Retroactive home sale?

Q:

Subject: Sale of residence

I am a tax preparer with a small office in MI and am wondering if you would give me your opinion on a transaction. I have a client who leased a former residence to someone for up to five years, with an option to buy at any time during the lease period. The buyer/tenant assumed all practical ownership responsibilities for maintenance, paid a higher than market rent during the 5 years so that a portion of the rent was applied to the option sale price and a portion of the "rent" was designated as property tax and insurance reimbursement. The buyer was trying to work out of some personal tax liens and they took most of the five years to do so. My client did not want to sell on a land contract because it would be harder to evict the buyer if the personal tax issues could not be resolved and third party financing obtained. The sale was completed in 2007.

My client, the seller, received a 1099 for the 2007 closing and they would like to exclude the gain on sale, other than depreciation recapture. Their contention is they really sold the property in 2001 when the lease/option started. The lease payment was equal to a reasonable interest rate, plus tax and insurance escrow and the amount applied to the down payment amount. While the title did not transfer in 2001, the client's contention is there was basically a land contract sale in 2001, at which time they met the ownership and occupancy requirements. All payments received during the almost five year period have been reported as rent and the property was depreciated- perhaps not the right thing to do (in hind sight).

I have not found anything right on point so I am wondering if you would give me your thoughts on this. Thanks for taking the time to read this and I look forward to reading your response

A:

I am assuming that your client didn't report the sale of his primary residence, with the Section 121 tax free exclusion, on his 2001 1040, which is where it should have been shown if he wanted to claim it as such. Trying to recategorize the sale from a normal lease-option (which it seems like to me) to a primary residence sale six years after the fact, when the statute of limitations bars any changes to his 2001 1040, is crazy and not something that would have any chance of standing up to the slightest bit of IRS scrutiny.

In addition, if he has been claiming depreciation since 2001, that also completely undermines his argument that he actually sold the property back then. Having his cake and eating it too seems to fit that scenario.

I am also assuming that your client hadn't been reporting any interest income from the buyer's payments; another contradiction to the argument that there was a 2001 sale.

Based on your description, your client had a standard lease option with a 2007 sale of a rental property. He could have obviously done a 1031 exchange into new rental property during 2007, but it is too late now to make that kind of change in the type of transaction he had.

If you've read much of my postings, you know that I have very little sympathy for people who are too short sighted and/or cheap to consult with a professional tax advisor before the consummation of a potentially taxable transaction and then cry about the consequences when their 1040 is prepared. The proper time for your client to consult with you would have been before the 2007 closing of the sale. You may have advised to set it up as a 1031 exchange or even as an installment sale if he could have afforded to carry back some of the sales price. Now, it is too late to set those things up and he has a fully taxable sale of a rental property.

That's how I see it. I hope this helps.

Kerry Kerstetter

Labels: 121

Comparing Business Entities

As has been quite obvious from the never-ending emails I receive, there is no shortage of confusion over the proper business entity to use. As I have to continually point out, the biggest mistake is when people try to make these choices on their own, without the assistance of professional advisors. That is nothing short of reckless and is no way to start off a business operation.

However, as I have pointed out, it will save time and fees if business owners will acquaint themselves with the basics of the various business structures before meeting with their professional advisors. In that vein, I pass along this IRS Fact Sheet that briefly describes the basics of the four most commonly used business entities.

The best bit of info in this Fact Sheet is at the very end:

It may be important to seek advice from business experts and professionals when considering the advantages and disadvantages of a business entity.

Labels: corp

IRS Increases Mileage Rates

At last, IRS has realized that the 50.5 cents per mile standard rate for business miles is woefully out of kilter with the current fuel prices, so they just announced that as of July 1, 2008, the rate will jump by eight cents to 58.5 cents per business mile.

The standard deduction for medical and moving costs will also increase as of July 1, to a whopping 27.0 cents per mile.

And, as always, the rate for using a vehicle for charitable purposes will remain at the statutory limit of 14.0 cents per mile because our imperial rulers locked that rate into the law.

This shows once again why it is important to keep track of actual expenses rather than rely on the out-dated standard rates when calculating vehicle deductions.

Labels: Vehicles

Rolling over retirement funds...

Q:

Subject: Question about IRA's

Hi Kerry,I have a friend who is a nurse at a hospital in Berkeley.She has two IRA accounts....one is noted as a 403(b)The other one has nothing to indicate what it is, so we are assuming that it is a traditional type IRA, tax defered account.Naturally both of her accounts are losing her money and she wants to roll-over both these accounts into some other tax defered plan. Both the broker(manager) and her human resources dept. are telling her that she cannot remove funds from either account until she turns 59 1/2 yrs old (this December). (assuming that she doesn't quit her job)They say that taking either account to "cash" and mailing the money direct to the "new fund" would still be a taxable event because she hasn't turned 59 1/2 yet.Actually....the manager said that she could take the 403(b) to another fund and she wouldn't be taxed....and the HR Dept said that was wrong even transfering the 403(b) would be taxable.Since she isn't quiting her job.....then there isn't a "distributable event".....YOU ARE THE GURU......PLEASE ENLIGHTEN US.Many Thanks,

A:

I'm not really a fan of second hand tax advice. Your friend really needs to work with her own personal professional tax advisor in order to work out the best plan for her unique circumstances. However, there are some good issues here that will make for an interesting blog post, so the following comments are more general than she really needs.

A 403(b) account is basically the non-profit equivalent to the 401(k) deferred compensation retirement savings account that many for-profit companies offer their employees.

What seems to be the confusion is the fact that there are very different rules for IRS in regard to what kinds of things would be taxable and the rules that are established by the administrator of the retirement accounts. In most cases, the paperwork that employees sign when enrolling in employer sponsored plans is much more restrictive in regard to withdrawals and loans than the IRS rules are.

Thus, I can only discuss the IRS rules with any confidence. She will have to review her plan documents to see what restrictions she has agreed to, such as not moving the money while she is still employed there.

For IRS, any person is allowed to roll over their retirement assets from any tax deferred account, such as 403(b) and conventional IRA accounts whenever the person feels it to be in her best interest. With a direct custodian to custodian transfer, the full amount is rolled over to the new account, without anything being withheld for income taxes.

However, if she were to take a check for the withdrawal, she has 60 days to roll it over into a new retirement account, or even multiple accounts if she feels it best to diversify. In this kind of situation, because there is no absolute guarantee that the employee will actually deposit the money into a new retirement account, IRS requires that the first custodian withhold 20% of the withdrawn amount and send it to them just like Federal income taxes withheld from paychecks. This amount can then be claimed as a credit on the person's next 1040. The big problem that arises is that for a completely 100% tax free rollover, the person will have to use other funds to make up for the 20% that was withheld or else it will be considered a taxable withdrawal.

As an observation, I have noticed over the past few years a number of cases where clients doing withdrawals from their retirement accounts did not have any taxes withheld and were thus able to easily deposit the full amounts into their new accounts. For some reason, their old employers and/or plan custodians were being nice guys and ignoring the IRS withholding requirement, which isn't always the case.

Rollovers of retirement accounts can be done at any age. Anyone claiming that only people over 59.5 years old are eligible for tax free rollovers is seriously ill-informed. The 59.5 years of age threshold is only important when taking out taxable withdrawals because if none of the exceptions applies, there will be early withdrawal penalties for both IRS and FTB.

So, in summary, IRS will allow a tax free rollover at any age. Any restriction on such a move would be in the plan's governing documents. Her own professional tax advisor should review those documents to see if she did formally agree to such restrictions.

In similar cases I have seen, where someone has been locked into a money losing retirement account, the next best thing to a rollover is to stop any new contributions to it by amending her agreement with the payroll department and diverting that money into another retirement account, such as one of the IRA plans.

I hope this helps.

Kerry

Follow-Up:

Thanks Kerry,So as far as the IRS is concerned, she can "roll-over" her Tax defered IRA's into new ones with a direct transfer into the new accounts. She will need to see if her current retirement funds have more restrictions, placed there by her employer, that would keep her from transfering at this time.Thanks so much,YOU ARE THE GURU !!

Labels: Retire

Multiple primary residences?

Q:

Subject: claim multiple primary residences

I have been told that people are able to claim multiple primary residences, since we did not use a second property as a second home. In fact we used it as our primary residence 2 or 3 days a week on the average, due to operation of the business in another town, for the last 5-6 years; not vacationing.Thanks,

A:

You appear to be mixing up the issue of multiple primary residences. At any point in time, each person can only have one primary residence for IRS purposes based on such items as time spent, mailing address, voter registration, driver's license, etc.

With a married couple, it may be possible for each spouse to have his/her own primary residence if they do in fact live in separate locations. As with all tax matters, the burden of proving the legitimacy of such a classification rests with the taxpayers. IRS does not have to prove it it isn't valid. You have to be able to prove that each spouse has his/her own separate primary residence.

Where you may be confused is the fact that each taxpayers is allowed to exclude up to $250,000 of profit from the sale of a primary residence each two years. Before May 1997, the tax law had included a once in a lifetime exclusion of gain from a primary residence sale. The liberalization of the law to allow multiple usage of this tax free break has been a great opportunity for tax free serial home selling, such as with rental properties that are converted into primary residences.

I have some info on home sales on my website.

Before undertaking any transaction related to this area of taxation, you should consult with a professional tax advisor.

I hope this helps.

Good luck.

Kerry Kerstetter

Labels: 121

Sec. 179 and converted assets

Q:

Subject: Tax Question

To Whom it May Concern,

Recently my father and I downloaded some material from your website. My father is involved in an appeal with the IRS. He needs some supporting documentation (case histories would be best) in reference to using 179A instead of depreciation for a tractor bought in 1999 then transferred to strictly business use in 2002. Where might we find this type on information. Any help you can offer would be greatly appreciated. Thank you

A:

This is shaping up to be a perfect example of the foolishness of trying to handle tax matters without the assistance of a qualified professional tax advisor.

First is the issue of Section 179 expensing of the tractor. From your question, I am assuming that your father tried to expense the cost of the tractor on his 2002 1040, when he started using it for farming. I can't provide any cases to support this position because it is wrong. Only equipment that has been newly acquired from an unrelated party qualifies for the Section 179 election. Converting a personal use asset to business use does not meet this test because it has been acquired from himself. Any competent professional tax preparer would have known that.

Next is the issue of handling an IRS audit without professional representation. This is insane and will result in heavy additional taxes, penalties and interest.

Since he is still with Appeals, it is not too late to hire a professional tax advisor to take over the case on his behalf. Since it is obvious he will be losing the tax break from the Section 179 on the tractor, it is imperative that a tax pro review the entire tax return to see if there are other areas in which legitimate deductions were overlooked. It is very likely that a competent tax pro will be able to locate enough other missed deductions to more than offset the loss of the Section 179 deduction.

This is all the more crucial due to the tax year being reviewed, 2002. Any additional taxes that are determined to be owed will also be assessed penalties and interest starting from 4/15/03, which will magnify the bottom line amount IRS will be demanding. When you toss in the comparable State taxes, penalties and interest on the final IRS determination, there could be a substantial amount due. Risking that in order to save from having to pay a tax pro's fee is ludicrous.

Good luck. I hope this helps.

Kerry Kerstetter

Labels: 179

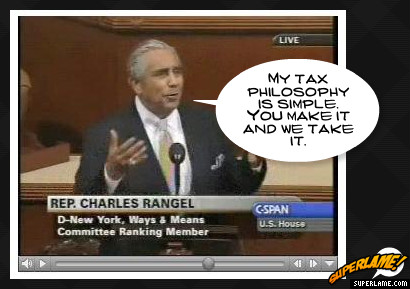

Scared of Charlie Rangel?

From Ohio CPA Dana Stahl:

Subject: Rangel's bill?

Mr Guru - I was at a conference this week. In a discussion I had with another CPA about my audit that you & I talked about last time, the fellow said that Charlie Rangel, the Chairman of House W&M, has put in a bill that will force S Corps to pay SE tax on their profits. I hadn't heard of this, but the fellow says that you can read the bill on the internet. Were you aware of this? Perhaps you mentioned it in your blog, but if so, I missed it.

The thing is: if this bill passes, can the same provision for LLC's be far behind?

Perhaps you can discuss this on the blog.

Later,

My Reply:

Dana:

You need to understand that Rangel always has at least a dozen or two tax raising bills in the works. As Rush constantly points out, Rangel's motto is something like "Gimme all your money" and he is somewhat of a joke in regard to the sheer volume of his wacky tax raising schemes.

It's the same kind of waste of time getting all freaked out about every one of Rangel's hare-brained tax hike plans as it is to panic over each example of the drive-by media's pro Dem bias.

Raising taxes on S corps and LLCs are obviously among those tax increases that Rangel would love to see in his 100% tax rate utopia. However, until he gets a lot of support from others in Congress for this, I'm not going to panic.

If we were to take seriously each of the tax hike ideas and assume that they will be here soon, we would literally be paralyzed in our ability to set up any kinds of plans for our clients.

If such a plan were to ever make it into a tax bill and be signed into law, it will obviously not be retroactive and will thus require modifications of tax savings plans that relied on the ability to avoid SE tax. Such modifications of tax savings plans have always been part of the environment and always will be, since we all know that our rulers in DC will never stop tinkering with the tax code. Devising a tax saving plan that will last intact forever is an impossibility because of the certainty of changes in the future.

Kerry

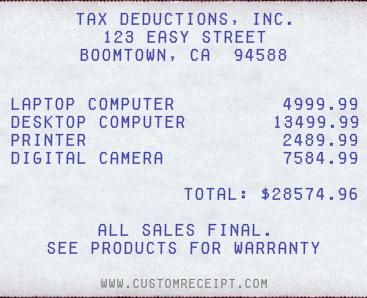

Creating receipts...

Not that I would ever condone creating false documentation, but this tool to create cash register receipts does make the mind wonder about the possibilities.

Anyone who has been frustrated by having to wonder what a faded out cash register receipt originally said might like this tool.

Thanks to The Generator Blog for noticing this.

Labels: Deductions

Comparing Tax Proposals

As I have constantly said, trusting anything a politician promises during a campaign is insane. However, for the sake of discussion, I wanted to pass along this side by side comparison of how the two main candidates stand on many of the tax issues that was created by the fine folks at TaxCoach Software:

(Click on image for full size)

Labels: taxes

Senate Moves to Tax Obama’s Windfall Campaign Cash - A timely parody by Scott Ott of the idiotic concept of having the government confiscate what they classify as Windfall Profits.

Gift Tax Questions

Looking at my backlog of questions to post, I noticed several related to gift taxes; so I’m doing a rare combination post. Each of the following questions was from a different person.

Q-1:

Mr. Kerstetter, CPA,

Your column regarding estate/gift tax in the website is very informative. I have one simple question. In 2010, gift tax is repealed. Does it mean that one can transfer any amount of money as gift in that year without having to pay any gift tax? I am looking forward to hearing from you.

Sincerely,

A-1:

Your information is incorrect. For people passing away during 2010, there will be no estate tax because that tax only is repealed for that year.

However, there is no similar repeal scheduled for the Gift Tax for 2010 or any other year. That will be treated in the same manner as we currently have.

It is confusing because the limits and many of the rules for Estate and Gift taxes used to be in sync with each other. However, a few years ago our imperial rulers in DC decided to separate the two taxes in a way and have different rules for each.

I hope this helps. You should be working with your own personal professional tax advisor if you have big gifting plans in mind.

Good luck.

Kerry Kerstetter

Q-2:

Thank you for posting very useful information on your web site. You stated that the current annual gift tax exlusion allownace is $12000. I will appreciate if you can advise whether this limit will be increased in the near future. If yes, to what amount and in what year?

A-2

The annual limit on gifting with no gift tax consequence is by law only increased in increments of $1,000 when the cumulative cost of living factor (inflation) since the last adjustment warrants it. This is reviewed each year after the end of August, covering the CPI increase from 9/1/07 through 8/31/08 for the next adjustment.

Considering the potentially large cost of living increase we are all suffering through right now, especially in terms of the skyrocketing costs of energy, transportation and food, I am guessing that for 2009, there will be more than enough of a cumulative increase in the CPI to raise the annual limit to $13,000.

I hope this helps you plan things.

Kerry Kerstetter

Q-3:

Hiread your "article" on gifts. .......Everyone knows you can gift $12000 effortlessly...........Everyone thinks you cannot gift more...............per your explanation......a rich Aunt with an estate of say $2,000,000 has gifted a lucky nephew $100,000 in one calendar year. She did not pay a gift tax.Are you saying that if the Aunt dies her estate is increased by $100,000 for tax purposes ?????ps how does one figure the gift tax ? what is it based on ????thankyou

A-3:

Gift taxes and estate taxes are an integral part of the same tax system, which is separate from the income tax system.

To prevent people from giving away enough of their wealth to avoid estate taxes when they pass away, there are potentially taxes on gifts made during the person's lifetime. To avoid being too ruthless, there has long been an annual exemption from gifts which are subject to this tax. This is currently $12,000 in a calendar year per donor (giver) per donee (recipient). No gift tax return is required if all gifts during a year are under that limit.

In addition to the annual limits, each person also has a lifetime exclusion of one million dollars of gifts that can be made without having to pay gift taxes. These gifts do have to be reported to IRS on Form 709 and will reduce the amount of the estate that will be free from estate tax after the person passes away.

So in your example, if your aunt had used up $100,000 of her lifetime gift exemption while she was alive, when her estate tax return is prepared, her tax free amount will be reduced by that same $100,000.

Gifts are calculated based on the current fair market values of the items being given. You can download the gift tax Form 709 and its instructions from the IRS website:

http://www.irs.gov/pub/irs-pdf/f709.pdf

http://www.irs.gov/pub/irs-pdf/i709.pdf

I hope this clears up your confusion.

Kerry Kerstetter

Q-4:

Would you please answer a question about check date versus date check cleared donor's account? Here's the situation:Donor writes and gives $10,000 check December 12, 2007 and is alive when check clears donor's bank January 4, 2008 and this is the only gift to recipient in 2007.Donor writes and gives $10,000 check April 1, 2008 and donor is alive when the check clears donor's account April 7, 2008 and this is the only gift to recipient in 2007.Question:Are these gifts made in separate years concerning the annual gift tax exclusion?Thank you in advance for your opinion or some lead to the answer.

A-4:

I'm sorry, but I have had a long standing policy of not answering homework questions for people. I don't have enough time to answer as many real world questions as I would like to.

Good luck.

Kerry Kerstetter

Labels: Gifting

Voluntary Taxes?

Q-1:

Subject: Is it true that income taxes are voluntary?

Kerry,

I have been doing much due diligence on the topic of my subject line. Do you still adhere to the same advice that you posted in 2000 on your Website?

Thank you in advance,

My reply:

You're going to need to be more specific as to what advice you are referring to. I have posted several thousand items to my websites and blogs.

Kerry Kerstetter

Q-2:

Kerry,

Sorry, here is the link http://www.taxguru.org/incometax/voluntary.htm

A:

Thanks for clarifying that for me.

Yes, the comments I made in that short piece seven and a half years ago are still as true today as they were back then. As the recent Wesley Snipes case proved, there is still no shortage of people stupid enough to believe the bilge being promoted by tax protestor scammers.

Back in 2000 and earlier, I was extremely frustrated by the official IRS policy of trying to ignore the crackpot theories being espoused by tax protestor groups in the hopes that they would dwindle out on their own. IRS finally learned that such silence was perceived as agreement by many gullible people, so they started their current aggressive campaign of prosecuting and imprisoning tax scam promoters and their celebrity customers.

Please check out this recent blog post for my feedback to a tax protestor who wants to pretend that there is no law requiring us to pay taxes:

I hope this helps.

Kerry Kerstetter

Newest Tax Laws

The first summary I’ve come across of the Farm Tax bill that our rulers in Congress passed over Bush’s veto is in this seven page pdf newsletter from CCH. It also covers the less controversial Military Tax Relief Bill.

I’m assuming that the other tax reference publishers will have their own summaries posted in the near future.

IRS Interest Rates Drop for the Third Quarter of 2008 - The downward trend continues, now down to 5.0%