Tax Guru-Ker$tetter Letter

Monday, May 31, 2004

Sunday, May 30, 2004

Consumption taxes are not the answer - Bruce Bartlett's take on two different ideas; John F. Kerry's desire to increase the tax on gasoline by 50 cents per gallon; and replacing payroll taxes with a national sales tax.

IRS Audit Changes

Except for a few short interruptions, I was able to see and hear most of the IRS webcast a few weeks ago on the changes to their audit procedures. While I had the show on one of my three computer monitors, I typed up a few notes on another; but have been too busy to flesh them out enough to make any sense to anyone else but myself.

There weren't as many changes announced as I had expected, but I did want to mention the following quick observations, which by no means include everything covered during the broadcast. The entire program has been posted to the archives and is available for viewing at everyone's convenience.

They are trying to have a more professional relationship with their "customers" (taxpayers and their representatives). This will include presenting an Engagement Agreement between the auditor and the rep to lay out the audit plan, along with an expected conclusion date. They had to admit that the reality of knowing with any certainty how long an audit would take up front is pretty close to unknowable. They admitted that their most lucrative findings (aka big bucks for Uncle Sam) come about from issues that are accidentally discovered during the audit and not from the items spelled out in the initial audit request.

Approximately mid-way through the audit, the auditor is supposed to assess things and decide whether to expand or drop the audit.

Audit manual with new procedures will be available online to practitioners.

High priority audits include tax avoidance promoters and their clients.

High income = high risk. $250,000 and up of income.

They made the same bogus and completely unsubstantiated claim that two thirds of the tax gap is from unreported self employment income. As I've mentioned several times before, I have attempted to track down the source of these statistics from IRS big-wigs and they admitted to me that they are using WAGs (wild ass guesses) in a blatant attempt to scare up more budget money from our rulers in Congress. Since the real tax gap numbers are by definition impossible to ascertain, their fabricated figures are technically just as good as any.

They have a top secret scoring model with four filters to assess risk, including:

High income, non-filers.

UI (Unreported Income) and - DIF (Differential Index Function) filter. Unreported income. Finds a lot of businesses and high income persons.

Many layers of entities. This has long created suspicion with IRS. They often suspect that this approach is just used to cheat on taxes. However, the truth is a bit different. While using several layers of partnerships, trusts, LLCs and corporations can help reduce taxes, I find it even more useful for preserving privacy and protecting against frivolous lawsuits. The tougher you make it for ambulance chasers to sue you, by operating behind layer upon layer of entities, the less likely they are to take on a contingent extortion case.

About a week after this IRS web seminar, I spent most of the day with an IRS auditor in my office and we had a chance to discuss the subject of these new procedures. She agreed with me that the agreed commitment date they come up with in their engagement agreement is, by necessity, pulled out of the air because nobody has any idea what new issues they may stumble across during the examination.

You Get What You Pay For

Although I have worked with dozens of different IRS agents over the past eleven years since relocating to the Ozarks, this was my first case with this particular woman. She asked me an interesting question. How would I compare the quality of the IRS agents I have worked with in this part of the country with those I had worked with back in the San Francisco Bay Area? Anyone who knows me knows that kissing butt, especially IRS fanny, is not part of my MO. However, in an honest reflection of my 29 years working with IRS employees, I realized that there has been a stark difference in their quality between here and back on the Left Coast; and I know exactly why.

One of the big problems IRS has when recruiting new employees is their pay rates. They are pretty much the same across the country. I can still recall when I was getting ready to graduate with my Bachelors degree in Accounting in 1977 and checking the employment opportunities. There were three main categories of prospective employers; Big Eight CPA firms, corporations, and the government. I can remember the IRS recruitment forms, where they laid out all of the criteria they desired. They wanted the best of everything. However, when it came to the salary, they were offering about one third of the starting pay for corporate accountants and a bit less than the Big 8 firms.

To put the CPA firms' pay scales into perspective, they were able to offer very low starting salaries because, in California, prospective CPAs were required to have at least two years experience as employees with a CPA firm. Anyone who aspired to becoming a CPA had to be willing to work for very low pay in order to obtain the appropriate on the job work experience. My starting pay, with the small CPA firm I worked for in Hayward after graduating, worked out to five dollars per hour.

That salary disparity persists to this day. In the Bay Area, IRS can still only pay a fraction of what other employers can. In lower cost parts of the country, such as here in the Ozarks, the IRS salaries are pretty much the same as in the Bay Area. However, they are much more attractive and in line with the pay rates being offered by other kinds of employers. It doesn't take a NASA scientist to see how IRS would be much more able to attract a much higher caliber of employee here than out on the Left Coast. The effects of this have been very obvious.

Saturday, May 29, 2004

Farm Subsidies for the Rich, Famous, and Elected Jumped Again in 2002

Woman Gets Fake $20 From ATM - You would think that banks would run their currency through counterfeit detection scans before loading up their ATMs.

What's Your 'Amt.' Under the AMT?

Flat Tax Fills Coffers In Russia - A few years back, Russia did something that many of us have been advocating for a long time here in the USA. They set income taxes as a flat percentage rather than use the Marxist "progressive" rate structure that punishes achievement. As would be the case here in the USA, such fairness actually results in more money for the government. It is still going to be a hard sell to the millions of people who thrive on class warfare and stoking the "hate the rich" fires to expect any such common sense in this country any time soon.

Productive Tax Cuts

President Requests "A Zillion Dollars" - The way our rulers burn through trillions of our dollars every year, with no control over them by Bush, this isn't that crazy a statement.

Friday, May 28, 2004

How high can they go? - As much as I've always believed in real estate as the most dependable investment, it's still important to buy wisely and avoid getting caught up in feeding frenzies that will sooner or later end.

Increases in User Fees May Tarnish Ehrlich's Anti-Tax Credentials

A boom with legs - The worst news for the DemonRats; a good economy that can't be exploited for their Big Government programs.

Thursday, May 27, 2004

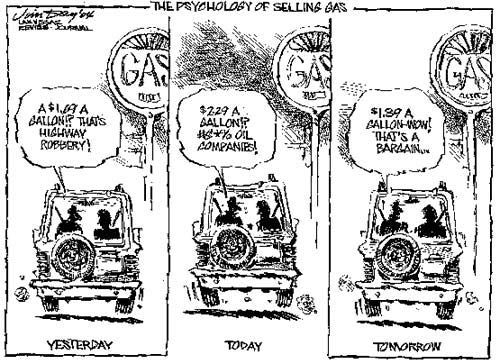

Relative Prices

I have long ago grown tired of the endless comparisons of the price per gallon of gasoline with what people routinely pay for other liquids, such as coffee, milk and bottled water. Such comparisons would actually be relevant if we bought coffee, milk or bottled water 20 gallons at a time. The fact of the matter is that we buy and consume fuels in much larger volumes than those other things; so the effect of the huge price increases is more staggering.

Although worrying about the truth has never been a high priority for the Bush haters, their claim that the Iraq war was all about oil has obviously been proven to be as bogus as all of their other spurious charges against the President. In spite of what the elite media want us to believe, Bush is a very intelligent man and knows all too well that two of the biggest influences on the economy are interest rates and the price of fuel. It is most definitely in the best interest of his reelection to keep both of those as low as possible. To claim that he wants high fuel prices to enrich his oil buddies (and in the process destroy the national economy) is completely idiotic.

Update on the IRS Front: There is still no mention of an increase in their per mile standard rate.

Wednesday, May 26, 2004

Sympathy for Suckers?

I received the following email a few days ago:

Subject: Tax scams, 3000 African-American Clients

In the Charlotte, North Carolina area many African-American individuals trusted a lady by the name of Anewa Tiari-El. She was paid thousands of dollars to file the so-called 1040X that enabled tax payers to receive large refunds based upon the Individual Master Files.

The IRS did send out these refunds to many taxpayers. However, Ms. Tiari-El had the clients sign a power of attorney which enabled her to have the checks transferred to her business account. Thus, she did not give many of the clients the monies.

When the matter hit the news it was publicized as if she was fraudulent and the IRS closed down her office. Now several thousands of African-American families are being penalized and their present taxes have been affected.

It appears that this lady did tap into something. Presently, the IRS is still sending out these refund checks.

Is there any hope for the truth to come out and how can these families be assisted?

Would anyone be interested in this matter?

Thanks,

Nadira A.

My response:

Nadira:

This sounds like the infamous slavery reparations tax credit scam.

IRS is not still sending out those refund checks. Some did slip out early in the life of this scheme; but not any more.

I don't mean to be insensitive, but I have no sympathy for those people foolish enough to pay someone to obtain these "too good to be true" refunds. Their greed and gullibility led them into a useful and possibly expensive lesson that I hope they learned.

You can see more info on this from IRS:

IRS Issues Consumer Alert on Slavery Reparation Scams

IRS Updates the ‘Dirty Dozen’ for 2003: Agency Warns of 12 Common Scams - Number 4 of the Dirty Dozen Tax Scams

Slavery Reparation Scam

Kerry Kerstetter

Tuesday, May 25, 2004

Leftist Tax Scorecard

Annual Scorecard Shows Who Passes and Fails America's Middle Class Families - Judging the quality of a tax system is by definition a very subjective task. The funniest thing about this "scorecard" is the claim that the group publishing it, Drum Major Institute, is non-partisan. Any group that gives John Kerry a 100% grade (and DemonRats as a whole 96%), on tax issues is obviously as Marxist as the JackAss Party. From this group's blog, which they call ProgBlog, they reveal their true nature. For many years now, leftists have been afraid of the stigma attached to the Liberal label; so they use the alternative term of Progressive.

Monday, May 24, 2004

A Guide for Correcting the Course of Your Retirement Savings

Tax Code Repeal Bill Introduced in Senate - It would be great if such an action were actually real and not just a publicity stunt.

Saturday, May 22, 2004

Against the American Aristocracy - Thanks to Dana Stahl for passing along this reminder that there are still plenty of Marxists around who welcome the idea of the big central government redistributing wealth. The concept of "equality" is too often misused to justify such measures. What we are supposed to have in our society is equality of opportunity; not equality of results. There will always be people who have more than others. To declare such a situation as inherently evil is just plain wrong and is really nothing more than a reason to justify central government control over all wealth.

Seeking the Wisdom of Ancients - The quest for the perfect tax system is universal and never ending around the world. In Japan, they are referring to how things were handled thousands of years ago in order to see how modern systems can be modified. How long will it be before our rulers in DC try the same approach?

Friday, May 21, 2004

Expanding the Child Tax Credit

Part I: A Profile of the Families Benefiting from the $1,000 Per-Child Credit

Part II: A Profile of the 4.6 Million Taxpayers Who Would Benefit from Raising the Phase-Out Threshold to $250,000

News Catch-Up

I've been tied up for the past few days and unable to check as many news stories as I normally do; so some of these are a little older than is usually the case.

Bush's shaky base - Taking the conservative voters for granted and trying to buy votes from liberals could be a problem for Bush. As I've said many times before, sitting out the November election won't make as powerful statement to Bush about our disenchantment of his embrace of Big Government programs than actually registering a vote for a party that shares the conservative principles of small constitutionally justified government, which just happens to be the Libertarians.

Frist: Senate May Debate Tax Cut Budget

Attorney argues blacks don't owe income tax - This is even more idiotic than the ridiculous reparations argument some morons have been trying to pursue.

Who's profiting off high gas prices? Not the owner of the Kwik-E-Mart.

Legislation on IRS Collections Reflects Clashes Over Outsourcing - An issue that pops up regularly - using outside services to collect on unpaid taxes. Privacy and confidentiality issues still remain controversial.

Child Tax Credit Approval Caps Busy Month

Internet Lowers Real Estate Commissions - This is as it should be with information becoming more widely available.

A Scan of the Headline Scanners - A good look at some of the most popular ways to use the RSS feeds that are becoming more prevalent on the web. I have been very happy with my setup on the Bloglines service for the past several months.

Shrinking Government - The only way we can ever expect to see lower taxes.

Presidential Tax Returns - Actual copies of the 1040s from a number of presidents, as well as veep Dick Cheney.

Wednesday, May 19, 2004

Tuesday, May 18, 2004

Tax hikers are relics of past - We can only hope.

Dems: Soak the poor! - Imagine that. The DemonRats don't want to make the new 10% tax bracket permanent.

Gassy EMails:

I'm sick of receiving those email chain letters claiming that not buying gas on Wednesday will have some effect on the price. Check out this analysis of that foolishness from the busy debunkers at Snopes.com.

Monday, May 17, 2004

History Of Tax Rates

More thanks to TaxProf Paul Caron for the link to this pdf chart showing the maximum Federal tax rates since 1916. I found it so interesting that I converted it to html and made it a permanent page on my main website for reference purposes.

Politics & Tax Exempt Religion

TaxProf Paul Caron has an interesting look at the issue of a church's tax exempt status and its technically illegal involvement in politics. While this current case deals with the Catholic church's problems with John Kerry, we shouldn't forget how the DemonRats have a history of using black churches as campaign vehicles. Bill Clinton, Al Gore and John Kerry have all very openly used such churches as campaign tools. Is there any wonder why we haven't seen any media outcry for those churches to have their tax exempt status revoked for violating the ban on political involvement? It doesn't take a NASA scientist to figure that out.

News From IRS

You can always find the latest news releases from IRS on their web site in easy html or in downloadable PDF, such as these latest ones:

IRS Lends a Hand to Small Business

IRS Offers Small Businesses New Tools to Help Manage Retirement Plans

IRS has been doing a good job of making an ever increasing number of tax resources available through their web site. However, we do need to keep in mind that they do have a natural bias in regard to generating revenues for the government. So, key decisions as to how to structure a business, such as the best type of corporation to use should still be evaluated with the assistance of a tax pro who shares your desire to minimize your taxes.

Sunday, May 16, 2004

Feds bust $50M tax scam - Another dose of reality for participants in the Global Prosperity tax evasion scam.

Rules of the 'Roth' and 'Roll' - No shortage of confusion over the rules for IRA accounts. The complexity will only increase as more new types of plans are introduced.

Budget Seeks 75% of Awards for Damages - Interesting attack on wacky lawsuits by Governor Arnold. Have the State government seize 75% of the punitive damage awards.

Riding out the Gas Spike - Still no word from IRS on increasing the official standard mileage rate. My hunch is that they are still waiting to see if the fuel prices will come back down soon.

How to Introduce an Effective Tax and Expenditure Limit

A Profile of the 70 Million Taxpayers Benefiting from the Wider 10-Percent Tax Bracket

Saturday, May 15, 2004

Fools and our money

Are lottery winners really less happy? - Who would have thought that people who work hard for their money would appreciate it more than those who have it handed to them? It's done wonders for trust fund jerks like the Kennedys, who have become de facto royalty from Joseph's bootlegging and stock swindling loot.

Baby gets credit card application - Who says 13 months old is too soon to start using credit cards?

NASA's Finances in Disarray; Auditor Leaves - What's the big deal about misplacing $565 billion dollars? They're only rocket scientists; not CPAs.

Friday, May 14, 2004

Tax News Updates

House passes tax-cut measure

Finally Some Good News on Taxes

Citizen Group Hails Rejection of Tax Hikes in Kansas; Warns Against New Attempts to Burden Taxpayers

Should Tax Cuts Be Paid For? - The real problem with this logic is that they use the completely unrealistic static analysis when calculating the effects of tax changes, disregarding the very real fact that lower tax rates stimulate more economic activity and higher overall revenues. It's what actually happened after the Reagan tax cuts of the 1980s; but our rulers insist on ignoring reality and claiming that tax cuts "cost."

Marriage tax tango

Teresa's Taxes

It's always been obvious why John Kerry has been afraid to have his wife's tax returns released. It would reveal just more of his hypocrisy, similar to his condemnation of SUVs, while Teresa uses them. He has been advocating plans to soak the evil rich with huge confiscatory taxes. They are still stonewalling the release of the actual tax forms; but the summary of Teresa's tax info that was released do show that she has taken steps to keep her tax bill down, as most reasonable people do. The discussion of this topic on the Lucianne.com site is very interesting and entertaining.

Thursday, May 13, 2004

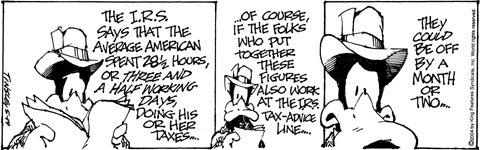

Other cost of tax compliance

This brings up a good point when considering the overall cost of preparing your tax returns. You could spend 30 or more hours doing your own, and hopefully not make any dumb mistakes; or you could pay a professional to do it in just a couple of hours. How much are those 30 hours worth to you? That's why I long ago stopped doing most of my own work on my cars and motorcycles. It's much cheaper to pay the professional mechanics to do it more efficiently and spend that time making even more money doing CPA type work.

The Tax Wars

Economic group resurrects idea of taxing big-box stores - In Montana, some people see lucrative tax targets in big retail stores. These people don't have enough long range perspective to understand how such an anti business attitude will scare away such companies, resulting in a lot fewer jobs for their citizens and less tax revenue from the workers. Such a short sighted approach is all too typical for tax lovers who want the easy quick score and couldn't care less about the long range consequences of their actions. It's exactly why fewer businesses open or expand in punitive tax areas, such as the PRC.

If you make $500,000, you've got New Jersey's governor seeing double - The attacks on the successful have always been a hot button topic with me. I've written extensively on how the threshold for being classified as "evil rich' and subject to punitive confiscations varies for each tax rule. Defining a millionaire as someone earning over $500,000 is at least closer to the truth than the Clinton-Gore millionaire surtax of 1993, which was levied on any single person or married couple with taxable income over $250,000. Truth in naming laws has never been a requirement for our rulers. Calling it a tax on millionaires enables them to rally the support of the "little people" who are taught to hate the super rich in this country.

Anti-tax group says its ads succeeded - I have been very impressed with the amount of effort Stephen Moore's group, Club For Growth, has been making in fighting high taxes and nailing RINOs around the country, such as this campaign in Nebraska. Their name says it all. Taxes stunt economic growth and lower taxes and fewer regulations encourage growth.

Wednesday, May 12, 2004

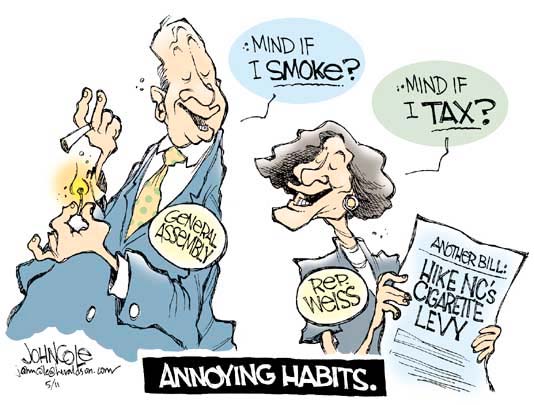

Exploiting the afflicted

Nicotine addicts have long been very popular targets for tax raisers. I'm sure the morality of exploiting personal flaws and illnesses escapes those who are just as addicted to the need for money for their Big Government programs.

Tuesday, May 11, 2004

Extreme Tax Makeover

In spite of the fact that many aspects of the show are faked (we're supposed to believe that the homeowners don't know the design team is coming, yet everyone is dressed and waiting by the front door at 7:00 am), Sherry and I have been enjoying the ABC show "Extreme Home Makeover."

The thought had obviously crossed my mind as to how the homeowners are taxed on the hundreds of thousands of dollars in improvements and furnishings they are given. This very issue has lead to some interesting discussions on Paul Caron's blog, as well as an article in Newsweek.

As creative and aggressive as I am with designing tax savings strategies for real life people, I have to side with the group of tax pros who are skeptical of ABC's attempt to classify all of the new stuff as tax free rental income, exploiting the long standing exemption for income generated by property rented for fewer than 15 days in a year.

My understanding is that, as with anything as lucrative as this, there are thousands of homeowners who apply to be on the show and to be selected is really no different than winning the lottery, and should be treated as gambling income for tax purposes. There could be some adjustments in the dollar values reported. I definitely wouldn't report full retail values. However, to consider it as 100% tax free is beyond even an approach I would take. I wonder if ABC indemnifies the homeowners and will pay their additional taxes if they are audited and forced to include this income.

Blog Features

Blogger, the main tool I have been using to prepare this blog since I started it three and a half years ago, has just had a major redesign in its interface and the features it can support. I have been spending some time today experimenting with the underlying HTML code and directories. As a result, there have been changes to the URLs linking to the archives and to the individual postings. If the new and improved system works as advertised, they should be more stable. If you have previously obtained links that no longer work, you should check the archives from this opening page.

One new feature that Blogger now offers, which I have decided not to implement at this time, is commenting, where readers can post their comments to my blog. It's not that I don't want or appreciate reader feedback; but my time is already stretched too far as it is, without adding the task of having to police the postings. From the volume of hate mail I already receive because of my support of lower taxes, I can envision having to spend too much time keeping the comments clean to make it worthwhile. As can be seen by the small number of things I am currently able to post, compared to many more prolific bloggers, I'm lucky to be able to find the time to add these few.

IRS Webcast

This month's webcast from IRS looks to be pretty interesting. It's on the latest changes to the IRS audit procedures, which should be useful to tax practitioners as well as anyone who files a tax return. The live broadcast, via the web, is this coming Tuesday, May 11, from 2:00 to 3:00 pm EDT. If you miss the live feed, it will be posted to their archives.

I've only watched a few of these over the past few years because most of the topics have been about things I'm not interested in, such as e-filing. The ones I did watch were quite educational and I learned enough to make it well worth the time. This will be even easier for me this time, as long as my DirecWay Internet connection stays up, because it will be the first one I've watched since I set up multiple monitors on my main computer. I can have the webcast showing on one screen while doing other things on the other two monitors. Excellent multi-tasking opportunity.

Watching the webcast is free, and while they do offer one hour CPE credit, the price of $25 for that credit is not even close to reasonably priced. I've found much more economical CPE from such places as The CPE Store and PASSOnline; both of which I have used and been very satisfied with their offerings and service.

Saturday, May 08, 2004

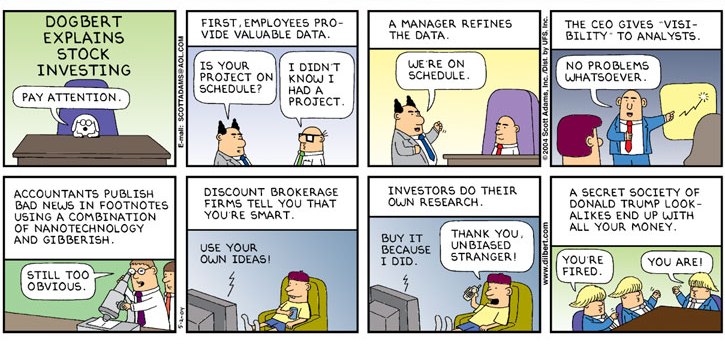

Stupid Stock Investments

I've discussed on several occasions why I'm not a big fan of investing in the stock market; mainly because it is too unpredictable, easily manipulated and completely out of the small investor's control. I've been skimming some of the news about the upcoming IPO for Google and am amazed that anyone thinks it is a good investment opportunity. As this comic illustrates, the current owners want to have their cake and eat it too by preventing the new shareholders from having any control over the company's operations; so they are planning to sell non-voting shares to the public. That is about as stupid from an investment perspective as the tracking stocks that were being sold during the dot-com stock market fiasco. Of course, there will be no shortage of fools eager to throw money at this latest hot thing.

Friday, May 07, 2004

Thursday, May 06, 2004

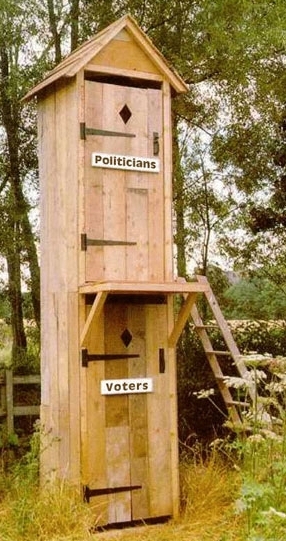

Thanks to Ben Cunningham for passing on this perfect illustration of the relationship between us voters and our public servants. Notice what they are serving us. It's consistent with my infamous poster of how tax legislation usually turns out.

Wednesday, May 05, 2004

On Fixing the Alternative Minimum Tax

House works to hold back minimum tax for a year - This is better than nothing; but adjusting the thresholds just for one year is only a band-aid to an issue that needs major corrective (removal) surgery.

Social Security Time Bomb

Teresa Heinz Kerry's Taxes

New Jersey Governor’s Attack on Business

Tuesday, May 04, 2004

Get on with the tax cuts

Why John Kerry Won't Release Wife's Tax Returns - Tax returns tell a lot about a person.

Ex-IRS Man Declares Himself Tax-Exempt - Tax protestor scam artist Joe Bannister continues to get plenty of press coverage. How long will it be until we see a story about his prison sentence, similar to this one about his fellow tax criminal, Richard Simkanin, who is on his way to a seven year stay in the Federal gray bar hotel? That should be soon, as it will be for anyone stupid enough to follow his advice.

Poll shows support for offshoring tax - I find this very hard to believe; that business executives would actually approve of a new tax on jobs they move off shore. If you look at the big picture, there already is a tax on such cost savings maneuvers. Lower costs for the company yield higher profits and higher income taxes.

Monday, May 03, 2004

Federal authorities investigating Smithsonian donation - Selling something to a charity for a below market price is tricky enough when claiming a charitable contribution deduction for the discount. It's a guaranteed IRS audit when the items are supposedly worth $50 million and a deduction of $32 million is being claimed.

No Net Taxes? Why Not? - Someone who thinks taxing Internet service is no big deal. The problem with this kind of logic -- defending a new tax as inconsequential because it's only a few dollars a month per person -- is the fact that everyone tries to get into that act. Unless a line is drawn in the sand, before you know it, there are hundreds of new such taxes, adding hundreds or thousands of dollars to everyone's monthly tax burden.

Senate Keeps Web Access Tax-Free

There will never be a right time to tax the Internet.

Treasury, IRS Warn of Identity Theft Scheme Involving Bogus E-mail, Web site - Similar to the dozens of info phishing scams that arrive in our emails each day pretending to be from eBay, PayPal, Microsoft and CitiBank.

Sunday, May 02, 2004

Virginia Republicans under fire for pro-tax position - Thus, the Scarlet T.

Finance: Should You Prepay Your Mortgage? - Rather than simply base a decision to pay off a mortgage on the interest rates, I always caution people against being "real estate rich and cash poor." Putting all of your money into your home can often be counter productive. It's a good feeling having some available cash for emergencies and unexpected opportunities. Often, paying off a mortgage is like a one way valve. It may be difficult or impossible to borrow that money back out later, if the need arises.

Using an Annuity to Play the Medicaid Game - Converting assets to annuities has long been a stock tool in impoverishment planning to help people qualify for programs like MedicAid.

Budget balanced illegally, court says - Oregon taxpayers could be receiving some refunds of their 2001 taxes.

Why Sept. 11 brought us bigger government--and why that's a bad thing

Saturday, May 01, 2004

Taxpayers Win Major Battle in Fight for a Tax Free Internet

Study: Lawmakers Lament Deficits but Most Draft Bills to Boost Budget Higher - They're hopelessly addicted to pork.