Tax Guru-Ker$tetter Letter

Tuesday, December 31, 2002

Monday, December 30, 2002

Year-end financial moves

Plus, don't forget to make a huge prepayment to your tax advisor by December 31 so that you can deduct it on your 2002 1040.

QuickBooks Passwords

As we continue our push to require more of our clients to use QuickBooks for both their personal and business bookkeeping, a couple of inconveniences related to this are becoming more common.

Not everyone updates their software every year when new versions are released. While I do always obtain the latest versions of QuickBooks, I can understand why others may be content using earlier versions for at least a few years before incurring the cost to upgrade. The confusing thing for me, when I receive a QuickBooks data file from a client, is that, unless they tell me which version of the program they are using, I have to use time consuming trial and error to figure it out on my own. The files from all versions of QuickBooks look exactly the same. I have been pleading with Intuit for years to have the program embed some identifying mark in the files that would show up when you right mouse click on it and select "Properties." So far, that improvement has not been implemented.

The other frustrating thing is when the clients have set up their QuickBooks with passwords and they forget to tell me what they are. That just happened to me today, as I was doing some year-end review work for a client's S corp in QuickBooks 2002. Almost a year ago, I discussed a program that was available that would decipher QuickBooks passwords. At that time, it didn't work on the 2002 version of QuickBooks. I went back to their website this morning and was pleased to see that it now works on all versions of QuickBooks up to 2002. I bought the program, downloaded it from their site, and within a few minutes had the password for the file I was working on.

I wanted to see just exactly which versions of QuickBooks this new updated password detection program would work on, so I tested it on data files from the many versions of QuickBooks I am currently running on my main computer. It worked on the regular versions of QuickBooks 1999, 2000, 2001 and 2002. It did not work on the regular version of QuickBooks 2003, nor either of the Enterprise Solutions versions (2002 or 2003) of QuickBooks. I am assuming that the next upgrade to the program will include the ability to handle the regular version of QuickBooks 2003.

I have no idea if they will be adding capacity for the Enterprise Solutions (ES) version. That shouldn't be a problem if they don't get around to the ES because I don't expect too many clients to be using it. For those who aren't aware of this powerful version of QuickBooks; it was originally code named Hercules and was designed to meet the bookkeeping needs of companies that outgrew the regular sized QuickBooks program. It is very expensive and can handle up to ten people accessing the same data file simultaneously. Other than the extra capacity for names and accounts, the look and feel are exactly the same as with the normal version of QuickBooks. I have been using the 2002 and 2003 ES versions since before they were released to the public because I was involved in the beta testing programs for both years.

One thing I did discover recently is that once the data files have been converted from the regular version of QuickBooks to the Enterprise Solutions version, there's no turning back. I tried to import data from ES 2002 in to the 2003 regular QuickBooks program; but it wasn't possible. That isn't a problem since I am happy using the 2003 ES program on our computers. However, this kind of thing is the reason I am still not endorsing the web based version of QuickBooks. Once you convert your data from the regular desktop version to the web based, you can't then use it in any desk based versions again. You become a prisoner to having to pay the monthly fee to QuickBooks to access your data via the web. As a life-long advocate of self sufficiency and independence whenever possible, being a captive to an online system is unthinkable.

KMK

Sunday, December 29, 2002

Two States In Very Different Shape

Because John Engler cut taxes, Michigan is a better place for everyone

California leads the way on road to financial ruin

Useful Tax References

As has become an annual tradition for me this time of year, I have been spending the last week taking care of my official continuing professional education (CPE) requirements for my Arkansas CPA license, which mandates at least 40 hours each calendar year. My California CPA license requires 80 hours each two year renewal period, ending every other August.

As someone who tries as hard as possible to be as thrifty as I can with both money and time, I have long found the self study method to be the most efficient approach for me. Living deep in the boonies, just the travel time I save over having to drive to live seminars is huge in itself.

While the list of self study CPE providers continues to grow each year, I have been very pleased for the past several years with the course offerings from The CPE Store. In fact, the most difficult aspect to using them is deciding on which courses to purchase. I generally see at least a dozen or so different courses each year that I'd like to take. This year, I bought one 20 hour and two ten hour classes. After reading through the texts that come with each course, I just circle the True-False and multiple choice answers on the answer sheet and fax it to The CPE Store. By the next day, I have my score and my certificate of completion faxed back to me. I was actually surprised to receive the last certificate today (Sunday) after just faxing it in last night (Saturday). You can't get much more convenient than that.

Over the past few years, I have noticed an improvement in the quality of the text books included by The CPE Store with its courses. For example, my 20 hour course this year included an excellent reference book from Nolo Press that is now on my shelf with the dozen or so other Nolo titles I have. I have been using Nolo Press books for at least the past 20 years and have always considered them to be excellent and very useful.

What really surprised and impressed me were the texts for the other two courses I took this year. They were written by a licensed tax preparer in California, Holmes F. Crouch. To be honest, at first glance, I was expecting them to be ivory tower type texts like they use in college, where the author has no practical experience and relies on the IRS instructions and treats the IRS as the all perfect all knowing deity that most people assume it to be. Boy, was I wrong. Mr. Crouch has written some very practical reference books, including several real life examples of dealing with the IRS and the Tax Court. Best of all, he has the same attitude regarding the IRS that I have; frequently mentioning where they are screwed up, incompetent, and downright dishonest as they pursue their goal of squeezing as much money out of people as they can, legally and illegally. When our rulers in DC start whining about the bum rap the poor IRS has gotten for "alleged abuses of power," these books would be very enlightening. I believe every word in them because I have seen the exact same kinds of IRS behavior in my 27 years of representing clients against them.

Mr. Holmes has been quite prolific in his literary output. He currently has dozens of different tax related books available from his company's website, AllYear Tax Guides. They would be very appropriate for anyone interested in better understanding the tax system in this country; taxpayers, as well as tax professionals.

Of course, now that I've said something positive about a non-CPA, I guess I can expect a nasty-gram from the Board of Accountancy. Back when I had my offices in the PRC, whenever I dared mention in any of my newsletters or speeches that people other than CPAs, such as Enrolled Agents, are just as capable of helping people with their tax needs, I would receive threatening letters from the California Board of Accountancy saying that I would be subject to discipline if I continued to imply that anyone other than CPAs could be competent in tax matters. I was a danger to the CPA profession because I was jeopardizing the public's perception of a CPA monopoly on tax related skills.

If that does happen again, my response to them will be the same as always. They can stuff their censorship rules where the sun doesn't shine and learn to respect my First Amendment right to freedom of speech. They have never claimed that anything I said was false or incorrect in any factual sense. My crime in their eyes was admitting that we CPAs aren't the only people who can be capable in areas of taxation.

KMK

Thursday, December 26, 2002

More Tax Cut Options

As always, everyone wants to come up with their own great ideas for reducing the tax burden, such as these ideas on income taxes.

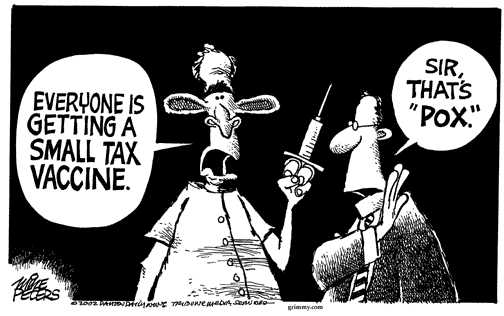

As much as it pains me to publicly agree with a liberal phony like John F. Kerry, who couldn't care less about real working people, he is correct that many people pay more in payroll taxes than they do in income taxes. An exclusion of the payroll taxes on the first $10,000 of income actually sounds like a good idea. However, it would only be truly fair if the employers were also allowed the same exemption and not required to pay any payroll taxes on the first $10,000 of wages per employee per year. The result of this just may be raises for the existing employees or the hiring of additional workers.

While JFK thinks he will be buying the loyalty of the working poor through what he calls a "tax holiday," he will paint himself into a corner with such a plan. If he tries to call off the "holiday" and force those same people to reduce their take home pay by $765 a year, he and his fellow DemonRats will create a lot of enemies from those same folks.

For those who claim such a break on payroll taxes will exacerbate the financial instability of the Social Security system, you need to acknowledge that, contrary to Al Gore's propaganda, there is no such thing as a lock box for Social Security funds. They have been commingled with the general revenues since Lyndon Johnson's days in the White House. Treating them as two separate tax systems in just plain dishonest. Looking at the overall tax burden of income and payroll taxes is the most realistic way to approach it, which is what I have always done when working with clients. Some of the strategies we use to reduce or eliminate their payroll taxes save them much more in those taxes than in income taxes.

KMK

Wednesday, December 25, 2002

Selling Off

If a real world person or company were in serious financial peril, one of the first options to be explored would be getting rid of unnecessary things in order to generate cash as well as cut back on operating expenses. Is it possible that the rulers of the PRC may also be seriously considering selling off some of the real estate they own? I'm sure the local counties where the properties are located will be happy if the State unloads the properties to private buyers because they can then start earning property taxes from them.

The next step is for our rulers in DC to do the same thing. Our founding fathers never intended for the Federal Government to own as much property as it does. Selling off unused federally owned property would be a very wise move, especially for a President with an MBA.

KMK

Taxation by the numbers

The country's best economics professor, Walter Williams, does a great job explaining how taxes affect the real world.

White House Aides Push for 50% Cut in Dividend Taxes

This would be an excellent long overdue Christmas present.

Tuesday, December 24, 2002

Residence Sale Rules

In May 1997, over five and a half years ago, the rules for tax free sales of primary residences were changed dramatically. There are still many people, including quite a few real estate and tax professionals, who believe we still have the old rules requiring that a new more expensive replacement residence be purchased.

As with most tax laws, our rulers in DC like to use a lot of vague terminology and expect the geniuses at the IRS to fill in all of the details as to how the law should be implemented in real life. In typical government fashion, IRS is rarely in any hurry to work on these matters, especially in cases such as this, where people are legally allowed to avoid paying taxes.

As I outlined in my explanation of the current residence sale rule, there were some cases where the seller didn't have to actually live in the home for a full two years in order to exclude part or all of his/her gain. The reasons were very vague: employment, health or other unforeseen circumstances. What exactly qualified as meeting those conditions was left up to IRS to define. In the meantime, we in the real world had to decide how to handle tax returns for real people.

This is one of many areas in taxation where there is a big difference between the attitude of tax professionals. Unfortunately, you would think that most tax advisors actually work for IRS in how they deal with this. I occasionally check out online tax Q & A discussion boards and am amazed at how willing supposedly independent tax advisors are to side with IRS.

IRS has the benefit of being able to take its sweet time interpreting the tax laws. In the meantime, those of us living in the real world have to conduct our lives. We can't put everything on hold waiting for IRS to decide.

This state can be dealt with in two ways. We can refrain from our own interpretations of the tax laws until IRS issues its formal pronouncements or we can do our best to interpret the law. Unfortunately for most taxpayers, the majority of tax professionals choose the former approach.

My approach to this situation has always been the complete opposite. My interpretation is that if IRS has not come out and definitively stated how something should or shouldn't be treated for tax purposes, they have no right to dispute our reasonable interpretation of the fuzzy gray areas in tax law. They can't come in after the fact and claim that we did it wrong if they refused to tell us ahead of time how to do it right. I have been doing this for almost 27 years, and continue to take this approach, and I have yet to have any of my interpretations overturned by IRS. There are occasionally IRS personnel who may try to use a proposed IRS regulation to bolster their argument. When I point out to them what the word "proposed" means, they always back down.

For those tax advisors whose loyalties lie on the side of the IRS, the IRS goal of avoiding tax saving steps is achieved just by their delays. For those of us who believe in doing everything we can to help clients, the delays help our case.

Back to home sales. IRS has finally released their official safe harbors for defining the terms of the 1997 law in regard to such matters as proper occupancy, mixed use (business and personal) property, land sold separately from the main home, as well as how to qualify for the pro-rated exclusion under the employment, health and unforeseen circumstances tests. Again, while many tax practitioners will use these IRS examples as the definitive list of what are acceptable reasons, that is not the case. They are merely safe harbors. This means that IRS will not disallow the tax free exclusion of gain by anyone meeting their examples. It does not mean that other reasons not included in their examples won't qualify under the normal facts and circumstances test.

In the IRS pronouncement, they mention that anyone who paid tax on a gain that now falls under one of the tax free safe harbors can amend his/her 1040. However, because the statute of limitations for modifying tax returns is only three years, only 1999, 2000, and 2001 1040s can legally be amended. Anyone who erroneously reported taxable gain on their 1997 or 1998 1040 is out of luck.

For those who want more details, here are some handy links:

IRS announcement of new rules

IRS three page pdf summary of safe harbors

IRS 22 page pdf of temporary regulations re: pro-rated exclusion

IRS 48 page pdf of final regulations re: tax free residence sales

My summary of the IRS summary in easier format.

KMK

Sunday, December 22, 2002

QuickBooks Transfer Utilities

As QuickBooks becomes ever more pervasive as the de facto standard for bookkeeping in this country, more and more programs are being developed to interface with it and magnify its usefulness. I am constantly on the lookout for such programs that can make using QuickBooks more efficient for both lay people and us accounting pros.

I've just learned about another useful set of utilities to allow transfers between QuickBooks files and to combine data from several different QuickBooks files into one that have been developed by a CPA in Texas, Karl E Irvin, based on Microsoft Access. The Transfer program only works with QuickBooks 2002 and 2003, while the Combiner program works with any version of QuickBooks and can even combine data from different versions. You can download demo versions of each program from Karl's website and test them before you decide whether or not to pay the $45 to buy each of the full power versions.

KMK

Saturday, December 21, 2002

Party Of the Evil Rich

Much has been said about the liberal bias permeating he mainstream media. Bias is actually too mild a term. True bias would entail presenting the actual news with a liberal slant. What the media have been doing is outright fraud; lying about the facts. There are so many examples.

The current campaign by the liberals and their sycophantic mainstream press lackeys to portray the media as biased in favor of conservatives is typical of their game plan. They want everyone to believe that Fox News, which does have a slightly conservative slant, is more influential than all of the other networks combined, which are all one-sided propaganda arms for the liberals and the Democrat Party. It's great that we finally have an alternative to the left wing ABC, CBS, NBC, CNN, MSNBC, and PBS. However, it's ludicrous to say that Fox News, which is only available via cable and satellite, can reach any more than a tiny fraction of the audience that receives the broadcast networks.

Another media fabrication that has long bugged me is their portrayal of George W. Bush as a dunce and Al Gore as a genius. The truth is 180 degrees apart. I have long been a keen student of intelligence (some call me an intellectual snob) and Gore, who barely squeaked through college and has less personality than the Disney animatronic figures, is an absolute moron. Bush, who earned an MBA degree, while frequently mangling words, is one of the smartest presidents we have had.

The false media template that triggered this rant has to do with how they portray the two major political parties. For generations, they have claimed that the Republicans are all a bunch of evil rich country club fat cats, while the Democrats are all a bunch of poor working stiffs. That's why I found this piece on donors to the parties very interesting. It seems that the big million dollar donations are predominately from Democrats, while the bulk of GOP donations are small amounts. It makes sense when you consider how most Hollywood stars are supporters of the leftist Party of the JackAss.

There is a similar disconnect between the media template and the truth in regard to the two parties' stance on racial matters; but that has already been beaten to death with the hysteria over Trent Lott.

KMK

Thursday, December 19, 2002

Heavy Vehicles

The Wall Street Journal has a good piece today on how much more lucrative the tax deductions are for business vehicles that weigh over 6,000 pounds. I have been advising on this tax break since it was first enacted by our rulers in 1984 and am always amazed when I hear of a tax pro who is unaware of it. In fact, after each of my seminars on tax tips for Realtors, I would receive several inquiries from other tax pros asking me when special rules were enacted for vehicles over 6,000 pounds, assuming they were brand new.

What's also been surprising is how little the car companies are doing to publicize the extra tax benefits of buying one of their heavier vehicles. I can still remember receiving a letter from American Motors in 1984 comparing the lucrative tax breaks (including the now defunct investment tax credit) from buying one of their Jeep Grand Wagoneers that weighed 6,100 pounds instead of a lighter weight vehicle from another manufacturer. Over the years, many of the formerly heavy vehicles, such as the Grand Wagoneer, have gone on diets and no longer qualify for the special rules. However, there are still plenty of other SUVs and trucks that do have gross vehicle weights over 6,000 pounds. As I have always advised, it's not a good idea to buy a heavy vehicle just for the tax breaks. However, if you are debating between a vehicle that weighs over 6,000 pounds and one that doesn't, the additional tax deductions may be the deciding point.

This is also a good opportunity to remind of how using a C corporation instead of an S can double the Section 179 expensing deduction. An individual could buy a big SUV for his personally owned business and deduct $24,000 of the cost in the first year. His C corp could also buy a heavy vehicle and claim its own $24,000 deduction. The combined deduction of $48,000 is double what would be available with an S corp, where all limits pass through to the shareholders.

KMK

Labels: 179

Wednesday, December 18, 2002

Choosing A Corporate Name

A big mistakes people make when setting up a new corporation is simply adding an Inc., Ltd., or Corp after their name when choosing a name for the new corporation.

Besides the very lucrative tax savings opportunities available in a corporation, it can increase your privacy and lessen the potential for frivolous lawsuits.

It is no secret that people will sue anyone for anything if they think they can get some money out of it. Ambulance chasing attorneys, when deciding whether or not to take on a case don't care one iota whether or not the case is justified. What they are concerned with is how deep your pockets are. They will do a search to see what assets you own. If your name is the same as your corporation's, it will be impossible to prevent the vultures from identifying everything owned by you personally and through the corp. If the names are different, there is less likelihood that a search will link ownership of assets. If there doesn't appear to be a lot of attachable assets, the normal ambulance chaser will pass on accepting the case.

The best corporate names are those that give away no hint of who owns them. There is no requirement that the name of a corporation identify the owner or even what it does. I'm a big fan of using as generic and vague a name as possible, such as initials or a made up name. Several clients have fabricated great corporate names from parts of their kids' or grandkids' names.

Besides protecting against nuisance lawsuits, using a vague corporate name allows a level of privacy that would not otherwise be available. Not everyone wants all of their transactions published in the paper for the whole world to see.

KMK

SUVs Are Not Evil

I couldn't agree more with this commentary that all the nosy busy-bodies who want to ban SUVs and condemn those who choose to own them should just shut the hell up and mind their own business. It's the typical liberal attitude of telling everyone else how to run their lives, while exempting themselves.

KMK

Living Trusts

I don't have time at the moment to describe all of the details of how living trusts work. Here is a good summary of the details.

From what I have seen over years, there are still a lot of misconceptions and errors with how living trusts are used in real life and death.

While most of the publicity and consternation is over the Estate (aka Death or Inheritance) tax, the truth is that most people don't have estates large enough to be paying any of that tax. What should be more of a concern are probate fees. While estate taxes are payable on the net estate after deducting liabilities, charitable bequests and final funeral, medical, legal and tax preparation costs, probate fees are based on the gross estate values. It is possible that the probate fees are more than the net assets in the estate, requiring the heirs to pay in before the estate can be finalized. For example, an estate with assets of two million dollars and liabilities and other qualified deductions of two million would have a net estate of zero and thus no tax. The probate fees would be around $100,000 depending on the state or states in which the assets reside.

A growing number of people are using revocable living trusts in order to avoid probate. However, there is still a lot of confusion as to how they work. Many people confuse living trusts and living wills, when they are in fact two very different things. A living will is to document your wishes if you become incapacitated, such as a DNR (do not resuscitate) authorizing someone to "pull the plug" on you.

Another common misconception is that assets in a living trust are exempt from estate taxes. A living trust, because it is a revocable trust, has no effect on estate taxes or any other taxes available to individuals, such as the tax free residence sale. An irrevocable trust is a completely different entity that files tax returns and will affect estate taxes.

Another problem that often occurs is that people have set up a living trust, often with one of those cheap do it yourself kits, and then never got around to titling their assets in the name of the trust. I have seen several cases where the trust ended up doing absolutely no good for this very reason. While I still believe in setting up corporations by oneself, that is not the case for setting up a living trust. A good estate attorney will obviously take care of the asset titling at the time of the trust's establishment, and prepare a pour-over will to cover assets obtained later on that aren't in the trust's name. The executor of the estate needs to be careful about titled ownership of assets as s/he is compiling the inventory and determining which assets can be transferred immediately to the heirs and which ones must go through the long and expensive probate process.

It looks like Scott Adams may be doing some estate planning.

KMK

Tuesday, December 17, 2002

Recipe For Failure

Ben Stein has an interesting list of what things are needed in a society to destroy capitalism and innovation. It's no surprise that almost all of the elements in his list are prevalent and growing in America today. The question is whether or not the growth trend of these counter-productive and outright destructive aspects of our society will be able to be stopped before it's too late to recover true market freedom.

KMK

Survivor Assistance

While it sounds cold hearted to say this, it is a fact that when someone passes away, that person has it easy. Those that are left behind suffer much more, both in the emotional loss, as well as the overwhelming burden of tasks that have to be dealt with to make sure nothing is overlooked. Even when the death is not a big surprise, it's hard for those left behind to know everything they need to take care. As I explained in this article from five years ago, the financial spouse is usually the first to go, leaving the non-financial spouse in the dark.

A new very handy resource is The Survivor Assistance Handbook, a 44 page booklet written by Certified Financial Planner Mark Colgan detailing all of the little things that a person needs to take care of after someone close to them passes away. I first learned of this booklet in this article on the FoxNews website. I ordered a copy from Mark's website and was very impressed with it. Mark's checklists of things to take care of after a person passes away is the most complete I have seen, even including such things as returning library books and videos that the decedent had out. At $14.95 plus postage for a single copy, it's a bargain compared to the potential cost of overlooking even the smallest detail. Mark is also encouraging bulk sales for gifts with wholesale prices of $9.95 each in lots of 25 or $7.95 each in lots of 100.

KMK

Monday, December 16, 2002

Tapping Into Equity

I have always considered it a shame to see older people sit on real estate worth hundreds of thousands of dollars, yet not be able to enjoy themselves. They are the classic real estate rich, cash poor. I normally meet heavy resistance when I recommend that they borrow against their property and live it up with the money. Because these people, who are often in their 70s, 80s and 90s, grew up during the big depression of the 1930s, they have a terrible fear of debt of any kind. They also have a misguided sense of duty to their kids. They feel guilty about the idea of saddling their kids with a mortgage when they pass away. I have to explain that anyone inheriting a $500,000 house with a $200,000 mortgage is still getting a heck of a windfall.

Reverse mortgages are becoming more common for situations such as this. My personal preference is to have the person borrow out a large lump sum of money as a conventional mortgage. This makes even more sense nowadays because the interest rate can be locked in at very low rates. Reverse mortgages are generally adjustable rate, which means they can go up.

While each person's circumstances are different, I have worked with several people over the years in this scenario, where a large amount is borrowed and half the money is available to play with and the other half is deposited into an interest bearing bank account, out of which the monthly loan payments are made for the remainder of the person's life. For someone in his/her 80s or 90s, such an arrangement isn't difficult to set up.

KMK

Sunday, December 15, 2002

Stock Losers

Here are some good tips on dealing with stocks that have declined in value. Some reminders:

To recognize a loss for tax purposes, you have to sell the stocks. Declines in portfolio value are not deductible, which is fair because portfolio gains in stocks still owned are not taxable.

Beware of the wash sale rule. You can't deduct a loss on stocks if you repurchase shares in the same company within 30 days of the sale. The non-deductible loss has to be added to the cost basis of the replacement shares. One way to get around this is to repurchases the shares through your retirement plan (IRA, SEP, 401k, etc) because IRS considers such plans to be different entities than the individual beneficiaries.

Donating to charity

It only makes sense to donate appreciated stocks to charity because you can deduct the full market value and avoid any capital gain tax. However, if the stock has gone down, you can only deduct the market value at the time of the gift; thus forfeiting the capital loss. It's a better plan to sell the stock, claim the loss, and donate the cash.

KMK

Saturday, December 14, 2002

Friday, December 13, 2002

Unintended Consequences

This is the term analysts use when commenting on how things in the real world turn out differently than they had expected based on their forecasts using static analysis, where they assume changes in taxes have no affect on people's behavior. Anyone with half a brain could have figured that the piling on of taxes on cigarettes would lead to smuggling and counterfeiting of the items. Our rulers assumed that people would buy just as many packs from the same suppliers as before the new taxes.

That these things are happening more frequently as taxes are raised shouldn't be a surprise to anyone grounded in reality. What never ceases to baffle me is how the morons who weren't able to anticipate this reaction to the higher taxes are still in power.

KMK

Thursday, December 12, 2002

Wednesday, December 11, 2002

Postal Service May Be Urged to Privatize

Here's an idea that's long overdue. Remove the Post Office's monopoly power and make them compete with UPS, FedEx and new services on a level playing field. I doubt that a private for-profit corporation would make anywhere near as many idiotic operating decisions as the bozos currently running the USPS.

Here's just one recent local example. In what is most likely a typical logistical decision by the USPS geniuses, the regional managers here in Arkansas have decided that the Harrison mail, which is sent from within Harrison and sorted separately from mail with other destinations, will be sent an hour and a half away to Fayetteville, Arkansas to be sorted and then returned to Harrison for delivery by the carriers. So, in the tiny town of Harrison, it will take at least three days for mail sent from inside Harrison to be delivered inside Harrison. This is ripe for a new company to take over local deliveries. I'm sure it's similar all around the country.

KMK

GOP Wimps

It was too good to be true to believe that the Left Coast Republicans could actually have the guts to start recall proceedings against any of their elected officials who vote for higher taxes. The person who proposed that is now being pilloried & censured by the party's executive board.

If both big parties see nothing wrong with continuing to squeeze the taxpayers, who is looking out for the taxpayers' interest? It was this very attitude in the PRC that made me want to leave ten years ago after 38 years in what I had always imagined would be my life-long home.

As this article describes, a short-sighted move by the rulers in Sacramento to dig out of the current fiscal problems by raising taxes will just end up making things worse for the PRC as more businesses and taxpayers finally reach their limits and bail.

KMK

Tuesday, December 10, 2002

Instant Karma

It looks like the GOP in the PRC is on the same page as I am. They are threatening to start an immediate recall action against any GOP elected officials who vote for increased taxes. I hope they have the guts to carry out that threat.

KMK

Monday, December 09, 2002

California Is at Fiscal Brink

The PRC on the brink of financial collapse? Deja vu. As much as a complete collapse would teach a valuable lesson to the PRC rulers, that's not likely to happen. Every ten years or so, they are in this exact same position. They survive and then continue to repeat the same mistakes. There is nothing to indicate this time will be any different than last time, or the time before that, etc.

KMK

Sunday, December 08, 2002

Clean Money

We've all heard the term "money laundering" in gangster shows. However, contrary to popular belief, that doesn't mean cleaning off the cocaine residue that allegedly is on much of the currency in this country. Laundering means to hide the illegal source of money and make it appear to be from a legitimate source. As the old cliche goes when trying to catch crooks, "follow the money." As we've seen in countless movies about drug lords, they deal with suitcases full of cash and need ways to make sure nobody knows where it came from.

For a long time, private citizens have been deputized in the war on drugs by being required to file Form 8300 with IRS in Detroit within 15 days to report any business transactions where they received $10,000 or more in cash or cash equivalents. Of course the crooks do everything they can to avoid having their payments reported. They try to break up transactions into multiple payments, each of less than $10,000. However, related payments are supposed to be combined and reported on an 8300 if they total more than $10,000.

A few weeks ago on the Sopranos show, Carmela was going around to several different stockbrokers and investing about $9,000 of cash she had taken from Tony's stash with each broker in order to avoid the 8300 reporting.

Each time the form is revised, the list of types of cash equivalents grows. It currently includes U.S. currency, Foreign currency, Cashier�s checks, Money orders, Bank drafts and Traveler�s checks. With the cost of postage stamps increasing, I wouldn't be surprised to see them listed soon. We use Priority Mail a lot and are constantly buying $3.85 stamps.

The penalty for not filing Form 8300 when you are required to can be the full amount of the cash involved. I can still recall a case in Silicon Valley shortly before we left there ten years ago. IRS checked the books of several auto dealerships and found where several expensive vehicles had been purchased for cash and no 8300s had been filed. IRS fined the dealerships millions of dollars, the full amount of unreported cash.

When I was presenting my real estate taxation seminars around Arkansas, I included a section on this reporting requirement because it is a well known trick for drug dealers to launder money through real estate. We even heard some first hand stories from some of the Realtors in attendance of being involved in investigations of just such a thing.

What triggered this longer than expected discussion of money laundering was this recent story about drug dealers laundering money through life insurance policies. Of course, I'm sure we are hearing about this at least a few years after it started and the crooks are already on to something new by now.

KMK

Tax Change Ideas

There's rarely a shortage of people voicing their opinions on how the tax system should be changed. Here are a few recent ones, obviously written before the announced departure of Treasury Secretary O'Neill. With that development, the floodgates will be open with suggestions for the benefit of his replacement.

Jack Kemp's suggestions

Victor Canto's proposals

Daniel Henninger on the growing tax burden

Daniel Mitchell saying good riddance to IRS Commissioner Rossotti

KMK

Strange Legacy

Most politicians do something during their term in office that makes such an impression that it is the one thing you think of when recalling that person. It sticks with them for the rest of their lives. For Dan Quayle, it was spelling potato. For Bill Clinton, it was his famous speech lying about his relationship with Monica. Treasury Secretary Paul O'Neill's legacy seems destined to be as a U2 groupie, which is rather odd for a financial person. As is their duty, the editorial cartoonists are having a great time with this.

KMK

Saturday, December 07, 2002

No Tears for O�Neill

It has been hard to take seriously a Treasury Secretary who has nothing better to do with his time than fly around the world with an Irish rock star discussing how much USA taxpayers should give away to ungrateful third world countries. Maybe Bush can find a replacement who will work on fixing the insane tax system we have to cope with.

KMK

Friday, December 06, 2002

Dividend Reform

Let's hope Bush is able to eliminate double taxation of corporate profits. That would change some of the dynamics of corporate finance, as pointed out by Larry Kudlow.

As much as I'd like to see a serious move to true capitalism, and the elimination of all taxes on dividend income, I'm not optimistic that such a drastic change will fly with the people who believe that only evil rich people receive dividends. What we are more likely to see is a return of something that I can remember from my earliest days in the tax business. Back in the mid 1970s when I started, each person was allowed up to $100 per year of dividends tax free.

KMK

Short Memories

What a surprise. Not a word during the campaigns about raising taxes and then once the polls close it's a mad rush to see how many taxes can be added and jacked up.

Our rulers know that they are safe from any voter backlash because the next elections are two years away and the collective memory of the populace is about two weeks, at most. What would be great for this country is a little Instant Karma for our rulers. No more waiting until the next formal election to punish them. As soon as they try to raise taxes, we start a recall or impeachment drive.

KMK

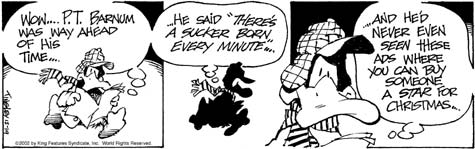

Don't Be A Chump

Here's a good summary of some of the most common work at home scams. Many of them are the same. You pay some scamsters for their "secret formula" to solicit other suckers to pay you that very same "secret formula." Can anyone say pyramid scheme?

KMK

Thursday, December 05, 2002

Misery Loves Company

Some other countries think that the USA has an unfair advantage on the world market because we have lower tax rates than they have. Just as with the similar argument that we should be willing to pay four dollars a gallon for gas because that's what they pay in Europe, the answer to the disparity in tax rates is for us to raise ours, not for them to cut theirs. Luckily for us, our ancestors fought a war 226 years ago to detach ourselves from having to take any orders from the Europeans. If they want to continue destroying their society with expensive socialist programs, that's their right to do. However, we have the right to ignore their advice and learn from their stupid mistakes.

KMK

Wednesday, December 04, 2002

Taxes Do Affect Behavior

Walter Williams has a good illustration of how ridiculous those people are who claim that changes in taxes have no effect on behavior. Unfortunately, almost all of our rulers use the unrealistic static analysis when setting policies, which is why they are never accurate in any of their predictions.

KMK

Facing Reality

Can it be true that people in the PRC are finally realizing that their rulers don't have the foggiest idea of what they are doing when they predict future revenues? Maybe there is hope for the rest of America because the bean counters in DC are no better at it.

KMK

The Other Washington

It looks like another of the few states without an income tax, Washington, is now considering adding one. If that happens, what are the odds that Microsoft moves to Nevada?

KMK

They Still Don�t Get It

The Democrats try to come to grips with the tax issue.

Normally people such as Rush Limbaugh and Neal Boortz are on the same page as I am when discussing the tax system in this country. However, I have to take exception with how they, along with some in the editorial section of the Wall Street Journal, have been improperly categorizing people who pay no income taxes as freeloaders. They admit that many of those people pay in a lot of payroll taxes, but consider those to be different because they are technically premiums for retirement and medical insurance programs.

These same people (Rush, Boortz, et al) on other occasions, are the first to acknowledge that these government programs (Social Security and Medicare) are shams and that most working people will never see any of their so-called premiums returned to them as benefits or services. In my book, money that you are forced to pay to the government for which you will never receive any future benefits, is no different from income taxes. It is just plain wrong to say that just because someone pays no income tax that they are not paying taxes.

While I know that it is nothing more than an insincere gimmick by the DemonRats to propose a reduction in payroll taxes, and it pains me immensely to agree with them, I have to say that this is an idea that is long overdue.

I intend to expand on this issue in future postings.

KMK

Tuesday, December 03, 2002

Quality Giving

It's always a good idea to help out charities by donating cash or things they can use or sell to raise cash. However, it really goes against the charitable spirit to use the Goodwill or Salvation Army drop-off spot as a place to take your worthless garbage. Many of these charities end up having to pay a fortune in hauling and dump fees to get rid of crap that is unusable and unsalable.

This brings up the issue of how much you can deduct for used things donated to charities. When I was answering questions on the AskMe.com site (now out of operation), there were several from people asking which they should do: sell their car for $1,000 or donate it to a charity and claim the $2,500 Blue Book value on their tax returns. I had to burst their bubble and explain that if the car could only be sold for $1,000, that is the value that can be claimed on your Form 8283, which is attached to your 1040.

People were totally unclear on their terms. They would claim that something was worth $1,000; yet they could only sell it for $300. I had to point out that they were contradicting themselves. An item is only worth what an unrelated party would be willing to pay for it. Guides such as the famous Kelley Blue Book are just that, guides. If you check out their valuation techniques, which you can do online nowadays, they base their valuations on all kinds of things beyond one flat amount for everyone. Such things as accessories, condition, and the number of miles are all important aspects in determining a realistic market value, which is what has to be used for tax deductions. It shouldn't be any higher than what you could sell the car for through a classified ad.

KMK

PRC Fiscal Futility

Here's a good summary of why California is doomed to always have such extreme budget problems. It's a typical grasshopper state, setting up all kinds of spending programs using idiotic revenue predictions based on what comes in during the best years and ignoring the reality of down-turns. It's a little difficult to feel sorry for idiots who are this incompetent at financial forecasting, or the fools who vote for them.

KMK

Most states with prepaid college tuition plans are forced to raise rates

Another example of why official statistics are not to be trusted. They are no more than SWAGs (scientific wild ass guesses). The states are no better at predicting tuition fees than they are at predicting future revenues.

KMK

Monday, December 02, 2002

Breaking Promises

For as long as I've been in this business, I've been warning people that the entire Social Security system is built on a teetering house of cards and that people in my and later generations will end up being stiffed when we retire, even after paying in hundreds of thousands of dollars during our working lives.

Although I don't think it is in the least bit fair, I still believe that to be the case and continue to believe that the only salvation for the bankrupt SS system is to install a means test for who will receive benefits. Anyone who has a net worth over a certain amount specified by our rulers in DC, or an annual income above a certain level (also specified by our rulers) will receive no SS benefits, regardless of how much had been paid in to the imaginary trust fund. This will increase the demand for services of those who assist in impoverishment planning, which currently deals mainly with qualify people for Medicaid assistance.

When I tell people this, they almost always express disbelief and claim the government would never break such a sacred promise as the one to support us in our golden years. As one who believes that we can learn from history, I have to remind them of examples of broken promises from our esteemed rulers in DC, starting from the treaties with the native American Indians to the current taxation of SS benefits in spite of the original promise that they would always be tax free to compensate for no deduction for the payments into the system.

I just came across this story of how the Feds are quite openly breaking the agreement that existed with military veterans who served for 20 years or more to cover their lifetime medical costs. For those skeptics who believe in the Social Security Tooth Fairy, ask yourself this. If the Federal government has no qualms about stiffing men and women who risked their lives for the security of this country, what's to stop them from doing the same thing to everyone who has paid in and has been counting on a monthly retirement check from the SSA?

KMK

Cut fraud instead of hiking taxes

This is a question I hope more people ask. Why are the taxpayers the first place our rulers look to when they have budget problems, when they should be reducing the huge amounts of money lost through fraud and incompetency?

KMK

Should immigrants be taxed?

This is an interesting issue, on which I'm not sure exactly how it should be. On one hand, I'm opposed to taxes and any impediment to the free use of one's money. If these people earn the money, and are in the USA legally, they should be allowed to spend it or send it where or however they choose.

However, if they are pleading poverty and therefor receiving a lot of services for free that the rest of us have to pay for, there may be some merit to having them pay some kind of fee or tax to reimburse the taxpayers who are subsidizing them. This is also similar to the argument against repealing the sales tax on food and medicine that I heard during the recent campaign season. Many people wanted to keep the sales tax on food and medicine just for the specific reason to force Mexican immigrants to pay something in taxes, since they spend a good portion of their disposable income on food.

This is no longer just an issue for border states, such as the PRC. Here in NorthWest Arkansas, there is a fast growing population of Mexicans who work for the Tyson poultry plants. Just a few weeks ago, I was behind a woman in a Conoco station who was using their Western Union service to wire some money back to Mexico and there were several others in line to do the same thing.

KMK

State of the states: budgets in crisis

Several "grasshopper" states are suffering the consequences for poor planning and wild spending programs.

KMK

Sunday, December 01, 2002

The Stock Market

I'm running late, so I will comment more fully on these issues later.

The investors' watchdog is having problems:

S.E.C. Facing Deeper Trouble

Stock market gurus are worse at predicting winners than tossing darts at the stock page.

Some widely touted analysts didn't perform so well

New disclosure rules have some in the media quite upset:

Since when did 'security' mean prior restraint of print media?

�Regulate Them, Not Me!�

KMK

Free Tax Program

As I said before, tax preparation software isn't a substitute for working with a knowledgeable and creative tax professional because it is too much GIGO (garbage in, garbage out). However, some people know that it's good idea to check your expected tax figures before the year is over, in case things need to be done before December 31. I normally advise getting a free version of the previous year's program, which TurboTax and other companies usually make available. However, I received an e-mail ad for a free 2002 preview TaxAct 1040 program that can be downloaded off the web. This is the earliest 2002 software I am aware of. The first version of my Lacerte 2002 programs aren't even scheduled to be available until December 16.

I downloaded the TaxAct program (only 6.7 mb file size) and checked it out and it's a pretty nice basic tax prep program. Of course, throughout the input time, the program keeps prompting you to buy their full deluxe version; but it isn't as annoying as I have seen with other software. It should be very handy for anyone wanting to get a preview look at their 2002 1040.

KMK

Discriminating Against Intelligence

With all of the hoop-la over racial and other kinds of profiling, why is one industry allowed to discriminate against one type of person? I'm referring to the gambling casinos refusal to allow anyone to play who has been able to count cards or otherwise turn the odds in their favor. The casinos will only let you come in if they believe that you are going to lose. If you are savvy enough to have developed a non-cheating system of winning, as these MIT students did, you are not welcome. It sounds like outright discrimination to me.

KMK

Concord Coalition

The Concord Coalition is portrayed as a bi-partisan group for Federal fiscal responsibility. Other than liberal Democrats, the token Republican founder is former Senator Warren Rudman. Unfortunately, Sen Rudman epitomizes the term RINO (Republican in name only). Every time I have heard him speak, he claims that the worst thing he ever did in his Senate career was vote for the Reagan tax cuts of 1981 because they caused the huge deficits.

That is the same historical lie that the liberals spout. The Reagan tax rate cuts actually stimulated more overall revenue to the Federal government. The deficit was completely the fault of Congress' out of control spending. I mention this for the umpteenth time because the Concord Coalition is speaking out against the current Bush tax cuts as being a repeat of the Reagan supply side economics, with larger deficits in store.

While it is actually another try at supply side economics, it will not increase the deficit unless Congress goes on a wild spending binge. Unfortunately, I'm not so sure that won't happen, even with the so-called fiscally responsible GOP in charge. Early indications are that they are just as fond of sending pork back to their districts as the Dems have been.

KMK