Tax Guru-Ker$tetter Letter

Saturday, April 26, 2008

Amended Clinton Tax Return?

Q:

Subject: hillary clinton tax return blog post

One of my co-workers ran across your blog post about a possible error on Hillary's return.

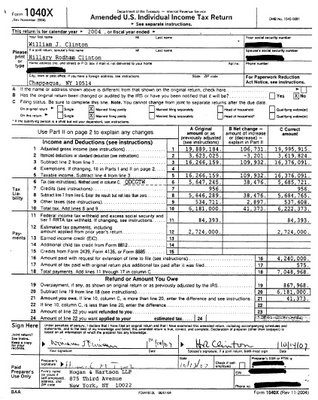

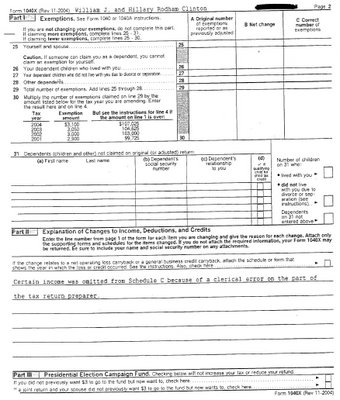

Note the last 2 pages of the 2004 pdf on the Clinton website, where it has an amended return.

A:

I did see that 1040X. However, the changes it had were not in any way related to the issues raised by my readers and posted on my blog. Those questions have yet to be answered.

Thanks for writing.

Kerry Kerstetter

(Click on image for full size)

(Click on image for full size)

Labels: Clinton

Monday, April 07, 2008

Clinton Tax Lessons - Some interesting commentary on the Clinton tax returns from the WSJ.

Labels: Clinton

Saturday, April 05, 2008

Funny bottom lines...

Q:

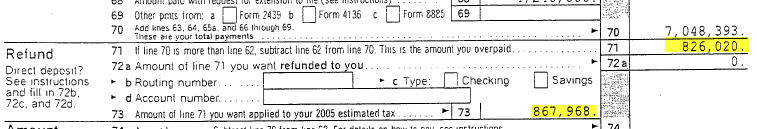

Subject: Clinton's 2004 Tax Return?CLINTON 2004 TAX RETURN Question?How could Line 73 (amount on Line 71 applied to your 2005 Estimated Tax) be $867,968 wheaeas Line Line 71 (Overpaid) is $826,020 ???

A:

Good catch. I guess I shouldn't have skipped over those middle years when I was perusing the 1040s.

A little while ago, when the Obamas released copies of their 1040s, I mentioned the possibility of the Clintons preparing phony versions of their tax returns to show to the public.

The problem with trying to do that is the need to make the numbers appear to be consistent from schedule to schedule and line to line. You may have spotted an example of somebody not being careful enough in that regard.

Thanks for pointing that out.

Kerry Kerstetter

Follow-up:

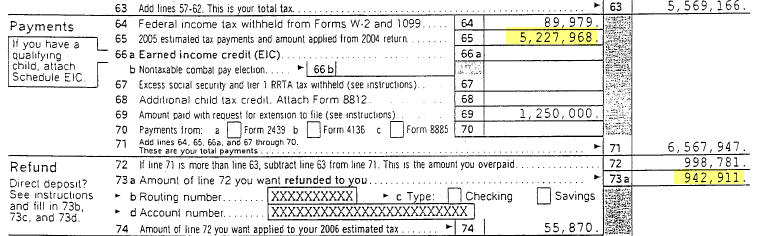

Subject: 2005 Clinton Tax Returns??

Another Strange twist to this story:

2005 Return:

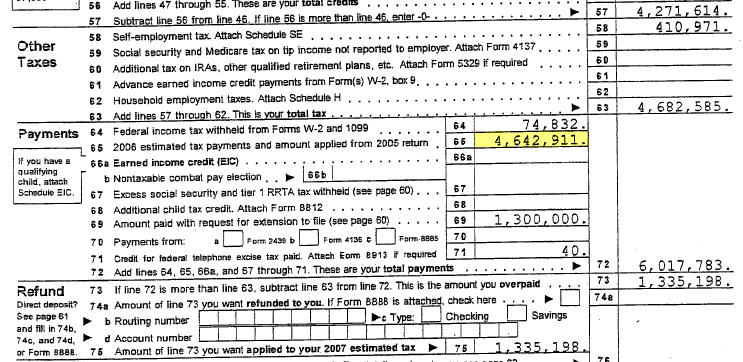

Also on Line 65 (2005 estimated tax payments and amount applied from 2004 return) $5,227.968 seems to reflect that $867,968 (Line 73 - 2004) was included or some part thereof.

http://www.hillaryclinton.com/feature/returns/2005.pdf

From another CPA:

"And following along the strange twist line if you look at the 2006 return the amounts on line 65 seem to include the amount in some fashion from the 2005 return of 942,911 which was listed as a refund of overpayment but appears to be included in the estimated payments for 2006".

Weird stuff

Labels: Clinton

Clinton Tax Returns

It looks like the campaign for a third term in the White House is a little more demanding on the need for disclosure than they expected. They have released copies of their 2000 through 2006 1040s, along with a one page summary of their 2007 income.

Several other media outlets have covered summaries of the figures, such as in this article in the Washington Times. From a geeky tax pro perspective, I noted how the tax returns evolved from 10 pages for 2000 to 68 pages for 2006.

You can download each year separately from links on the bottom of this page on their website or from this 16.5 mb zipped file I created that includes all of the 2000-2007 files in one handy download.

This close to April 15, I obviously don't have time to look over every page of these tax returns; but one other interesting schedule from a geeky perspective was this mortgage interest worksheet on page 38 of the 2006 1040. It shows the average personal residence mortgage to be $3,279,728 for the year, which means that only 33.5% of the interest they paid during the year was deductible because of the one million dollar limit on acquisition debt. This resulted in $105,673 of non-deductible interest for 2006.

Labels: Clinton