The new tax law changes

As always, our rulers in DC have screwed up any attempt at tax simplification with yet another new law changing the rules of the game.

Here are some highlights of the new tax related changes courtesy of one of my favorite reference sources, TaxCoach Software:

On Wednesday, July 30, President Bush signed the "Housing and Economic Recovery Act of 2008." While the bill focuses on protecting lenders and preventing foreclosures, there are three other tax provisions worth noting.

1. The 2008 Housing Act gives “first-time homebuyers” (those who have not owned a primary residence for three years) a tax “credit” equal to 10% of the new home’s purchase price, up to $7,500 ($3,750 for married couples filing separately). This “credit” is available for purchases from April 9, 2008 through June 30, 2009. But, if you take the credit, you have to pay it back, in equal installments, over the next 15 years. So it’s really just an interest-free loan, not a true tax credit. It phases out for incomes between $75,000 and $95,000 ($150,000 and $170,000 for joint filers).2. The law creates a temporary deduction, for 2008 only, for property taxes for non-itemizers. The deduction is limited to $500 ($1,000 for married couples filing jointly).

3. The law eliminates tax breaks on the sale of your principal residence for periods you don't use it as your principal residence. Under old law, you could take a rental property or vacation home, use it for at least two years as your primary residence (five years if you acquired it in a Section 1031 exchange), then sell it and exclude up to $250,000 of gain from your income ($500,000 for married couples filing jointly). This held true even if most of the gain occurred while you were renting the property or using it as a vacation home. The new law taxes you on any gain after 2008 attributable to periods you don't use it as your primary residence. (There’s no need to appraise the property to determine interim value; the new law determines excluded appreciation on a pro-rata basis, according to how long you own it.)

Labels: 121, Credits, PropertyTax

Interesting Tax Stats

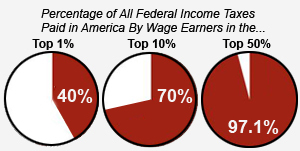

Summary of Latest Federal Individual Income Tax Data – via the Tax Foundation

Tell the Legislators: Low Taxes and Regulations Are Good for Growth – Reviewing the ALEC’s State Economic Competitiveness Index. You can download the full 114 page report here.

Labels: StateTaxes, TaxBurden

Rebate checks and the 1040

As we've discussed before, there has been a lot of confusion as to whether or not the advance rebate checks would affect the amount of refund or tax due with the 2008 1040. The IRS website has had conflicting info on this.

If you check the IRS's draft release of the 2008 1040 form, you can plainly see on Line 71 that there is a place for the "Recovery rebate credit" which should be a positive number for those people who did not receive the full amounts as checks during the year and either a zero or negative amount for those who received checks.

This will obviously end up affecting the amount of refund or tax due. As I have been saying, this is exactly the same mechanism as we had for the similar advance rebate payments that we had to deal with a few years ago. People who were claiming that the 2008 rebate checks were free money and would not affect the bottom lines on the 1040s were nuts.

Labels: Rebates

McCain's Tax Blunder – It took Bush 41 a few years in office to break his “No New Taxes” pledge. RINO McCain couldn't even make it to the nominating convention before accepting the DemonRat premise of higher payroll taxes.

It looks like higher taxes are in our future regardless who wins the White House. As always, that means more work for those of us in the tax minimization profession.

Labels: McCain

Girls Gone Wild Guru Francis Sues Ex-Accountant - What many call the “Willie Nelson Defense” against tax evasion charges, blaming the CPAs.

Labels: scams

Tax Relief, Sans Itemizing - Possible limited deduction for property taxes paid by non-itemizers.

Labels: PropertyTax

Pity The Celebrity Taxpayer – Making the big bucks puts them dead center in the IRS cross-hairs. The additional publicity IRS receives when busting celebs is a big bonus for their policy of intimidating us normal folks.

Forbes slide-show of some of the recent celebrity tax fights in the news. Since most IRS audits are technically confidential at the earliest stages, there are obviously many more that we never hear about.

Labels: scams

Their Fair Share - The WSJ looks at the status of the tax attacks on the evil rich in this country.

New IRS Tax Numbers: "Rich" Pay Highest Share in 40 Years - From Rush

Labels: TaxBurden

Future job market?

Neal Boortz had this funny video on how CPAs will find work in the future:

Labels: humor

Campaign Tax Proposals

Snopes.com has a look at some of the rumors floating around regarding the tax proposals of both McCain and Obama.

Rumored proposals or actual campaign promises – I wouldn’t trust any of them for actual tax planning purposes.

Labels: Obambi

California as No. 1 – This mindset of the rulers in the PRC, to tax the heck out of everything and everybody, was one of the contributing factors to my decision to leave that state 16 years ago. With a RINO as governor, there is no stopping the tax hiking mania that can only get worse.

From a professional perspective, this will be great for our business; those of us who understand the techniques for helping clients legally avoid having to pay Calif. taxes.

Labels: StateTaxes

Addicted to Nicotine Taxes – An interesting look at one of my many long held pet peeves about taxes, the willingness of our rulers to exploit nicotine addicts in order to fill their coffers.

Labels: SinTaxes

Sales Tax Holidays

CCH has a list of some upcoming special sales tax holidays in various states.

Labels: SalesTax

Section 179 for software?

Q:

Hello Kerry,

I work for an accounting software company and I have a question for you regarding Section 179. Our software is not “off the shelf” as we have resellers that customers purchase from. I am no accountant so please be kind and speak in laymen’s terms.

We have customers that initially purchased the software, but did not stay on a plan. They now want to come back on a plan and get all the software that they missed which has new functionality to benefit their business. Some need to update their computer hardware, server, printers, etc. for compatibility issues, and/or add additional user licenses and modules. If they decide to do this, does the software and/or plan fall under Section 179?

Thank you for your assistance.

A:

I hope you're not planning to give tax advice to your customers, because that is extremely dangerous for both you and for them. Sales people giving out tax advice is one of the pet peeves we in the tax profession have long had to deal with; often with bad results if that advice was heeded by a customer without verification with their own professional tax advisors.

The costs for your software, plan and the related hardware should be potentially deductible as either Section 179 or as normal operating expenses, based on the costs involved and the useful life of the software.

If deductibility is a deal breaker for your customers, they should each check with their own professional tax advisors to see how much they will be able to deduct in the first year. There are limits based on taxable income and the total cost of new property purchased during the year; so there is absolutely no way you can be in a position to know what Section 179 deductions they may be able to claim.

Good luck. I hope this helps.

Kerry Kerstetter

Follow-Up:

Hello Kerry,

I would personally never give out information in a territory I am unfamiliar with. Our Managers here have advised us already not to give out tax advice. This Economic Stimulus is not being used as a "deal breaker" by any means. We have a PDF on the Economic Stimulus (I attached it), but I wanted to find out if this is something worth while for the customer or if I should not even mention it at all. It seems like it is a case-by-case instance and there is no real black or white about it. For now, I'll just have them view the PDF and contact their CPA.

Thank you for your assistance.

Labels: 179

Tax Burden Trend Continues...

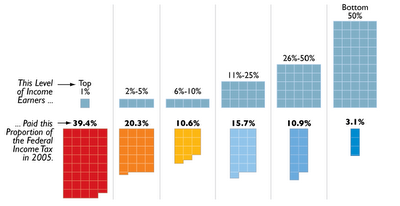

The polarization of the income tax burden in the spirit of screwing the evil rich continues. When more than half of the voting public has been practically winnowed out of the tax paying populace, our rulers can continue to financially rape the evil rich minority with complete impunity.

This chart illustrating the 2005 income tax burden from the Heritage Foundation is very enlightening:

(Click on image for full size)

These quotes come to mind on this aspect of heavily taxing a minority:

Milton Friedman:

"Congress can raise taxes because it can persuade a sizable fraction of the populace that somebody else will pay."

"A government which robs Peter to pay Paul can always depend on the support of Paul."

-- George Bernard Shaw

Vanya Cohen:

When there's a single thief, it's robbery. When there are a thousand thieves, it's taxation.

Labels: TaxBurden

Hard Numbers on Obama’s Redistribution Plan - Marxists who are upset that their more famous and experienced standard bearer, Hitlary Rodham, won’t be the DemonRat candidate for President, have nothing to worry about. Obama is a true Fellow Traveler in his devotion to the teachings of Marx and Engels.

Labels: comix, Obambi, TaxHikes

Filing Extensions Changing for Some Business Taxpayers Later this Year – Supposedly to give a longer time between the extended due dates for some types of K-1 pass-through entities and the related 1040s, the automatic extensions for 1065s and 1041s will only be for five months for those entities with a tax year ending after 9/30/08. For calendar year returns, this moves the extended due dates up to September 15, giving a full month before the October 15 extended due dates for 1040s.

Since S corps have an original due date of March 15, the current six month automatic extension already puts those returns due by September 15; so no change is required for S corps.

Labels: extensions