Tax Guru-Ker$tetter Letter

Friday, April 30, 2004

Time to transform Social Security into a wealth-creating vehicle. - Instead of the IOUs that disappear when you die.

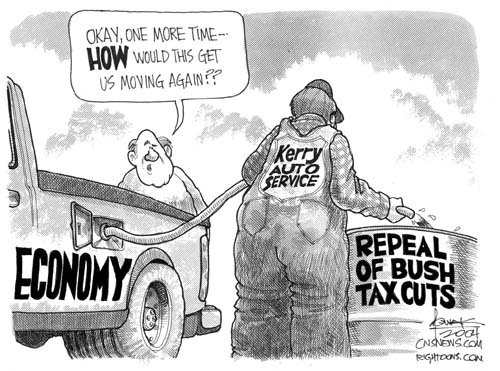

Tax & Fiscal Information for Senator John Kerry - Of course, this is rapidly becoming a moot point, as my prediction of someone else taking his place on the DemonRat ticket looks more likely every day of his totally inept and incompetent campaign.

Stop the Spree - Tax cuts don't cause deficits. Out of control spending does.

Sanford tax plan moves to Senate floor - A possible reduction in the state income tax rate for South Carolina.

Conservative Dividing Lines

Jonah Goldberg has an interesting look at the dilemma conservatives have in supporting RINOs and other members of the GOP who are violating basic conservative principles. He voices a common concern many of us have:

Many conservatives, myself included, are fairly outraged that President Bush is spending taxpayer dollars like a pothead teenager with a stolen credit card.

However, Jonah is making the same mistake as Rush Limbaugh in assuming that there are only two choices in an election and choosing the lesser evil is the only option we have; when in fact, there is a political party that is still true to the belief in small constitutionally authorized government, the Libertarians.

People who are upset about RINOs, such as PA's Arlen Specter, would make a more powerful statement in support of conservatism by voting for the Libertarian candidate than by voting for the RINO or by sitting the election out. Otherwise, Bush and the RINOs will continue to take conservatives for granted and will see no downside to usurping even more of the DemonRat agenda.

Thursday, April 29, 2004

Senate OKs Bill to Ban Web Access Tax

We Don't Need No Stinkin' License - Realtors in the PRC aren't too happy about people advertising their own properties on the web. Welcome to the 21st Century.

Vote Quiets Anti-Tax Clarion Call In Virginia

House, Senate Gridlocked Over Tax Cuts

IRS Mileage Rates

Back last October, when IRS established the standard rate for 2004 business miles as 37.5 cents, the price of fuel was much lower than it is now. Normally, when we have a large increase during the year, as long as it appears to not be a temporary spike, IRS issues a new higher rate for the later months of the year. They have not done so as of yet. My inquiries to IRS personnel have yielded no time frame for such a new rate. In the meantime, trucking companies and airlines have been adding fuel surcharges to their rates.

If IRS doesn't issue a new higher rate soon, it will be another perfect example of how important it is to keep track of actual out of pocket vehicle expenses so they can be claimed instead of the standard rate, if they turn out to be higher, which they could very well be for 2004.

Typos On New $50 Bill "Security Features," Insists Treasury

In Class, the Audience Weighs In - Interesting look at the high tech tools being used in law school and college classrooms, featuring Paul Caron, whose TaxProf blog has gotten off to an amazingly quick start. Things have changed quite a bit in the 30 or so years since my days as a college student.

Permanent tax cut OK'd - It's very premature to celebrate this as an actual victory. It's only the token marriage penalty reduction as passed by the House. While I have no doubt that Bush would sign this if it comes to him intact, the Senate has far too many RINOs (including the recently victorious PA Senator Arlen Specter) to guarantee its survival there.

Social Security Time Bomb, and the Candidates Aren't Talking - Standard operating procedure for our rulers here. Just ignore the problem and hope it goes away.

Wednesday, April 28, 2004

Invest In Yourself

A common scenario I have seen countless times. A person leaves the employ of a large company (sometimes voluntarily and sometimes not) and has a very substantial amount of money in the former employer's retirement plan. This is a very tempting source of money to use to start up a new business or expand an existing one. Unfortunately, if the person is under 59.5 years old, there are heavy penalties (10% Federal plus something for State) for touching that money. Added to the Federal and State income taxes, I have frequently seen the effective rate on such withdrawals exceed well over 50% of the account balance. I have normally advised people to roll their retirement funds into an IRA account and then take out an equity loan against their real estate in order to avoid the huge tax and penalty hit.

Once cash and stocks are rolled over from a company plan to an IRA, there is still a question as to how to invest that money. Most people think that the only options are cash and stocks. However, the options are wider than that. We have long used the concept of "prudent investments" to designate what are suitable for retirement accounts. Some things, such as collectibles, are statutorily ineligible investments. I can remember about a dozen years ago, when the prices for ostriches and emus were escalating and promoters were claiming that those birds were suitable investments for IRAs and other types of retirement accounts. As I predicted back then, the market prices for those flightless birds collapsed and anyone stupid enough to fall for that get rich quick scheme saw their retirement nest eggs fly away.

About a week ago, I received an email from a reader referring to a company in San Diego, BeneTrends, that has established a certain type of retirement account, called Entrepreneur Rollover Stock Ownership Plan (ERSOP), where the funds are invested into shares of stock of closely held C corporations. S corporations do not qualify; one more benefit to using a C instead of an S.

This actually addresses a couple of very big problems that I have discussed over the years; how to safely invest retirement funds and how to obtain working capital for small businesses.

Safe investments of retirement money. I have long ridiculed people who invest their retirement money in super risky stocks. I have frequently had the unpleasant task of informing people that, because their retirement accounts were pre-tax money, which give them a cost basis of zero, there was no deduction allowed for the losses they suffered in those accounts.

Whether it's a dot-com stock, fueled by pure speculation frenzy, or what are considered to be blue chip stocks, I have never been a big fan of playing the stock market because you have no control over the management of those companies. Recent corporate accounting scandals have illustrated how valid those concerns were. Investing in your own company fixes that problem. If you end up losing the money, you only have yourself to blame.

According to the service fee schedule I was sent, BeneTrends charges $4,000 to establish the ERSOP plus a $700 IRS User Fee to register the plan, and annual maintenance fees of $800 plus $40 per participant. While at first blush, this may seem like a lot of money, it is a small fraction of the taxes that would be payable if the money were withdrawn from the account and used directly. It is also much less than the fees routinely charged for small business loans. I have also seen small companies pay well over $10,000 to establish more conventional defined benefit retirement plans; so $4,000 is quite reasonable. BeneTrends also offers incorporation services for $800 plus the state fees; but I still think my earlier suggestions for setting up a new corporation are the best way to go.

Bush's costly tax favors - The only bit of truth in this diatribe against tax cuts is the cost of dealing with the complexity of the tax code. Blaming tax cuts for the deficit and income disparity is just the same socialist bilge the mainstream media have been pushing on the economically illiterate for decades.

Latest state revenue-raising wrinkle: taxing services - There has always been a huge lobby industry involved in defining what products and services are subject to sales taxes. Adding things that had traditionally been exempt, such as professional services, is an easy way to raise revenue without raising the actual tax rate.

Boost in taxes OK'd in Virginia

Don't Tax the Internet

Google hype has veterans of '90s bubble a bit worried - It's no secret that the collective memory in this country can be measured in months. Just look at how many people (most of the DemonRats) have completely forgotten about the terrorist attacks on 9/11/01. Anyone so willing to ignore the history of the 1990s dot-com stock market fiasco because it was ancient history from last century will deserve to lose any money they gamble in IPOs and other speculative stocks.

Tuesday, April 27, 2004

States Name, Shame Tax Scofflaws Online

Brown's attorney files for discovery - The latest on the Harrison Abstract embezzlement case.

A Profile of Couples Benefiting from Marriage Penalty Relief - As I've often explained, the provisions discussed here only offset a part of the true tax penalty on married couples. Many couples still pay several thousands of dollars in additional taxes than they would if they were able to file as single. I have long advocated true marriage penalty relief by allowing married couples to calculate their taxes under various scenarios and allow them to use the most advantageous one. Liberals, who think our taxes are too low, would be free to use the higher tax method; but of course they won't so as to not disturb their innate hypocrisy.

German immigrant leaves 70% of estate to IRS - While this isn't the choice most of us would make, that was her right to do.

Monday, April 26, 2004

Bush Calls for Ban on Broadband Taxes

Criminalizing business: part II - More from Thomas Sowell on why the name People's Republic of California (PRC) is so well deserved. The anti-business sentiment is even worse than it was eleven years ago, when we left there.

It's the economy, voters, but whose? - Judging the state of the economy is a very subjective undertaking.

Is Fair and Simple No Longer Possible? - Those are two words that will never be used to describe the income tax system in this country. The only way to achieve anything close to fair or simple would be to repeal the 16th Amendment, completely scrap the income and estate taxes, and use something like a national sales tax. When it comes to tax reform, the motto needs to be, "end it, don't mend it."

Not enough financial aid? Seek counseling.

Sunday, April 25, 2004

How to slash your taxes - The traditional way to reduce or eliminate income and payroll taxes is to just stop working, which becomes more attractive an option the higher and more confiscatory the tax rates are.

Criminalizing business - Another good piece by Thomas Sowell on the impossibility of every potential investor having exactly the same information as every other potential investor, and the ridiculousness of our rulers in DC trying to legislate this kind of thing from their high and mighty thrones.

Kill the Corporate AMT - As well as the idiotic AMT on individuals.

PAYGO on Tax Cuts Could Bring Back the Estate Tax - The entire way in which our rulers account for the effects of tax changes - using a static scoring system that assumes no related changes in behavior as a result - is the perfect example of the classic oxymoron, "government intelligence."

IWF Refutes So-Called 'Wage Gap' - It is true that the extent of the perceived gap between salaries of women and men is usually highly overstated and doesn't account for the extenuating circumstances that actually justify such disparities. However, the issue is not entirely fictitious. During my seven years involvement with the internal auditing profession (as an auditor, audit manager, and seminar instructor), where I examined the internal workings of a number of large businesses, I did see several very real examples of men being paid much higher salaries and given many more benefits (company cars, etc.) than women for the exact same jobs simply because of their gender. Managers even used those exact words to justify the differences. I was reprimanded on several occasions for discussing those disparities. Of course, it has been almost 20 years since I left corporate employment; so I hope such blatant discrimination has been tempered since then.

Saturday, April 24, 2004

Virginia Schools Cut Math Classes to Increase Lottery Sales - Consistent with the classic definition of lotteries as "taxation of the mathematically ignorant (aka morons)."

Friday, April 23, 2004

How to Irritate the IRS - I'm not endorsing these tricks; but showing what kind of crap IRS employees have to deal with; because people actually do these things to them

Do You Own Multiple Homes But No "Principal Residence" For Capital Gains Purposes? - Although this is from last July, I just came across it and even added a link to it on the page on my main website with the article on primary residence sales. It shows that establishing a home as a "primary residence," with up to $500,000 of tax free profit, depends on many of the same issues as are involved with establishing a particular state or country as a person's tax home; topics I deal with quite often. The number of days occupying the home aren't as important as the other indicators of intent to make it your primary residence, such as drivers licenses and voter registration.

Senate Revives Ban on Taxing Internet - They're finally doing something on this issue. It's about time.

Thursday, April 22, 2004

When Would the President's Tax Cuts Expire? - If our rulers in DC don't get off their butts and make the tax cuts permanent, everyone will be facing huge tax increases very soon. This is why, a few months ago, I added a link to my blogroll on the right side of this page to the impending tax increases we are all facing.

Adam Smith's Principles of a Proper Tax System - I've always admired the "invisible hand" concepts in his book, "Wealth of Nations."

FTB double-dips into taxpayers' accounts - I have always been against electronic filing of tax returns because of the inability to properly explain the info on the returns and thus avoid audits and other problems. This snafu in the PRC shows another danger to e-filing.

Pat Boone Fights the Death Tax - We all need to exert more pressure on our rulers to permanently eliminate this evil confiscation.

Giving by Affluent Is Less Generous On Basis of Assets - This is an interesting idea; to compare charitable donations as a percentage of a person's net worth versus as a percentage of annual income. I do have serious doubts as to the results because, as they admit, the people doing these calculations, New Tithing Group, had to use a lot of SWAGs *Scientific Wild Ass Guesses) for net worth figures. IRS statistics on income and donations are anonymous and grouped together; so it's not even possible to match them up with specific people for whom net worth figures may be available. Even there, as with the annual Forbes list of the wealthiest people, a lot of SWAGs are used.

Here are direct links to New Tithing's research report and their press release.

Wednesday, April 21, 2004

John Frugal Kerry - Going back to his 1991 tax returns, it looks there is a definite trend upwards in his charitable donations as he got closer to running for President.

Linder's Fair Tax dream gaining steam

Plotting the John Kerry tax curve

Laffer Lines - Good look at the relation between tax rates and revenues. Contrary to popular wisdom, tax rates are very powerful motivators and lower rates produce actual higher tax dollars, as shown by the Reagan tax cuts of the 1980s.

Tuesday, April 20, 2004

Middle-Class to be Burdened by Hidden Tax in 2010 - More people become ensnared in the idiotic AMT every year.

An IRS Promotion for Bush at Tax Time - Contrary to what many tax protestors claim, the IRS is a part of the Treasury Department, which is part of the Executive Branch of the Federal government. Having them in synch with the top executive (Bush) is the right way to have things. The Dems just don't like facts getting in the way of their lies about taxes and the economy.

Eric Rasmusen has some more analysis of John Kerry's tax returns. He has an interesting conclusion: "If Kerry can't find someone competent to fill out his tax forms, how can he run a government?" He has a good point that, being in high level politics, John Kerry knows full well that the media and the public will be checking over his personal income tax returns. Just as with Al Gore's miniscule charitable donations, it doesn't show a lot of brain power on their part to see that they didn't spruce those kinds of things up; especially when they (DemonRats) are always claiming to be the most compassionate people on Earth.

A good tax preparer should be aware of the intended audience for the returns s/he works on. It's not always just the IRS who will be using them. For decades, I have made a point of asking clients if they expect someone other than IRS to be looking at their tax returns, such as a lender for a loan application or an investor or buyer of a business. If so, we may go lighter than normal on some of the deductions in order to paint a better picture.

Thanks to Paul Caron for the link to this on his very useful new TaxProf Blog. He also has an interesting review of the recent book critical of the USA tax system, Perfectly Legal, on his blog.

Monday, April 19, 2004

Agency may redefine what a family farm is - Just as with the definition of evil rich for tax purposes, it varies program by program and agency by agency.

A house fit for a cat - Leaving an estate to one's pets requires some special estate planning techniques.

A Better Mutual Fund Reform - If the various governmental regulatory agencies carry out their (promise) threat to issue new rules to protect investors, we can expect it to be just as successful as Tax Reform has been. The wise move (unfathomable to our rulers) would be to let the market take care of itself.

Single Women in Retirement Peril - It always scares me when news stories start using terms like "crisis" and "peril" because that means some kind of new government program is in the wings to solve the perceived problem.

Fair Tax would live up to its name - Unfortunately, fairness is the last thing most of our rulers want for a tax system that they use for their social engineering projects, especially wealth redistribution.

Tax Compliance Costs - Good look at the increasing costs to our society just to stay in line with the ever changing tax rules. It echoes a sentiment I have long discussed on how unfair it is to require victims of the IRS research projects, with their line by line dissection of every item on their tax returns, to pay for their representation or take time off from work to handle it themselves.

A Taxation Policy to Make John Stuart Mill Weep - While I obviously don't accept the judgment of this piece, it does have an interesting look at tax policy in regard to "horizontal equity" and "vertical equity."

Recapping the Benefits of a 529 Plan - There is a lot of confusion regarding these education savings plans, including the misconception that there is a tax deduction allowed for contributions to these accounts. Having different rules for the various state plans also makes it tougher to know what to do.

John Kerry's Tax Hypocrisy - In typical liberal fashion, JFK is always calling for higher taxes on the evil rich. His state of Massachusetts actually has two ways of computing its income tax; at 5.3% or at a higher 5.85% for those who want to help out the state government some more. Guess which rate John Kerry paid. Higher taxes are only appropriate for everyone else, and when given a chance to pay more, in true selfishness, he does what 99.97% of his fellow MA taxpayers do, and pays the lowest rate available.

As those of us who believe in lower taxes have always said to liberals, they are free to send in every penny they have to support their beloved Big Government programs. It's a very different story when they push to have the government use its awesome power to forcefully take money from other people who don't believe in Big Government.

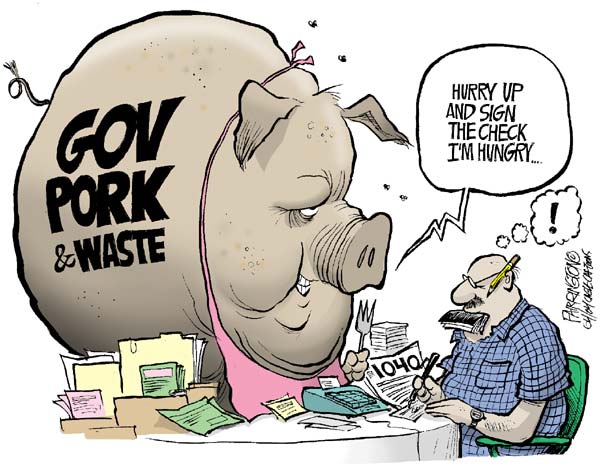

Special-Interest Add-Ons Weigh Down Tax-Cut Bill - Our rulers are hopelessly addicted to pork.

Sunday, April 18, 2004

"Bling Bling" Not Deductible, Says IRS

Anyone who lists the costs of purchasing or maintaining bling-bling as a tax deduction might as well write "Audit Me Please" in big red letters on their tax returns.

Ten Ways Income Taxes Violate Civil Liberties - As I've long said, the fastest way a President could restore some faith in our tax system would be to issue an executive order removing the IRS's power to ignore all of the constitutional protections that we have under the normal criminal system of law and force them to treat citizens with the same level of respect as mass murderers have, which is much more than taxpayers receive. It's always been a travesty that killers such as O J Simpson are afforded more rights and protections than someone who makes a tax mistake.

Who allows what?

This is not the way our rulers see things. According to their logic, we are blessed by every dollar of income that they deem to allow us to keep and we should be eternally grateful for their benevolence.

Iowa House advances citizen tax-vote measure - Letting voters have some power over large tax increases - what a concept.

Saturday, April 17, 2004

Busted

The analysis of John Kerry's income tax return by Texas CPA Bob McCombs has achieved a quick response from the John Kerry gang.

John Kerry Files Amended Tax Return, Pays More

Whoops! John Kerry antes up $12G

Millions of Americans Don't Pay Federal Taxes - Another look at the people who drop off the tax rolls at the bottom end of the income spectrum.

Why do average Americans seem to favor policies that reward the wealthy? - The tone of this article is the same disgusting "hate the rich" class envy that permeates much of our society and most of the media. They want us to all believe that it's inherently wrong for the people who actually pay the most taxes to receive the largest amount of savings from tax cuts. Of course, this shouldn't be a surprise from a communistic group such as this, that feels it is wrong for anyone to have any more than anyone else.

Friday, April 16, 2004

Texas CPA Claims John Kerry Owes Extra $12,000 in Capital Gains Tax - There appears to be an error in how JFK or his tax preparer reported the gain on the sale of a collectible, which has a higher tax rate than other kinds of capital gains. Interesting analysis by Bob McCombs.

Another Tax Scam Under Attack By The Feds

The Audit Defense Network, which used to run a lot of ads on the Rush Limbaugh show, is being charged with tax crimes. I first saw this in the paper Wall Street Journal and found the following coverage via a search in Google News

DOJ Files Suit Against Audit Defense Firm

Sham Websites And Home Businesses Allegedly Sold To 100,000 Customers For Obtaining Improper Tax Benefits-Bilking Treasury Of An Estimated $324 Million

Justice targets alleged tax scam

In a Lawsuit, U.S. Accuses a Tax Adviser of Fraud

Tax Business Accused of Bilking 100,000 Customers

Dave's Top Ten

Once again, David Letterman failed to invite me to be part of his annual Tax Day Top Ten. Of course, my being 1,200 miles away from the Ed Sullivan Theater does make it a bit more difficult.

Top Ten Things You Don't Want To Hear From Your Accountant

10. "Listen, I'm not good with math"

9. "The good news is you're getting a huge refund -- the bad news is you'll have to hide in Costa Rica for a while"

8. "I'll gladly waive my fee for a night with your wife"

7. "Hey, get me a drink!"

6. "Do you have any dedemptions or exuptions or whatever?"

5. "Relax, everything here will be fine -- I used to work for Enron"

4. "Screw the computer -- I do all my work on an Etch-A-Sketch"

3. "What's your rush? The deadline is June 15th, right?"

2. "You can't claim yourself as your own spouse"

1. "I was late filling your return so I could appear on Letterman"

And the Extras that didn't make it on the show, but are on the website.

"If I go down, I'm taking you with me"

"Are you cool with tax evasion?"

"Mininum-security federal prisons are actually pretty nice -- just ask my other clients"

"What do you call that squiggly number between 7 and 9?"

"If the IRS calls, you've never heard of me, okay?"

"Your paperwork might say 1040-ES, but that dress says 1040-EZ"

"Isn't White-Out delicious?"

"I have this little quirk where I can only fill out tax forms if I'm naked"

"Would you mind if I list my imaginary friend Curtis as one of your dependents?"

"If only there was a machine that could add numbers for you"

"I'm allergic to ink, so I'm going to fill out your form in my own blood"

"See you in six months for the audit"

"For legal reasons, we should probably take a few minutes to get our stories straight"

Thursday, April 15, 2004

Ordinary & necessary business expenses

This reminded me of a professional wrestler client I had back in the Bay Area. We deducted huge amounts for his food in order to maintain his 400 plus pound fighting weight, and IRS never had any problems with any of that.

Tax Scammer Irwin Schiff, who is still amazingly able to attract gullible followers with his ridiculous claim that taxes are completely voluntary:

In a Lawsuit, U.S. Accuses a Tax Adviser of Fraud

Anti-tax author appears in Vegas federal court on tax charges

Linder attempts to sell "Fair Tax" approach to Bush administration - Replacing the income tax with a national sales tax is too fair and rational an idea to ever become a reality. Such a radical change would remove far too much power from our rulers to ever be acceptable to them.

How Did He Make That Money? - Some analysis of John Kerry's 1040. I will have more on this in the next few days.

Civilize the Tax Code

A Tax Code Report Card

The Taxman's Dirtiest Secret

Bush: Tax Cuts Boosting Economic Growth - A simple basic fact that the Left wants to ignore.

28 Hours Needed to Fill Out Tax Forms - Why I have no sympathy when clients complain about how long it takes us to prepare a tax return. If we were to charge based on the amount of time IRS itself estimates it takes to prepare the various forms, our fees would be hundreds of times higher.

Teresa Fights To Keep Her Tax Returns Private - One of the prices to pay for being in or seeking high office, or married to someone who is, is the requirement to give up the privacy the rest of us have.

Wednesday, April 14, 2004

Tax politics - Using tax stats to promote various, often diametrically opposed, agendas.

Bushes Pay Over $225,000 in Federal Taxes

John Kerry Releases His 2003 Income Tax Returns

You Are What You Tax

Beyond April 15: How Washington Spends Your Taxes

The School-Spending Racket - This kind of abuse of taxpayer dollars by the New York public school system is repeated around the country. The public has been brainwashed to believe that more money always equals higher quality education and that anyone opposed to additional spending on schools is anti-child and inherently evil. Just as with any program with growing amounts of money, the opportunities for corruption and fraud increase in synch.

Best & Worst Tax-and-Spenders in 2003

The Growing Class of Americans Who Pay No Federal Income Taxes - People dropping off the income tax radar on the bottom end of the scale; not the top end, as many stories want to focus on.

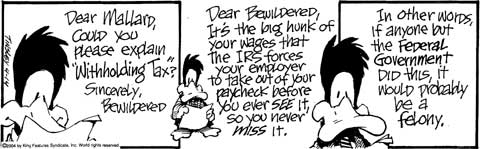

Out of sight, out of mind

Why most people have no clue as to how much they pay in taxes. If everyone had to write a check on April 15 for the full amount of the prior year's taxes, there would be massive support for controls over government spending.

Tuesday, April 13, 2004

Few Fear An IRS Audit Anymore - This just isn't true. Most people are so scared of getting into trouble with IRS that they intentionally overpay their taxes. I see it all the time.

Why Must Tax System Be a Burdensome Fear?

Good letter to the editor in today's Wall Street Journal

Why Must Tax System Be a Burdensome Fear?

It should be alarming to every beleaguered, taxpaying American that the IRS recently reported its accuracy rate in answering telephoned taxpayer inquiries fell to 76% so far this year from 84% two years ago (Tax Report, April 1). I suspect the reason is the increasing complexity and breadth of the Tax Code. This is the unintentional consequence of tinkering with tax law, while maintaining the empire and dominion of the IRS and the influence it wields in our lives.

Would we tolerate a 24% error rate by a surgeon? Would McDonald's be in business today if errors were made in 24% of its orders? Of course not. Why is there not a plan to do away with a system of taxation that makes miserable the lives of honest Americans, fearing an audit and April 15 each year? How can Americans be expected to suffer a system in which we cannot be assured of securing correct information as we navigate our way through the tax maze?

Will we ever elect a president who not only talks a good game about being a friend to the taxpayer, but who places his or her words into deeds, exerting political capital to end a system of tax law that even its administrators can't comprehend and interpret?

Oren M. Spiegler

Upper Saint Clair, Pa.

The Blue-State Tax - A new name for the insipidly ridiculous AMT.

Nearly 1 million signatures for new phone tax in the PRC

The Deadly Third Rail of Politics - Social Security

The FICA slush fund

Proving personal accounts work

Why Housing Is About to Go "Pop!" - It is true that the historically low mortgage interest rates have helped pump up demand and prices of real estate. As has happened before, this will reverse when interest rates rise and fewer people can afford to make their payments. It's a natural cycle and doesn't mean that real estate is a bad investment; just that you need to take it into account and not overpay for properties that are too sensitive to interest rate fluctuations.

Monday, April 12, 2004

John Kerry Sloganator - Some very funny and appropriate campaign signs for the possible DemonRat nominee. New ones are showing up continuously. Following are just a few of my favorites so far, including one I made myself with their easy to use tool.

Rising property taxes scare off homeowners - With property taxes, it is impossible to really truly own real estate. The complete tax burden is a combination of all taxes, including income, sales, excise, as well as those on property ownership and transfers.

States consider property-tax limits - California's 1978 Proposition 13 is still the role model for setting limits on property taxes.

GOP Spinal Implant for Senate - Pennsylvania conservatives have a great opportunity to finally get rid of their RINO Senator Arlen Specter.

Get-rich spruiker puts $1m in limbo - This particular story of gullible people falling for a get rich quick scam is from Australia, but could very easily be from here in the USA. The word spruiker is a new one to me. It seems to be like a carnival barker, or as this definition I found on the web:

Spruiker, pronounced Sprooker...is a guy who stands on the door outside of a seedy strip joint and tells you what’s going on inside in an attempt to get you to go in.

That reminds me of walking around the North Beach section of San Francisco, where guys were always trying to lure us into their strip clubs, even when we were in our teens. The analogy to use this term for the get rich quick scammers is appropriate.

Down To The Wire? Move The Wire! - Some good tips on filing for extensions. Because of my backlog of 2001 and 2002 tax returns, I will have only prepared one 2003 1040 by April 15, with the other 90+ on extension. I only did that one in order to test out the settings for the 2003 Lacerte program.

National High Five Day - April 15 isn't just Tax Day this year. It's also on the third Thursday in April.

Sunday, April 11, 2004

Saturday, April 10, 2004

Following Clinton's lead, John Kerry would raise everyone's taxes

IRAs: a Calculation, a Caution and a Charitable Benefit

Friday, April 09, 2004

The trouble with taxes: Too hard and they make no sense - This is breaking news to anyone?

In Pig Book, lawmakers go hog wild - As usual, we all get a good laugh at the tax dollars being wasted; and nothing ever changes.

Ploy by "Dirty Dozen" GOP conservatives planning to stymie spending via rules - It's nice to see that there at least a few politicians on our side who are willing to play the game a little tougher than the spineless wimps who don't want to appear mean and insensitive by opposing the flushing of tax dollars down the commode.

Reiner Drops Initiative to Raise Taxes for Schools - MeatHead is giving up in his attempt to mess with Prop 13 in the PRC.

Antitax groups hit 'big spenders' in Virginia

John Kerry Taxes Will Sock It To Middle Class Families

Despite Major Tax Cuts, Fiscal Voting Records Showed Only Minor Improvement, Non-Partisan Congressional Rating Finds

Comparing Tax Burdens Across the Nation

Thursday, April 08, 2004

No, Virginia, government isn't Santa Claus - More on the RINOs trying to raise taxes in Virginia.

New Data Show How Your State Ranks in Taxes

Justice Dept. Files Suit on Tax Shelters for Churches - IRS cracking down on the Corporation Sole scam that I've mentioned a few times before.

Top execs turn to tax code to boost fuel-efficient sales - Using the tax code for some more social engineering, encouraging purchases of vehicles that can't survive in the marketplace on their own merits.

Tax cuts are not 'spending' - One of the long running lies from the Left that has always bugged me is that allowing anyone to keep some of their own money is considered to be the exact same thing as taking money out of the pockets of poor people and cutting a check to evil rich fat cats.

Pro-taxers aren't real Republicans - That's where the term RINO (Republican In Name Only) comes from.

Give Peace a Chance - I hadn't heard of this new group set up to fix the dreaded AMT problem; nor could I find it via Google. It sounds very similar to the ReformAMT group I have been promoting for the past few years; so I hope they can work together for a common goal.

Six Fixes for the Tax Mess - I don't agree with some of these ideas - especially the concept of taxing capital gains and dividends the same as other income - but in the spirit of honest and open debate, we can look at them. In case anyone has forgotten my position on dividends and capital gains, they should be completely tax free; not just taxed at special rates.

Why Your Tax Cut Doesn't Add Up - NewsWeek fanning the flames of class envy.

The Most Taxing of Seasons - NewsWeek's leftist tax expert, defending all of the things I'm against, such as the estate tax and other punitive soak the rich schemes.

Annual Warnings

Every year at this time, as the nation turns its focus towards "Tax Day," IRS issues a series of warnings about how dangerous it would be to not follow the rules properly, such as the following.

IRS, Justice Department Note Increase in Tax Enforcement

IRS Warns Businesses, Individuals to Watch for Questionable Employment Tax Practices

Treasury and IRS Issue Guidance on S Corporation, Tax Exempt Entity Transaction

IRS, Justice Dept. Promise Vigilance in Tax Enforcement

Wednesday, April 07, 2004

Let Seniors Get Off the Sinking Medicare Ship

Private Investment Protects Environment Where Government Fails - Something I've always known. Privately owned property is better maintained than what is owned by the government. This is 180 degrees off from what the environmental extremists (Sierra Club, GreenPeace, et al) and their media allies, want us to believe. Their very explicit agenda is to ban private ownership of property entirely, which was also a plank in a certain well known manifesto from 1848.

Making Life's End a 'Good Death' - Some good info, with handy links, on living wills (which are not the same thing as living trusts, as many people think).

Treasury to Probe Kerry Tax Analysts - This is a completely bogus "scandal." The media are free to publicize and promote John Kerry's lies as gospel, and it's somehow wrong for the Treasury Department to look at the actual figures.

In Pig Book, lawmakers go hog wild - Where the drunken sailors' wild spending is documented. In defense of sailors everywhere, the big difference between them and our rulers in DC is that the sailors spend their own money when they become inebriated, while our rulers are spending our money in all states of sobriety.

John Kerry and Corporate Income Taxes

Stock spammers get rich quick - Anyone stupid enough to buy stocks based on some secret inside info they received in an email is probably also buying real estate on the moon and naming stars; other brilliant investments for morons.

Tuesday, April 06, 2004

Getting Organized

I've posted more details on how our tax return organizers function that should hopefully clear up some of the confusion.

Who pays the taxes? - The trend continues of having fewer and fewer people (the evilest rich) pay a larger and larger share of the overall tax burden.

Americans are too optimistic about retirement, study finds - That's especially true for anyone under 50 who believes Social Security and MediCare will be covering their retirement costs.

Tax Freedom Day Comes on April 11 in 2004, Earliest Since 1967 - Thanks to the Bush tax cuts.

Tax-Law Complexities Benefit Preparers, Software Cos. - There is no profession with more job security than the tax business. Our best allies are our rules in DC, who make more work for us very time they try to fix the tax code.

John Kerry Says Jobs Creation Bad for Economy

Many Firms Avoided Taxes in Boom - This is just more "hate the rich" type rhetoric, decrying tax breaks for the "other guys" (aka evil corporations). What these complainers fail to acknowledge is that corporations aren't intended to pay taxes under true capitalism. They are merely conduits for their owners, employees and suppliers, who pay more than enough taxes on corporate revenues.

Satellite TV Services Eyed For New Taxes

Don't tax my dish!

Stop the Satellite Tax

Dividend Tax Cut Causing Many Headaches - Problems on two fronts. Errors with info on 1099-DIV and then confusion on how to properly report the different types of dividend income on the 1040. This is another benefit in waiting until after April 15 to prepare tax returns. Hopefully by then, most of these errors will be straightened out.

Predicted bonanza from the IRS is failing to meet expectations - Mixed stats. Larger refunds for some people and little changed from earlier years for others. As any financial expert will tell you, it's much better to have the higher take home pay throughout the year than receiving a big check from the IRS every April; so I can't get too worked up over small refunds.

Is Your Retirement Plan Gouging You on Fees? - Besides not having your retirement funds invested in risky stocks, you need to be sure the administrative fees don't eat up your nest egg.

Monday, April 05, 2004

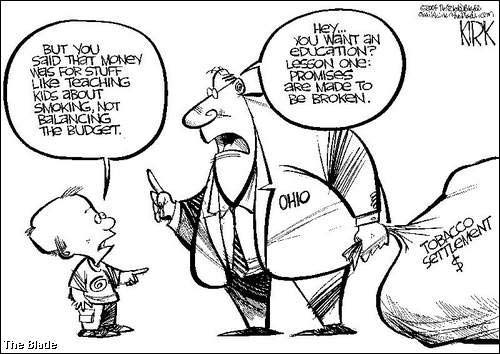

Just another example of things our rulers routinely do with impunity that would land private sector people in the slammer. Any time a new tax or fee is sold to the public as being for some great and noble cause, you can be sure that the money will eventually be diverted to other pet projects or just commingled with the general budget - another no-no in the real world.

Loophole makes drive time less taxing for state pols - This sounds more like sour grapes and resentment by the legislators who love too close to the capitol to be able to claim the larger out of town tax deductions.

E-mail tax forecast - The longer our rulers in DC take to address the issue of taxing the Internet, the less likely the chances of a reinstatement of the recently expired moratorium; especially if a bunch of tax hungry States and local jurisdictions jump in soon to fee off of this new source of revenue.

John Kerry admits corporate taxes are too high, but his plan would make things worse - Consistent with his practice of taking every side of every issue.

John Kerry Camp Hits Bush for 'Drunken Sailor' Spending - It takes one to know one. In fact, his mentor, Teddy Kennedy is the real thing - a lying politician who is also a very real drunken sailor (and driver).

GOP Sen. Specter Challenged From Right - The Club For Growth is doing a great job going after this RINO from PA.

Art imitating life...

This hits fairly close to home, since I have lost almost 35 pounds since Sherry & I started the Atkins Diet back last September.

A bill full of pork - The drunk sailors are firmly in charge in DC. Will Bush have the stones to veto this mess?

Sunday, April 04, 2004

Getting Your Child Tax Credit Right - It's really important to have good records and let your tax preparer know if you received the advance tax credit payments last year or not.

Saturday, April 03, 2004

New Software Seeking State Tax Scofflaws - While at first blush, this may strike many as more Big Brother, it seems to me to be a good thing that State tax agencies are using the high tech tools that are available to carry out their duties as efficiently as possible.

From MSN Money

Make a mistake? You can make amends - While not all items can be changed on an amended return, most can.

How refinancing costs you at tax time - It's never a good idea to pay out more just to get higher tax deductions. The biggest mistake I see regarding refinances, especially with most tax pros, is that they spread out (amortize) the deduction over the nominal life (15 to 30 years) rather than the more realistic expected lifespan of the loan (3 to 5 years), which I have been doing for decades. Both methods are technically correct, but mine results in larger deductions sooner than the more common wimpier method.

Friday, April 02, 2004

John Kerry has proposed $2.76 trillion in new spending

Defiant Republicans Could Break Va. Impasse - More RINOs on the loose raising taxes.

Strangest taxes - Rather than listing every kind of tax there is, it would be much less time consuming to come up with just those things that are not taxed, and then wait for John Kerry and his Fellow Traveler DemonRats to go after them.

IRS Puts Shelter Sold by KPMG On 'Abusive' List - This is an interesting tax avoidance technique - donating S corp stock to charities and shifting income to them. There should be a way to do this legally, but it sounds like KPMG was helping clients use it in very abusive ways.

April Fool pension joke falls flat - Actually, using lottery tickets as pension benefits may be better than some actual plans, such as Social Security.

Thursday, April 01, 2004

Our misspent tax dollars

The Power to Destroy - The nickname some give to taxation.

The Income Tax: Root of all Evil

House Speaker Willing to Negotiate on Tax Cut Deal