Charlie Rangel in yesterday’s show explaining his new tax plan, to eliminate the current Alternative Minimum Tax (AMT) and replace it with the No Alternative Maximum Tax (NAMT). He explains that this means “You make it and we take it. No alternatives.”

Streaming audio from Rush’s site

Labels: AMT, comix, Commies, TaxHikes

Time for New Alternatives - More from the NRO editors on the need to repeal the insane AMT, but without the humongous tax hikes proposed by Charlie Rangel.

Labels: AMT

Buying A Business

Q:

Subject: Buying a businessHello,I hope you can help me. I am in the process of buying a small retail business for sale in Massachusetts. The broker gave me the owners schedule c from 2006. The owner has 2 locations under the same name. They are a sole prop. The form shows a loss of $154,000. They claim it is due to a one time write off of old inventory. They said you are allowed to do this if you are selling or closing a business. Is this true? If so, where is it shown on the schedule c tax return?Thanks for any help!

A:

You are venturing into extremely dangerous territory if you are trying to evaluate any business purchase without the assistance of your own personal professional tax and accounting advisor. There are so many ways in which you can be screwed over, it would take me hours to list them. In fact, I have always advised people to insert into any agreement regarding the potential sale or purchase of a business that it is contingent on the approval of the person's legal, tax and accounting advisors. This escape clause gives you an easy way to back out of any deal that doesn't feel right to you or appear to be completely kosher to any of your advisors.

In the case you mentioned, they seller is not being exactly truthful. It is standard practice to adjust inventory values down on the books and tax returns to the lower of their actual cost or their current market value at the end of any tax year; not just when the business is going to be sold. Any such adjustment will be reflected in the Cost of Goods Sold section of the Schedule C. These adjustments should have been made at the end of each tax year and not in one big giant write-down as it appears to be from your description.

In regard to what you should be looking at in order to properly evaluate a business's history, the Schedule C is just the start. As your personal professional advisor will explain, you need to also see other more reliable records as well, such as Sales Tax and Payroll reports, as well as bank statements and QuickBooks or other accounting detailed records. It should be approached in a similar manner as an IRS auditor would use to examine the business's finances. Any business seller who refuses to allow you to see those records and will only provide you with a possibly phony Schedule C is not to be trusted and you should never do any kind of business with.

Again, a good professional tax and accounting advisor should be hired to review the records of any potential business purchase. Even if s/he advises against making the purchase, that is money very well spent. It is much cheaper to pay an accountant $500 or $1,000 now to warn you away from a dangerous purchase, than to lose the $100,000 or more that a hasty uninformed purchase would inevitably result in.

Good luck. I hope this helps.

Kerry Kerstetter

Gift Tax Exemptions

Q:

Subject: Questiion about the gift tax and exclusionsHello,My sister and I have a question about the gift tax exclusions.This year the max. gift is $12,000 per person annually. But there is a $1,000,000 "Lifetime exclusion"My sister belives that means that the doner can give a lifetime of 1 million in gifts (which includes the 12k per person annually) and anything over that is taxed. But I think that the 1 million lifetime exclusion means that whatever is over the annual 12k per person is deducted from the 1million. So if someone is given 30k in one year as a gift - 18k (30-12) is deducted from the lifetime one million.Could you please clarifry this for us?Also, if the 1 million exemption is not reached by the time somone dies- can it be given after death without being taxed? on top of the 2 million Estate exemption from taxes?Thank You so much,

A:

You really need to be discussing any kind of gifting program with your own personal professional tax advisor because there are many ways to accomplish whatever it is you want to.

However, I can clear up some of your misunderstandings.

First is the issue of gifts versus bequests. Gifts are only made while a person is alive. Once the person passes away, gifts are no longer possible. Bequests, per the instructions in his/her will or living trust, are the way items are passed from the deceased to whomever s/he wants to transfer things to.

This is an important distinction because a person can give away up to one million dollars worth of assets above the annual tax free amount while s/he is alive. If more than that is given while the person is alive, s/he must file a gift tax return (709) and pay gift tax to IRS.

After a person passes away, s/he is subject to the estate (aka Death or Inheritance) tax. Under this tax system, the amount of the estate that is not subject to any estate tax varies depending on the year in which the person passes away. As you can see on the chart on my website, people passing on during 2007 have a two million dollar exemption.

The way this interacts with the one million dollar lifetime gift tax exclusion is that, on the Estate Tax Return (706), the total amount of the lifetime gifts used during the person's lifetime is added back to the gross estate's value. The net effect is basically to reduce the tax free exclusion from the estate tax. For example, if $500,000 of tax free gifts had been used by someone who passed away in 2007, this would be added to the value of his taxable estate on the 706. After reducing the estate tax by the credit for the $2,000,000 allowance, it works out to be the same as if he only has $1,500,000 eligible for exemption from estate tax. The actual calculation is a little trickier than this, but it's an easy way to understand the concept.

So, your concern about the unused portion of the million dollar lifetime gift allowance is moot. Whatever hasn't been used while the person was alive will end up resulting in a higher exemption from the estate tax. For example, someone who passed away in 2007 without utilizing any of his million dollars in tax free gifts will have the full $2,000,000 available for his estate tax.

In regard to the annual gifting allowance and the lifetime exclusion, your explanation is the more accurate one. Someone making gifts that don't exceed the limit of $12,000 to any one person during any calendar year will not have to file any gift tax returns and will not have used up any of his/her million dollar lifetime allowance.

Someone who does give any single person more than the $12,000 during a single calendar year will have to file a gift tax return to report that and show how much of his/her lifetime exclusion is being used up at that time, as well as how much of the million dollars is remaining. Only the amount above the annual allowance needs to be deducted from the lifetime exclusion. As in your example, someone giving another person $30,000 during a single calendar year would only have to claim $18,000 as coming off of the million dollar lifetime exclusion. Each person is required to keep a running tally of how much of that million dollars has been used up during his/her lifetime so that the person preparing the final estate tax return can show the final cumulative amount.

As I said at the beginning, there are a number of very common gifting strategies, such as gift splitting between spouses, loans and debt forgiveness, and dividing gifts up between different family members, that can easily allow people to avoid having to ever dip into their lifetime exclusion at all These need to be planned out with the assistance of a professional tax advisor.

I hope this helps you understand this topic a little better and how important it is to have professional assistance before actually doing anything in this area.

Good luck.

Kerry Kerstetter

Labels: Gifting

Shifting income to corp...

Q:

Subject: Timing QuestionHi Kerry- I am an attorney who, although not a trained accountant, does deal with accounting issues from time to time in my work. My wife has a consulting business that she started with on a full time basis in January of 2006. She generates about $100K in revenue, and all of this revenue is captured on a 1099-Misc. Most of her business expenses are reimbursed by the main company for which she contracts. The only real deductions we can take advantage of are a home office, her computer equipment, and her travel in our car. In 2006, we paid taxes on all the revenue she generated on our jointly-filed income tax return. This year, however, I am thinking of creating a corporation for the business, and possibly converting it to S status. If I do so, I have 2 questions:

1) If the corporation is created in October 2007, can the revenue that the business generated prior to the entity's official creation be captured and reported on this year's tax return?

2) Is there any way that I can amend my 2006 tax filing by retroactively reporting the 2006 revenue as belonging to the corporation?

As the father of 2 young kids, I'm just now trying to work through these issues. Thank you in advance for any assistance you can provide!

A:

I can give quick answers as to what is possible and what's not.

If you can get a corp up and running before the end of 2007, it is possible to shift some or all of the 2007 year to date profit over to that corp by paying it for business services that would be deductible on your wife's 2007 Schedule C and reported as income on the 1120. There should be actual payments and you will need to make sure all future income is paid to the corp and the payer doesn't report it under your wife's SSN. If too much income is accidentally reported under her SSN, there is a way to fix that on the Schedule C, which any experienced tax pro can handle for you.

This can't be done for 2006 income for a couple of very basic reasons. No payments to the corp were made during 2006 and the corp didn't even exist in 2006.

You really need to be working directly with a tax pro to help you and your wife set up whatever entity or entities would be most appropriate for your situation.

Good luck.

Kerry

Labels: corp

Sales Tax Scammers

Q:

Subject: Tax /Ethical Question

Dear Mr. Kerstetter,

As an aspiring accountant, ive encountered an ethical dillema at my job. I currently work for a retail establishment(non accounting related job)where we sell high end luxury fashion goods. A few weeks ago, i noticed a transaction that wasnt "right". A sales associate sold some merchandise to her client that was over $100,000 in store. Come to find out, the sales associate and assitant manager did not charge the client tax(the tax was approximatly $9500). To "dodge" the tax issue, the assistant manager shipped out an empty box filled with catalogues and possibly magazines to give the impression that the merchandise was being sent out to the client at an out of state address via FedEx. The thing is, items that exceed over a certain amount(im guessing over $10,000) typically need to be sent out insured by an armoured security delivery service. My question for you is what kind of laws has the sales associate and assistant manager violated? Im under the impression this is tax fraud and quite possibly, mail fraud. I feel that this transaction should be reported for I feel its very dishonest yet i know the outcome will most likely be termination of those employees. I dont want people to lose their jobs but at the same time these kind of things should not go unspoken. Thanks

A:

This sounds very similar to the infamous art dealer cases in New York a few years back, where several very famous art dealers received prison sentences for helping their customers evade state sales taxes by pretending to ship paintings out of state.

So, what your superiors are doing is obviously very illegal and will come to light eventually. Anyone the government determines was part of this conspiracy to evade the taxes will most likely be prosecuted. The prosecutors will have to exercise their own discretion as to how vigorously they want to prosecute anyone they learn knew about the scheme and failed to report it.

Since you are aware of this ongoing crime by some people at your employer, you do have a dilemma as to how to proceed. I can think of a few options for you. You didn't say who your employer is or where you are located; so I'm not sure how many of these will be applicable for your particular situation.

At a minimum, you should report this illegal activity to the top CEO of your company, as well as to the person in charge of the company's Internal Audit department. When I was employed in the Internal Auditing profession, there were a number of instances where I was alerted to criminal activity by employees and I was allowed to follow those through with my own investigations that led to employee terminations and criminal prosecutions.

I'm assuming that the top corp big-wigs are unaware of this illegal activity and will welcome the chance to clean house of the lawbreakers before it ends up being discovered and costing the company a lot of money and bad press.

Of course, if the company's top brass are in on the tax evasion scheme, this won't do much good. In that case, the next option will be much more appealing to you.

Most tax agencies pay rewards to whistle blowers for info leading to the recovery of evaded taxes. Turning in the lawbreakers to your state sales tax agency could result in a nice financial reward for you.

In addition, if you are serious about a career in accounting, a job with the sales tax agency investigating this kind of thing at other companies could very well be possible if you make an impressive presentation of your findings when you turn in the tax scammers at your company.

Of course, other options are to just remain quiet about this and stay at your current job or leave and find employment at a more law abiding company.

Good luck. I hope this helps give you some ideas as to a course of action. Please keep me posted as to how this plays out.

Kerry Kerstetter

Follow-Up:

Dear Mr. Kerstetter,Thank you so much for your reply. I am actually going to quit my job at the end of the year for I just was offered an internship at a public firm for the busy tax season! However, im still trying to evaluate my decision on if I should report this or not. There is so much unethical things that happen on a store level in addition to this that I could report, yet nobody else has the courage to stand up to my superiors. I will definently keep you posted if I do decide to take action against them. Have a great day!

Labels: SalesTax

Rangel’s ‘Mother of All Tax Reforms’ Gets Abortion – Scott Ott has some fun with the recently announced tax plan by the Dims.

I’m not planning to waste much time dissecting this ridiculous tax hike package other than to agree with some commentators that this is what can be expected under the third term in office by the two headed president.

Labels: TaxHikes

Sharing the Client Guide

Q:

Subject: New CPA loves your agreement...Hi,

Your website is terrific. Where did you get that fabulous client service agreement? Did you buy from someplace?

I would love to use it with some minor modifications. There is another CPA who uses a very similar agreement which makes me think that there are templates out there with interesting client service agreements out there but I am unable to find them.

Let me know your thoughts and have a great week,

A:

Actually, I first wrote that from scratch over 20 years ago and have been tweaking it ever since.

It's not surprising that you've seen it from other tax pros. Many other tax pros have asked for permission to use it for their clients and I've never had a problem with that.

Please feel free to use it any way that you feel appropriate for your clients.

Good luck.

Kerry Kerstetter

Follow-Up:

Hi Kerry,Thank you so much for letting a novice like myself use your hard work. I certainly do appreciate that! It is such a good idea to post your fees and have a positive outline of your expectations. It saves a great deal of surprises and heart ache in the long run.Thanks again for your support and best wishes to you.

Labels: Clients

2008 Medicare Rates

From a reader:

Subject: Social Security & Medicare - 2008 & Beyond

Thanks for the SS information for 2008 as well as 2008 tax rates & info.

Here are the new monthly Medicare premiums for 2008 based on 2006 MAGI:

2008 Medicare Premiums based on MAGI for 2006 [AGI + TAX EXEMPT INTEREST].

You Pay If Your Yearly Income* is

Single

$96.40 MAGI=$82,000 or less

$122.20 MAGI= $82,001-$102,000

$160.90 MAGI=$102,001-$153,000

$199.70 MAGI=$153,001-$205,000

$238.40 MAGI-Above $205,000

Married Couple

$96.40 MAGI=$164,000 or less

$122.20 MAGI=$164,001-$204,000

$160.90 MAGI=$204,001-$306,000

$199.70 MAGI=$306,001-$410,000

$238.40 MAGI=Above $410,000

*[Modified Adjusted Gross Income (Includes Tax-Exempt Interest)]

In 2006, I was able to save a friend from jumping into a higher premium bracket by about $500 with a few end-of-year minor investment transactions.

Your predictions about what will happen to SS benefits for upper bracket payers is likely spot on. Favorable treatment of dividends & capital gains is likely to end also.

I've started a "Doomsday" folder as the assault on the evil rich "if the two-headed president" [or others so inclined] is elected. My ultimate doomsday strategy? All munis all the time.

Speaking of munis there is a vital tax case [Kentucky v. Davis] that will be heard before the U.S. Supreme Court on November 5, 2007

[http://legaltimes.typepad.com/blt/2007/10/municipal-bonds.html].

My reply:

Thanks for that additional info on the 2008 means tested Medicare premiums.

That is also a very interesting case you referenced, on the ability of State tax agencies to give tax free status to only interest from in-state muni bonds. I wasn't aware of it. That has been a logistical problem for taxpayers who move between states, and whose holdings change from tax free to taxable status as a result. I wonder if a positive (for taxpayers) finding in this case will result in a lot of amended State income tax returns.

Thanks again for sharing that.

Kerry

Labels: MediCare

MAKING TAXES SIMPLER & FAIRER – Another reminder of the exponential growth of the insane AMT; from its original goal of sticking it to 155 super rich folks to the current situation of over 25 million victims.

Labels: AMT

Changing Fiscal Year

Q:

Greetings Mr. Kerstetter,I just stumbled upon your site the other day. Thank you for maintaining it, it's a great resource.I wanted to ask you about your article "Choosing A Fiscal Year". In it, you talk about the virtues of choosing a FYE other than 12/31. You say "once the first 1120 has been filed with IRS, the fiscal year is set in stone."I was reading on another site about Form 1128 which seems to allow you to petition the IRS for a new FYE. Can you comment on this?Best,

A:

While you are correct that there is an official form to request a change in an entity's tax year, the actual use of it is very discriminatory. Because of the very well known tax savings opportunities in having a non 12/31 year end, IRS will almost always grant a request to change from a year ending in any other month to 12/31; but will almost never grant a request to change from 12/31 to the end of any other month.

I don't have any official stats on percentages of which tax year changes are granted and denied; but my 32 years of experience in this area have given me complete confidence in my conclusions. I would welcome any comments from any readers who have had a successful track record of obtaining IRS permission to change from 12/31 tax years to other months. I doubt any tax pro can cite such a record because of the well known IRS policy of doing what it can to force as many taxpayers into a calendar tax year as possible.

That is why it is so important to properly select the appropriate tax year with the very first 1120 filed.

I hope this answers your question.

Thanks for writing.

Kerry Kerstetter

Labels: corp

Trading in RV

Q:

Subject: Disposal of 179 asset

Kerry, I used 179 deduction in 2005 to purchase an RV that I use for business purposes. I plan on "upgrading" to a larger RV and trade the original one in on the new one. What are the tax implications? Will I be able to take an additional 179 deduction on the new RV? The old RV cost $103,000 and I should be able to trade it in for about $75,000. The new RV list price is $225,000. I file a schedule C and have other income from other sources ($450,000) other than the Schedule C income. Thanks for your help and I love your Blogs.

A:

I have discussed this very topic in a number of previous blog posts, so I will only give the quick and simple answer.

Only the new investment in business equipment would be eligible for the Section 179 deduction. In your case, that would be the additional $150,000 ($225,000- $75,000) that you would be paying for the new RV, assuming it is going to be used 100% for your business. How much you can actually deduct will be subject to the various other limits, such as applicable earned income and total investments in Section 179 property for the year.

If you've been reading my blog for long, you should be able to anticipate my biggest concern in your situation. Why are you asking a stranger on the net for this kind of advice instead of your own personal professional tax advisor? That is very scary and frankly reckless for someone earning $450,000 per year.

You need to start working with a tax pro ASAP and before you buy the new RV because there are some very simple tricks that can be used to allow you to very easily double the amount of your Section 179 deduction from the current maximum of $125,000 for 2007 to $250,000 by using a C corp to acquire some of the new business equipment. If you're running all of your income through a single 1040, you are grossly overpaying your taxes.

Good luck. I hope this helps.

Kerry Kerstetter

Labels: 179

How to work with S corps...

Q:

Hi Kerry,I'm confused. My accountant advised me to form an S-corporation citing dividend payments would lower my taxes. I'm confused about federal tax returns. As an S-corporation I have to declare all earnings on my 1040 and won't be able to deduct the corporation expenses? The way I presently have it structured is I'm paying myself 60% of the corporations earnings, and an additional 40% as nontaxable dividends.If you have a moment would you please clarify. Can I write off meals, uniforms, etc. as a sole owner LLC electing s-corp tax filing statues?Thank you,

A:

You need to be working with your accountant on this matter; not a stranger on the internet.

Your accountant should have explained all of the pros, cons and logistical details when s/he helped you come to the conclusion that an S corp was the proper format for your busyness. S/he should then be available to help you handle the finances properly for your situation, as well as help you maintain the books and prepare the tax returns.

It sounds like either your accountant abandoned you or you chose the insane path of going it alone. I'm not sure how you got the idea that business expenses are no longer deductible, but that is not the case, nor is it necessary to bleed out all of the profits from an S corp in the manner which you described. You are operating under some seriously misguided concepts that no decent professional tax person could possibly have told you; so it appears that you are trying the extremely dangerous task of navigating the tax waters on your own.

You need to either reconnect with your previous accountant and get all of the logistical details worked out or find yourself a new one ASAP before you do any more damage.

Good luck.

Kerry Kerstetter

Labels: corp

Higher SS Taxes

Social Security Announces 2.3 Percent Benefit Increase for 2008 – What the drive-by media aren’t publicizing is the other side of the equation, the increase in the income subject to the 12.4% Social Security tax from the 2007 level of $97,500 to $102,000 in 2008. This is an increase in the SS tax of $558 for the 12 million people SSA estimates will be in this income level.

As I’ve long predicted, and will almost certainly happen if the two-headed president is given a third term in the White House, the ceiling on income subject to this tax will be removed entirely, as it was for the 2.9% Medicare tax. This will also be accompanied by a reduction or complete elimination of benefits to people in these higher income levels.

Labels: SSA

IRS Official 2008 Tax Rates

IRS has announced their official calculations of the 2008 inflation adjusted tax rate schedules, standard deductions and exemptions. They match the ones I posted earlier that had been computed by CCH.

You can download the IRS 20 page pdf file with all of the details. This also includes a lot of other inflation adjusted figures that neither I nor CCH covered previously.

Labels: IRS

Verifying Donations?

A little joke courtesy of Pastor Tim’s Clean Laughs:

*IRS Call*

When the minister picked up the phone, Special Agent Struzik from the IRS was on the line.

"Hello, is this the minister?"

"Yes, this is."

"I'm calling to inquire about a member of your congregation, a Dr. Shipe. Do you recognize the name?"

"Yes, he is a member of our congregation. How can I be of service?"

"Well, on last year's tax return, the doctor claimed that he made a sizable tax-deductable contribution to your church. Is this true?"

"Well, I'll have to have our bookkeeper verify this information for you. How much did Dr. Shipe say he contributed?"

"Twenty five thousand dollars," answered Agent Struzik. "Can you tell me if that amount is true?"

There is a long pause. "I'll tell you what," replied the minister.......

"Call back tomorrow. I'm sure it will be."

Labels: humor

Tax Board Outs Simpson, Sinbad, Warwick – The entertainment press has picked up on my earlier piece on the Calif. FTB’s list of unpaid taxes by celebrities. I didn’t recognize Sinbad’s name on my first review of the list; but now we know who that is and that he owes over $2.1 million to the FTB.

Labels: StateTaxes

People will move due to taxes, a fact that short-sighted state rulers refuse to acknowledge.

Labels: comix, StateTaxes

Telephone Tax Credit

The IRS says taxpayers collected only half of the $8B available for the refund of phone taxes.

The form to claim this refund is very intimidating, with all of its lines and the need to have phone bill info going back into 2003. I have found that this has been another big benefit of having everything on QuickBooks and keeping multiple years running in the same file. When preparing tax returns, clients who didn't use QuickBooks have had to settle for the tiny standard amounts of $30 to $60. For those with their data in QB, going back at least into 2003, I have been able to fill in all of the necessary data in Lacerte in about 12 minutes and the credits have been averaging several hundred dollars.

IRS Steps Up Scrutiny On Popular Tax Strategy – Thanks to an alert reader for the heads up on this article about upcoming IRS scrutiny of 1031 exchanges. A big stumbling block for IRS will be in educating its agents on the proper application of 1031 rules, especially the fact that different kinds of real estate qualify as like kind. I’ve lost track of the number of IRS agents I’ve had to train on this and other 1031 related issues.

Labels: 1031

Comparing tax software

Interesting article from the Journal of Accountancy reporting on the results of their survey of professional tax preparers’ opinions on software. Very handy side by side comparison of the features in the different programs in this pdf file.

I just received a copy of the 2006 Drake program and will be taking it for a test spin to see if it’s a suitable replacement for Lacerte after I make it through the October 15 crunch.

Labels: preparers

Publicly shaming delinquent taxpayers

The California Franchise Tax Board has a policy of posting the names of taxpayers (or more accurately, non-payers) who owe more than $100,000 on this special page on their website. They show the amounts and the city where the taxpayer was last known to reside.

As I’ve always mentioned, merely crossing the borders of the PRC is no reason to feel secure from the FTB’s extremely aggressive collection actions. Several of the names have non-California addresses, including some celebrities such as:

Orenthal Simpson of Miami, FL owing $1,435,484.17 for personal income taxes

Dionne Warwick of S. Orange, NJ owing $2,665,305.83 for personal income taxes

What tax collector is crazy enough to go after OJ Simpson for back taxes, knowing his method of dealing with exes (ex-wife, ex home state)?

Labels: StateTaxes

Some interesting articles from the latest Intuit newsletter:

New Tax Preparer Penalty Standards on Hold

Year-End Strategies Can Boost Clients' IRA Benefits

IRS Issues New Rulings on Home Sale Exclusion

House backs bill to end private tax collections – But the Senate doesn’t appear to agree; so this program will most likely continue. I haven’t had any clients encounter these free-lance bounty hunters; so I would be interested in any real life comments from tax pros or taxpayers who would like to share their experiences.

Section 179 not safe for do it yourselfers...

Q:

Subject: please help

can you give me he formula on how to figure the 179 tax deduction of a 6,000 lb suv

let's say that I purchase this year (2007) a new H2 for $70,000 dollars

can you walk me thru the total deduction?

any help would be great - thank you

A:

The amount of your Section 179 deduction will depend on the business usage of the vehicle based on miles driven, as well as your qualifying earned income. This kind of calculation is not something that can or should be done on your own.

If you seriously need to know the tax benefits before you buy your new H2, you should have your personal professional tax advisor crunch the numbers for you.

If you don't have a personal professional tax advisor, you need to get one ASAP. Any business making enough money to afford a vehicles as expensive as that H2 is in serious trouble if you are trying to handle all of the tax and financial matters on your own.

Good luck.

Kerry Kerstetter

Labels: 179

2008 Taxes On Dividends

Q:

Subject: '08 tax rate scheds

Thanks for info on the new bracket breaks. I have one comment on your page. I believe dividend income that would otherwise be in the 10-15% brackets (pre-JGTRRA) is taxed at 0% (just like LTCG) not 5%. That's what the CBO says, but please let me know if the 5% on dividends is new information (for instance, I may have stale information).

A:

While that CCH article I quoted on the new inflation adjusted tax rate schedules didn't specifically mention the rate for qualified dividends, you are correct that they receive the same Zero tax rate as do long term capital gains for people in the lowest tax brackets. In fact, here is how QuickFinder Online describes it:

"Tax on qualified dividends is the same rate as long-term capital gains for dividends received after 2002 and before 2011 (5% for taxpayers in the 10% and 15% tax brackets, and 15% for taxpayers in the 25% and above tax brackets). A zero percent rate applies to taxpayers in the 10% and 15% brackets for 2008 – 2010."I will add this info to the 2008 tax rate page on my website.

I appreciate your bringing this item to my attention.

Kerry Kerstetter

Labels: CapGains

Both sides of the Fair Tax debate

The Lies:

FairTax is anything but – From a nut job in Kansas City

FairTax Is Pure Fantasy – More spurious attacks from Bruce Bartlett, who has yet to apologize for his idiotic claims that the FairTax is a Scientology plot.

The Truth:

A 59 minute video of a presentation by John Linder and Neal Boortz. I just finished listening to the entire thing. John Linder mentions that we CPAs are strongly in favor of this idea so that we can use our skills for more useful purposes than protecting clients from the IRS, something I have long been saying.

Labels: FairTax

Vehicle Weights

Q:

Subject: Question on 179Hi,I am a financial advisor and was wondering if you could answer whether or not section 179 (for the suv's) means "gross vehicle weight" or "gross vehicle weight rating (GVWR)"???? My understanding is that one can use the GVWR for the 6,000 lb. suv minimum. I am wondering if I am correct? Or is it "curb weight"?Thanks for your time.Sincerely,

A:

Here is a quote from Page 10-2 of the 2006 TaxBook that covers this point:

Passenger autos rated at more than 6,000 pounds unloaded gross vehicle weight, or trucks and vans rated at more than 6,000 pounds loaded gross vehicle weight are not subject to the Section 280F depreciation limits.

Kerry Kerstetter

Labels: Vehicles

State Section 179 Rules

Q:

Subject: Listing of States conformity to Section 179I was just viewing your website and was wondering if you had an updated list of each state and it's conformity/non-conformity to Section 179?

A:

I'm not aware of any such list. That sounds like an interesting project for one of the tax reference publishers.

In the meantime, we have to continue researching this on a state by state basis.

Thanks for writing.

Kerry

Labels: 179, StateTaxes

Changing Corp Tax Years

Q:

Subject: S Corps

If a corp has been using a fiscal year that ends in a month other than December, it will have to change to a 12/31 fiscal year end if it changes to an S status. If the S status is later revoked, you will not be allowed to change from the 12/31 year end.

Regarding the above statement if you have sent in a 2553 for S corp. status with a F/Y/E of 3/31 and it is denied what happens to the years you have functioned at a F/Y/E of 3/31. Do you have to amend the tax return with a F/Y/E of 12/31 even if it becomes a financial disaster. The corp. functioned as 3/31 and cleared out the income etc at 3/31 and now at 12/31 there is a lot of net income. Any recourse?

A:

As I constantly advise, you should be working with an experienced tax pro before undertaking something as major as changing from a C corp to an S.

From the logistics side, your corp would file regular C corp 1120s for the entire time period until the effective date of the S election as specified in the letter you will receive from IRS. The income and expenses from the effective date onward will be reported on an S corp 1120S.

Because of the required change in fiscal year, there will have to be at least one tax return covering less than 12 full months. Unless the effective date of the election is either January 1 or April 1, it's more likely that both the final 1120 and the initial 1120S will be for less than 12 months.

Again, an experienced tax pro can give you more specifics on how such a change would affect your business.

Good luck.

Kerry Kerstetter

Labels: corp

Appropriate attire for an IRS audit?

From FunnyBone:

A Visit To The IRS

A man, called to testify at the IRS, asked his accountant for advice on what to wear. "Wear your shabbiest clothing. Let him think you are a pauper."

Then he asked his lawyer the same question, but got the opposite advice. "Do not let them intimidate you. Wear your most elegant suit and tie."

Confused, the man went to his rabbi, told him of the conflicting advice, and requested some resolution of the dilemma.

"Let me tell you a story," replied the rabbi. "A woman, about to be married, asked her mother what to wear on her wedding night. 'Wear a heavy, long, flannel nightgown that goes right up to your neck.'

But when she asked her best friend, she got conflicting advice. 'Wear your most sexy negligee, with a V neck right down to your navel. The man protested: "What does all this have to do with my problem with the IRS?"

"No matter what you wear, you are going to get screwed."