Frist apologizes for tax deal - Whoops

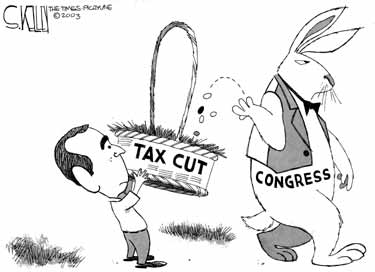

Republican Leaders of Congress Say They Will Strike Deal on Tax Cut

Tax Cuts Don't Resonate With Nontaxpayers - This shouldn't be any surprise. Our rulers have done an excellent job of pushing most of the tax burden in this country on a minority of the citizens and making the nontaxpayers believe that any tax break for the real taxpayers will be offset by some additional expense or reduced benefits for them. There is a real undercurrent in this country of wanting to stick it to the evil rich and do anything possible to keep them from getting any breaks.

Tax cuts: how big and how beneficial?

Bush must make some tough decisions about the tax cut

There�s a lot of pro-growth action on the Hill - And we know full well that the DemonRats will do everything possible to prevent those bills from becoming law. They need to keep the economy as hamstrung as possible for the 2004 elections.

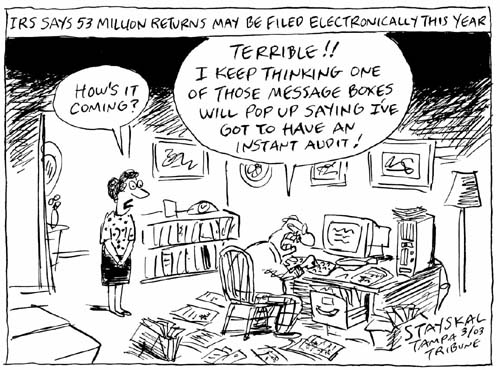

This isn't too far off track from what really happens with e-filing. I have heard of several cases where e-filed tax returns have been rejected because a dependent had already been claimed on someone else's tax return.

The sand bags are courtesy of the DemonRats and the balloons are from the true Republicans (not the RINOs).

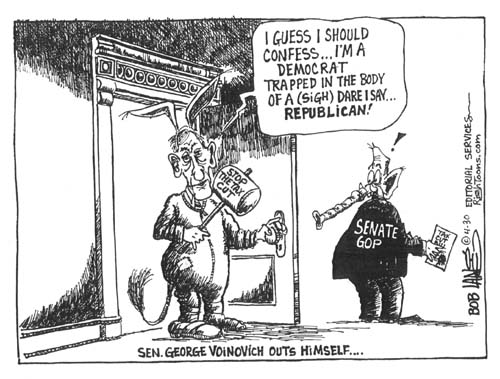

A more appropriate illustration of the turncoat Senators would be a rhinoceros, since they are perfect examples of RINOs (Republicans In Name Only).

QuickBooks Checks

Our goal of requiring all of our clients to put all of their personal and business finances on QuickBooks (QB) is proceeding, although quite slowly. We did scare off a few dozen long time clients, who refused to work with QB and went to other tax pros for services. We don't mind that a bit and are fairly confident that most of them will come crawling back when they see how high the taxes are with their new, less aggressive tax advisors. That's how things have worked out in the past, when clients left because of displeasure over our high rates and relative inaccessibility. Somehow, those things aren't as important in the big picture when they discover how much higher their taxes are with less expensive and more accessible tax pros.

Although most of the remaining clients have QB set up for their books, I have noticed that most of them are still not using one of its most powerful and useful features, the ability to print checks from within the QB program. They are creating a lot more work for themselves by writing their checks by hand and then entering the data into QB, usually months or years after the fact. As I have said on several occasions, QB is not meant to be a task in addition to a normal checkbook. It is intended to replace your checkbook.

You are missing out on one of the biggest time savings aspects of QuickBooks by not having the checks printed from within QuickBooks itself. By doing so, your books will be constantly up to date, and you will reduce the amount of time it takes for your bookkeeping by more than half. You can buy blank checks that work with QuickBooks from any check supplier. They cost almost the same as the checks that you write out by hand.

An even more efficient and inexpensive way to make checks for QuickBooks is to print your own with a program such as VersaCheck. I have been using it for several years for several different bank accounts. It really beats having to order 500 pre-printed checks and being stuck with 400 after the bank changes name or the account is closed. This is also the same program I use that enables us to accept faxed in checks, by making substitute checks that can be deposited just like regular ones.

While there will obviously be times when you will need to write a check by hand, and then enter its details into QuickBooks when you return to the computer, most of your checks can be printed from within QuickBooks a lot more efficiently than by hand. Besides cutting your bookkeeping time in half, this will make tax and financial planning much more efficient because your data will be constantly up to date. It is impossible to do an accurate job when the books are several months or years behind the times, especially when we need to do income shifting between corporate and personal accounts at the end of the tax years.

I know that most people don't do this just because of normal fear of the new and unknown. There is also a big misconception that setting things up to print out checks takes several hours of time and is very confusing. Nothing could be further from the truth. It takes just a few minutes to adjust the settings for your printer and the style of checks you are using. I have always preferred the one check per page voucher style checks to be loaded into the paper tray of my laser printers. The extra stubs are handy for attaching to my copies of the bills that are filed away. When you are entering the check info, with the first few letters, it remembers the name and fills in the rest. It also codes the payment to the proper account based on the last check that was made out to that payee. It saves a huge amount of time. You can also send the checks in standard window envelopes, saving even more time writing out addresses. I would never go back to hand writing checks, and neither would anyone else who has used this very handy feature of QuickBooks.

KMK

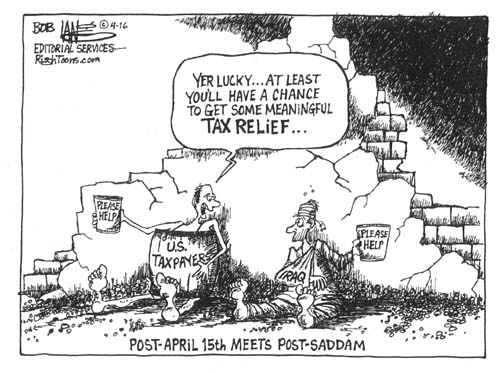

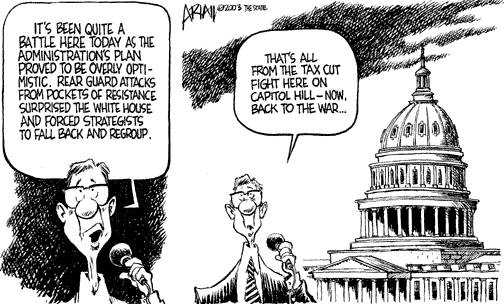

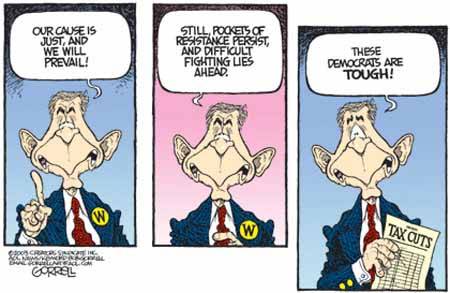

In the meantime, those of us who have to deal with the tax laws and pay the taxes have to just sit by and watch our rulers duke it out.

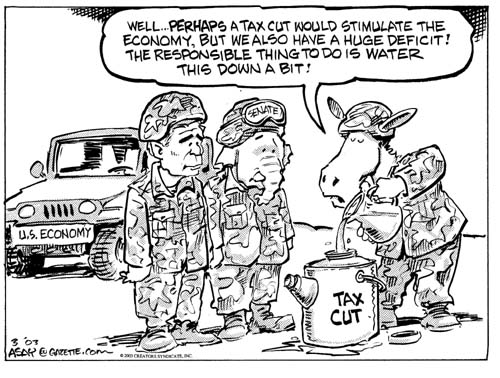

Treasury chief has to sell tax cuts - That will be quite an uphill battle against the massive volume of outright lies by the left, claiming that the tax cuts are boondoggles only for the evil rich and that they will cause a humongous budget deficit. The left is terrified of the tax cuts stimulating the economy and giving Bush an easy ride to a second term in the White House. Sabotaging any chance for an economic recovery is the only hope Queen Hillary has for beating Bush and getting her third term as co-president.

Lawmakers try to chip away at Prop 13's two-thirds vote majority - Just as with the Constitution or any other limit placed on the power able to be waged by our rulers, we need to be diligent to prevent increasing encroachment by money hungry folks. The PRC rulers just can't abide by the two-thirds majority requirement to raise taxes and want to bring it back down to a simple 50% vote.

Grassley aims for larger tax cuts

Finding wiggle room on taxes - Will it be $350 billion? $550 billion? Another number?

In House, Fight Brews Over Bush Tax Plan

Ways and Means Panel Targets President's Centerpiece -- Dividend Cut -- for Overhaul

It's not just the Senate that refuses to go along with Bush. What were all those promises by the GOP about how much they could accomplish when they controlled both Houses and the White House? It doesn't seem to be going as smoothly as they had envisioned.

Bush Launches Tax Cut Offensive

Bush Takes Tax Cut Battle on the Road

In GOP Holdout's State, Bush Pitches Tax Cut

|

|

Republicans Have Tax-Cutting Ax to Grind With One Another

Bush criticizes Senate's 'little-bitty' tax-relief proposal - For all of the criticism Bush receives for occasionally mangling the English language, I got a kick out of his use of this phrase yesterday. His point that we need the full tax break now, and not spread out over ten years, is right on the money.

More . . . or less of a tax cut? - More on the Wall Street Journal's confusion over the level of compromise the Bush team is willing to accept at this point in the process.

A silver lining - More optimism for the full tax cut.

Just as in real war, there are often more casualties caused by the actions of our own side than those of the enemy.

Reigning In the PRC Tax Collectors

As I've mentioned before, the PRC tax collectors make their IRS equivalents seem like pussycats in comparison. The California Franchise Tax Board actually trains IRS employees on techniques for squeezing more money out of people. The FTB has often acted with impunity all over the world in pursuit of tax money. In a recent court case where the FTB was hot on the trail of someone in Nevada, the victim has been given the green light to pursue the tax collectors for damages for their abusive tactics. This is very good news for the protection of our rights and has been reported in:

How the NY Slimes has been lying about the Bush tax cut.

Optimism about chances of the tax cut making it through.

It looks like the Wall Street Journal is having some problems getting the story straight on the Bush team's fight for the tax cut.

How to Shield Your Wallet From Your Parents' Woes - This is an interesting article on how to structure things for the best financial and tax advantages. It mentions a strategy that I have been using with clients for the past 25+ years; having the kids buy their parents' home and rent it back to them. Even now, with the replacement of the once in a lifetime exclusion for sellers over 55 with the $250,000 per person tax free gain for anyone, this technique still makes a lot of sense. It allows the kids to have a high cost basis on the home, claim deductions for depreciation and any other expenses paid for the home. It also allows a deduction for travel costs to go check on the property. There are also a lot of estate planning opportunities with the financing of the sale and annual gifting to reduce the balance of the carryback note.

GOP senators should support tax cuts

Bush Tries to Sway Voinovich on Tax PlanAnd their voters should definitely hold them accountable if they turn their backs on this opportunity to reduce the tax burden and increase tax fairness. If they have any brains, the GOP Senators will remember how Bush 41 was punished in 1992 for backing down on his "no new taxes" pledge. GOP voters do seem to have longer memories than their counterparts in the JackAss Party and are more willing to punish their elected rulers for straying from the party line.

Strange Bedfellows

It's nothing out of character for the DemonRats and their Fellow Marxist Travelers to oppose capitalism and fairness in the tax code in their class warfare to oppose the elimination of the double taxation of corporate income. What is a little odd is the selfish opposition to the change in dividend taxation by supposed capitalist financiers, such as the tax free muni and housing tax credit industries, who don't want the competition for investor money that they fear from tax free income from capital stocks. While, there can be genuine philosophical debates over the effects of the removal of the double taxation on the capital markets, these protectionist attitudes show that fans of high and unfair taxes can be found in unlikely places.

KMK

Loopholes

Most people assume that tax loopholes are only used by evil people and companies to avoid paying taxes. In actuality, loopholes are also used by our rulers to avoid the limitations placed on them by the voters in regard to raising taxes. This really isn't a new tactic, but out on the Left Coast, the rulers of the PRC have a laundry list of new fees that they are anxious to raise in order to avoid having to comply with the two-thirds vote required to officially raise "taxes." Splitting hairs with terminology allows the rulers to simply rename levies as "fees" and be free to increase them as much as they want.

KMK

President still seeks full package of tax cuts

Bush planning to press Ohio RINO senator on tax cut

Unions to Campaign Against Tax Cuts

- This is feeling like the pre-trial publicity for a murder case, with each side claiming a willingness to fight to the end and achieve complete victory.

White House Eases Stand on Dividend Tax

Cut Could Be Phased In Gradually to Win Passage

This is not a good sign; but we will have to be grateful for anything we can get in the way of increased tax fairness. Whether Bush will be able to get a bigger tax break later seems doubtful. If he can't use his current high popularity to get the full enchilada right now, what chance does he have of getting it later, when everyone has completely forgotten about Iraq?

To Save Tax Cut, Bush Banks on Political Capital - He had better use that capital soon. In a few weeks, most of the country will have forgotten all about the Iraq war. In USA politics, it's a constant matter of "what have you done for me lately" with the fleeting attention span most of the media and populace have.

Bush turns from war to pressing his case for tax cuts

James Baker, Bush 41's Secretary of State, explains the benefits to the economy of cutting tax rates.

Has the New York Times actually realized that taxes can only be raised so far before payers leave or do other things to avoid paying them? Donald Luskin thinks they may have.

The New Economy�s Sore Losers - An interesting review of the goofy stock market gyrations over the past decade.

States Warn Against War-Related Scams - There will always be scum-suckers who find ways to exploit every tragedy.

His Savings Tossed - And Found - Using a fake Liquid Wrench can to hide his money almost cost this man his $600 in savings.

Left behind: Copier slips reveal us - Making copies of your tax returns before mailing them in is a good idea. Leaving the originals behind at Kinko's is not.

Time to eliminate double taxation of dividends - Excellent advice from Jack Kemp

Back to the economy (stupid!) - Class warfare is always in fashion with the DemonRats.

Administration Launches Tax Cut Blitz

GOP moderates, conservatives wage ad campaign battle

Rival GOP Ads Fight Over Bush Tax Cut

Putting sugar in the gas tanks would be a better representation of what the DemonRats are trying to do to prevent the economy from improving.

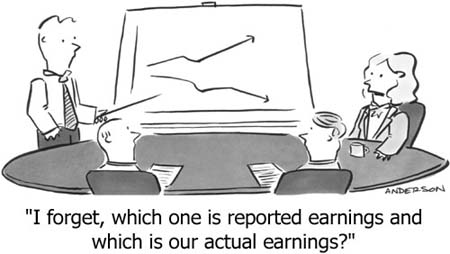

And, what was reported to IRS? Accounting does have much more room for creativity than most people assume.

The laws of capital taxation - Why removing the taxes on corporate dividends is not a tax break for the evil rich, but a remedy to restore fair capitalism to this country. The stimulus to the economy this will provide scares the heck out of the DemonRats, whose survival as a political party depends on hampering capitalism as much as possible so they can blame Bush.

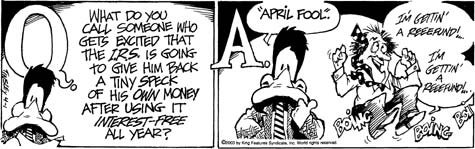

When It Comes to Taxes, We Need Some Real Pain - Out of sight, out of mind. So few people comprehend their actual tax burden because, in their minds, they think they are making a profit by getting money back when they file their tax returns. Eliminating withholding and requiring everyone to write actual checks to IRS will raise the awareness of taxes in this country to a level higher than at any time since the Boston Tea Party. This is why our rulers will do everything possible to maintain things as they are.

Attacking the RINOs

A group I respect, the Club For Growth, has launched a well deserved attack against the RINO (Republican In Name Only) Senators who are holding up Bush's tax cut plans with a series of ads. They are being called Franco-Republicans in honor of the great support the USA received from the nation of France in the Iraq situation.

David Letterman's Top Ten Signs Your Accountant Is Nuts - Once again, my invitation to fly to NYC to take part in this annual list was lost in the mail.

The IRS Isn't the Enemy -- You Tax Cheaters Are - According to the LA Times

Details on PRC Gov. Davis' Tax return

Bush compromises on tax cut - Let's hope he doesn't do as much compromising on this issue as his father did in 1990.

Bush pares tax cut plan to $550 billion

Bush Lowers Goal of Tax Cut Plan in a Concession

The White House is looking at three tax-cut options

Recipe For A New York Tax Revolt

Gephardt attacks Bush's tax cuts - It would be actual news if the little Missouri Socialist were not attacking tax cuts.

After day on slopes, professionals can catch a tax break - It is no coincidence that professional education seminars are normally scheduled for resort areas.

A tale of two tax plans - Bush vs the Dims

Bush Presses for $550 Billion in Tax Cuts - He's backing off a little from his original proposal; but hopefully, he won't back off much more.Our outrageous tax system - I couldn't agree more

Our Income-Tax Monstrosity - End it, don't mend it.

A Step Toward Tax Reform

Alternative tax sneaking up on millions in US - This ridiculous and unfair tax long ago outlived its usefulness.

Property tax tops list of least-favorite taxes - It is wrong to tax people for owning things.

The Bushies will do whatever it takes to win on tax cuts - Let's hope so.

Making the Tax System Fairer - More from the NY Slimes pushing for more money & power for IRS. The Slimes seems to be in cahoots with IRS in the same way as CNN has been with Saddam Hussein.

Right Direction on Taxes - The Left Coast version of the NY Slimes fights against tax cuts.

Some Taxpayers Don't Owe a Penny - Class envy is very much alive.

Outsourcing is the new name of the tax game - Just as I wouldn't even attempt to set up shop in another country and try to interpret its tax laws, I don't see how sending USA tax returns to India to be prepared can work out well for clients. It does seem to work for cookie cutter style assembly line tax return operations who don't care about personalized service.

Most Americans say their taxes are too high - Closer to the truth than the lefty class warriors want us to believe.

Tax Inquiries Fall as Cheating Increases - The New York Slimes does its part to lobby for more IRS money and power.

AP poll finds majority of Americans oppose tax cuts - If you believe this poll (which I don't), the class warfare propaganda campaign to portray any tax cuts as taking food out of the mouth of starving kids for the benefit of the evil rich, is working. I'm sure the poll questions were slanted in this direction, as is SOP for the media who try to mold public opinion rather than just report on it.

Life In A FishBowl

One of the benefits of being President is the ability to share your private tax information with the public. The details of Bush's return have been revealed. The one figure that stands out is the almost $70,000 of charitable contributions. I can't help but compare that with the $353 total for donations that Al Gore had on his tax return a few years back, on almost the same size income as the Bushes are reporting. It just seems to perfectly illustrate the old maxim "actions speak louder than words." Bush is willing to put his money where his mouth is, while Gore and his Fellow Travelers in the JackAss Party like to talk a lot about supporting charitable causes, but can only be generous with other people's (the taxpayers') money.

KMK

U.S. judge in Vegas extends temporary ban on no-income tax book - Anti-tax scammer Irwin Schiff loses another round.

As my critics constantly remind us, we should all feel so patriotic about sending as much of our money as possible to our rulers in DC because only they know how to spend it properly. We little people are just too stupid to spend our own money to do the most good.

IRS Horror Stories On TV

I just noticed, while reviewing today's TV listings, that A&E will be broadcasting an hour long show called IRS Horror Stories at 11pm EDT tonight (check your local listings for your time zone). I have not seen this show, but will be checking it out. Here is the show's description:

An eye-opening probe into how the Internal Revenue Service, in its blind desire to collect taxes, has destroyed lives, ruined businesses, and damaged careers. In their first TV interviews, IRS employees describe how the agency has terrorized taxpayers, and how its managers continue to resist positive reform. TV PG

Hopefully, this show will provide the truth to counterbalance the pervasive propaganda claiming that IRS has been so hamstrung by rules and budget problems that it is incapable of enforcing the tax laws.

Justice seeks end to slavery-tax scam - It is really hard to feel any sympathy for anyone stupid enough to fall for this long ago debunked scam.

Congress approves $2.2 trillion budget, but halves Bush cuts

Senate Vote Could Slash Bush Tax Cut in Half

Debunking Myths

My long-time favorite site for checking on the accuracy of rumors and other so-called news is Snopes.com. I have to keep reminding people to check there before forwarding any of the endless chain letters to everyone on their mailing list. Most of those are complete scams and do nothing but further clutter up everyone's email.

You can sign up for a periodic update email from Snopes to alert you to some of the newest items they have. There were a couple of good ones in today's update.

Fake work at home scams are among the most common spam emails. I must receive at least a dozen each day touting the ability to make big money processing refunds for customers of FedEx and UPS. I've never checked it out because it was obviously a scam; but Snopes has all of the details for anyone who is curious.

Among many other myths about how IRS selects tax returns for audit has long been the one claiming that using the pre-printed label that IRS sends you on your tax return will make it more likely to be chosen. That has never been true. In fact, I do usually stick those labels on the tax returns that I prepare and have never seen any correlation with IRS audits. However, I do not use the labels if they have any errors in the pre-printed name or address. I long ago learned that, even when I cross out and correct the erroneous info, IRS data entry personnel ignore my changes and perpetuate the errors. The only way to force them to correct the data is to make them key in the names and addresses from a tax return without the preprinted label.

KMK

IRS Sob Story

I'm sure I sound like a broken record, but stories like this, trying to drum up sympathy for the poor understaffed IRS, irritate me to no end. Their premise that everyone is a tax cheat is completely bogus. As I have explained on too many occasions, the truth is the exact opposite. More often than not, people overpay their taxes because of lousy bookkeeping and poor knowledge of tax planning strategies.

What also fries me is the way they toss around numbers of uncollected taxes from the supposed underground economy. Such figures are literally pulled out of thin air because an underground economy, by definition, cannot be measured with any accuracy. Obviously, bigger numbers attract more attention, and who would have the nerve to challenge IRS on them? I do and have challenged them directly. A few years ago, during a similar PR campaign trying to generate support for more IRS money and power, I spent a lot of time contacting IRS personnel at their upper levels. I was trying to track down how they calculated their figures for uncollected taxes. They finally admitted to me that they had made the numbers up under the premise that, although they couldn't prove the numbers were correct, neither could anyone prove they were wrong.

I'm not as much disappointed in the IRS for twisting the facts so as to bolster its case as I am with the lazy journalists who willingly accept the IRS's figures without double checking them with independent sources. Perhaps, they are practicing the admitted CNN policy of intentionally slanting stories in favor of the enemy so as to avoid retribution.

KMK

Not included in this article is a link to the IRS extension Form 4868.

You can find links to all state forms at SisterStates.com

Decision on Tax Cut Left Open in GOP Budget Deal

Lawmakers May Delay Tax Cut Debate

Kerry proposes $20b tax-cut package - This ridiculously tiny tax break ($2 Billion per year for ten years) is nothing but a campaign gimmick by the other Kerry, John F. (aka Mr. Theresa Heinz).

Whenever people ask me to list out all of the things they can deduct, I explain that the easier way to look at it is to review everything they spend money on. Anything that can be connected to their business can be deducted. However, things that are used for both business purposes and personal pleasure do have to be prorated.

Taxes On Dividends Are Unfair - A tiny little detail that has been lost amidst all of the rhetoric calling the proposal nothing more than a tax cut for the evil richest one percent of the population.

Balking at tax cuts - More on the uncooperative GOP Senators.

Negotiators Reach Rare Deal on Tax Cut - It gets smaller on each vote.

GOP Tries to Hold Together Budget Deal

With Bush's popularity riding high with the successful Iraq actions, the only hope the DemonRats have for any success in the 2004 elections is to do everything they can to sabotage the economy and, with the willing assistance of their Fellow Travelers in the media, pin the blame on Bush. They know full well that the Bush tax cut plan would stimulate the economy so much that they might as well not even campaign in 2004; so they are pulling out all stops in their opposition to it, including their standard class warfare ("tax cuts for the rich," etc) lies.

Tax Trends

I like to stay on top of as many new developments as possible in the world of taxation. Since the PRC is one of the most creative and aggressive in concocting new ways to get money out of people, it's always educational to see what the rulers out there on the Left Coast are up to. If they succeed in generating enough revenues, you can be sure other states will jump on for their share of the loot.

Widening the state sales tax to include services is still being debated; but it isn't sailing through as smoothly as the rulers had hoped. With estimates of $30 billion of potential new tax dollars at stake, don't expect the supporters of this idea to give up very easily.

While there are a few jurisdictions around the country that already have income taxes at the city and county level, the rulers in the PRC are working on making it available to those levels of government in their state. That means that you can soon look forward to preparing four separate income tax returns every year. More work for professional tax preparers.

Family Employees

As humorous as this may seem, there are several very lucrative tax breaks for hiring your kids to help out in your business. Besides deducting what you pay them, the kids under 18 are exempt from payroll taxes and you can deduct their employee benefits, such as medical and school costs. Payments for any kind of business support services, including filing and cleaning work, are perfectly valid deductions. With a closely held corporation, many of these tax breaks can be doubled. If you have kids and a small business and are not claiming these deductions, you are literally throwing away thousands of dollars every year. There are also lucrative business deductions available for animal helpers, such as pest control handled by feline friends and security services by canine companions.

Left hypocritically asks how much the war cost

Although I am a numbers type person, I have always understood that there are some things more important than money. It has long been bugging the heck out of me to hear the Bush critics complain about the cost of defending ourselves against terrorism. They are true hypocrites because they never worry about the cost of any of their other government welfare programs; yet the one most important thing that the Federal government is supposed to do, protect the people, can't be afforded.

I see this as similar to another pet peeve that I have written about before. Any time I see or hear a news story about a murder, where the reporter mentions how terrible it was due to the small amount of money involved, it sets me off. I've lost track of how many letters I've written to news organizations asking for their thresholds to justify murder. When they express such shock because someone was killed for just a few dollars, I ask them if the murder would be more acceptable if the amount had been a million dollars. To date, no news person has had the decency to respond to my requests.

Putting a ceiling on what we can spend to prevent another September 11 terrorist attack just seems to be the same kind of mind set.

KMK

Tax Myths of '86

I remember the Tax Reform Act of 1986 very well. It had been sold as the most wide sweeping simplification of the tax code ever. The reality was exactly the opposite; making the tax code more complicated than it had ever been. I inherited several clients after it passed when their tax preparers quit rather than have to learn the new rules. It was also the inspiration for my infamous poster.

Iraqi Currency Hot on EBay - It's like Confederate money, worth much more as a collector novelty than its face value

Senate likely to accept smaller tax cuts - Better than nothing

House, Senate GOP at Odds Over Tax Cut - Those dim-bulb GOP Senators who sided with the Dims need some lessons in economics.

The Dims Want No New Tax Cuts - No surprise here

Senate Rolls a Pork Barrel Into War Bill - Incurable Spendaholics are still in control in DC. On a similar note, you can check on how your rulers have plundered the Treasury in this online version of the CAGW's Pig Book and download a 49 page pdf summary of the Pig Book.

Simplifying Your Own taxes

The trite and true answer to anyone who asks how to eliminate his/her income tax has long been to stop working. No income = no income tax. Since our taxes are not at 100% level, and most of us appreciate the good things we can do with money, that is not a very realistic approach; so we are forced to deal with the income tax system.

This advice column on how to simplify your taxes from Jonathan Clements strikes me as similarly naive. While his idea to have good records is obviously something I have always endorsed, his others ideas are not the most practical.

While it is true that fewer stock trades would save time in preparing Schedule D, that is a crazy way to make investment decisions. If a stock has peaked and on the way down, it would be ridiculous to hold onto it just to reduce the tax return paperwork.

Likewise, the recommendation to avoid partnerships is overly naive. There are plenty of very good reasons to use a partnership or LLC format for certain business endeavors. With several clients, each having dozens of partnership investments, it is a bit of a hassle to integrate all of their data into a 1040. Luckily, my Lacerte software does an excellent job of making that task as painless as possible.

The advice to refrain from claiming the home office deduction is extremely short sighted. While it is true that the actual dollar amount of the deduction is often relatively small, that doesn't account for the full range of benefits. For example, having a home office allows all miles driven to be deductible, rather than have a lot of nondeductible commuting miles to an outside work location. I have actually amended dozens of tax returns where we added in the home office and saved thousands of dollars in taxes just from the additional deductible miles, while the actual home office deduction was just a few hundred dollars.

KMK

Apples & Oranges

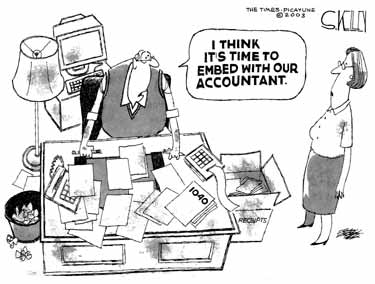

This comic is a perfect illustration of some very common misconceptions regarding tax returns and tax preparers.

First is the cost of tax pros. Tax work is by no means a commodity that can be comparison shopped based on price. Anyone who chooses a tax preparer based on the lowest fee is, for lack of a better word, an idiot. As I have often reminded people, which is a better move: paying H&R Block $100 to have your tax returns prepared, or paying someone like me $1,000, when the total taxes on my returns are $10,000 less than on the Block returns?

No two tax returns are exactly the same. I get this one a lot. Why are the taxes higher for one person, while his/her co-worker or neighbor, who supposedly makes the same amount of money, has a completely different amount? Such comparisons are ridiculous. There are literally dozens of things that can make tax returns of co-workers completely different, such as expenses and dependents. In my 27+ years of tax work, I have never seen two tax returns exactly the same, even for the same people from year to year. Tax returns are like snow flakes. This also goes for the cost to prepare tax returns. We have never charged flat rates and have based everything we do on the amount of time it takes us because everyone has very different issues to deal with and different levels of organization of their records.

It's also all too easy to criticize investment ideas after the fact, with 20/20 hindsight. Of course, anyone who continues to follow the lead of someone who consistently picks losers is too stupid to feel sorry for.

KMK

Vehicle Costs

People are always asking which is better to use for tax deductions, the IRS's standard mileage rate (36.0 cents for 2003) or the actual expenses, which are prorated based on the business miles driven compared to the total for the year. My advice has always been to keep track of the actual expenses during the year. Then, when preparing your tax return, use whichever results in the higher deduction. Contrary to what many believe, if straight line depreciation is used, it is possible to switch back and forth between methods in different years. It is also true that the calculation method used for each vehicle stands on its own. You can have one vehicle using the standard rate method at the same time as another vehicle is using its actual expenses on the same tax return.

I have seen every possible variation imaginable in regard to which is the higher deduction. For example, with many of our clients who are real estate agents with annual business mileage of 40,000 to 50,000, the standard rate now frequently gives a higher total deduction than the actual expenses. This became more consistent a few years ago when IRS changed the standard rate to be the same for all business miles, rather than its previous policy of the maximum rate for the first 15,000 miles and a much lower rate for additional miles.

When calculating its official standard rate, the IRS has just one opinion of what the costs are to own and operate a vehicle. AAA just released its study concluding that the average vehicle cost is 51.7 cents per mile to operate. Every year, car rental companies, such as Hertz, put out press releases claiming that it costs well over a dollar per mile to operate. Considering their obvious motivation for trying to justify their rental rates, I would have more faith in the AAA being a bit more objective in their calculations.

There really is no universal cost that applies to all kinds of vehicles. For example, our three Toyotas cost us almost nothing for repairs, while most clients pay thousands per year in maintenance costs. That is why it is so important, as I have been stressing for so long, to use QuickBooks to capture all possible information on costs paid through checks, credit cards, and actual cash in order to do a valid comparison with the IRS standard rate.

KMK

Virginia Speaker Draws the Line on Taxes

No Increases Will Accompany State Code Revision, House Leader Vows

We all know how reliable such pledges are from our rulers.

This is not the way to get your things together for your tax preparer. It would be much easier to crunch the numbers if things were set up on QuickBooks, which we are appreciating even more right now, as we work on 100+ extensions.

As an overloaded CPA who barely has time during Tax Season for anything personal, such as sleeping, I have always felt it was the absolute worst time of the year to have us lose a precious hour of time and wondered why it couldn't be at the end of April rather than the beginning.

Instead of hating taxes, why not celebrate them?

One way to look at things; appreciating what our tax dollars accomplish. However, this does remind me of the quote from Arthur Godfrey:

"I'm proud to be paying taxes to the U.S. The only thing is -- I could be just as proud for half the money."

Inn Allows Guests to Check in and Get Taxes Checked Out

A natural combination for a CPA who owns a bed & breakfast.

Tax protesters report more interest since war began

This kind of thing was tried back in the VietNam War days, and is just as wrong now as it was back then. Holding back our tax money as a protest against certain government programs or projects is not how things work in this country. Otherwise we could all come up with plenty of reasons to reduce our own tax payments. All of us disagree with some of the things the Feds spend our tax dollars on. It isn't our place as commoners to make those decisions. We elect Rulers who sit on their thrones in DC and make the important decisions on how much wealth to confiscate from the populace and where to spend it. The only way to change how the money is spent is to elect Rulers who agree with as many of your own priorities in this regard as possible. Nobody will be a 100% match; but we can do a lot better than the gang in there right now. Holding back part or all of your tax payments as a kind of line item veto over certain spending will accomplish nothing more than richly deserved torture from the IRS.

KMK

Anti-TaxPayer Warfare

Not exactly news. The New York Slimes, unable to make Bush look bad in the Iraq war, is working hard to spread its leftist propaganda to derail his tax cut. Of course, they're not alone in waging the class warfare against fairness and capitalism. Lefties just hate the idea of people being allowed to keep one dime more of their own money rather than have it all pass through the control of our Rulers in DC. Of course, using distortions of the facts and outright lies is a traditional technique of the liberal media, their Fellow Travelers in the JackAss Party and other disciples of Karl Marx. However, to have the concept of tax cuts attacked by Senators from the President's own Party, who are obviously too stupid to see through the Left's lies, is inexcusable. Let's hope the constituents of these Dashole Republicans will remember this at the next election.

KMK

IRS to Troops: Take Another 180 Days on That 1040

IRS finally admits that there is something more important for people to worry about than tax returns.

It's well known that States can�t tax their way back to prosperity; but that won't stop the PRC's Rulers from continuing to try.

Dave Barry has figured out the secret of the Tax Code. It was created by Satan. He is proposing a Survivor like strategy to rewrite the Code so that real life humans can actually understand it. We all know that will never happen; but it could make for an interesting reality show for us tax geeks.

Who knew that Little Tommy Dashole has a tax cut plan of his own? It slipped under the radar because it's not a real tax cut; just a one-time gimmick with no lasting impact, as the Bush plan will have.

Study: Male-Run Mutual Funds Favored

This sounds like one of those Wall Street coincidences that people like to pretend are real, such as predicting the stock market based on which NFL conference wins the Super Bowl. In my 27+ years in this business, I have never heard of anyone selecting a mutual fund based on the manager's gender.

States consider raising beer taxes to help balance the budget

Equal opportunity. It's not just smokers who will be forced to pay more taxes.

Tax Returns Are For Self Defense

One of the biggest mistakes many people make is assuming that because a sale of assets didn't result in any taxable gain, that they don't have to report it on their tax returns, or even file a tax return at all if they didn't have much other income. That is a very incorrect and dangerous assumption.

I have seen cases where people have had huge stock market losses and assumed they didn't need to report the sales on their tax returns. I have seen cases where people qualified for the tax free residence sales or Section 1031 tax deferred exchanges and assumed they didn't need to show them on their 1040s. I have also seen cases where recently inherited property was sold and the heirs didn't report the sales on their 1040s because they knew that the stepped up cost basis of the property resulted in no net gain.

In almost all of these cases, the individuals came in for a rude awakening when they received bills for taxes, interest and penalties on those sales from the IRS and/or State tax agencies. This is because the 1099 information that is provided to the tax agencies only provides half of the equation, the gross sales price. IRS and the States have very efficient document matching programs that compare the gross income items reported on tax returns with the 1099s that have been received. When items have been left off (or no tax return even filed), they assume that it was unreported income and that the sales price represented 100% profit, and assess taxes accordingly. They have no information on the cost basis of the assets sold. If you want them to know that you had a net loss, or qualified for the primary residence exclusion, you must report the sale on Schedule D with your tax return and include that additional information.

KMK

Labels: 1031

D-I-Y Tax Prep Software

Again, I am not endorsing the concept of anyone preparing their own tax returns. However, if you are set on doing this, you really should use a computer program. There are far too many things that can be left out or screwed up when doing returns by hand to justify scrimping on the cost of a copy of one of the consumer programs. I would never even consider doing a tax return by hand because of all of the interrelated forms and schedules that make it too easy to leave something crucial out. Here is an updated review of some of the most popular consumer level programs.

One tip for those who do use one of these programs. Make sure you have it print (or hand-write it yourself) "Self Prepared" in the paid preparer's section. I handled an IRS audit a few years ago for a couple where the wife had used TurboTax to prepare their 1040; but had left the paid preparer section blank. IRS suspected it had been prepared by one of the underground preparers that they have been trying to catch. The audit opened a can of worms that took me several months to straighten out with the Auditor and Appeals Officer, costing thousands for my fees.

A first crack at dynamic scoring

Foes of dynamic scoring are at it again

Thick haze of economic misunderstanding

Bush Will Fight for Smaller Tax Cut

Bush aide sees 'give-and-take' shaping tax cuts

President Seeks To Revive Plan For Tax Cuts

Signs Suggest Bush, Hill GOP May Accept Smaller Proposal

The status of the tax cut plans, as well as how they are measured, are both still important issues. As I have to constantly remind everyone, the numbers that are used to describe the "cost" of tax cuts are completely bogus on several levels. Most important is their use of static analysis or scoring methods, which do not allow any consideration of changes in behavior due to changes in tax rates and rules. Second is the fact that nobody has an accurate crystal ball that can predict the future. Even changing from static to dynamic scoring moves the figures from being mere WAGs (wild ass guesses) to SWAGs (scientific wild ass guesses). It always fries me to hear anyone discuss tax legislation figures as if they were gospel, when they are anything but.

White House Signals Flexibility on Tax Cuts

Not a good sign. Little Tommy Dashole must be like a shark smelling blood in the water.

Congress Hearing

It couldn't be worse timing for a hearing scheduled for April 8 in DC by the House Ways & Means Committee to discuss the current filing season and the next year's budget for IRS. Anybody involved in actual tax return tasks will be up to our eyeballs in work. Coincidence?

For those unable to make it in person, the committee is soliciting written comments by April 22 via email or fax (202-225-2610). Snail mail is still not being accepted by our rulers due to the continuing anthrax scare.

Passing away in Virginia will be more expensive than in most other states as the governor there fights to keep a death tax.

GOP to Revive Tax Cut on Dividends

However, rather than just completely eliminate the second income tax on the same corporate income (as Bush had originally requested), some of our rulers are discussing other options, such as making half of dividend income tax free or taxing it like long term capital gains. Simple is never good enough for the sausage makers in DC.

The dividend tax cut must survive

Senate should learn from history about tax cuts

GAO Studies

Not too long ago, I signed up with the US General Accounting Office (GAO) to be notified of newly issued reports related to taxes. Every week or so, I receive an email alerting me to what has recently been released, along with link to the actual report, in pdf format. There were a couple of new reports that I downloaded today that I found interesting

Vehicle Donations - This is a study of vehicle donation programs run by charities. It describes their results from the perspective of both the charities (which normally only end up receiving a tiny percentage of the vehicle's perceived value) and the donors (who usually claim deductions of much more than the vehicles are really worth). Neither result is a surprise, considering that professional fund raisers skim off most of the value of donations before passing on a small percentage to the actual charities; and the misconception that many people have that they can claim a tax deduction for full Kelly Blue Book value, when their jalopies could actually only be sold for much less. I hear this one a lot from people.

Paid Tax Preparers - This is an interesting report on the GAO's survey of how satisfied clients are with the work of professional tax preparers. In a style more typical of the media, they make a big deal about their conclusion that five percent (5%) of clients of tax pros are being poorly served. Maybe it's the optimist in me; but I can't help but see that in a completely different light. That means 95% of clients are being well served by their preparers. That seems like a very impressive statistic; not something to get all panicky about.

I've taken the liberty of excerpting the following useful exhibit from the GAO's report:

Precautions to Take When Using a Paid Tax Preparer

When searching for a preparer, get recommendations from friends, co-workers, or other trusted people. Find out if you qualify for free services.�

�

Interview the preparer before hiring to check out qualifications, experience, discipline problems, and any history of complaints.�

Be sure you understand other services you will be getting, such as electronic filing or Refund Anticipation Loans. Find out whether these services are optional, what they will cost, and how they will benefit you.�

Don�t hire a preparer who guarantees a refund before seeing your tax documents or whose fee is a percentage of your refund.�

Make sure your preparer understands your personal circumstances, income, and expenses. Show your official tax documents to your preparer, including W-2s and 1099s.�

Review your completed return before you sign it. Check that your tax information is correct. Even though someone else completed it, you are responsible for the accuracy of every item on your return.�

Don�t sign a blank return and don�t sign in pencil.�

Make sure your preparer�s signature and tax identification number are on the return before you submit it. Keep a copy of the final return.�

Don�t make checks for taxes due payable to preparers. Checks should be made payable to the United States Treasury.

It was to be expected that the DemonRat Senators would vote against the tax cut. They want the country to stay in the economic doldrums in order to bolster their election chances in 2004. But there's no excuse for the GOP Senators who opposed it.