Deductions for the Evil Rich

Q:

Subject: 2009 Standard Deduction

Hi:

Your Blog indicates that in 2009, the Standard Deduction will be eliminated for those filing jointly, and earning over $166,800.

What will it be replaced with ?

Will this be positive, or negative, for those whose AGI is $2000,000 + ?

Regards

A:

You are misunderstanding what that provision of the tax law means.

Standard deductions aren't eliminated for anyone based on AGI.

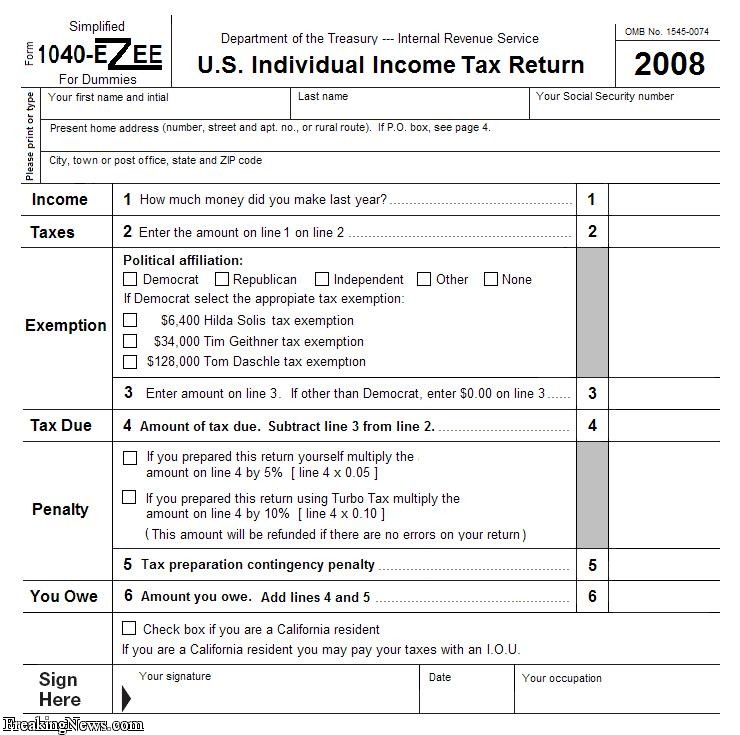

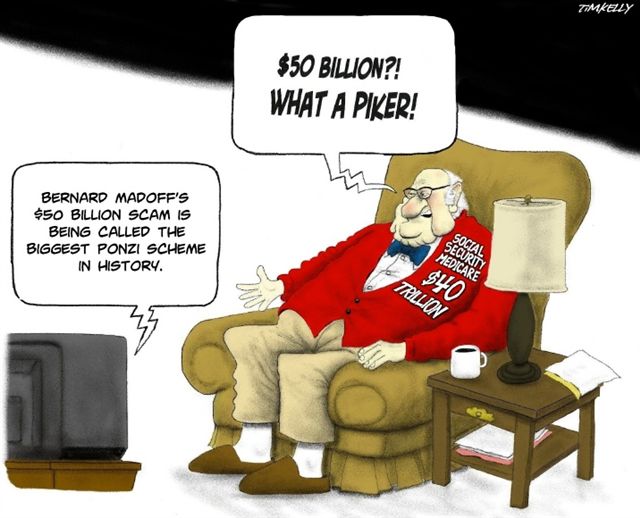

What has been part of the tax code for several years now has been a dollar limitation on the total amount of itemized Schedule A deductions that people considered to be evil rich (as measured by AGI) are allowed to claim. At the threshold levels, which are increased each year based on inflation, the limit starts to be applied.

However, although this type of penalty on the evil rich can completely eliminate their personal exemptions, I have never seen where it has completely eliminated their Sch. A deductions.

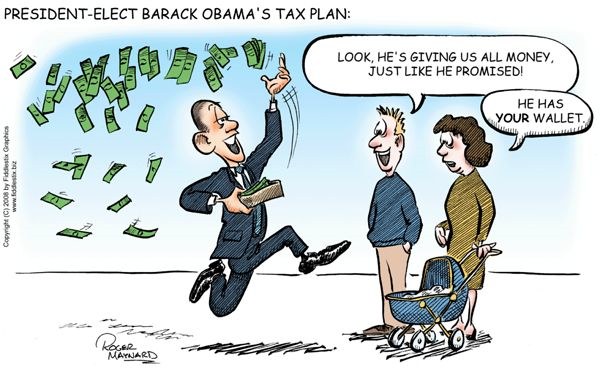

The trend of punishing people with high AGIs is looking like it's going to get worse. From what I have heard about our Supreme Ruler's plans for future tax laws, there will be even tighter limits on the deductions allowed to be claimed by those folks he considers to be evil rich.

I hope this helps you understand this part of the tax code.

Good luck.

Kerry Kerstetter

Follow-Up:

Hi Kerry:

Many thanks for your explanation.

Labels: Deductions

Higher Tax Free Employee Benefits

From a reader:

Subject: Mass Transit Provision of the Stimulus Package Provides $1K

Kerry,

I have been following your posts lately and thought you'd be interested to know there is a provision in the bill for commuters to save up to an additional $1,000 per year on transportation costs. A raise in the cap on pre-tax commuter benefits should increase mass transit ridership and help hard working Americans keep a good chunk of money in their wallet, according to TransitCenter (the non-profit that has been advocating this change for nearly seven years).

The CEO of TransitCenter, Larry Filler, decided to setup a blogger resource room to explain the change in the IRS Code to help individuals get access to the information they need to take advantage of this opportunity. Feel free to use any of the material on the blogger resource room to inform your readers and get them the $1K per year.

Also, Larry's happy to provide a personal quote that would be exclusive for your blog. Feel free to contact me if you have any questions.

http://www.transitcenterblogresource.com/accounting.html

Best,

Jonathan Blank, representing TransitCenter

My Reply:

Jonathan:

I have always been a huge fan of pre-tax employee benefits as a great way for both employees and employers to save on their taxes.

I appreciate your alerting me to this recent increase for mass transit users and I will make sure to post the link to your site on my blog.

Thanks for writing.

Kerry Kerstetter

Reporting sale of inherited property

Q:

Subject: Gain on Inherited Property

How do I record my gain on inherited property?

I inherited property in 1982 when my husband died. I am considered 1/12 owner and received 1/12 of the proceeds when the house sold in 2008. If the house was assessed at $60,000 in 1982, then is my cost basis $5,000 (1/2 of $60,000). In addition, do I reduce my proceeds by the settlement charges I paid at closing. Finally, does this get reported on Schedule D?

A:

You really need to be working with a professional tax advisor on this because there are many factors that need to be considered.

Some of the issues that you will need to discuss with your own personal professional tax advisor so that s/he will know how to properly report the sale include the following.

For the basis of the property, it is important to know if it was owned as separate property by your late husband or jointly by both of you. The amount of the step-up in basis will also depend on whether or not you were in a community property state or not if it was jointly owned.

Any improvements to the property that you paid for will be added to the basis.

You didn't say what kind of property it was and what it was used for. If it had been used for rental or other business purposes, any depreciation claimed or claimable will reduce the basis and trigger depreciation recapture at a higher rate than the other profit. It will also require reporting the sale on Form 4797, which will then flow onto Schedule D.

I assume you received the full amount of your share of the proceeds; but if you are receiving periodic payments, it will probably need to be reported as an installment sale on Form 6252, with any interest received reported on Schedule B.

If you had been living in the property as your primary personal residence, you would most likely be eligible to exclude up to $250,000 of profit.

These are all important items to clear up with your own personal professional tax preparer who will then now how to show the sale on your 1040.

Good luck.

Kerry Kerstetter

Cap. Gain Tax Worksheets

From a reader:

Subject: Capital Gains Rates

In the Tax Guru-Ker$tetter Letter of 02/15/09 titled "When you may want to show capital gains..." you write "Special Zero Percent Capital Gains Tax - For 2008, 2009 and 2010 sales by individuals, all or part of any long term capital gain is subject to a Federal tax rate of zero percent. "

Another factor which determines the tax rate on LTCG are the amount of qualified dividends. The "Qualified Dividends and Capital Gain Tax Worksheet-Line 44" on page 38 of i1040.pdf [2008] calculates how Capital Gains plus qualified dividends are taxed above and below the 0% rate level. I just copy that worksheet into an Excel spreadsheet, add formulas, & enter the appropriate numbers.

My Reply:

That is an excellent point to make. Many of us forget the fact that the special zero percent tax rate has to be shared between long term capital gains and qualified dividends.

I will be posting a pdf copy of the IRS worksheet you referred to, plus a similar one from The TaxBook.

Thanks for writing.

Kerry

Reader Followup:

Note for those individuals who will soon be doing their 2009 Estimated Tax [f1040es], your 2008IRSCapGainWS.pdf will work fine for 2009* by changing Line 8 using your "2009 Individual Income Taxes Federal - Form 1040" at http://taxguru.org/incometax/Rates/1040-09.htm as follows:

Line 8

Single 2009=$33,950 [2008=$32,550]

MFJ/Qualifying Widower 2009=$67,900 [2008=$65,100]

HeadHousehold 2009=$45,500 [2008=$43,650]

*The above assumes that the tax rates for CapGains/QualDivds are not repealed.

My Reply:

Excellent suggestions.

Thanks for your input.

Kerry

Labels: CapGains

Sec. 179 With Pass-Through Entities

Q:

Subject: 179 Question

There is a question which falls through the cracks of the answer provided below. It's pretty clear from your answer that Corporations can not reduce income below zero using a 179 deduction, but that a Schedule C business can (provided that there is sufficient wage income to produce a total taxable income > 0.00). However, what about a Partnership or LLC? Can they have a loss based on a 179 deduction, and have the partner use it on their 1040 via a K-1, provided that they have sufficient wage income to have a taxable income remain > 0.00?

Thanks,

A:

I have discussed this point on a few occasions, but it has been a while.

With pass-through entities, such as S corps and partnerships, the Section 179 limit is tested against taxable income at both levels; that of the 1065 or 1120S and again at the owners' 1040 level.

One big difference is the fact that, for this test, the 1065 or 1120S income can be increased by any owner compensation that has been deducted, such as wages or guaranteed payments. This could result in a Section 179 deduction giving the business a net loss.

From a logistical perspective, a 1065 K-1 would most likely net out to zero when taking into account the entries for net loss, Section 179 and Guaranteed Payments. This contrasts with the K-1 from an 1120S, which could have a net overall loss because the W-2 income isn't shown on the K-1.

The interplay of these kinds of tests are why it is important to be working with an experienced professional tax advisor with up to date tax prep software.

I hope this isn't too confusing to follow. You should work with your own tax pro to see how it would look with your own businesses.

Good luck.

Kerry Kerstetter

Labels: 179

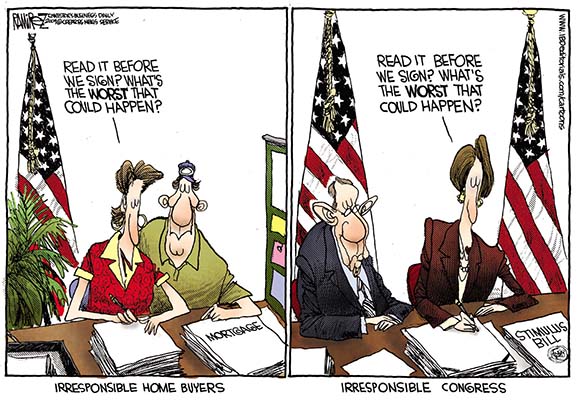

Tax Provisions In Porkulus Bill

Just as none of our rulers in DC had the time to actually read the humongous 1,000 plus page spending bill before voting on it, none of us in the tax profession have time to slog through it. The first summary of the tax provisions I have come across is this five page one from ClientWhys.

Here are some of the provisions about which I have received the most questions over the past few months:

Vehicle 50% Bonus Depreciation – Some years ago, to prevent higher-income taxpayers from creating large tax writes-offs from expensive vehicles, Congress implemented the "Luxury Auto Limitations," which places a cap on first-year depreciation. The provision that extends the 50% first-year bonus depreciation to 2009 purchases (mentioned elsewhere in this article) also extends the increased dollar cap for new vehicles placed in service in 2009 by $8,000. The regular luxury auto depreciation caps for 2009 have not yet been announced by the IRS. For 2008, the regular cap was $2,960 but was increased to $10,960 when the 50% bonus depreciation was claimed. The 2009 amount will likely be similar.

Bonus Depreciation Extended - Businesses are allowed to recover the cost of capital expenditures over time according to a depreciation schedule. Last year, Congress temporarily allowed businesses to recover the costs of capital expenditures made in 2008 faster than the ordinary depreciation schedule would allow, by permitting these businesses to immediately write-off 50% of the cost of depreciable property (e.g., equipment, tractors, wind turbines, solar panels, and computers) acquired in 2008 for use in the United States. This temporary provision has been extended through 2009.

Extension of Enhanced Small Business Expensing - In order to help small businesses quickly recover the cost of certain capital expenses, small business taxpayers may elect to write-off the cost of these expenses in the year of acquisition in lieu of recovering these costs over time through depreciation. This is commonly referred to as the Sec. 179 deduction. Until the end of 2010, small business taxpayers are allowed to write-off up to $125,000 (indexed for inflation) of capital expenditures subject to a phase out once capital expenditures exceed $500,000 (indexed for inflation). Last year, Congress temporarily increased the amount that small businesses could write-off for capital expenditures incurred in 2008 to $250,000, and increased the phase-out threshold for 2008 to $800,000. Those increased amounts have been extended to 2009.

I'm sure more such summaries will be published over the next few weeks. I will post links to those as I learn about them.

Labels: NewTaxLaws

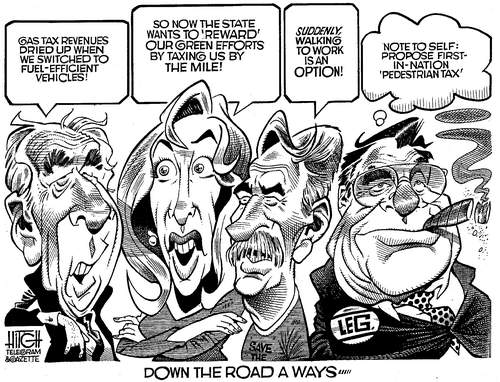

Dangerous trend with state tax agencies...

Kansas suspends income tax refunds – It’s not just the PRC pulling this scheme.

Labels: StateTaxes

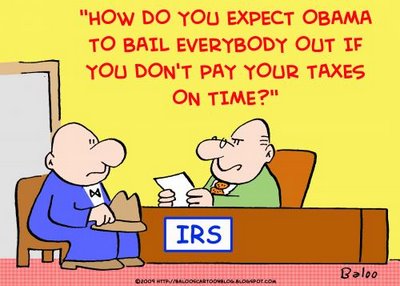

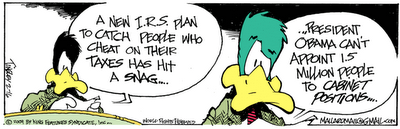

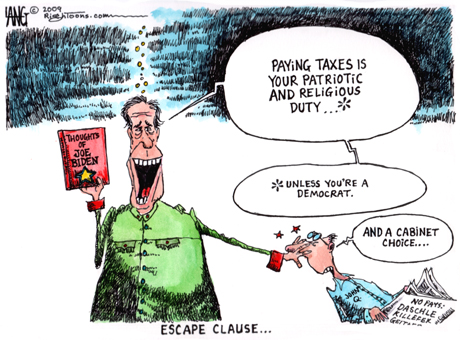

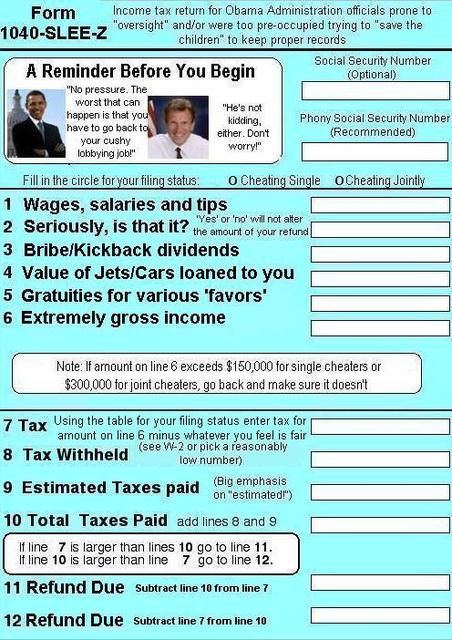

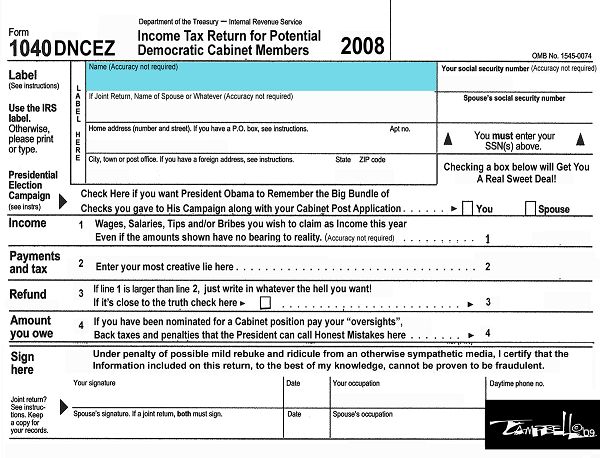

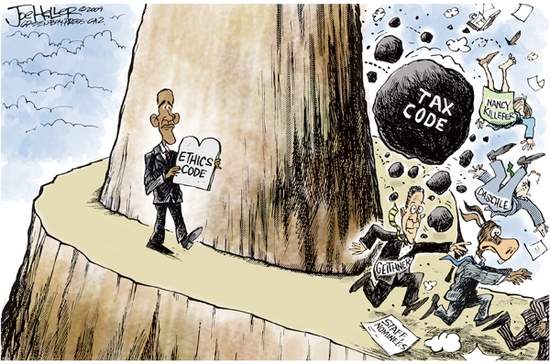

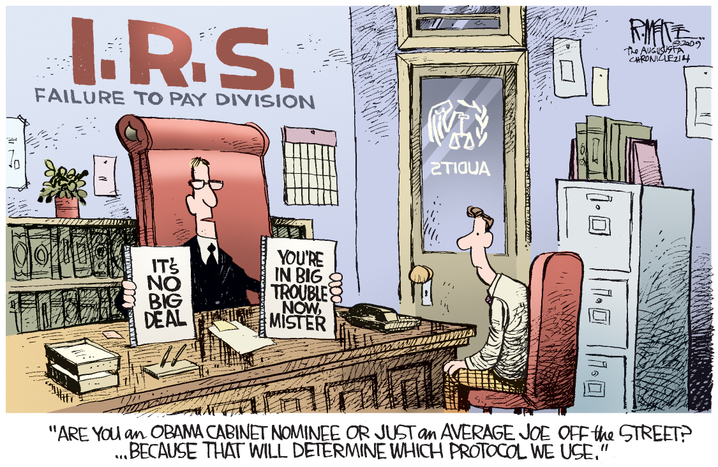

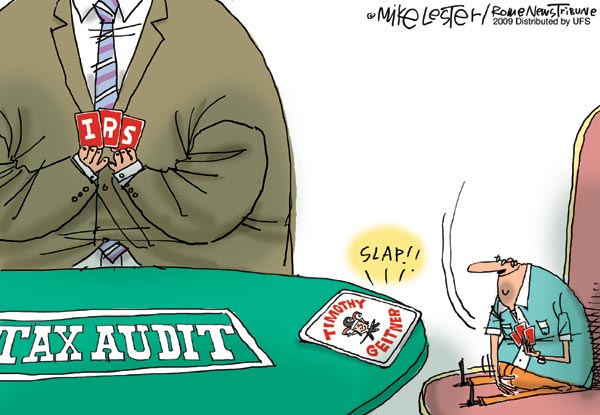

From last night’s Conan show via NewsMax:

Yesterday, one of Obama’s top advisers said that choosing Cabinet members is not like picking American Idol. Yeah, mainly because “American Idol” contestants have paid their taxes.

Labels: humor

Non-Cash Donations Worksheet

I was browsing the new additions to the always useful TaxTools program and noticed the worksheet they have for listing and valuing non-cash donations. It has suggested values for used items, making it easier to work with than having to refer to outside sources such as the Salvation Army's guide.

I made up a blank PDF version of this worksheet that you can download from my site.

Labels: Charity, Deductions, worksheets

When you may want to show capital gains...

Many people just assume that they need to do a Section 1031 like kind exchange in order to save on their taxes. This decision may be premature if the taxpayers haven't had their professional tax advisors run the numbers to see if an outright sale would in fact cost them anything in taxes.

I have seen many cases where people assumed that a sale would result in taxes, when in fact that wasn't the case. Here are some of the most common reasons that a sale may not cost any actual taxes, starting with a new one that is just now starting to show up on tax returns.

Special Zero Percent Capital Gains Tax - For 2008, 2009 and 2010 sales by individuals, all or part of any long term capital gain is subject to a Federal tax rate of zero percent. The actual calculation of this is rather complicated and should be handled by your professional tax advisor's tax software.

While this has the potential to save large amounts of taxes and thus make doing a 1031 exchange unnecessary, there are some other factors to consider.

This is for Federal purposes only and most states have not gone along with this; so there could still be State taxes on a sale.

This only applies to the long term capital gain portion of a sale. It does not apply to short term capital gains for assets held less than 12 months. It also does not apply to gain attributable to depreciation recapture, which is still subject to a 25% Federal tax rate plus the State tax rate.

The other key consideration is the political environment. The new president said during his campaign that he wanted to eliminate any special tax breaks for capital gains and make them subject to the same much higher tax rates for other kinds of income. He said that he is will aware that this will reduce the government's revenues from capital gain taxes as more people take steps to avoid paying them; but he sees it as the Fair thing to do. He can't do anything to affect the tax on 2008 sales, but he could repeal the special tax break for 2009 and/or 2010 sales as he has been promising/threatening to do.

Loss Carry-forwards - Many people have large losses that they have been carrying forward for several years on their tax returns that can be used to offset gains from the sales of business and investment properties. These carryover losses include Capital Losses, Net Operating Losses and Passive Activity Losses. There should be some kind of schedule with your latest tax return showing how much of these kinds of losses are being carried over into the current tax year. Similarly, your professional tax preparers should have those losses already set up in their tax return software when running proforma tax calculations of a possible sale.

Basis Mistakes - To determine whether you have a gain or loss on a sale, it is critical to understand the proper cost basis to use for the asset. One of the most common mistakes has to do with inherited property. The cost basis for the heir is the asset's fair market value at the time of the previous owner's death. This means that an inherited asset being sold shortly after it has been received will normally result in no gain, and possibly even a loss after deducting selling costs. Doing a 1031 exchange only makes sense if there is a profit to defer.

On the flip side, the other common basis mistake has to do with items received as gifts from living persons. In those cases, the cost basis to the recipient is the same as it was for the giver. While the actual receipt of a gift is tax free for the recipient, recipients are essentially accepting responsibility for future capital gain taxes on it. It is important that the giver provides the cost basis info to the recipient along with the gift.

As always, no tax oriented transaction, especially dealing with capital gains and 1031 exchanges, should be attempted before the numbers have been run by your professional tax advisor. Any fees they charge will be minimal compared to the potential tax savings.

Labels: CapGains

Mutiple Corps

Q-1:

Subject: Small Business asking for a little help or direction.

Dear Kerry,

I came across your website while researching corporate tax information and was very impressed with the information and your desire to limit tax liability.

I was hoping you could offer a little help on my businesses.

Last year I purchased 3 small businesses from a single owner. The businesses sell very similar products, but are run as 3 separate corporations. 2 are “C” corps and 1 is a “S” corp. All located in Chicago, IL. Combined total annual sales of $2.8 million for all 3 companies.

I hired a new accounting firm to review my financials, do tax planning and file annual tax returns.

They are strongly recommending I change the 2 “C” corps into “S” corps. To avoid the future possibility of “double taxation” on dividend payments and keep things simple by changing all 3 companies to a true calendar fiscal year.

Historically over the last 10 years these businesses have never paid dividends. So I don’t see the benefit. The previous owner managed expenses across the 3 companies to avoid paying excessive taxes and never paid himself dividends just a nice salary.

After doing some research on line and reading your web site I feel like I have received some very bad advice. I believe I need to find a new accounting firm that has my best interests in mind. Also, with the new administration coming in January I think keeping my income as low as possible on my 1040 will be more important than ever.

I want to aggressively manage the businesses to limit my tax liability and I need a financial firm who thinks the same way.

Can you kindly offer some advice on how to proceed.

I would love for you to handle my financials or provide financial advice.

Any advice, direction or referral you can offer would be greatly appreciated. Do you know of a good professional tax advisor near Chicago?

Thank you in advance for your time and response.

Thanks and Best Regards,

A-1:

You are correct in recognizing the fact that your current accountant is not looking out for your best interests. Unfortunately, there is no shortage of lazy short-sighted tax pros who try to force everyone into a one size fits all approach, often just using S corps.

As I have been preaching for decades, there are huge tax and liability saving opportunities by using multiple corps with different fiscal years. The ability to smooth income out and even multiply certain tax breaks, such as Section 179, can save huge amounts of money in taxes. As I have explained countless times, the big fear of double taxation is crazy. Any creative tax advisor worth his/her salt can find methods to shift income in ways that avoid the same money being taxed twice.

Using nothing but S corps for profitable businesses is completely counter-productive, especially in this environment. That puts everything onto your 1040. With the incoming administration in DC hyping the fact that they intend to soak people in the upper income levels, adding more income to your 1040 will just make you a more attractive and inviting target for more of your income to be confiscated and spread around. Unless you agree with that definition of being "Patriotic," the goal for preserving more of your hard earned income should be to take steps to keep your 1040 income down as low as possible and slide under the radar of the Socialists who are now in charge of our lives.

I am still not at a point where I can accept any new clients; so you will need to keep looking for someone who will help you reduce your taxes instead of trying to structure things to make it easier on themselves, as it sounds like your current accountant is doing. You may want to start with the tax pro who helped the previous owner of the businesses because it sounds like s/he understands how to work with multiple entities in a tax efficient manner.

Unfortunately, we don't have anyone specific to whom we could refer you. I did recently post some names and links for some like-minded tax pros around the country.

If you haven't already done so, you should check out my tips on how to select the right tax preparer for you.

You should note that geographic location should not be the main criterion for selecting a tax pro.

I wish I could be of more assistance; and I wish you the best of luck.

Kerry Kerstetter

Q-2:

Dear Kerry,

Thank you very much for your detailed response and advice. We are in agreement on the correct strategy for limiting taxable income for my businesses and on my 1040. I have begun a search for a new tax pro who will have my best interests in mind.

I greatly appreciate your comments.

Would it be possible to add my name to you waiting list of potential customers should you ever be ready for additional clients?

Please let me know.

Thanks again for your response.

A-2:

I will keep you posted if my workload ever allows me to accept any new clients. I do have several names already on the waiting list; so I will be very selective as to the criteria any new clients must meet.

One of the most important factors will be that they are already up and running with proper accounting on QuickBooks for each of their entities.

Good luck.

Kerry Kerstetter

Labels: corp

Setting Up Corp

Q:

Subject: C or S corporation, no employees/partners

I am not sure if you reply to emails asking for additional advice, but I'll give it a shot.

I am starting a marketing company in Ca. with no employees. (new babies, need money)

I do have a full time job, and this will be on the side.

>From your article a C corporation makes more sense for me.

But, I am scared of ticked off tigers, cobras, AK-47s, and the IRS.

Will I be asking for trouble if my company makes no money, and I decide to end the corporation in a year or so?

Does my separate tax return get red-tagged if I start a corporation that does/does not make money?

Thank you in advance for your time.

A:

You really need to be working with an experienced professional tax advisor to set up the best strategy for your unique situation.

A corp that only has losses doesn't really attract a lot of dangerous attention from IRS; so that really isn't a concern here. However, there are some other more important issues that you need to evaluate.

For example, I am wondering why you are so anxious to jump into the cost and hassle of setting up a corp right now. Most small businesses start off as Schedule C sole proprietorships and then evolve into a corp entity as they become more profitable.

Sole proprietorships cost nothing to set up or dissolve; unlike corps in Calif, which have a $800 minimum annual tax. Losses from Schedule C can also be used to offset other income on your 1040. While losses from S corps can be used to offset other 1040 income, C corp losses can't do that.

Please consult with a tax pro before you take that expensive leap into a corp.

Good luck.

Kerry Kerstetter

Follow-Up:

Thank you so much for taking the time to answer my email Mr. Kerstetter, especially in these holiday times. I have taken your advice, and will be seeing a tax pro. ASAP to seek some advice in these matters.

Labels: corp

Deducting Bad Debts

Q:

Subject: declaring bad loans

Hi

we have made some loans guaranteed by mortgages. However these are in different countries.

The amounts are quite large. Basically I have lost the money and the individuals are nowhere to be found. We are speaking in the hundred of thousands of dollars. the loans were securied by foreign real estate. The foreign country is Lebanon and in a semi state of war or civil unrest so it is hard to foreclose as well.

How can I take a deduction on my taxes. I have not declared the interest income. I am thining of filing a 1040 X for last year and declaring the interest income. Have not filed 2007 taxes this year and am getting ready to do so. I want to take a the bad loan deduction in 2008

Do not want the deduction to trigger an audit.

can you help.

A:

You need to be working with an experienced professional tax advisor to make sure you do things properly here.

Interest income that has accrued on the notes but hasn't been received does not need to be reported as income on your 1040. However, if you did receive actual interest payments, those should be reported for the years in which they were received. If that is the case, you should file amended Federal and State income tax returns to correct that situation. You will have to pay the additional taxes plus interest, but IRS and most states will waive late penalties if you voluntarily disclose the under-reported income rather than wait for them to catch you.

Writing off investments as uncollectible and worthless can trigger an IRS audit if the tax return doesn't include a lot of attached documentation as to why you have concluded that 2008 is the appropriate year it became completely worthless and how you calculated your unrecovered adjusted basis. IRS loves to disallow bad debt deductions for either being claimed too early or too late. A good tax pro can help you document the proper year to claim the loss. A good tax pro can also ensure that you are claiming the proper amount. A common mistake people make is to try and claim a bad debt loss for accrued but unpaid interest. That is not allowed.

Good luck. I hope this helps.

Kerry Kerstetter

Labels: Deductions

Closing Biz After Sec. 179

Q:

Subject: section 179 question

If I have taken section 179 expense deduction in 2006 and 2007 and have had to close my business in 2008 will I have to claim these deductions from these years as income in 2008?

Another question if you could please give me advice. I installed new carpet, laminate flooring and countertops/cabinets in my leased office in 2008 could these items be considered section 179 expenses or are they items that could be classfied as building repairs or would I have to depreciate them and over how many years?

Thanks,

A:

You need to be working with an experienced professional tax advisor to make sure you do things properly here.

Basically, if you claimed Section 179 for business equipment on previous tax returns, the adjusted cost basis of those assets is zero. This means that anything you receive for them in a sale is going to be taxable gain; technically a recapture of the previously deducted Section 179.

If you just shut down the business and don't sell off the assets, there will still be a smaller taxable recapture because their business usage has fallen below 50%. Your personal professional tax advisor should have tax software that will calculate that recapture amount.

There are various ways in which your leasehold improvements can be expensed and/or depreciated. Your personal professional tax advisor should be able to use the method most appropriate and beneficial for your unique situation.

I hope this helps.

Good luck.

Kerry Kerstetter

Labels: 179

Prorated Home Sale Exclusion

Q:

Subject: Home Sale Gain Exclusion

Situation:

5 years ago, was laid off in Minnesota and had to settle for a California job.

Commuted every 2 weeks for 1 year then moved family to a rental.

Wife and children lived in MN home every time children not in school (about 3 months per year), nevertheless total days is well shy of 730.Kept a car registered in MN, voted in MN, kept MN drivers licenses, bank account in MN while trying unsuccessfully to transition to a job back in Minnesota. Even had several in-person interviews in MN over the years.

Finally gave up & sold in Minnesota; just closed. We expected to exclude 50K of gain.

Can we

A) Exclude the gain because our beloved MN home was our primary residence defined by that we never bought anything else and always considered & treated it as "our home".

B) Exclude the gain because the wife was always staying there... it may be shy of 730 days but there is no way to audit that.

C) Exclude the gain because I was forced to sell due to a job situation and we used it as a primary residence for 1 year, 50% of the 2 year standard, and all we need to exclude is $25K apiece.

D) SOLThanks!

A:

You need to be working with an experienced professional tax advisor to make sure you do things properly here.

It looks like you should be able to qualify for the prorated tax free exclusion based on your change in employment. Since your gain is only 10% of the total possible Section l21 exclusion of $500,000, there shouldn't be a problem in excluding the full amount of your profit.

However, your personal professional tax advisor will be better able to evaluate the details of your situation and decide if that is the case.

Good luck.

Kerry Kerstetter

Labels: 121

Refundable Tax Credits

Q:

hey i was looking at your tax website and have a quick question...

hopefully you can give me a non-committal answer without alot of research.

have you ever heard of a situation where someone with no income can qualify for a tx refund, even though theyve paid nothing in?

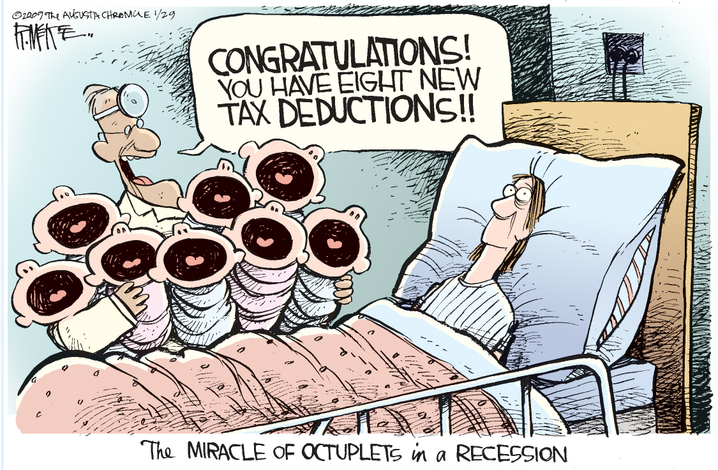

for example an unwed mother living with her parents: she hasn't worked, yet wouldnt she qualify for some type of credits taking care of a newborn? and if so, those credits applied to her tax liability, but no actual liability as there was no income, does that soemhow turn into a credit & subsequent refund?

any suggestions would be appreciated, even if its just steering us where to research further. Again, not looking for legal tax advice, I've just never heard of someone getting a tax refund without paying any taxes in through the year.

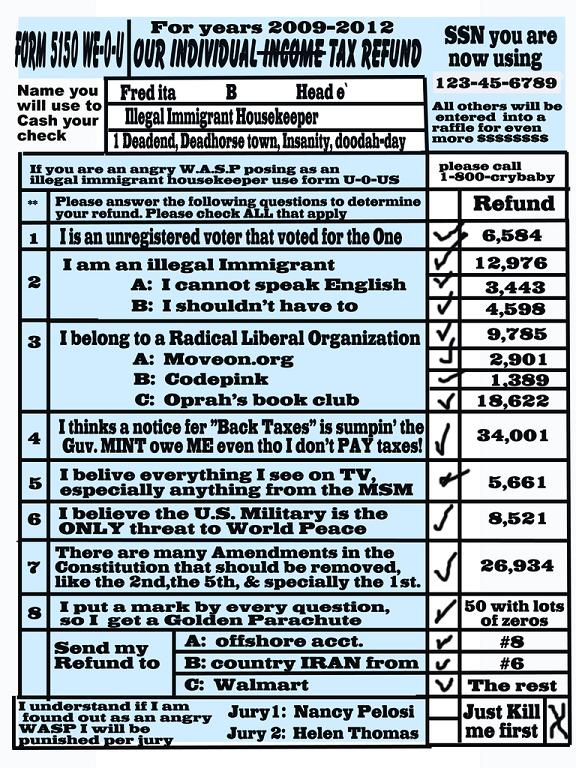

A:

While you are correct that most tax credits are non-refundable, meaning they can zero out the taxes, but not create an actual refund to tax return filers, there are an increasing number of actual refundable credits that allow people to receive money even if they hadn't paid anything in. The largest is the Earned Income Credit (EIC), often generating refunds of thousands of dollars in "free" money for the filers.

If our new President gets his way, there will be even more of those kind of credits, which some people are calling welfare.

Most of these credits don't apply to people who are being claimed s dependents on someone else's return, so your friend probably wouldn't qualify for a refund if her parents are showing her and/or her child as dependents. However, it wouldn't hurt to have a professional tax advisor look at her particular situation to see if filing a 1040 makes sense.

I hope this helps.

Kerry Kerstetter

Labels: Credits

Selecting a cabinet...

From Jay Leno via NewsMax:

Just a few days after being nominated, New Hampshire Sen. Judd Gregg withdrew as the nominee for commerce secretary. In a statement explaining why he turned it down, he cited “irresolvable conflicts.” So apparently he must have paid his taxes. He just wouldn’t fit in.

Labels: comix, Crooks, humor, Obambi

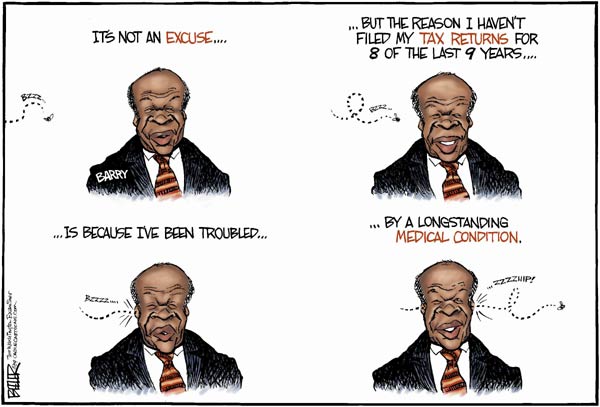

From Jay Leno via NewsMax:

Prosecutors have asked a federal judge to send former Washington, D.C., mayor Marion Barry to jail for failing to file tax returns for eighth time in nine years. He hasn’t paid taxes for eight years straight. So it’s either jail or a Cabinet position in the Obama administration. Take your pick.

From Scott Ott - Obama Plan Has Already Boosted IRS Tax Collections

Courtesy of NewsMax:

From Jay Leno:

This week in Washington, President Obama took time out from his busy day to read a book to a group of second graders. It was a fairytale about a Cabinet nominee who once paid all his taxes.

From Craig Ferguson:

Another Obama nominee had tax issues. Which just proves one thing: that while Democrats like raising taxes, they don’t like paying them.

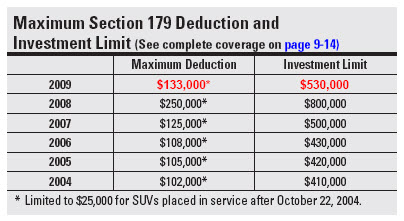

2009 Section 179

Q:

Subject: Section 179 for 2009

Hello Mr. Kerstetter,

My company is trying to publish some Section 179 information for our lessees. We are having a difficult time gathering some of the information. Your website typically lends itself to helpful and up-to-date facts. Is there a place I could go to better gather this information? I’ve looked at the IRS and their site is difficult to find what I need.

I’m assuming the first year write off is $128,000, but what is Cola?

Also, 2008 is the last year it lists a phase out $ amount.

Thank you,

A:

We've been out of power for a while now, so I haven't been able to update my main website lately. I have attached the Section 179 chart from the latest edition of TheTaxBook.

As you can see, as it stands right now, the 2009 maximum Section 179 deduction is $133,000, which is the base of $125,000 plus an additional $8,000 for the annual Cost Of Living Adjustment (COLA).

As you can also see on this chart, the phaseout of the Section 179 deduction for 2009 begins at $530,000 of new equipment purchases, which is the base of $500,000 plus an additional $30,000 for the annual Cost Of Living Adjustment (COLA).

Preparing a completely accurate long term multi-year chart of the Section 179 limits is close to impossible because it is a favorite item to be changed by our rulers in DC. It is one of the best incentives for small business owners to invest in new equipment, so chances are good that it will be bumped up in future economic stimulation legislation.

As with all tax matters, it is a full time job just staying current on all of the changes; so be sure to include that in any tax related materials you produce. A warning such as "All information presented is subject to changes at the whims of the politicians in DC. Check with your own personal professional tax advisor before undertaking any tax related transactions" would help cover your rear in case someone relies on info you produce that becomes outdated.

Good luck. I hope this is helpful.

Kerry Kerstetter

Labels: 179

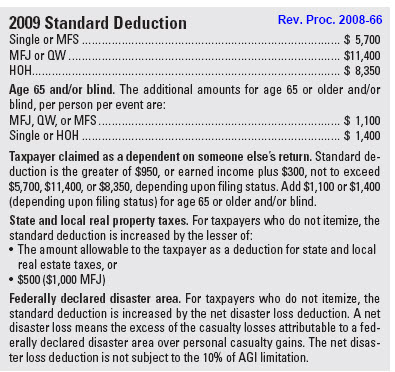

2009 Standard Deduction

Q:

Subject: 2009 Standard Deduction >65

On your web page "2009 Individual Income Taxes Federal - Form 1040", the section "2009 Standard Deductions" shows:

Single: $5,700 + $1,350 if over 64 and/or blind

However Form 1040es for 2009 shows:

• An unmarried individual (single or head of household) and are:

65 or older or blind . . . . . . . . . . . . . . . $1,400

A:

The $1,400 figure is correct, as you can see on the attached excerpt from the latest TaxBook.

I will fix that on my website as soon as we get our power back and can start up our main computers.

Thanks for catching that.

Kerry

[Update] The web page has been updated to correct the figure.

Labels: Deductions

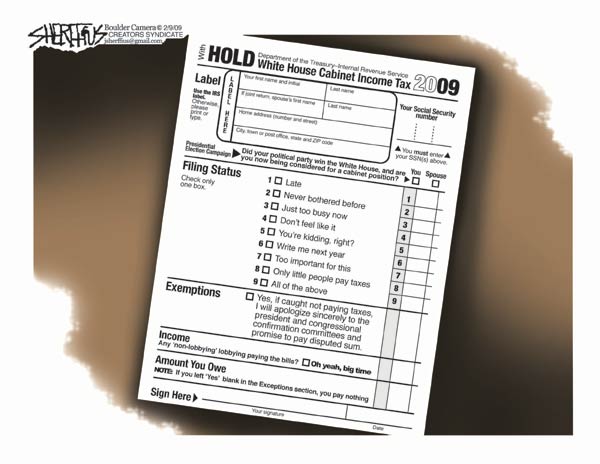

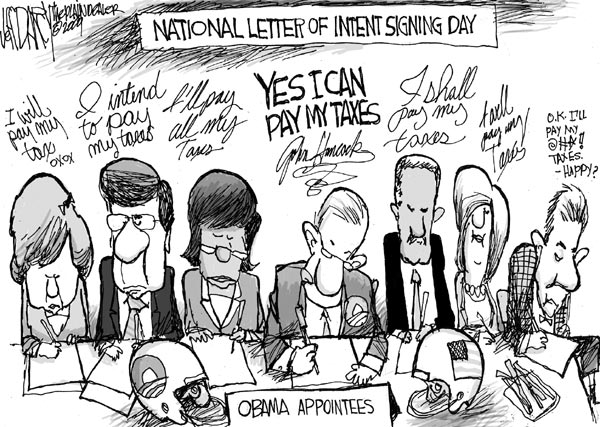

More Cabinet Jokes

Via NewsMax:

Leno:

Obama is a genius. Whenever he nominates someone, they pay their taxes. He’s found a way to eliminate the deficit — nominate everyone in the country, one person at a time, and they’ll pay their taxes.

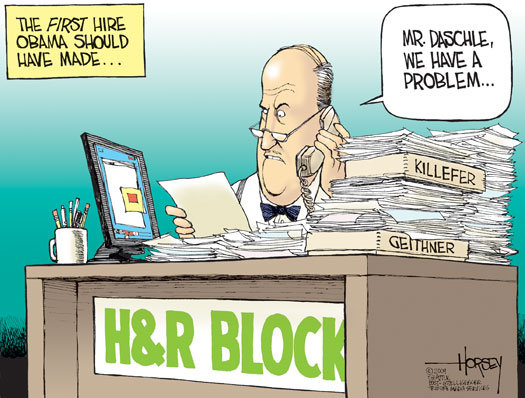

Tom Daschle withdrew his name to be in Obama’s Cabinet, due to IRS problems. He said, “I will not be a distraction.” Distraction is Washington talk for “Uh-oh. There’s a lot more crap you don’t know about yet.”

Daschle says his problems with the IRS were unintentional. Of course, they were unintentional — he never intended to get caught.

To Democrats, IRS means, “I’m really sorry.”

Letterman:

Obama has now lost two nominees because of tax trouble. Good luck to the new Health and Human Services nominee — Wesley Snipes.

Former Sen. Tom Daschle form South Dakota had to withdraw because he “forgot” to pay taxes on $150,000. I believe the guy because in South Dakota there are so many distractions.

Conan:

President Obama is working very hard to get the stimulus passed. He has asked the Senate to cut $50 billion from the plan. He said we no longer would need the $50 billion once everyone in his Cabinet pays his taxes.

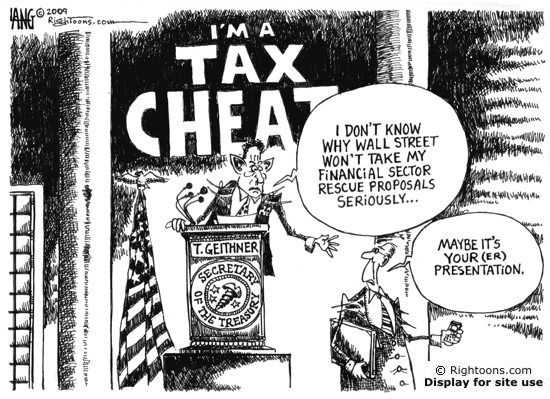

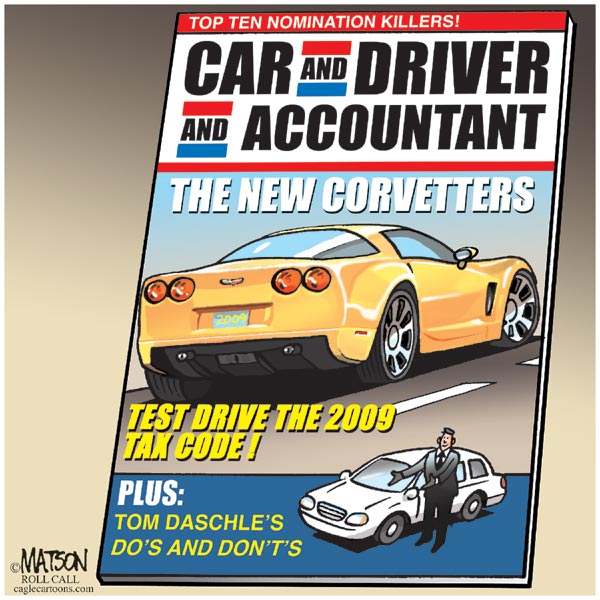

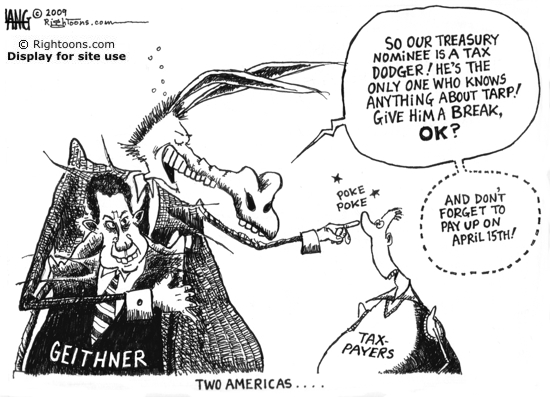

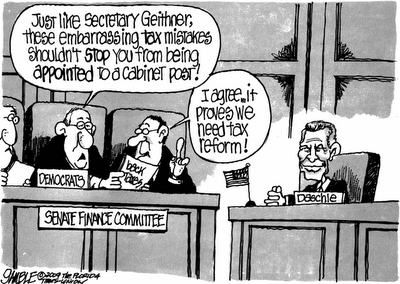

DemonRat Tax Attitudes

From Jonah Goldberg: Hypocrites on Paying Taxes

From National Review Editors: Daschle Goes, Geithner Stays?

From The WSJ: Driving Mr. Daschle

From The Readers Digest: Note to Dems: Paying taxes is not voluntary

From CNSNews: Liberal Elite Plays by Its Own Rules

Tax Free Cabinet

From last night’s Leno show, via NewsMax.

There was a huge scientific breakthrough today. Researchers say they’re very close to finding someone from Obama’s Cabinet who’s actually paid their taxes. Tom Daschle, who President Obama wants as his secretary of Health and Human Services, apparently did not pay $128,000 in taxes that he owes to the government. Do you realize Obama hasn’t had a Cabinet member with an embarrassing tax problem like this since . . . the last guy they appointed?

Because of a huge budget crisis, California is now going to delay paying tax refunds. To which Tom Daschle said, “That’s why I didn’t pay them in the first place.”

From Andy Borowitz:

Obama Considers Tax on Cabinet

From Scott Ott:

Obama to Pick from IRS List of ‘Paid Up’ Democrats

The Ice Storm Cameth

For clients and others wondering where we are, we have been out of power since last Tuesday morning as the result of what everyone is calling the worst ice storm ever to hit this area. Just one more fact proving AlGore's global warming theories to be a pile of donkey crap. We all wish we had warming after digging out of the ice and cutting down hundreds of fallen trees to barely clear the roads.

Needless to say, we have had no internet access up on the mountain and we received our first snail mail delivery since last Monday yesterday by meeting our mailman half-way.

Parts of the Ozarks do finally have power and we were able to make it off the mountain this afternoon to set up a satellite office in a Super 8 motel room in Harrison with two laptop computers and a laser printer from my main office.

Our electric company is vague about when we will have power restored, but they do have some pictures on their website of what things are looking like around here. Tax returns will be delayed a bit; but I will do my best to answer emails as soon as possible.