Minimum Wage Hike Would Likely Worsen Poverty - Basic economic principles are so poorly understood by most people that the DemonRats can get away with supposedly being the compassionate ones by forcing businesses to pay entry level workers more than they are worth in the marketplace. It doesn't take a rocket scientist to see where that will lead.

Benefits of the Bush Dividend Tax Cut

From poverty to prosperity

Death From Complications

It's fairly safe to say that we all die in many ways from the complexity of the tax code.

IRS Isn't Perfect?

The only real surprise in these stories from Tax Analysts is that the IRS error rates aren't higher. I would say that these qualify as good examples of non-scientific studies.

TIGTA Report Gives Low Score on Accuracy to IRS Phone Reps

TIGTA Reports Problems With Some IRS Seizures

IRS Interest Rate Increases On October 1 - It will rise from its current four percent (4%) to five percent (5%) for at least the last three months of this year. I've updated the Quick Reference page on my main website to reflect this.

In about three months from now, we'll find out what the rate will be for the first quarter of 2005.

These figures are the nominal interest rates charged by IRS. The actual interest charged is compounded daily, so the effective rate (APR) is slightly higher. It is not, as many people believe, charged at four or five percent per day. That's reserved for loan sharks.

To show how numbers can be used to slant a story, this could accurately be reported as either a one percent increase in the rate IRS charges, or it could be stated as a 25% jump in the IRS interest rate (from four to five percent) if I want to be an alarmist.

In L.A. real estate, $10 million is the new $1 million - Why I've always been a big believer in real estate as the most dependable investment for amassing wealth.

Dumping gas guzzler a savvy investment move - I've always countered the freedom hating busybodies who want to ban SUVs that their operating costs are penalty enough to punish the people who choose to buy them.

Old ways of paying bills get bounced - Businesses do have a right to reward customers who make things more efficient for them.

Fogbound income data?

In Speech, Bush to Stress 'Ownership' - That is the main distinction between capitalism and communism. In John Kerry's Marxist Shangri-La, the big central government owns everything, while capitalistic societies hinge on private property ownership rights.

Why World Magazine isn't spending time covering income-tax protesters - I can relate to this. I've lost track of the number of people who accuse me of being part of the big government conspiracy because I refuse to endorse the idiotic and illegal theories and tactics used by the various tax protestor scammers around the country. Their using the name "Tax Honesty Movement" doesn't make their arguments any more credible.

This is news to anyone?

Most investment gurus base their entire careers on peddling this kind of simplistic pabulum.

Learn the Basics of Mutual Funds - It always amazes me how many people still think that mutual funds have nothing to do with the stock market.

Taxed to the Max - Gail Buckner covers some good points. However, in her discussion of how to work for changing the insane AMT, she fails to mention the best group I have seen, Reform AMT. Anyone interested in this issue should check them out. If AMT hasn't hit you yet, it will within the next few years; so assuming it's only applied against the evil rich is an expensive naive attitude.

Deducting Stock Losses As Thefts

I've written before about groups such as 165 Services, that supposedly allow investors to deduct the full amounts of their stock market losses as being caused by thefts by their stockbrokers, rather than being limited to the insanely unfair $3,000 per year Schedule D capital loss deduction. I've never endorsed this idea because, as I've described on several occasions, I consider most stock losses to be the result of stupidity, which as far as I know doesn't make it any more deductible.

Roth & Company has a funny look at an investor who tried a similar attempt to fully deduct his stock losses with the claim that his broker took advantage of him by forcing him to consume alcoholic beverages and then agree to ridiculous investment decisions. His claim was disallowed by the Tax Court.

However, this is one more bit of substantiation of my claim that playing the stock market is no different than gambling in a casino. Casinos routinely provide free alcoholic beverages for the express purpose of encouraging stupid bets by their customers. Why shouldn't stockbrokers do the same thing?

Coin-laden suspect caught at car wash - Why launder money through banks when you can use car washes?

Big Four Get Mixed Marks From U.S. Accounting Panel - As if the Big CPA firms' reputations aren't bad enough; now they admit to breaking the law by charging clients a percentage of tax savings. Such contingency fees are specifically prohibited by IRS rules of practice.

Taxing Times for South Carolina Democrats

Imagine receiving 100% of your paycheck! - Fellow Libertarian Neal Boortz looks at the Fair Tax plan to replace the Federal income tax with a national sales tax.

The Well's Running Dry

Why those of us financial advisors with realistic foresight have cautioned everyone about relying on Social Security and Medicare for our future care. Taking steps to reduce the amount of money wasted on these government programs and setting things up to be independently provided for have always made sense.

Greenspan Warns on Baby Boomer Benefits

Greenspan-Aged Population to Hit Finances

Social Security, Medicare too generous

Women Win from Lower Tax Rates

Bold Ideas About Taxes

Killing Off the Death Tax

Understanding Income Inequality in the United States

The Price of Feminists' Love Affair with High Taxes

Dueling Tax Plans – Bush and sKerry Tax Plans Spar Over Treatment of Wealthy - From Deloitte Tax LLP

Killing Off the Death Tax

John Kerry Seeks More Regressive Tax System

Emerging Bush agenda stresses tax cuts, savings

Middle Man Mess

Bring on the 'price gougers' - I really like the concept of price changes due to disasters as "economic triage."

Downturn Made States and Cities More Dependent on Property Taxes

Tar Heels shouldn't wait on a Taxpayer Bill of Rights to scrutinize how the state (NC) spends their money

The Widening Income Gap - From The Onion

A Little Learning Is a Dangerous Thing to Deduct - More on the issue of deducting education costs.

CBO's taxing pie fight - As the old saying goes, "statistics don't lie; but liars use statistics" to distort their meaning and push their agendas.

CBO Overstates Breaks To The Wealthy - It always makes me laugh when the CBO is referred to as "nonpartisan" or "bipartisan." We all know that it's a tool for DemonRat propaganda.

Getting Our Hopes Up

Bush eyeing major tax-code overhaul - We can only hope for the best; but will probably get the same thing we always get when our rulers promise sweeping tax reform, a much bigger mess and a lot more work for us tax pros.

Taking Government a-PART - Thanks to Ben Cunningham for this article on how much of our tax money is literally flushed down the crapper by our rulers in DC. It should make everyone feel so patriotic when forking over their hard earned money to the IRS.

For Pete Rose, Tax Hits Keep On Coming - One of the pitfalls of being a celebrity is the publicity surrounding things like this, which are normally relatively private matters.

John Kerry is lying about the economy and the New York Times proves it - Of course. He lies about everything. Who would have thought the DemonRats could scrape up a candidate who makes Bill Clinton appear honest by comparison?

President Can Reform Social Security Without Raising Taxes or Cutting Benefits

Global Taxes Are Back, Watch Your Wallet

Elimination of the Internal Revenue Service

Auditor Turnover: SEC Seeks 'The Rest of the Story' - It's long been an obvious sign of funny business going on in a company's accounting when their CPA firm refuses to handle the audit any more.

M.B.A. Students May Lose Tax Break - The cases cited are mainly for W-2 employees who deducted their education costs on Schedule A. As with most deductions, this kind of thing is more powerful tax-wise as a Schedule C deduction, which is how I claimed my MBA costs. As required to be deductible, the MBA classes didn't qualify me to do anything new (I was already a CPA), but the things I learned have been very useful in running my businesses and servicing my clients.

Real Tax Cuts, Imaginary Analysis

Brown In Jail - I have to admit that I'm surprised how quickly this case was wrapped up. With all of the legal maneuvers possible, it was looking like this case could take years before Dian Brown received any punishment for stealing money through her Harrison Abstract business.

We're hoping this puts an end to comments Sherry has received from local Realtors and investors who complain about the fees she charges for 1031 exchanges with "Dian Brown charged a lot less." Having seen some of the incompetent exchange paperwork prepared by Dian Brown and her Harrison Abstract staff, it's obvious that her legal headaches are far from over. Any of her exchange clients who are examined by IRS will have excellent grounds for legal action to recoup their additional taxes, penalties and interest charges when their exchanges are disallowed. Somehow, the old "you get what you pay for" standard fits so well here. Saving a few hundred dollars by using an incompetent exchange service can very easily cost hundreds of thousands down the road when IRS catches up.

Labels: 1031

State Tax Amnesty Programs

These are popular around the country. Some other upcoming state tax amnesty programs include:

Mississippi - From September 1, 2004 through December 31, 2004

West Virginia - From September 1, 2004 through November 1, 2004

How Lawyers Helped Drive The Boom in Tax Shelters - So, what's so wrong about attorneys charging people hundreds of thousands of dollars for "objective" opinion letters on tax shelter scams those same lawyers created? It looks like a high growth legal specialty is going to be in handling malpractice suits against these guys.

Calif. Tax Amnesty Program

During the months of February and March 2005, the California Franchise Tax Board (income taxes) and Board of Equalization (sales taxes) will have an amnesty program for people who haven't filed their 2002 or earlier tax returns or did so but failed to include some income or claimed too much in deductions. People who 'fess up during those two months and pay their back taxes and interest will be free from any penalties and criminal prosecution.

As the FTB says in their Tax Amnesty Quick Reference, this won't apply to anyone who they have already started criminal proceedings against. The application to participate in the amnesty isn't scheduled to be available until January 15, 2005.

As with any State amnesty program, this creates a new variety of tax planning decisions. As I've mentioned several times before, anyone who is ready to come clean with the State tax authorities had better be ready to do the same with IRS because all info provided to the State will be shared with IRS, which has no similar amnesty programs in the works.

Buffetted. The Sage of Omaha loves the estate tax — as well he might - Why we were upset that Arnold Shwarzenegger was relying on him as an advisor during his run for Ruler of the PRC.

Tax burden politics - According to the lefties, nobody should be happy about their own tax breaks if anyone else received more, especially the evil rich who pay almost all of the taxes.

Bush Tax Cuts Erased Income Tax Burden for 7.8 Million Families

Socialism is evil: Part II - Another great lesson from Walter E. Williams.

Bush's Tax Cuts -- No Good Deed Goes Undistorted - It is quite an uphill battle to counter the vast reach of the leftist media in their attempts to convince everyone that tax cuts are evil because rich people had their taxes reduced.

Media Push Kerry Spin on How Tax Cuts Help Rich the Most - Same old story. What are people supposed to believe - their own tax returns or what the elite media tell them is happening?

2004 California Tax Rates

Spidell has produced an updated list of the inflation adjusted tax rates and other items for 2004 individual income taxes. There is a typo at the end. It is the 2004 rate schedule, and not 2003. I have also added a link to this page on the tax rate page on my main website.

Bush Seen Taking Incremental Tax-Reform Approach

The John Kerry Campaign's Funny Math

John Kerry criticizes 'national sales tax' - Such a change is contrary to his Marxist beliefs in high punitive income and estate taxes.

Some good analyses and debunking of the deluge of leftist propaganda in the past week over how the Bush tax cuts supposedly only benefited the evil rich folks. Their standard line is that every dollar an evil rich person is allowed to keep by our rulers is taken directly out of the pocket of a poor person who will die of starvation as a result.

Taxes and the Media

Tax Cut Myths Debunked by CBO

Stiffed Out Of Pension

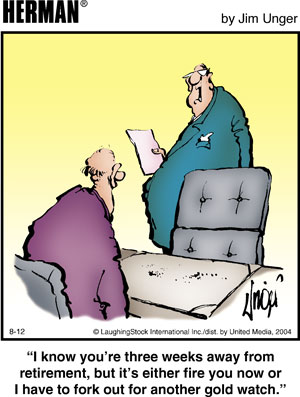

Unfortunately, this kind of thing is fairly common. Employers do very openly discriminate against older workers, who cost them more in medical and retirement benefits. This is just one more reason to have one's own business and not be at the mercy of others.

Ninth Circuit Affirms Order Enjoining Irwin Schiff and Two Associates - Another dose of reality for this tax protesting scammer. Names of all of his customers will be turned over to authorities; so anyone stupid enough to fall for his line of crap will be looking at a possible stay in the old gray bar hotel.

Tech Company Settled Tax Case Without an Audit - Could there by some hanky panky going on at the IRS?

Impossible Goal?

I'm not sure why this person thought there was a way to avoid taxes on the sale of some highly appreciated real estate without doing a 1031 exchange; but I guess it doesn't hurt to ask.

I Bought a piece of land I thought we would build on. But plans have changed. I can now sell it for 2ce as much as I paid for it just a few months ago. How can I avoid capital gains and not do a 1031? Or if I have to pay capital gains what is the %?

thank you,

My Reply:

If you don't want to do a 1031 exchange, you will be forced to report the profit, which will be taxed at your normal income tax rates since you have owned the property for less than 12 months. Your actual tax rates (Federal + State) will obviously depend on your other levels of income.

You can spread the tax hit out over a number of years if you carry back part or all of the sales price. You can then use the installment method to report the gain each year as you receive the principal payments.

Your personal tax advisor should be able to help you with this. It's very basic taxation law.

Good luck.

Kerry Kerstetter

Labels: 1031

Multi-State Taxes

My recent piece on the need to file tax returns with non-resident states prompted this email from a reader.

Hi -

I was reading your blog entry about "Missouri Tax Fishing" and wondered about my situation. I am a sales manager for a company based in California. I live in CA and I have an office in CA. However, I travel to Colorado, Washington, Oregon, Idaho, Nevada, Utah, plus British Columbia & Alberta in Canada on business. The trips are to visit customers and work with local sales rep. I am out of state on these trips 30% - 40% of the time.

I am physically working in these other states. Does this mean I must file multiple state returns?

Thanks,

My Reply:

I later received the following additional info:The proper way to handle this has a lot to do with whether you are a W-2 employee or self employed. From your description, it sounds as if you are a W-2 employee. Let me know if that is an incorrect assumption on my part.

With W-2 employees, your employer's payroll department should be keeping track of the amount of time you spend physically working in each different state (USA & Canadian) and reporting your annual W-2 wages accordingly. I have had some clients where they had several W-2s from their employers with several different State Wages amounts in as many as a dozen different states, including occasionally Canadian states.

As a W-2 employee, you are generally safe if you file tax returns consistently with how your employer has reported your payroll in the State Wages box on your W-2. The state tax agencies will be matching those up with your state tax returns.

If your employer is not properly allocating your payroll between states where you physically work, your employer has some serious potential liability to those other states when they are caught. State tax agencies are always looking for this kind of thing; so the current reporting situation could change. In cases where the employer is nailed for not properly allocating wages between states, the related penalties are normally assessed against the employer and not the employees.

If you are self employed, the burden of keeping track of the amount of time you spend and money you earn inside each state is on you. You are required to file tax returns with each state accordingly.

Good luck. I hope this helps.

Kerry Kerstetter

Kerry:

Thanks very much for the response -- it was enlightening. I am a W-2 employee, but my employer reports all of my annual wages in my home state of CA. I have been working under these circumstances for 20 years with time at two major companies, and this is how both have handled things. I also know plenty of colleagues in the same industry working for different companies, and I have never heard of anyone getting wages allocated among several states.

I will have a discussion with my company's Accounting Dept. Thanks again for getting back to me.

I wrapped this up as follows:

It sounds as if you keep a low profile when working in the other states.

Odds are that if the situation were reversed, and you were based outside of Calif and doing a lot of work there, part of your wages would be required to be allocated to Calif. That is the most aggressive state for snagging as many taxpayers as possible.

Kerry Kerstetter

John Kerry’s Whopper Tax Hike? The senator has limited himself to only one (painful) way of saving Social Security.

Scrap the code

The Case Against Tax-Reform Leadership. Move on Social Security instead.

How would you fix Social Security, Sen. Kerry? He could legitimately be accused of implicitly endorsing tax increases

Skill trumps luck for Pick 3 player, friends - News to those of us who make fun of lottery players. It seems that under certain conditions, with special promotions, it is possible to make a guaranteed 20% profit on lottery tickets.

Missouri Tax Fishing

I've frequently discussed the issue of state taxes and income sourcing, as well as the requirement for non-residents to file tax returns for certain kinds of income earned in other states. This has been receiving a lot of publicity recently under the term "jock-tax" because of its application to professional athletes who earn their money in several different states, with the implication that it's a new development in taxation. It's not new and has been an issue to be concerned with for as long as I've been in the tax game.

Obviously the various states are always looking for ways to make sure they get their pieces of the tax pie. They use information documents (W-2s, 1099s, etc) to match up with non-residents. Withholding of taxes up front, such as on some real estate sales, is a powerful way for states to force nonresidents to file tax returns.

State tax agencies also receive tax return info from IRS and look for non-filers that way. Several years ago, I had to help unravel some Arkansas state tax problems that were caused by new clients who had filed tax returns for their Nevada based corporations using the owners' Arkansas addresses. IRS shared that info with the Arkansas DFA and then DFA sent notices requesting state corp returns. Now, we always use the Nevada corp address on the returns and we never hear a peep from any other state tax agency.

I mention this now because, in the past few weeks, I have had two clients who are full time Arkansas residents receive notices from the Missouri Dept. of Revenue requesting Missouri income tax returns for 2000, 2001 and 2002. Unlike when other states such as California do this kind of thing, there was no listing of any specific income items coming from Missouri sources. I asked the first client to call the number on the notices and ask for specifics. The DOR rep told him they had noticed that he had a Realtor license for Missouri, but they had no indication that he had earned any taxable income in Missouri. She told him they sent those notices out as a fishing expedition to possibly flush out some unreported income. She told my client to just write on the notices that he had no Missouri income and mail them back in and that would put an end to that issue. He did that and then the MO DOR sent back a notice accepting the fact that he had no Missouri taxable income.

When the second client called DOR, she was told a similar thing. Her name had come up as having a Missouri insurance license and the MO DOR was fishing for some taxable income. My client admitted that some of her clients did live in Missouri and wondered whether this meant she had to report that portion of their income to the State of Missouri. I explained how the issue of income sources works as follows, which I hope is informative for others around the country.

The key factor is not where your clients and customers live; but where you actually do your work. If you have an office in Missouri or you drive up to the homes of MO residents, that would be MO source income, which would need to be reported on a MO income tax return.

However, if all of your work is done through your Arkansas office, all income is Arkansas source and properly reported to and taxed by the State of Arkansas.

This is the exact same situation for us. We have clients all over the country. I am also licensed as a CPA in California. However, since we do all of our work from our office here in Arkansas, we don't have to file tax returns with any other states, including Calif.

If that is the case for your insurance business, you can write on the notices that all insurance income has been generated from inside Arkansas and none was earned in Missouri and that a MO income tax return is not required.

If you do conduct business with a physical presence inside MO, we will need to pro-rate your income accordingly and file MO and amended AR tax returns.

She assured me that all income was earned while physically inside Arkansas, so she is writing that fact on the MO DOR notices and we will not have to file any Missouri tax returns.

Club For Growth

Andrew Roth, over at the Club For Growth blog, has been doing an excellent job monitoring the political side of tax issues. He has quite a few great posts today.

He has also posted the Club's new ad (in three downloadable video formats) about John Kerry's tax attacks on the "evil rich" who, as I have frequently explained, include just about everyone in the country when defined by DemonRats. For those who think I am exaggerating, a reminder that evil rich Social Security recipients include anyone earning over $25,000 per year, as defined by the Clinton-Gore 1993 Tax Hike, which was supported by John Kerry.

Helped by Tax Cuts, Business Owners Producing Lion's Share of Income Tax Revenue

Another Bush Term Might Well Include Tax-Overhaul Push - While this plan sounds great, it is disappointing that the Bush team is afraid to discuss this much during the campaign in order to not offend the fans of class warfare.

Another John Kerry Flip-Flop -- Taxing the Rich

Life and Taxes

California's SUV Ban - The same magic weight of 6,000 pounds which makes a vehicle eligible for the Section 179 expensing election of up to $102,000 also makes it illegal to be driven on many roads in the PRC.

Labels: 179

John Kerry Threatens Middle Class Taxpayers - He threatens the entire country in oh so many ways.

Let's Put the "Litigation Tax" on Trial - Interesting way to look at the inflated cost of so many things in our society due to ambulance chasers like the Breck Girl, John Edwards.

Report: Tobacco Taxes Drive Obesity - I'm sure we've all known plenty of ex-smokers who have substituted food for cancer sticks to satisfy their oral fixations.

Be Careful What You Call Second Homes

In many areas of taxation, there are big differences in the financial consequences strictly based on how things are described, such as with this recent email I received.

My reply:Hi! I was reading your tax page. Can you answer a question? If you sell a secondary residence and buy a different secondary residence, is that done under a 1031? How do you prove a property is a secondary residence? I find a lot of info about rental for rental or sale of primary residences but I can't find anything about sale of a secondary or part-time residence.

Thanks,

Tax treatment for the sale all depends on what call the residence.

If you call it a "personal use" property, there is no way to avoid taxes on any gain on its sale. It does not qualify for a 1031 exchange. The best you can do is delay some of the taxes by carrying back as much of the sale price and reporting the gain on the installment method.

If you call the residence "investment" property, which you may have visited occasionally to maintain, it is eligible for a 1031 exchange and can be replaced with any investment, farm, rental or business real estate in the country, as described at www.tfec.com.

You would be well advised to consult with your personal tax advisor to see how much tax you are looking at and whether the property can be considered as an investment.

Normally, if there is a large gain from the sale of an asset, that proves it was a smart investment.

Good luck.

Kerry Kerstetter

Labels: 1031

No Sale for Kerryedwards.com

Weapons of class warfare

A Social Security Plan to Last

Read GOP lips: No more IRS

Minimum wage is an immortal myth

Cost of Keeping A Corporation Alive

One of the issues I often advise considering when deciding whether or not someone should charter a new corporation and in which state to do so is the minimum cost to keep the corp in good legal standing because it is often necessary to curtail corp activities without actually going through the steps of officially dissolving the entity, or it may take a few years before actually using the new corp.

For Federal purposes, there is no annual cost to keep a corp alive other than the need to file a corporate income tax return (Form 1120). If there is no taxable income, there is no tax due. However, as I've always said, an 1120 should always be filed to show IRS that there was no taxable income and to prevent them from using their wild imagination to assume that non-filing means there were millions of dollars in unreported taxable income.

Most states have a corporate income tax and an annual filing or franchise fee. Most of the states with an income tax base it purely on the net taxable income, just as IRS does. A few, most notably the PRC, have a minimum tax regardless of the net profit. For at least the past dozen years, this has been $800 per year for any corporation (C or S) operating in California. A corp showing no activity or a loss of thousands of dollars still has to pay the $800 minimum tax. The justification for this by the rulers in Sacramento is that "they can afford it." This is a direct quote from one of the tax-writing legislators who spoke at a CPA meeting I attended several years ago. In addition to the $800 minimum income tax, the PRC has an annual filing fee, which is currently $25.

As I've mentioned several times in my discussions of corporations, a completely unexpected bonus of relocating to Arkansas was the fact that its corp income tax has no minimum and the annual franchise fee has been only $50 for as long as I've been here.

That is about to change, for the very same reason as given by the PRC Rulers. I just received several copies of the snail mail newsletter (dated as July 2004, it hasn't been posted to the web yet) from the Arkansas Secretary of State, Charlie Daniels (not the country singer) with a mention that the 2005 annual franchise fee will be tripled, to $150 per year.

While this will still be cheap compared to the Left Coast, it does change the economics of holding onto inactive corporations. Several years ago, back when we expected to be doing farming full time, I had set up another Arkansas corporation that was intended to handle the ranch operations. Since I was drawn back into tax work full-time, that corp has been inactive and I have just been paying the $50 annual fee in order to keep it legal until I decide to use it more fully. Now that it will be costing $150 per year, I am seriously just considering dissolving it.

For 2005, the annual franchise fee will also be due a month earlier than the traditional deadline of June 1. Filing it by May 1 is no big deal, but it will catch many by surprise next year.

John Kerry Won't Be Punished For Senate Absence - It's great having a highly paid taxpayer funded job that doesn't require actually doing anything, allowing plenty of time to campaign for other offices.

I like his new nickname, The Frenchurian Candidate, as used by a caller on today's Rush Limbaugh show.

Aug. 16 Deadline Approaches for Extension Filers - I'll be sending in another 80 or 90 extensions in the next two weeks, since I've been so busy working on 2002 and older tax returns to do very many 2003s.

Contrary to popular belief, you don't need a tear-jerking excuse for the October 15 extension. Save those for the extensions beyond October 15. The following text has sufficed for the past 25 years just fine.

We have been unable to assemble all of the information we require to prepare a complete and accurate tax return by the deadline.

Republicans Plan Push For Elimination Of IRS - It sounds too good to be true; but we can hope so.

Hastert Book Says GOP Plans to Abolish IRS