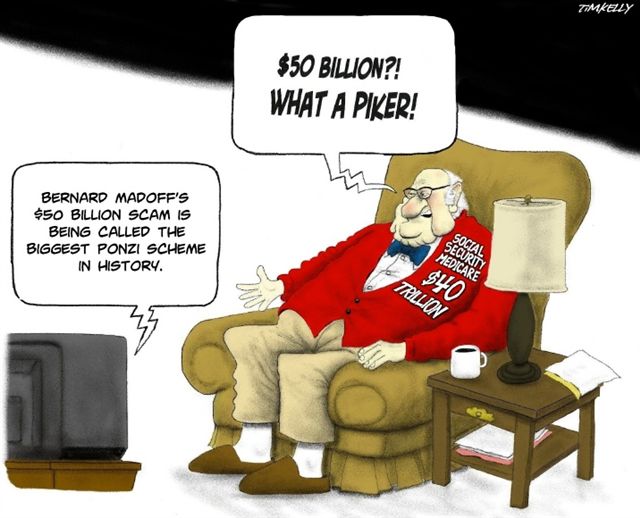

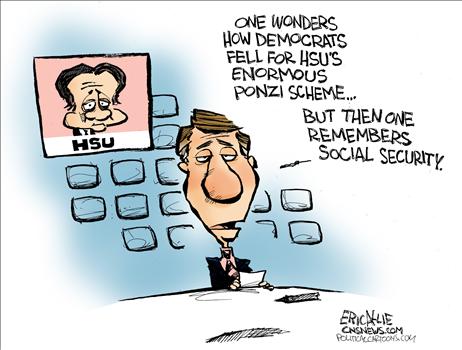

Comparing Ponzi Schemes

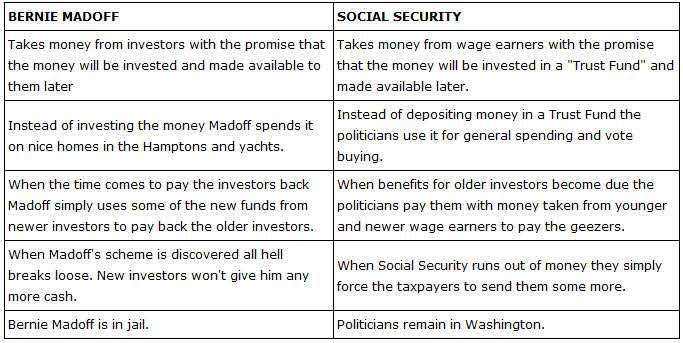

Neal Boortz recently posted this side by side comparison of the two largest Ponzi schemes used to steal investor money in this country.

Another big difference between the two schemes was the fact that Madoff's victims invested their money voluntarily, while Social Security is funded at the point of a gun. Madoff's investors stopped giving him their money as soon as it was revealed to be a fraud. IRS is still forcing people to pay in to the SSA even now that's its collapse has been revealed to be imminent.

Next in Line for a Bailout: Social Security – All Ponzi schemes eventually collapse on their own.

Labels: SSA

No increase in SS tax base for 2010

There has already been a lot of press coverage of the fact that there will be no increase in the monthly benefits paid to Social Security recipients in 2010 because of the low inflation rate for the past year.

For the first time I can recall, we also have a freeze in the other side of that equation, the maximum earned income that is subject to the Social Security (aka FICA) tax. The maximum for 2010 will be the same $106,800 as it has been for 2009 according to IRS and the SSA.

I still stand by my prediction that it is only a matter of time before that ceiling is completely removed, as it was a while ago for the MediCare tax. The politics of class envy and soak the rich rhetoric are as hot and heavy as they’ve ever been; so forcing those “evil rich” people to pay more SS tax will be a very popular move.

Likewise, there will be also a stronger push to “means test” eligibility for future Social Security benefits, with those having an AGI and/or a net worth over a certain limit established by our all-wise rulers in DC phased out of receiving anything back from the SSA.

So, people earning over $100,000 will be forced to pay in more to the SS system with the probability of receiving even less of it back than ever before. If this doesn’t encourage more people to take legal steps to reduce what they pay in to the SS system now, such as by the effective use of corporations, it’s hopeless for those folks.

Labels: SSA

Higher SS Taxes

Social Security Announces 2.3 Percent Benefit Increase for 2008 – What the drive-by media aren’t publicizing is the other side of the equation, the increase in the income subject to the 12.4% Social Security tax from the 2007 level of $97,500 to $102,000 in 2008. This is an increase in the SS tax of $558 for the 12 million people SSA estimates will be in this income level.

As I’ve long predicted, and will almost certainly happen if the two-headed president is given a third term in the White House, the ceiling on income subject to this tax will be removed entirely, as it was for the 2.9% Medicare tax. This will also be accompanied by a reduction or complete elimination of benefits to people in these higher income levels.

Labels: SSA

Facts of life...

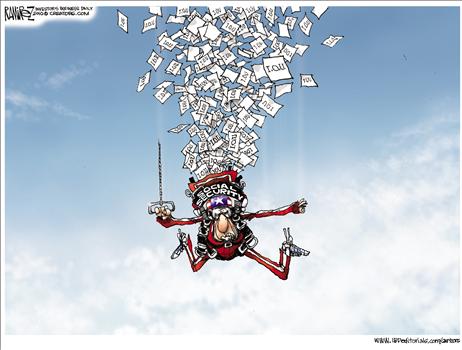

The best way to explain how Social Security works is to describe a typical Ponzi Scheme.

(Click on image for full size)

SS Base Increases

Anyone who understands the future of the current Ponzi Scheme setup for Social Security knows that the only way it can continue to survive is to increase the tax rate and the amount of income subject to the tax, which is FICA for W-2 wage slaves and Self Employment tax for those of us in control of our own income.

My long running prediction that the ceiling on the income subject to the tax will be removed completely is still on target and should be implemented shortly after the Dems take control of the White House. In the meantime, Spidell just sent out an email with the following scheduled increases in the taxable income base according to the SSA's projections.

2008: $102,300

2009: $106,800

2010: $111,600

2011: $116,400

2012: $121,500

2013: $126,300

2014: $131,700

2015: $136,800

2016: $141,900

As I have been explaining for decades, there are very legitimate ways to reduce or possibly eliminate the requirement to pay any Social Security or Medicare tax by the proper use of other legal entities, such as LLCs and corporations. Any good tax pro should be able to help clients set things up to accomplish this.

Labels: SSA

Upcoming Ponzi Scheme Collapse...

The financial and actuarial assumptions and predictions for Medicare are the same as they are for Social Security; which means that fewer workers are forced to shoulder the cost for more retirees each and every year until they reach their breaking points and the programs collapse.