Vehicle Donations

Tax change drives away donations of vehicles – This is really a misleading description of the change in the law. It doesn’t eliminate the ability to claim the market value of vehicles. It just tightens up on what can be used to determine what exactly that market value is. As I’ve discussed on several occasions, people were claiming completely bogus values for their donated vehicles when they knew full well that they could never have sold them for those prices. This new law just makes it mandatory that the actual sales prices be used.

I offend professional appraisers every time I get into this area; but it is a fact that appraisals are no more than guesses of an asset’s value. A real bona fide sale on the open market is a much more reliable number to use. If the Kelly Blue Book says that a car is worth $5,000 in tip top condition, and the car can only be sold for $1,000, the only number I would trust as accurate would be the actual sales price.

As I’ve said many times before, this is not technically a new change in the law. It is just tightening up the valuation method because of the widespread abuse by so many people, as well as the various services that had popped up to receive donated vehicles and give part of the sales proceeds to actual charities by promising much larger deductions for people than they could get from actually selling the vehicles themselves. If these services go out of business, so what?

As I’ve long told clients, highly appreciated assets are good candidates for donation to charities. With depreciated assets, such as vehicles, it’s most efficient financially to just sell them and donate the cash. You then don’t have the issue of appraisals and follow-up sales prices to even worry about.

Tax Protester Is Convicted on 13 U.S. Charges – Another of ex-IRS agent turned tax protesting leader Joe Banister’s disciples bites the dust for following Banister’s insane advice to not file tax returns or even withhold taxes from employees.

Politicians Flouting 'No Work, No Pay' Rule, Taxpayer Group Says – As I’ve long noted, the main reason we don’t have many outsiders running for public office is that we have to actually do some work in order to earn a living. Professional politicians are paid whether or not they actually do anything and can easily spend most of their time campaigning. This perpetuates the cycle of control by professional career politicians.

How Much Do You Want to Pay? Your answer on a postcard, please. – Freedom to Choose Flat Tax.

Catching Up Pays Off – Gail Buckner on the catch-up contributions that can be made to retirement accounts by people over 50.

Reinvested Dividends

Q:

Subject: Taxes on Dividend Reinvestment

Kerry, have reinvested dividends for the 1st time, and had a few questions. If you received, say $100, in dividends in 04 which all were reinvested (in a DRIP program), do you load $100 to line 9 of the 1040? What if you sold your stock (a long-tern capital gain) including these dividends in 04? Is the $100 of dividends taxed a 2nd time as a capital gain, with a $0 cost basis?Thanks for your time. Glad to see you over at the new SS blog.

A:

As you know, reinvested dividends are reported on Schedule B and subject to the same income tax as are dividends paid in cash.

The reinvested amounts won't be subjected to two taxes if you or your stockbroker do a proper accounting. The offset to the dividend income is an increase in your cost basis of the stocks. When you sell the stock, you need to show its cost basis as the accumulation of the original purchase price plus the reinvested dividends that were reported on Sch. B. This is most efficiently accounted for if you use QuickBooks. You credit dividend income and debit the stock asset account.

This is relatively easy to account for if you sell all of the stock at the same time. However, if you sell shares in multiple transactions, you will need to either specifically identify the cost of the individual shares you are selling, or recalculate the average cost per share of your total holdings each time you make a new purchase, such as through a reinvested dividend.

If your stocks are managed by a stockbroker, I have found that most of them are very good at providing their clients with good year-end reports showing the sales and the cost basis of the shares sold. This is especially true with mutual funds.

I hope this helps. Your personal tax advisor should be able to help you set up and operate your accounting system to keep track of the reinvested dividends.

Kerry Kerstetter

Terminated S Corp

Q:

Subject: S Corp problemTwo shareholders own a 66% share of a Tennessee S Corp. The other 33% shareholder left disgruntled and formed a C Corp that bought his 33% share of the S Corp stock. The sale takes effect as of January 1, 2005. I am an Enrolled Agent with the IRS but do not understand the legal ramifications. Also this is not my area of expertise for tax consequences either. I understand that this terminates the S status but how else does it affect the corp and its shareholders? Can you share your expertise?

A:

Actually, because this change is effective precisely at the end of the previous tax year, this should be relatively easy to deal with. The 2004 1120S will be marked as final and then you will report 2005 on an 1120.

It would have been messier if the change were mid-year and you had to file two short-year returns.

There are some other statements that will need to be attached to the returns and you will need to do some calculations of the retained earnings to prevent previously taxed income from being taxed again.

I strongly encourage you to buy a copy of the Small Business Quickfinder book. It covers this in much more detail than I can right now. It's my number one reference tool for questions about all non-1040 tax returns. You can order it from www.quickfinders.com

Good luck.

Kerry Kerstetter

Various Topics

Ohio CPA Dana Stahl brought up several good points in a recent email exchange we had and has graciously allowed me to post them here.

DS:

Mr Guru - as usual, I haven't been receiving your daily email blog updates, so I spent my lunch hour going back over the past few weeks & reading your blog. Some thoughts:

KMK:

That email feature with Bloglet became so unreliable that I took the sign-up form off of my blog a few months back. You may want to try out subscribing to it via the rss feed, such as with a service like Bloglines. That's how I keep up with hundreds of blogs.

DS:

1. On outsourcing, you really articulated points that Accountants/CPAs ought to consider when deciding whether to use this. I had planned to use as a marketing campaign how my firm does NOT outsource, but instead keeps the work right here in the good ol' USofA. May I pull a Senator Biden and plagiarize some of your points in my letter to clients, current & potential?

KMK:

1. Stressing that your firm does all of its work in-house is an excellent marketing angle that I would encourage you and everyone else who is resisting the outsourcing trend to highlight in your marketing efforts. In fact, whenever this fact is not mentioned in a tax prep office's ads, I encourage potential clients to explicitly ask about it.

As always, you are welcome to excerpt from anything that I have posted on my web sites.

DS:

2. On the 1040X/IRS audit issue, I'll have a really good test case coming up. I just completed a 1040X for 2002 & 2003 with a client who says we overstated his business revenues. When we first updated his books, we took all deposits shown on the bank statements and classified it all as income. We explained what we were doing all along, but he finally got the idea that perhaps some of his deposits could have been money he put into the business to cover bills. He compiled his own billings directly for each year and said we should use those figures for each year. So, we made the change accordingly. He'll have a combined overpayment of just under $16,000. We advised him about the 1040X issue, in that he may be facing an audit since we are claiming a large amount of refund. I hope we'll be able to get this through with no hassle, but I'll keep you posted on what happens.

KMK:

2. Good luck with the 1040X. I just finished up one of my audits last week. This one actually went rather smoothly because everything was in QuickBooks and I just printed out a G/L for the auditor, who spot checked a few things and then allowed the full $15,000 refund claim. The other audit is not going as well because the client's records aren't as organized, plus the auditors stumbled over a huge bad debt deduction that they are trying to disallow after failing to disqualify most of the actual changes we had made. I may have to take that one to Appeals.

DS:

3. As to the IRS "tax gap", there was an article in Accountants' World citing a $315B gap, according to an interview with IRS Comm Everson. Nowhere in the article was there any challenge to this figure, but it appears to have been meekly accepted as the gospel truth by the author. Since I deleted AW's email, I can't link you to it. Just wanted to let you know that your comments on the tax gap were born out through this article.

KMK:

3. It has always been SOP for the media and almost everyone else to blindly accept the IRS's tax gap figures as gospel because they do toss those figures around so confidently. A number of years back, I attempted to track down their actual calculations, even speaking with some high level IRS execs in DC, who admitted that they guessed at the numbers since unreported income is something that can never be quantified with any real precision.

DS:

4. Forgive me if I've already mentioned this, but I've been looking at dailyhowler.com for comments on Social Security from the leftist point of view. The blogger of that site, Bob Somerby, really takes conservatives in general and Bush in particular for wanted to revise the structure of SS. You should really give it a look if you want information on the arguments put forth by various leftists.

KMK:

4. As you have hopefully already read today, I have been enlisted to help with the Club For Growth's efforts to counter balance the leftist propaganda related to the current Social Security reform efforts through their new blog at SocialSecurityChoice.com. We are addressing the left's bogus arguments head on, such as their idiotic claim that everything is hunky dory and that Bush is manufacturing this crisis. You should monitor this new blog because there is a lot of excellent info being posted there.

DS:

5. I still haven't heard from Edward Jones regarding the former IRS Commish's comments on how the 1997 anti-IRS testimony was false. I'll keep pursuing this, as I contacted EJ again and demanded some type of response on this matter.

KMK:

5. Just like with the tax gap figures, nobody really challenges people who make claims about IRS issues; so that person was unprepared to document his claim that the IRS abuse stories were bogus. As we all know, he was full of crap when he made that claim.

DS:

6. I'm considering joining Dan Pilla's group Tax Freedom Institute. He seems to have a lot of good insider knowledge on IRS procedures, etc. However, he charges $995/year for membership. I'm always looking for more contacts and resources in dealing with IRS, so what do you think? Would it be worth it?

KMK:

6. Dan Pilla is very knowledgeable and current with his info; but I really have no idea what joining his group would entail. I'm assuming that it would entitle you to be the first to learn of things he comes up with in order to help your clients deal with IRS. While at first blush $995 seems like a lot of money, I've seen plenty of seminars and conferences costing many times that. Since you are working on building up your practice, that seems like a pretty good investment for a year. As you know, it's a lot less than the other practice building services that often charge in the range of $20,000 or more for their "secret formulas" for success.

DS:

7. Finally, have you considered setting up a bulletin board for tax practitioners who regularly visit your site or even possibly starting some type of organization like Dan Pilla has? It would be good to have contact with others across the country on tax matters. I spoke to the one fellow from CA who had passed along his experiences with the 1040X/IRS audit issue, and he thought it might be a worthwhile enterprise. Any thoughts?

Thanks for all your contributions to the tax discussions and for your great blog. Who knows, perhaps you can be the next Andrew Sullivan, or even better, Powerline.

KMK:

7. I'm not sure I have the time required to monitor an official discussion board. I'm already stretching myself pretty thin with the limited amount of web activity I am currently doing. However, I have long dreamed of at least having a network of like minded tax pros to whom we could refer clients who are in need of good assistance. Since we are actually trimming back on our client base, it is frustrating for us when someone asks us to take them on and we don't have anyone to whom we can refer them.

Speaking of discussion boards, I recently joined up with the Yahoo based one on LLCs. They haven't gotten into the SE tax issue yet, but they have covered some interesting points. They are at: http://groups.yahoo.com/group/lnet-llc

You may want to join up and see if the other members have more experience with the SE tax issues that will help you with your clients.

I hope this helps. Good luck with tax season.

Kerry

Names On Title Of 1031 Properties

Q:

I had a quick question about a 1031 exchange we are performing. We sold a property in which we had a 50% share. Those funds are being held by an intermediary right now. We have located another property in which we will be tenants in common with four other people.

Now my question is at what point can we form an LLC to hold this new property? Could this be done before the close of escrow or do we have to wait a few months before we can do it? What is the IRS's stance on this topic? The escrow agent is saying it should be done after the close of escrow.

Thank You,

A:

One of the basic requirements for a valid 1031 exchange is that the names on the title of the old and new properties are the same.

Thus, if you owned the previous property in your personal name, you need to take title to the new one in the same way.

Later, after the dust has settled and you have acquired the new property, you can then contribute it to an LLC if that is what you want to do.

There are some possible twists to doing this that you will want to work out with your personal tax advisor, such as setting the property's basis on the LLC's books as the same as it was on your personal books.

I hope this helps. To be honest, your exchange facilitator should have covered this with you as it is a basic component of 1031 exchanges.

Good luck.

Kerry Kerstetter

Labels: 1031

New Celebrity IRS Spokesman

This famous singer-songwriter has had more experience dealing with the IRS than most people would ever want to have.

Deducting State Taxes

Q:

Mr. Kerstetter:A tax preparer at H&R Block mentioned to me that the Schedule A deduction for state and local taxes for employees should only be for net taxes, taxes that are paid on the state tax return. Thus for 2004 taxes, one should prepare their state income tax return first then place the tax paid on the 2004 state tax return onto the Schedule A for the 1040.

I have not heard that this is the “correct” way to report state taxes.

What I am familiar with is to deduct on Schedule A taxes withheld, then count as next year’s income when the W-2G comes. Or, if taxpayer does not itemize, no income in reportable from the W-2G.

What is the correct method, if there is one?

A:

You are right. State taxes are deductible on a purely cash basis. Whatever was paid in during the year can be claimed on that year's Federal Sch. A. If the person does receive some of that previously deducted money back, it is considered income on the 1040 for the year in which the refund was actually received or applied to a future state tax year.

Just because a person itemized on the previous year's 1040 doesn't automatically make subsequent refunds taxable. Under the Tax Benefit Rule, if the state tax deduction didn't actually result in any actual additional Federal tax savings, refunds of those taxes are not required to be reported as taxable income. I see this situation a lot when the taxable income figure was negative on the return where the state tax payments were claimed.

As much as I often poke fun at H&R Blockheads, I can only assume that the preparer with whom you were speaking was sleeping through the section of their training course that covers Schedule A, because that has been the proper procedure for at least the past 30 years I have been in this business.

There are times when the net state taxes are used in some situations. I prepare a lot of multi-state income tax returns, where we often need to claim a credit against the clients home state taxes for the taxes paid to the other nonresident states. In those cases, we can only use the actual tax as shown on the other state form.

I hope I've cleared this up for you. I also hope you aren't seriously considering allowing that Block employee actually prepare your income tax returns. If this person is so wrong about a very basic simple tax matter, there's no telling how many other areas s/he is ignorant about.

Good luck.

Kerry Kerstetter

Lawsuit alleges ‘online currency’ scam – Here’s how a classic privately run Ponzi Scheme is run. As always, I have a hard time coming up with sympathy for people stupid enough to believe that there is such a thing as a safe and legitimate investment producing guaranteed monthly returns of 30% to 40%.

Lawmakers Look to Tax Cosmetic Surgery – Rulers in some states are equating this idea as just another sin tax, no different from taxes on alcohol, tobacco, and gambling.

Can an S-Corp Help Avoid Certain Taxes? – While I agree that LLCs are often better than S corps for owning investment properties, I can’t stress enough how important it is to get competent professional advice about the type of entity before setting one up. Every day, I receive emails and see messages on the online discussion boards from people who set up a corp or LLC without the foggiest idea of what they were getting into. Doing things that way is no different than jumping off a bridge before checking the depth of the water ahead of time.

Treasury and IRS Announce Guidance On Like-Kind Home Exchanges – Formalizing the part of last October’s law that sets a five year waiting period for people to sell their homes tax free if the homes were acquired as part of a 1031 exchange. I discussed this new rule earlier, right after the law was signed, as well as in this follow-up.

Labels: 1031

Is TurboTax Really Competition For Tax Pros?

I have been receiving questions like this one from Ohio CPA Dana Stahl from other tax pros every year since the 1980s:

I've seen lots of advertising by TurboTax on TV lately. I wonder if this may cut into our tax prep business to some degree, as has been predicted many times by various commentators (who say user-friendly tax software will take away much of our market!). One story concerning me: I heard from a tax client who said she wasn't coming back this year. She said she took my data from her 2003 1040 & inputted it into TurboTax, which resulted in an additional $7 refund. Therefore, I must have screwed up when I should have gotten her another $7. I told her to send me a copy of that 1040, and that this was probably due to rounding or something. Oh, well, another one bites the dust.

My reply:

Assuming that your client's TurboTax actually came up with the exact same figure for taxable income as your program did, a slight difference in the tax is quite possible based on the method the programs use to calculate it. If they do an exact dollar percentage calculation, there will be one figure. If they use the IRS tables, which use $50 wide brackets, there will most likely be a slight difference.

I have seen the tons of TurboTax commercials on TV. My opinion on TurboTax and other consumer tax prep programs as a threat to our profession hasn't changed one bit since they were first made available back in the 1980s. If there was ever a perfect illustration of the old GIGO (garbage in, garbage out) maxim, tax prep software is it. This covers all tax software, including the heavy duty and very expensive programs that we professionals use.

I have never discouraged my clients from using TurboTax. In fact, I used to have several clients submit their annual tax info to me on a TurboTax print-out instead of my normal organizer forms. I would then enter that data into my tax program and the bottom line numbers never came out the same because I was able to use my knowledge to better enter the info to reduce the clients' taxes. I don't have as many doing this any more, as we have mandated most of them to use QuickBooks and to just send me a copy of their QB data file.

As I've said since the 1980s, form filler tax services, which just enter numbers onto tax forms (manually or via computer) with no thought as to the various options that may be available, do have a lot to fear about losing business to software like TurboTax. This could very well be the case for the super simple 1040A and EZ clients, which are the bread and butter of the assembly line tax prep outfits. However, we all know that with each additional tax schedule and type of transaction to report, there are dozens of options for how they can be reported in order to minimize the tax hit. This takes much more brain power than the form fillers have and makes those of us who keep up on the tax rules worth the big bucks we charge. I know it sounds crass, but clients who are too dense to understand this aren't who want to be working with.

Just as with the emphasis on doing your own work and not sending it to India, you may want to highlight something like the fact that you and your staff are entering more than numbers into your computers. You are entering your years of experience and vast knowledge, things that are not included in cheap do it yourself programs.

Anyway; those are my thoughts on that.

Kerry

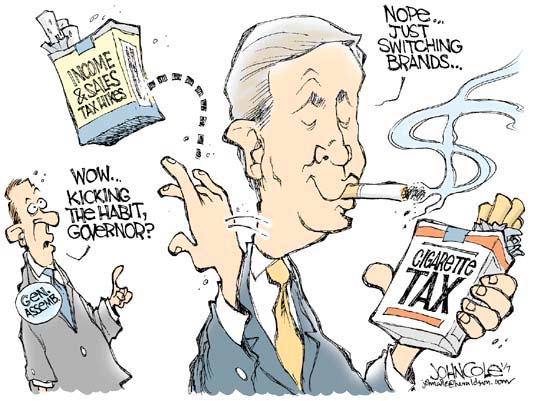

Hoosier RINO

Indiana GOP Governor Proposes Tax Hike – How does this quote differ from what we have long heard from DemonRats?

"I ask the most fortunate among us, those citizens earning over $100,000 per year, for one year, to pay an additional 1 percent on the income they receive."

This is too much like Dick Gephardt’s classic description of people who do well as “winners of life’s lottery.”

Bush 2006 Budget Will Not Address AMT or 'Other Tax Policy Issues' – it seems that there’s a limited amount of political capital available for Bush, so he has to prioritize and Social Security reform appears to be winning the contest for his attention at this time.

Bipartisan Group Pushes Permanency for State Sales Tax Deduction – Otherwise, we will only have it for 2004 and 2005 1040s.

Homeowners can expect bigger property tax bite

Gift Tax Exclusion

Q:

Hello, I saw your website and was hoping you may be able to tell me what the allowable tax free gift amount is for 2005? Has it increased from the $11,000 in 2004 to $12,000 for 2005?

Thank you kindly,

A:

The annual exclusion is still $11,000 for 2005.

Unlike some tax items that are adjusted each year in small increments to account for the inflation rate, this is only allowed by law to be adjusted in $1,000 increments when the cumulative CPI change since the previous increase warrants it. This means it may be another few years before another hike is required.

You can see more on this at the IRS's website.Kerry Kerstetter

CBO Forecast Shows Runaway Spending—Not Tax Cuts—Causing Deficits – Why it always makes me sick when the media and their Fellow Travelers just readily accept the premise that Bush’s tax cuts created or worsened the deficit. As was the case after the Reagan cuts of the 1980s, the rate cuts resulted in increased revenue and prevented the deficit from being even worse than it would have been. The drunken sailors in DC need to be stopped in their wild reckless spending sprees if there is any hope of ever seeing anything resembling a balanced budget again.

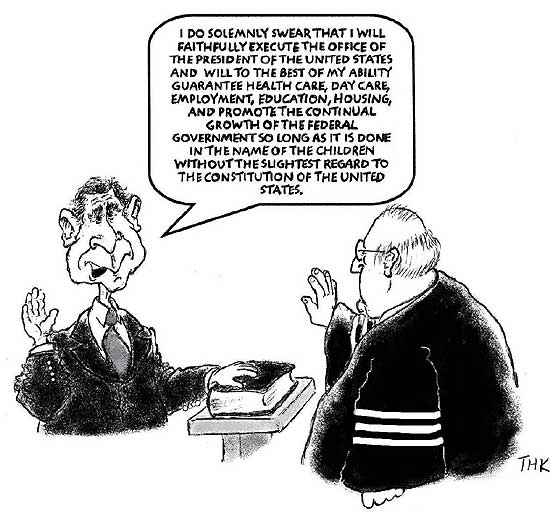

The Truth About Social Security

It has been no secret that one of the issues that I have long felt strongly about is the Social Security Ponzi Scheme. Ever since we analyzed its financial criteria in my very first college accounting class in 1973, I have understood what a sham it is for most people. We compared it analytically with other similar programs, such as private annuities and life insurance policies, and found it was far worse from an investment perspective than any of the other options. That was almost 32 years ago, and it has become even worse since then.

For the past several months, one of the best places to find articles and links to news coverage of the Social Security mess has been at the Club For Growth’s blog. I make a point to check it every day, as well as subscribe to their RSS feed via my Bloglines account. As the volume of information on this important topic has exploded, with so many outright lies, the Club has established a blog style web site, Social Security Choice, devoted exclusively to discussing the Social Security system from a free market capitalist approach.

Andy Roth of the Club has done an outstanding job, in a very short time (I just heard about it last Friday), of assembling an interesting mix of people, including a certain opinionated CPA, to write on this topic from our various perspectives. As I do in my own blog, I intend to address the Social Security issues from the viewpoint of a real world tax practitioner and from how they affect my clients, readers, and seminar attendees in regard to the payment in of the SS taxes, as well as the maximization of the benefits; all very important issues that I have been dealing with for 30 years now, and continue to do on a daily basis.

I do feel very honored to have been invited to join this esteemed group to contribute to the capitalist side of the debate on improving the Social Security system. It will be an uphill battle getting the capitalist message out to counter the wider coverage that the liberal media have. However, as was proven during the elections last November, the new media outlets, such as blogs and talk radio, can overcome the lies and Socialist agenda of the conventional media.

I do feel very honored to have been invited to join this esteemed group to contribute to the capitalist side of the debate on improving the Social Security system. It will be an uphill battle getting the capitalist message out to counter the wider coverage that the liberal media have. However, as was proven during the elections last November, the new media outlets, such as blogs and talk radio, can overcome the lies and Socialist agenda of the conventional media.

To avoid unnecessary repetition, I will only be posting my thoughts, as well as comics, on the SS issue on this new blog and will continue adding other tax and financial items here on my personal blog. I suggest that you bookmark this new site, and/or add its RSS feed to your reader in order to keep up with the truth on this very important issue. I have also added a link to it on the very top of my blogroll on the right side of this page.

The volume of lies and distortions will only get larger in the coming months, as this matter works its way through the legislative/digestive process that our rulers in DC use; so having at least one source that you can trust for accurate information should help us all be better informed and ready to recognize the lies that will continue to pile up from the Left.

‘Survivor’ Winner Arraigned on Tax Evasion – The latest on someone who portrays himself as being so smart, yet is really so stupid. All of the stories I have seen on this “accidental oversight” of over a million dollars of income give the impression that Hatch prepared his own tax returns. This is actually a positive angle to the story; because I would hate to think that there was a professional tax preparer who would be so stupid and oblivious that s/he would fail to include this income that everyone in the country knew about.

Deficit-Minded Republicans Eyeing Entitlements – Will wonders never cease? Another story about GOP rulers wanting to limit government spending.

If only...

Some folks have more creative options for dealing with tax collectors than do the rest of us.

Is your tax return being prepared in India?

Outsourcing Sparks Returns – I’ve discussed this trend of using accountants in India to prepare USA income tax returns on a number of occasions. From this article, as well as a lively discussion thread on the Kleinrock board, the trend is still growing, in spite of my explicitly stated opinions that this is a disservice to clients who are often unaware of the fact they are paying top dollar fees to their USA preparers, while those preparers are farming the actual work out to a third world country where pay rates are a small fraction of what they are here in the USA. The fact that most of the USA tax firms quoted in this article were unwilling to have their names used is a perfect indication that they know they are doing something seriously wrong and are too embarrassed by it.

Maybe it’s just a difference in operating philosophy. In my case, I have always considered each tax return I prepare to be an extremely customized work of art. I have also always charged strictly by the time spent in order to appropriately reward the organized clients and penalize the messy complicated ones.

Even when I had my multiple offices in the Bay Area with a staff of preparers working for me, they were all required to abide by the very strict standards and procedures that I had established. I also reviewed and signed each and every tax return. This was tough enough to do when they were working in my offices. How it would be possible to properly supervise people from a different culture living and working on the other side of the planet escapes me.

Based on the multitude of incompetent tax pros who were born and raised here in the USA, I have a very hard time accepting the claim that these outsourcing companies can adequately train people from such a different culture in how we do things here. I have met and worked with many Indian accountants over my career, and they are very well educated and intelligent. However great they may be in their own environment, it’s impossible for them to be as skilled when out of their element. It would be the same situation if I were to start preparing tax returns for people in other countries. As well versed as I may be here in the USA, I would be a fish out of water.

From the solicitations I have seen for these Indian outsourcing companies, their main market is with the assembly line tax services that charge fixed amounts for their returns. They base their appeal on the fact that the USA firms can still charge their clients the same amounts while cutting their labor costs down dramatically. Quality of the product isn’t generally of as much concern to these kinds of tax prep firms as is quantity; so they will probably continue to expand their use of Indian preparers. Client beware is all I can say for people who use these USA tax firms.

It's not gambling when you cheat

Pepsi iTunes Contest: The Tilt Still Works – Some easy, yet legal, ways to improve the odds of winning free goodies when buying sodas.

IRS Must Get Grip on Tax Gap, Taxpayer Advocate Says – As I’ve explained on several occasions previously, I have tried to track down how IRS calculates the “tax gap” and they have admitted that they make the numbers up in order to justify more money and power for themselves. Since such a gap is by definition unknowable, they claim that their guess is as good as anyone else’s.

Having been in the tax profession for 30 years now and having reviewed the tax returns of thousands of people, I know that the popular wisdom that everybody cheats on their taxes is flat out wrong. Most people are so frightened of the IRS, as well as incapable of understanding the insane tax code, that they actually over-pay their taxes and don’t claim all of the deductions to which they are legally entitled.

Feds To Lotto Winner: Pay Up – In a sane world, where people are responsible for their actions, this wouldn’t even be debatable. Someone who recently skipped out on $45,000 of debts should have no hesitation in making good on those debts from the $60 million lottery check he received.

Social Insecurity? – Thomas Sowell takes on the DemonRats’ asinine argument that there is no Social Security crisis.

It's time to reform Social Security – George Will

You're too stupid to manage your own money – The DemonRat philosophy in a nutshell.

Quiz: Are You Ready To Sell Your Own Home? – It’s not as easy as it often appears to be.

A Word to the Wise For Timeshare Buyers – I have no hesitation n proclaiming that buying timeshares at full retail price is the biggest rip-off in the real estate market. It’s not such a bad deal, however, when you pay only $1,000 on the secondary market for an interest that someone else paid over $20,000 for. Just don’t be the idiot paying the $20,000, regardless of what freebies the promoters give you.

Can LLCs Own Primary Residences?

Q:

Subject: primary residence held in LLC

Question:If I have my primary residence placed in an LLC will there be any capital gains due when I sell it after living there 2 yrs or more??

A:

The tax free exclusion for gains from primary residence sales of up to $250,000 per person is only available for homes owned by individuals.

Properties owned by other entities, such as corporations, partnerships and LLCs, are not eligible for any such tax free sale because only individuals (human beings) can have primary residences under the tax code.

On the books of the other kinds of entities, the property is normally treated as an investment, business or rental property and the only way to defer taxation of any gain is via a 1031 like kind (aka Starker) exchange.

If you are serious about being involved with LLCs and real estate, you really should be working with a tax pro or you could easily find yourself owing a lot of unexpected taxes.

Good luck.

Kerry Kerstetter

Labels: 1031

Section 179 & Rental Properties

Q:

I don't know whether you respond to specific questions/individuals but in trying to do some research came across your site. I have gotten two different responses to a tax question so thought I would give you a try.

I did a 1031 exchange this year--sold a condo I had rented for years and bought a home in a resort area in Delaware that will be rented on a weekly basis. In order to rent this home it had to be fully furnished--can this furniture and everything purchased to set up the kitchen for use be deducted in one year as a Section 179 expense?? I am a real estate agent so I know all my losses this year are not limited and since I didn't settle on this till June I did not have a lot of rental income on it.

Thanks for any insight you can give.

A:

It depends on how you are going to show the new rental property on your tax return.

If you are going to show it on Schedule E as a regular rental property, you can't claim Section 179 for the furnishings.

However, if you show it on Schedule C as a short-term rental property (average stay of seven days or less), you will be able to use Section 179 for the furnishings.

This special rule, which I usually call the "motel exception," and many tax pros overlook, makes the activity not considered to be a passive one and thus not subject to those deductible loss limitations. You do need to be actively involved in the operation of the property to be able to claim the losses.

Another big benefit of this approach is to generate self employment losses on the rental Sch. C to offset self employment income from other business activities, such as real estate sales.

Good luck. I hope this helps.

Kerry Kerstetter

Increased Vehicle Weight

Q:

Dear Sir,

I saw your advice on the net and really appreciate the work you have posted. I have a question I am hoping you can help with. I purchased a used BMW for the depreciation deduction at the end of 2004 to use in my

business, a vocational school, transporting books from the publisher to our school. It was 5,840 pounds, but when I added the necessary roof rack to carry the inventory it meets the 6,000 pound requirement. This works for the IRS

requirement, right?

Thank you in advance for your time.

A:

If the new rack becomes permanently affixed to the vehicle, you can add its weight to that of the vehicle to see if it is more than 6,000 pounds. If it's a removable stick-on rack, you will have a tougher time proving that its weight should be counted along with the vehicle's.

This is no different than what some car dealers do when they sell their "tax upgrade packages" with various other features, such as towing equipment and racks installed to push the weight of an SUV or truck over that magical 6,000 pound threshold.

Kerry Kerstetter

Upgrading QuickBooks

Q:

HelloI am currently using QuickBooks Pro 99. My office manager thinks we should upgrade to 2005. Any real advantages? Everything seems to workfine on this old version. We are a 2 million dollar graphic design firm. If you have time - any comments would be helpfulRegards

A:

I wholeheartedly agree that it's long past time for you to upgrade.

While you rarely see huge differences in each year's new version of QB compared with the previous year's, when you jump six years forward, you will see dozens of very useful improvements that will make the upgrade very worthwhile.

It is also the case that Intuit officially abandons all versions of QB that are more then three years old, as another incentive to motivate hold-outs like you to upgrade. QB 99 was dropped by Intuit years ago. QB 2002 is scheduled to be orphaned in April of 2005.

Good luck. I hope this helps.

Kerry Kerstetter

Followup Q:

Thank you for your quick reply. You have made Laura, our office manager very happy.Do you think we will have trouble pulling the data from 99 to 05 since - as you correctly pointedout - our version is old and not support. I really appreciate your insight.

A:

You shouldn't have any problem rolling your data from the 99 program to any newer version, including the newest 2005. I've done hundreds of such conversions, often skipping several years, and have never had any problems.

Good luck.

Kerry

IRS says "Survivor" winner didn't report his million dollar prize – Let’s see if Richard Hatch can survive this challenge, from IRS and the Federal government. Not reporting his well publicized winnings was just plain stupid.

With Social Security's well documented record as the worst performing investment, opponents of change have a lot of nerve claiming that people will be worse off by investing that money themselves.

NYC Smokes Out Smokers Who Buy Cigarettes Online – Nicotine addicts are always under attack, especially when they try to save money.

Are No-Interest Offers As Good as They Sound?

IRS Searching for Taxpayers of Mass Deception

Breaking the Code – Thanks to Andrew Roth at the Club For Growth for the heads up on this NY Times lengthy look at the tax reform efforts.

Fighting Fires

For most of us in the tax and accounting profession, fighting fires is just an often used metaphor. However, for those of us in the boonies, it sometimes becomes all too real. Although I began Saturday evening working on income tax returns, this is how Sherry & I spent the rest of the night. We got dressed in our turnout gear and left shortly after the 8:30 call, and returned slightly after midnight.

Sherry has spent most of today (Sunday) on the phone with the Red Cross and others trying to help the Halls recover from losing everything except their lives in that horrendous fire.

Q:

Subject: sale of primary residenceHelp!

I’ve been scouring sources from the Internet looking for a clue on the ramifications of selling my primary residence. Yours is the first site that I could make heads or tails of.This is the situation. We have owned our home since 12/01/2003. We began building a new home in a new development in 8/04 (less than 50 miles). The new house will be ready for occupancy 3/05. We want to sell our home, but know that we do not meet the “2 year” rule. We estimate that we will realize about 75k in gain. We do not qualify with change of employ or health. How do we calculate the taxes?

Any info will help.

Thanks

A:

There are a number of issues that you need to consider here, hopefully along with a personal tax pro who can more specifically advise you.

First, I would look a little more aggressively and creatively at the employment aspect of your need to move to a new home prior to the full two years in your current one. While your outside job may not be changing, I have seen cases where a new home was being built or purchased in order to better accommodate a home based business and the pro-rated tax free exclusion was then justified.

If that doesn't work, you will be facing a long term capital gain. This means that you want to do a very thorough job of calculating the cost basis of the home you are selling. Make sure to include every improvement you made to it, along with any appliances and furnishings that you are leaving with the property. The higher your total cost basis in the home, the lower your taxable gain.

Since you are selling so early in the year, you have plenty of time to offset the gain with capital losses. You don't want to intentionally lose money on anything. However, if you own stocks or other investments that have dropped in value, you can sell them to be able to claim those losses. If you want to get back into those investments, you will need to wait 31 days before you repurchase them in order to avoid the "Wash Sale Rule" which would disallow the losses.

If you still have a net capital gain after all of that, the Federal income tax will most likely be 15%, although you may have part of it taxed at 5%, depending on the level of your other income. You will also be looking at State income tax, unless you live in one of the states without an income tax.

I hope I covered your question properly. As I said up front, these are very general comments. You really should discuss your strategies with a tax pro who can take into account other aspects of your life that may be helpful for you.

Good luck.

Kerry Kerstetter

Sale of land next to home

Q:

Good Evening;

I would like to know if this qualifies as a resident. I just signed a Purchase and Sales on my property. I have a parcel of land that was always included as pert of my primary residence. I sold same aprrox 2 mos ago. I would like to know where I have been living here in my home along with the parcel of land as part of my home, would that qualify as 2 yrs in the primary residence which would cover me from paying capital gains on said property?

A:

From the way you described this, as long as both sales take place within two years of each other, you should be able to count them both as the sale of your primary residence, which would qualify for the tax free exclusion.

Check out the section called "Vacant Land" on my page describing residence sales to see if your case matches this:

Good luck.

Kerry Kerstetter

Phobia Over Paying Taxes

Q:

Subject: Primary residence tax exclusion Safe HarborTax Guru,Saw the articles on 'Safe Harbor' when selling a primary residence but see if you can answer this. I have a rental property which I would like to move back into to get the 500K married couple no tax benefit. This property is 15 miles south of where I live now. Here's the problem ; in order for me to live in that property and commute to work this must be done via freeway. I have owned the property for 10 years but have since come down with a phobia about driving on freeways. One to Two exits on a freeway and then I begin to get panic attacks while driving, therefore I have been treating myself by avoidance of using freeways. To move back into this condo would cause me to have to commute via freeway which I physically can't do. How can I get a tax break if I can't live there without losing my job due to my phobia of driving on freeways. I don't fit the Safe Harbor's as described !

Help ......

A:

I can't tell if you are trying to make a joke with this premise or are serious.

Giving you the benefit of the doubt that you are honestly trying to apply the health exception to the two year residency rule, such an argument would fail miserably on at least two counts that pop immediately to mind.

1. The law allowing a sale in less than two years for health reasons is intended to cover health issues that arise after you begin living there; not something that you know full well about and are suffering from before taking up residence there.

2. Even if you could justify using the pre-existing medical condition as a reason for selling before two years of personal occupancy, that only allows you a pro-rated tax free exclusion, not the full $500,000. For a couple, that works out to about $685 of tax free gain per day of occupancy ($500,000 / 730). If you never actually use the home as your primary residence, you have zero qualifying days of occupancy, which would give you an allowable exclusion of zero.

As I constantly have to remind people, I do not make the laws. I do admire creative interpretations of the details and loopholes that are part of those laws. However, your little stab at it here just doesn't even come close.

If you truly do have $500,000 of potential gain in that rental property and want to dispose of it, you should be seriously evaluating using a 1031 (aka Starker) exchange to defer all or even part of the profit into other property or properties. You can see the rules for that strategy at various sites around the web, including my wife's company,Tax Free Exchange Corporation (www.TFEC.com).

Good luck.

Kerry Kerstetter

Labels: 1031

Create A Diary of Your Final Wishes – Gail Buckner covers the need for good planning for the end, including some more discussions with Mark Colgan about his excellent and highly recommended Survivor Assistance Handbook, which has been included in my blogroll on the right side of this page for a long time now.

Amended Return Audits

My earlier comments and experiences with the current IRS project (which is what they are calling it) to audit refund claims dealt with individual returns (1040X). I wasn’t aware whether or not the project also included corporations, which raised a dilemma for us a few months ago when a client wanted to carry a corporate net operating loss (NOL) back to recover some previously paid tax. Such a carryback should be a straight forward calculation, with nothing for IRS to need to examine in excruciating detail. However, because of the current uncertainty, we opted to hold off the carryback and roll the loss forward instead.

The other day I was speaking with an IRS auditor who is examining some 1040Xs I had prepared and was among those who had told me of the IRS's current policy of auditing all amended returns claiming refunds. When I told him that we had held off carrying back an 1120 NOL because of this situation, he said that was a wise move because they are also examining those.

As I said earlier, I wasn't aware if the current IRS attack on amended returns included 1120s. Now I know and am glad that we held off doing one for my corp client.

While an NOL carryback or over sort of works its way out and is more of a timing issue as to the tax savings, with the other kinds of things that create most amended returns, such as overlooked deductions, not being able to claim them on an amended return means they are lost forever. It’s a classic use it or lose it situation.

I wasn’t given any idea of how long this current IRS project will continue. However, I was given a heads up on their next project, extensive audits of pass-through entities, such as partnerships, S corps, LLCs, and trusts, which will also trace each item to the owners’ tax returns. While checking the owners’ tax returns, auditors will also almost definitely fish around for other things to mess with.

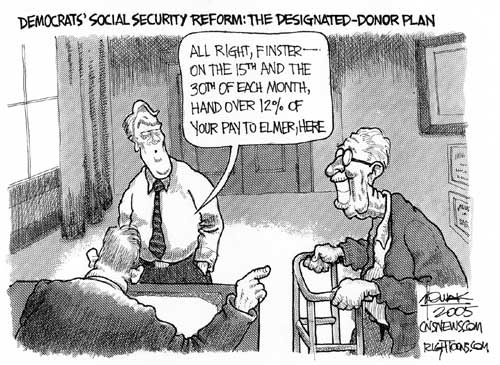

Social Security: Defending the cap – One of my long running predictions on how our rulers will try to keep the Social Security system anywhere close to solvent is the removal of the cap on income subject to the tax, while at the same time denying benefits to those same people. Those “evil rich” people have long been high profile targets for the leftys who love to exploit class warfare and others’ envy of the wealthy to garner support from their base.

Grading the Social Security debate – Good look by Alan Reynold at many of the bogus issues being discussed in this debate, including AARP’s extremely dishonest propaganda campaign to equate private control of retirement accounts with outright gambling.

The Net Is Modernizing Home Buying and Selling – How I wish we would have had the current access to real estate info via the internet 13 years ago, when we were scoping out places to relocate to in our escape from the PRC.

The Social Security crisis begins in just 5 years – From Donald Luskin. I’ve considered the system to be in crisis for decades already, considering the hundreds of thousands of dollars people have been forced to pay into the Ponzi Scheme.

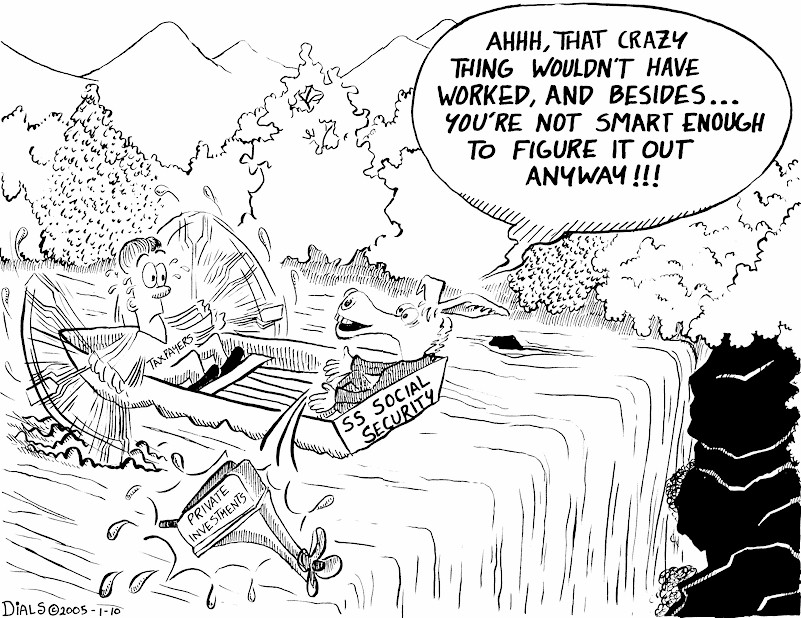

Emulating their spokesman Dan Rather's approach to dealing with reality, the DemonRats think they can continue to control all of our money by denying that there are any problems with Social Security and continuing with their arrogant attitude that people are just too stupid to see the truth for themselves.

Daunting tax-reform task – Bruce Bartlett is also not too optimistic about the the tax reform panel’s chances of actually accomplishing anything worthwhile. As I said earlier, without the input of at least a few real world tax practitioners, the entire exercise seems futile. They don’t have to remove any of the current members. Just add someone from one of the big CPA firms who can address tax issues facing large clients and a small firm CPA or EA who can convey how things are for smaller clients.

Expiring Tax Provisions

One of the many frustrations in dealing with the tax system in this country is the propensity for our rulers to continuously tinker with it. To say that it is a constantly moving target is quite the understatement.

To add to the already mind boggling level of complexity is the fact that so many of the minute details of the tax code have different expiration dates. These are meant to give our rulers an opportunity to revisit those issues on a perpetual basis and renew them for a few more years, or just allow them to die off.

Thanks to Tom Herman at the Wall Street Journal for the link to this recently published 18 page pdf list of the various tax provisions expiring for each year from 2004 through 2014. Most of them are esoteric items that few regular people ever encounter; but some are very important, such as an end to the reduced capital gain rates at the end of 2008.

Of course, this entire list is subject to change at the whim of our rulers, especially if the tax reform panel does anything.

New Mac Computer & QuickBooks

I was intrigued by the new low cost Apple Mac mini that was just introduced because we have long had a few clients who use Macs for their QuickBooks and it has been impossible for me to work with their data files, as I do with clients using Windows versions of QB. The conversion feature in the Mac version of QB, which is supposed to allow data files to be accessed by Windows users, has never worked for any of our clients, so I have been stuck having to rely on printed reports and write out journal entries for the clients to enter themselves.

I was actually starting to order one of these new computers from Apple, as well as a KVM switch and USB keyboard from Tiger, when I thought I should check to see if the Mac version of QB was among the dozen or so discs that I was sent a few months back as part of the 2005 product release. It had been my understanding that we QuickBooks Pro Advisors were supplied with every version of the program so that we could service our QB using clients.

After a lengthy wait on hold, and a discussion with the Pro Advisor contact, I learned that I would have to actually buy a copy of the QB for Mac at the new user price of almost $300 for the cheapest version. The fact that I have been using QuickBooks since it first came out in the DOS and Windows formats, and have been a Pro Advisor since that program was started, don’t mean anything to them. I’m obviously a little disappointed in this attitude by the powers that be at Intuit. We Pro Advisors are provided with free copies of the useless Online and Simple Start versions; but not the Mac, which I would be more likely to actually use.

I told the QB rep that if they want to enlarge their user base among Macs, they would need to support us Pro Advisors in that format. She said that there are currently so few Mac users of the program that they don’t care about them and don’t see any need to help Pro Advisors with those users. It seems like we have a classic “chicken or egg” scenario here that Steve Jobs may want to look into if he is serious about expanding Apple’s market share beyond its current three percent.

For now, I’m holding off on buying one of the new Mac minis and will continue to work with print-outs for those clients using QB for Mac.

State of MA eyes property tax relief for seniors – Good point made by Rush on his show today that if they can afford a special tax break for a specific demographic, why can’t they afford similar breaks for other groups?

Age gap may be trouble for Bush – Pitting age groups against each other in their attempt to keep the Ponzi Scheme alive by forcing younger people to continue paying in.

Crooks faking Web sites to bilk unwitting donors – Any time there’s a lot of money involved there will be scum floating up to try and steal it.

How to Spot a Loaded Mutual Fund

Financial Front in 'War on Terror' Expanding – Following the money has long been the most effective way to catch crooks.

AARP on Social Security Risk – According to them, we’re all too stupid and irresponsible to have any control over our own retirement accounts. Have I mentioned recently Art Linkletter’s United Seniors, which opposes the AARP on many issues involving higher taxes and bigger government?

National Taxpayer Advocate Cites Complexity as Top Issue – A good grasp of the obvious there.

A New Real-Estate Agent Must Fire Difficult Clients – We do it here a lot because some clients are just too much hassle, regardless of the money.

Taxes: What You Need To Know For This Year – Handy tips related to real estate from the Wall Street Journal.

DC Mayor says traffic cameras needed for revenue – It always bugs be when fairness takes a back seat to money for government, an all too prevalent occurrence at all levels of government in this country.

AARP’s Selfish Gamble – The propaganda war is in full swing to convince people that only the big central government can protect our retirement funds from losses. As I scan hundreds of editorial cartoons each day, there is no shortage of ones equating changes in the SS system to gambling at a casino and as a windfall to Wall Street fat cats in attempt to scare everyone.

Politickles

I always enjoy F.R. Duplantier’s verses, and have been looking forward to some tax related ones to post here, such as from this week’s update:

PORK RINOS

The Republicans have been disgraced

By their failure to rein in the waste.

Are they really expected

To get reelected

When they act like the pigs they replaced?

TAXING OUR PATIENCE

The flat tax is best, some contend,

But the sales tax has much to commend.

Taxing income or sales --

These are minor details

'Til we limit what Congress can spend!

IRS Audits of 1040Xs

Although I haven’t received any more direct updates from other practitioners on how this problem is playing out around the country, it is still ongoing. Last week, I came across and responded to this posting from a California CPA on the Kleinrock discussion board. I’m copying it here because I think you need to be registered to read it directly on the board.

Would appreciate your comments/suggestions on the following situation:

Taxpayer filed 1040X for 2001 in May, 2004 requesting huge refund.

IRS issued notice in Sept 2004 notifying t/p that case will be referred to district office

T/P received notice of exam Dec 29, 2004

Question:

Since refund claim was filed timely, if the exam is conducted past 4/15/05, would the statute of limitations have any effect on the refund?

It might be wishful thinking to delay the case for 3+ months, but I certainly hate to deal with any exam during the tax season. After all, the IRS is taking 8 months to notify the T/P. ( I wish I knew the date that the district office got the case. My understanding is that examination or other audit action must take place within 30 days after the District Office receives the claim from the regional service center.)Selina Kong, C.P.A.

Reply 1:

Selina...when the taxpayer did the 1040X...he started the wheel again....

Reply 2:

If the refund claim was timely, your client can file suit in District Court

(or Court of Claims) after 6 months from the time the 1040X was filed. The

limitations period for filing the suit is generally 2 years after the

refund claim is denied. See IRC 6532.

Assuming the original return was filed on or before 04/15/2002, the statute

of limitations for assessments expires 04/15/2005. After that date, unless

the statute is extended, the tax shown on the original return cannot be

increased, although the requested refund could be decreased or eliminated

entirely by the IRS audit.

Ralph H. Weintraub, CPA

Los Angeles, CA

My first reply:

Selina:

What state are you in? I have been chronicling the spread of this program by IRS to audit 1040Xs with refunds and violate the statute of limitation in my blog, such as here.

Kerry Kerstetter

Osage, Arkansas

From Selina:

I'm in CA.

I'm just frustrated for the IRS's delay to notify T/P of the audit (8 months from the date 1040X was filed, not to mention the fact that its the start of tax season now).

May be the amount of refund requested has something to do with it: close to $ 40k. May be it's the complexity of the issue: I.R.C. Sec. 1202.

You mentioned in your blog that IRS have recently started a policy of running full blown audits of anyone who files amended tax returns requesting a refund. Is this "policy" in writing, & if so, did you get your hands on a copy of same?

Selina Kong, C.P.A.

My Last Post:

Selina:

I haven't been able to get the auditor or audit manager to give me anything official in writing from DC authorizing this new practice; just their verbal claims that this is the new policy. I think it's time for me to submit a FOIA request, which may or may not turn up anything in writing.

I have an auditor coming out to my office on Tuesday to go fishing for things that he can disallow in order to offset the $13,000 + that we requested on a 1040X that had been in IRS limbo for several months.

The other similar situation is with a 1040X for about $10,000, where the auditor went fishing around and opened up completely new issues that have cost us a lot of time to defend against his imaginative theories. He is definitely exploiting the burden of proof anomaly by tossing out all kinds of crazy ideas and making us scramble to prove him wrong without his having to prove his theories are anywhere close to accurate.

Good luck with your case. I will be posting my ongoing findings on these matters on my blog.

Kerry

Why Don't Loan Payments Reduce Corp Income?

Q:

Subject: QB TipsDear Sir,Your QB Tips have been extremely useful. Thank you! I do have a question which you haven't covered directly (I don't think).

For a business C-corp, how is business income (say from consulting fees) that is used to pay Stockholder Loans treated? For example, say the business received $100,000 income and paid $30,000 of this to Stockholder Loans, how do you show the income reduction, since this is not a taxable event? I know you record it against the Stockholder Loans account, but since it is not an expense, how does QB let you reduce the $100,000 by the $30,000 on the income/expense reports so that only $70,000 is taxable in this case?

Perhaps you could cover this in a revision?

Thank you!

A:

Actually, this topic is covered in my tips. It involves "Loan Activities" and mixing balance sheet entries with income statements.

Basically, payments on loans have no effect on the net income. This is why it's not a very wise idea to just look at the bank account balance as a reliable indicator of a company's net income.

There are ways to reduce corporate income by payments to the owners; but those would have to be picked up by the owners as income on their 1040s.

You really should be working with a tax pro to prevent these kinds of misunderstandings that could cause serious problems and work out a strategy to minimize your taxes.

Good luck.

Kerry Kerstetter

Homes Become a Legacy As Kids Get Priced Out – Good look at passing homes between generations.

Revised Schedules K-1 to Reduce Filing Complexity – We’ll see how well the simplification efforts have succeeded.

U.S. gets tough on student loan debts

Stock Picking Secrets

How the stock gurus come up with their "no-lose" investment plans they sell to suckers.

Due Date Anomaly

For the past week, I’ve been working on taxes that are due January 15, including C corporations with their years ended 10/31/04, as well as final 2004 estimated tax payments for some individuals, when I noticed that the due date this year is actually Tuesday, January 18 because the 15th is on Saturday and Monday, the 17th is a Federal holiday. It always slips my mind when Martin Luther King Day comes around. Anyways, anyone panicking about getting their taxes and payments in by the 15th can relax and use those three extra days.

Money Is Money

Money in its less convenient form, cold hard cash:

Trucker missing; so is cargo of 3.6 million nickels – $180,000 weighing 45,000 pounds.

Fine paid in pennies leads to dropped case – 8,200 pennies that the owner is now trying to sell to some idiot on eBay for $25,000. I was hoping to link to the actual eBay auction for this, but it didn’t turn up in my various searches.

Elephant sized pork

It seems that a lot of people are noticing how the GOP has so shamelessly abandoned its principle of small constitutionally authorized government. That was an easy stand to take when they weren't in control of the Federal Treasury. Now that they've seen how much fun it is to dole out the pork, they're like crackheads and there doesn't seem to be any way of stopping them. Bush has been their enabler by not having the balls to use his veto power to at least slow down the spendaholics in Congress.

Bottom line, bigger government leads to higher taxes. There is no way around that.

Perceptive

One sign of a person's maturity is when he realizes that none of these fairy tales is true.

Taxpayers most likely to foot bill for Huckabee's highway designs – Plenty of higher taxes in store for us here in Arkansas, from our GOP governor.

Principled Giving in Times of Crisis – There are so many scams surrounding charitable donations, that it is difficult to be certain your donations are going to the right place.

Congress Passes Law Extending Tax Deductions on Tsunami Aid – I don’t mean to be too Scrooge-like here, but as someone who has to prepare actual income tax returns, I hope this doesn’t start a trend of allowing taxpayers to essentially keep their books open for all kinds of certain deductions made after the normal year has ended. Besides the differences this will create between federal and state returns that I already mentioned, it will lead to double counting of these expenditures when they are also accidentally included in the totals for 2005. While receiving double deductions for the same payments may seem like a good thing from the taxpayers’ perspective, I am just as interested in honesty and accuracy in the tax calculations as is IRS, and this kind of thing can do nothing but mess that up.

Tax Reform Panel – If I come across as overly skeptical of the current tax reform projects, it’s because I have been in this business 30 years and have heard and seen these lofty promises countless times before, with the exact same results. I would be more than glad to assist in any truly sincere efforts to make taxation simpler and fairer in this country. However, based on the roster of people chosen as members of the official President's Advisory Panel on Federal Tax Reform, I don’t see how this time will be any more effective at doing anything but screw the tax code up even more. While they claim to have a diverse mix of members, I can’t help but notice the glaring absence of any real life tax practitioners. While politicians and academicians have their different viewpoints, there is no substitute for the real life world of doing actual tax returns and fighting with IRS on behalf of real people. Contrary to popular belief, there are countless huge differences between the theoretical and real world applications of the tax system. Ignoring the real world aspects is ridiculous and shows an utter lack of sincerity in this year’s stab at fixing the tax code. I am surprised and disappointed that our first MBA president would establish such an incomplete panel and truly expect it to do any better than the dozens of similar ones previously.

Currency Conversion

I was recently working on a 2003 1040 for a client who had earned some income in Portugal. The statement showing the income and tax withholding amounts was in euros. I thought it would be an easy thing to convert these amounts to US dollars; but the normal web sites I have used in the past, such as Yahoo’s and the Wall Street Journal, only had the current exchange rates and don’t allow historical rate searches.

Since the income was received in July of 2003, and there has been a lot of well publicized fluctuation in the exchange rate since then, I wanted to use the July 2003 rate. It took a bit of Google web searching before I found a handy free web site that does allow this kind of historical research, www.x-rates.com. With a URL like that (x-rates), I’m sure they’re mistaken for a completely different type of web site.

Since I have a number of clients who receive income from foreign sources, this kind of conversion tool will be very handy, so I have been added it to my blogroll for quick access.

It did make a difference. The current exchange rate is 1.31, while it was only 1.16 back in July 2003. On several thousand dollars of income, using the more precise figure was helpful for the client. As I always do, I attached this documentation to the 1040.

AARP's Social Security Ads Mislead the Public – Just singing from their usual DemonRat hymnal.

Study: Congressional Retirees Reap Huge Taxpayer-Funded Pensions  – Royalty has its privileges, so we mere peons have no right to be jealous of what our rulers are able to set up for themselves at our expense.

– Royalty has its privileges, so we mere peons have no right to be jealous of what our rulers are able to set up for themselves at our expense.

Congressional spendthrifts  – Drunken sailors are still in charge in DC, and it’s not just Teddy K.

– Drunken sailors are still in charge in DC, and it’s not just Teddy K.

Congress has concluded its 108th session. Beginning with the 102nd session, members of the House submitted 5,756 bills to increase spending, and just 1,158 to cut it. In the same period, senators offered 3,896 bills to raise spending and 504 bills to reduce it. What's more, the trends are headed the wrong way: In both houses the 107th and 108th sessions marked the low point for the numbers of bills to cut spending and the high point for bills to raise it.

Ex-Senators to Lead Panel on Tax Code  – Great idea! Who better to unravel the insane tax code than some of the same bozos who created it? Nothing could go wrong there. Gee, I wonder how this simplification effort will turn out?

– Great idea! Who better to unravel the insane tax code than some of the same bozos who created it? Nothing could go wrong there. Gee, I wonder how this simplification effort will turn out?

Bush Panel to Outline Tax Reform Options by July 31

Texas Lawmaker to Urge Statewide Property Tax for School Finance

Bush Signs Extension of 2004 Deduction Window for Tsunami Relief Donations – But most states won’t be able to pass legislation in time to conform with this new Federal law, such as in California.

Big Spenders Seek Divine Help With Debt - Nothing new here. People have been begging for God's help every time they toss the dice or pull the handle on a slot machine for centuries.

$40 Million Hunch - An "inner voice" in this Brooklyn man's head gave him the winning lottery numbers.

Lotto winner delays $60 million jackpot for divorce

Cash-hungry cities target online sales

It Pays to Locate Your Real Estate Agent Online

Celebrity's not the same as credibility - Good piece on why it's important to be wary of financial gurus who seem to be more concerned with being famous than in serving their clients properly. I've long had similar thoughts about the experts on the many stock picking shows.

William F. Buckley's thoughts on the prospects for tax reform.

The Medicare Mess. Itâs hemorrhaging money. - No surprise here. Medicare is the classic case of incompetence by our rulers in forecasting future costs, which is why I always remind people that all such official financial predictions are nothing more than WAGs (wild ass guesses) and anyone (especially in the media) who refers to them as reliable is either an idiot or a liar, or more likely both. Please remember this as numbers are tossed around during discussions of tax and Social Security reform. Those numbers will be as bogus as the figures were when the Medicare program was started.

Evil Rich

I guess if you had seen one of my comments without the proper context or any knowledge of my history, you might come to the same conclusion as this person. Actually, calling me disrespectful of rich people is as accurate as calling Bill Clinton gay or celibate. Nothing could be further from the truth.

Tax Guru:

I was linked to your web-site when I queried my search engine on new information regarding the 2004 tax brackets. I was very surprised to read your definition (Evil Rich) of those individuals who have worked very hard and persevered to be able to live a comfortable lifestyle. As a "Tax Guru" I find your comments to be tremendously un-professional and down right offensive. Moreover, it's clients like the "Evil Rich" that allow CPAs to charge a more than healthy fee.

My Reply:

I can't tell if you are joking here or are truly unclear as to my opinions on people who I routinely sarcastically refer to as "evil rich."

Just in case it's the latter, and assuming that others may share your confusion, I will clarify.

I have never considered people who are wealthy to be evil. I have long been a very proud Libertarian and defender of capitalism to the nth degree. Punishing or otherwise degrading people who have worked hard to achieve success is entirely opposite from all of my beliefs.

My use of the term "evil rich" is a very unsubtle slam at people who subscribe to the undeniable and very pervasive undercurrent in this country among most of the mainstream media and people in the DemonRat Party who consider it the epitome of evil for any person to have one dollar more than anyone else. It is their mission in life to rectify this situation by any means possible; but most often by use of the tax code to redistribute wealth from the producers to those who don't have as much.

As a result, we have a tax system that is extremely punitive of success. The list of provisions that punish people for doing well is literally endless and those punishment are meted out based on arbitrary definitions of "evil rich" that are established by our elected officials who consider their jobs to include ruling our lives as subjects in a kingdom, which is why I refer to them as our "rulers."

If you think my pointing this fact out is unprofessional, that is your right to have that opinion. One of my long running complaints about many people in the tax practitioner community is how they just accept the tax system as it is and ignore the underlying reasons for why things are as they are. They act as if tax policies and laws just materialize in a vacuum. I have always recognized the tax system as just the symptom of much bigger underlying problems and I feel it is my responsibility to point those facts out.

I hope this clears this issue you for you. If you were just making a joke, I'm sorry for being too dense to catch it.

Thank you for writing.

Kerry Kerstetter

Don't Use Your Mortgage To Play the Stock Market - This is almost too obvious a warning to need stating; but there are plenty of people who do foolishly play the risky stock market with their home equities and their retirement accounts. However, using the equity in one property to purchase additional real estate is a standard long running technique to use leverage to accumulate considerably more wealth over time than tossing the dice in the stock market.

The U.S. has dropped out of the top 10 freest economies in the world because of its high tax rates. - As I've always said, when you take away someone's money, you are reducing that person's freedom. The full list of freedom rankings does have some very odd components. I'm not sure how Hong Kong can be anywhere near Number One now that it is controlled by the murdering rulers of Red China.

Social Security: All Trust and No Fund - Any private market or employer sponsored retirement plan with the same kind of financial commingling as used by Social Security would be shut down and its officers tossed into prison. Why our rulers in DC are allowed to continue to perpetuate such a scam has always been a testament to the ignorance of the American people and the cover-up by those on the Left who insist on having the government control every aspect of our lives.

Social Security pickle fuels expert discord - I'd say that anyone under 50 who counts on Social Security being a safe investment will be in a very sour pickle indeed.

What Social Security reform would mean for blacks - The lower a person's life expectancy, the worse the return on the "investment" in SS. Those who have little chance of living long enough to recover all or any of their contributions get screwed the worst since the SS accounts aren't actual assets that can be left to survivors, as privately owned retirement accounts can be.

Social Security Formula Weighed - The left's "scare the old folks" strategy is underway.

Graham Crackers on Social Security - RINO Senator wants to raise Social Security taxes.

Finance Leaders Propose to Extend 2004 Deduction Window for Tsunami Relief Donations - We may be able to claim disaster relief donations made in January 2005 on our 2004 1040s rather than having to wait to claim them on the 2005 1040. If this passes, we'll need to be careful to not overlook these donations when assembling info for 2004 tax returns. I usually run QuickBooks reports based on the client's calendar year, so I'll need to extend the report into January for the Donations expense account.

Tax Pros Doubt U.S. Code Will Get Any Simpler - It never gets simpler. The more our rulers try to simplify things, the more they mess them up even more. All we ever get is more work for us tax pros.

Slow Start Expected for Tax Reform Panel

IRS Updates Sales Tax Table Publication -Something tells me this modification for Arkansas, California & Virginia won't be the last change IRS has to make to their tables if they used rates in effect as of 1/1/04 for all of their tables.

Lottery winner, 94, loses in court - The judge has ordered this woman to stick around until she is 114 years old if she want to see all of her lottery winnings.

Social Security Fear Factor - In their true loyal left fashion, the DemonRat's official newspaper (NY Times) twists things to claim Bush is an alarmist for pointing out how financially unstable the Social Security Ponzi Scheme is, while ignoring the true fear tactics being used by AARP and other of their Fellow Travelers who are petrified at the mere thought of allowing average people control over their own money rather than allowing the all knowing, all seeing, imperial federal government to control everything.

Medicare dwarfs Social Security as long-term issue - Another government program constructed by the same financial geniuses who developed Social Security, and using many of the same idiotic underlying assumptions.

IRS's Highlights of 2004 Tax Law Changes

Sales Tax Deduction Option - From IRS

State taxes roundup - Handy list of income and sales tax rates for each state.