It has always been a hot issue, distinguishing where the boundaries are between functions we CPAs can legally do and when we cross over into the forbidden territory of practicing law.

George W's tax cut victory (George Will)

Bush's tax cut bridge (Larry Kudlow)

Bias against tax cuts (Bruce Bartlett)

President Signs Major Tax Cuts... Now What? (Gail Buckner)

A tax tally: the winners and losers

Some Candidates Quick to Urge Tax-Cut Repeal - The DemonRats are just so predictable that it's getting a little boring listening to them whine about lower tax rates. Lower tax rates = less power that they can exert over our lives.

Sunset Spending, Not the Tax Cuts, If lawmakers are really serious about eliminating the deficit.

Democrats Criticize Latest Tax Bill - They are scared to death that it will do the trick and boost the economy, crushing Queen Hillary's chances for a third term in the White House.

Corporate Tax Appeals Up in Sour Economy - If the value of commercial property has declined, it's only faith that the property taxes on them be reduced accordingly.

Bill in PRC stiffens penalties for some tax shelters. Investors in schemes would pay more fines

The Death Tax Lives On In Several States - It is more expensive to pass away in those states that are not following the Federal phase-out and one-year (2010) elimination of the Estate Tax. While not the easiest thing to do, choosing what in which to reside during your last days on Earth could be part of an overall estate plan.

Same As Cash

I have been receiving some questions as to whether the Section 179 expensing election requires that you pay for the asset, such as a vehicle weighing more than 6,000 pounds, in full or if you can finance it. This brings up one of the biggest mistakes I see people make, causing them to overpay their taxes, both because of ignorance and lousy bookkeeping.

For income tax purposes, how you finance a purchase is irrelevant for purposes of deductibility, including the Section 179 election, which is now up to $100,000 per year. It is exactly the same whether you pay cash or put zero money down and take out a loan for 100% of the price.

Likewise, using a credit card is considered to be the same as paying cash for income tax purposes, regardless of when the card is paid off. You can literally go to a store, such as Best Buy (where we bought our three most recent computers) on December 31, use your credit card to buy $50,000 of computers and other business equipment, and you can claim a Section 179 deduction for the full $50,000 on this year's income tax return, as long as you plug them in and start using them before midnight. An often overlooked requirement of the Section 179 deduction is that the asset be placed in service during the tax year for which the deduction is being claimed; not just paid for. The credit card bill won't be received until next year; but that doesn't matter for tax deductions.

A lease of a vehicle or other business equipment does not qualify for the Section 179 unless it is a disguised purchase, such as a lease to own with a one dollar buy-out at the end.

If you have a loan for the purchase, you can then also deduct the interest as a business expense on the same schedule where you claimed the Sec. 179. Likewise, finance charges on deductible credit card purchases can also be deducted. This is another often overlooked deduction by people, and even tax pros, who believe that vehicle and credit card interest are always nondeductible personal interest.

As I have said too many times, most people miss out on claiming their full possible deductions because of crappy bookkeeping (to use the technical term). They only look at just their checks paid out for the previous year and miss out on the purchases made through loans and credit cards. That is why it is so important to have everything properly set up on QuickBooks. It does a beautiful job of combining purchases made through all of those means into the proper years.

Labels: 179

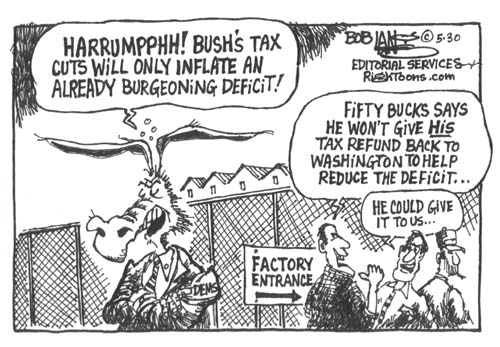

How many people actually believe that Warren Buffett and his fellow travelers who condemned the tax cuts will send their tax savings back to the IRS? Fat chance of that.

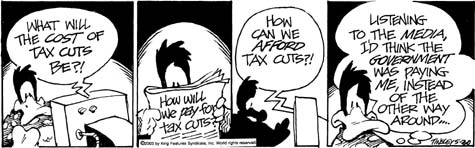

It has always made me sick that allowing people to keep any of their own hard earned money is considered to be a cost to the government. The argument from the Left is that's a cost that we can never afford as a civilized society; yet we can always afford to spend trillions more on ridiculous and corrupt welfare programs.

The Tax Revolt Turns 25 - Remembering the property tax revolt in the PRC in 1978.

President Signs Tax Cut Package Into Law

Economic Impact Analysis of the Jobs and Tax Relief Reconciliation Act of 2003

Tax Law Omits Child Credit in Low-Income Brackets

Bush Signs $350 Billion Tax Cut Measure

$350-Billion Tax Cut Spells Relief, Bush Says

Bush signs his 2nd big tax cut

Bush signs $350b tax cut package

Tax cutters now take aim on �sunsets�

Bush Signs Tax Cut Bill, Dismissing All Criticism

DUBYA'S TAX-CUT CATCH-22 FOR DEMS

Tax Cut Great News for Retirement Security - Contrary to the left's propaganda that only evil rich people have income from stock dividends, as I have seen with hundreds of real life clients, most dividends are received by older middle income folks. How the DemonRats can ever claim to be the saviors of senior citizens, especially after the 1993 Clinton-Gore hike in the tax rate on Social Security benefits, is a credit to the left-wing bias in the mass media and their ability to shape public perception. Their opposition to lower taxes on dividend income is just one more way in which they are anything but helpful to the older citizens in this country.

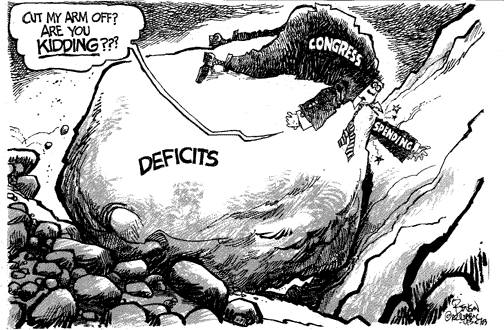

The Deficit Game - The libs and their fellow travelers love to fake concern over perceived budget deficits and their imaginary connection with tax rate cuts. They refuse to acknowledge the fact that deficits are strictly caused by too much spending and never have any problem fighting for more of that. They never mention any concern over deficits when pushing for another expensive big government program.

As with the Iraq war, the underlying motivation for the opposition from the JackAss Party is pure hatred of George W. Bush. Whatever he wants, they have a knee-jerk reflex opposition to it.

Advanced Child Credit Payments

Starting on July 25, IRS will be sending out checks to people who, based on info from their 2002 tax returns, will qualify for the new higher $1,000 per child (formerly $600) credit. They expect to be sending out about 25 million checks for the extra $400 per qualifying child. They have more details on this, including the expected payment schedule on this page of their website. As I said earlier, if you do receive one of these check from IRS, be sure to label it properly in your checkbook and/or QuickBooks register and give that info to your tax preparer when s/he works on your 2003 1040. Otherwise, we'll have more of same kind of problems we had with the 2001 IRS checks.

Bush expects tax cuts to fuel economy, campaign

Bush to sign tax cut he once belittled

Fix a Real Tax Problem - This bill does nothing to address the problems with the insane AMT.

Tax Cut an Empty Gesture to Cities

President Signs Tax Cut Package Into Law

UPDATE - Bush signs tax cut bill; Republicans promise more

Bush Signs Tax Cut Bill, Asserting It Will Revive Economy

Tax cutters now take aim on �sunsets�

The Tax-Cut Skeptics Back Home

Tax Cuts Revisited: A Benefit For All Americans

Liberals lose in federal poker

Your tax refund should arrive shortly - These advance refund checks are going to create another headache like the ones in 2001 for people with lousy records. I had scores of clients who had no idea whether or not they had received their 2001 refund checks; so we had to guess when completing the 2001 1040s. At least half the time, they were wrong and IRS had to change the refunds or add more tax due. That is just one of the reasons we are requiring everyone to have their finances on QuickBooks; so that I can look and find out whether or not tax refunds were received, as well as what estimated tax payments were made, another big problem with lousy records.

Democratic Presidential Hopefuls Criticize Tax Cut - As if we need another reason to avoid the DemonRats.

Let's hope Bush can make it very permanent and completely tax free on the next try.

This would do more good than just suing everyone over idiotic investments.

Something for those people who believe the left's propaganda that IRS has been neutered.

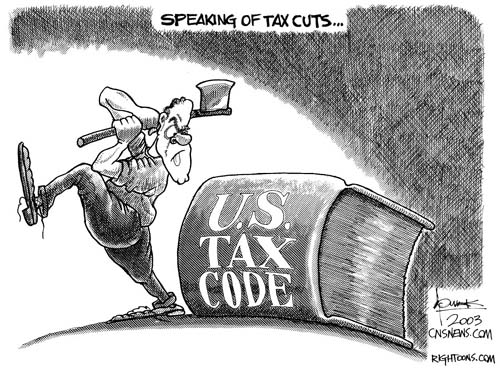

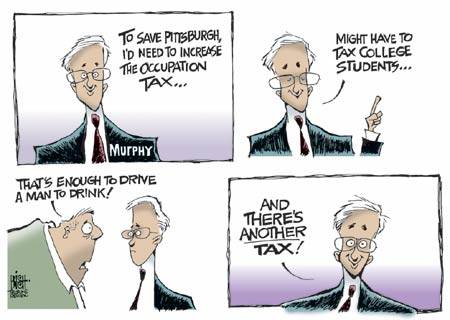

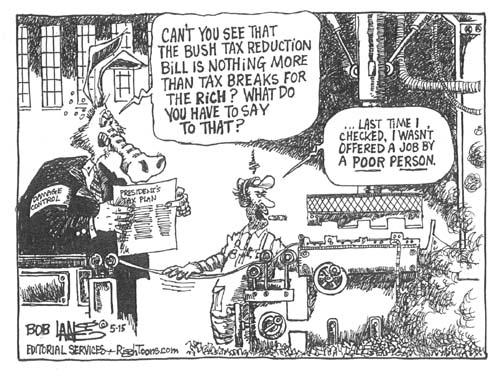

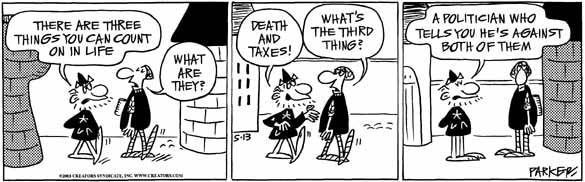

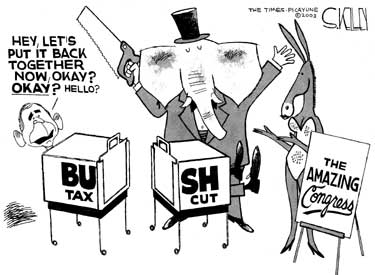

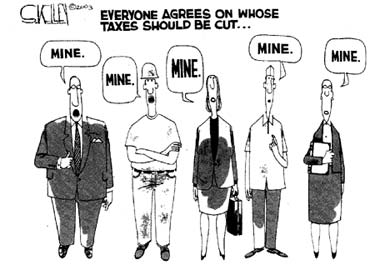

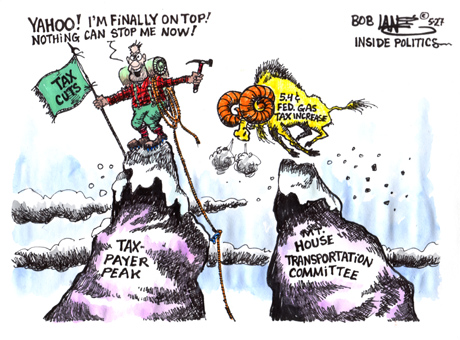

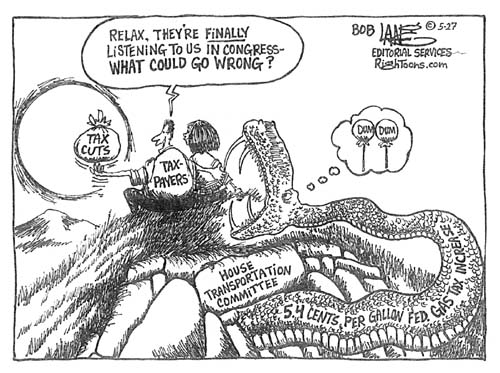

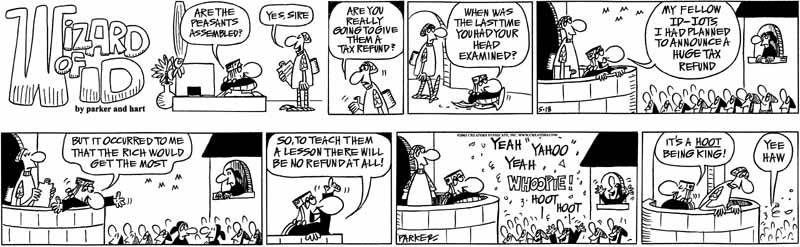

This is what I visualize whenever I hear or read some bonehead claim that tax cuts cause deficits and only benefit the evil rich.

Accounting Firms Attempt To Dispel the Cloud of Fraud - About a year ago, after the Enron collapse and disclosure of "creative accounting" by several large companies, the very definition of unreliable and untrustworthy in the punch lines of late night jokes was Arthur Andersen. Luckily for the CPA profession, the definition of unreliable and untrustworthy has now become The New York Times and CNN.

ABC Pushes Liberal Spin: Top 5% Get More Than Half of Tax Cut - It would really only be news if the Anti-American Broadcasting Company did otherwise.

Tax-dodging companies feed at federal trough

This ain't the last tax cut we're gonna see - Let's hope they can make it part of each year's annual budget legislation to have some reduction in tax rates. High taxes didn't happen overnight, so gradual and permanent reduction will take some time to accomplish.

FRIST VOWS MORE TAX CUTS AHEAD

Bigger Than You Think. The tax cut is not necessarily half of the president�s original proposal.

Dividend Hunt May Backfire on Investors - They are just another part of the equation for evaluating investments.

More Companies Find It's Better to Go Private. Regulatory scrutiny and high costs of being in the public market are driving many firms to consider a way out. - While it may seem prestigious to have your company's stock traded on the exchanges, it adds a ton of costs and issues to the management process that make it an entirely different ball game. For example, with a normal closely held business, you only have to keep in good standing with the IRS and your State tax agency. When you have outside investors, you assume massive fiduciary responsibilities towards each one of them, plus you are limited in what you can say and do to an entirely new level.GOP in the PRC hints at softer stance on taxes. Some say increases might be OK if Democrats agree to curb future spending.

L.A. Times Defends High Taxes In PRC - Typical leftist drivel. Just because some taxes may be higher in other locales, we have no right to complain here. That kind of idiotic reasoning is used constantly to defend high gas taxes by comparing prices in the USA with what they pay in Europe.

With Wall Street on Defensive, Claims Against Brokers Surge - Although I'm sure there were plenty of cases of churning and other abuses by stockbrokers, this trend of suing over losses just seems too much like the new tactic of suing casinos for gambling losses. As I have always said, playing the stock market is exactly like trying your luck in casinos and anyone who believes winning is guaranteed is stupid enough to deserve an expensive lesson or two on life's realities.

Minimum of Understanding. Wage floors are stealth jobs killers. - Anyone with even the most basic grasp of supply and demand concepts should understand that raising mandatory minimum wages will result in fewer people being hired.

Our rulers in DC will still get plenty of our money. We can spend our income tax savings on higher gas taxes when we fill up our vehicles.

A tax cut of varied proportions

Modest Jolt in Economy Seen From Tax Cut

Bush Declares Tax Cuts Will Boost Economy

Frist Says Republicans Want To Make Bush's Tax Cuts Permanent

New Tax Rates

I've updated the 2003 tax rate schedules to reflect the new law. I also added a lot of info at the bottom of the page on the new special rates for dividend income and long term capital gains. The lower rates on dividends kick in as of January 1, 2003; but the lower long term capital gains rates don't apply until sales made after May 5, 2003. For installment sales, we will need to keep track of separate totals for principal received between 1/1/03 and 5/5/03 and what is received from 5/6/03 through 12/31/03 so that the proper rates can be applied. We can expect a very messy Schedule D for 2003.

I also updated the Section 179 info to reflect this new tax law.

Labels: 179

Man could face three years in jail for bulldozing 300 oak trees on his own property - This kind of thing is a perfect example of why we left the PRC ten years ago. Control over your own property isn't allowed by the Left Coast rulers. When we came here to the Ozarks and learned that property owners are allowed to do whatever they want with their property, the decision was easy. For example, we have about 150 acres of forest (oaks and other kinds) on our property here. We could cut, burn or bulldoze them all if we want to. Of course, we wouldn't do that; but it's a good feeling knowing that we won't be tossed into prison if we change our minds. A foundation of capitalism and freedom is private ownership and control over property. That's not the case in the PRC.

Bush Lauds Congress for $330B in Tax Cuts

President Bush Praises Congress for Tax Cuts

Tax cut will help a bit � economists

With Tax Cut Bill Passed, Republicans Call for More & Permanent Cuts

Tax-cut bill adds up to a big win for Bush - And for everyone else in the country, except for the DemonRats who want to keep the economy in recession.

Congress Passes $350 Billion Tax Cut Bill - The fact that the cited cost of the tax cut bill varies from story to story doesn't bother me because all such "costs" are completely bogus to start with. Letting people keep more of their own money doesn't cost the government anything. As happened after the Reagan cuts of 1981, the increased economic activity will actually result in more money flowing to DC. Any deficits will be caused solely by reckless spending.

Liberals misread the tax issue

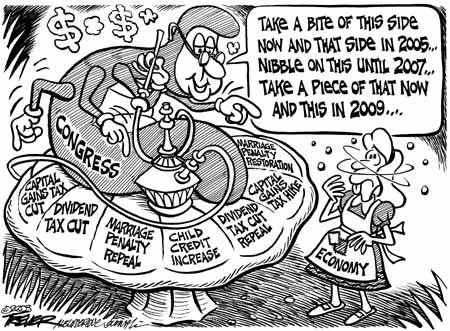

The New Tax Law

While looking over the details of the new tax law, and updating them on my main website, I had a few observations, especially in regard to how those of us living in the real world (as opposed to the fantasy world in which our rulers reside) will deal with it.

Overall, it is a very good step in the right direction of lower taxes. The most amazing change was the quadrupling of the Section 179 expensing election from $25,000 ($50,000 for owners of C corporations) to $100,000 ($200,000 for owners of C corps). This is much more generous than the $30,000 to $75,000 figures that had been included in the early versions of the bill as it worked its way through the sausage factory, digestive system, of DC. This should encourage a lot of capital spending on new business equipment, including evil SUVs, if they weigh more than 6,000 pounds.

Besides raising the annual deductible amounts, this new law made some other nice changes to the Section 179 rules. For 2004 and 2005, the annual amounts are to be adjusted for inflation. Up until now, the Section 179 election was only allowed on originally filed tax returns. People who overlooked it were not allowed to claim it on amended returns. This new law allows the Section 179 expensing election to be claimed or revoked on amended returns for 2003, 2004 and 2005.

There are several aspects of the new law that leave a lot to be desired. The short time horizon, with all of the changes disappearing after 2004 or 2005, does make long range planning a bit tenuous. We have to hope that the GOP's strategy of bringing this matter back up for a vote in 2004 will have the desired effect of making those opposed have to defend raising everyone's taxes.

The failure to eliminate the double taxation of corporate income is very disappointing. The compromise, to tax dividends at the special long term capital gains rates of 5% and 15%, is just one more example of how our rulers never miss an opportunity to make things more complicated in the tax system. This will obviously be great for stimulating more business for us tax pros and our software suppliers. I've even heard predictions of a 25% increase in H&R Block's stock price due to this new tax law requiring more people to seek out their help in preparing tax returns.

The biggest failure of this new law is its attempt to remove the marriage penalty. The marriage penalty is a very real aspect of our tax system. I have seen countless couples either get divorced or refuse to get married just because the thousands of dollars in additional taxes they would be required to pay for the privilege of being married. As I have always advised, if our rulers really wanted to eliminate this penalty, they would just allow people to compute their taxes under both methods, married and as if they were single, and pay the lower amount.

However, our rulers always come up with some half-assed token deduction for married couples that is just a drop in the bucket toward wiping out the actual penalty. This new law's approach is no better. In fact, this new law even adds new marriage penalties with the phase-out amounts for the new tax credits and deductions that are in the law to prevent the evil rich from receiving any of the tax breaks. The phase-out amounts are much higher for two single people than for a married couple. How our rulers can claim to be removing the marriage penalty while actually adding new penalties is a skill that only politicians seem to have. A disconnect between their perception and the real world reality in which the rest of live.

KMK

Labels: 179

Fiscal Conservatives Say Hurray for Tax Cut

GOP Mission Accomplished: Tax Relief

Fiscal Conservatives Say Hurray for Tax Cut

Tax Cut Plan Cut in Half, But Dan Rather Still Calls it "Big" - Any tax cut is by definition too big and dangerous in the minds of the lefties.

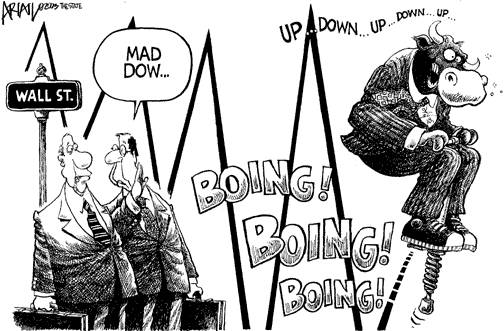

Yo-Yo Economics - These new cuts still have to be made permanent or else they will disappear in a few years, snapping us all back to the higher tax rates we had until now.

Most to Reap Benefits of Bill - Not just the evil rich.

Bush Claims Tax Cut Victory as Congress Nears Final OK

Congress Passes $350 Billion Tax Package. Cheney Casts Deciding Vote in Close Senate Passage - There's just something ironic about Cheney being the tie breaker of a large retroactive tax cut ten years after AlGore cast the tie breaker for the largest retroactive tax increase in 1993.

Bush likes 'little bitty' tax cut

Bush Lauds Congress for Cutting Taxes

Bush retreat eased tax bill�s advance. President, aides find compromise tax cut beats none at all

Taxpayers to get new round of cuts. $400-per-child refunds, less withholding among cuts

A Tax Cut Without End - This is a bad thing in the opinion of the New York Slimes.

Planned Tax Cut Called 3rd Biggest

Tax-Cut Scorecard. It�s not all Bush asked for, but it will add materially to economic growth.

A Tax Cut Worth Cheering. It will boost the economy � and Bush.

Breaks for almost everyone in tax bill

PREZ HAILS HIS BIG WIN ON TAX CUT

Tax cut heads for final OK in Congress. Quick passage means bigger payday July 1

Reverse Mortgage Can Really Help Seniors

One of the most frustrating things for me has long been trying to convince seniors that it's not a sin to tap into the equity in their homes and enjoy their lives a little before they pass away. Even with a mortgage, their heirs will still be receiving very lucrative tax free windfalls when they go. They shouldn't feel the least guilty about using some of their own wealth while they are alive, in spite of pestering by greedy kids who want their parents to live the most Spartan lifestyles to preserve their inheritance.

While reverse mortgages are useful methods of getting access to equity, a more effective approach is often to borrow a large lump sum, especially with current low interest rates, stick half in the bank from which to service the debt for the rest of the borrower's life, and play with the other half.

Bush can still claim victory on tax cuts

Senate Approves Tax Cut in 51-50 Vote

The tax cut: What's in it for you?

Silicon Valley-backed tax break gets the ax. Tech industry looked forward to economic boost - A lot of special interest tax breaks ended up on the cutting room floor in the final version. That's what always happens, which is why it's never a good idea to change behavior until the law is finalized.

Three Wise Men? - Another great debunking by Neil Cavuto of the supposed financial gurus.

States Look for New Sources of Tax Revenues

Senate Approves $330 Billion in Tax Cuts

Understanding Changes May Prove to Be Taxing - A good summary of most of the changes in the new tax law. I am planning to incorporate these new changes into the tax rate info on my main website over this weekend. I will post a note when it is ready.

Tax Cuts Need to be Pro-Growth, Immediate and Permanent

Lawsuits Over Tax Shelters Suggest Hard Sell by KPMG

It should be a dead giveaway that things are fishy when you are required to pay millions of dollars, sign a confidentiality agreement, and are barred from seeking a second opinion from any other experts in order to participate in a top secret tax savings plan. If you aren't allowed to verify the legality of a tax strategy with another independent source, that's a huge red flag that it's a crooked deal. Proceed any further at your own risk.

To be honest, I'm having the same feelings about the people who fall for these schemes as those who follow the tax protestor scamsters. Anyone that stupid really deserves to lose their money. I know it sounds cruel; but it's my Darwinian way of looking at the world and seeing that the smartest among us survive and the idiots don't. It's a kind of financial JackAss for weeding out those with too little intelligence to survive.

Investors Find New Ways to Put Pension Money Into Real Estate - This is good news, as I have for years been trying to convince more people to invest their IRA, SEP and Keogh funds in real estate so they could avoid the Enron type pitfalls; but it's been tough finding plan administrators who were willing or able to handle it. I'm hoping more administrators add real estate as a standard choice for investing retirement money. As I've always said, real estate is a lot more reliable in regard to accumulating wealth for retirement years than investing in stocks.

I first saw this a few months ago. I'm still not sure if it's a hoax or not. The State of Kansas is supposedly trying to get drug dealers to buy tax stamps ($100 minimum) to put on their products. If I'm reading the rules right, there may be a bigger penalty for being caught with illegal drugs that don't have the tax stamp than just for being a dope dealer.

This seems to illustrate a couple of truisms.

If you can't stop an activity, at least tax it.

As happened with Al Capone, authorities are much more able to throw someone in jail for tax evasion than for what most people would consider to be more serious crimes (murder, drugs, bribery, etc.).

I contacted the Kansas Dept. of Revenue and asked them how much money they actually collect from this. I will post their response.

Bush: Will Sign $350B Tax-Cutting Bill

Bush Says He Will Sign $350 Billion Tax Cut Deal

Bush embraces tax-cut compromise. $350 billion package set for likely passage Friday

Tentative Tax Cut Deal Reached. House and Senate Negotiators Back $350B Plan

Republicans leave some dividend money on the tax table.

Bush's tax-cut victory Is A Good Deal

Weak link on the left - Libs are lying in their attempts to connect tax cuts to deficits.

Warren Buffett Is Wrong! What he calls �voodoo,� is just what we need.

The Stooge of Omaha? - Both Stephen Moore and Neil Cavuto share my opinion that the supposed capitalist guru is nothing more than a typically selfish Marxist. He made his billions and now wants to make sure others aren't able to do the same.

Dangers of the dividend tax cut to Marxism - Lower tax rates = less control and power for the central government, something Buffett and his Fellow Travelers can't stomach.

$318 Billion Deal Is Set in Congress for Cutting Taxes

Gas Tax Hikes In The Works - With income tax rates ready to be reduced, our rulers in DC are working on plans to add another 5.4 cents in Federal tax to each gallon of gasoline we buy. They realize they can sneak this in pretty well undetected with the recent drops in pump prices. Some groups that are opposed to this new increase:

Citizens Against Government Waste

Dividend-Tax Cut Runs Risk Of Opening More Loopholes - Of course it will. That's how the tax game is played; utilize every technique that is legally available.

"The Congress is a circus. To the music of braying donkeys, each elephant is led in circles by the tail of another. While they have the peoples' attention, the clowns write the tax laws."

--Jim Boren

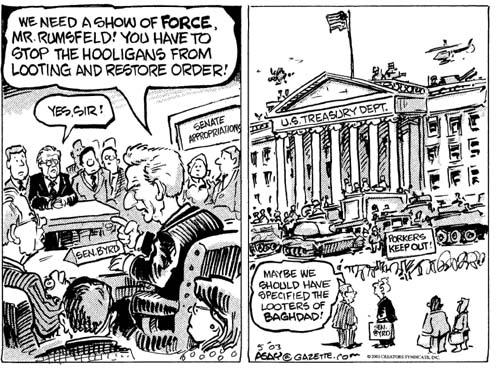

The deficit is directly the result of the big spenders, such as Klansman Robert Byrd, and has nothing to do with allowing people to keep more of their own money through lower tax rates.

Congress Reaches Tentative Tax-Cut Deal

President Supports House Tax Bill

House GOP accepts $350 billion tax cut

Agreement close on tax cut bill

House, Senate Reach $383 Billion Tax Cut Agreement

Congress Tax Package Said to Total $382.8 Billion

Plan for Overseas Tax Increase Dropped - US corporations fought back against this idea because they would have ended up paying those extra taxes on behalf of employees stationed abroad or else be unable to find anyone to take on those assignments.

Bayh�s vote for tax cut vexes Dems - Both parties have their defectors from the standard playbooks.

70B gaffe in Senate tax plan - Who cares? The methodology they use to analyze proposed effects (static scoring) has been proven to be nothing more than WAGs (wild ass guesses) anyway.

House G.O.P. Leaders Agree to Eliminate Dividend Tax

Tax-Cut Victory Is at Hand. Congress has work to do, but the pro-growth future is bright.

There are harmful tax increases in the Senate tax package.

Permanent or not, these tax cuts will help.

The scent of pork -The true reason for the budget deficit; out of control spending by our rulers.

House GOP Targets Waste, Fraud In Government Programs - So far, it's been all talk & no actual action.

Warren Buffett's Marxist View of the World

Coring the Apple - The massive tax hikes in New York are going to be the equivalent of killing the goose that lays the golden eggs, as those high income earners who are being targeted for fiscal rape decide to leave the Empire State.

Tricky Dick - Since Roth IRAs were first introduced into the tax game about five years ago, I have consistently expressed my concern over relying on them very much because they only make economic sense if we can trust our rulers in DC to honor their promise regarding their tax free pay-outs. I have always had big problems advising anyone to give up current tax breaks, such as with conventional deductible IRAs, in exchange for some promised tax break ten, twenty or thirty years down the road. Since the beginning, I predicted that our rulers would pull the same switch on Roth IRAs as they did with Social Security, and tax payouts for anyone who is considered to be evil rich, such as anyone with more than $25,000 of income per year, as it is for SS. Rather than wait to stick it to Roth savers, one of our least favorite Socialist Congress-Critters, Dick Gephardt of St. Louis, is already proposing a radical change in the allowable retirement plans, including full taxes and penalties on those who used Roth IRAs. The scariest thing is that, among all of the DemonRat presidential wannabes, Little Dick Gephardt is considered a moderate.

Political Payoffs for Tax Cut Vote Switchers

GOP Seeking 3rd-Largest Tax Cut Ever

Talks zero in on $400 billion tax cut

GOP Will Aim for Smaller Tax Cut

Congress Plans to Deliver Tax Cut by Memorial Day

Try to get a tax-cut - A look at the games required to get a tax cut bill through the ridiculous rules of the Senate.

House's sensible tax cuts outweigh anemic Senate plan

Tax-Cut Critics don�t have a leg to stand on.

Tax Cuts Complicate Democrats' Campaigns

All Three Journalists on ABC's This Week Denounce Tax Cut - Business as usual for the Anti-American Broadcasting Company.

Dems get concessions in the tax bill, but concede nothing

This contorted tax cut is still good policy.

Unfair, If You�re Over There. France doesn�t tax expatriate incomes. Why do we? - The Senate version of the tax cut bill repeals the long standing tax free exemption for foreign earned income, which is currently $80,000 per year. My guess is that these people, being out of the country, are deemed easy targets by our rulers, who obviously have less to fear from retaliation at the voting booth.

Legislature overrides gov - & we're gonna pay - They are determined to ream the taxpayers in New York. Rudy Giuliani isn't happy about that, although his successor in the mayoral position, Nurse Bloomberg, obviously loves it.

Of course, this is minimal compared to the volume of spam from the libs with their lies claiming that the tax cuts will only help the evil rich and will create huge deficits.

Caution: Tax Cuts Are Bigger Than They Appear in Budget - Some typically dishonest numbers games from our rulers in DC. However, this time, it works in our favor. They set artificial expiration dates for some of the tax cuts, with full intent to renew them in the next few years, just to meet their arbitrary budget numbers over a certain time frame. Since the numbers being used to gauge the effects of the tax cuts are completely bogus to start with, I can't get too indignant over this latest charade. While it isn't an honest way to look at financial projections, it's no less truthful than the Left's constant lies about the tax cuts causing massive deficits and only benefiting the evil richest Americans. We just have to keep the heat on the GOP to make the cuts permanent and prevent the Donkeys from repealing them, as some of them are still trying to do with the 2001 tax cuts.

The Senate tax cut saves the wrong jobs.

Will tax cut mean less government? Bush's bid to restrain growth isn't likely to succeed, analysts say.

Military waste under fire

$1 trillion missing -- Bush plan targets Pentagon accounting - Of course, nobody will lose their job for misplacing a trillion dollars of taxpayers' money. However, try leaving off $1,000 of income from your tax return and you'll have bloody hell to pay with IRS.

Web Vigilantes Give Spammers Big Dose of Their Own Medicine - Some good news in the spam war. These freelancers will get the job of shutting down spammers done much faster than is possible by governmental agencies.

Charities get just dimes on dollar. State report shows amount fund-raisers skim from donations. - Why it's best to donate directly to the charities you support and prevent the middlemen from siphoning off most of the money.

Insiders Say Lack of Financial Knowledge is Common - No kidding.

Business exodus from PRC looms - People will only put up with so much abuse from their rulers before they reach their breaking point and look for a friendlier environment; as we did ten years ago, when we made the exodus from the Left Coast to the Ozarks. The Forbes article mentioned on the best places in the country to work and run a business is here. Coincidentally, their third best location is Fayetteville, Arkansas, which is very close to us here.

This is unfortunately too close to how the mind-set is in this country. Anything that helps the evil rich is by definition a bad thing; even if it also helps everyone else.

House Is Pushed to Accept Senate's Tax Cut

The new hot issue for Democrats: Tax-cut rollbacks

Do the math - Critics of tax cuts: Analyze fiscal policies honestly

Bush to Fight to Make Dividend Tax Cuts Permanent

Bush hails passage of Senate tax cut

Avoiding Sales Taxes - Whenever the issue of replacing the Federal income tax with a national sales tax comes up, people wonder what we tax practitioners will do for a living. I always have to remind them that there will still be plenty of business for us helping people use the rules and loopholes to avoid or reduce the sales taxes they pay, just as as is currently happening in the PRC, where there are services that exploit certain twists in the law to avoid having to pay sales taxes on some vehicles and boats. To think that those kinds of services won't be needed to help people cope with a national sales tax is just naivety.

$350 billion tax bill approved by Senate (Wash Times)

Senate Adopts a Tax Cut Plan of $350 Billion (NY Times)

Senate Narrowly Passes $350 Billion Tax Cut (Fox News)

Senators OK $350b in tax cuts (Boston Globe)

Senate passes tax-cut package (MSNBC)

Senate Approves Tax Cut Proposal (Wash Post)

Senate Passes $350-Billion Tax Cut Bill (L.A. Times)

Firms Cautious on Prospect of Dividend Tax Change

While we will definitely be very happy to have dividends tax free, and will almost certainly start paying them out after the new law takes effect, people do need to remember that this upcoming change is currently for Federal income tax purposes only. Whether or not the same tax break will apply to State income taxes will have to be seen. Many States have their income tax calculations based on the Federal number, so Federal changes would automatically affect those states, unless their rulers pass special legislation specifically denying those changes at their State level. Other states, such as here in Arkansas, have independent tax calculations and have to themselves pass special legislation to conform with any new Federal rules. That often taxes a few years to happen, making it trickier than normal to calculate taxes until the State and Federal rules are back in synch with each other. With the current financial and budget crises faced by most State governments, there will definitely be some hesitation at enacting anything that they think may reduce their revenue. Hopefully, State rulers will look at the long term perspective and realize that, if they don't allow their residents the same tax breaks as the Feds do, people will move to States that do. Money is a big motivator of behavior, and sooner or later, the additional costs of living in a certain State become too high to tolerate in comparison to other less expensive States.

Democrats wary of plan to cut 1 percent of budget fat - For the Dims, it's absolute heresy for the size or cost of government to ever decrease. Their one main purpose in life is to continue the growth of government involvement in every aspect of our lives. Less money means less power; something they will never sit still for.

We are getting closer to an actual tax cut bill. As soon as the differences are hammered out between the House & Senate versions, we can start making plans on how to best utilize the new changes, especially in regard to corporate dividends and the much higher Section 179 expensing election.

Cheney Breaks Tie on Senate Tax-Cut Bill

Senate Votes to Hold Stock Dividends Tax

Excluding some dividends and all economics

Senate Backs Temporary Dividend Tax Cut Measure

Senate turns back tax-cut amendment

Senate Republicans Gain Crucial Democratic Vote on Tax Cut

Senate continues debate on Bush tax cut

Tax cut support grows - As always, it depends on how the poll questions are worded.

Rather Describes Poll as Finding Tax Cut �A Problematic Sell�

DeLay tells chiefs to make real cuts - Cutting the cost of Federal programs, by reducing waste and corruption, by a measly one percent should be a walk in the park.

Labels: 179

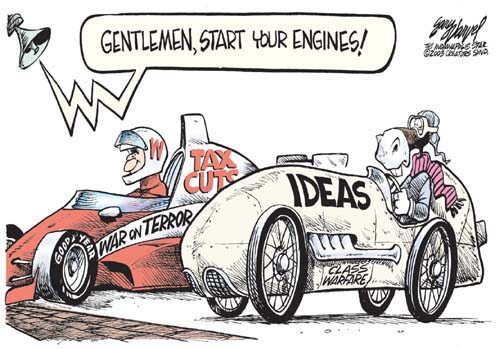

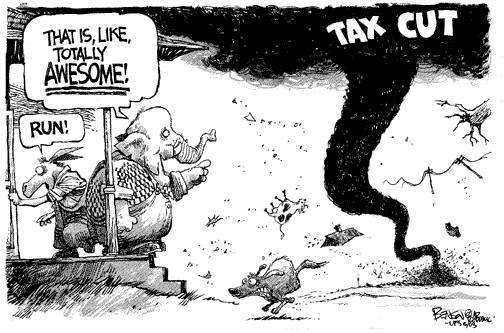

The little donkeys are petrified of the tax cuts doing their thing to improve the economy and sweep the GOP into victory in 2004 elections.

The real reason why we have higher and higher taxes; government encroachment into more and more areas of our lives.

A Tax Cut for the Wealthy? - The class warfare rhetoric from the Left isn't anywhere close to true.

Senate Begins Debate on Tax Cuts

Temporary Dividend Tax Cut Proposed - Proving that our rulers can never pass up a chance to make the tax laws more convoluted, they propose this idiotic idea; phase in lower taxes on dividends over five years and then immediately switch back to full taxation. Complete lunacy.

The Bush tax cut is an investment the country can�t afford to miss.

GOP leaders striving to save dividend cuts

Cut taxes, cut taxes, cut taxes - How to improve the economy, which is why the DemonRats are so adamantly opposed to it.

Bush tax cut is key to strong economy

How well done for taxpayers? - It's time for our rulers to stop jerking around about nit-picky details and get the tax cut onto the President's desk.

IRS Laments It's Too Poor to Pry Loose Billions Due - In spite of their current meltdown, the NY Times doesn't miss a chance to do its job kissing up to the IRS and pushing for more power for them.

States �Forced to Raise Taxes,� But Zilch on Soaring Spending - How ABC News sees the world.

Senate Delayed by Debating Wrong Tax Bill

Rove protects Senate RINO foes of Bush tax cut

Typical ABC News Slanting of Coverage of Tax Issues

Bush: Tax Cuts Aren't Just For The Rich

Bush Blunts 'Fairness Question' on Taxes

Bush Takes Tax-Cut Message On the Road

Bush Heads West to Urge Senate Support for Tax Cut Plan

Neb., N.M. Lawmakers Are Key Targets

Bush Trails a Democratic Senator to Nebraska for His Tax Cut Vote - He's given up on the RINOs.

'Soggy' Economy Needs a Shot of Tax Relief, Bush Says

Make 'Balanced Budget' Myth a Reality for PRC

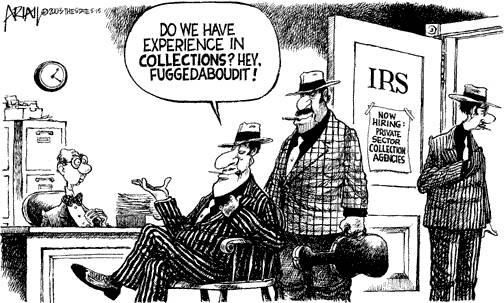

IRS Wants Private Agencies to Collect Back Taxes - The potential problems that could be created by this are almost limitless.

British Tax Group Accuses Government of Privacy Violations - They have similar problems over there in the UK as we have with the IRS here in the States.

The real cause of deficits is not a shortage of revenue. It's caused by out of control spending by our rulers.

The deficit is big enough to take care of itself - Contrary to the Left's propaganda claiming that tax rate cuts will increase the size of the Federal budget deficit, the opposite is true. Lower tax rates result in much more incentive for people to generate taxable income, with much higher tax revenues for our rulers to spend. The Reagan tax cuts more than doubled Federal revenues; so this has been proven in our real world. Anyone who says this isn't true is about as trustworthy as CNN or the New York Times, and should not be relied on at all.

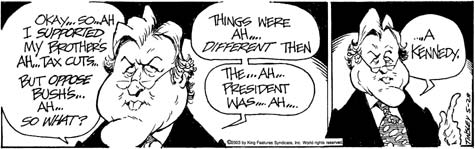

In fact this basic economic concept isn't anything new. Rush Limbaugh has been receiving a lot of flack from DemonRats for daring to play an actual sound clip from 1962 of President John F. Kennedy touting the need for tax rate cuts to stimulate the economy. Current members of the JackAss Party are offended that JFK's words are being used to support what is now a GOP concept, lower tax rates. When asked about this diversion from the ideas of JFK, his brother, Teddy tries to defend the current hypocrisy by claiming that things were different back then. The 90% top income tax rate was confiscatory; but today's rates are just fine according to Teddy. As Stephen Moore explains, that isn't the case. Put into perspective, our current effective tax rates, especially the two levels of tax on corporate income, are just as confiscatory as the rates were in 1962, and a reduction of those rates is just as important for the economic vitality of the country as they were when JFK advocated them 41 years ago.

The claim that the tax cuts that Bush enacted in 2001 caused the current deficit are completely bogus. They were so back end loaded that the actual amount of tax savings so far has been a tiny drop in the bucket. As I said back when they were passed, waiting for ten years for the cuts to take effect was a cruel and stupid joke. What we need to really get the economy moving is all of those tax reductions right now.

Bloomberg to New York: Drop Dead

The mayor tries to destroy the city in order to save it.

Bloomberg won't be able to tax his way out of hard times - How can somebody, especially a capitalist, be so obtuse when it comes matters of raising taxes or trimming the fat? Nurse Bloomberg will definitely be a one term mayor, if he lasts even that long.

Counting on Bush tax slash - What nerve. Nurse Bloomberg is rooting for Bush's tax cut to pass so he can raise taxes on New Yorkers without them feeling it.

No, New York, You Don't Pay Highest Taxes

Tax Cut Debate Moves to Senate Floor

Tax Cut Debate Returns to Senate

Senate set to futz with tax bill

Dubya takes tax cut show on the road

Bush using popularity to sell tax cuts

Bush Urges Workers to Press for Tax Cuts

Snow Favors Tax Cut For 'Soggy' Economy

Snow: Tax Cut Needed for 'Soggy' Economy

Senate Finance has altered the Bush plan from recognition

California taxpayers hostile to Bush plan

Long-term deficits, mortgage rise feared - They're swallowing the Left's bogus propaganda about the effects of tax rate cuts out there in the PRC.

THE TAX-CUT DEBATE: How Much More Can The System Take?

Senate tax-cut debate postponed until Wednesday

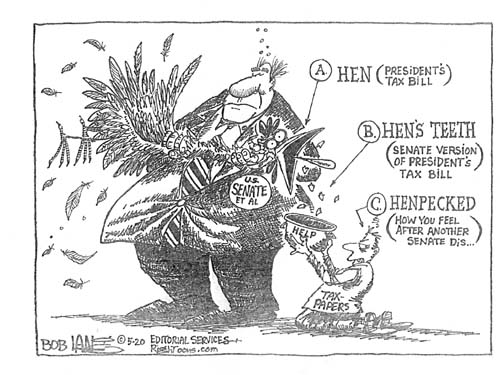

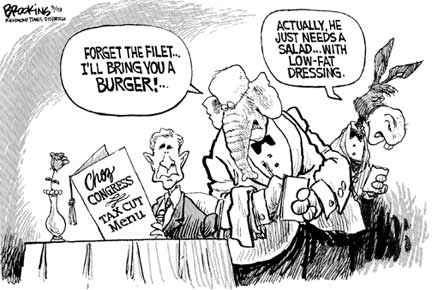

Comparing the three different plans for changing how corporate dividends are taxed, as proposed by Bush, the House and the Senate. We'll most likely end up with some kind of Frankenstein's monster hybrid of these.

Coverage of the Tax Cut Bill Passed By The House

There is still a lot of haggling to go on between the House and Senate versions. When we get down to a bill that will become law, I will be discussing the ways in which people can exploit the new rules to their best advantage ASAP. I have been working on several strategies that could save some serious money for people. However, we need to see which version of the tax law makes it to Bush's desk before deciding which plan is most practical.

Bush Urges Americans to Demand Tax Cuts - This should be done all of the time, not just now. Our rulers equate silence with assent; so if you don't like how things are, you need to let them know or else they will assume that you are happy with everything.

Quicken Tips

For those using Quicken, here is a good list of free sources of tips that are available on the web, courtesy of the Houston Chronicle. I actually learned about this because they included a link to my tips.

Compared to some of the things people invest in (i.e. stocks, get rich quick schemes, slot machines, etc) this may be a safer way to go.

House Debates $550B Tax-Cutting Bill

Glenn Hubbard: We need you now - Help from former Whiter House economic advisor would be helpful in pushing for the Bush tax cut plan.

House Passes $550 Billion Tax Cut Package

GOP Senators Endorse Tax Hikes

Mayor John V. Bloomberg

New York City stands on the brink of Lindsayesque catastrophe. - Amazing incompetence for someone who is supposedly a financial guru. The cost of one-way U-Haul rentals will be shooting up soon.

Arkansas Tax increases become law - Nicotine addicts are looking at another 25 cents per pack and everyone is going to have a 3% additional income tax. This extra income tax is supposed to only be for two years; but we all know that temporary taxes are rarely that.

Solons should tighten their own belts first

What is it with Arkansas legislators? They're in Little Rock raising taxes left and right in their search for enough money to keep state programs going, yet they're not willing to make what's basically a symbolic gesture by foregoing their $300 raises.

Pay More or Get Less? from Neil Cavuto

As this great tax debate continues, a question: Why is it when states and cities are running budget deficits, they invariably raise taxes? Why is that a given?

FTC Sues Web Sites Over Do-Not-Call Scam - Don't fall for this scam and pay for something that can be done for free by checking with the FTC's website.

Lawmakers wrestle with competing tax-cut plans

U.S. Senate panel set to pass compromise tax plan

Senate Lawmakers Debate Dividend Taxes

Snowe wins victory on tax-cut limit

The Daschle Republicans (Cont.) - aka RINOs

Senate Tax Cut Package Would Include Tax Increases

Analysis Deficit - As I've always said, the numbers being bandied about to describe the size of the tax cut are bogus, fabricated out of thin air with no foundation in reality. They claim that lower tax rates cost the government money; when the truth is that lower rates generate much more revenue to the Treasury.

As Bush Tax Plan Falters, Conservatives Find a Silver Lining - Lower capital gains tax rates would be a step in the right direction.

GOP Senators Reach Tax Cut Pact

Senate Republicans Reach Deal on Dividend Tax Cut

GOP senators strike tax-cut bill agreement

GOP sets plan for dividend tax cut

Senate Panel Debates Dividend Tax Cut - As I predicted several months ago, the most likely outcome of the debate over taxation of dividends will be a certain nominal amount per year tax free per person; similar to the $100 per year of tax free dividends that was part of the tax law in the 1970s, when I started in the tax business. That satisfies the requirements of the DemonRats; a tiny tax break for small investors and not enough incentive to motivate corporations to make the huge dividend payments that would stimulate the economy.

Broken Promises

I always receive a lot of flack when I dare show any skepticism regarding the government's veracity when it comes to honoring its promises. This attitude isn't based on any kind of hatred for the government; but rather an honest assessment of the past record. Our rulers have no qualms whatsoever about breaking promises. I am referring mainly to tax issues here; but there is no shortage of about-faces by our rulers.

When Social Security was first established, the promise was that the benefits would always be completely tax free. What we have now is quite different, with 85% of the benefits subject to income tax for many of our seasoned citizens.

A few years ago, I was one of the lone voices warning against a popular move to convert ordinary IRA accounts into Roth IRAs. This required people to pay real taxes based on the promise of tax free benefits several years down the road. My concern then, as it still is now, is that by the time those people start withdrawing from their Roth IRAs, our rulers will establish a means test along the same vein as with Social Security recipients, requiring them to pay taxes on the Roth IRA pay-outs.

States also break tax promises. As shown in this article about the Section 529 college savings plans, many states that promised to waive income taxes on the accounts for people who go out of state are going back on their word and starting to tax them.

It just shows that tax planning is a never ending process, with constantly changing rules and moving targets.

KMK

Tax Cut Plans Proceed in Congress

Senate GOP Supports a Temporary End to Taxes on Dividends

Grassley Proposes Tax Plan

$415 Billion Package Is Open to Revision, Senator Says

GOP tax-cut bill clears House panel

The need for tax cuts � then and now

A Stubborn White House

The economic landscape has changed. So should the tax cut.

In special session: Wham, bam, tax 'em

Arkansas' legislators are going through tax increases as fast as a chainsmoker puffing away on Death Row.

On the economic front - While the proposed tax breaks for the "evil rich" are getting all the publicity, the real battle is whether the economy is going to be given any help or will it continue to be stymied by high punitive and unfair taxes. All the talk about the deficit is a load of typical donkey droppings. The DemonRats are as desperate as they have ever been to prolong and even worsen the economy so they can blame Bush and supposedly increase their hold on the reins of power in 2004. If things improve between now and November 2004, the JackAss Party is looking at a record number of losses.

Grover Norquist to Warren Buffett:

Don't Like Tax Relief? Then Give it Back.

Multibillionaire investor Warren Buffett repeatedly slams President Bush for "injustice" of tax relief. Taxpayer advocate reminds Buffett that if he doesn't like tax cuts, he shouldn't take them.

WebSite Update

I've made a few more changes to my main website.

I added a Quick Reference page to include some of the rates and info that people ask about quite often. If you have any ideas for other things to include, please let me know.

Clarified that a QuickBooks class should not be set up on corporate books for "Personal." This is an issue that I have been coming across a lot lately, as people send me their QuickBooks data files to work with.

Time to worry. Most people needlessly freak out just by receiving a letter from IRS in the mail. Most of those are no big deal. However, if you consistently ignore those letters, you may see something like this. If you don't file a tax return or otherwise put up a defense for your true tax liability, IRS is allowed to fabricate its own numbers and do whatever it wants to take that money from you.

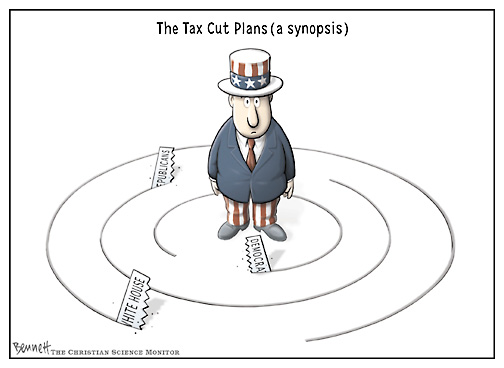

To make this picture more realistic, Tom Dashole and the RINO Senators would be peeing on the matches as Bush tries to light up the economy.

For those who may not understand this comic, it goes back to last year's revelations about creative accounting that was done by some large companies by reporting phony income. Most of the companies that did this only used the fake numbers on the financial statements that they presented to the SEC and investors, while they reported their true income to IRS in order to avoid paying taxes on fictitious income. This practice of keeping multiple sets of books is what prompted many of us to call for the release of corporate tax returns to investors so they can better see the discrepancies.

For some reason, some of the corporations using creative accounting tricks opted to pay income taxes on income that didn't exist. Now that they have been busted for the phony numbers by the SEC and investor lawsuits, they are trying to recover the overpaid taxes. Because of the statute of limitations with IRS, those companies will find that they will only be able to recover the overpaid taxes from the past three years. Anything from before that is lost forever.

The fact that this kind of phony income was allowed to be reported on corporate books for so long is why the CPA profession is under such scrutiny right now and the largest firm, Arthur Andersen, is no longer in existence.

Bush seeks voter rally for tax cuts

Bush Presses Congress on Tax-Cut Plan

Pushing Tax Cut Plan, Bush Urges Arkansans To Call Lawmakers

Senate GOP Works on Dividend Tax Cut

American families will suffer without permanent tax cuts.

Cost of not cutting taxes - Lower tax rates will stimulate economic activity; something the DemonRats do not want to happen until after they are back in control of the government.

Bush Sees Progress on His Tax-Cut Plans

House Tax Cut Chafes Liberals More Than Bush Plan

Tax Cut Trickery: Part II - More panic from the left over the possibility of lower tax rates.

George Stephanopoulos: Raising Taxes Helps the Economy - Just one more example of how ABC News is nothing more than the propaganda arm for the DemonRats.

Bush Asks Arkansas to Press Senator for Vote on Tax Cuts - Unfortunately, our Senator, Blanche Lincoln, has a history of putting loyalty to the JackAss Party ahead of doing what's best for the country; so there is almost zero chance of her voting for a tax cut.

House sold on capital gains tax cut - It messes things up by tossing new ideas into the mix.

Bucking Bush, Senator Takes a Thorny Path - The Left love to give plenty of publicity to the RINOs when they turn against Bush.

Bush Tax Cut Drive: Heat Replaces Sweet - The DemonRats are putting up a fairly unified stand against supporting anything that could possibly help the economy; so efforts to sway them to vote for tax cuts are virtually useless.

The Yard Sale of the Century Could Ease the Crunch - Selling off government owned assets makes a lot of sense, both at the State level, as well as for the Feds.

TAXING 'TIL WE DROP - The PRC doesn't have a monopoly on the knee-jerk reaction to budget deficits by enacting huge tax increases. New York is looking at record level increases that will motivate even more people to relocate to lower tax states.

Cutting Up the Tax Cut - The GOP is disappointing a lot of people by failing to use its control of the government to accomplish something as simple as reducing taxes.

Phase-In Fallacies - Bush & Co. need stimulus now, not post-election.

As I've always said, tax breaks that are phased in over several years are even more idiotic than most everything else that our rulers do to meddle with our lives. It's also very counter-productive. If the dividend exclusion is phased in over several years, that will just motivate companies to hold off payments until the later years. What is needed to stimulate the economy is immediate payment of dividends, not five years from now.

This is just more overt economic sabotage by the DemonRats, who need as much misery as possible in order to take back control of the government. Their hypocrisy on this is so blatant that we can only hope that more people can see through it. They don't miss any chance to slam Bush for the drop in the stock market and the size of many retirement accounts that were invested in stocks. [For example, their idiotic joke that 401Ks are now 201Ks] However, any effort by Bush to improve the stock market, which tax free dividends will do in a big way, is blocked by those same critics.

Nature Conservancy Under reported President's Pay and Perks of Office - A long running pet peeve of mine has been the bloated administrative costs of many big charities, who spend much more money for the personal benefit of their executives than for the charitable causes they were allegedly created to assist. This is why donations given to small local charities will be of much more benefit to society than to the big ones, which follow the example of the Federal government's ever-growing bureaucracy and goal of self perpetuation rather than doing actual good things.

Everson Confirmed as IRS Commissioner

Everson testified to a Senate committee that he would pursue tax evaders, including the companies that market tax scams and tax avoidance schemes. He also promised to continue technology upgrades and reorganization plans begun by his predecessor.

Work pays! - Good analysis by Thomas Sowell of the evil rich and why they are so rich; they work for their money. They are considered to be evil by so many in our society because they actually believe they should be able to keep some of the fruits of their labor, rather than send it all to our rulers in DC to redistribute.

E-Filing Clarification

After my comments a few days ago about people having their e-filed tax returns rejected because they were claiming a dependent that had already been reported on someone else's tax return, I received some inquiries from other tax pros wondering what was wrong with that. Finding out about that kind of problem early on should be a good thing.

That really isn't how I see it. As I have consistently said in my discussion of e-filing, I don't like it because we can't attach additional info to the tax returns to explain unusual things. In almost all of the cases that I have seen where e-filed returns were rejected due to disallowed dependents, the person who had claimed the dependent wasn't legally entitled to do so. However, the e-file program with IRS has become a first come, first served game. The earliest filed return is automatically given the dependency exemption by IRS, even though that person may not be legally entitled to do so. Then, when the person who should be legally claiming the exemption tries to file his/her 1040, IRS kicks back the entire tax return and forces the person to go through a very lengthy and messy process to resolve the discrepancy.

I have had clients where they received notices and reduced refunds based on similar problems, with dependents who had been claimed on the other parent's tax return. We were able to resolve those issues rather quickly with IRS by sending them copies of the divorce decree or other documentation of my client's legal right to claim the dependent. IRS then nailed the other parent who took the improper exemption. In subsequent years, and in other cases where we suspected such a situation, I attached the documentation to the 1040 to prove to IRS that we were entitle to claim the dependency exemption. IRS allowed them with no more problems. This kind of additional documentation is not possible with an electronically filed tax return; so that problem will just happen year after year, unless the client can beat the other parent to the H&R Block office. Rushing to file a tax return just to beat someone else to the punch is not a good thing. Taking your time and making sure everything is as accurate as possible is still the best way to go.

KMK

Networks Mischaracterize Greenspan as Opposed to Bush Tax Cuts - Why anyone would trust the leftist media for anything after their completely discredited coverage of the Iraq war is beyond me. ABC and CNN have especially proven that their anti-American philosophy colors everything they report on.

Dividend Tax Down, but Not Out, in House's $550-Billion Plan

House Republicans Retreat From Plan to End Dividend Tax

Compromise floated on dividend tax-cut plan - As always, our rulers are looking for more ways to complicate the tax system and make more work for those of us in the professional tax practitioner community. Having a variety of different tax rates for different kinds of income makes it impossible to calculate the taxes without a sophisticated computer program and creativity for classifying income and expenses in order to minimize the tax damage.

New State Laws Complicate Naming Relatives as Trustees - There are plenty of very good reasons to set up trusts, both while you are alive and for after you have passed on. This article has some good tips on selecting a trustee, such as deciding between using a relative or a professional service, such as a bank, or a combination of those. I've worked with clients using dozens of variations of these, each with their own peculiarities and no universal one size fits all best way to set things up.

Don't count the tax-cut out yet - Larry Kudlow has been the most consistently optimistic about the possibility of seeing this tax cut make it through of anyone I can think of.

Tax Cut Push Continues in Key Senators' States, but Impact May Be Small - Club For Growth campaign to shame the RINO Senators to support the Bush tax plan

Lawmakers Weigh Dividend Tax Cut Compromise

Simpler Tax Cut Is Floated - House Leaders Offer Uniform Rate on Dividends, Capital Gains

This is one way to scuttle the tax bill; throw in completely new ideas to muddy the water even more than it already is.

Pointing the Finger

According to IRS, their recent program for people to avoid prosecution by voluntarily admitting their participation in schemes to hide money offshore has paid off well in terms of money and in names of the people promoting these scams. More than 1,200 people took advantage of this opportunity to come clean. A partial analysis of some of the cases has already identified more than $50 million in uncollected taxes and 80 new offshore promoters. As I have always said, shutting down the promoters of illegal tax evasion scams is a much more effective approach for IRS enforcement than going after their followers on a one by one basis.

KMK

Frist to push bigger tax cut - It will be an uphill battle to overcome the perception that this is nothing more than a tax giveaway for the evil rich, such as in this editorial from the Atlanta Urinal-Constipation, where anyone who wants any lower taxes is by definition greedy and selfish.