IRS Interest Rates

Interest Rates Remain the Same for the Second Quarter of 2010

Four (4) percent for overpayments [three (3) percent in the case of a corporation];

Four (4) percent for underpayments;

Six (6) percent for large corporate underpayments; and

One and one-half (1.5) percent for the portion of a corporate overpayment exceeding $10,000.

Labels: IRS

Debunking Tax Protestors

Long time readers know that one of my long running pet peeves is having to waste time debunking ridiculous theories espoused by tax protestors. For a long time, I felt like I was doing the IRS’s job because they refused to even acknowledge publicly that those arguments were floating around under the completely mistaken belief that to even mention them would in some way legitimize them. The promoters of those arguments used the IRS’s silence as an endorsement of their arguments.

Finally, after decades of ignoring the idiotic arguments used by tax protestors to convince others that they don’t need to file tax returns, IRS has been taking a more pro-active approach. They have recently updated their guide to most of these bogus claims, entitled The Truth about Frivolous Tax Arguments.

IRS Press Release – IRS Debunks Frivolous Tax Arguments

The table of contents below gives us a good idea of the growth in this segment of our society, as there have obviously been enough stupid people advocating these ridiculous theories to earn a spot on this list of morons.

THE TRUTH ABOUT FRIVOLOUS TAX ARGUMENTS

January 1, 2010

I. FRIVOLOUS TAX ARGUMENTS IN GENERAL

A. The Voluntary Nature of the Federal Income Tax System

1. Contention: The filing of a tax return is voluntary

2. Contention: Payment of tax is voluntary

3. Contention: Taxpayers can reduce their federal income tax liability by filing a “zero return.”

4. Contention: The IRS must prepare federal tax returns for a person who fails to file.

5. Contention: Compliance with an administrative summons issued by the IRS is voluntary.

B. The Meaning of Income: Taxable Income and Gross Income

1. Contention: Wages, tips, and other compensation received for personal services are not income.

2. Contention: Only foreign-source income is taxable.

3. Contention: Federal Reserve Notes are not income.

C. The Meaning of Certain Terms Used in the Internal Revenue Code

1. Contention: Taxpayer is not a “citizen” of the United States, thus not subject to the federal income tax laws.

2. Contention: The “United States” consists only of the District of Columbia, federal territories, and federal enclaves.

3. Contention: Taxpayer is not a “person” as defined by the Internal Revenue Code, thus is not subject to the federal income tax laws.

4. Contention: The only “employees” subject to federal income tax are employees of the federal government.

D. Constitutional Amendment Claims

1. Contention: Taxpayers can refuse to pay income taxes on religious or moral grounds by invoking the First Amendment.

2. Contention: Federal income taxes constitute a “taking” of property without due process of law, violating the Fifth Amendment.

3. Contention: Taxpayers do not have to file returns or provide financial information because of the protection against self-incrimination found in the Fifth Amendment.

4. Contention: Compelled compliance with the federal income tax laws is a form of servitude in violation of the Thirteenth Amendment.

5. Contention: The Sixteenth Amendment to the United States Constitution was not properly ratified, thus the federal income tax laws are unconstitutional.

6. Contention: The Sixteenth Amendment does not authorize a direct nonapportioned federal income tax on United States citizens.

E. Fictional Legal Bases

1. Contention: The Internal Revenue Service is not an agency of the United States.

2. Contention: Taxpayers are not required to file a federal income tax return, because the instructions and regulations associated with the Form 1040 do not display an OMB control number as required by the Paperwork Reduction Act.38

3. Contention: African Americans can claim a special tax credit as reparations for slavery and other oppressive treatment.

4. Contention: Taxpayers are entitled to a refund of the Social Security taxes paid over their lifetime.

5. Contention: An “untaxing” package or trust provides a way of legally and permanently avoiding the obligation to file federal income tax returns and pay federal income taxes.

6. Contention: A “corporation sole” can be established and used for the purpose of avoiding federal income taxes.

7. Contention: Taxpayers who did not purchase and use fuel for an off-highway business can claim the fuels tax credit.

8. Contention: A Form 1099-OID can be used as a debt payment option or the form or a purported financial instrument may be used to obtain money from the Treasury.

II. FRIVOLOUS ARGUMENTS IN COLLECTION DUE PROCESS CASES.

A. Invalidity of the Assessment.

1. Contention: A tax assessment is invalid because the taxpayer did not get a copy of the Form 23C, the Form 23C was not personally signed by the Secretary of the Treasury, or Form 23C is not a valid record of assessment.

2. Contention: A tax assessment is invalid because the assessment was made from a substitute for return prepared pursuant to section 6020(b), which is not a valid return.

B. Invalidity of the Statutory Notice of Deficiency.

1. Contention: A statutory notice of deficiency is invalid because it was not signed by the Secretary of the Treasury or by someone with delegated authority.

2. Contention: A statutory notice of deficiency is invalid because the taxpayer did not file an income tax return.

C. Invalidity of Notice of Federal Tax Lien

1. Contention: A notice of federal tax lien is invalid because it is unsigned or not signed by the Secretary of the Treasury, or because it was filed by someone without delegated authority.

2. Contention: The form or content of a notice of federal tax lien is controlled by or subject to a state or local law, and a notice of federal tax lien that does not comply in form or content with a state or local law is invalid.

D. Invalidity of Collection Due Process Notice

1. Contention: A collection due process notice (Letter 1058, LT-11 or Letter 3172) is invalid because it is not signed by the Secretary or his delegate.

2. Contention: A collection due process notice is invalid because no certificate of assessment is attached.

E. Verification Given as Required by I.R.C. § 6330(c)(1)

1. Contention: Verification requires the production of certain documents.

F. Invalidity of Statutory Notice and Demand

1. Contention: No notice and demand, as required by I.R.C. § 6303, was ever received by taxpayer.

2. Contention: A notice and demand is invalid because it is not signed, it is not on the correct form (such as Form 17), or because no certificate of assessment is attached.

G. Tax Court Authority

1. Contention: The Tax Court does not have the authority to decide legal issues.

H. Challenges to the Authority of IRS Employees.

1. Contention: Revenue Officers are not authorized to seize property in satisfaction of unpaid taxes.

2. Contention: IRS employees lack credentials. For example, they have no pocket commission or the wrong color identification badge.

I. Use of Unauthorized Representatives.

1. Contention: Taxpayers are entitled to be represented at hearings, such as collection due process hearings, and in court, by persons without valid powers of attorney.

J. No Authorization Under I.R.C. § 7401 to Bring Action.

1. Contention: The Secretary has not authorized an action for the collection of taxes and penalties or the Attorney General has not directed an action be commenced for the collection of taxes and penalties.

III. PENALTIES FOR PURSUING FRIVOLOUS TAX ARGUMENTS

IRS Shotguns

Rush also picked up on the Drudge item about IRS purchasing a bunch of new shotguns. He had this to say about the topic, as transcribed on his website.

Look at this: "The IRS Is Looking For 60 12-Gauge Pump Action Guns To Arm Its Investigators." This is from BusinessInsider.com. "Working for the IRS doesn't sound so wimpy anymore. The IRS apparently has plans to buy 60 Remington Model 870 police 12 gauge pump action shotguns for the Criminal Investigation Unit. According to the federal business government website, these guns are serious. The Remington parkerized shotguns come fully loaded with:

A fourteen inch barrel

Modified choke

Wilson Combat Ghost Ring rear sight

XS4 Contour Bead front sight

Knoxx Reduced Recoil Adjustable Stock

Speedfeed ribbed black forend

"We're not sure what kind of IRS duty requires this kind of combat artillery, but it sounds badass. And oddly, these are the only guns the IRS is allowed to use, 'based on compatibility with IRS existing shotgun inventory.'" (interruption) No, I don't think this is for Geithner. You mean to get him to repay? You know, I'll tell you what, with as much as they're going to raise taxes they're going to have to be a big problem. It won't be long before they bring the military in to do this. Sixty 12-gauge pump action shotguns for the IRS?

IOUs From IRS?

I must admit that I hadn’t heard this rumor that Snopes.com debunks regarding all 2009 Federal tax refunds being in the form of US Savings bonds. However, after last year’s ridiculous situation in the PRC, where they did actually issue IOUs in place of refunds for state income tax refunds, it would be a natural progression to think that this nutty idea would be used by the IRS and our imperial rulers in DC.

For better and usually worse, there is a long history of California starting ludicrous tends that soon become national. Who knows? If the Chi-Coms refuse to loan us more money, it could very easily evolve into mandatory loans from the taxpayers. Again, as I’ve mentioned before, the PRC has been doing a similar thing with mandatory over-withholding of taxes from employees as a means of extracting interest free loans from them.

Labels: IRS

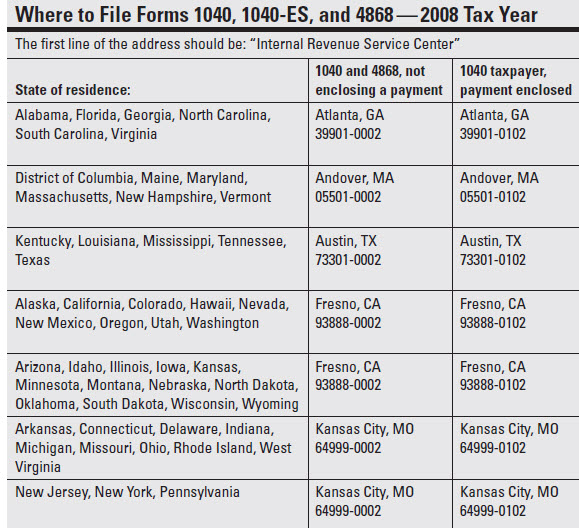

New 1040 Mailing Addresses For Some People

Taxpayers in Nine States and the District of Columbia File with Different Centers this Year – IRS’s annual re-shuffling of the Service Centers. The annoying thing is that, although our tax software usually gets this right for the current tax year, the previous years programs are still set up for the old Service Centers, so we need to remember to manually over-ride them.

This latest change affects taxpayers currently living in the following states:

Maine

Maryland

Massachusetts

New Hampshire

Vermont

Virginia

Indiana

Michigan

Alabama

District of Columbia

Remember, it’s where you live when you are filing the tax return that matters; not where you were living during the tax year of the 1040.

Labels: IRS

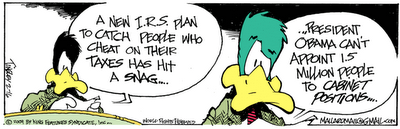

Making fun of the IRS Commissioner

From Late Night with Jimmy Fallon via NewsMax:

During a recent interview on C-SPAN, IRS Commissioner Douglas Shulman said he doesn’t do his own taxes because he finds “the tax code complex.” That’s like a surgeon saying, “You guys, blood grosses me out. So I don’t wanna . . . ”

From The Hill:

IRS commissioner doesn't file his own taxes – This is actually a misleading headline because the writer doesn’t seem to understand the difference between preparing tax returns and filing them with IRS. The Commissioner does file tax returns, but he uses a paid professional to prepare them. As embarrassing as this may be for the person in charge of enforcing this country’s tax laws, it doesn’t seem to be as bad as a Treasury Secretary or the Chairman of the House Ways and Means Committee who both intentionally cheat on their tax returns by omitting thousands of dollars of income.

Labels: IRS

Let's all try 71% worth...

It’s long been a stupid cliche when athletes and others promise to give an impossible 110 or more percent effort towards their goals. I found it funny that IRS is only promising to try to answer 71 percent of calls from the tax paying public and that is considered a great goal.

If you are lucky enough to have your phone call answered after their expected average wait time of 12 minutes, there is then the issue of whether you will get the correct answers. The odds of that happening are most likely going to be the same as in the past; 33% to 50%. It’s like a lottery.

Of course, the double standard is firmly in place. If you were to file a tax return with the stated goal of being 71% accurate in your figures, guess what hell you will be faced with.

If that were acceptable, the fine print info above the taxpayer’s signature on Page 2 of the 1040 would need to be modified to read as follows.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are 71% true, correct, and complete. Declaration of preparer (other than taxpayer) is based on 71% of all information of which preparer has any knowledge.

There are a couple of lessons to be learned from this IRS announcement.

1. Those people who foolishly try to save a few bucks by not utilizing the services of professional tax preparers will be risking their necks even more than ever.

2. This same philosophy of striving for a 71% rate of answering the phone is what we can expect for our health-care after that entire segment of our society is socialized and IRS employees are put in charge of administering our medical treatment. A 29% death rate will be considered as a success.

Labels: IRS

IRS Regulating More Tax Preparers

H&R Blockheads. The IRS wants to save you from your rogue tax accountant. - Being subject to extensive regulation and continuing education requirements as a CPA, I can't share this writer's sentiment that IRS is overstepping its bounds by requiring other "mom and pop" tax preparers to be regulated and take update courses.

I do share the writer's sentiment that the trend towards having the State and Federal governments prepare tax returns for people is not a positive development because of the extreme conflict of interest that entails.

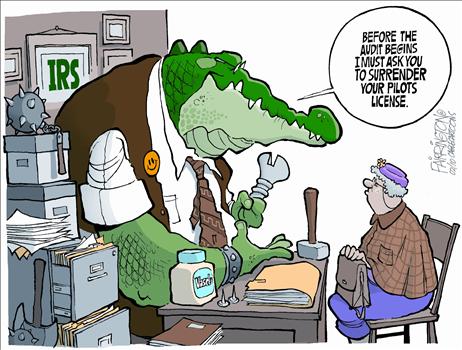

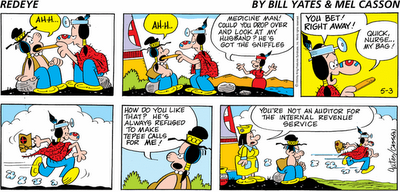

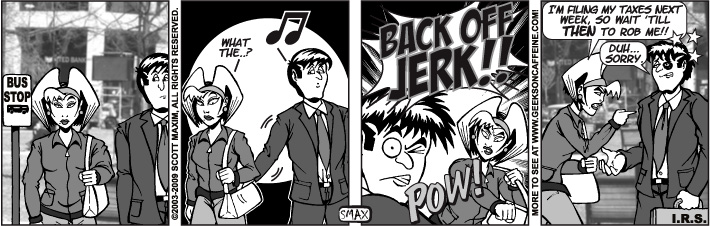

Screwing with the IRS

Last week's episode of Nip/Tuck had an encounter between one of the plastic surgeons and an IRS auditor unlike any I have have ever seen or heard of. It’s wacky enough to amuse taxpayers, tax pros, and IRS employees.

|

Official IRS 2010 Inflation Adjustments

For those folks not satisfied with the CCH calculations of the 2010 inflation adjustments that I posted a month ago, IRS has officially released their figures.

New IRS Phone Scam

It appears that our friends at the real IRS have even more competition in separating people from their money from imposters.

Earlier this morning, a client called and said that there was a voice mail message on her husband’s cell phone, claiming to be from the IRS and that they needed to call back by the end of business today. I didn’t recognize the 800 number given as being one of the regular ones that IRS uses.

Instead of calling that number back, we decided that it would be best for her to call the main IRS info line at 1–800–829–1040 and ask them to pull up her account.

She just called us back and said that when she called the main IRS switchboard, they had no pending actions against them or anything else that would have warranted any contact from an IRS agent. They also told her that they didn’t even have any of their cell phone numbers in their database.

So, this was obviously another scam from some scumbag looking to trick people into revealing their personal identification, credit card and bank info, much like the email version that I mentioned last month.

Calif. IRS agent admits cheating on his own taxes – Drudge has this article reminding us that even IRS has some tax cheats working in their midst. The article is vague as to several details, such as whether he tried to use the Tim Geithner defense and which cabinet position he is now in line to take over.

IRS Drops Interest Rates

Per their news release, the following rates will be in effect for the quarter starting April 1, 2009.

four (4) percent for overpayments [three (3) percent in the case of a corporation];

four (4) percent for underpayments;

six (6) percent for large corporate underpayments; and

one and one-half (1.5) percent for the portion of a corporate overpayment exceeding $10,000.

Labels: IRS

Visiting IRS HQ...

Last night, we were watching a NetFlix DVD by the extremely funny and talented ventriloquist, Jeff Dunham, and he had the following short bit about our favorite government agency. As Jeff has said in interviews, he is lucky by being able to say a lot of politically incorrect things through his dummies that wouldn’t be tolerated from a human.

New IRS Filing Addresses

In their annual shuffling of service center workload, IRS has just announced that taxpayers in four states have to send their 1040s to different service centers than previously.

Delaware, New York and Rhode Island now mail to Kansas City

Illinois taxpayers send their 1040s to Fresno

I checked the filing addresses in the latest copy of TheTaxBook and they actually already had the new ones in there.

Labels: IRS

IRS Interest Rates Drop for the First Quarter of 2009

The main IRS interest rate will be 5.0% for at least the first three months of 2009.

Labels: IRS

IRS 2009 Inflation Adjustments

Individual Tax Brackets, Standard Deductions, Exemptions, and Gift Tax exclusion – Same as CCH announced a month ago.

Labels: IRS

Will the Obama-Biden administration change our favorite agency's name to something more fitting, such as the Department of Patriotism?

IRS Too Nice?

From Ohio CPA Dana Stahl:

Mr Guru - thought you'd find this interesting, but full of bulls**t!

Has the IRS lost its appetite for collecting payroll tax?

DS

My Reply:

Dana:

That article sounds so similar to all of the other scare stories on the dreaded tax gap crisis, and about as accurate, using fabricated numbers as a justification for giving IRS more Draconian powers than they already have.

Kerry