The most recent Intuit ProConnection newsletter has some very useful and interesting content, including the following.

When Fraud Knocks on Your Door – Helping clients minimize the damage from being ripped off by “trusted” employees. This also includes a handy doc file to alert clients on the Top Ten Tips To Help Prevent Fraud.

New Tax Increase Prevention Act – A summary of some of the key components of the recently enacted legislation. This also has a handy doc file for clients on how this new law may apply to them.

More On Setting Up A Tax Blog

For quite a while now, I have been advising other tax pros who want to increase their clientele that a blog is the most effective way. I hope these exchanges with Gina in Texas are helpful for others who are considering doing the same thing.

From Gina:

Kerry,

Thanks for the traffic to my blog :-) ! I've been trying to add more articles, a site feed and allow for comments as you suggested. There are still a lot more things I can do with the blog and I'll add them as time allows. Late yesterday I talked to the editor from my local paper and it looks like they may be interested in publishing an article or two after all. So, things are starting to pick up for me. You're a great mentor.

Thanks,

Gina

I wrote back:

Gina:

I'm glad to help.

Since I have also been using Blogger since the beginning for my blog, I can give you more suggestions than if you had chosen to use one of the other programs. You should occasionally look over the various items under the "Settings" section of your Blogger page. They are always adding new ones. For example, they have a built in RSS capability, so you don't have to rely on outside services, such as the Feedburner one you have set up.

Blogger also has long had a built-in comments function. I have chosen not to use it because I barely have enough time to do regular posting and do not want the hassle of monitoring the comments, which will undoubtedly be bombarded with spam. I have found that using the Q&A format based on actual emails readers send to me has allowed me much more control than an open comments section would.

If your experience turns out like mine and that of other bloggers around the country, you should see the readership grow exponentially. Besides bringing in new clients, it will also bring in a lot of other media coverage, including requests to submit articles to other publications, as well as interviews specifically about your blogging experiences. If there aren't a lot of people currently blogging in your local community, your local paper will probably want to do an article about your experiences for their local readers to learn from.

And the end result will be like it was for me, that you will have more tax clients than you can properly handle and will be able to be very selective as to who you work with.

Good luck.

Kerry

Starting New Tax Blog

This is a follow-up to this earlier conversation.

Subject: Re: just starting out on my own...Kerry,

I took your advice and started a blog. My blog is http://glgcpa.blogspot.com and I just posted my first article this morning. I think I'm going to like blogging.

I have also tried to contact the editor of our local newspaper to see if she is accepting any freelance articles, but she has not gotten back in touch with me.

I contacted our Chamber of Commerce and evidently their treasurer is a CPA and was the contact person and said that if they needed anyone to speak he would do it. I had no idea it would be so hard to give away free information :-) .

The good news is that I do have a handful of clients and one of them is a gem. They have already referred me to two other people who I am hoping will become clients.

Thanks again for your help and any advice you have to give me on my blog or whatever I appreciate it.

Gina

My Reply:

I'm impressed that you got onto that so quickly. It looks very nice.

You should go into the "Site Feed" tab in your Blogger settings and set up for your blog to produce an RSS feed, and then post the link for that on your blog. That is the most efficient way for people to read blog posts. You can see the ones I subscribe to here.

You can slowly add other features as you see fit and after you check out what looks good on the blogs. Almost all of the blog tools I use are free; so check those out.

Your articles are very good. If you run out of ideas, you may want to consider giving some real life examples of how you helped real life clients solve various tax problems, without revealing any client identities of course. That will show people the areas in which you have experience. I have also found that people appreciate real life stories of how the tax laws work more than the theoretical examples used by most academics.

You can also invite readers to submit questions, which could very easily turn into paying clients. I literally receive half a dozen requests each week from my readers to take them on as clients, often after they have submitted a few questions that I have posted on my blog. As far as I know, the only blogs that currently address reader questions are mine and Eva Rosenberg (www.TaxMama.com) who actually answers her questions in her podcasts.

Congratulations on getting started. Keep up the good work.

Kerry

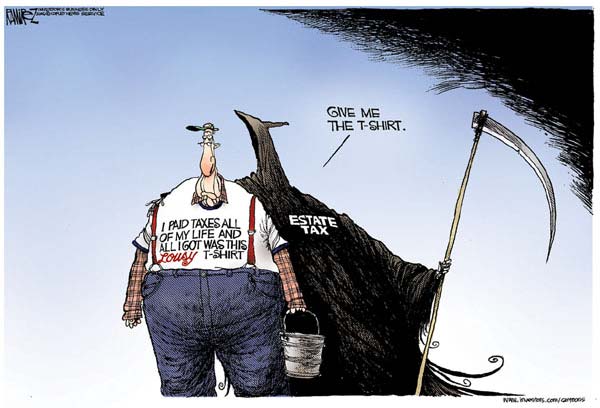

A lot of mysterious deaths in 2010?

In a recent Jay Nordlinger column, he mentions this little warning about the current status of the estate tax law.

The estate-tax issue is multilayered, but I’d like to stress the macabre: A friend was saying the other day, “You know, there are people — not necessarily bad ones, either — who are kinda sorta hoping that their parents will die in 2010. They have to die sometime, goes the reasoning, and if they’re going to kick off — why not in 2010, when the estate tax is zero?” Another friend joked, “If you’re wealthy, be sure to protect yourself from your children, during 2010! Watch that they don’t put something in your Metamucil!” Certain heirs will feel like they hit the jackpot, four years from now.

A sick tax, this death tax — really.

Dealing With Tax Bug

Q-1:

Subject: ClientsAre you taking clients? I have the tax bug bad!

A-1:

I wish I could help you fight your tax bug; but I already have too many clients to take care of; so we are still trimming back on the difficult clients and are not accepting any new ones at this time.

Unfortunately, we don't have anyone to whom we could refer you. If you haven't already done so, you should check out my tips on how to select the right tax preparer for you.:

I wish I could be of more assistance; but I wish you the best of luck.

Kerry Kerstetter

Q-2:

Thanks for your response Kerry. I was reading your tips on selecting the right preparer when I suddenly realized I needed one, or at least one like you where describing. Congratulations on your success and I can see from your web page and how you handle others why you're so busy. I bet you feel like one crying in the wilderness "there is a better way" I speak to others about these tips and tactics and they act as if I am giving them a virus. I don't think people relate tax savings to real money or that is my perception.There is one thing you could help me with if you have any spare time. There is a company online called www.drewmiles.com who offers one year of coaching on aggressive tax strategies, tips and lawsuit protection. I listened to the audio version, which peaked my interest and then spoke with a representative. His ideas have weight and validity and now I am contemplating purchasing personal coaching and I would be interested in any opinions you may have about this move. It is fairly expensive (3,995.00) however the tax savings for me could be substantial (he has a 110% money back guarantee if I don't save at least $30,000.00 my first tax year) Have you ever heard anything about this company or this individual? Thanks for your time and keep up the good work! It is our constitutional right to minimize taxes or at least the Supreme Court agrees it is.

A-2:

I am familiar with Drew Miles. Several months ago, another CPA sent me some of his promotional material. Here is my reply to him.

"That's just another one of the many so-called tax experts who claim to be the only ones who know how to help people lower their taxes; when in actuality every one of his ideas is something that I and many other tax pros have been using for decades for our clients. It is insulting that he feels a need to belittle us CPAs in an effort to make himself sound smarter. Nothing new."After that, I made the mistake of signing up for Drew Miles' email alerts and now receive a dozen or more high pressure emails each and every day.

My opinion is still the same. Drew Miles' ideas are valid, but are nothing unique that any competent and creative tax advisor can't accomplish for much less cost. For example, I do those exact same kinds of things for my clients for much less, and I am one of, if not the, most expensive CPA in the area (an intentional but unsuccessful way of limiting the size of my client base).

While those of us in the tax practitioner community who believe it's our duty to do everything legally possible to help clients minimize their taxes are obviously in the minority, there are enough of us to be able to service those clients who desire our services. If you are diligent in your search, you should locate such a person.

Good luck.

Kerry Kerstetter

Most Flexible Business Entity?

Q:

Subject: Tax Guru-Ker$tetter Letter: Setting Up CorpKerry,Since an LLC can choose to be taxed as a Corp and is a simpler form of organization that a C corp, doesn't the LLC provide the most flexibility?Blog: Tax Guru-Ker$tetter Letter

Post: Setting Up Corp

Link: http://www.TaxGuru.net/2006/06/setting-up-corp.html

A:

Choosing the method of taxation is only one of many aspects to be considered when deciding on the appropriate business entity to work with.

It is also something that is generally only available for the first year of operation. If you were under the impression that you could switch back and forth each year, that is not how it works. Changing the classification has some very messy requirements, often resulting in immediate taxation of certain types of gains; so it is not to be done without the careful consideration of competent professional advisors.

Kerry Kerstetter

New Anti-Tax Song

Jeff Parnell, a congressional candidate up North of us in Missouri, is also a singer song-writer. He has some funny political songs available for download on his website. The one called “Red State Blues” is very funny, making good use of the widely known insane screams by the head DemonRat, Howard Dean.

The song that most caught my attention is obviously the one addressing the current state of our tax system, “Perhaps We Need A Tea Party Again,” which I first heard about from some of the FairTax supporters, who have this song playing on their website, as well as available for MP3 download. They also have the lyrics, which make a lot of sense.

"Perhaps We Need a Tea Party Again"

Lyrics and music by: Jeff ParnellOne night in Boston Harbor, the tea flew overboard.

They said, "We don't owe King George a thing, we answer to our Lord."

They built this land of freedom, but things have changed since then.

Perhaps we need a tea party again.They passed the 16th amendment, and the income tax was law.

But it punishes achievement, and that's just one of many flaws.

Then along came withholding, we don't know what we pay in.

Perhaps we need a tea party again.There's a better way to pay the bills, and the Fair Tax is its name.

We can fully fund this government, and end these silly games.

We can save Social Security, and Medicare it's true.

And the Congress needs to hear all this from You.Career politicians love the power of tax and spend.

And it's time that all of us take a stand and reign them in.

This country is worth saving, and I'm telling you my friends,

"Perhaps we need a tea party again."

Selling Residence To Controlled Entities

Q-1:

Subject: RE: Sale of Personal Residence

Kerry,I'm puzzling over this discussion.I'm not sure when the questioner is assuming Sec 121 kicks in.When is the property "sold" for purposes of Sec 121: when "sold" to the LLC for the note or when the units are sold by the LLC? For tax purposes the LLC is disregarded so is it possible to even "sell" to the LLC from the IRS point-of-view? Would the answer be the same or different if an S-corp were used in that it is a unique "person" under the law?In my case I am considering transferring my personal residence condo to an LLC or S-corp and converting to a rental and would want the liability protection of the LLC or S-corp; but how/when would it be reported to the IRS for purposes of Sec 121? Or would I lose the benefit of the Sec 121 exemption if I hold it for rental beyond three years after converting it to rental?I've searched everywhere and this question is the closest I've come to a discussion about this scenario. I can't find anything on the IRS site that seems to give a definitive response.Thanks,

A-1:

The gist of that Q & A was to highlight the fact that the Section 121 exclusion is available to be used when a home is sold outright to a related party. According to the IRS Pub quote, the only time it's not available is when a remainder interest in the home is sold.

This means that a sale to a controlled C or S corp would be eligible for the Section 121 exclusion, assuming all of the normal conditions are met.

As always, you should be working with an experienced tax professional before setting up any of these kinds of transactions.

Good luck.

Kerry Kerstetter

Q-2:

Kerry,Thank-you for your reply. You didn't say but I take it from your reply that you don't think that sale to an LLC would qualify for Sec 121 treatment; is that correct?Can you recommend a tax professional in Denver, or anywhere, that is competent and can answer questions? I have tried to find one to discuss this with and have not been able to find anybody that knows what they are talking about. Or maybe they just want to deal with the easy and usual.Twice I was referred to the related party rules that govern 1031 exchanges. When I pointed out I wasn't looking at a 1031 exchange they both told me the rules still apply to my case. When I asked where in the regulations I could find that they just said its too complicated and I don't want to get into it. In response to my questions I've been asked why I want to do it, told not to do it, sell it to a third party, etc. etc. but never just an answer to my questions. So I go hunting through IRS pubs and the internet trying to find answers.I want to explore my options: where do I find someone who is competent and can answer questions?Thanks,

A-2:

Actually, it was the opposite. That sale to the LLC should qualify for the Sec. 121 tax free exclusion.

There are obviously some gray aspects to this issue. For example, a sale to an LLC that is being reported on the owner's Schedule C (disregarded entity) would probably not qualify; but a sale to an LLC that files its own 1065 or 1120 should be okay.

The rules for related parties are stricter for 1031 exchanges than they are for primary residence sales.

You will need to work directly with an experienced tax pro who can analyze your unique circumstances. I wish I could help; but I already have too many clients to take care of; so we are still trimming back on the difficult clients and are not accepting any new ones at this time.

Unfortunately, we don't have anyone to whom we could refer you. If you haven't already done so, you should check out my tips on how to select the right tax preparer for you.

I wish I could be of more assistance; and I wish you the best of luck.

Kerry Kerstetter

Labels: 1031

Lease vs. Buy?

Q:

Subject: Leasing semi-trailersMr. Kerstetter,I have been in the semi-trailer leasing business for over 17 years. Naturally one of the biggest obstacles I face on a daily basis is competing against the bank or other financial institutions who offer typical financial arrangements, conditional sales or leases with purchase options. The arrangement we offer is an operating lease. Most companies seem to want to own the asset and shy away from the operating lease.

Is there any way to target companies that an operating lease would be to their advantage? Also where could I go to find out further tax advantages of leasing vs. owning and have it presented in laymen’s term for the sake of an easy, understandable presentation. Any help or suggestions you might have would be greatly appreciated!!

A:

There really is no universal answer to the lease versus buy question. It really boils down to the terms involved in a particular deal, especially the interest rate built into the lease payments. As I've mentioned on several occasions, I am not a fan of leasing cars and trucks because the leasing companies often have interest as high as 30% built into the payments. Comparing that to the interest charged on normal purchases makes that decision practically a no-brainer.

Other than the Section 179 expensing allowance for purchases, the tax breaks between leasing and depreciating are pretty close to the same for each.

From a business and financial perspective, one of the selling points for leasing instead of buying is the ability to often keep the debt off of the company's balance sheet, improving the important debt to equity ratio. We covered this point 33 years ago in my college accounting classes and it is still used today. In fact, I remember stories about Enron, before it crashed, mentioning how they artificially kept their debt levels low by leasing assets from subsidiaries and other entities that were owned by Enron executives.

I'm sorry I couldn't be more help.

Kerry Kerstetter

Labels: 179

Setting Up Corp

Q-1:

Subject: your articleI would like to take this opportunity to thank you very much for your informative article. I found your “S” vs. “C” article using a google search. Your insight has made my decision of which way to go as I incorporate my medical office very simple. I wasn’t entirely sure of all the facts, but now I am definitely going with the “C” corp. Thank you again, as your help is much appreciated.

A-1:

I'm glad that you found my article informative. I must caution you that using that as your only reason to set up as a C corp is as dangerous as someone taking a medicine based on something he read on the web. You absolutely need to work with a tax pro who is experienced in utilizing corporations to maximize tax savings.

This is especially important for anyone in your profession because there are some important steps you need to take in order to avoid having your corp classified as a Personal Service Corporation (PSC) which is subject to much higher tax rates than normal C corps. There are easy ways around this, often by the use of two entities. A competent tax advisor should have no problem in helping you set things up properly.

Good luck.

Kerry Kerstetter

Q-2:

Thanks again for all of your help. Do you have anyone that you would recommend to work with in the San Diego area?

A-2:

Qualifying SUVs

Q:

Subject: SUV

Kerry

I stumbled upon your web site while searching the web trying to find a list of SUV's that Qualify for the section 179 $25,000 deduction for my business. The IRS does't have one (How do they check our returns?).

Would you have such a list?

Thank you for your time.Sincerly

A:

A few years ago, I posted some sources of such a list on my blog.

I haven't checked them lately; so some may not be valid or up to date any more.

Good luck.

Kerry Kerstetter

Labels: 179

Is Genghis Khan a UM accounting professor's forefather? – Talk about breaking the classic stereotype of accountants!

Update: It seems they were very premature (and wrong) in declaring a genetic link. Let the student hazing begin.

Who really get our tax dollars:

As I've long pointed out, the best return on investment in this country is available from campaign contributions (aka bribes). Out rulers will return millions and billions of dollars in special programs in exchange for a tiny fraction of that. Unfortunately, the GOP rulers are just as generous with our tax dollars as are their DemonRat partners in crime.

Some things are just indefensible.

I refuse to be put on the defensive by opponents of the efforts to repeal the estate tax, such as in this article sent to me by Ohio CPA Dana Stahl, along with the following note.

Mr Guru - any comments? Some arguments here to keep the estate tax going.DS

My reply:

Dana:

I happen to be one of those who consider Communism and all of its planks to be inherently evil. Just because one of its planks (confiscating inheritances) only affects a limited number of people doesn't make it right. Neither does doing immoral things for the sake of money.

Kerry

California Moves to Ease Oversight on Accountants. Regulatory officials take steps to promote the profession and roll back tough post-Enron standards. - Looks like creative accounting may soon be back in vogue out on the Left Coast.

More Truth In Advertising

This would also be so appropriate at the PRC border crossings for those who enter legally.

Get Real About Real Estate for Your IRA – Gail Buckner looks at some of the complications involved in doing this properly.

Billable Hours

I’m pretty sure the following question has to do with how many professionals, including some accountants, bill based on a 50 minute hour. I have always included a note on our bills that we use 60 minute hours, which we keep track of using actual stop-watches while working on clients’ projects.

Subject: What is .1Hi Kerry,What is .1 when talking about billable hours.Thanks,

My Reply:

.1 is 6 minutes; one-tenth of an hour.

Kerry Kerstetter

Follow-Up:

Thank you so much!

Building A Manageable Tax Practice

From a CPA in Texas:

Subject: just starting out on my own...I'm just starting out on my own and according to my business plan...my goal is to be where it appears you are today.

Anyway, I just wanted to thank you for your website and blog as they have been tremendous resources for me.

Also, since you are no longer taking clients, I was wondering if you would feel comfortable passing on any new Texas leads my direction? Since I am just starting out on my own, I am limiting my practice to just the state of Texas (where I live). Since you don't know me I would understand if you wouldn't feel comfortable doing as I request.

If you have the inclination and time, my website is here: and I'd appreciate any and all comments, advice, suggestion, etc.

Thank you again,

My Reply:

I checked out your website and think it is well laid out.

I particularly like how you have carved out a specific niche for yourself, both geographically and in the services you provide.

I will definitely keep you in mind for Texas clients that I come across. One of my goals is to eventually have a list of tax pros with whom clients can work with around the country.

You didn't mention what your marketing plan is to build up your client base; but I can share what has worked for me.

Both back in my old stomping grounds in the San Francisco Bay Area, as well as here in the Ozarks, I was able to quickly build up a large client base by giving speeches on new tax topics to local service groups (Lions, Rotary, Kiwanis, etc), as well as presenting seminars on various tax topics for chambers of commerce and Realtor groups. This did entail a lot of driving around, but by the time I got back to my office there would always be calls from new potential clients. Since you have a very specific geographic area in mind, you can limit your coverage accordingly.

When I gave my speeches and seminars, I did no specific selling of myself. I just spoke about the topics. Hard selling speakers who claim to the be the best in the world are huge turn-offs; so I kept that very low key. People would actually come up to me afterwards and ask if I just spoke about taxes or actually did tax work.

Those were before the internet had grown to the coverage it has today. As you have noticed, I do receive at least three or four requests each week from people who want to work with me based on what they have seen on my website and blog. Unfortunately, I do have to turn them away. However, for anyone wanting to attract new clients, a blog seems to be much more powerful a tool than personal speeches. Just as speeches and seminars allow potential clients to see what you know and your attitude (like a mini-audition), blog postings accomplish the same thing, with no travel time.

If you are interested in starting your own blog, I would be glad to share my experiences. If you want to write an article on a certain tax or accounting topic, I would also be glad to post it as a guest column on my blog, either to jump-start traffic for your own blog or just to steer some visitors to your website.

I wish you the best of luck.

Kerry Kerstetter

Follow-Up:

Kerry,

Thank you so much for taking the time to look at my site and respond to my email. It means a lot to me. I also appreciate that you are willing to refer potential Texas client's in my direction.

To be honest, I don't have much of a marketing plan right now. I've been making cold calls - dropping by businesses. I'm planning on sending out postcards during the 2nd week of January in hopes of gaining individual clients. I'm gathering that address list now.

Your advice on speaking engagements is a very good one. I have contacted the Chamber of Commerce asking for information about becoming a member (real small town here - the chamber doesn't have this information on it's website). When I apply for membership I will inform them that I'm available if they would like me to speak at their next meeting. As for the other local groups I will have to check out what my area has to offer.

I don't know much of anything about blogs, but I keep hearing more about them daily so I will have to do some research. So yes, I would love to hear your experiences with blogs. I've never written any articles so I would have to read some with that in mind (as opposed to just reading them for content), before I would feel comfortable writing any - I guess this would go for my blog as well.

Thank you again,

Being Good With Numbers Won't Guarantee Success – Some tips on starting a new tax practice from the Wall Street Journal.

Sec. 179 For Machinery To Be Leased

Q:

Subject: Section 179 DeductionDear Kerry,Just a short question. If I set up a company (sole proprietor or partnership) and purchased a large piece of machinery (punch press for $90,000.00), then lease (5 years) it to a corporation (that I own 15%) does it qualify for a Section 179 Deduction on my 1040?Thanks in advance for your prompt reply.

A:

As always, this kind of thing needs to be discussed and evaluated with your own personal professional tax advisor.

The short answer to the way you described your proposed investment is probably not. If you look at this excerpt from IRS Pub. 946 you should be able to see the fatal flaw in that particular arrangement.Leased property.Generally, you cannot claim a section 179 deduction based on the cost of property you lease to someone else. (This rule does not apply to corporations.) However, you can claim a section 179 deduction for the cost of the following property.1. Property you manufacture or produce and lease to others.

2. Property you purchase and lease to others if both the following tests are met.

- The term of the lease (including options to renew) is less than 50% of the property's class life.

- For the first 12 months after the property is transferred to the lessee, the total business deductions you are allowed on the property (other than rents and reimbursed amounts) are more than 15% of the rental income from the property.

Your personal tax pro should be able to help you set up thing in such a way as to work around this restriction, such as by possibly setting up a new corp to buy and lease the machinery.

Good luck.

Kerry Kerstetter

Labels: 179

Fine Print

From today’s excellent batch of Thomas Sowell’s Random Thoughts:

More than half of all people filing income tax forms use someone else to prepare the forms for them. Then they have to sign under penalty of perjury that these forms are correct. But if they were competent to determine that, why would they have to pay someone else to do their taxes for them in the first place?

That actually may be connected to another of his points:

If you read all the fine print in all the documents you have to sign, you would have no time left to live a life.

Group Blogs

Q:

Subject: from Brice at TradingMarkets.comHello Kerry-I’d like to invite you to be a part of www.themoneyblogs.com/. It’s gonna be big—we expect it to be the largest money blog site on the Web. The entire site was built around maximizing page views—to our knowledge, no one else has done this. Best of all, it's free and it would not require any additional work at all from you—we can use your RSS feed to post. You could drive additional traffic to your blog and get even wider exposure. I have a media campaign starting shortly, and it would be nice to have you in there to receive the benefits from this.What do you think? Can I set you up today?Brice

A:

Brice:

I appreciate the offer; but must respectfully decline. I value my independence and the ability to openly express my uncensored opinions far too much to be able to handle being part of a blog that is controlled by anyone else.

However, I wish you the best of luck in your endeavor.

Kerry Kerstetter

Follow-Up:

OK. Just to let you know, we are just repostintg blogs, not doing any editing.Brice

Claifying Home Sale Limiits

From an interested reader:

Subject: Re: outsourcing to India

Mr. Kerstetter,Just a note to say I liked what you said on June 12 about outsourcing. I support anything that promotes an informed consumer. I feel the same way about genetically modified foods. I have no problem buying and eating them, but will support anyone who bothers to put that information on the label because it increases my choices.Also, on the 11th you told a couple they would each qualify for the exemption on their home sales. You might want to add that it is a per person exclusion, not really a 500k per couple exclusion. In other words, if they were hoping that if one fell short of the exemption the remainder could be credited toward the other, they are out of luck.

My reply:

That was the point I was trying to make regarding the tax free home sale exclusion; but your explanation makes it even clearer that each spouse's exclusion stands alone and they can't be added together in the way that you mentioned.

Thanks for writing.

Kerry Kerstetter

India picks up accounting work as part of outsource trend – More on an issue I have discussed on several occasions.

I still think it’s a good idea for tax and accounting firms that don’t farm their work out to other countries to explicitly state that fact in their promotional and advertising materials. Since I doubt that most clients are aware of the extent to which accounting firms are using Indian sub-contractors, having that item mentioned in firm literature should hopefully make them more aware to the point that they come out and ask firms that don’t cover it and expose those that are keeping their use of Indian outsourcing a secret.

Of course, if USA firms openly disclose their use of outsourcing to current and potential clients, and those clients have no problem with that fact, there should be no problems.

Home Sale By Newly Married

Q:

Subject: Love your blog; have a question

Hi Kerry - I've been reading your blog this evening trying to see if you've already answered this question... I can't seem to find it answered already, so here goes:My partner and I are planning to get married. Each of us owns a primary residence (I've owned my house about 4 years; he's owned his house 2 years.) We'd like to sell both houses this year, and we each want to be able to take advantage of the primary residence exemption from capital gains tax.The question: can we sell the houses and get married in the same year (and still have the tax benefits on our real estate sales)? or do we need to wait to get married until next tax year?Thanks in advance!

A:

Whether you are married or not won't make any difference.

If you each meet the tests for your respective residences, you will each qualify for the tax free exclusion of up to $250,000 of profit, either on a joint 1040 or on two separate ones.

You can see more on this issue in the IRS's Publication 523.

Your own personal professional tax advisor can give you more specifics for your particular situation.

Good luck.

Kerry Kerstetter

Corporate Complications

From a CPA in California:

Hi KerryOne if my clients sent me the article you wrote about The negatives of Sub-S corporations. With what you say you have some valid points i.e. the used of Multiple Section 179 deductions. Which would be valid if you have a machine shop or other company with a lot of new equipment purchases.

What you did not mention is the high cost of Social security taxes (15%) of the earned income also the Double taxation of retained earnings distribution and the deferred taxes for the retirement contributions.

While I can see why you did not go into detail on them you should least give them mention as being considered in the overall picture of the clients tax situation.

If I can be of any help please call or e-mail.

My Reply:

Having to address each of those issues, plus dozens more, is the very reason I insist that nobody make decisions on what entity structure to use without consulting with a qualified tax pro.

Thanks for writing.

Kerry Kerstetter

Labels: 179

Tax Exempt Partnerships?

Q-1:

Subject: tax-exempt partnershipI got some info today about the 5 Cees Compaines and a "tax-exemptpartnership" for use in real estate holdings.I dislike anything sold as seminars. But I usually research the ideas theypitch in their marketing.I can't find much info on tax-exempt partnerships and hope that you mightenlighten me. Could it be a tool for long held real estate? Could this beused with existing partnerships? What exacty is it.

A-1:

I'm not clear on what kind of arrangement you're referring to.

Please send me a link to the company you are working with and I will check out their info.

Kerry Kerstetter

Q-2:

I can't find much about the company or the technique.

http://5cees.com/Here is the 'plan'

http://5cees.com/UsersWeb/WPP_Strategy.htmHow it works1. The owner establishes a family Limited Partnership with two typesof family interests.a. One is the general partner who has total controlb. The other is the limited partner who has no voting rights or control.2. Forming a corporation that holds the general partners interest canprovide the owners "Limited Liability Benefits".3. By gifting limited partners interest to a tax-exempt organization -creates a tax-exempt partnership.4. The owner exchanges the property for partnership interests andmaintain 100% ownership of the general partners5. The owner now acquires a large income tax deduction, avoids estatetax and grows tax-free based upon percentage gifted.a. When the property is sold it avoids capital gains tax and the ownermaintained 100% control to buy more property or other assets of choice.

I checked out the website and it doesn't give me a lot of confidence of being legitimate with no names of real people.Also, the basic premise is completely flawed. Giving a share of a partnership to a tax exempt entity doesn't make the entire partnership tax exempt. Whoever came to that conclusion is completely nuts and not to be trusted.

Unless there is more to back up this plan, I would stay as far away from it as possible.

Kerry Kerstetter

Not True!

And any tax advisor who recommends intentionally losing real money in order to save on taxes should be avoided at all costs.

Exotic Mortgages Remain Popular Despite Their Increasing Risks

Why the super-rich don't mind the death tax – Interesting take on the matter, even though the supporters of Karl Marx’s wealth confiscation program seem to currently be winning the debate with their exploitation of class envy. As always, the big winners from retaining this form of grave robbery will be those of us in the wealth preservation profession. For those practitioners who fear a loss of business due to do it yourself tax and accounting programs, I constantly have to remind them that, as long as the government wants to confiscate anyone’s money, there will never be a shortage of clients for us to work with.

Mutual Fund Investors Unite! – Gail Buckner looks at a pending bill in Congress that would allow deferral of taxes on reinvested income.

Section 179 Income

Q:

Subject: When is my AIG NOT really AIG?I have tried to do a section 179 on my business expenses for 2006. It seems as thought I cant exceed the 22k that was reported on my W-2's even though the IRS is saying my early withdrawal of IRA funds is being reported, taxed, and penalized as 2006 income. My total income was about 67K but i cant go higfher in my business losses than the 22k reported on my W-2? Something doesnt seem right here. The IRS is counting my 1099 income as income only when it is beneficial to them? Why wont they count it as income for my business losses?Thanks in advance,

A:

The rules are very clear. The kind of income that qualifies as an offset to Section 179 is "earned" income, which is the kind that is subject to Social Security taxes. IRA withdrawals are not subject to SS tax, and thus do not count, even though they are subject to normal income taxes. The same thing applies to all other kinds of unearned income, including pensions and investments (interest, dividends and non-business capital gains).

You should be working with a professional tax advisor before making any of these kinds of moves so that you aren't surprised by the consequences.

Good luck.

Kerry Kerstetter

Labels: 179

1031 With Low Equity

Q:

Subject: 1031 Exchange Question

Dear Sir:

I wish to sell my house in Los Angeles, which is an investment property now, and in which i have not lived for over 3 years, for about a million dollars in a few months, and then within 180 days i wish to have closed escrow on a 600,000 dollar property, planning in time to knock down the shabby building on it, but borrowing a million dollars to build 8 units where that shabby property was within the 180 day period of the sale of my original property.Question 1. It I have bought the new cheaper property, and received the construction loan to build on the site where that shabby property is, within the 180 days of selling my original home, will this quality as a 1031 exchange? Or is such a project not covered by the 1031 program since it would take more than 180 days to build the 8 units, or for any other reason?Question 2. I bought my original home long time ago for 275,000, and i invested 100,000 dollars in renovating it. But now I owe 540,000 on this property since i refinanced it in the interim. If i sell this original house for a million dollars, satisfying all relevant 1031 exchange requirements, are these following steps the steps which would occur in this transaction? First, the 540,000 loan is paid back, and then my net return now due to me after the sale of my original home, which should probably be a million dollars minus the 540,000 ( and also minus real estate commissions), is put into the new building or real estate project, plus a new loan is obtained for whatever additional moneys are needed to get into the new building or real estate project, keeping in mind that the new project would need to exceed the one million dollar value of the original building?I thank you in advance for your answers to these 2 questions, and any helpful further thoughts which you may have on my planned project. I will also keep you in mind for all my 1031 exchange needs, including conveyances, and facilitations.Sincerely,

A:

You really need to be working on this kind of plan with your own personal professional tax advisor who can look at your actual figures. In fact, we always advise people contemplating a 1031 exchange to have their tax advisors do the calculations on the tax effect of a full cash sale in order to see if an exchange makes economic sense.

With the brief description that you gave, it will probably be worthwhile to look into an exchange. One of the issues that you need to discuss with your personal tax advisor is the adjusted cost basis of the original property. If you did take out equity via a mortgage, and did not use that money to make capital improvements, it is very likely that the current loan balance is much higher than the cost basis, especially after reducing the basis for depreciation.

In regard to the rules for reinvesting the exchange proceeds, it isn't required that the new property be completely finished within the 180 days. You just have to spend, via cash and debt, an amount equal to or higher than the net proceeds within the 180 days. With unfinished construction projects, you need to be very careful in regard to prepaying the contractor because there have been plenty of cases where the contractor disappears without finishing the job.

Good luck.

Kerry Kerstetter

Labels: 1031

Oil Wells

Q:

Subject: tax questionthanks for your interesting blog.i have question for you.suppose i invest 10k in an oil well.do i get to write it off? is the income it produces, say 5k/yr deductible against my initial investment?regards

A:

There is no one size fits all answer because of the multiple varieties of investments that could be involved.

For example, if you are purchasing oil drilling equipment, it could possibly be expensed under Section 179.

If you are buying the royalty rights to a well, there is a potential to deduct the investment over time as the oil is extracted, as a depletion allowance.

You really need to be working with your own personal professional tax advisor who can look at your proposed investment and give you more accurate advice for that particular situation.

As I've pointed out in other examples, the last person you should trust for this kind of tax advice is the person trying to sell you the investment. Those kinds of high commission sales people will tell you anything to make a sale and will be long gone when you discover that the lucrative tax deduction was a lie.

Good luck.

Kerry Kerstetter

Labels: 179

IRC RIP?

GOP Policy Chair Wants Vote on Tax Code Termination – Letting the Internal Revenue Code die on 12/31/09 is an excellent idea. However, the reason this kind of legislation has no possibility of success is the fact that it would only be applicable “provided an alternative is in place by July 4, 2009. “ Such a weasel clause effectively nullifies the entire sunset provision. It should be that the IRC expires 12/31/09 no matter what.

Why different tax rates for interest and dividends?

Q:

Subject: Interest Income vs. Dividend Income

Kerry (Tax Guru),

My name is … I am currently a Doctoral student studying financial planning at Texas Tech University. I was searching for an answer to a question posed to me by one of my students and I stumbled upon your site. Funny enough I grew up in Harrison, Arkansas. Small world I guess. Anyways... I was talking in class last semester about the current tax cuts and there effect on the financial planning community. More specifically, how clients should diversify their tax retirement vehicles just as they would a portfolio.

One of my students posed the questions, "Why has the government cut rates on capital gains and dividends, yet did not reduced that tax rates on interest income (taxed as ordinary income)?" I suppose it has something to do with double taxation, but I am not an accountant nor an economist.

I was wondering do you have a short answer to this question or at least a sense of direction as to where I might look?

Thanks,

A:

I wasn't part of the discussions in Congress as to the different taxation on dividends versus interest; but I do have a theory to explain it. It has to do with both the concepts of the tax benefit rule and double taxation on C corporations.

Under the tax benefit rule, when one taxpayer deducts an expense, another taxpayer reports that same amount as income. It's a kind of balancing act. Interest is an example of this. Banks, businesses, and other payers of interest deduct it on their tax returns, thereby saving taxes at their ordinary income tax rates. The recipients of those interest payments then report them as ordinary income on their tax returns.

Dividends, on the other hand do not currently qualify as deductible expenses on the corporate tax returns. Since dividends are after tax dollars, this results in a second income tax on the same income.

While those of us who believe in capitalism would love to see a complete elimination of the double taxation through either a deduction on the corporate tax return or completely tax free on the stockholders' tax returns, that has never been politically feasible in this country, where hatred of evil corporations and rich people is stock in trade for politicians.

Over the decades, we have had some very minor offsets to the double taxation, usually designed to only assist the smaller investors. For example, there used to be an annual tax free exclusion of $100 in dividend income per person. This latest change, to tax dividends at the lower long term capital gains rates was explicitly designed as a mid-way compromise between those who believe there should be no double taxation at all and those who still want to stick it to corporations and their shareholders.

I hope this helps you understand some of the history behind the taxation of dividends.

Thanks for writing.

Kerry Kerstetter

Follow-Up:

Thank you so much,

Very Helpful!

Tracts Like $1M Bills Seized By Secret Service – From Texas, where some idiot actually tried to deposit one of the bills.

Proposition 13 Still Has Dangerous Enemies – There are always enemies of anything that helps keep taxes lower.

50-year mortgage gains momentum – This may make more sense than refinancing every few years to pull out equity.

Yeager suit accuses children of diverting money from fund – With all of the news about companies screwing their employees out of their retirement benefits, now it’s your kids you need to watch out for.

QuickBooks vs. Quicken

Q:

Subject: QuickBooks vs. QuickenDear Kerry,I just read your article about QB vs. Quicken. As a sole proprietor I have one question. Is QuickBooks strictly for business accounting or can it handle personal finances as well? Should I use QB for my business and Quicken for personal? I want to do what is simplest and most effective.I would be most appreciative for your response.Thank you sincerely,

A:

You should browse more of the info I have on my website regarding QuickBooks and Quicken.

I addressed your point exactly a few years ago.

Good luck. I hope this helps.

Kerry Kerstetter

Cash Received From 1031 Exchange

Q:

If I intentionally left $10,000 out of the reinvestment leg of my 1031 exchange, is my only downside the paying of the tax on that $10,000?

A:

First, if you were wondering whether holding out any cash would nullify the 1031 exchange, that would not be the case. The only real issue is how much, if any, of the case held back would be taxable.

As Sherry said, the taxability of any cash taken out of the exchange isn't a cut & dried answer. It hinges on the numbers involved, as worked out on the 8824 worksheet, which we have posted on our website for downloading.

From a simplistic viewpoint, if there is no debt involved in the new purchase, and you end up with cash, that will generally be taxable.

If there is debt taken on the new property, any cash received on the deal is generally only taxable to the extent it exceeds the exchange expenses, which are the total closing costs from all of the exchange legs.

The tax rate on any taxable boot (cash) will be based on a number of factors. If there was depreciation recapture on the old property, it will be taxed first at the special 25% Federal rate. Next is the capital gain, which is taxed at ordinary tax rates if the original property was held less than 12 months or the special long term capital gain (LTCG) rates (5% and/or 15%) if the property was owned for more than a year. Arkansas tax will also be applicable to any taxable gain. This is usually 5% for LTCG and 7% for other types.

I hope this helps you understand the issue. Your own personal tax advisor should be able to more precisely calculate any potential tax for your particular situation.

Kerry

Labels: 1031

S Corp Stock

Q-1:

Subject: S-Corp single class of stock questionAn S-Corporation initially issues 1000 shares to its single shareholder for $1/share. Later, it issues 1000 shares for $20/share to anothershareholder. Does the different price per share constitute a second class of stock (assuming all shares receive an equal distribution of profits)? How about if all 2000 shares were issued at initial capitalization (that is, one shareholder paid $1/share and another paid $20/share, all at startup)?

A-1:

What the stock sells for doesn't determine the class, as long as all ownership rights are the same for both batches.

Here is the description from page D-2 of the Small Business QuickFinder Handbook:One Class of Stock

An S corporation can have only one class of stock. It is treated as having only one class of stock if all outstanding shares possess identical rights to distribution and liquidation proceeds. Differences in voting rights are allowed as long as the other requirements are met. For example, issuing nonvoting common stock or paying bonuses to key employees does not create a second class of stock. (Letter Rul. 200118046)

Caution: If not properly structured, a shareholder loan to an S corporation can create a second class of stock and disqualify S status. If the debt is convertible to equity, or if terms of the loan are contingent on profits or dependent on the borrower’s discretion, the loan may be considered a purchase of a second class of stock.

Q-2:

Is the shift in capital immediately taxable (as, I understand, it would be were the company a partnership)? Or do you wait until liquidation, and get a (possibly long-term) capital gain?

A-2:

You really need to be working directly with a professional tax advisor who can explain how corporations work because you seem to be very mistaken on some basic accounting and tax concepts.

If you sell some of your shares to another person, you will have a capital gain to report on your 1040.

If the corp sells new stock to a new person, that isn't a taxable event and has no tax consequences.

That new stockholder will need to keep track of his/her basis in the stock for proper tax treatment of corp events, as does the original stockholder.

Kerry Kerstetter

Incorporating In Different State

Q:

Subject: corp!HII would like to know how easy it is to incorp in adifferent state than where you live! I came acrossyour website and found it to be very informing,andfound that I should be asking alot more questions tosomeone that really knows what they are talking aboutbefore I incorporate my business.I also believe thatgetting any good advice will benefit us ,even if it isbeing directed to ask the important questions withanother proffessional.And thats another question whatdo you really need to ask ?I /we have a development company -Construction inCaliforniaand we are starting a consaulting company >which wouldconsault our clients in working with all generalcontractors ,interior designers etc!This was our idea to relieve our personal tax burdens.We would hire our own development company along withother needed companies through our corporation tryingof course to keep the main funds in the corp,and notinto our personal .Our development company is a soleprop.So if you have a better suggestion I would love tohere it! I just dont want to make the wrong choicesand end up over my head ,or in trouble. I was told toopen up an s corp.Simply because you can use fundsfrom your s corp and your personal ,or sole propbuisness as long as you keep your papers in very goodorder. This is easier because you can move thingaround to meet your needs. What do you think aboutthat! I have been told so many different things Ireally dont know what to believe.

A:

This is the exact kind of issue that you should be discussing directly with an experienced professional tax advisor.

Anyone can set up a corporation in any state. You just need to have someone residing in that state who can act as your corp's registered representative. There are dozens of companies that provide such services, especially in states with no income tax, such as Nevada.

The really tricky issue will have to do with where the corp earns its money and conducts its operations. If any business activity happens inside the California borders, regardless of where the corp is chartered, you will have to file a Calif. corp income tax return and pay at least the $800 minimum corp tax each year.

If, on the other hand, all business activity happens outside of the Calif. borders, no Calif corp tax return would be required.

Proper sourcing of income in various sates is a tricky thing to handle, and an area where you most definitely need to be working with an experienced tax pro. The California Franchise Tax Board is the most aggressive tax agency in the country at tracking down and nailing anyone they suspect of failing to pay every last bit of required taxes.

Even if all of your business activities are conducted inside Calif, there are still plenty of tax savings opportunities by setting up a corp. Any good tax pro should be able to help you develop the best strategy for your unique circumstances.

Good luck.

Kerry Kerstetter

Roth IRA For Home Purchase

Q:

Subject: Roth IRA Question / New Home Exclusion

Kerry, thanks for your help on a # of subjects I have found on your website.Quick question about using Roth IRA contributions towards a purchase of a new home. I believe I have read that an individual can w/draw (tax free) money contributed towards a Roth IRA, capped at $10K/ea, used towards the purchase of a 1st home.I've also read that a 1st time homebuyer isnt really a 1st timer, just the 1st time in the last two years. How do you define 2 years? From closing date to closing date, or tax years? What if the 2nd purchase is being built and you have a construction loan and a mortgage?Any idea why there is this "loophole" for the not really 1st time home buyer?My wife and I will have rented for just over 1.5 yrs when we think our home will be built and ready to close and the extra $20K would be a nice addition to the downpmt.Any ideas?Thanks again for your help.

A:

This is the exact kind of issue that you should be discussing with your own personal professional tax advisor because it seems that you are very unclear on how Roth IRAs function.

In most cases, because it was not deductible from your 1040 at the time you deposited it, the money you contributed to the Roth can be withdrawn at any time without any income tax or early withdrawal penalties being applicable.

The taxes and penalties for early withdrawal are applicable on the earnings that have been generated by the Roth IRA account, if those are taken out prematurely. There is a five year minimum holding period for Roth IRAs that affects their taxation.

The first time home-buyer exception to the early withdrawal penalty is often misunderstood in regard to several factors. First is the fact that the withdrawal from conventional IRAs is still subject to normal income taxes, even if it qualifies for the exception to the early withdrawal penalty. This is also the case for withdrawals from Roth IRAs made in less than five years after the Roth was opened. Withdrawals of earnings after five years that are used for a new home purchase by a qualifying first time home-buyer are tax and penalty free, up to $10,000 per person.

The $10,000 per person exclusion is for an entire lifetime.

The time frame for qualifying as a "first time home-buyer" is very specific. You must have had no ownership interest in a residence within 24 months prior to the actual withdrawal. So, if you sold your previous home less than two years prior to the withdrawal, the exception does not apply.

The other requirement that confuses many people is the fact that the withdrawn money must be actually spent on the home purchase within 120 days after it was removed from the IRA account. This means that you don't want to take it out too soon prior to the actual purchase.

These are some of the specific points that you should review with your own personal professional tax advisor. From the way you worded your questions, it could very well turn out that, even though you won't qualify as a first time home-buyer by purchasing in 1.5 years after your previous home was sold, you may be able to withdraw enough of your actual Roth IRA contributions tax free to make a dent in your down payment, since it sounded as if you were under the impression tat those withdrawals would be taxable.

Good luck.

Kerry Kerstetter

Fiscal Definition?

Q:

Subject: FISCAL

What exactly does "FISCAL" stand for? =) I know it is an acronym for something, but no one I ask seems to know. Do YOU?

A:

I had never heard that theory or ever considered that word to be an acronym of anything. It always meant money or financial to me.

In fact, the dictionary shows that it is a variation of a Latin word:

Etymology: Latin fiscalis, from fiscus basket, treasury

Kerry Kerstetter

Follow-Up:

The reason I was asking is because someone once told me that is stood for Federal-Income-something-something-Annual Liabilities (ish) and I was just curious. If you ever do hear of that again you should let me know. =) Thanks Again!

What you are probably thinking about is the acronym used for withholding of Social Security & Medicare taxes, FICA.

That stands for Federal Insurance Contributions Act.

Kerry Kerstetter

QuickFinders has its summary of the recently signed 2006 tax law available for free, much more reasonable than the $30 plus versions various companies are selling.

Friends Are Friends, Not Tax Advisors – NATP addresses an issue that pops up all too frequently here.

There is almost nothing that makes life more enjoyable than family and friends, but don’t rely on them for tax advice.

New accounting laws make internal auditors 'rock stars' – That’s quite a switch from how it was when I was in the internal auditing profession.

Differing Opinions

Q:

Subject: Yet another geek seeking wisdom

Hi Ken - Greetings from Panama City Beach, Florida. My husband and I just purchased an established small business, and would like to incorporate or become an LLC. I have talked to several local CPAs for advice, read several books on the topic, and visited countless websites. The result--disbelief at how three different CPAs, etc., have given me differing advice. I have a masters degree in communications, but my ability to comprehend data and info at a higher level is not working in this instance because every answer I receive leads me to another set of questions. I ordered a book by Mancuso off your website and hope that will help out.May I also ask your opinion? I know you can't give advice, but could you steer me in the right direction to educate myself? Scenario: My husband and I are both 52. We will operate this business for about 10 -12 years--and then sell it (possibly to buy something that gives passive income). The business net is about $100K annually--maybe more as time goes on. We would like to purchase a new home soon (we own two properties currently), as well as save as much as possible for retirement.Any help will be appreciated. By the way, do you still take clients?

A:

There are far too many options to consider and possible scenarios that can be used to achieve your goals for me to even begin giving you specific advice via this medium.

You will need to work directly with an experienced tax pro who can analyze your unique circumstances. I wish I could help; but I already have too many clients to take care of; so we are still trimming back on the difficult clients and are not accepting any new ones at this time.

Unfortunately, we don't have anyone to whom we could refer you. If you haven't already done so, you should check out my tips on how to select the right tax preparer for you.

The fact that you would receive a wide variety of opinions from different professional advisors is nothing surprising. I've used this analogy many times; but business and financial advice is similar to medical consultations. Without even knowing who said what to you, I would probably have much more faith in the person who took the time to ask you a ton of very personal and probing questions as to your current status and future plans.

Anyone who just shot out a strategy without getting to thoroughly know your unique situation is being criminally irresponsible and should be avoided at all costs. There are unfortunately too many tax pros who, either through ignorance or laziness, try to stick everyone they meet into the same type of business format without adequate analysis; S corps being the most common. Anyone who was able to give you their answer before subjecting you to a barrage of questions would fall into that category and, while that answer may through sheer luck actually be correct, should be avoided. If that person doesn't understand the importance of a proper analysis, there is no guarantee that s/he will ever be able to give proper advice.

I wish I could be of more assistance; but I wish you the best of luck.

Kerry Kerstetter

Correcting Tax Rate Schedule

From an eagle-eyed reader:

Subject: Typo on 2006 tax rate pageJust a note you have $366,551 as the top bracket in the Married filing jointly. It should be $336,551?

My Reply:

You have good eyes.

You are right.

I've made the correction.

Thanks for helping me keep things as accurate as possible.

Kerry Kerstetter

Follow-up:

No problem, I have referred to your web page for years. It is the best source for the ACTUAL number in the clearest presentation. I use a homegrownspreadsheet to do my taxes at the beginning of each tax year to verify withholdings. I get my IRS numbers from your page each year.So, thank you.

Subscribing to Blog Posts

From Ohio CPA Dana Stahl:

Subject: Life League!!Mr Guru - I haven't visited your blog for a while (once again, I'm not getting the daily emails), so when I saw the email exchanges from "Liz-LifeLeague", I was floored. Jeez, she sound like some of my clients!I didn't know you were such an SOB! (Keep it up!).DS

My Reply:

Dana:

As we all know, there are plenty of nut-jobs out there. Fortunately, most of the people who write to me are very nice and seem to be appreciative and understanding of what I do, and that wacko Liz is the exception. I do have to admit that while I normally have empathy for and want to help readers who are looking at large tax bites, I can't say the same thing for Liz, who deserves whatever happens to her. With an attitude like hers, I can't see any sane tax pro working very long for her.

The Bloglet service that used to send out my blog posts via email has shut down. The best way to get them is by subscribing to its RSS feed, which is how I read most of the blogs I like (using Bloglines). I did also set up a new email feed via FeedBlitz, which I tried to shift the Bloglet subscribers to. You can subscribe to it from the box on the top right side of my blog page. That seems to be working much more reliably than Bloglet.

Kerry

Follow-Up:

Mr Guru - as I said, "Liz" reminds me of some of my clients! I've really been encountering a lot of unreasonable people in the past year or so. One cardinal rule I'm trying to adhere to: no more pain-in-the-ass clients. Sound like a plan?DS

My Reply:

Dana:

That's what we have been doing - dropping the PIAs and it has helped ease up on the stress level considerably.

Kerry

Wishful Thinker

How great would it be to read this story?

Produced with the help of the free Newspaper Clipping Generator

Tax-return bill dies in Assembly – No more free tax return preparation by the Calif. FTB. The people that qualified for this program would be better off availing themselves of volunteers working with the IRS’s VITA program, where I got my start in the tax prep profession.

Government Contractors Under the Gun – New withholding requirements starting in 2011. That’s five years away, almost an eternity in tax-land. Knowing how our rulers in DC can’t resist monkeying with the tax code every chance they can find, that rule will most likely be changed before 2011, possibly for the worse if the IRS’s Tax-Gap propaganda continues to convince people that every small business owner is a a conniving tax cheat. .

Five Tips for Succeeding As a Young Entrepreneur

Popular Trusts May Shield Profits Made During Housing Boom – Private annuity trusts.

Updated Link For SS-4

From a Reader:

Subject: broken link on your website

This link - http://www.irs.gov/pub/irs-fill/fss4.pdf on this page - http://www.taxguru.org/corps/corp.html is broken. The IRS changed their website. The new link is http://www.irs.gov/pub/irs-pdf/fss4.pdf. I like your blog and website. You have a lot of useful information. I really enjoyed the snot that flamed you. A real classic.

My Reply:

Thanks so much for noticing that outdated link.

I've updated that page to include the current IRS link.

Please feel free to pass along any other news or changes that you feel may be appropriate.

Kerry Kerstetter

Using Your Nest Egg To Buy a Franchise – Another look at the BeneTrends concept that I have mentioned many times.

Lies About Tax Cuts

Thomas Sowell looks at how the left persists in distorting the effects of tax rate cuts.

The truth is that they result in overall higher revenue and anyone who says otherwise should not be trusted.

IRS Audit Selection Criteria

From another CPA:

Subject: Small Business Audit Risk

Here is some interesting data for IRS examination coverage based on returns filed in 2004:Type of Return % coveredSch C(gross receipts under 25K) 3.68Sch C(25 to 100K) 2.21Sch C(over 100K) 3.65Small Corp(assets under 10M) 0.791065 0.331120S 0.30It appears that the overall audit risk is much greater for Self-employed versus partnership or corporation filings. However the data is broken down further. It turns out that Sch C with gross receipts of less than 100K have only about a 0.5% chance of examination by a Revenue Officer or Tax Compliance Officer. The balance being Compliance Center inquiries which usually ask for clarification, more data, etc. In the rest of the filing categories, most of the exams are Revenue or Tax Compliance Officer, meaning a face to face visit.I wonder if the cause of the differences could be that many, many Sch C are completed by the taxpayer whereas most entity returns are prepared by a tax professional. We will probably never know the real reason as the IRS avidly protects its selection criteria.

My Reply:

While that is a plausible theory to explain the disparity in audit coverage, I had a slightly different one when I saw those stats a few months back.

I think it has a lot to do with the looser internal controls with most small Sch. C businesses than is normal with more formally established business entities, allowing for much greater opportunity for the owners to put money in their pockets. This difference is especially true when there are multiple owners of the business, such as with a partnership. One of the most basic internal controls is the division of duties and the inability of one person to handle all of the money without anyone else checking on him/her. While it obviously possible for multiple owners to collude to cheat on the business's taxes, it is much less likely to happen than with a single person operation who has nobody looking over his/her shoulders.

It has also long been known that IRS has had their sights set on businesses that operate mainly with cold hard cash because of the skimming opportunities available and no bank account paper trail for IRS to work with. While I don't have any stats on these particular businesses in terms of entity, I'm guessing that more of them are Sch. C because of the lack of formal business requirements. Somebody who would want to cheat on their taxes by under-reporting income would most likely opt for the lowest profile business structure, which we all know is a Sch. C.

That's just my theory.

Thanks for writing and sharing yours.

Kerry Kerstetter

Follow-Up:

Yes, internal controls are certainly a problem and I am sure that the IRS recognizes that. I have also found that problem in family businesses that are organized as partnerships or S corps. They usually start off paying attention to the details of cash moving through the company but then get sloppy and cash ends up going to non-business purposes. Most do it from ignorance and I encourage/help them fix it. I've had a few that feel that actual cash is not income and have had to drop them as clients.Thanks for the response.

Residence Sale

Q:

I have a question. I hope you can answer. I signed a contract to buy a house for primary resident about 2 yrs ago. My settelment is this week for that house and currently i am renting. I am planning to sell that house and buy another one within one year of time. If i sell my house the one i am getting this week. I will have a capital gain and i like to if i were to buy another house will i be paying capital gain tax?

If you can get back to me, i will appreciate it. And what will be your fee.

Thank You,

A:

I assume you are talking about a home in the USA because that is the only country's tax laws I am familiar with.

You need to check out the info on home sales on my website plus discuss your potential gain with a professional tax advisor.

Some of the specific issues that you will need to cover with him/her include:

The tax free exclusion of gain is only available based on time that you both own and occupy the home as your primary residence. This means that the past two years do not count. Having an option to buy a home is not the same as actually owning it.

Since you plan to sell it after less than two years of ownership, your gain will be taxable unless the quick sale is due to health, employment. or other unforeseen circumstances. Seeing as you are going into this with the preconceived goal of selling within one year, it may be difficult to support the use of this pro-rated tax free exclusion. It is normally associated with unexpected events that happen after you start owning and residing in the home. Your personal tax pro should be able to better work with you to see if you qualify.

What you do with the sales proceeds is completely irrelevant to the issue of taxable gain. It won't make one bit of difference whether you buy a new house or not.

If your gain will be taxable, and it's a large amount, there are a couple of additional things to keep in mind.

If you can close the sale more than 12 months after your purchase date, you will be able to use the long term capital gains tax rates instead of the much higher ordinary income tax rates.

You should protect yourself from being unable to pay the taxes on time by holding back their estimated amount from the cash you put down on the purchase of your new home.

These are just some of the issues you will need to discuss in much greater detail with your own professional tax advisor.

Good luck.

Kerry Kerstetter