Amended Clinton Tax Return?

Q:

Subject: hillary clinton tax return blog post

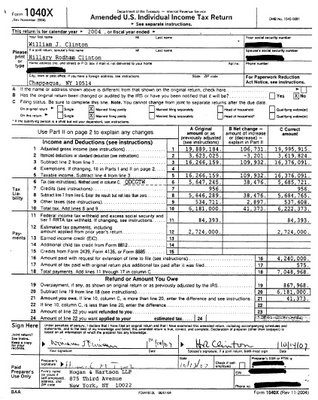

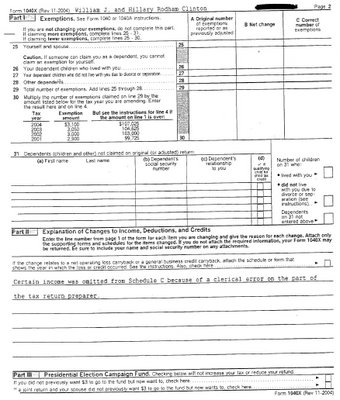

One of my co-workers ran across your blog post about a possible error on Hillary's return.

Note the last 2 pages of the 2004 pdf on the Clinton website, where it has an amended return.

A:

I did see that 1040X. However, the changes it had were not in any way related to the issues raised by my readers and posted on my blog. Those questions have yet to be answered.

Thanks for writing.

Kerry Kerstetter

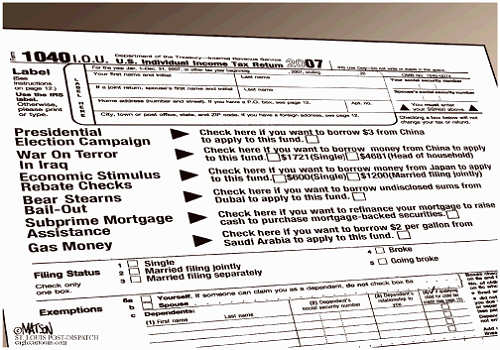

(Click on image for full size)

(Click on image for full size)

Labels: Clinton

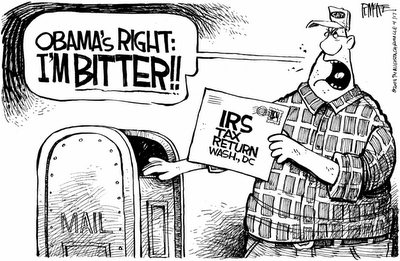

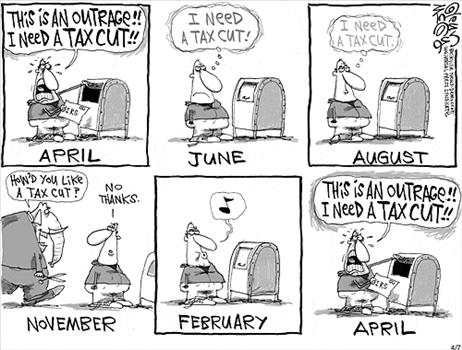

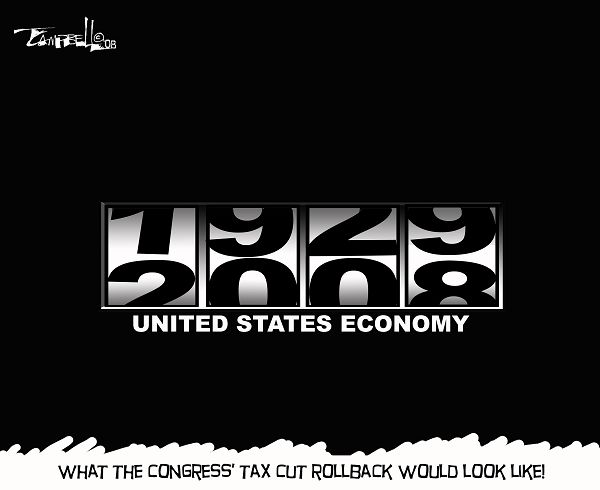

Taxes in 2008 vs. 1999

Snopes.com has an interesting look at the Federal income taxes at various income levels under the tax rate structure from the Clintons' 1999 and Bush’s 2008. No surprise which is lower for every income level.

If the Bush tax cuts are allowed to expire, eveyone at all income levels will see their taxes jump by quite a bit.

Labels: TaxBurden

Other tax protestors...

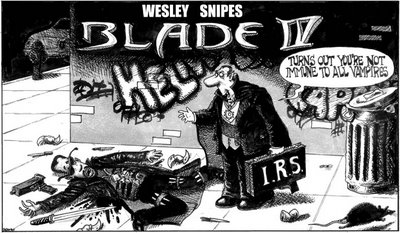

A few weeks ago, I received the following email from someone who obviously wants to follow in Wesley Snipes’ footsteps in regard to taxes.

Subject: Tax Question

Hi My name is Frank

My Friend told me to check out you web page and that you are claiming that YOU MUST FILE at Tax return or else.

So if what you are telling me is true according to your web page then it should be very simple to SHOW ME THE LAW.

After all there has to be a Law, Right? If there is a law then I will send you an apology an I will also get a group that will actually PAY YOU MONEY should you find this LAW.

You are stating SCAM so if this is true then it won't be any problem for you to prove your point right?

Please refrain from double speak or dancing around the issue and show me the law, because after all that is what we base our constitution on isn't it? Unfortunatly I did NOT see where you were specific about the LAW on this issue.

Thanks

Frank

My Reply:

Frank:

It's been a while since I've received an email like yours, espousing the idiotic tax protestor arguments against the tax system. I used to receive several every day before the IRS started directly addressing these ridiculous claims on their own.

As many of your compatriots have done in the past, you have obviously mistaken me for someone else. I am a private citizen and have no responsibility for the administration of the tax law. I have no requirement to answer any of your stupid questions or waste any more of my time debunking your moronic theories about how the tax system works in this country.

I actually couldn't care less if you want to pretend that there is no law requiring you to file tax returns and spend the rest of your life fighting for your life in court and prison. In fact, the more time the IRS spends dealing with idiots like you and your cohorts, the less time they will have available to harass those of us who obey the laws.

You need to address your concerns to the governmental agency that handles tax matters, the IRS.

To save you time, they have a special web page dealing with the frivolous arguments that you are trying to use. You should start there if you truly care about the truth.

Good luck.

Kerry Kerstetter

Labels: Morons

Wesley Snipes Verdict In

Judge sentences Snipes to 3 years for tax convictions

Wesley Snipes Sentenced to Three Years in Jail

Labels: Morons

Some interesting articles by Terry Myers & Dee DeScherer in the latest Intuit ProConnection:

Help Your Clients Navigate a Troubled Stock Market – Includes a downloadable doc file to explain to clients about taxes on capital gains and losses.

New Tax Return Disclosure Regulations Hit Client Communications

Documenting vehicle weight...

Q:

Subject: Section 179 & Toyota Highlanda Hybrid, GVWR 6150 lbs

Tax Guru,

I've come across an interesting situation. The 2008 Toyota Highlander Hybrid has a sticker/plate inside the drivers side door that states the GVWR as 6150 lbs. However, all the marketing brochures and even Toyota's web site lists the GVWR as 6000lbs. We're thinking of buying this SUV for our small business and want to understand if it qualifies under Section 179.

The plate on the SUV would seem to indicate it does but all other posted information seems to indicate it doesn't.

Any advice?

Thanks.

A:

You really need to be discussing this with your own personal professional tax advisor. However, I am willing to explain how I would address this if it were with one of my clients.

I am guessing that the discrepancy in the listed weights may have something to do with some optional equipment that was installed on the vehicle with that ID plate. The promotional literature from Toyota most likely deals with the standard vehicle before the addition of any optional equipment.

I've mentioned on several occasions how some auto dealers actually offer "tax deductibility" add-on packages of options that take an under 6,000 vehicle into the over 6,000 pound qualifying area. This is why feeling limited to the weights shown on promotional literature is not appropriate.

If, as it seems, you are nervous about IRS possibly disallowing your larger Section 179 deduction for a vehicle over 6,000 pounds, I would go the extra mile in documenting the legitimacy up front. As I've mentioned on numerous occasions, one of the main reasons I am opposed to electronic tax returns is the inability to include additional documentation of potentially questionable items. This is a perfect example.

In your case here, I would take a photograph of the ID plate indicating the GVW of 6,150 pounds and attach it to the tax return where you are claiming that Section 179 deduction. I can't imagine any IRS auditor wanting to quibble over that being wrong. If anything, you may be questioned about your business usage of the SUV; but I can't see the weight being an issue of contention if you have that photo attached.

Again, you should run this by your own professional tax advisor.

Good luck.

Kerry Kerstetter

Labels: Vehicles

Reduced tax free gain on home sale...

Q:

I came across your information on the web and was wondering if you could clarify what the pro-rated capital gains exclusion (amount) is for selling your primary residence less then 2 years. Is this $342.47 per day, per person for the length of time that you lived in the house before selling?

I would be happy to compensate you for your advice.

Thanks

A:

The tax free gain does work out be $342.46 per day that you both owned and lived in the home as your primary residence. This is $250,000 divided by 730 days.

IRS has a worksheet for calculating the reduced excludable gain in Publication 523 on their website.

Most professional tax software has the capability to calculate this based on the number of qualifying days; so be sure to give that figure to your personal professional tax preparer.

Good luck.

Kerry Kerstetter

Labels: 121

Working with cash...

Q:

Subject: Cash Tags

KerryCash tags, does cash have to be taken out of your business to be spent on expenses as cash. Or is all cash spent on expenses regardless of its source deductible as long as you have your receipts saved. Money from savings an example.Do you have to divulge the source of the cash to use the deduction?

A:

If you are posting cash expenditures made for business related expenses, it doesn't matter where the cash came from, as long as it wasn't from unreported taxable cash income. It could be from personal or business accounts.

Depending on the overall size of the cash expenditures for the year, the level of documentation should coincide. Small amounts shouldn't be anything to worry about.

However, if you're getting into thousands of dollars, you need to be prepared to defend the original source of the cash in case IRS were to ever inquire about it. They actually have audit teams that examine people in businesses that deal primarily in cash to ensure that every penny is accounted for. Many of those people actually cut their own throats by reporting thousand of dollars more in personal and business expenses than the level of income they are reporting. There are plenty of classic cases of tax fraud where people are living very high on the hog, while reporting very small amounts of income on their tax returns.

IRS auditors are trained to start off from the premise that all money received is taxable income unless the person can prove otherwise. So if you do come into a large amount of cash that was a gift, inheritance or one of the few tax free sources, you need to be diligent in documenting this fact.

One of the best ways to document cash is with QuickBooks. Set up a bank account called Cash and show money going in and out just as you do with a normal bank account. Doing it that way would protect you from IRS accusations of having unreported income.

Good luck. I hope this helps.

Kerry

Labels: Accounting

Is double taxation good?

Q:

Subject: Double taxation?

Kerry,

Thanks very much for your informative and enjoyable blog.

I often hear the line that C corporations are a bad choice because of the double taxation issue. I know you have explained before that there are many ways to avoid double taxation. But I have tried to figure out why "double taxation" is really worse than the alternative.

Let me explain my thinking. As I understand it, the first $50,000 in income for a C corporation is taxed at 15%, and any dividend that would be paid to shareholders is also taxed at 15% (maximum). Combined, that is a 30% tax rate. This seems like a bargain compared to the corporation paying a salary: The individual would likely pay a 28% tax rate on the salary (assuming the individual has already reached the 28% bracket from other income), and then would pay an additional 15.3% FICA tax (half paid by the corporation), for a total federal tax rate of 43.3%. Since 43.3% is more than 30%, isn't "double taxation" actually the preferred outcome here, at least for $50,000 worth of corporate income?

Thanks,

A:

I'm too busy right now to go into too much detail.

However, you may have missed the point that I am not a fan of using payroll as a means of shifting income from the corp to the 1040 because of the payroll taxes. We use unearned income, such as interest, rents and royalties, which have no payroll taxes associated with them; just normal income tax.

By properly shifting income back and forth, we have been able to very easily achieve a maximum Federal income tax of just 15% overall; not the 30% under your double taxed scenario.

A good tax advisor, along with accurate up to date QuickBooks data, should be able to help you achieve this.

Good luck.

Kerry Kerstetter

Labels: corp

Phony IRS Emails

I received the following from a client about a week after another client faxed me a copy of similar email she had received:

Subject: Is this a scam?-->> Tax refund - Online form

Kerry

I got the below notice – supposedly from the IRS. There is a link to push – but I see the words –redirect- and I think this is some kind of scam to get my ss# or who knows what.

Do you think that this is legit or scam?

------ Forwarded Message

From: Internal Revenue Service <taxrefund@service.irs.gov>

Reply-To: <taxrefund@service.irs.gov>

Date: Tue, 15 Apr 2008 13:09:37 -0700

Subject: Tax refund - Online form

After the last annual calculations of your fiscal activity we have determined that

you are eligible to receive a tax refund of $620.50.

Please submit the tax refund request and allow us 3-6 days in order to

process it.

A refund can be delayed for a variety of reasons.

For example submitting invalid records or applying after the deadline.

To access the form for your tax refund, please click here

Note: For security reasons, we will record your ip-address, the date and time.

Deliberate wrong inputs are criminally pursued and indicated.

Regards,

Internal Revenue Service

Copyright 2008, Internal Revenue Service U.S.A. All rights reserved.

My Reply:

That URL appears to be in Japan.

That is one of the scams that IRS has been warning people about.

Snopes.com covered this specific scam on their site.

Kerry

Labels: scams

Estate Tax Hypocrisy

The Kennedy Klan has been promoted to a status of as close to royalty as can be attained in this country, in spite of the fact that their fortune was amassed by Joe Kennedy through illegal bootlegging and stock fraud activities. To top it off, they have long used trusts to avoid having to pay the kinds of estate taxes that they want everyone else to pay.

This is an interesting video of Teddy explaining how they pay their fair share.

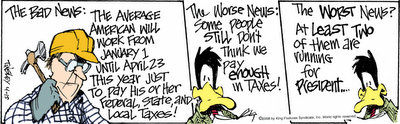

Tax Freedom Day

The Tax Foundation has calculated that this year's Tax Freedom Day is tomorrow, April 23. They've produced an entertaining and informative video on what this means.

Labels: TaxBurden

Gifting ceases with death

Q:

Subject: Gift tax question

Hello: I read your blog, but could not figure out how to ask you a question. My 90 year old mother died in 9/2007. Prior to her death she had been gifting $12,000 per person and paying tuition directly to institutions. The estate has not yet settled because the executor asked for an extension. I just received my tuition bill for $11,000. 1) Do the $12,000 per person gifts continue after death, and 2) do the tuition payments continue after death? When you answer, could you point me to the appropriate IRS literature? Thank you,

A:

This isn't really a tax issue that you are dealing with. It is more of an estate settlement issue that you need to work out with the attorney and executor who are handling the disposition of your mother's estate. Some of the exact answers will depend on the rules for your mother's particular state of residence when she passed away.

Basically, when a person passes away, her ability to make gifts terminates at the same time. So, the annual gifts your mother was giving you can't continue.

however, this is when her will or living trust kicks in. She may have left you a lump sum of money to use to continue your education or she may have designated that a trust be established for your benefit, out of which your tuition will continue to be paid. Both of these, as well as other variations and combinations, are common estate planning scenarios.

Again, you need to consult with the attorney and executor to see how you will be affected.

Good luck.

Kerry Kerstetter

Follow-Up:

Kerry: Thank you so much for your response! I thought that her ability to gift died with her, but I could not find anything that actually said it. Sincerely,

Labels: Gifting

Taking a piece of the action...

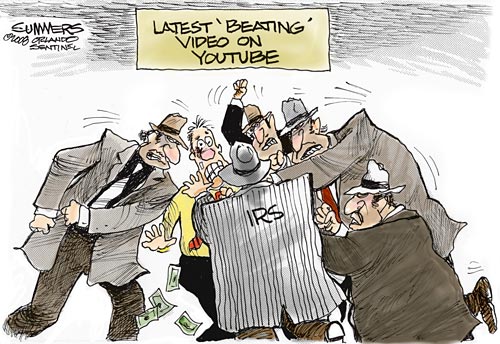

From the recent Freaking News PhotoShop contest with examples of how it would look if taxes were extracted in other, non-monetary, ways.

Letterman's annual tax preparer top ten as delivered by ten tax pros:

Top Ten Reasons I Like Being An Accountant

10 "My exciting lifestyle is the envy of all my claims adjuster colleagues" (Arthur Drucker)

9 "I made ten grand doing taxes for Leona Helmsley's dog" (Richard Koenigsberg)

8 "Numbers are my only friends" (Andrew Rubin)

7 "What other job allows you to show up for work in just a suit and tie?" (Lou DeFalco)

6 "Mild-mannered day job protects my true identity: Batman" (William Bregman)

5 "I'm always the first to hear about all the latest calculator innovations" (Steven Goldsteen)

4 "I was a finalist on last season's "Accounting With The Stars"" (Vicki Penino)

3 "When some idiot asks me about a form 8038-G information return for tax-exempt governmental obligation, when they really mean a form 1038-R recovery of overpayment under arbitrage rebate provisions -- that s***'s hilarious!" (Andrew Ross)

2 "If I screw up something, you go to jail, not me!" (Sandra Busell)

1 "I get more tail than George Clooney" (Richard Cohen)

Labels: humor

From Craig Ferguson via NewsMax:

It’s tax day! Or as Wesley Snipes calls it, Tuesday.

From Jimmy Kimmel via NewsMax:

Taxes were due today. I don’t like writing the check. I thought we were supposed to be passing the irresponsible spending onto our grandchildren. What happened to that?

Labels: humor

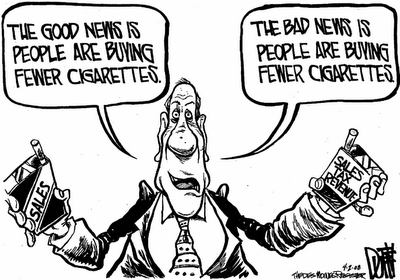

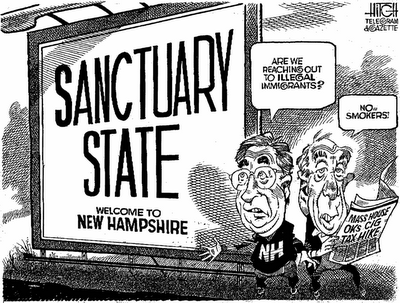

Tax Sanctuary?

Most of our tax loving rulers make the big mistake in assuming that changes in the taxes will have no effect on the behavior of people. For example, if state rulers set their sin taxes too high, the targets of those taxes will just go and do their sinning somewhere else or use other means to avoid those taxes, such as smuggling and internet purchasing.

(Click on image for full size)

From last night's Letterman show via NewsMax:

It’s tax time. I saw this the other day: The United States government takes a third of your money. A third. My God, it’s like being married to Heather Mills.

Labels: humor

Why Tax Day Makes Mr. Zelin Want to Sing – WSJ profile of the Singing CPA. Check out his funny parody songs on his CDBaby page.

Ozarks Disaster Relief Delay

We have been having a ton of rain and nasty weather in this part of the Ozarks for the past several weeks. I received this from a client with whom I have been working on establishing payment amounts for their extensions:

Kerry, I thought our county got an auto extension because of the flooding until late may. If not, I can come up with 52k like i did last year without a lot of pain.

I checked both the IRS and DFA websites and found this notice on the DFA site:

April 11, 2008

Tax Relief for Disaster Victims

LITTLE ROCK, AR— The Department of Finance and Administration announced today that taxpayers in 52 counties declared state disaster areas due to damages caused by severe storms, tornadoes, and flooding will be provided special tax relief. The Department is extending the deadline for taxpayers who reside or have a business in the disaster areas to file and pay any tax due on their individual or corporate income tax returns until August 15, 2008.

Affected Counties The affected counties are: Arkansas, Baxter, Benton, Boone, Carroll, Clark, Clay, Cleburne, Conway, Crawford, Craighead, Cross, Faulkner, Fulton, Garland, Greene, Hot Springs, Howard, Independence, Izard, Jackson, Jefferson, Johnson, Lawrence, Lee, Logan, Lonoke, Madison, Marion, Mississippi, Monroe, Nevada, Newton, Perry, Phillips, Pike, Pope, Prairie, Pulaski, Randolph, St. Francis, Saline, Scott, Searcy, Sharp, Stone, Van Buren, Washington, White, Woodruff, and Yell.

In addition the Department will waive the failure to file, failure to pay, and interest charges for businesses unable to make withholding deposits for tax payments due April 3, 2008 to May 27, 2008 because of the recent storms, tornadoes, and flooding.

When claiming the special extension on a 2007 State income tax return payment document, please write Disaster Storms” on the front of the mailing envelope and on the top left corner of the income tax form. This helps speed-up processing of your return. If you receive a notice of penalties and interest, call (501) 682-1100 to request relief.

My reply to the client:

The floods were only a state level disaster, not Federal. DFA has put out announcement that they are giving people in the flood counties until 8/15/08 to file their Arkansas tax returns. This does not apply to IRS. I just checked the IRS news site and there is no mention of any special extensions.

My experience with DFA is that they are terrible about actually following through with this kind of special deal. The relief notice even says that anyone receiving penalty notices will have to call a special phone number in order to get them dropped.

If you have the money, it would be safest to just pay both the IRS and DFA amounts by Tuesday.

Kerry

Additional Info:

Because these severe weather problems also affected the Missouri part of the Ozarks, I wondered if that state had a similar extension of the tax deadline. I just checked on the MDOR’s website and they have given people in the affected counties until May 19, 2008 to file their 2007 tax returns..

Labels: StateTaxes

New Taxes...

Looking at new tax schemes being proposed and perpetrated in different states and countries can give us a preview of what we may be seeing in our own jurisdictions. Here are some new ones that recently hit the news in two of the main categories of taxation (punishment).

Sin Taxes – These obviously depend on the need to allow our imperial rulers to decide what things are bad for us, which is unfortunately a growing trend as more people accept government as our nanny.

Soak the evil rich – this kind of punishment on success never goes out of style. Some reminders are in order for those who have no sympathies for new taxes on millionaires. Once you accept the premise of extra taxes on certain income levels, it is a very simple task for our rulers to reduce that level to capture more money from more people. It happens all of the time, the classic camel’s nose under the tent..

The other is the fact that in 1993, one of the first accomplishments of the Billary Clinton presidency was a huge retroactive tax increase that included a “Millionaire Surtax” that actually kicked in at taxable income levels of $250,000.

The cost of being rich. New tax bracket for Md. millionaires becomes law

Labels: TaxHikes

The Double (Tax) Life Of Americans Abroad – Dealing with the interplay of taxes in both the USA and other countries is one of the trickiest aspects to working with clients who work outside our borders.

Capitalizing on new tax break

It still amazes me that all of the media coverage of the recent tax law focuses on nothing but the tiny rebate checks and ignores the huge increase in the Section 179 deduction that could save small business owners a lot more money than the stupid rebates would provide.

It was interesting to receive a mass email today from HP with the following subject:

See how the new economic stimulus bill might benefit you!

The top text:

The economic stimulus bill signed into law by President Bush on February 13, 2008 provides some exciting benefits for business!

One provision substantially increases the amount that small businesses can deduct for certain capital equipment expenditures from $128,000 to $250,000.

A second provision allows for bonus depreciation in 2008 on certain capital equipment expenditures purchased this year that would normally be depreciated over many years.

Of course, we recommend you speak with your tax advisor on how these provisions can benefit you directly.

This reminds me of a snail mail letter I received in 1984 from American Motors shortly after our rulers in DC had instituted the luxury car limits on vehicle depreciation. The letter was addressed to tax professionals, advising us of how much more in tax savings via depreciation and the Investment Tax Credit our clients could have if they were to purchase a Jeep Grand Wagoneer because it weighed over 6,000 pounds, instead of a lighter vehicle.

I have always thought this kind of angle is a smart marketing approach and have been surprised that more companies didn’t use it.

Labels: 179

The Coming Tax Bomb – If the Bush tax cuts are allowed to expire, we’re all in for a whopper of a tax hike. Of course, the “silver lining” in this is much more work for those of us in the tax reduction industry.

Labels: TaxHikes

Always remember that our rulers need our money more than we do…

From last night’s Kimmel show, via NewsMax:

Taxes are due next week. We all hate paying taxes, but without our tax money, many politicians would not be able to afford prostitutes.

Labels: humor

Some tax jokes from the late night shows last Friday, via NewsMax.

Letterman:

Just a few days away from tax time. The governor and Mrs. McGreevey had a four way with H&R Block.

Conan:

The Clintons just released their tax returns. Over the past eight years, they’ve donated over $10 million to charity. When they asked Bill Clinton why he gave so much money to charity, he said, “She’s a really good dancer.”

Labels: humor

Clinton Tax Lessons - Some interesting commentary on the Clinton tax returns from the WSJ.

Labels: Clinton

Marriage & residence sales

Q:

Subject: a question

Dear Expert

In the sale of a residence do the two out of 5 years of married and occupancy need to be consecutive to get the married deducion?

Could I have the first of the five yrs with my husband and and then remarry and re occupy in year five and get the married deduction?

Help

A:

If this is a real world issue, you and your new husband need to work with your personal professional tax advisor to see how to report the home sale.

If, as it seems, this is merely a hypothetical question, you should take a look at this section of IRS's Publication 523 which deals with this issue.

Your question actually covers two different matters. The non-consecutive issue is easy. The rules have always allowed any amount of consecutive or non-consecutive time totaling 24 months within the 60 months prior to the sale. This is the case for the same taxpayers.

It's quite a different story for a case with different taxpayers, such as a new husband. Your new husband can't count the time your previous husband lived in the home as his own.

While in this scenario, you wouldn't be able to exclude the full $500,000 maximum gain, you would qualify for an exclusion of $250,000 and your new husband would have a pro-rated exclusion. Depending on the size of your actual gain, that combined exclusion may be enough to shelter it all.Again, if this is a real situation, your own personal professional tax advisor will be able to crunch your numbers for you.

Good luck.

Kerry Kerstetter

Funny bottom lines...

Q:

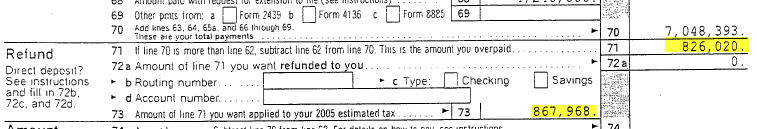

Subject: Clinton's 2004 Tax Return?CLINTON 2004 TAX RETURN Question?How could Line 73 (amount on Line 71 applied to your 2005 Estimated Tax) be $867,968 wheaeas Line Line 71 (Overpaid) is $826,020 ???

A:

Good catch. I guess I shouldn't have skipped over those middle years when I was perusing the 1040s.

A little while ago, when the Obamas released copies of their 1040s, I mentioned the possibility of the Clintons preparing phony versions of their tax returns to show to the public.

The problem with trying to do that is the need to make the numbers appear to be consistent from schedule to schedule and line to line. You may have spotted an example of somebody not being careful enough in that regard.

Thanks for pointing that out.

Kerry Kerstetter

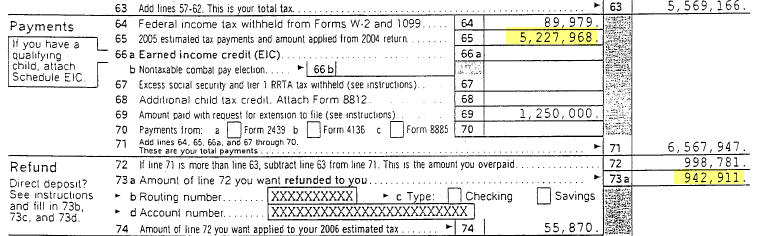

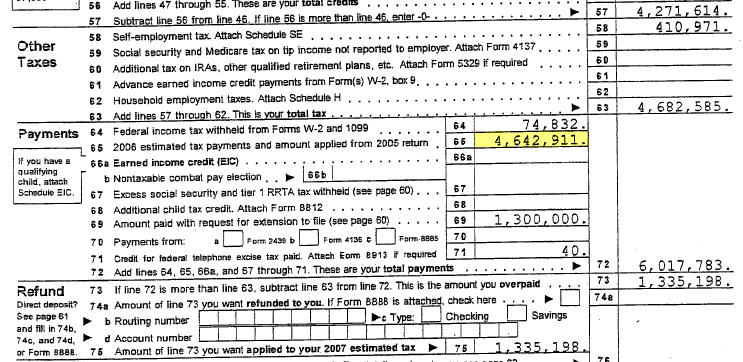

Follow-up:

Subject: 2005 Clinton Tax Returns??

Another Strange twist to this story:

2005 Return:

Also on Line 65 (2005 estimated tax payments and amount applied from 2004 return) $5,227.968 seems to reflect that $867,968 (Line 73 - 2004) was included or some part thereof.

http://www.hillaryclinton.com/feature/returns/2005.pdf

From another CPA:

"And following along the strange twist line if you look at the 2006 return the amounts on line 65 seem to include the amount in some fashion from the 2005 return of 942,911 which was listed as a refund of overpayment but appears to be included in the estimated payments for 2006".

Weird stuff

Labels: Clinton

Clinton Tax Returns

It looks like the campaign for a third term in the White House is a little more demanding on the need for disclosure than they expected. They have released copies of their 2000 through 2006 1040s, along with a one page summary of their 2007 income.

Several other media outlets have covered summaries of the figures, such as in this article in the Washington Times. From a geeky tax pro perspective, I noted how the tax returns evolved from 10 pages for 2000 to 68 pages for 2006.

You can download each year separately from links on the bottom of this page on their website or from this 16.5 mb zipped file I created that includes all of the 2000-2007 files in one handy download.

This close to April 15, I obviously don't have time to look over every page of these tax returns; but one other interesting schedule from a geeky perspective was this mortgage interest worksheet on page 38 of the 2006 1040. It shows the average personal residence mortgage to be $3,279,728 for the year, which means that only 33.5% of the interest they paid during the year was deductible because of the one million dollar limit on acquisition debt. This resulted in $105,673 of non-deductible interest for 2006.

Labels: Clinton

Scammers file taxes for York man – This man was actually quite lucky that the theft of his identity was discovered Who knows how many similar scams go undetected?

Labels: scams

From Letterman's show last night per the NewsMax recap:

It's tax season. You always gotta be careful. In fact, I always ask my date for a receipt.

Labels: humor

Comparing tax prep methods...

Taxes, Three Ways – Thanks to Ed Lyon from TaxCoach Software for the link to this interesting article comparing three different ways to have your tax return prepared. It was featured in his latest weekly email bulletin, which anyone can subscribe to, even if you don’t subscribe to the full TaxCoach service.

The gist of the article is just what I have always said. Those of us in this profession who stay up to date on tax savings opportunities for our clients have absolutely nothing to fear from do it yourself software or the assembly line tax prep services. I have never considered either to be any kind of competition.

To be quite frank, anyone not savvy enough to understand the benefit of paying someone like me one or two thousand dollars in fees in order to reduce their annual tax bill by $10,000 to $20,000 from what it would be with the other kinds of tax returns isn’t really the kind of person I want to work with. Of course, those kinds of fees are more for timely advice and strategic planning assistance, while the assembly line firms’ fees are just for filling in forms, as it is for do it yourself software.

Labels: preparers

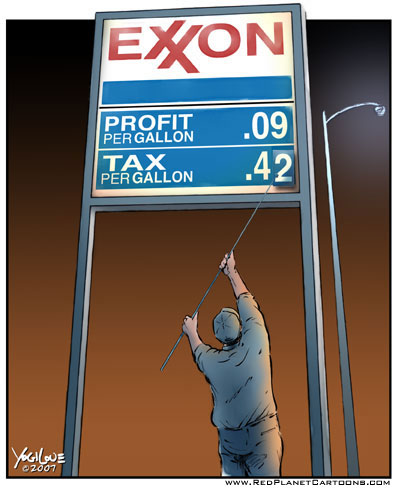

Who makes the most profit from high gas prices?

When are the congressional hearings going to be scheduled on price gouging by our bozo rulers in DC?

Do extensions affect the upcoming rebates?

Q:

Hi Kerry

Questions:

If I file my 1040 in Oct, does this mean no rebate?

If I do get a rebate is it taxable?Is 2008 the year where there is ZERO capital gains?

If so, does this mean that if I sell some highly appreciated stock (held 15-17 years) before 12/31/08 that I will NOT have to pay ANY cap gains?

A:

The rebates, which are supposed to be sent to anyone who files a 2007 1040 by October 15, 2008, are similar to rebates we had a few years ago.

While not technically taxable as income; they will decrease the refund or increase the tax due with the 2008 1040. It's pretty much the same effect as having $600 less withheld from your paycheck for the year or reducing your 1040-ES payment by $600. If IRS sends you a check for that amount, it will just mean that your refund next tax season will be $600 lower than it would have been. It's a desperate plan to give people part of their next year's tax refund a year early in order to give them some spending money to goose the economy now.

People who don't file their 2007 1040s by 10/15/08 will actually be able to have their rebate amounts applied against their 2008 tax return.

The special 0% Federal tax rate for some long term capital gains does start in 2008. It's not the entire gain that is subject to the 0% rate; just the portions that would have been taxed at 10% and 15%. Check out the bottom of my web page on 2008 tax rates.

I hope this isn't too confusing.

Kerry

Labels: Rebates

Deducting 100% of meals?

Q:

Subject: Meals 100% Deductible for Strategic Planning Meeting?

Kerry,

I am a sole practitioner and I came across this article on CNN Money.

Linda Rey (pictured at right, with sister Laura and father Frank) is co-owner of Rey Insurance, a broker based in Sleepy Hollow, N.Y. She and her partners (who also happen to be family members) hold a monthly dinner at a restaurant, which they treat as an offsite strategic planning meeting (100% deductible) rather than a business meal with a client (50%). Even with coffee and Dunkin' Donuts for the Friday morning meeting, she always takes the full 100% deduction, while many companies wrongly file this under meals and take half. "I pay careful attention," says Rey. "Otherwise you end up giving a lot of money away."I have never heard of deducting meals at 100% for an off-site strategic planning meeting. I researched this issue and could not find support their comment. I can't see where this type of meal falls within the 100% allowed M&E categories. Everything I find says 50% disallowed for this type of expense. Are you familiar with deducting meals at 100% for an off-site strategic planning meeting (and morning donuts), or is this just another case of the media giving false information which makes us explain why it is wrong to our clients.

Thanks,

A:

I've heard of people trying this; but I can't agree with the logic or stand behind this idea.

As we know, there is a lot of the honor system in the tax game in regard to how we post expenses. Calling something a "Meeting Expense" effectively hides it from the 50% limit that business meals have.

I browsed the online QuickFinder and the printed and WebCD TaxBooks for any mention of 100% deduction for meals at strategic planning meetings and came up empty.

For example, QuickFinder online had this for a similar situation:Home MeetingsI've had cases where meals were one part of a business related meeting that had a single admission price. I have posted those to 100% deductible Meetings expense. However, where the meeting is at a restaurant and the full amount being paid out is for food, I have to believe that the deduction would be limited to the standard 50%.

Direct sellers who hold business meetings in their homes can deduct expenses for the meetings as entertainment expenses and expenses related to the business use of their home only when they meet certain tests.

The expenses of entertaining business associates in the direct seller’s home are deductible as entertainment expenses if they meet the rules discussed under Meals and Entertainment. The expenses of maintaining the direct seller’s home as a place of business are deductible if he or she meet the tests discussed under Business Use of the Home.

Example: Barbara and Bill hold bi-weekly meetings in their home for the direct sellers who work under them. They discuss selling techniques, solve business problems and listen to presentations by company representatives. Because the meetings are for business, Barbara and Bill can deduct 50% of the cost of the food and beverages they provide. See Deduction Limit. They keep a copy of their grocery receipts for these refreshments, and record the date, time and business nature of each meeting. Because the meetings are held in their living room rather than in a special area set aside only for business, they cannot deduct any of their home expenses for the meetings.

It would be interesting to hear what other tax practitioners have to say about this.

I feel that those people bragging about deducting 100% of their meals in that article had better prepare themselves for an IRS audit which will also delve into other creative deductions they may be claiming.

Thanks for writing and good luck with the rest of this Tax Season.

Kerry Kerstetter

Assuming someone else's Sec. 121 eligibililty?

Q:

Subject: 1031 question

Hello,

I know you deal in the 1031 exchange field and I also know from reading your blog your deal with tax issues in a liberal reading. So I feel you are a good person to get an open minded view from.Is there a way to use someone else's 2 out of 5 years? Drew Miles, Tax Attorney claims there is a way/program to do this. Is this something you have heard about? Can you guide me to some references.

Thanks,

A:

The only way I am aware of for one person to benefit from someone else's time in a home in terms of qualifying for the $500,000 tax free exclusion, is with spouses. IRS allows the full exclusion if either spouse owns the home for at least two out of the previous five years. However, they require both spouses to use the home as their primary residence in order to exclude the full $500,000. Shorter times as a residence by each spouse would require prorated adjustments in the excludable gain.

In regard to being able to walk in and assume the tax benefits of an unrelated person's use of a home as if they were yours, I don't see how that is possible.

I checked Drew Miles' various websites and see nothing other than his vague promises of tax savings secrets, with no mention of this issue. I would be interested in seeing what you are referring to before concluding that you are misreading it.

Kerry Kerstetter

Labels: 121

Early withdrawal penalty exceptions...

Q:

Subject: Early distribution of retirement funds

If one withdraws money from a retirement plan before turning 59 1/2 there's a 10% penalty unless one of several exceptions is met. One of the exceptions is disability of the participant. Does the same exception apply if the participant's spouse becomes disabled? I've researched this but the only references I've found are to the disability of the participant. If's it's possible could you refer me to the pertinent tax reference? Thanks.Thanks for your help.

A:

My reference sources also only mention the disability of the participant, with no mention of the exception applying to disability of any other family member.

If the withdrawn money is being used to cover excessive medical costs for the disabled spouse, some or all of it may be exempt from the 10% early withdrawal penalty under Exemption 05 on Form 5329. Those medical costs can be for anyone in the family; not just the participant.

Good luck.

Kerry Kerstetter

Follow-Up:

Thanks for the help. I was focusing so much on the disability exclusion I hadn't thought about the excessive medical costs exclusion. I don't think it'll apply in this case but it's certainly worth checking into.

Thanks again.

Labels: 5329