No increase in SS tax base for 2010

There has already been a lot of press coverage of the fact that there will be no increase in the monthly benefits paid to Social Security recipients in 2010 because of the low inflation rate for the past year.

For the first time I can recall, we also have a freeze in the other side of that equation, the maximum earned income that is subject to the Social Security (aka FICA) tax. The maximum for 2010 will be the same $106,800 as it has been for 2009 according to IRS and the SSA.

I still stand by my prediction that it is only a matter of time before that ceiling is completely removed, as it was a while ago for the MediCare tax. The politics of class envy and soak the rich rhetoric are as hot and heavy as they’ve ever been; so forcing those “evil rich” people to pay more SS tax will be a very popular move.

Likewise, there will be also a stronger push to “means test” eligibility for future Social Security benefits, with those having an AGI and/or a net worth over a certain limit established by our all-wise rulers in DC phased out of receiving anything back from the SSA.

So, people earning over $100,000 will be forced to pay in more to the SS system with the probability of receiving even less of it back than ever before. If this doesn’t encourage more people to take legal steps to reduce what they pay in to the SS system now, such as by the effective use of corporations, it’s hopeless for those folks.

Labels: SSA

Tax refugees staging escape from New York – As always, any State rulers who didn’t see this as the inevitable result of increasing taxes are complete idiots.

Labels: StateTaxes

Costly fraud and error reported in home buyers' tax program

Wow! Who would have suspected that a refundable $8,000 tax credit would be an invitation for un-deserving people to cheat? Of course, the answer is that our imbecile rulers in DC obviously weren’t able to anticipate what anybody with half a brain could see would be an inevitable result of such a program. Common Sense has to be the scarcest commodity in all of DC.

And the response from our rulers to this? The sub-head of this article sums it up:

Lawmakers consider extension.

Typical problem solving by our moronic leaders. When a government program is filled with fraud and corruption, just make the program even bigger and more costly and available for more people to scam.

Is anyone else in favor of a constitutional amendment to change the eligibility requirements for our elected officials to include an IQ above 50? That would wipe out most of the current ruling class right off the bat.

Official IRS 2010 Inflation Adjustments

For those folks not satisfied with the CCH calculations of the 2010 inflation adjustments that I posted a month ago, IRS has officially released their figures.

Tax Hike in a Lab Coat… Dare to say no to Baucus-care.

– And anyone opposing this socialist takeover of the medical profession is going to be portrayed as racist, evil and cold-hearted.

Eight Year-End Moves That Can Cut Clients Tax Bills for 2009 and 2010 – Some good ideas from the most recent issue of the Intuit ProConnection Newsletter.

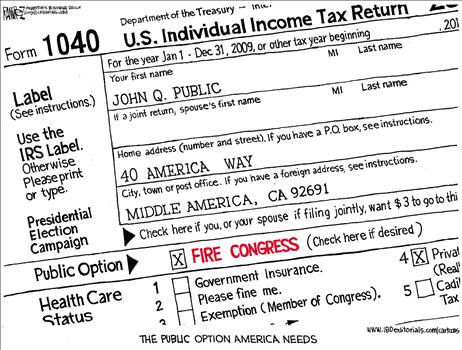

These are obviously not the only ways by which to reduce taxes. For example, they don’t mention the huge potential savings from setting up a C corp before year-end to move income off of a 1040 (aka Income Shifting), a subject that I hope to be able to cover in more detail in a webinar in the near future..

Tax the Rich? How's That Working? – Idiotic politicians always assume that they can just continue to financially rape the people with the money and they will just stand still and allow it to happen. While that worked for Roman Polanski, who was able to prevent his 13 year old victim from leaving by drugging her up, more and more wealthy people are taking actions to stop it, such as leaving the high tax states. How hard is it for the mental midgets in power to understand the concept that five percent of billions of dollars will result in a lot more revenue than ten percent of nothing?

Mrs. Pelosi's VAT. The Speaker floats a middle-class tax hike. – It looks like we may have missed our opportunity to enact something like the FairTax national sales tax to replace the current income and payroll taxes. Our rulers in DC want to have it in addition to all of the taxes we currently have and the hundreds of new ones the insatiable spendaholics in DC are cooking up. The analogy of Queen Nancy’s vat as a witch’s cauldron of poison does seem to fit on several levels.

New IRS Phone Scam

It appears that our friends at the real IRS have even more competition in separating people from their money from imposters.

Earlier this morning, a client called and said that there was a voice mail message on her husband’s cell phone, claiming to be from the IRS and that they needed to call back by the end of business today. I didn’t recognize the 800 number given as being one of the regular ones that IRS uses.

Instead of calling that number back, we decided that it would be best for her to call the main IRS info line at 1–800–829–1040 and ask them to pull up her account.

She just called us back and said that when she called the main IRS switchboard, they had no pending actions against them or anything else that would have warranted any contact from an IRS agent. They also told her that they didn’t even have any of their cell phone numbers in their database.

So, this was obviously another scam from some scumbag looking to trick people into revealing their personal identification, credit card and bank info, much like the email version that I mentioned last month.

Gifts From Parents

Q:

Subject: gifts of 13,000

Good Afternoon,

If I am reading it correctly, it states that a married couple can receive up to $52,000 a year.

Would it be done like this, My mother writing a check out for 13,000 to both my husband and I and then my dad writing a check for $13,000 to both my husband and I. Now the money would be out of the same account with both their names on the check. One signing 2 checks and the other signing the other 2 checks. We are in Ct and they are in North Carolina. We are trying to buy a house and they want to give us money. Thank you.

A:

Gifting strategies are the kinds of things you and your parents should be discussing with your own personal professional tax advisors because there are several different ways in which they can be structured.

I noticed some aspects of gifting that you appear to be confused about.

First, there is no maximum amount of gifts that can be received. For the recipients, gifts are exempt from income tax. However, if you were to be given non-cash items, such as stocks or real estate, that have appreciated in value since your parents purchased them, there could be tax consequences when you sell them because you are required to maintain your parents' cost basis.

From the givers' (your parents) perspective, there is also no maximum that they can give away in a year. However, if either of them were to give any person more than $13,000 during a single calendar year, they would be required to file a Gift Tax return (Form 709) to report that to IRS. There is also a lifetime exemption of one million dollars of gifts per giver, so even if they exceed the annual $13,000 limit, they wouldn't have to actually pay any gift tax until they have used up the million dollars.

There is a provision in the tax law allowing for married couples to split their gifts if they are made by only one spouse from his/her separate money. This enables both spouses to use their $13,000 annual exemption.

In the proposed plan that you mentioned, it sounds as if the bank account is jointly owned, so each could give you $13,000 and your husband another $13,000 without the need for any gift tax returns or gift splitting. Added all together, that would be $52,000.

This was a rather lengthy way to say that your plan appears valid. However, there are ways to transfer even larger amounts of money without exceeding the annual limits that should be discussed with your own personal professional tax advisor.

For example, if you needed $200,000 right now, your parents could gift you the $52,000 in 2009 and loan you the additional $148,000. In future years the principal of the loan could be forgiven as gifts in those years in increments of $13,000 or whatever the annual limit is in those years.

I hope this helps.

Good luck.

Kerry Kerstetter

Follow-Up:

thank you so much for getting back to me.

Labels: Gifting